- Subjects: Mathematics, Interdisciplinary Applications

- |

- Contributors:

- Marek Lampart ,

- Giuseppe Orlando

- entropy

- multifractal analysis

- financial time series

- determinism

- risk management

- investments

This video is adapted from 10.3390/e25111527

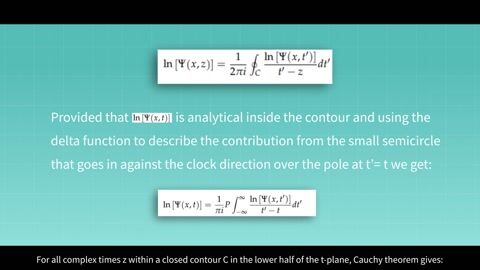

Entropy serves as a measure of chaos in systems by representing the average rate of information loss about a phase point’s position on the attractor. When dealing with a multifractal system, a single exponent cannot fully describe its dynamics, necessitating a continuous spectrum of exponents, known as the singularity spectrum. From an investor’s point of view, a rise in entropy is a signal of abnormal and possibly negative returns. This means he has to expect the unexpected and prepare for it. To explore this, researchers analyse the New York Stock Exchange (NYSE) U.S. Index as well as its constituents. Through this examination, researchers assess their multifractal characteristics and identify market conditions (bearish/bullish markets) using entropy, an effective method for recognizing fluctuating fractal markets. Our findings challenge conventional beliefs by demonstrating that price declines lead to increased entropy, contrary to some studies in the literature that suggest that reduced entropy in market crises implies more determinism. Instead, researchers propose that bear markets are likely to exhibit higher entropy, indicating a greater chance of unexpected extreme events. Moreover, a power-law behaviour and indicates the absence of variance is revealed.