Robotic Process Automation (RPA) is a software-based technology that uses configurable algorithmic software agents (bots) to replicate manual user activities across digital systems. It represents an evolution from earlier workflow scripting tools, and is distinguished by its ability to be used without requiring substantial IT infrastructure modifications or extensive programming knowledge. In the banking and insurance sectors, organizations face increasing pressure to adopt modern technologies that streamline operations and reduce costs while complying with strict regulatory requirements. Robotic Process Automation (RPA) has emerged as a viable and cost-effective solution, enabling automation of repetitive and rule-based tasks without requiring major changes to legacy IT systems. This paper conducts a literature review to examine the current use cases of RPA technologies in banking and insurance, analyzing how these technologies are employed to enhance corporate efficiency and performance. The review draws from recent academic publications and case studies between 2017 and 2025, identifying core implementation areas such as customer onboarding, claims processing, compliance reporting, and underwriting automation. The results highlight substantial improvements in processing speed, error reduction, and resource optimization, along with evolving metrics for measuring effectiveness. The study concludes by identifying key success factors, performance measurement approaches, and challenges in RPA implementation, offering insights for both practitioners and researchers aiming to understand the role of automation in financial services transformation.

Today’s organizations are experiencing unprecedented change driven by emerging technologies and digital transformation initiatives. Amidst the emergence of AI, ML, and advanced analytics, Robotic Process Automation (RPA) has become a pivotal technology evolving from traditional scripting languages, and enabling organizations to re-establish their operational models with a lower technological burden and lower needs for highly specialized IT and Software Engineering teams. RPA represents a form of business process automation (BPA) that utilizes software robots or “bots” to emulate human interaction with web applications and desktop-based software, effectively automating repetitive, rule-based tasks without requiring fundamental changes to existing IT infrastructure

[1][2]. The financial services industry, particularly the banking and insurance sectors, has been at the forefront of RPA adoption, not only because of the general drive for optimizing operational efficiency that is shared across all industries, but more importantly due to the distinctive characteristics of their work: large volumes of repetitive, rule-based transactions, substantial volumes of structured data, a high dependency on legacy IT systems, and stringent compliance obligations. These factors make RPA especially well-suited for automation in these contexts

[3].

This literature review aims to address two critical questions: What are some of the specific applications of RPA technology in the insurance and banking sectors, and how is corporate performance measured? This includes important questions such as how this technology is being evaluated in regard to its effectiveness, the results achieved, and the benefits gained, as well as some new challenges faced, such as deciding when it makes more sense to choose different options or even potentially consider decommissioning automated robots for alternative solutions. This review intends to provide insight into how companies in these industries leverage RPA as a technology and not to critique the previous work of other studies directly. Considering the rapid evolution of RPA technology, prior work and current implementations may differ, and direct comparison between the two may therefore not be possible on equal terms.

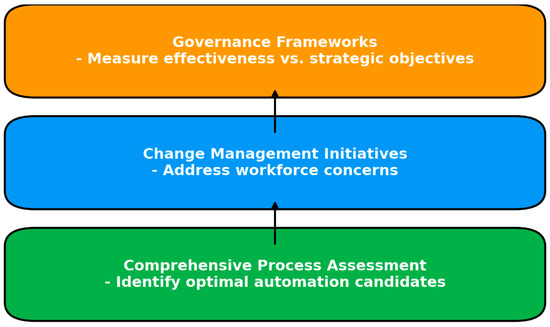

Successful RPA implementation depends on several key considerations: comprehensive process assessment for identifying optimal automation candidates, change management initiatives addressing workforce concerns, and governance frameworks measuring effectiveness against strategic objectives

[4]. These factors are shown in

Figure 1.

Figure 1. Key considerations for successful RPA implementation.

This research aims to present recent scholarly findings on RPA applications in banking and insurance, analyze methodologies for measuring performance improvements, and identify best practices for maximizing automation benefits. It is anticipated that this exercise will contribute valuable insights for stakeholders, such as financial services executives, technical leadership, and groups that take part in digital transformation initiatives, such as professional services consultants, client advisors providing services related to process automation, and academic researchers investigating business process technologies, information systems, and business analytics.