| Version | Summary | Created by | Modification | Content Size | Created at | Operation |

|---|---|---|---|---|---|---|

| 1 | Marilena Sibillo | + 576 word(s) | 576 | 2020-10-02 20:24:14 | | | |

| 2 | Catherine Yang | Meta information modification | 576 | 2020-10-21 11:03:14 | | | | |

| 3 | Karina Chen | Meta information modification | 576 | 2020-10-26 09:37:06 | | | | |

| 4 | Marilena Sibillo | + 333 word(s) | 909 | 2020-11-10 20:27:00 | | | | |

| 5 | Catherine Yang | + 6 word(s) | 915 | 2020-11-11 02:49:33 | | | | |

| 6 | Marilena Sibillo | + 1980 word(s) | 2895 | 2020-12-07 01:06:53 | | | | |

| 7 | Marilena Sibillo | + 1980 word(s) | 2895 | 2020-12-07 01:11:57 | | | | |

| 8 | Marilena Sibillo | Meta information modification | 2895 | 2020-12-07 01:14:31 | | |

Video Upload Options

The recent pandemic and the recommendations of the WHO regarding the systematic nature that will characterize the spread of the future pandemic in the world require a deep rethinking of economic-social logics. ESG (Environmental Social Governance) strategies will play a key role in all sectors to ensure sustainable development together with the reduction of social inequalities. In this context, the insurance sector cannot fail to be a proactive and resilient player.

The challenges of the pandemic and insurance responses

In this contribute, we would like to highlight how a socially sustainable investment insurance scheme can be effective and efficient into the serious economic-financial context determined by the SARS COVID-19 epidemic.

The worldwide spread of contagion from COVID-19 endagers our life with a long-term socio-economic impact. Nevertheless, this can be an opportunity to make bold choices; in fact the COVID-19 pandemic leads us to explore new forms of public health protection, also through new economic paradigms.

Even before the dramatic challenges posed by the pandemic, one of the most urgent issues is summarized in the following question: what are the strategies for obtaining more sustainable economies and societies?

This question inevitably implies another one: how the economic system and practice could serve people, families and productive activities? And how to strike a balance among profit, sustainability and protection of social well-being?

Moreover, the present circumstances make the same questions more and more urgent, if we consider the interplay between the COVID-19 contagion impact and the economic forecasts.

There is already a growing interest of insurance companies in Environmental, Social and Government (ESG) investments, especially in the green economy sector (cf. [1][2][3][4][5]).

The strategic role of insurance companies appears more adequate than ever, since their activity is inherently connected to the protection of primary areas, such as healthcare and welfare and, in general, is linked to the protection of people and productive activities.

In light of these issues, we believe that the design of new virtuous cycles of investments may be of interest; in particular, a project which would unfold through insurance policies’ contractual lines, securitization schemes, investment policies and socially responsible corporate strategies could well fit the new social needs.

The recent financial and insurance literature is offering new and interesting contributions, also to meet the goal to raise the capital needed to face the health and economic emergencies of the pandemic (cf. [6][7][2])). These are schemes that involve governments, private and institutional investors.

In [6], for instance, the Authors propose a pandemic insurance solution through a pandemic-related “Insurance Linked Bond”: the governments promote this process to the aim of covering the costs due to a pandemic. The idea stems from previous experiences that have developed in other pandemics. In fact, in 2017 the World Bank issued two types of pandemic bonds, maturing in 2020, the first connected to influenza pandemics and coronavirus, the second to epidemic diseases such as Ebola (see [8][9]). The urgency of cooperation between the various market players that is inspired by wide-ranging ethical and social values is now clear; within this context, scientific contributions are multiplying and attempt to connect contexts which were considered antithetical until recently (see [6][10][11][12]).

However, it is inevitable to find a balance between the needs of the world of finance and the objectives of public health and protection. This is a conflict of interest that has already aroused controversy in the past: think for example of the issue of the first pandemic bond in 2017 during the Ebola pandemic in Africa (cf. [13][14]).

The insurance business based on guidelines oriented to the workplace safety, has as its effect the propulsive action for an improvement in the health conditions of a community and produces the effect of a reputational benefit of the insurer involved, with positive results in terms of competitiveness.

So, the idea of designing insurance schemes to be proposed to firms with the aim of protecting the safety of the workplace and the health of workers appears particularly stimulating, especially if inserted in a risk sharing system through the inclusion of a further counterpart. According to [15], the actors involved are welfare organizations or insurers, firms that stipulate insurance contracts to protect the workplace, and institutional investors. The risk-sharing strategy allows the insurer to allocate a bonus to the firm that implements a careful policy of protecting the health of workers.

Three aims, basic for sustainable activities, are pursued: the risk of contagion infection that potentially impacts on the health of workers and the entire community is managed and controlled; virtuous behavior is rewarded; the risk is shared among several actors. Such a system is achievable as it allows an increase in the reputational value of the insurer and an increase in the satisfaction of investors sensitive to sustainability issues.

At the basis of the analysis we place the concept of safety at work as a social value. This implies the grafting of a virtuous cycle aimed at raising the quality of daily life standards of workers and therefore of the entire community. Safety at work becomes a "social value", like the universally shared categories of the environment, climate change, energy saving, etc., on which innovative investments can be implemented.

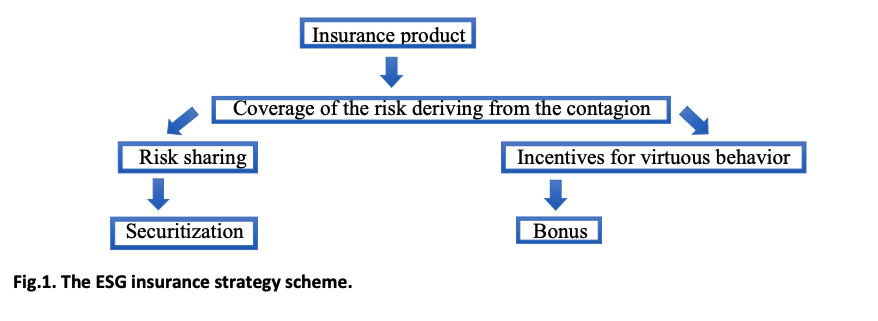

We can refer extensively to insurance contracts that aim to cover the risks of damage to workers' health. The idea is to build an insurance product that combines the two aspects of risk sharing and incentives for virtuous behavior, in a structure that sees the insurance product oriented towards the pursuit of objectives related to the common wealth, as is the case for all products, including insurance, typical of the sustainability sector. Coverage of the risk deriving from contagion is implemented through a sharing system such as securitization, which implies the involvement of a third figure, that is the investor/subscriber of the derivative security issued with the product itself. In this way, the common aim of improving the general state of health is made concrete with incentives granted to insured companies that have behaved virtuously in terms of health safety regulations. The incentive, as mentioned above, may consist in the reduction of the premium in contract renewal, to the extent of an appropriate percentage that becomes a decisional variable of the scheme. This is shown in figure 1, where the contract relevant elements are highlighted in a simple scheme.

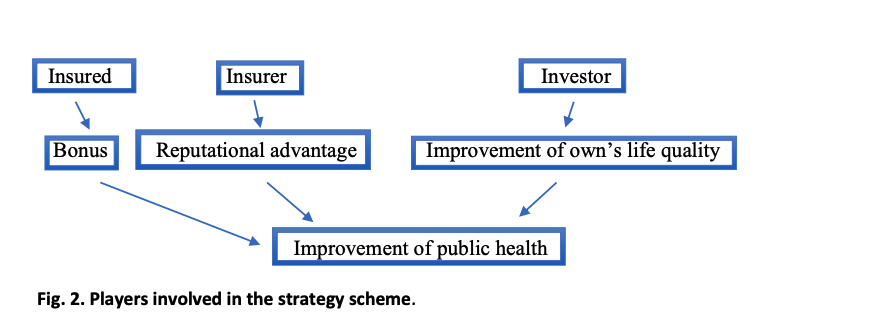

All the parties in this scheme join the same goal, the improvement of the general state of public health, and are recipients of possible benefits from the operation in a single virtuous cycle. The first is the insured company, which is awarded the bonus, a tangible form of savings on the next premium. The second is the insurance company (but why not a public body?), which gets substantial reputational advantages, increasingly recognized as a result of activities oriented to the common good. And finally the investor/subscriber, who invests in the quality of life by gaining personal and community benefits in a broader sense. Further details will be treated in the following.

In figure 2 al the parties involved in the process are represented with their main advantages and the common goal.

Insights about the product can be found in [15], where we have proposed for the first time our idea.

Derivatives and Sustainability

An ambitious – yet by now unavoidable – move towards a more sustainable economy requires investments in the order of trillions of dollars, as indicated by the note drawn up by the Joint Ministerial Committee of the Board of Governors of the Bank and the Fund on the Transfer of Real Resources (see [16]): complying with the objectives of the United Nations’ 2030 Agenda for Sustainable Development (SDGs – Sustainable Development Goals) thus entails a huge financial effort, as well as a wide-ranging political vision.

The magnitude of such investments requires the participation of a multiplicity of investors, most notably institutional investors, who are able to freeze high liquidity over long time horizons (see [17]).

In 2016, the G20 Sustainable Group (see [18]), was tasked with studying how the securitisation of bank loans may be employed to support and promote sustainable investments.

Banks and institutional investors have to inject liquidity into the market, but this constitutes a demanding and risky challenge, as it involves investing a striking amount of resources in projects that require long-term investments, and, therefore, also involves dealing with fixed liquidity assets that are hard to reconcile with the constraints imposed by capital requirements. It is precisely on capital and regulatory requirements that the debate among international Authorities is currently focusing (see [19]), and it aims at defining a regulatory and control framework relevant to ESG transactions, including securitisations.

The international attention placed on securitisation schemes’ potential in relation to the implementation of SDGs, however, has highlighted both pros and cons (see [19], and [20]) especially whenever the more technical aspects of analysis are to be framed within a broader political vision. The chief fears are related to the expansion of privatisation processes in the context of public services. It cannot be ignored, in fact, that the economic and social wounds caused by the 2008 global financial crisis are still sore and it is precisely this dramatic and persistent economic situation that has highlighted, among other things, the pitfalls of the securitisation markets. A range of ethical and political reservations (see [21]), have been voiced by several parties, mainly due to the negative stigma attached to many financial procedures undertaken by banks – and increasingly by shadow banks – during the pre-crisis years.

There is therefore no doubt that the current challenge is predominantly of a regulatory nature, and seeks to prevent past mistakes from paralysing the future, while stimulating virtuous procedures. In particular (see [20]), it is essential to evaluate securitisations’ impact on balance sheet indicators, in ways that might allow for the development of efficient and effective schemes in virtuous practices of sustainable finance.

Securitisation, in a nutshell, is able to channel liquidity towards a sustainable economy, within a regulatory framework that systematises clear and transparent schemes. To this end, the European Commission issued, already in 2015, two legislative measures aiming at granting liquidity and security to securitisation markets (see [22]). These measures establish a set of regulations applicable to all securitisation products and, above all, a unique list of criteria identifying simple, transparent and standardised (STS) securitisations. Further advancements in this direction are provided by the changes proposed in a document drawn up by the European Commission in July 2020 (see [23]) consistent with the needs dictated by the Covid-19 pandemic.

It is clear that these criteria will allow for adequate securitisation schemes for specific sustainable finance projects, according to the aims indicated by the High-Level Expert Group on Sustainable Finance, which, in its institutional mandate, is also tasked with studying the regulatory changes aiming at improving the “funding capacity of private capital”, as stated in its Final Report 2018 (see [24]).

Securitization in insurance: notes on riskiness

As known, through the securitization technique, a series of rights that, by their nature, are not liquid, are transformed into exchangeable instruments on the financial market (cf. [25]). This is precisely the key concept that makes securitization an effective tool in a historical moment of profound economic and social transformation: in our opinion, the topicality obliges also the insurers to become promoters of new and resilient products and traditional commercialization would produce negative effects on insurers' risk control.

The securitization mechanism belongs to the set of efficient and flexible investments that aim at effective de-risking in view of the Sustainable Development Goals (SDG). Through securitization, a virtuous risk-sharing action is carried out that would otherwise weigh totally on the insurer, likely leading to a consequent abandonment of product. This is the characteristic that makes this technique both irreplaceable and highly appropriate in contexts where socially extreme events become detrimental to fundamental and inalienable rights, such as the right to health. However, the de-risking activity must be added to another, not secondary, aspect in the capital management, which is the liquidity realised at the issue time as monetary effect of the transformation of intangible assets (cf. [26]), liquidity that the insurer will be able to manage accordingly with his/her needs or peculiarities. In any case, it is a form of financing and can improve the ROE value. In [26] is presented an important analysis of the various aspects that make the securitization instrument an important resource specifically for the insurance sector. In particular, the Author looks at the problem also from the investor's point of view, placing him/her likely to be among the so-called prudent and risk-averse individuals, tending towards fixed income investments. This audience is increasingly interested in investments in insurance-link securities, showing willingness to take on the related risks. This is fundamentally for two reasons: the investor does not assume any counterparty risk with respect to the insurer, while at the same time he/she diversifies the portfolio by investing in low-correlation financial activities, compared to the financial market. The risk assumed by investors can be appropriately mitigated through the inclusion in the cash flow scheme of the derivative appropriate thresholds to the payments due, which becomes a decisional variable.

Social enhancement of insurance cycles.

The securitization process develops in a circular system that elaborates and leads to the implementation of a policy of inclusion of economic parties whose action achieves shared objectives in a society where social values are redefined with a view to sustainability and a solidarity-based economy. In this way, a virtuous transition is developed from the typical schemes of the traditional economy to structures based on new concepts of collective well-being.

In this evolution the role of the insurance sector can and perhaps must play an important and propulsive role.

References

- Evan Mills; A Global Review of Insurance Industry Responses to Climate Change. The Geneva Papers on Risk and Insurance - Issues and Practice 2009, 34, 323-359, 1057/gpp.2009.14.

- Kissler, S.M.; Tedijanto, C.; Goldstein, E.; Grad, Y.H.; Lipsitch, M. Projecting the transmission dynamics of SARS-CoV-2 through the postpandemic period. Science 2020, 368, 860–868. [CrossRef] [PubMed]

- Insurance-linked securities framework . Gestione finanziaria verde Generali Group. Retrieved 2020-10-4

- Herman Aguinis; Ante Glavas; What We Know and Don’t Know About Corporate Social Responsibility. Journal of Management 2012, 38, 932-968, 1177/0149206311436079.

- Bannier, C.; Bofinger, Y.; Björn, R. Doing Safe by Doing Good: ESG Investing and Corporate Social Responsibility in the U.S. and Europe; Goethe University, Center for Financial Studies: Frankfurt, Germany, 2019.

- Gründl, Helmut ; Regele, Fabian: Pandemic insurance through pandemic partnership bonds: A fully funded insurance solution in a public private partnership. Frankfurt a. M. : Leibniz Institute for Financial Research SAFE (2020)

- Simon Glossner Pedro Matos Stefano Ramelli Alexander F. Wagner: Where Do Institutional Investors Seek Shelter when Disaster Strikes? Evidence from COVID-19. ECGI Working Paper Series in Finance November 2020

- Erikson, S. Global health futures? Reckoning with a pandemic bond. MAT 2019, 6. Available online: http://www.medanthrotheory.org/read/11401/global-health-futures (accessed on 28 July 2020). [CrossRef]

- Erikson, S.L.; Johnson, L. Will financial innovation transform pandemic response? Lancet Infect. Dis. 2020, 20, 529–530. [CrossRef]

- Frydman, R.; Phelps, E.S. Insuring the Survival of Post-Pandemic Economies; The Center on Capitalism and Society, Columbia University: New York, NY, USA, 2020

- Macdonald, D. COVID-19 and the Canadian Workforce: Reforming EI to Protect More Workers; Canadian Centre for Policy Alternatives: Ottawa, ON, Canada, 2020.

- Palacios, R.J.; Robalino Aguirre, D.A. Integrating Social Insurance and Social Assistance Programs for the Future World of Labour; IZA—Institute of Labor Economics: Bonn, Germany, 2020.

- Susan L Erikson, Leigh Johnson: Will financial innovation transform pandemic response? The Lancet, Volume 20, Issue 5,pp. 529-530, May 01, 2020-11-28

- Olga Jonas: Pandemic bonds: designed to fail in Ebola. Nature. 2019; 572: 285

- Emilia Di Lorenzo; Marilena Sibillo; Economic Paradigms and Corporate Culture after the Great COVID-19 Pandemic: Towards a New Role of Welfare Organisations and Insurers. Sustainability 2020, 12, 8163, 10.3390/su12198163

- Development Committee Discussion Note: From Billions to Trillions: Transforming Development Finance. Post-2015 Financing for Development: Multilateral Development Finance. 2015 http://pubdocs.worldbank.org/en/622841485963735448/DC2015-0002-E-FinancingforDevelopment.pdf

- Borsa Italiana: Nuovo impiego dei derivati a supporto della sostenibilità. Forum per la Finanza Sostenibile, 05 Nov 2018 https://www.borsaitaliana.it/notizie/finanza-sostenibile/news/forum/asset-backed-securities.htm

- G20 Sustainable Finance Study Group: Towards a sustainable infrastructure securitization market: the role of collateralized loan obligations (CLO). November 2018.

- Daniela Gabor: Securitization for Sustainability. Does it help achieve the Sustainability Development Goals? Heinrich Böll Stiftung Washington, D.C., October 2019

- Sergiy Legenchuk, Maryna Pashkevych, Olga Usatenko, Olha Driha, Valentyna Ivanenko: Securitization as an innovative refinancing mechanism and an effective asset management tool in a sustainable development environment. E3S Web of Conferences 166(2):13029, pp. 1-16, 2020

- Bonnie G. Buchanan: The way we live now: Financialization and securitization. Research in International Business and Finance, Volume 39, Part B, January 2017, pp. 663-677

- European Commission: Securitisation. Commission proposal to free up capital for economic growth trough simple, transparent and standardises securitisation. 2019 https://ec.europa.eu/info/business-economy-euro/banking-and-finance/financial-markets/securities-markets/securitisation_en

- European Commission: Proposal for a REGULATION OF THE EUROPEAN PARLIAMENT AND OF THE COUNCIL amending Regulation (EU) 2017/2402 laying down a general framework for securitisation and creating a specific framework for simple, transparent and standardised securitisation to help the recovery from the COVID-19 pandemic. 24.7.2020https://ec.europa.eu/finance/docs/law/200724-securitisation-review-proposal_en.pdf

- High-Level Expert Group on Sustainable Finance: Financing a Sustainable European Economy. Final Report 2018https://ec.europa.eu/info/sites/info/files/180131-sustainable-finance-final-report_en.pdf

- Iglesias-Casal, A., Lopez-Penabad, M. C., Lopez-Andion, C., Maside-Sanfiz J. M., Securitization, financial stability and effective risk retention. A European analysis, PLOS One, 2020

- Holzheu, T., Kurt, K., Helfenstein, R. Securitization – new opportunities for insurers and investors, Swiss Re, no.7/2006https://www.researchgate.net/publication/316583575_Securitization__new_opportunities_for_insurers_and_investors#fullTextFileContent