Your browser does not fully support modern features. Please upgrade for a smoother experience.

Please note this is a comparison between Version 1 by Danilo Simões and Version 2 by Yvaine Wei.

The commonly used methods for the financial evaluation of plantation forest investment projects do not incorporate uncertainties and ignore the value related to flexibility. The real options analysis makes it possible to capture these values in investment projects, increasing their value and return. Investment projects in Pinus elliotti plantations that contemplate the land purchase analyzed through the real options analysis present higher financial returns than those that consider land lease, inverting the result provided by the traditional analysis.

- managerial flexibility

- binomial model

- silvicultural practices

- net present value

1. Introduction

The forest plantations require important financial contributions because they are being long-term projects, usually under conditions of uncertainty, with managerial flexibilities that can be exercised over the useful life of the biological asset. In addition to the financial aspect, the forest plantations provide multiple ecosystem services like supporting (e.g., nutrient cycling), provisioning (e.g., wood and non-wood forest products, and fresh water production), regulating (e.g., local climate regulation, carbon sequestration and storage, and preventing soil erosion), and cultural (e.g., aesthetic values, recreation, and eco-tourism) when compared to previously deforested lands [1][2][3][4][1,2,3,4].

The planting of homogeneous forests has been increasing in order to meet the growing demand for wood in world markets [5]. In Brazil, the area of forest plantations totals 9.6 million hectares. Of this total, 19.0% represents Pinus spp., with 1.8 million hectares [6].

Forest management integrates silvicultural practices and business concepts, as economic alternatives, in order to better achieve the investor’s objectives [7]. The analysis of a forest investment involves the use of techniques and criteria that compare costs and revenues inherent to the project, aiming to verify whether or not it should be implemented [8].

The commonly used methods for the financial evaluation of forest investment projects are those based on performance metrics, among which is net present value (NPV). However, NPV does not incorporate uncertainties and ignores the value related to flexibility, that is, management is not able to adapt and review decisions in response to changes in market conditions [9][10][11][9,10,11].

The price of wood, for example, has associated uncertainties that culminate in price fluctuations mainly due to the volatility of wood demand in the forest sector [12][13]. Reliable price and wood production estimates, as well as the calculation of criteria that include uncertainty, are necessary to make the decision-making process more robust [13][14]. The stochastic methods of investment analysis contemplate investors with possibilities that add value to the project, exploring uncertainties and, consequently, managerial flexibilities.

The real options analysis makes it possible to capture the value of managerial flexibilities in investment projects [14][15][16][17][19,20,21,22] by means of options available throughout the life of the project, increasing its value and return. This is possible when management uses real options as a way to limit possible losses and enhance or protect positive results [18][19][20][23,24,25] in environments with irreversibility and uncertainties, like the forest sector [21][22][23][24][25][26,27,28,29,30].

A real option is a right, not an obligation, to execute a particular investment project or to make certain decisions in more advanced stages of the project [20][26][27][28][25,31,32,33] at a predetermined cost called the exercise price of the option. The real value of an investment project can be assessed by combining the value provided by real options of this investment with the value of the result of traditional static NPV [29][30][34,35]. However, as real options are usually not traded in the market, each one is exclusively defined by its context and needs a personalized assessment [31][36].

Among the methods used to calculate the value of real options is the discrete-time binomial model (CRR) [32][37]. The CRR model is also called the binomial tree, as the pricing process is to build a binomial tree to evaluate underlying assets over a given period of time [32][33][37,38]. This model is one of the most common tools for real options and its structure provides greater modeling flexibility to analyze multiple real options [34][35][36][39,40,41].

2. Deterministic Economic Model

The investment project with the land lease was viable. However, the investment project with the land purchase was not viable, as the NPV was less than zero since disbursements were not recovered over the life of the project and managers only decide to invest if the project creates value, that is, if the NPV is positive. Therefore, by the traditional analysis of investment based on discounted cash flow, the project with land purchase would be neglected and an investor would look for alternatives with a positive NPV to allocate his capital. It is noteworthy that a traditional NPV ends to undervalue the value of an investment project, and this makes it unsuitable for risky projects [37][38][84,85] and with long planning horizons, as is the case of Pinus elliottii plantations. Thus, when accepting or rejecting investment projects based only on current information and not considering future uncertainties [39][40][86,87], inherent in the forest sector, the NPV did not reflect the potential value of the investment projects analyzed. These weaknesses related mainly to the non-approach to flexibility by the traditional model which can cause inaccurate estimates regarding value generated by cash flows and, consequently, can lead to a devaluation of investment projects [41][42][43][88,89,90].3. Stochastic Model

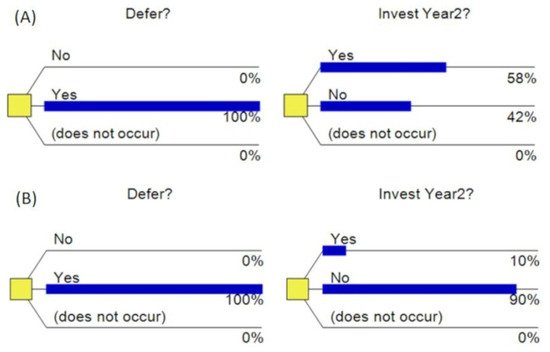

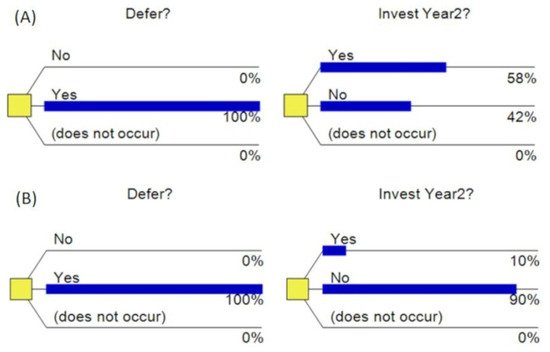

The premium for the deferral option was higher for the land purchase project and, consequently, the percentage valuation and ENPV were greater. The volatility of the project with purchased land was greater, and according to [44][91], with increased uncertainty, the option to defer becomes more valuable. This happens because that uncertainty generates a risk premium for waiting to obtain more information, which is the value of the option to defer. According to the authors of [45][92], this relationship shows that a higher level of uncertainty results in a higher value of deferral option. In the execution of the binomial model, both investment projects would not be implemented immediately. The option to defer would be exercised, which would postpone the decision to invest for year two of the binomial tree, that is, within the term of the option’s maturity. When designing an investment, its feasibility will depend on the planning and analysis of financial impacts. When solving expected cash inflows and outflows, it is expected that a well-informed forest manager has an awareness of market risks and fluctuations in projected profitability. Incorporating the real options analysis into forest investment projects promotes the investor’s perception of risk and managerial flexibility by strategically guiding decision-making. Negotiating the right of deferral does not necessarily impose on the forest manager, when the project is implemented, its feasibility, but rather configures a perspective of opportunity for, if feasible at the time, its assimilation. The deferral option concatenated to the underlying asset modeled the implementation of the project, aiming to improve profitability by postponing the investment until, according to [46][93], the emergence of favorable market conditions. Essential in conducting uncertain scenarios, this option provides high quality in management decisions [47][48][94,95]. In this period, the greatest probability would be that an investment should occur for the land lease project (Figure 15A), mainly because the project already has a positive NPV. On the other hand, the greatest probability would be that the option was expired, and no investment occurred in the project with land purchase (Figure 15B). As the uncertainty increases, the probability of the project being implemented at that moment decreases [49][96].

Figure 15. Real probability of exercising deferral option for the project with (A) land lease and (B) land purchase.

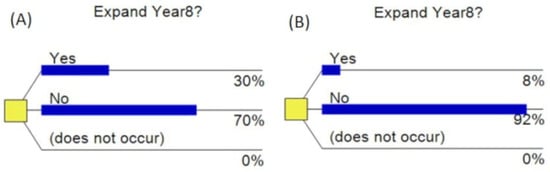

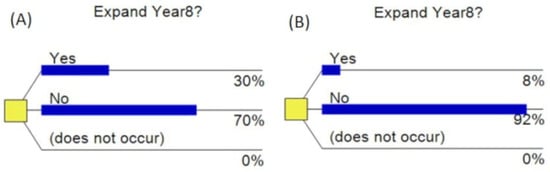

The option to expand the project should only be exercised when the market presents favorable conditions, which allows a greater investment to increase production [50][51][97,98]. Thus, the real probability of exercising the expansion option demonstrated that projects should be expanded only in the best scenarios (Figure 26A).

Figure 26. Real probability of exercising expansion option for the project with (A) land lease and (B) land purchase.

In the project with land purchase, the low probability of exercising the option to expand (8%) explained why valuation was lower compared to the other options (Figure 26B). When indicating non-expansion, it means that the present value of the project’s expected cash flows, if expanded, would not exceed the additional disbursement needed to finance the expansion [52][99]. This means that when the project has a negative value, it does not obtain any value from the option to expand.