The recent pandemic and the recommendations of the WHO regarding the systematic nature that will characterize the spread of the future pandemic in the world require a deep rethinking of economic-social logics. ESG (Environmental Social Governance) strategies will play a key role in all sectors to ensure sustainable development together with the reduction of social inequalities. In this context, the insurance sector cannot fail to be a proactive and resilient player.

- pandemic

- sustainability

- workplace safety

- securitization

In this short survey, we briefly highlight how a socially sustainable investment insurance scheme can be effective and efficient into the serious economic-financial context determined by the SARS COVID-19 epidemic.

A socially sustainable investment insurance scheme can be effective and efficient into the serious economic-financial context determined by the SARS COVID-19 epidemic.

The worldwide spread of contagion from COVID-19 endagers our life with a long-term socio-economic impact.

Nevertheless, this can be an opportunity to make bold choices; in fact the COVID-19 pandemic leads us to explore new forms of public health protection, also through new economic paradigms.

Even before the dramatic challenges posed by the pandemic, one of the most urgent issues is summarized in the following question: what are the strategies for obtaining more sustainable economies and societies?

This question inevitably implies another one: how the economic system and practice could serve people, families and productive activities? And how to strike a balance among profit, sustainability and protection of social well-being?

Moreover, the present circumstances make the same questions more and more urgent, if we consider the interplay between the COVID-19 contagion impact and the economic forecasts.

There is already a growing interest of insurance companies in ESG investments, especially in the green economy sector (cf. [1][2][3][4][5]).

The worldwide spread of contagion from COVID-19 endagers our life with a long-term socio-economic impact.

The strategic role of insurance companies appears more adequate than ever, since their activity is inherently connected to the protection of primary areas, such as healthcare and welfare and, in general, is linked to the protection of people and productive activities.

Nevertheless, this can be an opportunity to make bold choices; in fact the COVID-19 pandemic leads us to explore new forms of public health protection, also through new economic paradigms.

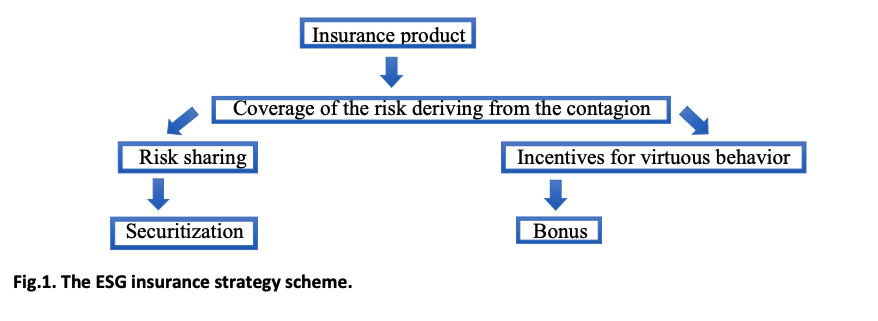

In light of these issues, the design of new virtuous cycles of investments may be of interest; in particular, a project which would unfold through insurance policies’ contractual lines, securitization schemes, investment policies and socially responsible corporate strategies could well fit the new social needs.

Even before the dramatic challenges posed by the pandemic, one of the most urgent issues is summarized in the following question: what are the strategies for obtaining more sustainable economies and societies?

The insurance business based on guidelines oriented to the workplace safety, has as its effect the propulsive action for an improvement in the health conditions of a community and produces the effect of a reputational benefit of the insurer involved, with positive results in terms of competitiveness.

This question inevitably implies another one: how the economic system and practice could serve people, families and productive activities? And how to strike a balance among profit, sustainability and protection of social well-being?

So, the idea of designing insurance schemes to be proposed to firms with the aim of protecting the safety of the workplace and the health of workers appears particularly stimulating, especially if inserted in a risk-sharing system through the inclusion of a further counterpart. According to [6], the actors involved are welfare organizations or insurers, firms that stipulate insurance contracts to protect the workplace, and institutional investors. The risk-sharing strategy allows the insurer to allocate a bonus to the firm that implements a careful policy of protecting the health of workers.

Moreover, the present circumstances make the same questions more and more urgent, if we consider the interplay between the COVID-19 contagion impact and the economic forecasts.

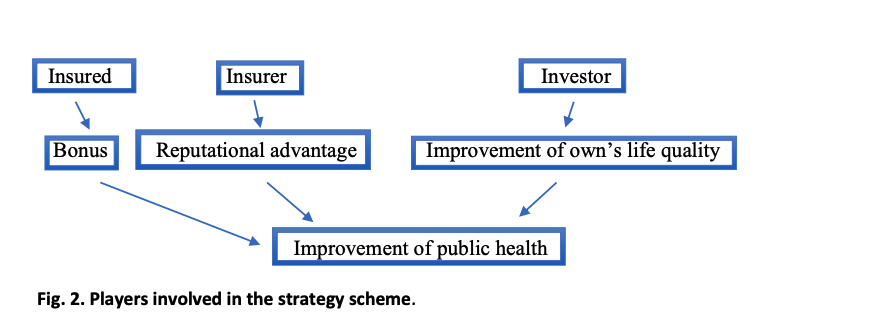

Three aims, basic for sustainable activities, are pursued: the risk of contagion infection that potentially impacts on the health of workers and the entire community is managed and controlled; virtuous behaviour is rewarded; the risk is shared among several actors. Such a system is achievable as it allows an increase in the reputational value of the insurer and an increase in the satisfaction of investors sensitive to sustainability issues.

There is already a growing interest of insurance companies in ESG investments, especially in the green economy sector. Mills (cf. [1][2][3][4][5]).

At the basis of the analysis, there is the concept of safety at work as a social value. This implies the grafting of a virtuous cycle aimed at raising the quality of daily life standards of workers and therefore of the entire community. Safety at work becomes a "social value", like the universally shared categories of the environment, climate change, energy saving, etc., on which innovative investments can be implemented.

The strategic role of insurance companies appears more adequate than ever, since their activity is inherently connected to the protection of primary areas, such as healthcare and welfare and, in general, is linked to the protection of people and productive activities.

Let us extensively refer to insurance contracts that aim to cover the risks of damage to workers' health. The idea is to build an insurance product that combines the two aspects of risk sharing and incentives for virtuous behaviour, in a structure that sees the insurance product oriented towards the pursuit of objectives related to the common wealth, as is the case for all products, including insurance, typical of the sustainability sector. Coverage of the risk deriving from contagion is implemented through a sharing system such as securitization, which implies the involvement of a third figure, that is the investor/subscriber of the derivative security issued with the product itself. In this way, the common aim of improving the general state of health is made concrete with incentives granted to insured companies that have behaved virtuously in terms of health safety regulations. The incentive, as mentioned above, may consist in the reduction of the premium in contract renewal, to the extent of an appropriate percentage that becomes a decisional variable of the scheme.

In light of these issues, we believe that the design of new virtuous cycles of investments may be of interest; in particular, a project which would unfold through insurance policies’ contractual lines, securitization schemes, investment policies and socially responsible corporate strategies could well fit the new social needs.

The insurance business based on guidelines oriented to the workplace safety, has as its effect the propulsive action for an improvement in the health conditions of a community and produces the effect of a reputational benefit of the insurer involved, with positive results in terms of competitiveness.

All the parties in this scheme join the same goal, the improvement of the general state of public health, and are recipients of possible benefits from the operation in a single virtuous cycle. The first is the insured company, which is awarded the bonus, a tangible form of savings on the next premium. The second is the insurance company (but why not a public body?), which gets substantial reputational advantages, increasingly recognized as a result of activities oriented to the common good. And finally the investor/subscriber, who invests in the quality of life by gaining personal and community benefits in a broader sense.

So, the idea of designing insurance schemes to be proposed to firms with the aim of protecting the safety of the workplace and the health of workers appears particularly stimulating, especially if included in a risk sharing system through the inclusion of a further counterpart. According to (cf. [6]) the actors involved are welfare organizations or insurers, firms that stipulate insurance contracts to protect the workplace, and institutional investors. The risk-sharing strategy allows the insurer to allocate a bonus to the firm that implements a careful policy of protecting the health of workers.

Three aims, basic for sustainable activities, are pursued: the risk of contagion infection that potentially impacts on the health of workers and the entire community is managed and controlled; virtuous behavior is rewarded; the risk is shared among several actors. Such a system is achievable as it allows an increase in the reputational value of the insurer and an increase in the satisfaction of investors sensitive to sustainability issues.

Details and insights can be found in [6], where the idea has been proposed for the first time.

Details and insights can be found in [6], where we have proposed for the first time our idea.

References

- Evan Mills; A Global Review of Insurance Industry Responses to Climate Change. The Geneva Papers on Risk and Insurance - Issues and Practice 2009, 34, 323-359, 10.1057/gpp.2009.14.

- Projecting the trasmission dynamics of sars-cov-2 through the post pandemic period . Pub Med. gov. Retrieved 2020-10-4

- Insurance-linked securities framework . Gestione finanziaria verde Generali Group. Retrieved 2020-10-4

- Herman Aguinis; Ante Glavas; What We Know and Don’t Know About Corporate Social Responsibility. Journal of Management 2012, 38, 932-968, 10.1177/0149206311436079.

- Bannier, C.; Bofinger, Y.; Björn, R. Doing Safe by Doing Good: ESG Investing and Corporate Social Responsibility in the U.S. and Europe; Goethe University, Center for Financial Studies: Frankfurt, Germany, 2019.

- Emilia Di Lorenzo; Marilena Sibillo; Economic Paradigms and Corporate Culture after the Great COVID-19 Pandemic: Towards a New Role of Welfare Organisations and Insurers. Sustainability 2020, 12, 8163, 10.3390/su12198163.