Your browser does not fully support modern features. Please upgrade for a smoother experience.

Submitted Successfully!

Thank you for your contribution! You can also upload a video entry or images related to this topic.

For video creation, please contact our Academic Video Service.

| Version | Summary | Created by | Modification | Content Size | Created at | Operation |

|---|---|---|---|---|---|---|

| 1 | Pei-Fen Tsai | -- | 1480 | 2023-12-13 04:25:05 | | | |

| 2 | Jessie Wu | Meta information modification | 1480 | 2023-12-18 01:15:04 | | | | |

| 3 | Jessie Wu | Meta information modification | 1480 | 2023-12-18 01:15:58 | | |

Video Upload Options

We provide professional Academic Video Service to translate complex research into visually appealing presentations. Would you like to try it?

Cite

If you have any further questions, please contact Encyclopedia Editorial Office.

Tsai, P.; Gao, C.; Yuan, S. Random Forest, Feedforward Neural Network, GRU and FinGAT. Encyclopedia. Available online: https://encyclopedia.pub/entry/52642 (accessed on 10 March 2026).

Tsai P, Gao C, Yuan S. Random Forest, Feedforward Neural Network, GRU and FinGAT. Encyclopedia. Available at: https://encyclopedia.pub/entry/52642. Accessed March 10, 2026.

Tsai, Pei-Fen, Cheng-Han Gao, Shyan-Ming Yuan. "Random Forest, Feedforward Neural Network, GRU and FinGAT" Encyclopedia, https://encyclopedia.pub/entry/52642 (accessed March 10, 2026).

Tsai, P., Gao, C., & Yuan, S. (2023, December 13). Random Forest, Feedforward Neural Network, GRU and FinGAT. In Encyclopedia. https://encyclopedia.pub/entry/52642

Tsai, Pei-Fen, et al. "Random Forest, Feedforward Neural Network, GRU and FinGAT." Encyclopedia. Web. 13 December, 2023.

Copy Citation

Stock prediction has garnered considerable attention among investors, with a recent focus on the application of machine learning techniques to enhance predictive accuracy. Prior research has established the effectiveness of machine learning in forecasting stock market trends, irrespective of the analytical approach employed, be it technical, fundamental, or sentiment analysis.

machine learning

fundamental analysis

artificial intelligence models

financial ratios

random forest

feedforward neural network

1. Introduction

In recent years, numerous studies have explored the application of machine learning techniques in stock prediction. H. Yu et al. [1] introduced SVM and PCA in 2014, while X. D. Zhang et al. [2] experimented with AdaBoost in 2016. Additionally, K. Sabbar et al. [3] ventured into stock prediction in 2023, incorporating machine learning and deep learning models. Notably, V. Dhingra et al. [4] in 2021 and K. Olorunnimbe et al. [5] in 2023 delved into deep learning models for this purpose. Most of these studies center on technical and sentiment analysis.

Beyond predictive modeling, there have been surveys and reviews in recent years. I. Ibidapo et al. [6] conducted a study in 2017, and R. M. Dhokane et al. [7] carried out a review in 2023.

In a historical context, the works of B. Graham [8] in 1962 profoundly influenced stock selection and investment. These works span diverse topics, encompassing value investing, fundamental analysis, behavioral finance, risk management, and various investment philosophies rooted in Graham’s enduring principles.

In 1999, Quah and Srinivasan [9] developed a model employing a Feedforward Neural Network (FNN) for stock selection based on quarterly fundamental financial factors. The model demonstrated remarkable success in outperforming the market during testing.

In 2003, Eakins and Stansell [10] employed neural networks to predict stock prices using financial ratios and yearly financial data from 1975 to 1996. Their portfolio of the predicted top 50 stocks outperformed the S&P 500 and Dow Jones Industrial Average.

In 2008, T.S. Quah [11] focused on applying neural networks to fundamental analysis for stock selection in the Dow Jones Industrial Average (DJIA). This research aimed to enhance decision-making processes, offering valuable insights for portfolio management.

In 2018, Namdari and Li [12] utilized an FNN for fundamental analysis to predict stock trends by analyzing 12 financial ratios. Their dataset included 578 companies listed on Nasdaq between June 2012 and February 2017. The FNN model employing fundamental analysis outperformed the one using historical prices.

In 2021, Z.Y. Lu and S.M. Yuan [13] employed an FNN model with 18 financial ratios and sector dummy variables to predict potential stock returns for the next quarter. This approach improved prediction accuracy by incorporating sectors as dummy variables.

In the same year, Huang Y., Capretz L.F., and Ho D. [14] used FNN, Random Forest (RF), and the Adaptive Neural Fuzzy Inference System (ANFIS) to predict potential stock returns by analyzing 20 financial statements and returns. Their portfolio selections yielded substantial excess returns.

W. Chen [15] et al. proposed a novel model, the Graph Convolutional Feature-based Convolutional Neural Network (GC-CNN), for stock prediction in 2021. This model incorporates both individual stock information and stock market data, demonstrating superior performance and adaptability for long-term stock trend prediction.

In 2021, D. Zhang et al. [16] explored the backpropagation algorithm in neural networks for stock price pattern classification and prediction, offering valuable insights for investors and traders.

In 2022, J. Hong et al. [17] introduced a correlational strategy focusing on the analysis of stock technical indicators (STI) and stock movement using neural networks and other machine learning tools. This approach aims to improve prediction accuracy and reduce error rates in stock market analysis, catering to various stockholders’ investment decisions.

2. Random Forest (RF)

Random Forest (RF) stands out as an ensemble learning technique purposefully tailored for stock selection. It draws its inspiration from the concept of decision trees and, during the training process, constructs a multitude of trees. Initially developed by Leo Breiman [18] and Adele Cutler [19], this algorithm is engineered to forge a predictive model for a target variable’s value by assimilating straightforward decision rules from the dataset’s features.

In the realm of stock selection, Random Forest employs a strategic approach. It leverages a random subset of training data and input characteristics to craft each tree within the set. This approach serves the dual purpose of mitigating overfitting concerns and bolstering the model’s capacity to generalize effectively when confronted with unseen data. By incorporating the practice of bootstrap aggregation (bagging), the algorithm further augments tree diversity and curtails variance.

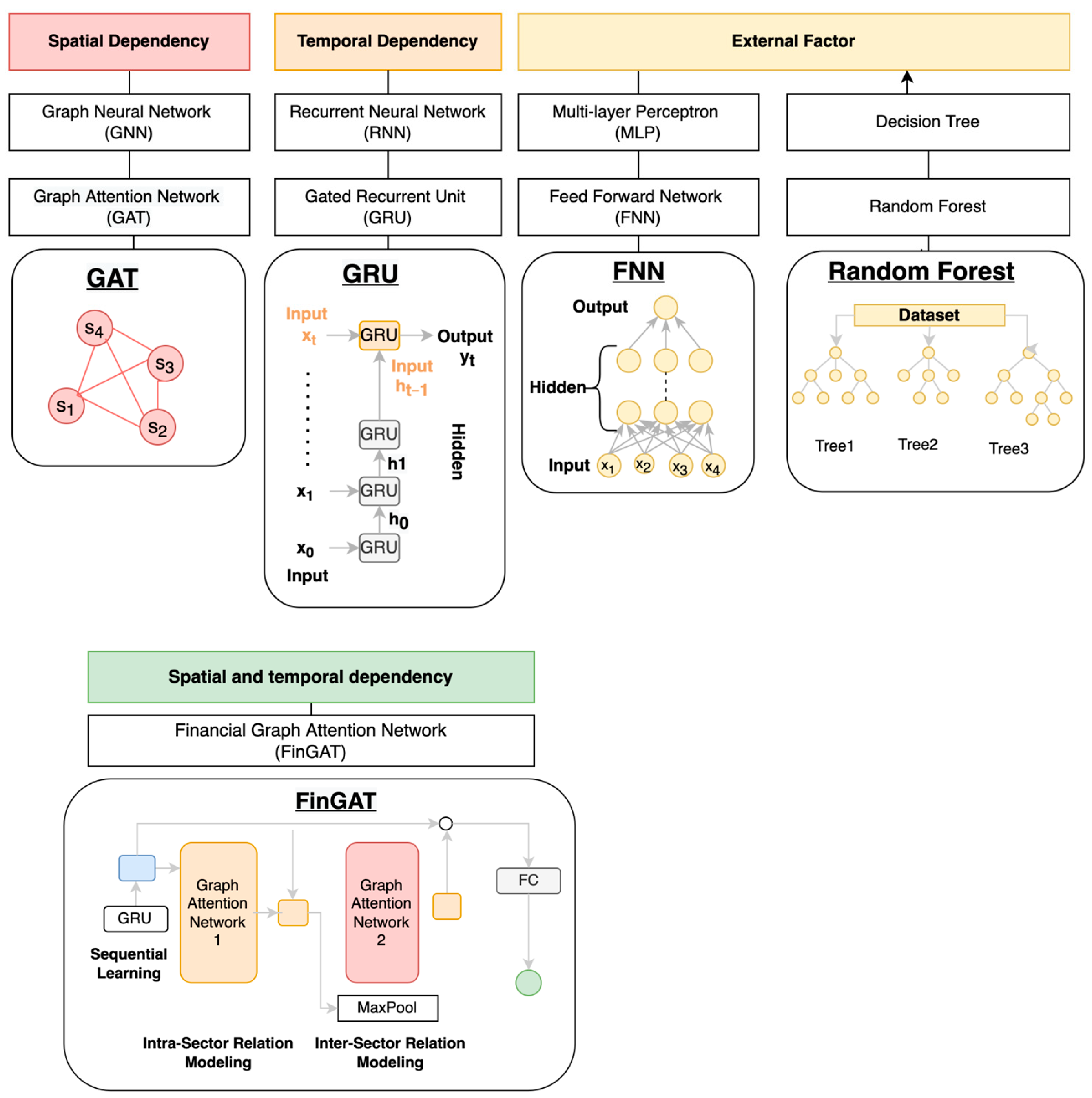

The paramount aim of employing Random Forest for stock selection revolves around forecasting stock performance and behavior, guided by a mosaic of characteristics and factors. Via an examination of historical data and patterns, this model can furnish insights into the potential value or trajectory of stocks, as depicted in Figure 1. Such insights are of paramount importance to investors and traders as they navigate the terrain of making well-informed decisions.

3. Feedforward Neural Network (FNN)

The Feedforward Neural Network (FNN) [10][20][21][22][23][24][25][26] emerges as a robust artificial neural network model with notable relevance in the domain of stock selection. Typically, it consists of three or more layers, encompassing an input layer, at least one hidden layer, and an output layer. As depicted in Figure 1, each neuron within a layer establishes connections with every neuron in the subsequent layer.

In the context of stock selection, FNNs are harnessed to model and dissect intricate non-linear relationships between input variables and desired outcomes, such as forecasting stock returns or identifying potential investment prospects. The FNN’s prowess in grasping complex data patterns and dependencies positions it as a highly suitable tool for this endeavor.

The inception of FNN can be traced back to 1990 when Kimoto et al. [21] published its use for forecasting buying and selling signals for the TOPIX index, spanning from January 1987 to September 1989.

In summary, the FNN plays an invaluable role in stock selection by adeptly modeling and scrutinizing non-linear associations between inputs and outputs. Leveraging the backpropagation algorithm, the FNN can be trained to enhance its performance and elevate the precision of stock predictions and investment decisions.

4. Gate Recurrent Unit (GRU)

The Gated Recurrent Unit (GRU) is a recurrent neural network (RNN) architecture introduced by Kyunghyun Cho et al. [27] in 2014. It exhibits similarities with the long-short-term memory (LSTM) [23] network and delivers comparable performance. Nevertheless, GRU stands out for its efficiency, as it necessitates fewer parameters, resulting in computational savings compared to LSTM. You can observe the architecture of GRU in Figure 1.

GRU is expressly tailored to handle sequential data, enabling the smooth flow of information from one step to the next. In 2018, M.A. Hossain et al. [28] successfully demonstrated its efficiency in capturing temporal dependencies in sequential data, making it a promising tool for stock selection. Notably, when tested with S&P500 data, it exhibited superior capability in managing the stochastic nature of stock price movements, thus minimizing errors.

In summary, GRU, with its adept handling of sequential data, proves highly effective in analyzing historical stock data and uncovering influential patterns and trends that can impact future stock performance. As a result, GRU assumes a pivotal role in stock prediction models, contributing to the precision of stock selection for investment purposes.

5. Graph Attention Network (GAT)

An escalating body of research is delving into the application of graph neural networks (GNNs) within the financial realm, driven by their aptitude for capturing the intricate interconnections between stocks. A study published in 2021 [26] synthesized the typical architectures of GNNs deployed in the financial sector.

The Graph Attention Network (GAT) [29] is a specific subtype of graph neural network (GNN) renowned for its proficiency in dissecting the intricate relationships prevalent in stock markets. The financial domain has witnessed a growing number of investigations delving into the utilization of graph neural networks (GNNs) due to their adeptness at comprehending the intricate linkages between stocks. This research has neatly outlined the prevailing structural patterns of GNNs as applied in finance.

6. Financial Graph Attention Network (FinGAT)

In 2021, Hsu, Y. L. et al. [30] introduced an innovative network named FinGAT, which amalgamates the capabilities of the Gated Recurrent Unit (GRU) and the Graph Attention Network (GAT) to forecast stock returns using price data. This method ranked stocks based on their predicted returns and constructed portfolios accordingly. The dataset encompassed 100 stocks in the Taiwan stock market, 424 in the S&P500 index, and 1026 in the NASDAQ index. Impressively, FinGAT outperformed other competing models, including FNN, GRU, and RankLSTM.

FinGAT stands as an advanced neural network meticulously designed for the precise prediction of stock returns. It effectively harnesses the power of graph attention mechanisms to grasp the intricate relationships between diverse stocks. The system comprises three pivotal components: the Gated Recurrent Unit (GRU) for sequential learning, the intra-sector relationship within the Graph Attention Network (GAT), and the inter-sector relationship of GAT, as visualized in Figure 1. The synergy of GAT and GRU is the defining attribute of FinGAT, enabling it to efficiently comprehend and leverage the relationships both within and among sectors of stocks.

References

- Yu, H.; Chen, R.; Zhang, G. A SVM stock selection model within PCA. Procedia Comput. Sci. 2014, 31, 406–412.

- Zhang, X.-d.; Li, A.; Pan, R. Stock trend prediction based on a new status box method and AdaBoost probabilistic support vector machine. Appl. Soft Comput. 2016, 49, 385–398.

- Sabbar, K.; El Kharrim, M. Average variance portfolio optimization using machine learning-based stock price prediction case of renewable energy investments. In E3S Web of Conferences; EDP Sciences: Ulys, France, 2023; Volume 412, p. 01077.

- Dhingra, V.; Sharma, A.; Gupta, S.K. Sectoral portfolio optimization by judicious selection of financial ratios via PCA. Optim. Eng. 2023, 1–38.

- Olorunnimbe, K.; Viktor, H. Deep learning in the stock market—A systematic survey of practice, backtesting, and applications. Artif. Intell. Rev. 2023, 56, 2057–2109.

- Ibidapo, I.; Adebiyi, A.; Okesola, O. Soft computing techniques for stock market prediction: A literature survey. Covenant J. Inform. Commun. Technol. 2017, 5, 1–28.

- Dhokane, R.M.; Sharma, O.P. A Comprehensive Review of Machine Learning for Financial Market Prediction Methods. In Proceedings of the 2023 International Conference on Emerging Smart Computing and Informatics (ESCI), Pune, India, 1–3 March 2023; pp. 1–8.

- Graham, B.; Dodd, D.L.F.; Cottle, S.; Tatham, C. Security Analysis: Principles and Technique; McGraw-Hill: New York, NY, USA, 1962.

- Quah, T.-S.; Srinivasan, B.; Lee, M. Segmental Stock Market Prediction Using Neural Network. In Proceedings of the Applied Informatics-Proceedings, Innsbruck, Austria, 15–18 February 1999; pp. 23–24.

- Eakins, S.G.; Stansell, S.R. Can value-based stock selection criteria yield superior risk-adjusted returns: An application of neural networks. Int. Rev. Financ. Anal. 2003, 12, 83–97.

- Quah, T.-S. DJIA stock selection assisted by neural network. Expert Syst. Appl. 2008, 35, 50–58.

- Namdari, A.; Li, Z.S. Integrating fundamental and technical analysis of stock market through multi-layer perceptron. In Proceedings of the 2018 IEEE Technology and Engineering Management Conference (TEMSCON), Evanston, IL, USA, 28 June–1 July 2018; pp. 1–6.

- Lu, Z.-Y. A Deep Reinforcement Learning-Enabled Portfolio Management System with Quarterly Stock Re-Selection Based on Financial Statements. Master’s Thesis, National Yang Ming Chiao Tung University, Taiwan, China, 2022.

- Huang, Y.; Capretz, L.F.; Ho, D. Machine learning for stock prediction based on fundamental analysis. In Proceedings of the 2021 IEEE Symposium Series on Computational Intelligence (SSCI), Orlando, FL, USA, 5–7 December 2021; pp. 1–10.

- Chen, W.; Jiang, M.; Zhang, W.-G.; Chen, Z. A novel graph convolutional feature based convolutional neural network for stock trend prediction. Inf. Sci. 2021, 556, 67–94.

- Zhang, D.; Lou, S. The application research of neural network and BP algorithm in stock price pattern classification and prediction. Future Gener. Comput. Syst. 2021, 115, 872–879.

- Hong, J.; Han, P.; Rasool, A.; Chen, H.; Hong, Z.; Tan, Z.; Lin, F.; Wei, S.X.; Jiang, Q. A Correlational Strategy for the Prediction of High-Dimensional Stock Data by Neural Networks and Technical Indicators. In International Conference on Big Data and Security; Springer: Singapore, 2022; pp. 405–419.

- Breiman, L. Random forests. Mach. Learn. 2001, 45, 5–32.

- Cutler, A.; Cutler, D.R.; Stevens, J.R. Random forests. In Ensemble Machine Learning: Methods and Applications; Springer: New York, NY, USA, 2012; pp. 157–175.

- Svozil, D.; Kvasnicka, V.; Pospichal, J. Introduction to multi-layer feed-forward neural networks. Chemom. Intell. Lab. Syst. 1997, 39, 43–62.

- Kimoto, T.; Asakawa, K.; Yoda, M.; Takeoka, M. Stock market prediction system with modular neural networks. In Proceedings of the 1990 IJCNN International Joint Conference on Neural Networks, San Diego, CA, USA, 17–21 June 1990; pp. 1–6.

- Quah, T.-S. Improving returns on stock investment through neural network selection. In Artificial Neural Networks in Finance and Manufacturing; IGI Global: Hershey, PA, USA, 2006; pp. 152–164.

- Chung, J.; Gulcehre, C.; Cho, K.; Bengio, Y. Empirical evaluation of gated recurrent neural networks on sequence modeling. arXiv 2014, arXiv:1412.3555.

- Matsunaga, D.; Suzumura, T.; Takahashi, T. Exploring graph neural networks for stock market predictions with rolling window analysis. arXiv 2019, arXiv:1909.10660.

- Tsai, Y.-C.; Chen, C.-Y.; Ma, S.-L.; Wang, P.-C.; Chen, Y.-J.; Chang, Y.-C.; Li, C.-T. FineNet: A joint convolutional and recurrent neural network model to forecast and recommend anomalous financial items. In Proceedings of the 13th ACM Conference on Recommender Systems, Copenhagen, Denmark, 16–20 September 2019; pp. 536–537.

- Wang, J.; Zhang, S.; Xiao, Y.; Song, R. A review on graph neural network methods in financial applications. arXiv 2021, arXiv:2111.15367.

- Cho, K.; Van Merriënboer, B.; Gulcehre, C.; Bahdanau, D.; Bougares, F.; Schwenk, H.; Bengio, Y. Learning phrase representations using RNN encoder-decoder for statistical machine translation. arXiv 2014, arXiv:1406.1078.

- Hossain, M.A.; Karim, R.; Thulasiram, R.; Bruce, N.D.; Wang, Y. Hybrid deep learning model for stock price prediction. In Proceedings of the 2018 IEEE Symposium Series on Computational Intelligence (SSCI), Bangalore, India, 18–21 November 2018; pp. 1837–1844.

- Veličković, P.; Cucurull, G.; Casanova, A.; Romero, A.; Lio, P.; Bengio, Y. Graph attention networks. arXiv 2017, arXiv:1710.10903.

- Hsu, Y.-L.; Tsai, Y.-C.; Li, C.-T. FinGAT: Financial Graph Attention Networks for Recommending Top-KK Profitable Stocks. IEEE Trans. Knowl. Data Eng. 2021, 35, 469–481.

- Scarselli, F.; Gori, M.; Tsoi, A.C.; Hagenbuchner, M.; Monfardini, G. The graph neural network model. IEEE Trans. Neural Netw. 2008, 20, 61–80.

- Medsker, L.R.; Jain, L. Recurrent neural networks. Des. Appl. 2001, 5, 2.

More

Information

Contributors

MDPI registered users' name will be linked to their SciProfiles pages. To register with us, please refer to https://encyclopedia.pub/register

:

View Times:

1.0K

Revisions:

3 times

(View History)

Update Date:

18 Dec 2023

Notice

You are not a member of the advisory board for this topic. If you want to update advisory board member profile, please contact office@encyclopedia.pub.

OK

Confirm

Only members of the Encyclopedia advisory board for this topic are allowed to note entries. Would you like to become an advisory board member of the Encyclopedia?

Yes

No

${ textCharacter }/${ maxCharacter }

Submit

Cancel

Back

Comments

${ item }

|

More

No more~

There is no comment~

${ textCharacter }/${ maxCharacter }

Submit

Cancel

${ selectedItem.replyTextCharacter }/${ selectedItem.replyMaxCharacter }

Submit

Cancel

Confirm

Are you sure to Delete?

Yes

No