Your browser does not fully support modern features. Please upgrade for a smoother experience.

Submitted Successfully!

Thank you for your contribution! You can also upload a video entry or images related to this topic.

For video creation, please contact our Academic Video Service.

| Version | Summary | Created by | Modification | Content Size | Created at | Operation |

|---|---|---|---|---|---|---|

| 1 | Danilo Simões | + 1452 word(s) | 1452 | 2022-01-13 04:07:36 | | | |

| 2 | Yvaine Wei | Meta information modification | 1452 | 2022-01-25 01:42:56 | | |

Video Upload Options

We provide professional Academic Video Service to translate complex research into visually appealing presentations. Would you like to try it?

Cite

If you have any further questions, please contact Encyclopedia Editorial Office.

Simões, D. Investments in Pinus elliottii Plantations: Real Options Analysis. Encyclopedia. Available online: https://encyclopedia.pub/entry/18708 (accessed on 07 February 2026).

Simões D. Investments in Pinus elliottii Plantations: Real Options Analysis. Encyclopedia. Available at: https://encyclopedia.pub/entry/18708. Accessed February 07, 2026.

Simões, Danilo. "Investments in Pinus elliottii Plantations: Real Options Analysis" Encyclopedia, https://encyclopedia.pub/entry/18708 (accessed February 07, 2026).

Simões, D. (2022, January 24). Investments in Pinus elliottii Plantations: Real Options Analysis. In Encyclopedia. https://encyclopedia.pub/entry/18708

Simões, Danilo. "Investments in Pinus elliottii Plantations: Real Options Analysis." Encyclopedia. Web. 24 January, 2022.

Copy Citation

The commonly used methods for the financial evaluation of plantation forest investment projects do not incorporate uncertainties and ignore the value related to flexibility. The real options analysis makes it possible to capture these values in investment projects, increasing their value and return. Investment projects in Pinus elliotti plantations that contemplate the land purchase analyzed through the real options analysis present higher financial returns than those that consider land lease, inverting the result provided by the traditional analysis.

managerial flexibility

binomial model

silvicultural practices

net present value

1. Introduction

The forest plantations require important financial contributions because they are being long-term projects, usually under conditions of uncertainty, with managerial flexibilities that can be exercised over the useful life of the biological asset. In addition to the financial aspect, the forest plantations provide multiple ecosystem services like supporting (e.g., nutrient cycling), provisioning (e.g., wood and non-wood forest products, and fresh water production), regulating (e.g., local climate regulation, carbon sequestration and storage, and preventing soil erosion), and cultural (e.g., aesthetic values, recreation, and eco-tourism) when compared to previously deforested lands [1][2][3][4].

The planting of homogeneous forests has been increasing in order to meet the growing demand for wood in world markets [5]. In Brazil, the area of forest plantations totals 9.6 million hectares. Of this total, 19.0% represents Pinus spp., with 1.8 million hectares [6].

Forest management integrates silvicultural practices and business concepts, as economic alternatives, in order to better achieve the investor’s objectives [7]. The analysis of a forest investment involves the use of techniques and criteria that compare costs and revenues inherent to the project, aiming to verify whether or not it should be implemented [8].

The commonly used methods for the financial evaluation of forest investment projects are those based on performance metrics, among which is net present value (NPV). However, NPV does not incorporate uncertainties and ignores the value related to flexibility, that is, management is not able to adapt and review decisions in response to changes in market conditions [9][10][11].

The price of wood, for example, has associated uncertainties that culminate in price fluctuations mainly due to the volatility of wood demand in the forest sector [12]. Reliable price and wood production estimates, as well as the calculation of criteria that include uncertainty, are necessary to make the decision-making process more robust [13]. The stochastic methods of investment analysis contemplate investors with possibilities that add value to the project, exploring uncertainties and, consequently, managerial flexibilities.

The real options analysis makes it possible to capture the value of managerial flexibilities in investment projects [14][15][16][17] by means of options available throughout the life of the project, increasing its value and return. This is possible when management uses real options as a way to limit possible losses and enhance or protect positive results [18][19][20] in environments with irreversibility and uncertainties, like the forest sector [21][22][23][24][25].

A real option is a right, not an obligation, to execute a particular investment project or to make certain decisions in more advanced stages of the project [20][26][27][28] at a predetermined cost called the exercise price of the option. The real value of an investment project can be assessed by combining the value provided by real options of this investment with the value of the result of traditional static NPV [29][30]. However, as real options are usually not traded in the market, each one is exclusively defined by its context and needs a personalized assessment [31].

Among the methods used to calculate the value of real options is the discrete-time binomial model (CRR) [32]. The CRR model is also called the binomial tree, as the pricing process is to build a binomial tree to evaluate underlying assets over a given period of time [32][33]. This model is one of the most common tools for real options and its structure provides greater modeling flexibility to analyze multiple real options [34][35][36].

2. Deterministic Economic Model

The investment project with the land lease was viable. However, the investment project with the land purchase was not viable, as the NPV was less than zero since disbursements were not recovered over the life of the project and managers only decide to invest if the project creates value, that is, if the NPV is positive. Therefore, by the traditional analysis of investment based on discounted cash flow, the project with land purchase would be neglected and an investor would look for alternatives with a positive NPV to allocate his capital.

It is noteworthy that a traditional NPV ends to undervalue the value of an investment project, and this makes it unsuitable for risky projects [37][38] and with long planning horizons, as is the case of Pinus elliottii plantations. Thus, when accepting or rejecting investment projects based only on current information and not considering future uncertainties [39][40], inherent in the forest sector, the NPV did not reflect the potential value of the investment projects analyzed.

These weaknesses related mainly to the non-approach to flexibility by the traditional model which can cause inaccurate estimates regarding value generated by cash flows and, consequently, can lead to a devaluation of investment projects [41][42][43].

3. Stochastic Model

The premium for the deferral option was higher for the land purchase project and, consequently, the percentage valuation and ENPV were greater. The volatility of the project with purchased land was greater, and according to [44], with increased uncertainty, the option to defer becomes more valuable. This happens because that uncertainty generates a risk premium for waiting to obtain more information, which is the value of the option to defer. According to the authors of [45], this relationship shows that a higher level of uncertainty results in a higher value of deferral option.

In the execution of the binomial model, both investment projects would not be implemented immediately. The option to defer would be exercised, which would postpone the decision to invest for year two of the binomial tree, that is, within the term of the option’s maturity.

When designing an investment, its feasibility will depend on the planning and analysis of financial impacts. When solving expected cash inflows and outflows, it is expected that a well-informed forest manager has an awareness of market risks and fluctuations in projected profitability.

Incorporating the real options analysis into forest investment projects promotes the investor’s perception of risk and managerial flexibility by strategically guiding decision-making. Negotiating the right of deferral does not necessarily impose on the forest manager, when the project is implemented, its feasibility, but rather configures a perspective of opportunity for, if feasible at the time, its assimilation.

The deferral option concatenated to the underlying asset modeled the implementation of the project, aiming to improve profitability by postponing the investment until, according to [46], the emergence of favorable market conditions. Essential in conducting uncertain scenarios, this option provides high quality in management decisions [47][48].

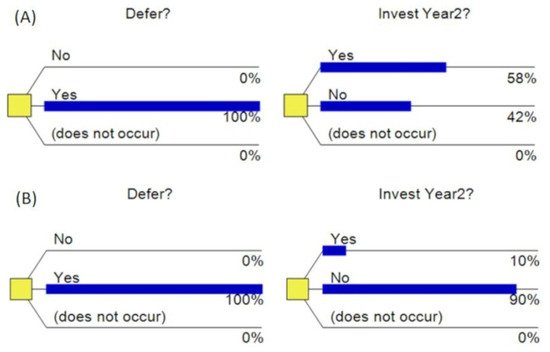

In this period, the greatest probability would be that an investment should occur for the land lease project (Figure 1A), mainly because the project already has a positive NPV. On the other hand, the greatest probability would be that the option was expired, and no investment occurred in the project with land purchase (Figure 1B). As the uncertainty increases, the probability of the project being implemented at that moment decreases [49].

Figure 1. Real probability of exercising deferral option for the project with (A) land lease and (B) land purchase.

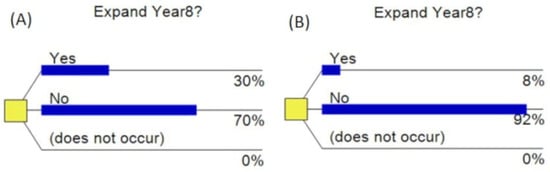

The option to expand the project should only be exercised when the market presents favorable conditions, which allows a greater investment to increase production [50][51]. Thus, the real probability of exercising the expansion option demonstrated that projects should be expanded only in the best scenarios (Figure 2A).

Figure 2. Real probability of exercising expansion option for the project with (A) land lease and (B) land purchase.

In the project with land purchase, the low probability of exercising the option to expand (8%) explained why valuation was lower compared to the other options (Figure 2B). When indicating non-expansion, it means that the present value of the project’s expected cash flows, if expanded, would not exceed the additional disbursement needed to finance the expansion [52]. This means that when the project has a negative value, it does not obtain any value from the option to expand.

4. Conclusions

When applying a real options analysis, individually, the deferral, expansion, and abandonment options add value to investment projects in Pinus elliottii plantations.

The option to expand the forested area is the one that adds the most value to the investment project with land lease. In the investment project with land purchase, this option is abandonment.

Combined real options show the intrinsic financial potential of investment projects in Pinus elliottii plantations, as they simulate the multiple management decisions that can be exercised over a planning horizon.

Investment projects in Pinus elliotti plantations that contemplate the land purchase analyzed through the real options analysis present higher financial returns than those that consider land lease, inverting the result provided by the traditional analysis.

References

- Vihervaara, P.; Marjokorpi, A.; Kumpula, T.; Walls, M.; Kamppinen, M. Ecosystem services of fast-growing tree plantations: A case study on integrating social valuations with land-use changes in Uruguay. For. Policy Econ. 2012, 14, 58–68.

- Brockerhoff, E.G.; Jactel, H.; Parrotta, J.A.; Ferraz, S.F.B. Role of eucalypt and other planted forests in biodiversity conservation and the provision of biodiversity-related ecosystem services. For. Ecol. Manag. 2013, 301, 43–50.

- Marchi, M.; Paletto, A.; Cantiani, P.; Bianchetto, E.; De Meo, I. Comparing Thinning System Effects on Ecosystem Services Provision in Artificial Black Pine (Pinus nigra J. F. Arnold) Forests. Forest 2018, 9, 188.

- Torres, I.; Moreno, J.M.; Morales-Molino, C.; Arianoutsou, M. Ecosystem Services Provided by Pine Forests. In Pines and Their Mixed Forest Ecosystems in the Mediterranean Basin. Managing Forest Ecosystems; Ne’eman, G., Osem, Y., Eds.; Springer: Cham, Switzerland, 2021; pp. 617–629.

- Rossato, F.G.F.S.; Susaeta, A.; Adams, D.C.; Hidalgo, I.G.; de Araujo, T.D.; de Queiroz, A. Comparison of revealed comparative advantage indexes with application to trade tendencies of cellulose production from planted forests in Brazil, Canada, China, Sweden, Finland and the United States. For. Policy Econ. 2018, 97, 59–66.

- Brazilian Institute of Geography and Statistics Vegetal Extraction and Forestry Production. Available online: https://biblioteca.ibge.gov.br/visualizacao/periodicos/74/pevs_2020_v35_informativo.pdf (accessed on 20 November 2021).

- Bettinger, P.; Boston, K.; Siry, J.; Grebner, D. Forest Management and Planning; Academic Press: San Diego, CA, USA, 2019.

- De Rezende, J.L.P.; de Oliveira, A.D. Análise Econômica e Social de Projetos Florestais; UFV: Viçosa, Brazil, 2008.

- Hazra, T.; Samanta, B.; Dey, K. Real option valuation of an Indian iron ore deposit through system dynamics model. Resour. Policy 2019, 60, 288–299.

- Venetsanos, K.; Angelopoulou, P.; Tsoutsos, T. Renewable energy sources project appraisal under uncertainty: The case of wind energy exploitation within a changing energy market environment. Energy Policy 2002, 30, 293–307.

- Yao, J.-S.; Chen, M.-S.; Lin, H.-W. Valuation by using a fuzzy discounted cash flow model. Expert Syst. Appl. 2005, 28, 209–222.

- Shogren, J.F. Behavior in forest economics. J. For. Econ. 2007, 12, 233–235.

- Salles, T.T.; Nogueira, D.A.; Beijo, L.A.; da Silva, L.F. Bayesian approach and extreme value theory in economic analysis of forestry projects. For. Policy Econ. 2019, 105, 64–71.

- Allen, F.; Bhattacharya, S.; Rajan, R.; Schoar, A. The Contributions of Stewart Myers to the Theory and Practice of Corporate Finance. J. Appl. Corp. Financ. 2008, 20, 8–19.

- Borison, A. Real Options Analysis: Where Are the Emperor’s Clothes? J. Appl. Corp. Financ. 2005, 17, 17–31.

- Kumbaroğlu, G.; Madlener, R.; Demirel, M. A real options evaluation model for the diffusion prospects of new renewable power generation technologies. Energy Econ. 2008, 30, 1882–1908.

- Ford, D.N.; Lander, D.M. Real option perceptions among project managers. Risk Manag. 2011, 13, 122–146.

- Driouchi, T.; Bennett, D.J. Real Options in Management and Organizational Strategy: A Review of Decision-making and Performance Implications. Int. J. Manag. Rev. 2012, 14, 39–62.

- Miller, L.T.; Park, C.S. Decision Making Under Uncertainty—Real Options to the Rescue? Eng. Econ. 2002, 47, 105–150.

- Savolainen, J. Real options in metal mining project valuation: Review of literature. Resour. Policy 2016, 50, 49–65.

- Dyner, I.; Larsen, E.R. From planning to strategy in the electricity industry. Energy Policy 2001, 29, 1145–1154.

- Yin, R. Combining Forest-Level Analysis with Options Valuation Approach—A New Framework for Assessing Forestry Investment. For. Sci. 2001, 47, 475–483.

- Bouchaud, J.; Potters, M. Theory of Financial Risk and Derivative Pricing: From Statistical Physics to Risk Management; Cambridge University Press: Cambridge, UK, 2003.

- Santos, L.; Soares, I.; Mendes, C.; Ferreira, P. Real Options versus Traditional Methods to assess Renewable Energy Projects. Renew. Energy 2014, 68, 588–594.

- Ajak, A.D.; Lilford, E.; Topal, E. Real Option Identification Framework for Mine Operational Decision-Making. Nat. Resour. Res. 2019, 28, 409–430.

- Fichman, R.G.; Keil, M.; Tiwana, A. Beyond Valuation: “Options thinking” in IT project management. Calif. Manag. Rev. 2005, 47, 74–96.

- Triantis, A.; Borison, A. Real Options: State of the Practice. J. Appl. Corp. Financ. 2001, 14, 8–24.

- Xiao, Y.; Fu, X.; Oum, T.H.; Yan, J. Modeling airport capacity choice with real options. Transp. Res. Part B Methodol. 2017, 100, 93–114.

- Manfredo, M.R.; Shultz, C.J. Risk, Trade, Recovery, and the Consideration of Real Options: The Imperative Coordination of Policy, Marketing, and Finance in the Wake of Catastrophe. J. Public Policy Mark. 2007, 26, 33–48.

- Trigeorgis, L. The Nature of Option Interactions and the Valuation of Investments with Multiple Real Options. J. Financ. Quant. Anal. 1993, 28, 1–20.

- Lambrecht, B.M. Real options in finance. J. Bank. Financ. 2017, 81, 166–171.

- Cox, J.C.; Ross, S.A.; Rubinstein, M. Option pricing: A simplified approach. J. Financ. Econ. 1979, 7, 229–263.

- Guo, K.; Zhang, L.; Wang, T. Optimal scheme in energy performance contracting under uncertainty: A real option perspective. J. Clean. Prod. 2019, 231, 240–253.

- Herath, H.S.B.; Park, C.S. Multi-stage capital investment opportunities as compound real options. Eng. Econ. 2002, 47, 1–27.

- Ho, S.-H.; Liao, S.-H. A fuzzy real option approach for investment project valuation. Expert Syst. Appl. 2011, 38, 15296–15302.

- Hu, X.; Jie, C. Randomized Binomial Tree and Pricing of American-Style Options. Math. Probl. Eng. 2014, 2014, 291737.

- Dimitrakopoulos, R.G.; Sabour, S.A.A. Evaluating mine plans under uncertainty: Can the real options make a difference? Resour. Policy 2007, 32, 116–125.

- Lee, I.; Lee, K. The Internet of Things (IoT): Applications, investments, and challenges for enterprises. Bus. Horiz. 2015, 58, 431–440.

- Liu, X.; Ronn, E.I. Using the binomial model for the valuation of real options in computing optimal subsidies for Chinese renewable energy investments. Energy Econ. 2020, 87, 104692.

- Suttinon, P.; Nasu, S. Real Options for Increasing Value in Industrial Water Infrastructure. Water Resour. Manag. 2010, 24, 2881–2892.

- Boomsma, T.K.; Meade, N.; Fleten, S.-E. Renewable energy investments under different support schemes: A real options approach. Eur. J. Oper. Res. 2012, 220, 225–237.

- Martínez-Ceseña, E.A.; Mutale, J. Application of an advanced real options approach for renewable energy generation projects planning. Renew. Sustain. Energy Rev. 2011, 15, 2087–2094.

- Shaffie, S.S.; Jaaman, S.H. Monte Carlo on Net Present Value for Capital Investment in Malaysia. Procedia-Soc. Behav. Sci. 2016, 219, 688–693.

- Benaroch, M.; Kauffman, R.J. A Case for Using Real Options Pricing Analysis to Evaluate Information Technology Project Investments. Inf. Syst. Res. 1999, 10, 70–86.

- Golub, A.A.; Lubowski, R.N.; Piris-Cabezas, P. Business responses to climate policy uncertainty: Theoretical analysis of a twin deferral strategy and the risk-adjusted price of carbon. Energy 2020, 205, 117996.

- Cardin, M.-A.; Zhang, S.; Nuttall, W.J. Strategic real option and flexibility analysis for nuclear power plants considering uncertainty in electricity demand and public acceptance. Energy Econ. 2017, 64, 226–237.

- Cardin, M.-A. Enabling Flexibility in Engineering Systems: A Taxonomy of Procedures and a Design Framework. J. Mech. Des. 2014, 136, 011005.

- Sabri, Y.; Hadi, P.O.; Hariyanto, N. Decision Area of Distributed Generation Investment as Deferral Option in Industrial Distribution System Using Real Option Valuation. Int. J. Electr. Eng. Inform. 2016, 8, 1.

- Folta, T.B.; Johnson, D.R.; O’Brien, J. Uncertainty, irreversibility, and the likelihood of entry: An empirical assessment of the option to defer. J. Econ. Behav. Organ. 2006, 61, 432–452.

- Arango, M.A.A.; Cataño, E.T.A.; Hernández, J.D. Valoración de proyectos de energía térmica bajo condiciones de incertidumbre a través de opciones reales. Rev. Ing. Univ. Medellín 1970, 12.

- Guo, K.; Zhang, L. Guarantee optimization in energy performance contracting with real option analysis. J. Clean. Prod. 2020, 258, 120908.

- Durica, M.; Guttenova, D.; Pinda, L.; Svabova, L. Sustainable Value of Investment in Real Estate: Real Options Approach. Sustainability 2018, 10, 4665.

More

Information

Subjects:

Forestry

Contributor

MDPI registered users' name will be linked to their SciProfiles pages. To register with us, please refer to https://encyclopedia.pub/register

:

View Times:

873

Revisions:

2 times

(View History)

Update Date:

19 Apr 2022

Notice

You are not a member of the advisory board for this topic. If you want to update advisory board member profile, please contact office@encyclopedia.pub.

OK

Confirm

Only members of the Encyclopedia advisory board for this topic are allowed to note entries. Would you like to become an advisory board member of the Encyclopedia?

Yes

No

${ textCharacter }/${ maxCharacter }

Submit

Cancel

Back

Comments

${ item }

|

More

No more~

There is no comment~

${ textCharacter }/${ maxCharacter }

Submit

Cancel

${ selectedItem.replyTextCharacter }/${ selectedItem.replyMaxCharacter }

Submit

Cancel

Confirm

Are you sure to Delete?

Yes

No