Your browser does not fully support modern features. Please upgrade for a smoother experience.

Submitted Successfully!

Thank you for your contribution! You can also upload a video entry or images related to this topic.

For video creation, please contact our Academic Video Service.

Video Upload Options

We provide professional Academic Video Service to translate complex research into visually appealing presentations. Would you like to try it?

Cite

If you have any further questions, please contact Encyclopedia Editorial Office.

Lee, B.; Park, S. Competitiveness for Smart Technology Diffusion of Construction Industry. Encyclopedia. Available online: https://encyclopedia.pub/entry/25553 (accessed on 07 February 2026).

Lee B, Park S. Competitiveness for Smart Technology Diffusion of Construction Industry. Encyclopedia. Available at: https://encyclopedia.pub/entry/25553. Accessed February 07, 2026.

Lee, Baul, Seung-Kook Park. "Competitiveness for Smart Technology Diffusion of Construction Industry" Encyclopedia, https://encyclopedia.pub/entry/25553 (accessed February 07, 2026).

Lee, B., & Park, S. (2022, July 27). Competitiveness for Smart Technology Diffusion of Construction Industry. In Encyclopedia. https://encyclopedia.pub/entry/25553

Lee, Baul and Seung-Kook Park. "Competitiveness for Smart Technology Diffusion of Construction Industry." Encyclopedia. Web. 27 July, 2022.

Copy Citation

The fourth industrial revolution (4IR) emerged as a major issue at the 2016 World Economic Forum in Davos. Countries are trying to implement various policies from a preemptive point of view to respond to the fourth industrial revolution. Especially, the construction industry is also going through huge technological innovations, affected by 4IR. And technological innovation leads to improvements in various project outcomes and is a key factor that greatly affects the development of the construction industry.

smart technology

industrial competitiveness

diffusion of innovation

digitization

construction industry

contract

1. Introduction

1.1. Fourth Industrial Revolution and Construction Industry

The fourth industrial revolution (4IR) emerged as a major issue at the 2016 World Economic Forum in Davos. Countries are trying to implementing various policies from a preemptive point of view to respond to the fourth industrial revolution. In the UK, the “Construction 2025” strategy aims to reduce construction period by 50% through research and development in digital design, cutting-edge materials, and innovation in new technologies, reducing carbon emissions by 50% and reducing overall cost and life-cycle costs by 33% [1]. The German government announced its “Industry 4.0” strategy and selected nine key technologies, such as big data, self-aware robots, and simulations, as future drivers for its manufacturing industry and is pushing ahead with its evolutionary strategy [2]. The Japanese government is pushing for “I-Construction” to cope with the productivity degradation caused by the expected manpower shortage of the construction industry in the future. This is a policy that utilizes new technologies such as ICT throughout the production process and aims to improve the productivity of the construction industry by 2025 [3]. The Chinese government has announced its “China Manufacturing 2025” strategy, which focuses on 10 key areas such as IT technology, digital control, and robots through innovation, quality, and green development [4]. These policy trends are considered as a center of the key strategy for national industry development in the future.

The construction industry is also going through huge technological innovations, affected by 4IR. The construction industry generally has been considered as stuck with labor-centered construction, low-tech images, low productivity, and poor quality [5][6][7][8][9]. In addition, this industry tends to adapt slowly to new technologies and has conditions where it is difficult for innovation to take place [10][11]. This is a unique characteristic of the construction industry, and the challenge of innovation is applying the technology used in other industries to the construction industry [12][13]. Meanwhile, 4IR is able to create an opportunity for the construction industry to bring a much higher efficiency than ever before in terms of productivity, the business model, and the value chain. This opportunity is possible, via a convergence between existing technologies and emerging technologies from 4IR, and this change is called Construction 4.0 [13][14][15]. In the 4IR trend, Construction 4.0 represents a change in the construction industry, ranging from automated construction in the construction phase to high-level digitization by connecting virtual space and real construction projects [14][15]. The innovative technologies arising from the transition to Construction 4.0 are also called smart technologies [12][16], which improve the productivity, safety, and quality of the construction project [11][17][18][19][20]. Therefore, technological innovation leads to improvements in various project outcomes and is a key factor that greatly affects the development of the construction industry [21][22].

1.2. Necessity of Industry Competitiveness

Smart technology located in the center of technological innovation can change the paradigm of productivity in the construction industry, so construction firms are trying to utilize smart technology. In order to expand smart technology into the construction industry as a whole, the various factors of the industry must be corresponding with the acceptance condition of technology. The construction industry as public contracting work is more sensitive to government policy than other industries. The economic stimulation policies based on the construction industry have led to an increase in the volume and budget of construction projects, which affects the economic stimulus in the construction market and the impact of related industries. In addition, there are various stakeholders that comprise the construction industry. In particular, smart technology has unique characteristics in which the source technology of various industries is applied to construction technology in the project phases [15][23]. Source technologies such as sensors, drones, IoTs, and robots are developed in the electronics, telecommunications, and machinery industries, but these technologies are used in various ways in the construction industry for aircraft surveys, as safety sensors, and in robotics construction. Moreover, since the performance of the project is affected by various structured aspects such as systems, contracts, regulations, etc., institutional perspectives should also be considered for technical innovation in the construction industry [24][25][26][27]. As set out in the above, an industrial approach needs to consider a wide range of aspects, from the introduction of smart technology by companies to government policies.

2. The Diffusion of Innovation

In order to consider the industrial competitiveness, the current status of a country regarding the acceptance of innovation needs to be understood. This is because industrial competitiveness changes dynamically due to the country’s efforts for improving competitive [28]. In this regard, the national background for technology innovation needs to be understood about the innovation diffusion of users in the construction industry as well as the country’s policy activities. In other words, experts dealing with technology have to be considered as innovation adopters and national policies relating to smart technology have to be reviewed in detail.

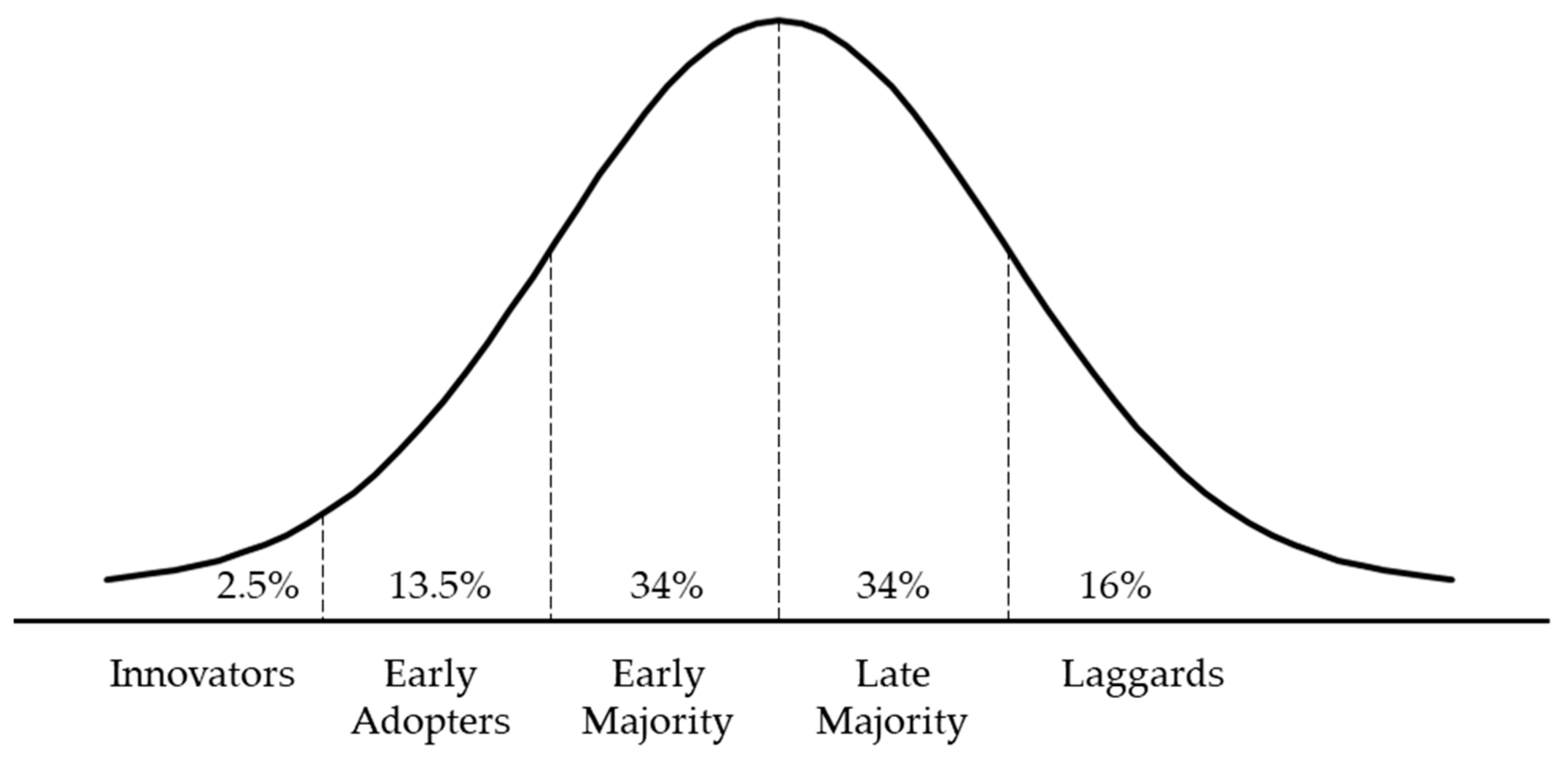

The diffusion of innovation theory (DIT) describes the process of accepting and adopting innovation, regarding the innovation of novelty felt by the acceptor, and has been studied in a wide variety of fields [29][30][31][32][33]. Rogers first proposed the theory of diffusion of innovation in 1962, which has evolved into a five-step study of the property of innovation and an acceptor perspective on innovation [34]. In particular, the innovation-acceptance curve is able to classify innovation adopters and indicates the size of a group varies depending on the period since innovation was introduced. It is significant in that it has shifted primarily from a conceptual study of the property and diffusion process of innovation to an acceptor perspective that accepts innovation over time [34]. The innovation-acceptance curve is described in five stages over time from the perspective of the acceptor who accepts the innovation (Figure 1). First, innovators are aggressive in innovation, adventurous, and willing to actively embrace uncertainty. Second, early adopters form a decisive cluster of large groups as innovations spread, which has a significant impact on innovation as groups discuss prior to adoption. Third, the early majority refers to layers in which innovations are accepted and adopted before they spread and reach their average values. Fourth, the majority is cautious and passive, showing a tendency to adopt innovation after it reaches an average point. Fifth, non-innovators are very unlikely to adopt innovation because they are negative about it and tend to choose to be very secure. From the perspective of accepting innovation, the innovation-acceptance curve shows that sales of innovative products are distributed with a bell-shaped curve when an innovation is released to the market. This curve separates the process of settling in the market from the time when an innovative technology appears in the market, which makes it easy to understand the current state of the industry where innovative technology is being introduced. Therefore, this research studies the current status of the introduction of smart technology in the KCI through the innovation-acceptance curve.

Figure 1. Adopter categorization on the basis of innovativeness.

3. Policy in Korean Construction Industry

The Korean government announced the “4th Industrial Revolution Response Strategy” in 2017 to respond to 4IR. Korea’s Ministry of Land, Infrastructure and Transport announced the “6th Construction Technology Promotion Framework Plan” at the end of 2017 to reflect the fourth industrial revolution and respond to government policy directions. Since then, with the announcement of the “Smart Construction Technology Roadmap” as a detailed action plan, for the basic plan, the KCI has begun to move toward smart technology in earnest (Table 1). This roadmap is in the early stages of introducing technologies that develop other technologies, and has been conducting pilot tests from 2020 while establishing short-term goals to establish a foundation for using smart technologies by 2025. It also aims to complete automation of the construction industry by 2030 from a long-term perspective.

Table 1. Smart technology policy in KCI.

| Smart Technology Policies | Governments | Date | Policy Goals |

|---|---|---|---|

| 4th Industrial Revolution Response Strategy [35] | A 1 | April 2017 | Four goals are presented, such as smart land, transportation service industry innovation, public infrastructure safety efficiency improvement, and innovation foundation. |

| 4th Industrial Revolution Response Plan I-KOREA [36] | B 2 | November 2017 | Challenges are promoted by securing technology for growth engines, creating industrial infrastructure/ecosystems, and responding to changes in future society. |

| 6th Construction Technology Promotion Framework Plan [37] | A | December 2017 | It will present “Smart Construction 2025”, which is applied by BIM and AI as its vision by 2025. |

| Construction Industry Innovation Plan [38] | A | June 2018 | Presentation of innovation measures on four themes, such as technology, production structure, market order, and jobs. |

| Smart Construction Technology Roadmap [39] | A | October 2018 | A roadmap is presented to specify the tasks implemented in the “6th Construction Technology Promotion Framework Plan”. |

| Construction Engineering Development Plan [40] | C 3 | September 2020 | Proposal of paradigm shift and smart-construction engineering promotion and development centered on high value-added construction engineering. |

1 A = the Ministry of Land, Infrastructure and Transport, 2 B = the 4th Industrial Revolution Committee, 3 C = joint government departments.

In order to understand the current status of smart technology spreading in the KCI, an interview with an expert was conducted on policies and the status of government policies. According to the interview, a few major firms were using smart technologies, but construction firms outside the top five in revenue were only aware of smart technologies. A common situation in the small number of major firms utilizing technology is that they are building independent teams to have smart-technology expertise, because they have expectations for business performance despite uncertainties related to the verification of smart technology. It started as a separate task-force team and operated within the firm as a project-support team. A common opinion of most construction firms is that they do not utilize smart technology, as they were collecting technical information by surveying the market situation from a risk-avoidance perspective, along with having doubts about the utility of smart technology. Although there is no separate smart-technology team, the management-support team has been collecting information or visiting sites utilizing technology.

Despite the government’s activation policy, the status of the KCI is one of restrictively using smart technology. A few major firms were organizing their own teams to spread technical information to project departments and to provide guidance on technology utilization, and they were exploring construction sites for finding smart-technology needs. However, most construction firms have observed, rather than actively accepted, smart technology and have avoided the potential risks of unfamiliar technology. Firms utilizing smart technologies were less than 1% of the whole number of construction firms, ones that could handle the potential risks, had formed a special organization within the firm, and had tried to use technologies on their construction sites. Thus, considering the circumstances of the policies and firms, KCI was considered as having a few innovators that led to smart-technology application in the early stages of technology introduction, which implies that it is important to be expanding smart technology to the construction industry as a whole.

4. Industry Competitiveness

The theory of industrial competitiveness was largely classified as a theory of national competitiveness, and various theories have emerged over time. In the 1930s, American economists developed the structural–conduct–performance (SCP) model to understand the causal relationship between the environment, behavior, and performance of a company, in an attempt to eliminate factors that hinder competition in the industry. Starting with this, research on competitiveness from an industry perspective has continued to develop [41]. Based on the SCP model, the most influential model presented as an analysis of the corporate perspective is the five-forces framework, developed by Michael Porter [42]. However, the model is limited in that it does not describe specific competitive strategies between companies, because it describes the industrial structure as a static analytic component of changes in industrial trends. Therefore, the proposed model to overcome these limitations is the diamond model [43].

The diamond model explains that a country’s competitiveness is due to environmental conditions, including the characteristics of the industry. These environmental conditions have Factor Condition, Demand Condition, Firm Strategy, Structure and Rivalry, and Related and Supporting Industry as endogenous variables, and Governance and Chance as exogenous variables [28]. For each factor, the endogenous and exogenous variables are divided as follows. Factor Condition represents everything in the human, technological, resource, and supply chain that is fundamental to production. It is divided into basic elements such as natural resources, workers, and advanced elements such as technology. Demand Condition refers to the presence of local and important consumers under market conditions that facilitate the continuous research on and development of products and businesses. In general, market size and demand can be viewed as related factors. Firm Strategy, Structure, and Rivalry derive the overall structure and strategy in which an enterprise is created, organized, and operated in a country, indicating the extent to which it can continue to gain a competitive advantage. Related and Supporting Industry indicates the presence of internationally competing related industries or support industries. These industries support target industries or competitiveness and make production activities work well. Government affects national competitiveness externally through the role of regulations on trade, industrial competition, etc., and Chance can be an unexpected opportunity for related industries through events such as war, climate change, and social events. Porter suggested that the diamond model consists of these endogenous and exogenous variables, which affect each other, and endogenous elements are influenced by exogenous variables.

The diamond model can effectively analyze the competitiveness of industries [44], and a lot of research applying this model has been conducted in various industries, including the construction industry [45][46][47][48][49][50][51]. As such, the model provides a good framework for analyzing the concept of competitiveness at the national level and provides directions for presenting elements that diagnose the competitiveness of the industry [47]. Therefore, this research intends to derive and analyze the industrial competitiveness of smart technology in the construction industry by utilizing the diamond model.

References

- HM Government. Construction 2025-Industrial Strategy: Government and Industry in Partnership; HM Government: London, UK, 2013.

- Macdougall, W. Industrie 4.0: Smart Manufacturing for the Future; Germany Trade & Invest: Berlin, Germany, 2014.

- Tateyama, K. A New Stage of Construction in Japan i-Construction. IPA News Lett. 2017, 2, 2–11.

- Li, L. China’s manufacturing locus in 2025: With a comparison of “Made-in-China 2025” and “Industry 4.0”. Technol. Forecast Soc. Change 2018, 135, 66–74.

- Opoku, D.G.J.; Perera, S.; Osei-Kyei, R.; Rashidi, M. Digital twin application in the construction industry: A literature review. J. Build. Eng. 2021, 40, 102726.

- Al-Qutaifi, S.; Nazari, A.; Bagheri, A. Mechanical properties of layered geopolymer structures applicable in concrete 3D-printing. Constr. Build. Mater. 2018, 176, 690–699.

- Håkansson, H.; Ingemansson, M. Industrial renewal within the construction network. Constr. Manag. Econ. 2013, 31, 40–61.

- National Research Council. Advancing the Competitiveness and Efficiency of the US Construction Industry; National Academies Press: Washington, DC, USA, 2009.

- Buswell, R.A.; Soar, R.C.; Gibb, A.G.; Thorpe, A. Freeform construction: Mega-scale rapid manufacturing for construction. Autom. Constr. 2007, 16, 224–231.

- Kissi, E.; Aigbavboa, C.; Kuoribo, E. Emerging technologies in the construction industry: Challenges and strategies in Ghana. Constr. Innov. 2022. ahead of print.

- Gerbert, P.; Castagnino, S.; Rothballer, C.; Renz, A.; Filitz, R. Digital in Engineering and Construction; The Boston Consulting Group: Boston, MA, USA, 2016; pp. 1–22.

- Craveiroa, F.; Duartec, J.P.; Bartoloa, H.; Bartolod, P.J. Additive manufacturing as an enabling technology for digital construction: A perspective on Construction 4.0. Sustain. Dev. 2019, 4, 6.

- Baduge, S.K.; Thilakarathna, S.; Perera, J.S.; Arashpour, M.; Sharafi, P.; Teodosio, B.; Mendis, P. Artificial intelligence and smart vision for building and construction 4.0: Machine and deep learning methods and applications. Autom. Constr. 2022, 141, 104440.

- Hwang, B.G.; Ngo, J.; Teo, J.Z.K. Challenges and strategies for the adoption of smart technologies in the construction industry: The case of Singapore. J. Manag. Eng. 2022, 38, 05021014.

- Irizarry, J. Construction 4.0: An Innovation Platform for the Built Environment; Routledge: Oxfordshire, UK, 2020.

- Edirisinghe, R. Digital skin of the construction site: Smart sensor technologies towards the future smart construction site. Eng. Constr. Arch. 2018, 26, 184–223.

- Baek, J.; Choi, Y. Smart glasses-based personnel proximity warning system for improving pedestrian safety in construction and mining sites. Int. J. Environ. Res. Public Health 2020, 17, 1422.

- De Soto, B.G.; Agustí-Juan, I.; Hunhevicz, J.; Joss, S.; Graser, K.; Habert, G.; Adey, B.T. Productivity of digital fabrication in construction: Cost and time analysis of a robotically built wall. Autom. Constr. 2018, 92, 297–311.

- Osunsanmi, T.O.; Aigbavboa, C.; Oke, A. Construction 4.0: The future of the construction industry in South Africa. Int. J. Civ. Environ. Eng. 2018, 12, 206–212.

- Wang, C.; Cho, Y.K. Smart scanning and near real-time 3D surface modeling of dynamic construction equipment from a point cloud. Autom. Constr. 2015, 49, 239–249.

- Tian, G.; Chu, J.; Hu, H.; Li, H. Technology innovation system and its integrated structure for automotive components remanufacturing industry development in China. J. Clean. Prod. 2014, 85, 419–432.

- Van de Ven, A.H.; Garud, R. Innovation and industry development: The case of cochlear implants. Res. Technol. Innov. Manag. Policy 1993, 5, 1–46.

- Niu, Y.; Lu, W.; Chen, K.; Huang, G.G.; Anumba, C. Smart construction objects. J. Comput. Civ. Eng. 2016, 30, 04015070.

- Park, H.; Han, S.H.; Rojas, E.M.; Son, J.; Jung, W. Social network analysis of collaborative ventures for overseas construction projects. J. Constr. Eng. Manag. 2011, 137, 344–355.

- Zaghloul, R.; Hartman, F. Construction contracts: The cost of mistrust. Int. J. Proj. Manag. 2003, 21, 419–424.

- Luo, Y. Contract, cooperation, and performance in international joint ventures. Strateg. Manag. J. 2002, 23, 903–919.

- William, I.C.; Ashley, D.B. Impact of various construction contract clauses. J. Constr. Eng. Manag. 1987, 113, 501–521.

- Porter, M.E. The competitive advantage of nations. Compet. Intell. Rev. 1990, 1, 1–14.

- Müller, S.; Rode, J. The adoption of photovoltaic systems in Wiesbaden, Germany. Econ. Innov. N. Technol. 2013, 22, 519–535.

- Manley, K. Against the odds: Small firms in Australia successfully introducing new technology on construction projects. Res. Policy 2008, 37, 1751–1764.

- Meseguer, C. Policy learning, policy diffusion, and the making of a new order. Ann. Am. Acad. Pol. Soc. Sci. 2005, 598, 67–82.

- Brown, S.L.; Eisenhardt, K.M. Product development: Past research, present findings, and future directions. Acad. Manag. Rev. 1995, 20, 343–378.

- Moore, G.C.; Benbasat, I. Development of an instrument to measure the perceptions of adopting an information technology innovation. Inf. Syst. Res. 1991, 2, 192–222.

- Rogers, E.M. Diffusion of Innovations, 5th ed; The Free Press: New York, NY, USA, 2003.

- Ministry of Land, Infrastructure and Transport. 4th Industrial Revolution Response Strategy; Ministry of Land, Infrastructure and Transport: Sejong, Korea, 2017.

- Presidential Committee on the Fourth Industrial Revolution. 4th Industrial Revolution Response Plan I-KOREA 4.0; Presidential Committee on the Fourth Industrial Revolution: Seoul, Korea, 2017.

- Ministry of Land, Infrastructure and Transport. 6th Construction Technology Promotion Framework Plan; Ministry of Land, Infrastructure and Transport: Sejong, Korea, 2017.

- Ministry of Land, Infrastructure and Transport. Construction Industry Innovation Plan; Ministry of Land, Infrastructure and Transport: Sejong, Korea, 2018.

- Ministry of Land, Infrastructure and Transport. Smart Construction Technology Roadmap; Ministry of Land, Infrastructure and Transport: Sejong, Korea, 2018.

- Ministry of Land, Infrastructure and Transport; Ministry of Trade, Industry and Energy; Ministry of Economy and Finance. Construction Engineering Development Plan; Ministry of Land, Infrastructure and Transport: Sejong, Korea, 2020.

- Evanoff, D.D.; Fortier, D.L. Reevaluation of the structure-conduct-performance paradigm in banking. J. Financial Serv. Res. 1988, 1, 277–294.

- Barney, J.B.; Hesterly, W. Strategic Management and Competitive Advantage Concepts and Cases, 3rd ed.; Pearson: New York, NY, USA, 2005.

- Cho, S.-J.; Park, H.-H. A Study on improving the competitiveness of agri-good export sector in Korea with Porter’s Diamond Model. Int. Commer. Rev. 2011, 13, 249–274.

- Jin, B.; Moon, H.C. The diamond approach to the competitiveness of Korea’s apparel industry: Michael Porter and beyond. J. Fash. Mark. Manag. 2006, 10, 195–208.

- Öz, Ö. The Competitive Advantage of Nations: The Case of Turkey: Assessing Porter’s Framework for National Advantage; Routledge: New York, NY, USA, 2019.

- Chung, T.W. A study on logistics cluster competitiveness among Asia main countries using the Porter’s diamond model. Asian J. Shipp. Logist. 2016, 32, 257–264.

- Deng, F.; Liu, G.; Jin, Z. Factors formulating the competitiveness of the Chinese construction industry: Empirical investigation. Eng. Manag. J. 2013, 29, 435–445.

- Zhao, Z.Y.; Zuo, J.; Zillante, G.; Zhao, X.J. Foreign architectural and engineering design firms’ competitiveness and strategies in China: A diamond model study. Habitat Int. 2012, 36, 362–370.

- Kale, S.; Arditi, D. Competitive positioning in United States construction industry. J. Constr. Eng. Manag. 2002, 128, 238–247.

- Öz, Ö. Sources of competitive advantage of Turkish construction companies in international markets. Constr. Manag. Econ. 2001, 19, 135–144.

- Ofori, G. Formulating a long-term strategy for developing the construction industry of Singapore. Constr. Manag. Econ. 1994, 12, 219–231.

More

Information

Contributors

MDPI registered users' name will be linked to their SciProfiles pages. To register with us, please refer to https://encyclopedia.pub/register

:

View Times:

1.1K

Revisions:

2 times

(View History)

Update Date:

28 Jul 2022

Notice

You are not a member of the advisory board for this topic. If you want to update advisory board member profile, please contact office@encyclopedia.pub.

OK

Confirm

Only members of the Encyclopedia advisory board for this topic are allowed to note entries. Would you like to become an advisory board member of the Encyclopedia?

Yes

No

${ textCharacter }/${ maxCharacter }

Submit

Cancel

Back

Comments

${ item }

|

More

No more~

There is no comment~

${ textCharacter }/${ maxCharacter }

Submit

Cancel

${ selectedItem.replyTextCharacter }/${ selectedItem.replyMaxCharacter }

Submit

Cancel

Confirm

Are you sure to Delete?

Yes

No