| Version | Summary | Created by | Modification | Content Size | Created at | Operation |

|---|---|---|---|---|---|---|

| 1 | Grzegorz Maciejewski | + 1436 word(s) | 1436 | 2020-09-28 11:31:27 | | | |

| 2 | Conner Chen | + 1618 word(s) | 3054 | 2020-10-13 08:40:11 | | | | |

| 3 | Conner Chen | Meta information modification | 3054 | 2020-10-29 07:28:07 | | |

Video Upload Options

We have recently seen two conflicting trends in the use of cash. The share of e-payments in retail transactions is steadily increasing, but the same upward trend is true for the share of cash in circulation or at least the cash share remained unchanged. This paper shows the significance of perceived risk for consumers’ precautionary demand for cash after they make a decision to use e-payments. We use data from a study involving Polish consumers. The main conclusions are as follows: surveyed consumers perceive a level of risk associated with card and mobile payments and continue to carry cash for precautionary reasons. Factors such as the consumer’s mental state, lack of trust in e-payments, and attitude to risk influence the decision to maintain cash reserves, while the consumer’s income and age may be considered the main determinants of the value of the cash reserve. Consequently, the decision to use e-payments does not necessarily mean that the demand for cash drops to zero. A degree of difficult-to-reduce, autonomous demand for cash may exist independent of the traditionally studied determinants, in particular, those related to the transaction demand.

1. Perceived Risk Associated with Card and Mobile Payments

In order for the theory of consumer risk to have any explanatory power, it is necessary to exceed a certain minimum threshold of perceived risk, i.e., the consumer must be aware of the possibility of an event that might be unfavourable. At the same time, this is a necessary condition to analyse risk in terms of the determinants of consumer behaviour.

Our research shows that respondents were aware that something might go wrong during a card or mobile payment and that the payment might not be effective despite having sufficient funds in their account. Certainly, this was not true for all respondents, but for a vast majority—nearly 80% of respondents said they perceived a risk of not being able to pay by card or phone.

Those respondents who perceived a level of risk associated with CMP were presented with the scales described above, i.e., the scale showing the level of importance attached to the inability to make a CMP despite having sufficient funds, and the level of likelihood of the inability to make a card or mobile payment despite having sufficient funds. The results are presented in Table 1.

Table 1. Types of perceived risk associated with card and mobile payments and their level (N = 377).

| Specification | Importance of a Negative Consequence | Opinion on the Likelihood of Risk Occurrence | Additive Risk Model | ||||||

|---|---|---|---|---|---|---|---|---|---|

| Me | Mo | M | SD | Me | Mo | M | SD | ||

|

5 | 7 | 4.47 | 1.899 | 4 | 4 | 4.48 | 1.763 | 8.95 |

|

5 | 7 | 4.53 | 1.943 | 4 | 5 | 4.26 | 1.900 | 8.79 |

|

4 | 5 | 4.05 | 1.902 | 4 | 4 | 4.14 | 1.750 | 8.19 |

|

4 | 5 | 4.04 | 1.820 | 4 | 3 | 3.96 | 1.797 | 8.00 |

|

4 | 4 | 4.05 | 1.849 | 4 | 4 | 3.89 | 1.814 | 7.94 |

|

4 | 4 | 3.88 | 1.733 | 4 | 4 | 3.64 | 1.683 | 7.52 |

|

4 | 1 | 3.74 | 1.977 | 3 | 3 | 3.53 | 1.728 | 7.27 |

|

4 | 1 | 3.70 | 2.043 | 3 | 2 | 3.26 | 1.806 | 6.96 |

|

3 | 1 | 3.16 | 1.987 | 3 | 1 | 3.23 | 1.961 | 6.39 |

|

2 | 1 | 2.92 | 1.994 | 2 | 1 | 2.60 | 1.600 | 5.52 |

Where: Me—median, Mo—modal value, M—arithmetic average, SD—standard deviation. Additive Risk Model: the arithmetic average of the opinions regarding the importance of negative consequences of card and mobile payments + the arithmetic average of the opinions regarding the likelihood of occurrence of negative consequences of card and mobile payments. Data source: Collected by this research.

In the context of making card or mobile payments, the surveyed consumers were mostly concerned about only learning of the absence of a payment terminal at a given POS at the register, as well as about a possible failure of the terminal. These consequences were also considered most likely, although the possibility of terminal failure was considered more likely. The data contained in Table 1 also show that the surveyed consumers have different attitudes towards negative consequences and the likelihood of their occurrence in real life. They also attach more importance to the significance of negative consequences than to the likelihood of their occurrence, which has already been observed in previous studies [1].

Then, using the ARM to measure the magnitude of the perceived risk associated with CMP, we determined that the greatest risk identified in our research is the risk of payment terminal failure (value 8.95). Also noteworthy are the relatively high values attributed to the risk associated with only learning of the absence of a payment terminal at the POS at the register (value 8.79) and the risk of the internet connection being cut off (value 8.19). In contrast, the lowest values were attributed by the respondents to the risk of damaging the card when inserting it into a payment terminal (value 5.52) and the risk of entering an incorrect PIN (value 6.39)—see Table 1.

Analysing the magnitude and types of consumer risk when making a card or mobile payment, we considered it useful to also draw attention to the measures taken by consumers to reduce the risks that they do not accept. Therefore, those respondents who declared making payments by card or phone and who perceived the risk associated with the possibility that the payment might not be effective despite having sufficient funds in their account were asked about how they deal with such potential threat.

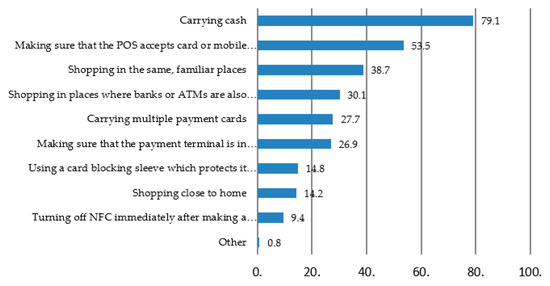

The responses show that consumers use many different methods of reducing risk, depending on the consumer’s degree of involvement in the purchasing process (active and passive prevention strategies) and the magnitude of risk being reduced (strategies to reduce uncertainty and strategies to reduce the likelihood of negative consequences)—see Figure 1.

Figure 1. Strategies used by respondents to deal with the risk of being unable to pay by card or phone (N = 385, in %). Note: The percentage of responses does not add up to 100% because respondents could indicate more than one prevention strategy. Data source: Collected by the authors.

According to respondents, the most effective strategy for reducing the risk associated with card and mobile payments is carrying a certain amount of cash, as indicated by almost 8 out of 10 respondents. More than half of the respondents make sure that a given POS accepts e-payments before shopping and 1 in 3 always shop in the same familiar places (Figure 1).

The strategy of carrying a certain amount of cash is assessed by respondents as the most effective prevention strategy. Nearly 60% of respondents gave this strategy the highest rank among all strategies aimed at reducing the risk associated with card and mobile payments (Table 2).

Table 2. Effectiveness of used strategies to reduce the risk associated with card and mobile payments—respondents’ assessment (N = 385, in %).

| Strategy | Rank I | Strategy | Rank II | Strategy | Rank III |

|---|---|---|---|---|---|

| Carrying cash | 58.9 | Making sure that the POS accepts card or mobile payments before shopping | 26.4 | Shopping in the same familiar places | 20.6 |

| Making sure that the POS accepts card or mobile payments before shopping | 11.1 | Carrying multiple payment cards | 13.4 | Carrying cash | 15.0 |

| Shopping in the same familiar places | 7.3 | Making sure that the payment terminal is in working order at the POS before shopping | 13.4 | Shopping in places where banks or ATMs are also located | 13.9 |

| Carrying multiple payment cards | 6.8 | Shopping in the same familiar places | 13.1 | Making sure that the POS accepts card or mobile payments before shopping | 13.1 |

| Shopping in places where banks or ATMs are also located | 5.1 | Shopping in places where banks or ATMs are also located | 12.8 | Making sure that the payment terminal is in working order at the POS before shopping | 12.0 |

| Using a card blocking sleeve, which protects it against contactless theft | 5.1 | Carrying cash | 9.5 | Shopping close to home | 7.5 |

| Turning off Near Field Communication (NFC) immediately after making a mobile contactless payment | 3.0 | Shopping close to home | 5.9 | Using a card blocking sleeve, which protects it against contactless theft | 7.1 |

| Making sure that the payment terminal is in working order at the POS before shopping | 1.9 | Using a card blocking sleeve, which protects it against contactless theft | 3.0 | Carrying multiple payment cards | 6.0 |

| Shopping close to home | 0.8 | Turning off NFC immediately after making a mobile contactless payment | 2.4 | Turning off NFC immediately after making a mobile contactless payment | 4.5 |

Where: Rank I—the strategy that is the most effective in the respondents’ opinion; Rank II and Rank III—other highest ranked strategies in terms of effectiveness, in the respondents opinion. Data source: Collected by the authors.

The fact that respondents use prevention strategies might prove that they are extremely prudent, but it might also mean that they do not trust e-payments due to their perceived unreliability. The question is whether the perceived unreliability is linked to problems that they have actually experienced in the past. To answer this, respondents were also asked to indicate how many times in the last three years they had encountered problems when making a card or mobile payment despite having sufficient funds in their account. These responses indicated that 39.0% of respondents could not recall any such situation, 32.3% admitted that they encountered such a situation not more than once or twice, and 28.7% indicated that they had problems with e-payments at least three times. The most common reasons for the payment not being effective were: payment terminal failure (49.8%), internet connection being cut off and a related problem with data transfer (23.4%), or a failure/maintenance break at the bank (14.7%).

The collected research results do not justify such a high level of respondents’ prudence. However, as indicated earlier, nearly 80% of respondents perceive a risk associated with card and mobile payments and have worked out ways to deal with it. These results are the same as those obtained in the regression analysis (model 1.5).

2. Cash Reserves of Surveyed Consumers

Those respondents who declared making payments by card or phone and who perceived a risk associated with the possibility that the payment might not be effective despite having sufficient funds in their account were asked whether they also carried cash apart from their card/phone since they were aware of such risk. Respondents confirmed this, with 9 out of 10 (89.9%) answering “yes, always” (37.7%) or “yes, sometimes” (52.2%). Then, we asked them about the amount of cash they were carrying. The responses were in the range between PLN 10 (approximately EUR 2, ca. 0.42% of the modal and 0.24% of the median monthly salary in Poland before tax) and PLN 2000 (approximately EUR 400, ca. 84% of the modal and 49% of the median salary in Poland before tax) [76]. The median and the modal value amounted to PLN 100 (approximately EUR 20). We observed that the responses were clearly linked to the denominations of notes in circulation. Consequently, a cash reserve of PLN 20 was declared by 5.0% of the respondents, PLN 50—21.9%, PLN 100—32.7%, and PLN 200—14.9%. Therefore, the amounts corresponding to the values of the individual denominations represented almost ¾ of all variants of the responses.

3. Determinants of Cash Reserves of Surveyed Consumers

We then examined the determinants of cash reserves maintained by consumers who declared making payments by card or phone and who perceived a level of risk associated with the possibility that the payment might not be effective despite having sufficient funds in their account.

We started with investigating the determinants of the decision to maintain a cash reserve. The response variable was an event in the form of making a decision on maintaining the cash reserve. We studied the significance of the variables obtained in the EFA as well as variables such as past experiences with technical problems; declared attitude to risk, age, and education; and declared level of income. Definitions of the variables are presented in Table 3.

Table 3. Definitions of vari

| Variable | Definition |

|---|---|

| PDC | precautionary demand for cash; an event consisting of maintaining a cash reserve despite having made a decision to use CMP, 1—yes or sometimes yes; 0—no |

| PDC_v | volume of precautionary demand for cash; the range of the value of the cash reserve 1. PLN 50 and less; 2. PLN 51-100; 3. PLN 101 and more |

| 1PC1 | risk of technical problems with the terminal |

| 1PC2 | risk associated with how the consumer handles a transaction |

| 1PC3 | risk of other technical problems |

| 2PC1 | unusual purchase situation (commute, high value, new card) |

| 2PC2 | perception of lack of mental comfort during payment |

| 2PC3 | sales channel considered risky (internet, abroad) |

| 2PC4 | low level of trust, e.g., due to making a purchase for the first time |

| 3PC1 | trust in the state and its actions, e.g., in the economy and in the scope of cybersecurity |

| 3PC2 | trust in the payment system, understood as a product of trust in the state and technology |

| 3PC3 | risk of armed conflict |

| 3PC4 | perception of corruption |

| tech_prob | technical problem with the payment |

| unac_risk | risk of the transaction not being accepted despite having sufficient funds; 1PC1 + 1PC2 + 1PC3 |

| att_risk | attitude to risk |

| gender | gender of respondents |

| age | age of respondents |

| income | subjective assessment of respondents’ own financial situation |

| education | declared higher education |

Data source: Collected by this research.

Unfortunately, the selection of variables for the model is hindered by the fact that there is no commonly accepted theory of which its conclusions could be tested during the research. Our research is mostly exploratory. Therefore, our strategy was to test the significance of those groups of variables that were interesting to us, either on account of relations described in literature or due to their usefulness in achieving our research objectives. We then built a model through a backward stepwise regression (other methods of variable selection produced identical or similar results). Both model building strategies led us to the baseline model, which was subject to final interpretation. All models have undergone basic testing (including the Hosmer–Lemeshow test).

The results of the logistic regression have been presented in Table 4. Models 1.1–1.6 show the results of testing individual groups of variables. Model 1.7 is our final model. In each case, age, education, and declared income level were used as control variables. However, these were not statistically significant in any model.

Table 4. Logistic regression results.

| Variable | Model 1.1 | Model 1.2 | Model 1.3 | Model 1.4 | Model 1.5 | Model 1.6 | Model 1.7 | |||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| β | se | p | OR | β | se | p | OR | β | se | p | OR | β | se | p | OR | β | se | p | OR | β | se | p | OR | β | se | p | OR | |

| 1PC1 | −0.039 | 0.190 | 0.839 | 0.962 | ||||||||||||||||||||||||

| 1PC2 | 0.652 | 0.221 | 0.003 | 1.920 | ||||||||||||||||||||||||

| 1PC3 | 0.189 | 0.181 | 0.297 | 1.208 | ||||||||||||||||||||||||

| 2PC1 | 0.402 | 0.200 | 0.044 | 1.495 | 0.385 | 0.194 | 0.047 | 1.470 | ||||||||||||||||||||

| 2PC2 | 0.504 | 0.200 | 0.012 | 1.655 | 0.484 | 0.198 | 0.014 | 1.622 | 0.420 | 0.203 | 0.038 | 1.522 | ||||||||||||||||

| 2PC3 | 0.310 | 0.173 | 0.073 | 1.363 | ||||||||||||||||||||||||

| 2PC4 | 0.025 | 0.192 | 0.897 | 1.025 | ||||||||||||||||||||||||

| 3PC1 | 0.165 | 0.180 | 0.360 | 1.179 | ||||||||||||||||||||||||

| 3PC2 | −0.484 | 0.201 | 0.016 | 0.616 | −0.473 | 0.207 | 0.022 | 0.623 | −0.523 | 0.213 | 0.014 | 0.593 | ||||||||||||||||

| 3PC3 | 0.131 | 0.178 | 0.463 | 1.140 | ||||||||||||||||||||||||

| 3PC4 | −0.409 | 0.191 | 0.033 | 0.664 | −0.523 | 0.204 | 0.010 | 0.593 | −0.555 | 0.207 | 0.007 | 0.574 | ||||||||||||||||

| Technical problem with the payment | 0.254 | 0.397 | 0.523 | 1.289 | ||||||||||||||||||||||||

| Unacceptance risk | 0.242 | 0.114 | 0.033 | 1.274 | 0.193 | 0.116 | 0.098 | 1.212 | ||||||||||||||||||||

| Attitude to risk | −0.289 | 0.138 | 0.037 | 0.749 | −0.347 | 0.129 | 0.007 | 0.707 | ||||||||||||||||||||

Data source: Collected by this research.

Models taking into account individual groups of variables identified during the factor analysis show that when making a decision to maintain cash reserves, considerable significance is attached to concerns related to handling e-payments (model 1.1), the perception of mental distress during e-payments, and unusual purchase situations (model 1.2), as well as trust in the e-payment system, understood as a product of trust in the banking system and technology (model 1.3). The perception of corruption in model 1.3 is also quite surprising. Model 1.4 shows the results of the backward stepwise regression for all variables identified during the factor analysis.

It is worth noting that maintaining cash reserves is not a result of past experiences with the unreliability of payment systems (model 1.5), but rather of the perception of associated risk (such perception does not necessarily have to result from past experiences). However, it is the level of acceptance of the risk from this group of variables that determines whether one maintains cash reserves (model 1.6). Those consumers who accept higher risk levels are less likely to do so.

Finally, model 1.7, which we treat as a baseline, takes into account all the tested variables which, in a statistically significant way, determine the decision to maintain a cash reserve despite having made the decision to use e-payments.

The most important results can be summarized as follows. Assuming the standard significance level at p < 0.05, the decision to maintain a cash reserve despite having made a decision to use e-payments depends on the:

-

mental state of the respondent, i.e., mental reaction to the purchase situation (stress, haste, bad mood); the higher the perception of this phenomenon, the more likely the consumer is to make the decision to maintain a cash reserve;

-

trust in electronic payment systems (this trust is the result of both trust in the banking system and in technology); this dependence is negative, i.e., the higher the trust, the less likely the consumer is to make the decision to maintain a cash reserve;.

-

attitude to risk; consumers declaring a higher level of risk acceptance maintain a cash reserve less frequently.

Some results indicate the role of the perception of corruption (the higher this perception, the less likely the consumer is to make the decision to maintain a cash reserve). This surprising result is interpreted under “Discussion”.

The results show that the decision to maintain a cash reserve is not dependent on the perception of the magnitude of the various types of risk associated with e-payments (payment terminal failure etc.) and consumer’s past experiences. It is worth noting that although the perception of specific types of risk has no significance, the very fact that such risk exists is the cause of maintaining a cash reserve, as indicated in our research. Age, education, and declared level of income are also insignificant.

As the second step, we analysed the determinants of the value of the maintained reserve. We divided the reserve values declared by the respondents into three ranges, organized by the value of the reserve, from smallest to largest (Table 5). Then, we calculated the ordinal regression. In principle, the research strategy was the same as in the first step; however, since the results were not dependent on the selection of variables for the model, we have only published two intermediate models and the final model. Models 2.1 and 2.3 have undergone basic testing (including the Test of Parallel Lines). Model 2.2., which does not pass some of the tests, was published for information only and it has not been the subject of further interpretation. The results are presented in Table 5.

Table 5. Ordinal regressio

| Variable | Model 2.1 | Model 2.2 | Model 2.3 | |||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| β | se | p | OR | β | se | p | OR | β | se | p | OR | |

| 1PC1 | −0.164 | 0.116 | 0.156 | 0.848 | ||||||||

| 1PC2 | 0.354 | 0.128 | 0.006 | 1.425 | 0.224 | 0.107 | 0.036 | 1.244 | ||||

| 1PC3 | −0.120 | 0.121 | 0.320 | 0.887 | ||||||||

| 2PC1 | 0.048 | 0.116 | 0.680 | 1.049 | ||||||||

| 2PC2 | −0.064 | 0.120 | 0.594 | 0.938 | ||||||||

| 2PC3 | −0.156 | 0.115 | 0.176 | 0.855 | ||||||||

| 2PC4 | −0.037 | 0.114 | 0.744 | 0.964 | ||||||||

| 3PC1 | −0.114 | 0.111 | 0.305 | 0.892 | ||||||||

| 3PC2 | 0.018 | 0.123 | 0.882 | 1.018 | ||||||||

| 3PC3 | −0.151 | 0.111 | 0.172 | 0.860 | ||||||||

| 3PC4 | −0.090 | 0.113 | 0.426 | 0.914 | ||||||||

| technical problem with the payment | 0.228 | 0.084 | 0.674 | |||||||||

| Unacceptance risk | 0.063 | 0.683 | 0.975 | |||||||||

| Attitude to risk | 0.078 | 0.918 | 0.992 | |||||||||

| age | 0.038 | 0.008 | 0.000 | 1.038 | 0.036 | 0.009 | 0.000 | 1.037 | 0.036 | 0.008 | 0.000 | 1.036 |

| income | 0.291 | 0.107 | 0.006 | 1.338 | 0.300 | 0.105 | 0.004 | 1.350 | 0.283 | 0.103 | 0.006 | 1.335 |

| education | 0.144 | 0.230 | 0.532 | 1.155 | 0.025 | 0.214 | 0.907 | 1.025 | ||||

Data source: Collected by this research.

The most important results can be summarized as follows. Assuming a standard significance level at p < 0.05, the decision on the value of the cash reserve maintained despite having made a decision to use CMP does not depend on the assessment of the magnitude of risk (except for problems due to consumer’s mistakes), past experiences, and attitude to risk. The main determinants are income (higher income increases the likelihood of maintaining larger reserves) and age (the likelihood of maintaining larger reserves increases with age).

References

- Maciejewski, G. E-consumers against the risk a failed purchase. Manag. Gouv. Enterp.–Territ.–Soc. 2013, 10, 95–104.