We collected data pertaining to Chinese listed commercial banks from 2008 to 2016 and found that the competition between banks is becoming increasingly fierce. Commercial banks have actively carried out diversification strategies for greater returns, and the financial reports show that profits are increasingly coming from the non-interest income benefits of diversification strategies. However, diversification comes with risk. We built a panel threshold model and investigated the effect of income diversification on a bank’s profitability and risk. Diversification was first measured by the Herfindahl–Hirschman index (HHI), and the results show that there is a nonlinear relationship between diversification and profitability or risk does exist. We introduced an interesting index based on the entropy to test the robustness of our model and found that a threshold effect exists in both our models, which is statistically significant. We believe the combination of the entropy index (ENTI) and the HHI enables more efficient study of the relationship between diversification and profitability or risk more efficiently. Bankers and their customers have increasingly been interested in income diversification, and they value risk as well. We suggest that banks of different sizes should adopt the corresponding diversification strategy to achieve sustainable development.

- commercial banks

- Herfindahl–Hirschman index (HHI)

- entropy index (ENTI)

- profitability

- risk

- income diversification

- threshold effect

View Full-Text[11. Introduction

1.1. Background

Since 2006, the reform of China’s banking industry has taken a new and important step. The “Big Five” banks, the Bank of China Limited (BOC), Industrial and Commercial Bank of China Limited (ICBC), China Construction Bank Corp. (CCB), Agricultural Bank of China Limited (ABC), and Bank of Communications Co., Ltd. (BOCOM), have successfully completed shareholding system reform and are listed on the Chinese A-share stock market. At the same time, the reform of interest rate marketization (IRM) has been steadily promoted. Zhou Xiaochuan, China’s central bank chief, pointed out that IRM enlarged the banks’ pricing power and the pricing power on loans and deposits. Moreover, the reform will help the market play a role in allocating resources and reflect the independent pricing power of financial institutions on their products and services. In addition, customers can choose from similar financial products at different prices, so financial institutions will be able to provide a variety of financial products and services and offer different prices according to the customer’s risk [1]. Additionally, in recent years, the Chinese government has emphasized the importance of promoting IRM reform in reports on the work of the government.

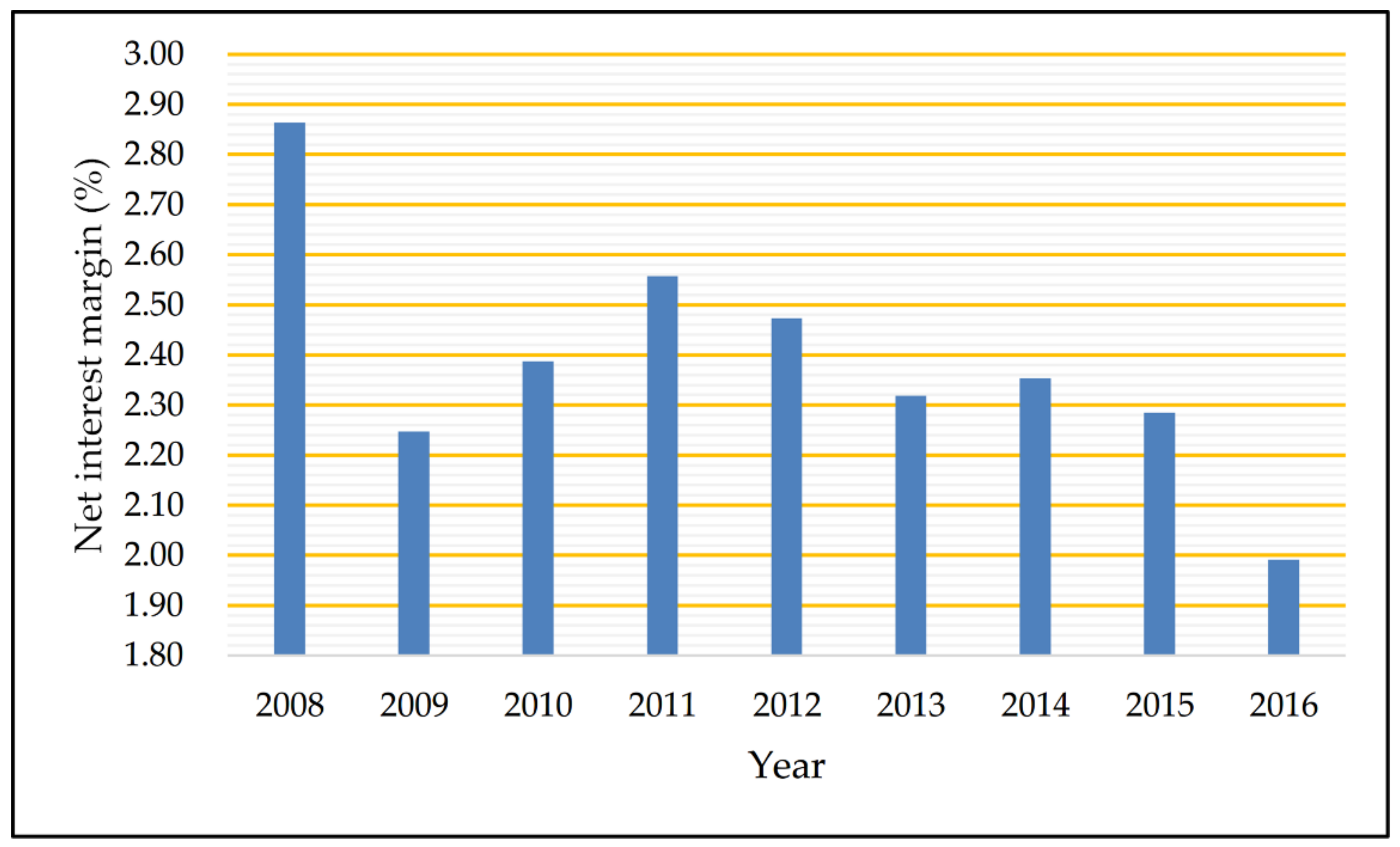

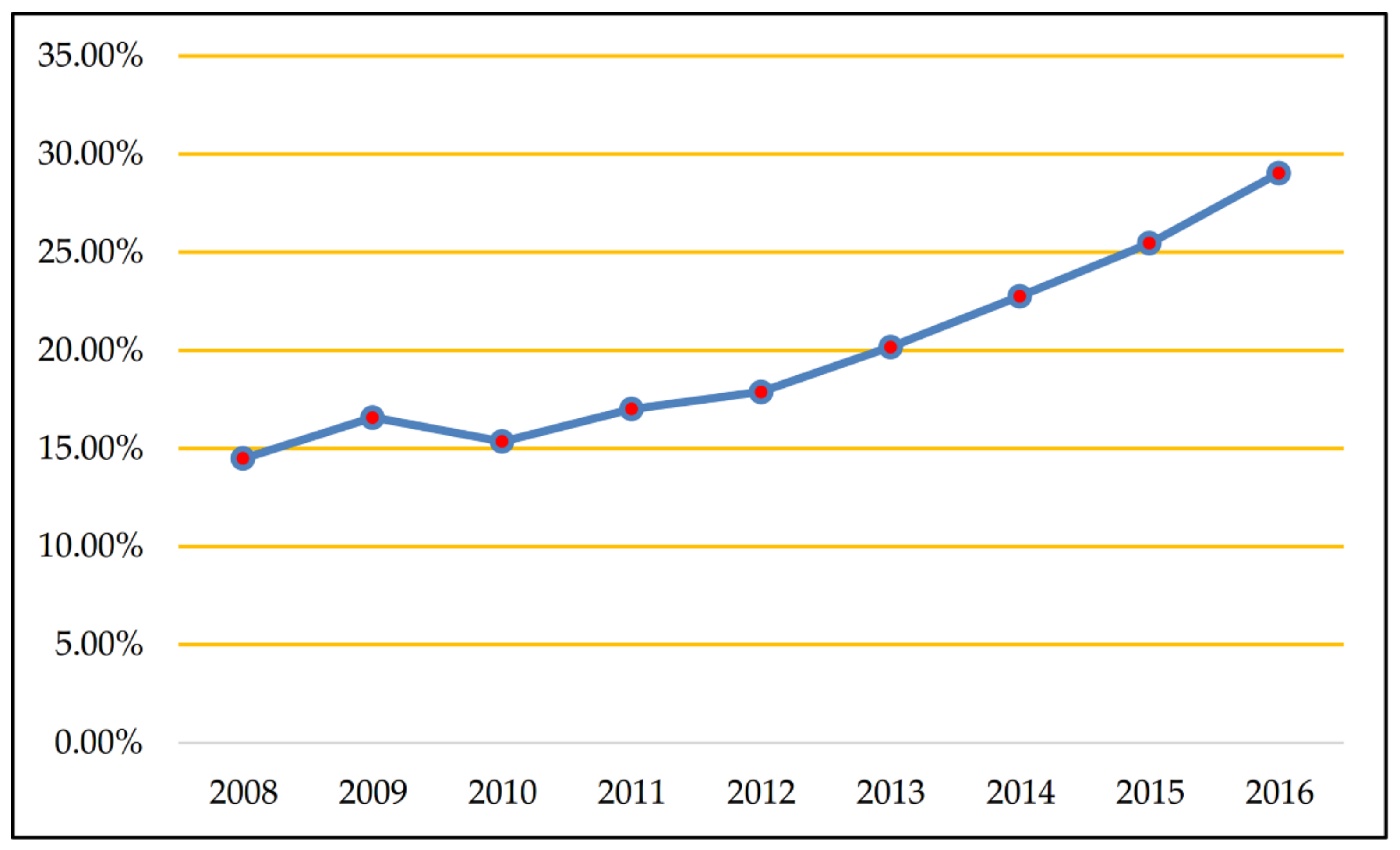

The outbreak of the global financial crisis in 2008 had a substantial and far-reaching impact on China’s banking industry. Against the background of the global financial crisis, with the continuous reforms and innovations of China’s financial system, interbank competition has intensified. According to our calculation, the net interest margin has been volatile over the years (see Figure 1), which means the traditional operating strategy based on interest income should be changed. Therefore, there is an urgent demand for Chinese commercial banks to transform and upgrade main businesses, and many banks have adopted the strategy of income diversification, by providing more abundant financial products and services (non-interest business) to broaden their income channels. As shown in Figure 2, non-interest income has increasingly contributed to operating income from 2008 to 2016.

Figure 1. The net interest margin of listed commercial banks.

Figure 2. The percentage of non-interest income in operating income.

1.2. The Income Diversification of Banks

Income diversification has become an important trend in the development of modern banking. Most early studies were focused on the income diversification strategies of the European and American banking industries and described the potential benefits of income diversification from a variety of perspectives. First, by engaging in a wider range of financial activities, diversification can broaden revenue channels and cultivate new growth points. Second, banks can achieve operational synergies in providing a variety of financial products and services and enhance profitability with the economies of scale. In addition, since the non-interest business of a bank is irrelevant or not completely relevant to the interest business (which was believed to be more highly related to the economy), the diversification of income structures can reduce the volatility of the bank’s income and stabilize it. Furthermore, by making full use of the customer information accumulated in traditional businesses, universal banks that adopt income diversification incur lower costs than specialized banks engaged only in traditional banking (see [2–5]). Moreover, some scholars believe that universal banks achieve well-diversified incomes and face lower risks than specialized banks. According to statistics from the Great Depression in the United States, most of the bankrupt banks were specialized, engaging only in a single business. To summarize, income diversification makes banks operate more efficiently by reducing cost, lowering risk, and enhancing profitability. Additionally, it can contribute to financial stability and economic development (see [6,7]).

With the development of non-interest business all over the world, research can deepen our understanding of the effect of diversification on banks’ profitability and risk. Studies have increasingly provided empirical evidence showing that diversification can benefit banks. Pennathur et al. [8] concluded that diversification benefited the public-sector banks of India by reducing default risk during the period 2001–2009. Shim [9] found that diversification reduced the likelihood of insolvency risk based on data of a USA bank holding company from 1992 to 2011, as the diversified income portfolio lowered the volatility of income. Other studies have found that income diversification may increase risk and reduce income and stability, theoretically and empirically. Lepetit et al. [10] found that there was a positive relationship between fee-based activities (commission income, which is a type of non-interest income) and solvency risk based on the data of European banks from 1996 to 2002. Hayden et al. [11] showed that, for most German banks, a higher level of diversification may result in a lower return, by using data of the loan portfolios of banks during the 1996–2002 period. Using data pertaining to banking in the USA from 1997 to 2002, Stiroh [12] analyzed the influence of income diversification on bank performance, and found that decreased interest income volatility contributed to income stability, while non-interest income was more volatile than interest income. Additionally, components of non-interest income, such as service charges and fees, are highly correlated with interest income. According to income structure statistics on the European banking industry from 1994 to 2002, Wang pointed out that, although the contribution of non-interest income to operating income increased significantly during the period, the growth of non-interest income to some extent compensated for the decline in interest income. However, the data show that, in 1995 and 1997, the rise in non-interest income was accompanied by a certain degree of increased operating costs. In other words, the impact of non-interest income on the profitability of banks is, on the whole, uncertain [13]. Additionally, Mercieca et al. [14] found that there was no direct diversification benefit for small European banks from 1997 to 2003, as they lacked experience and expertise on new types of business. Some researchers explored the heterogeneous effect of diversification, while some found that this effect does not exist. According to Baele et al., the diversification gains and costs are not significant for small and large banks in the European Union [15]. Hidayat et al. [16] studied the relationship between risk and diversification in Indonesian banks, and the results showed that the effect highly depends on the scale of the bank.

In sum, most research is currently focused on banks in the U.S. or in E.U. member countries, and the financial system and level of financial development in China are different from these countries. Therefore, whether or not income diversification is advantageous to Chinese banks is of great importance. In addition, there are no unanimous conclusions regarding the relationship between a bank’s profitability and risk. Some people believe income diversification is beneficial for banks by improving profitability and income stability, while others argue that diversification may increase risk and income volatility. Moreover, it is worth noting that some research found that diversification may have a heterogeneous impact on banks. Therefore, we decided to use the panel threshold model to check whether the effects of diversification on profitability and risk are different among banks.