Smart city initiatives have become recurrent strategies used by local governments to provide better services, improve their managerial effectiveness, and increase citizen participation in cities’ decision-making processes. Great potential exists to use data, information, and communication technologies (ICT) more extensively to improve city operations. However, depending on the size and financial situation of the cities, some smart city initiatives could be considered investments that are too expensive and not easy to maintain in the long term. If city governments want to achieve most of the benefits arising from the intense use of technology and data, building financially sustainable smart cities should be seen as a priority.

- financial sustainability

- budgeting

- financial management

- smart city

- sustainable city

- ICT infrastructure

- long-term capital decisions

1. Introduction

2. Smart Cities and Sustainability

-

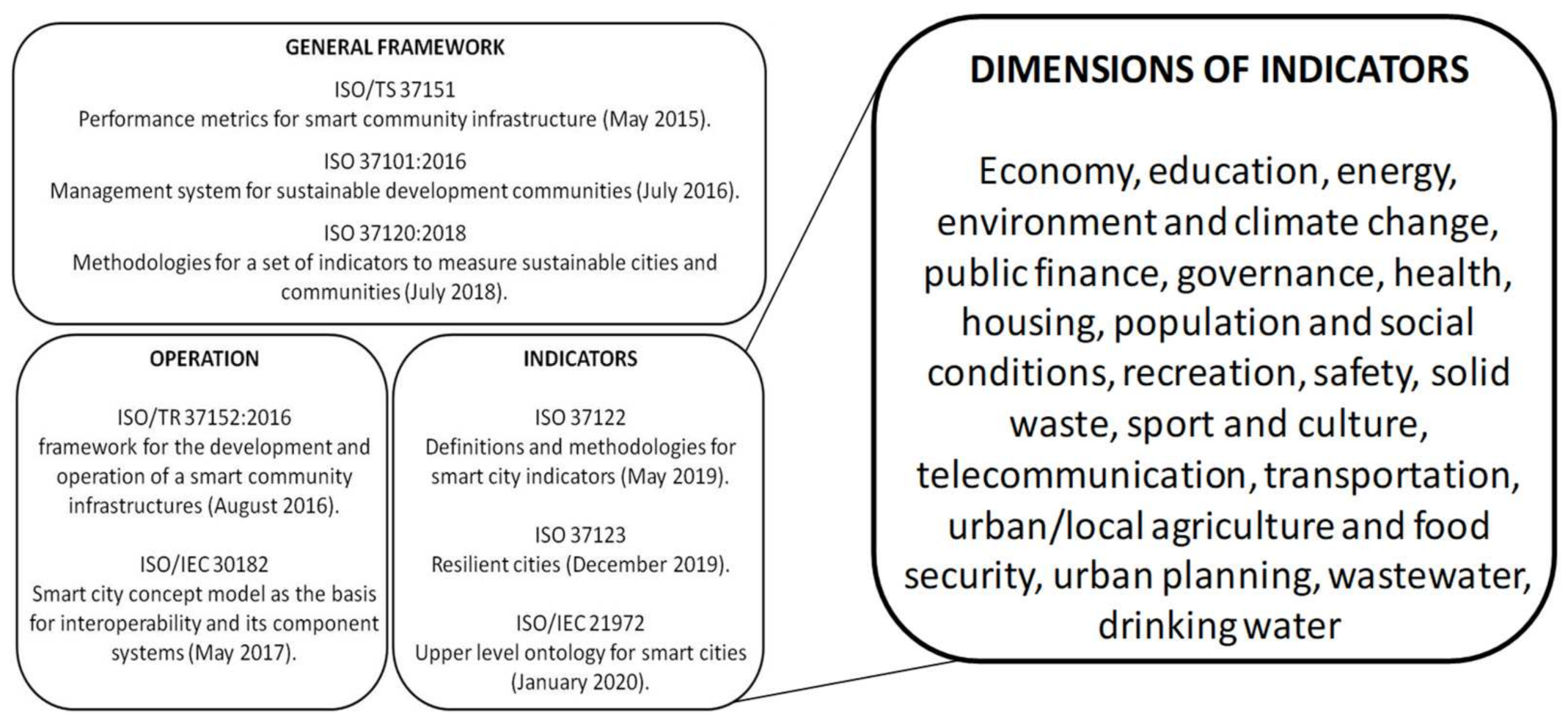

ISO/TS 37151 defines the principles and requirements for performance metrics for a smart community infrastructure (May 2015).

-

ISO 37101:2016 establishes the requirements for a management system for sustainable development communities (July 2016).

-

ISO/TR 37152:2016 outlines the basic concept of a common framework for the development and operation of smart community infrastructures (August 2016).

-

ISO/IEC 30182 describes and gives guidance for a smart city concept model as the basis for interoperability, along with its component systems (May 2017).

-

ISO 37120:2018 defines and establishes methodologies for a set of indicators for city services and quality of life by which to measure sustainable cities and communities (July 2018).

-

ISO 37122 specifies and establishes the definitions and methodologies for a set of indicators for smart cities (May 2019).

-

ISO 37123 complements ISO 37122 for resilient cities (December 2019).

-

ISO/IEC 21972 is the standard that establishes the general principles and guidelines for an upper-level ontology for smart cities (January 2020).

3. FS for Smart Cities

References

- Matus Ruiz, M.; Ramírez Autrán, R. (Eds.) Ciudades Inteligentes en Iberoamérica; Ejemplos de Iniciativas Desde el Sector Privado, la Sociedad Civil, el Gobierno y la Academia; INFOTEC Centro de Investigación e Innovación en Tecnologías de la Información y Comunicación: Ciudad de México, Mexico, 2016.

- Gasco-Hernandez, M. Criterios para Evaluación de Buenas Prácticas en el Ámbito del uso de las Tecnologías de la Información y las Comunicaciones (Criteria to Assess Good Practices Related to the Use of Information and Communication Technologies); Fundació Pi i Sunyer: Barcelona, Spain, 2009.

- Lombardi, P.; Giordano, S.; Farouh, H.; Yousef, W. Modelling the smart city performance. Innov. Eur. J. Soc. Sci. Res. 2012, 25, 137–149.

- Neirotti, P.; De Marco, A.; Cagliano, A.C.; Mangano, G.; Scorrano, F. Current trends in Smart City initiatives: Some stylised facts. Cities 2014, 38, 25–36.

- Cabaleiro, R.; Buch, E.; Vaamonde, A. Developing a Method to Assessing the Municipal Financial Health. Am. Rev. Public Adm. 2013, 43, 729–751.

- Navarro-Galera, A.; Rodríguez-Bolívar, P.; Alcaide-Muñoz, L.; López-Subires, M.D. Measuring the financial sustainability and its influential factors in local governments. Appl. Econ. 2016, 48, 3961–3975.

- Giffinger, R. Smart City Concepts: Chances and Risks of Energy Efficient Urban Development. In Smart Cities, Green Technologies, and Intelligent Transport Systems. In Proceedings of the International Conference on Smart Cities and Green ICT Systems, SMARTGREENS 2015, VEHITS 2015, Lisbon, Portugal, 20–22 May 2015; Springer: Cham, Switzerland, 2016; pp. 3–16.

- Timeus k Vinaixa, J.; Pardo-Bosch, F. Creating business models for smart cities: A practical framework; Special issue: Management, Governance and Accountability for Smart Cities and Communities. J. Public Manag. Rev. 2020, 22, 726–745.

- Adams, C.A.; Muir, S.; Hoque, Z. Measurement of Sustainability Performance in the Public Sector, Sustainable Accountable. Manag. Policy J. 2014, 5, 46–67.

- ESA. European System of Accounts 2010; Eurostat European Commission, Publications Office of the European Union: Luxembourg, 2013.

- IFAC. Reporting on the Long-Term Sustainability of an Entity’s Finances; IFAC: New York, NY, USA, 2013.

- IMF. Government Finance Statistics Manual 2014 (GFSM 2014); International Monetary Fund: Washington, DC, USA, 2014.

- UN. System of National Accounts 2008 (SNA 2008); United Nations: New York, NY, USA, 2009; Available online: https://unstats.un.org/unsd/nationalaccount/docs/sna2008.pdf (accessed on 12 May 2022).

- Castelnovo, W.; Misuraca, G.; Savoldelli, A. Smart Cities Governance: The Need for a Holistic Approach to Assessing Urban Participatory Policy Making. Soc. Sci. Comput. Rev. 2016, 34, 724–739.

- Caird, S.P.; Hallett, S.H. Towards evaluation design for smart city development. J. Urban Des. 2019, 24, 188–209.

- Batty, M. Smart cities of the future. Eur. Phys. J. Spec. Top. 2012, 214, 481–515.

- Anthopoulos, L.; Tsoukalas, I.A. The implementation model of a digital city. J. e-Gov. 2005, 2, 91–110.

- Yovanof, G.S.; Hazapis, G.N. An architectural framework and enabling wireless technologies for digital cities & intelligent urban environments. Wirel. Pers. Commun. 2009, 49, 445–463. Available online: https://link.springer.com/article/10.1007/s11277-009-9693-4 (accessed on 12 May 2022).

- Kanter, R.M.; Litow, S.S. Informed and Interconnected: A Manifesto for Smarter Cities; Working Paper; Harvard Business School General Management Unit: Boston, MA, USA, 2009; pp. 9–141. Available online: https://www.hbs.edu/faculty/Pages/item.aspx?num=36185 (accessed on 12 May 2022).

- Lindskog, H. Smart communities initiatives. In Proceedings of the 3rd ISOneWorld Conference, Las Vegas, NV, USA, 14–16 April 2004; Available online: http://www.heldag.com/articles/Smart%20communities%20april%202004.pdf (accessed on 12 May 2022).

- Noori, N.; de Jong, M.; Janssen, M.; Schraven, D.; Hoppe, T. Input-Output Modeling for Smart City Development. J. Urban Technol. 2021, 28, 71–92.

- Trencher, G.; Karvonen, A. Stretching “smart”: Advancing health and well-being through the smart city agenda. Local Environ. 2019, 24, 610–627.

- Giffinger, R.; Fertner, C.; Kramar, H.; Kalasek, R.; PichlerMilanoviü, N.; Meijers, E. Smart Cities: Ranking of European Medium-Sized Cities; Centre of Regional Science (SRF), Vienna University of Technology: Vienna, Austria, 2007; Available online: http://www.smart-cities.eu/download/city_ranking_final.pdf (accessed on 12 May 2022).

- Bosch, P.; Jongeneel, S.; Rovers, V.; Neumann, H.M.; Airaksinen, M.; Huovila, A. CITYkeys Indicators for Smart City Projects and Smart Cities; CityKeys, European Commission: Brussels, Belgium, 2017; Available online: http://nws.eurocities.eu/MediaShell/media/CITYkeysD14Indicatorsforsmartcityprojectsandsmartcities.pdf (accessed on 25 January 2018).

- Hollands, R.G. Will the real smart city please stand up? Intelligent, Progressive, or Entrepreneurial? City 2008, 12, 303–320.

- Komninos, N. Intelligent Cities and Globalization of Innovation Networks; Taylor & Francis: London, UK, 2008.

- Landry, C. The Creative Centre; Earthscan: Londres, UK, 2008.

- Pereira, G.V.; Luna-Reyes, L.F.; Gil-Garcia, J.R. Governance innovations, digital transformation and the generation of public value in Smart City initiatives. In Proceedings of the 13th International Conference on Theory and Practice of Electronic Governance, Athens, Greece, 23–25 September 2020; pp. 602–608.

- Gil, O.; Zheng, T.C. Smart cities through the lenses of public policy: The case of Shanghai. Rev. Española Cienc. Política 2015, 38, 63–84.

- Leydesdorff, L.; Etzkowitz, H. Can “The Public” Be Considered as a Fourth Helix in University-Industry-Government Relations? Report of the Fourth Triple Helix Conference. Sci. Public Policy 2003, 30, 55–61.

- Toli, A.M.; Murtagh, N. The Concept of Sustainability in Smart City Definitions. Front. Built Environ. 2020, 6, 77.

- Oberti, I.; Pavesi, A.S. The triumph of the smart city. TECHNE J. Technol. Archit. Environ. 2013, 5, 117–122. Available online: https://oaj.fupress.net/index.php/techne/article/view/4300 (accessed on 12 May 2022).

- Dameri, R.P.; Rosenthal-Sabroux, C. Smart City and Value Creation. In Smart City. How to Create Public and Economic Value with High Technology in Urban Space; Dameri, R.P., Rosenthal-Sabroux, C., Eds.; Springer International Publishing: Cham, Switzerland, 2014.

- Caragliu, A.; Del Bo, C.; Nijkamp, P. Smart cities in Europe. J. Urban Technol. 2011, 18, 65–82.

- Aurigi, A.; Odendaal, N. From “Smart in the Box” to “Smart in the City”: Rethinking the Socially Sustainable Smart City in Context. J. Urban Technol. 2020, 28, 55–70.

- Carli, R.; Dotoli, M.; Pellegrino, R.; Ranieri, L. Measuring and managing the smartness of cities: A Framework for classifying performance indicators. In Proceedings of the 2013 IEEE International Conference on Systems, Man, and Cybernetics, Manchester, UK, 13–16 October 2013.

- Monfaredzadeha, T.; Krueger, R. Investigating Social Factors of Sustainability in a Smart City. Procedia Eng. 2015, 118, 1112–1118.

- Castillo, H.; Price, A.; Moobela, C.; Mathur, V. Assessing urban social sustainability: Current capabilities and opportunities for future research. Int. J. Environ. Cult. Econ. Soc. Sustain. 2007, 3, 39–48.

- Martin, C.H.; Evans, J.; Karvonenc, A. Smart and sustainable? Five tensions in the visions and practices of the smart-sustainable city in Europe and North America. Technol. Forecast. Soc. Chang. 2018, 133, 269–278.

- Monfaredzadeh, T.; Berardi, U. Beneath the smart city: Dichotomy between sustainability and competitiveness. Int. J. Sustain. Build. Technol. Urban Dev. 2015, 6, 140–156.

- Haarstad, H. Constructing the sustainable city: Examining the role of sustainability in the ‘smart city’ discourse. J. Environ. Policy Plan. 2017, 19, 423–437.

- Komninos, N. Smart City Governance and Financing. 2013. Available online: http://innovatv.it/video/2807981/nicos-komninos/finanziare-le-smart-city-soluzioni-confronto#.VLpqsv45DIU (accessed on 25 June 2015).

- Shen, L.Y.; Jorge Ochoa, J.; Shah, M.N.; Zhang, X. The application of urban sustainability indicators—A comparison between various practices. Habitat Int. 2011, 35, 17–29.

- Cocchia, A. Smart and Digital City: A Systematic Literature Review. In Smart City. How to Create Public and Economic Value with High Technology in Urban Space; Dameri, R.P., Rosenthal-Sabroux, C., Eds.; Springer International Publishing: Cham, Switzerland, 2014.

- Albino, V.; Berardi, U.; Dangelico, R.M. Smart cities: Definitions, dimensions, performance, and initiatives. J. Urban Technol. 2015, 22, 3–21.

- Da Silva de Santana, E.; Nunes, E.; Santos, L.B. The use of ISO 37122 as standard for assessing the maturity level of a smart city. Int. J. Adv. Eng. Res. Sci. 2018, 5, 309–315.

- Huovilaa, A.; Bosch, P.; Airaksinen, M. Comparative analysis of standardized indicators for smart sustainable cities: What indicators and standards to use and when? Cities 2019, 89, 141–153.

- Berne, R.; Schramm, R. The Financial Analysis of Governments; Prentice Hall: Englewood Cliffs, NJ, USA, 1986.

- Hendrick, R. Assessing and measuring the fiscal health of local governments. Focus on Chicago suburban municipalities. Urban Aff. Rev. 2004, 40, 78–114.

- Rodríguez Bolívar, M.P. Financial Sustainability in Public Administration. A synthesis of the Contributions for Improving Financial Sustainability. In Financial Sustainability in Public Administration; Rodríguez, M.P., Ed.; Palgrave Macmillan: Cham, Switzerland, 2017.

- Chapman, J.I. State and Local Fiscal Sustainability: The Challenges. Public Adm. Rev. 2008, 68, S115–S131.

- Norcross, E.; Gonzalez, O. Ranking the States by Fiscal Condition; Mercatus Research, Mercatus Center at the George Mason University: Arlington, VA, USA, 2017.

- Wang, X.H.; Dennis, L.; Tu, Y.S. Measuring Fiscal Condition: A Study of US States. Public Budg. Financ. 2007, 27, 1–21.

- Montesinos, V.; Dasí, R.M.; Brusca, I. A Framework for Comparing Financial Sustainability in EU Countries: National Accounts, Governmental Accounting and te Challenge of Harmonization. In Financial Sustainability of Public Sector Entities; Caruana, J., Brusca, I., Caperchione, E., Cohen, S., Cohen, F.M., Eds.; The Relevance of Accounting Frameworks; Palgrave MacMillan: Cham, Switzerland, 2019.

- Groves, S.M.; Valente, M.G.; Schulman, M. Evaluation Financial Condition: A Handbook for Local Government; International City/County Management Association (IMCA): Washington, DC, USA, 2003.

- Kavanagh, S.; Pisano, M.; Tang, S.Y.; McGrath, M.F.; Linkhart, D.; Hudson, M.; Colon, E. Financial Sustainability Index: A Self Assessment Tool for Financial Sustainability; Working Paper WP17MP2; Lincoln Institute of Land Policy: Cambridge, MA, USA, 2017; Available online: https://www.gfoa.org/sites/default/files/pisano_wp17mp2_0.pdf (accessed on 15 July 2019).

- McDonald, B. Measuring the Fiscal Health of Municipalities; Working Paper WP17BM1; Lincoln Institute of Land Policy: Cambridge, MA, USA, 2017.

- Aquino, A.C.; Cardoso, R.L. Accounting framework (re)interpretation to accommodate tensions from financial sustainability competing concepts. In Financial Sustainability of Public Sector Entities. The Relevance of Accounting Frameworks; Caruana, J., Brusca, I., Caperchione, E., Cohen, S., Manes Rossi, F., Eds.; Palgrave MacMillan: Cham, Switzerland, 2019; pp. 83–102.

- De Aquino, A.C.; Cardoso, R.L. Financial resilience in Brazilian municipalities. In Governmental Financial Resilience: International Perspectives on How Local Governments Face Austerity; Ileana Steccolini, I., Singh Jones, M.D., Saliterer, I., Eds.; Emerald Publishing Limited: Bingley, UK, 2017; Volume 27.

- Lima, D.V.D.; Aquino, A.C.B.D. Financial resilience of municipal civil servants’ pension funds. Rev. Contab. Finanças 2019, 30, 425–445.

- Gupta, S.; Keen, M.; Shah, A.; Verdier, G. Digital Revolutions in Public Finance; International Monetary Fund: Washington, DC, USA, 2017.

- Ndou, V. E-Government for Developing Countries: Opportunities and Challenges. Electron. J. Inf. Syst. Dev. Ctries 2004, 18, 1–24.

- Alawadhi, S.; Aldama-Nalda, A.; Chourabi, H.; Gil-Garcia, J.R.; Leung, S.; Mellouli, S.; Nam, T.; Pardo, T.A.; Scholl, H.J.; Walker, S. Building understanding of smart city initiatives. In Proceedings of the EGOV 2012, LNCS 7443, Kristiansand, Norway, 3–6 September 2012; Scholl, H.J., Janssen, M., Wimmer, M., Moe, C.E., Flak, L.S., Eds.; IFIP International Federation for Information Processing: Laxenburg, Austria, 2012; pp. 40–53.

- Leon, N. Attract and connect: The innovation district and the internationalization of Barcelona business. Innov. Organ. Manag. 2008, 10, 235–246.