| Version | Summary | Created by | Modification | Content Size | Created at | Operation |

|---|---|---|---|---|---|---|

| 1 | Amr Sufian | + 9007 word(s) | 9007 | 2021-04-22 09:03:17 | | | |

| 2 | Bruce Ren | -21 word(s) | 8986 | 2021-04-28 03:03:41 | | | | |

| 3 | Bruce Ren | -21 word(s) | 8986 | 2021-04-28 03:07:08 | | | | |

| 4 | Amr Sufian | + 435 word(s) | 9421 | 2021-05-02 02:09:20 | | | | |

| 5 | Amr Sufian | Meta information modification | 9421 | 2021-05-06 14:06:53 | | | | |

| 6 | Amr Sufian | Meta information modification | 9421 | 2021-05-11 13:01:18 | | | | |

| 7 | Bruce Ren | Meta information modification | 9421 | 2021-08-05 08:13:53 | | | | |

| 8 | Bruce Ren | Meta information modification | 9421 | 2021-08-06 05:04:21 | | | | |

| 9 | Bruce Ren | Meta information modification | 9421 | 2021-08-06 05:07:28 | | | | |

| 10 | Bruce Ren | Meta information modification | 9421 | 2021-08-06 05:11:53 | | | | |

| 11 | Bruce Ren | Meta information modification | 9421 | 2021-08-06 05:14:01 | | |

Video Upload Options

The fourth industrial revolution is the transformation of manufacturing into smart manufacturing. Advanced industrial digital technologies that make the trend Industry 4.0 are considered as the transforming force that will enable this transformation. However, these technologies need to be connected, integrated and used effectively to create value and to provide insights for data driven manufacturing. Smart manufacturing is a journey and requires a roadmap to guide manufacturing organizations for its adoption. The proposed roadmap is a simple holistic management strategy for an Industry 4.0 implementation journey. It serves as a strategic practical tool for rapid adoption of Industry 4.0 technologies. It bridges the gap between the advanced technologies and their application in manufacturing industry, especially for SMEs.

1. Introduction

The fourth industrial revolution is an era of digital transformation in the manufacturing industry. This change is seen as an evolution of previous industrial revolution and is often considered disruptive [1]. To better understand this phenomenon, its causes, effects and impacts, one needs to go back in history to review previous industrial revolutions, to understand the cause of their evolution, the context behind them, their key drivers and continuous expansion.

Prior to the industrial revolution, societies were agriculturalists. Agricultural stability has been reached through continuous development of the irrigation engineering techniques. Civilizations through history harnessed the power of water, animals and gearing mechanism to increase the amount of work done mainly for irrigation. These engineering techniques enormously advanced partially due to the progress made in mathematics in the 9th century and the introduction of the crank shaft systems in the late 12th century, translating rotary motion into linear motion. This gave birth to the concept of automatic machines subsequently enabling the development of self-driven water raising machines, water pumps and automatic clocks [2]. Mechanical machines further advanced over time to work with steam power, a key technological drive for the first industrial revolution in the late 18th century. It enabled mechanical production allowing societies to move into city living and working in purpose-built factories.

The second industrial revolution in the late 19th century was another great leap forward in technological advancement. Mainly driven by electricity, gas and oil to power combustion engines. This led to advances in manufacturing methods and processes such as the introduction of productions assembly lines by Henry Ford allowing mass production especially for automobiles and airplanes. The second wave in industrial advancements revolutionized public transport and considerably reduced the cost of industrial products.

The third industrial revolution appeared at the second half of the 20th century with the rise of electronics, computers and information technology that penetrated the manufacturing industry leading to automation in manufacturing. The use of Programmable Logic Controllers (PLCs) and robotics allowed more flexibility, this enabled the production of sophisticated products at even lower costs.

The fourth industrial revolution is now underway which builds upon the third industrial revolution digitalization and automation capabilities. Its further driven by the advancement of the internet and communication, the power of advanced computing and data science [3]. It enables new levels of connectivity and integration that produces insightful information that can solve problems once considered unsolvable by finding patterns that have not been seen before [4]. It enables changes in the manufacturing industry by connecting the digital and the physical world together to build a new virtual world from which the physical world can be steered [5][6]. This is acting as a gateway into smart manufacturing and smarter factories [3]. In computing context, the application of cyber physical systems (CPS) within industrial production systems defines the fourth industrial revolution [7].

The smart factory is a concept consisting of a flexible production system with connected processes and operations—via CPS and advanced digital technologies—that can self-optimize performance, adapt to and learn from new conditions in real-time that can autonomously run production processes [8]. Smart manufacturing on the other hand is a term used to define the area of digital manufacturing [9]. It is a set of manufacturing practices using a combination of data and digital technologies to manage and control manufacturing operations [10]. It represents the implementation of advanced industrial digital technologies to empower people with information for better visibility into manufacturing processes and operations. This new level of information drive improvements and enhance the manufacturing processes, diagnose issues, and overcome challenges in relatively short time, turning the data into actionable insights [11]. This is recognized as a new way of lean manufacturing, empowering people with insightful data to drive improvements and provide opportunities to increase productivity and flexibility [12][13].

It is argued that the fourth industrial revolution offer opportunities for the manufacturing industry to improve its processes, asset performance, customer experience and workforce engagements [3][5][6][7][8][9]. This subsequently could result in improved productivity and increased efficiencies, the two of which reduce cost and facilitate revenue growth. It brings more resilience and flexibility to the manufacturing industry to meet the challenges of this decade associated with sustainability, remaining competitive and making employment experience more attractive comparable to other industries [8].

The term Industry 4.0 is often used to refer to the fourth industrial revolution. The term was coined by the German Government’s national strategic initiative “High Tech 2020” to drive digital manufacturing forward by increasing digitalization and enhancing competitiveness in the manufacturing industry [14][15]. Since then, it has been institutionalized with the platform Industry 4.0 and the Reference Architectural Model Industry 4.0 (RAMI 4.0) [1]. It now serves as a central point of contact for policy makers demonstrating how to approach Industry 4.0 in a structured manner and working towards national and international standardization. The huge potential of value creation by Industry 4.0 for the German manufacturing market is estimated to be between 70 and 140 billion Euros in the next five to ten years [5][15].

Although Germany was the first to tap into this new way of pursuing digitalization in the manufacturing industry it has become a global trend and the race to adapt Industry 4.0 is already happening in Europe, USA and Asia. Initiatives such as the UK “Made Smarter” strategy 2030 [16] sets out how the UK manufacturing can be transformed through the adoption of industrial digital technologies to become a global leader in industrial digitalization with the potential to create enormous opportunities for the manufacturing industry by increasing growth, creating new jobs, reducing CO2 emission and improving industrial productivity. Other global strategies and initiatives are also in place to support the digital transformation and competitiveness in manufacturing. For example, the “Made in China 2025” initiative [17] aims to move manufacturing up the value chain in China. The USA “America Makes” [18] supports additive manufacturing and 3D printing. South Korea “Manufacturing Innovation 3.0” [19] supports the adoption and transformation into the smart factory. Japan’s “Robot Strategy” aims to establish Japan as a robotics superpower to address the challenges of demographics and labor in an aging and declining population [20].

Manufacturing leaders are already taking a lead in their Industry 4.0 journeys as they have the sufficient infrastructure and resources to continue improvements [9]. However, the majority of small and medium enterprises (SMEs) in manufacturing sector who represent the backbone of the manufacturing industry have less mature journeys [21][22][23] Several industrial reports and research papers suggest that the lack of clear strategy and vison available to SMEs are amongst the top challenges for Industry 4.0 adoption [6][15][16][21][22][23][24][25][26]. The lack of clear strategy subsequently highlights (i) lack of awareness of industrial digital technologies associated with Industry 4.0 [16][27] (ii) lack of real-world applications demonstrating the benefits and the potential of the available opportunities [15][28] (iii) the complexity of Industry 4.0 technologies and various terminologies used to describe it making it difficult to understand [29] (iv) lack of trusted advice and the know-how of integration [17][21] and (v) lack of prioritized knowledge of where to start and how to apply it to align with the business strategy [9][24].

2. Technology Jigsaw Map

Figure 1 shows a graphical three-dimensional map that summarizes the key technological drives behind the industrial revolutions together with the timeline they have evolved around and the impact they made to the manufacturing industry.

Figure 1. Three-dimensional map of industrial revolutions (Y-axis: Technology drive, X-axis: Timeline of evolution, Z-axis: Impact to the manufacturing industry). (Author’s creation).

Technology has advanced enormously in the past decades and is continuing to do so. The advanced digital technologies that make the trend Industry 4.0 are considered as the transforming force that will arguably modify the production infrastructure, the development of products and services and will potentially bring about improvements to the business-customer relationships [30]. Smart manufacturing is the outcome of a successful connectivity, integration and co-ordination of the capabilities of Industry 4.0 technologies, which subsequently results in people, IT systems, physical assets (e.g., machines/products) and data connected along the entire manufacturing process [5][8]. Real-time access of data from multiple sources in the factory is valuable because it allows manufacturers to utilize and respond to the actionable information derived from the data. It allows manufacturers to differentiate themselves from others by making better decisions regarding the manufacturing process, hence, the term ‘Data Driven Manufacturing’ is revolutionary for the manufacturing industry [31][32].

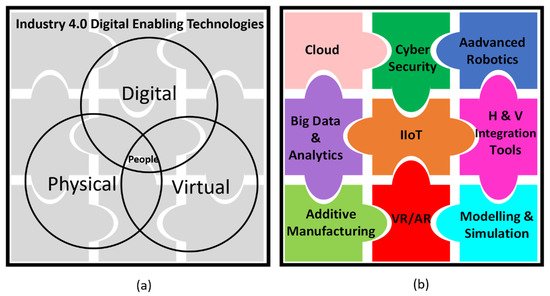

Figure 2a shows relationship circles connecting people with three entities: (i) digital represented by IT systems; (ii) physical represented by machines/products; and (iii) virtual represented by modelling systems. This relationship enabled by Industry 4.0 digital technologies can transform all aspects of a manufacturing business. Data is abundantly available in manufacturing and getting real-time access to this data and information exchange between the three entities allows greater insights for a rapid decision-making process [6][7][8][9][10][11][33][34][35].

This results in an increased labour and resources productivity, increased asset utilization due to reduced machine downtime and reduced costs of maintenance, quality inspection, inventory and time to market [1][5][8][9][15][16][36][30].

Figure 2b shows nine key Industry 4.0 technological elements [5][16] presented inside a technology jigsaw map. These technologies can be seen as a rich collection of available tools to use; therefore it is important to know when and how to use these tools and where would they create value to the business [37].

3. The Six-Gear Roadmap

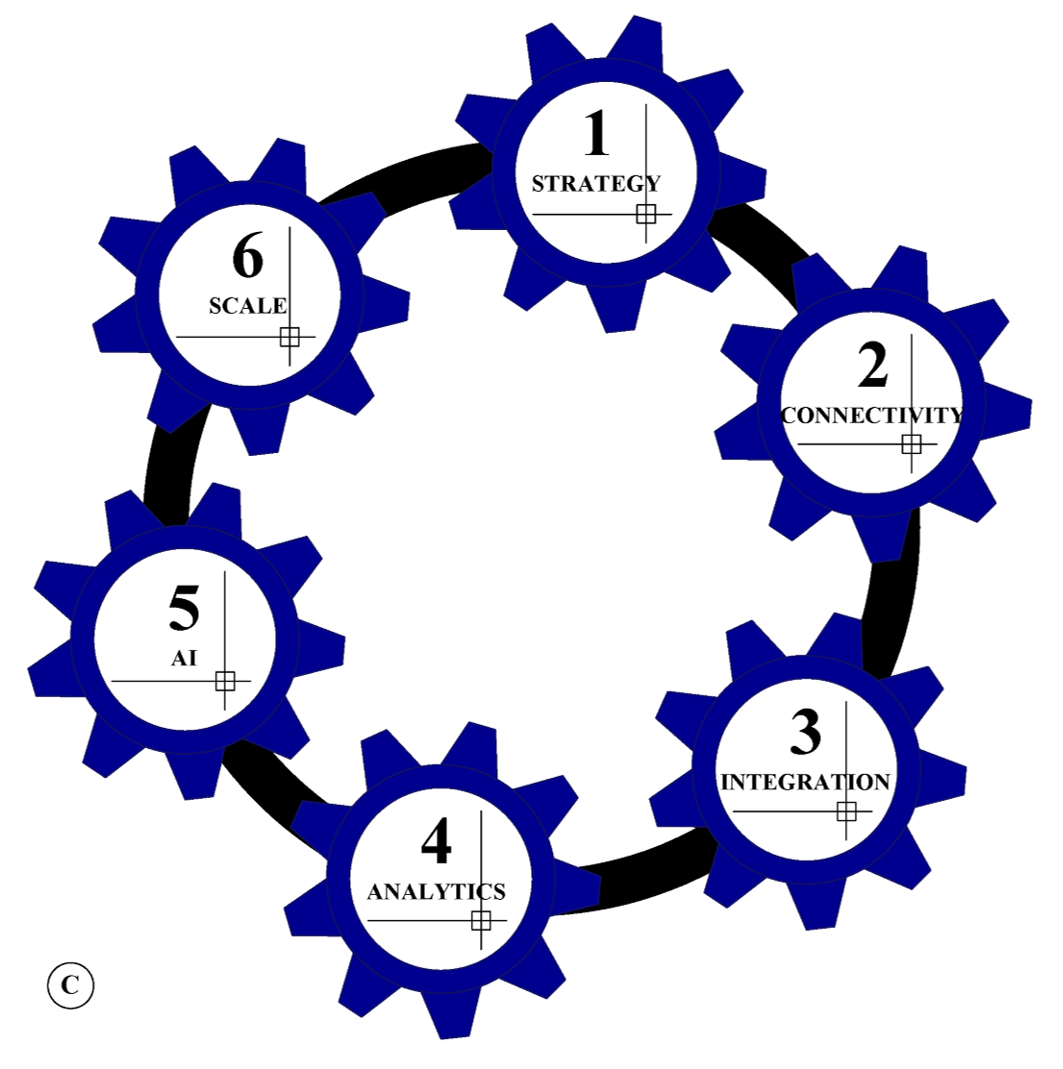

The transition into a smart factory is a journey and the best way to implement it is through a gradual process, building on initial digitized capabilities and following continuous improvements. Figure 3 shows the Six-Gear Roadmap towards the Smart Factory. The gears represent different stages of the journey which have been inspired from the motoring industry. The roadmap serves as a holistic strategic vision towards a successful Industry 4.0 adoption and transformation into smart manufacturing. It is divided into six stages, within each stage there are sub-stages highlighting key areas to be considered. A technology jigsaw is presented alongside the roadmap stages to show the building blocks of key enabling Industry 4.0 technologies.

Figure 3. The six gear roadmap towards the smart factory.

The first gear of the roadmap is the strategy stage which discusses the strategy to build for the adoption journey. The second gear is the connectivity stage which identifies ways to build the foundations for the connectivity infrastructure. The third gear is the integration stage which discusses system integration strategies between information and operation technologies. The fourth and fifth gears are the Analytics and AI stages that highlights the analytical tools and methods that can be used to capitalize on the data turning it into actionable information. The last gear is the Scale stage which outlines different possible approaches that can be adopted to scale, optimize and continue the development of the different stages of the roadmap throughout the Industry 4.0 journey.

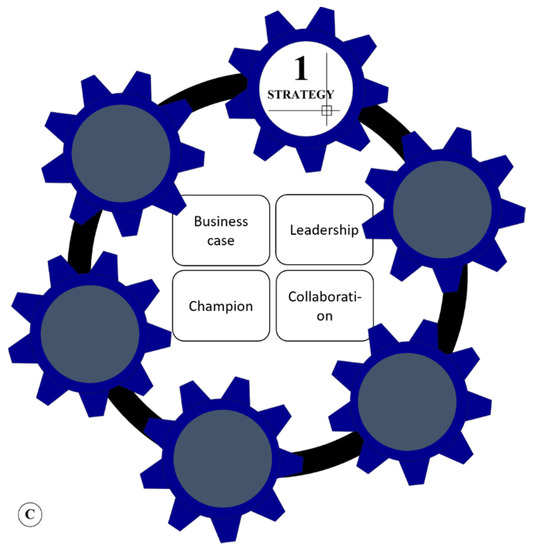

3.1. Gear 1: Strategy

Manufacturing organizations have started to appreciate and embrace Industry 4.0 realizing the potential it can offer in terms of improving efficiencies, cost savings and responsiveness to the market demands [17]. However, it can be confusing on how it can be achieved in practice especially with limited case studies available and the journey could vary from one organization to another [6][21][28]. To achieve the goal towards smart manufacturing, the proposed models suggest building a strategy to assist manufacturing SMEs throughout their journey. Figure 4shows four main areas that should be considered in this stage.

Firstly, a business case should be in place with clear vision, goals and objectives of what is to be achieve that best suits the organization’s business model. This can be done by prioritizing the areas in which it will offer the most benefit and long-term Return-On Investment (ROI) [9]. Recent surveys from the aerospace industry suggest that the majority expect Industry 4.0 investments to payback within two years [25][38]. Early and fast adoption via launch and lean approach could also be significant for competitive advantage and cultural change over late adopters [25]. Manufacturing organizations within the same industry might share similar drives and goals, for example, the aerospace industry common drives are to increase productivity as demand grow, reduce the cost of manufacturing for competitiveness and to add value to the products and services they offer [8][38]. Every manufacturing company can have a different starting point, and a bespoke digital transformation journey. It’s important to identify a specific starting point, understand where the value to be created and begin the journey [39].

Secondly, a key to a successful journey is the role of leadership. The challenge in the manufacturing industry is that leadership is not at the required level to deliver an optimum strategy for faster technology adoption [28] because of lack of available examples or case studies from which leaders can inspired and take lead from. To overcome the leadership challenges, digital transition should be a strategic investment—Possibly written in company’s annual strategic document-to ensure an informed investment to get the confidence on the ROI. Leaders should also consider the wider technical infrastructure and skills needed to manage and accommodate the technologies in-house and what is needed to source them. Managing cultural change and getting the buy-in should be driven from the top with clear communication strategy on where the organization is heading and why they are doing it in order to bring the whole organization onboard throughout the journey [8][28][29].

Thirdly, is to appoint a champion. Due to the nature of an Industry 4.0 project, i.e., being complex, requires multi-disciplinary skills and cross communication between different departments that often operate independently (e.g., IT and operations), a champion with the right leadership and technical skill set is needed that can act as a digital officer and a project manager whose responsibilities include: (i) overseeing the strategy; (ii) facilitating activities between various departments; (iii) managing the project implementation and technology adoption; (iv) constantly updating and communicating the ROI as well as success metrices to leadership; and (v) establish vison of future potential projects and applications to scale along the journey [40].

Finally, foster collaboration and plan them while developing the strategy. Industry 4.0 projects are complex as they touch on many inter-disciplinary areas (e.g., integration of sensors, IT, analytics, etc.). The level of technical readiness, maturity and skills of the company workforce should be assessed to identify the relevant support needed. Collaboration and partnership with academia, technology hubs and technology providers at different stages of the roadmap should be considered. Specialist skills and development support enable quick wins and faster adoption, de-risking failures and investments [28][40][41].

3.2. Gear 2: Connectivity

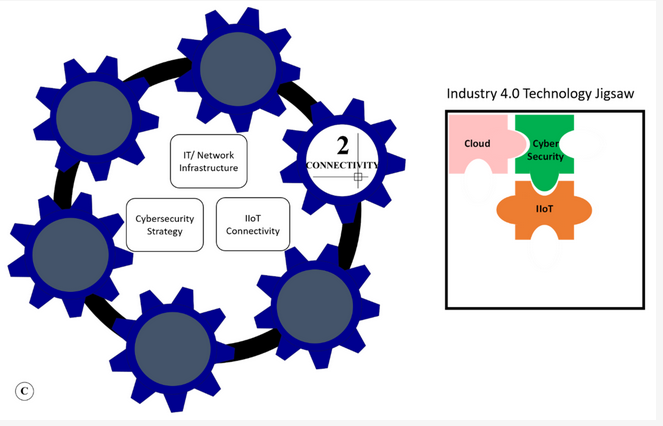

The connectivity stage of the roadmap is the most essential stage because it serves as the foundation for other stages to build upon. Figure 5 shows the three sub-categories that should be considered and the three key enabling technologies associated in this stage.

2.2.1. IT/Network Infrastructure

To establish a stable foundation for smart manufacturing, a resilient and secure IT/network systems are relied upon and must be sought to move forward [41][42]. Existing IT and network infrastructure capabilities in the factory can be the starting point. It is proposed that building upon the existing infrastructure should depend upon the volume of the potential data generation, its flow/communication through the network and data processing capabilities needed as a result, a dedicated server. Having a dedicated IT infrastructure in place for Industry 4.0 projects should be considered, for example a local on premises data centre, a dedicated cloud infrastructure or a hybrid solution. There are advantages and limitation of each in terms cost, maintenance, scalability, reliability, flexibility and security. All these should be considered to best suit the organization capabilities and workloads now and in the future. Wright, J [41] outlines fives steps for manufacturing organizations to lay stable IT foundation and considers cloud hosting (private, public or hybrid cloud solutions) as a viable option to take in preparation for the Industry 4.0 journey.

3.2.2. Industrial Internet of Things (IIoT) Connectivity

The currency of the online world today is data as it drives business and services [43]. Data is in abundance in the manufacturing sector. To access this data, physical assets and operations in the factory floor needs to be connected. Connectivity technologies have become more accessible and affordable due to the considerable drop in the cost of sensors and computing in the last few decades, further enabled by the advancement of the internet [28]. An IIoT system is a collection of an ecosystem of combined technology elements that collect, store and harness data [44] in order to provide information, trigger events and recommended actions to be taken.

There has been several initiatives and close collaboration between research and industry to standardize the reference architectures for IIoT connectivity in industrial applications. These reference architectures all serve as a general guide and aim to facilitate interoperability, simplicity and ease of development [45]. Reference architectures like the Industrial Internet Reference Architecture (IIRA) and the Industrial Internet Connectivity Framework (IICF) by the Industrial Internet Consortium (IIC) facilitate broader industry applications to help evaluate connectivity of IIoT solution [46]. The Internet of Things-Architecture (IoT-A) provides detailed overview of the IoT information technology aspects [47]. RAMI 4.0 provides a three-dimensional map for smart factories covering manufacturing and logistics applications [48]. The International Organization for Standardization (ISO) and the International Electrotechnical Commission (IEC) provides six domain model frameworks for the (IoT) Reference Architecture focusing on resilience, safety and security [49].

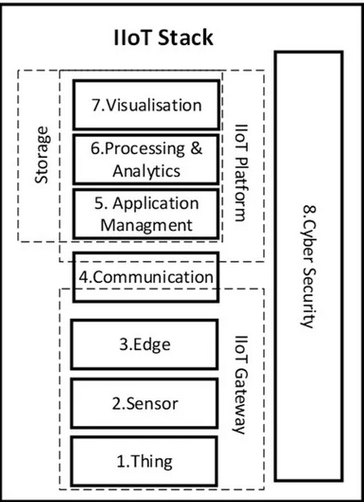

An illustration on an IIoT stacks system is shown on Figure 6. IIoT systems contains different layers that communicate and integrate in coherence with one another without interfering with existing automation logic of the physically connected entities. There are multiple options to consider when building the IIoT stack, this can depend upon existing capability and the application needs.

The ‘Thing’ layer represents the core hardware of the physical entity where the raw data normally exists.

The ‘Sensor’ layer is where the embedded sensors are used to detect and measure the parameter(s) of interest.

The ‘Edge’ layer normally consists of embedded computing hardware and/or software that operates and controls the functionality of the sensors and performs onboard processing of the data. For example, CNC machines/robots used in manufacturing normally consists of the first three layers. They have embedded sensors wired to the PLC unit, interfaced and controlled via a supervisory control and data acquisition (SCADA) system built within for management and control acting as the edge layer. However, that’s not the case with legacy machines as further additional sensors and edge devices are needed to access and communicate data to upper layers of the stack.

The ‘Communication’ layer consists of multiple communication standards and protocols that enable communication and data transportation. Key networking technologies for transporting the data can be wired or wireless (e.g., Ethernet, Wi-Fi, Bluetooth, Cellular 4G/5G, LoRa, Sigfox, NB-IoT, etc.). The amount of information generated may increase exponentially and there is a need for fast communication network for acquiring such information in real-time [50]. Although Industrial Ethernet has been the de-facto backbone of many plant floor connectivity, it is worth to mention that the emergence of 5G technologies are a key enabler of the next generation communication technologies operating at much higher frequencies and larger bandwidth [51]. Key communication protocols for data representation that are widely used in industrial environment are OPC-UA, DPWS, UPnP, MT-Connect, DDS and other key messaging transfer protocols includes MQTT, JSON, XML, HTML, HTTP, CoAP, REST [52].

The ‘Application and Management’ layer consists of software components to communicate and manage the ‘Thing’ connected as well as creating the environment for the IIoT applications.

The ‘Processing and Analytics’ layer is associated with the processing and analysis of data and subsequently converting it into meaningful information. Further insights to the data can be achieved by applying data science techniques for deeper insights or even correlating and contextualizing it with the data obtained from other IT systems connected via the communication layer.

The ‘Visualization’ layer is where the meaningful information and insights are presented in visual format in the form of metrics dashboards for ease of interpretation by non-specialists.

The ‘Cybersecurity’ layer encapsulates all the different layers of the stack as secure by design approach of the IIoT architecture.

The stack layers ‘Sensor’, ‘Edge’ and ‘Communication’ can sometimes be combined in one device often referred to as an ‘IIoT Gateway’ combing both the hardware and software with internet-enabled components enabling communication and data transfer to a digital platform or infrastructure. In the aerospace industry, regular audits, inspections and quality checks are performed during manufacturing and assembly as it is less dependent on the use of robotics and automation because of the tight regulations regarding aircraft construction, therefore, IIoT enabled gateway devices and tools are key to enable workers to increase productivity [53].

The ‘Storage’ layer is where the IIoT platform will be hosted in the chosen IT infrastructure to operate, store, organize and manage the data flow. IIoT platforms are excellent examples of software applications that can facilitate, organize and manage communication, data flow, storage, device management and the functionality of applications addressing the layers of the IIoT stack (Figure 7). This further enables integration with Information Technology (IT) and Operation Technology (OT) that will be discussed in detail in the next stage.

3.2.3. Cybersecurity Strategy

Cybersecurity (CS) is one of the main challenges to connectivity in smart manufacturing [42] and one of the biggest barriers to Industry 4.0 adoption [16]. As soon as any device is connected to the internet, if not handled correctly, makes the whole network less secure and resilient, therefore, CS becomes critical because of the risks associated with it. An example of such risks can be hacking the machines and causing the production process to stop or even cause danger to the operator if the machines are externally manipulated. Also, as the network grow, so does the attack surface and to protect critical manufacturing assets, a CS defence strategy must be in place to address the threats.

To get started on building a CS strategy, risks must be identified because security measures can be defined based on the risk profiles of the connected devices [54]. In manufacturing most likely the risks will be the machines, tools and the data they handle, its functions within the network operation and the potential impact to the network when it is breached. Once the risks have been identified, security strategies can be implemented where applicable ranging from designing a secure connectivity architecture at every layer of the IIoT stack, secure configuration of connected devices and systems on the network during system installation as well as continuous maintenance of the IT/Network infrastructure.

There are regulations and code of practices available to identify suitable procedures and measures ensuring privacy and security of connected devices over the internet [54][55][56][57][58]. However, in the manufacturing industry, the confidentiality or privacy of the data collected from the plant floor is not crucial because no personal data is collected, therefore, security measures to protect such data that complies with the General Data Protection Regulations (GDPR) [55] might not be required. However, the integrity of the data collected is fundamental to the operation of the service and that has to comply with the NIS Directive [56] as IIoT connected devices provide data collection service to the manufacturing industry.

When designing the connectivity architecture of the smart factory, it is important to get the IT department on board from the start to assist on building upon existing IT, network and security policies to address the inclusion of connected devices and their interoperability [59]. A recent survey by Cisco suggests that only 26% of companies that began IoT initiatives succeeded [60] mainly due to best practice approach taken in terms of collaboration with IT and IIoT experts.

A case study presented an example of an industrial collaboration to address factory level network connectivity and cybersecurity of an IIoT system; known as the iSMART factory concept [61][42]. This collaboration was between global machine equipment manufacturers “Yamazaki Mazak” and the IT giants “Cisco” teaming up together to connect machines securely via MT-Connect protocols and Industrial IT switches embedded with network security to help prevent any issues with unauthorized access to or from the machines and equipment within the network.

3.3. Gear 3: Integration

This stage is associated with the integration of IT and OT systems in manufacturing that often operate independently, the former manages business applications from the front office and the latter keeps the plant operations run smoothly. Integration of IT and OT are the backbone of the smart manufacturing architecture which have been addressed by various Industry 4.0 smart manufacturing frameworks, standards and reports [1][5][6][8][9][10][15][33][62].

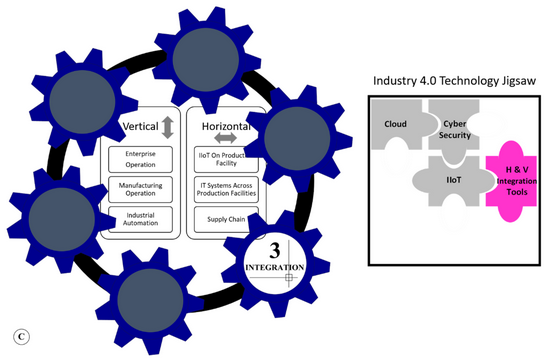

Figure 7 highlights vertical and horizontal integration requirements from an operational perspective that should be considered in this stage. Vertical integration aims to tight together all the operation layers within the manufacturing organization keeping as much of the value chain in-house as possible. The horizontal integration on the other hand aims to connect networks of cyber-physical and enterprise systems presents within the production facilities and the entire supply chain to establish partnerships building an end-to-end value chain [63]. In this stage, vertical integration is discussed in detail as its considered essential for systems and data integration between IT and OT, in order to provide agility in finding patterns for finer control of the manufacturing process [4]. Horizontal integration is discussed briefly in stage 6 when scalability adds additional value to the connectivity and integration architecture of the smart factory.

Figure 7. Gear 3—integration stage and Industry 4.0 technology jigsaw. (Primary technologies represented in colour, secondary technologies represented in grey).

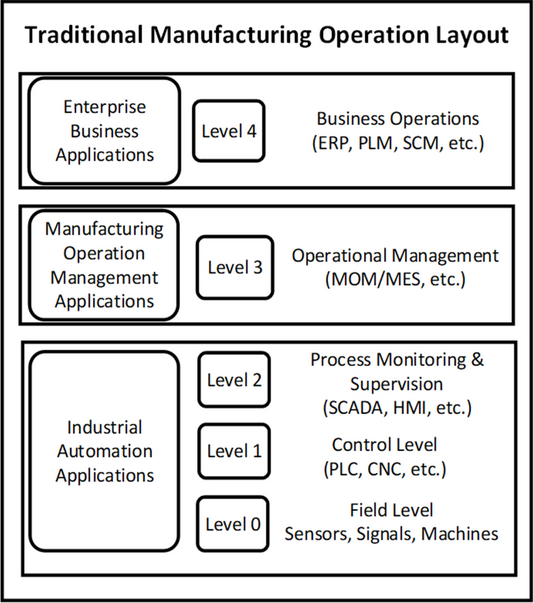

Figure 8 presents an example of the international standard ANSI/ISA-95 traditional manufacturing operation layout [64]. It encompasses five traditional operational levels (0–4) where manufacturing information exists side-by-side together with some examples of manufacturing software applications used in each level. It is widely developed and applied in the manufacturing industry to provide the terminology for clarifying application functionality and the way information is used.

IT systems in the manufacturing industry have been traditionally developed to collect data and manage work processes within manufacturing, to meet specific functional areas within each operational level [65]. These systems have been purposely built to resolve specific set of issues and often operate independently. They have difficulty obtaining data across operational levels and they can’t scale or sustain with the increasing complexity of manufacturers needs [65]. For example, enterprise resource planning (ERP) systems used in the business operation level play a major role in connecting day-to-day activities across the manufacturing facility, providing essential insights into operations and the manufacturing process integrated into one database [66]. In the operational management level, manufacturing operation management (MOM) systems and manufacturing execution systems (MES) operates to bridge the gap between the enterprise business level and the automation levels but there are limitations and complexities associated with connectivity and vertical integration of real-time production data [33][67]. They are still heavily dependent operators’ inputs and lack data processing analytics capabilities.

Connectivity, vertical integration and synchronization between the manufacturing operations levels are essential for greater insight into the production process for rapid decisions making, corrective actions to be taken and to enable optimization. This can have a significant improvement in business and financial performance making it one of the challenging applications and cornerstones of Industry 4.0 vision for smart manufacturing [68][69]. Recent reports have shown that only few digitally capable advanced manufacturing companies have fully integrated and correlated plant data with enterprise applications since a more advanced connectivity and integration tools are needed [68][67].

There are number of key challenges associated with the integration stage. They include: (i) interoperability (breaking down the silos in the factory floor machines and equipment’s that speak different languages depending on the communication protocols set by the vendors); (ii) data security (privacy issues with external sources and third parties in the horizontal integration as it requires data to be kept secured and accessed on a need to know basis); (iii) scalability (easily scaling the IT infrastructure by shifting IT systems operation to the cloud when data volume and velocity significantly increase with time); and (iv) adopting cost-effective IT applications (with strong orchestration capability to handle the integration complexity as well as providing end-to-end visibility with robust tools for data analytics to be performed) [70][63][71].

The IT technology market is already providing solutions to overcome the complexities of IT and OT integration to solve the challenges of interoperability (using open and multiple standards and protocols for communication), data security (using best practice CS standards and protocols) and scalability (via cloud ready solution) [44][52][67][69][71]. Table A2 in the Appendix A shows a list of leading Industry 4.0 ready IT platforms used in the manufacturing industry that use best practices connectivity and integration architecture that combine elements of IIoT and MOM/MES. These platforms do not completely replace or rebuild long established systems but acts as a new layer to the infrastructure orchestrating the new way of Industry 4.0 in smart manufacturing. This involves sourcing data from anywhere with minimal connectivity and integration costs together with having analytical capabilities to deliver insights via digital dashboards that can be accessed from anywhere including mobile devices, augmented and virtual reality displays.

Manufacturing companies should carefully consider when implementing an IIoT system whether to buy off-the-shelf solutions or build an in-house solution taking into account the skills needed to build the technology stack, the scalable capability of solution, the availability of resources, technical skills and time [4][72]. Industrial research reports find that most successful IIoT projects use off-the-shelf solution as the basis of their operation can get a quick ROI on the technology implementation [4][67][72].

A strategy should be in place for choosing an IIoT solution to suite the company’s appetite. Some of the considerations include the additional capability of the platform, the additional IT infrastructure and hardware needed, the cost of using the platform, the customization flexibility, the technical skills required to use and manage the platform and the ability to scale in the future.

IIoT platforms with built-in MOM/MES applications are a viable option. They are capable to seamlessly integrate with enterprise and industrial automation applications [66] and are accompanied with the elements of the IIoT stack (e.g., analytics tools, IIoT gateways connectivity, cloud scalability) [8]. Case studies in [73][74] shows examples of manufacturers implementation of such option. Other option combines industrial code-less IT systems with built-in software bridges, modules and communication protocols that are capable of connecting and integrating data across the manufacturing operation layers [52]. Examples of such IT systems are OPC Router [75] and Kepserver [76]. Another option is to adopt a full-fledged IIoT platform to seamlessly connect and integrate all layers of the manufacturing operation, enhanced with additional manufacturing operation apps [59]. Case studies in [77][78] shows manufacturers implementation of such option. Embracing an ecosystem of solutions that work in harmony enable a successful system level integration [67]. All three strategies have the potential to combine data from different manufacturing operation levels enabling capabilities to move to the next stages of the roadmap.

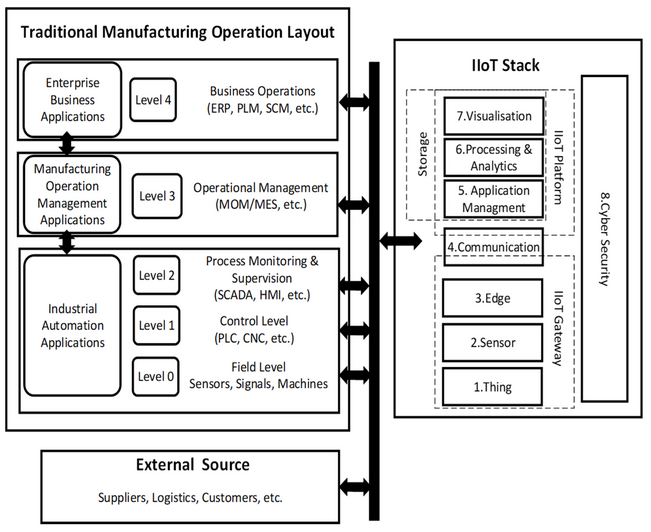

Figure 9 shows an illustration of a smart manufacturing integration architecture that combines elements of the manufacturing operational levels applications with elements of the communication layer of the IIoT stack bridging the gap between IT and OT resulting in a connected and integrated smart factory.

Figure 9. Manufacturing operation levels and IIoT integration architecture. (Author’s creation).

3.4. Gear 4: Analytics

This stage is associated with analyzing data collected from different sources of the manufacturing operation layers. Big Data refers to the vast amount of data generated due to the volume, variety, velocity, variability and value [79]. Big Data is categorized as smart data when collected in a structured manner, condensed, processed and particularly analyzed in a way that turns it into an actionable information. Data analytics create value in manufacturing by providing a diagnostic approach to enable root-cause problem solving and guidance to reduce deviations that occur during manufacturing. Big Data is categorized in three ways: (i) structured data (data that comes from traditional database and equipment); (ii) time series data (continuously changing and event-based data); and (iii) unstructured data (other kind of data and information not typically used in manufacturing, e.g., weather, videos, etc.) [27][80].

The challenges of dealing with the vast amount of data include data handling complexity, data volume, speed of the network and bandwidth to process such large amount of data. To reduce the handling complexity and network bandwidth issues/limitations, data should be initially extracted, handled, cleansed, time stamped and processed at the edge (e.g., in the IIoT gateway/machine control level). This is to produce relevant information before transferring it to the fog (IIoT platforms/operation management level applications) for further processing and detailed analysis [81].

The traditional view of the analytics framework, that drives improvements of industrial operations, is divided into four types: descriptive, diagnostics, predictive and perspective [9][80]. Descriptive analytics are a set of metrics that describe the event (what happened). They are referred to as key performance indicators (KPIs). These KPIs are represented by mathematical calculations to provide insights into the performance of manufacturing operations [82]. Diagnostics, predictive and perspective are analytics that uncover questions such as, why things happened, what would happen as a result and what action to take in such instances. Descriptive, diagnostic and predictive analytics are widely used as analytical tools in the manufacturing industry to drive operational improvements [80]. Manufacturers, largely SMEs, still rely on common KPIs to gauge the health of their business [27].

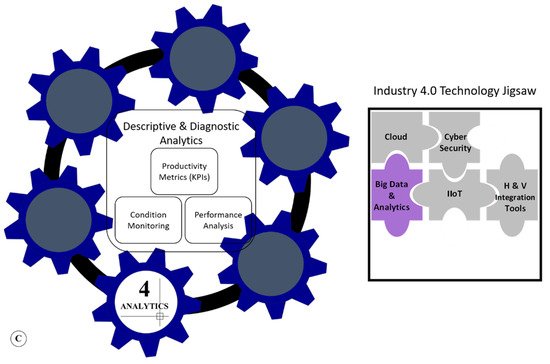

Figure 10 shows common descriptive and diagnostics analytical applications (e.g., Productivity KPI metrices, condition monitoring, performance analysis) for this stage along with the technology jigsaw map showing Big Data and analytics tools to be the fundamental technologies in this stage. Predictive and perspective analytics and their applications are described in the next stage.

Figure 10. Gear 4—analytics stage and Industry 4.0 technology jigsaw (Primary technologies represented in color, secondary technologies represented in grey).

Amongst the most common and popular productivity KPIs that the manufacturing organizations rely on (for managing operations) are mainly focused on financial business performance (e.g., manufacturing cost per unit), efficiency focused metrices (e.g., factory efficiency, overall equipment effectiveness (OEE)) and quality related metrics (e.g., scrap rate, yield) [83]. However, more from the acquired data can be achieved by implementing a range of KPIs that allow for the assessment and tracking of the manufacturing process as well as success evaluation in relation to the goals and objectives. Reporting of KPIs can also be improved using real-time digital visualization dashboards built within MOM applications, IIoT platforms or business intelligence (BI) tools.

Asset condition monitoring is a snapshot of the health conditions of the assets in the factory (e.g., manufacturing machine). Tracking changes of the status, performance, utilization, etc. of manufacturing machines enable significant change to be easily spotted once occurred. Historical records of the snapshots collected over time from various machines in the production line enable comparison and performance analysis to be performed [7]. For example, machines utilization history, maintenance history, failures modes etc. can be captured and compared with its peers to identify trends and behaviours related to the manufacturing process. This is valuable for diagnostic analytics to enable manufactures understand why things happened.

Industrial research reports in [27][80] recommend manufacturing SMEs to consider reviewing KPIs already being used with industry standards to ensure most important metrics are captured that drive operational performance. They also recommend KPIs tracking, their transformation into a continuous development program for operational excellence and preparation for the move into predictive and perspective analytics.

3.5. Gear 5: AI (Artificial Intelligence)

This stage is associated with the advanced data analytics and tools used to provide new answers to questions raised from the data analysis stage to add real and unexpected value to the manufacturing industry. It is based on using Big Data, predictive and perspective-based analytics and artificial intelligence-based analytics.

AI is the ability of the computer to think and learn itself. Big data, intelligent algorithm and computer systems drive the AI process to enhance machines and people through digital capabilities such as perception, reasoning, learning and autonomous decision-making [84]. In the manufacturing industry, AI is seen as the brain of the Industry 4.0 transformation while other digital technologies provide the muscles to drive the transition from automation to autonomy.

Key driving factors to implement AI in manufacturing includes: (i) to improve cost savings; (ii) to transform operations; (iii) to provide better customer service; and (iv) to create better workplace environment [85][86][87]. AI also has a potential impact on the economy leading to a stronger and improved economical prospect as a result of a more efficient, sustainable and competitive manufacturing [3].

Applications of AI and the use cases vary in manufacturing. Predictive maintenance of machines and tools is one of the key values created, which has the potential to reduce repairing costs by 12% [87]. AI-based learning algorithms spot trends in the data for early warnings and indications of possible failures and breakdown. This allows maintenance to be scheduled and intervened rather than being dependent on periodic checks, enabling a proactive behaviour instead of a reactive behaviour, which leads to a more reliable and sustainable production line.

An example of an AI predictive maintenance application in the aerospace industry is used by the British engine manufacturers Rolls Royce. The IoT capabilities and advanced analytical tools of Rolls Royce engines in the aircrafts are capable of predicting wear and tear in the engine so that an intervened repair and maintenance awaits as the airplane lands in order to maximize the aircraft availability [88]. Another application of AI in the aircraft industry is the Airbus Skywise platform [89] empowered by machine learning algorithms to enable insights into the data, collected from various sources of the aircraft for maintenance and repair operations. They also provide insights into operational efficiencies optimize the parts usage, reduce aircraft downtime and cut down service costs.

A manufacturing application of predictive maintenance is presented in the case study by Lee et al. in [90] where an intelligent spindle monitoring system was developed to monitor and predict the performance of the tool spindle of a CNC machine minimizing maintenance costs and optimizing product quality. AI application in manufacturing also plays crucial role in empowering workforce with a baseline knowledge to improve process efficiency and productivity. AI based algorithms can provide workforce with real-time recommendation(s) to act upon especially for young inexperienced workforce. They can also autonomously act to address raised issues making machines to adjust themselves in order to optimize quality or energy efficiency during production operations [91]. Other use cases of AI in manufacturing include but are not limited to: (i) improvements in quality inspection using images processing and recognition techniques for process optimization and scrap reduction [85][87]; (ii) in safety monitoring and control using AI-based self-learning models embedded within manufacturing automation systems (e.g., robots). These systems learn from prior experience and human interventions and react to unforeseen situations, resulting in taking pressure off people, reducing human error and improving workplace health and safety [85]; (iii) production scheduling using AI, combined with mathematical optimization tools to plan, schedule and optimize capacity planning [92].

Although, many manufacturing companies are making significant steps in AI adoption, there are still challenges that form barriers to AI uptake. A recent global survey reported by plutoshift [93] indicates that only 17% of manufacturing organizations are in full implementation stages of AI. These challenges are normally associated with the lack of strategy. The nature of an AI-based system is that it needs to be continuously trained, monitored and evaluated while guarding against bias, privacy violations and safety concerns; therefore, an AI strategy should be in place. The Microsoft AI Maturity Model [85] is a good example that highlight AI development. It consists of four stages namely Foundation, Approach, Aspiration, Maturity and is based upon organization’s assessment and maturity level to guide adoption of the right kind of AI tool(s) at the right place and time.

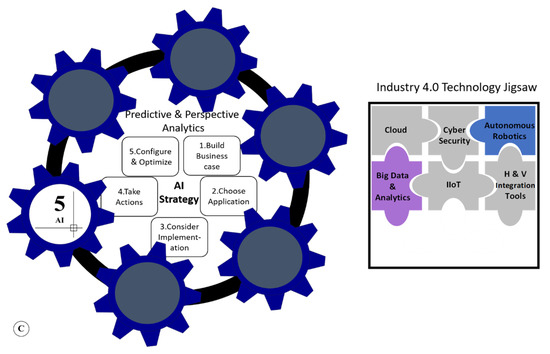

Figure 11 shows a simple process for manufacturing companies to use as a guide to deploy an AI strategy. The aim is to enable predictive and perspective analytics that can be practically achieved. It consists of five steps and utilizes six Industry 4.0 technologies. The first step is to identify a business case that is aligned with the business strategy (e.g., to maintain a reliable and sustainable production line in order to improve customer service). The second step is to choose a suitable analytical application to meet the business case objective (e.g., predictive maintenance of machines in the production line). The third step is to consider how to best build and implement the application. Examples include (i) the type of analytical tools needed to build the application (e.g., Software service/IIoT platform) (ii) the type of Big Data needed (e.g., structured, unstructured, time series data) (iii) the location of storage and the computing power needed (e.g., local, cloud), (iv) the analysis methods to use for the identified application (e.g., machine learning, deep learning techniques) (v) the skills needed to build the application and (vi) the cost of implementation (In-house development or outsourcing). All these should be considered while taking into account the culture and capabilities that match the maturity of the company. The fourth step is to have an adequate alerting, visualization and reporting mechanism in place to enable people to make decisions and take actions based upon the information produced. Machines and robots can also be further enabled to execute actions themselves. The process can allow them to self-adapt to the control commands based on the information provided by the AI application. This subsequently enables autonomy and the application of CPS in manufacturing. The fifth step is to have a continuous feedback and configuration control to optimize the AI application, the preventative actions and the decisions being taken.

Main challenge in this stage is associated with data. Data availability, data quality, adequate connectivity and data infrastructure are needed to embrace analytics and fully utilize AI applications [93]. These challenges can be addressed by using robust IIoT platforms/analytics applications that are capable of data mining from anywhere, perform necessary computing and providing adequate visualization of information that translate data into actionable information [85][68].

Other challenges of adopting AI are associated with cultural change and new technology adoption. These include perceived fears of workforce around technology being too difficult to use, lack of trust, or often the fear that it will take jobs away. However, according to HPE survey in [86], it is predicted that AI-created jobs will balance or outweigh those made redundant. Therefore, leadership from the top should have continuous communication strategy in place to overcome such issues. There is also a lack of data science knowledge and AI skills in the manufacturing industry [85][86][87], therefore, professional development of the internal staff, hiring of technically skilled people or collaboration with external expertise in the field could possibly overcome these issues.

3.6. Gear 6: Scale

The proposed “Six-Gears Roadmap” is anticipated and envisioned to be dynamic and continuous. The sixth stage in the process is thus related to the scalability stage. It is designed to increase the scale and scope of the application within each stage in the roadmap by capitalizing upon the capacity of the Industry 4.0 digital technologies.

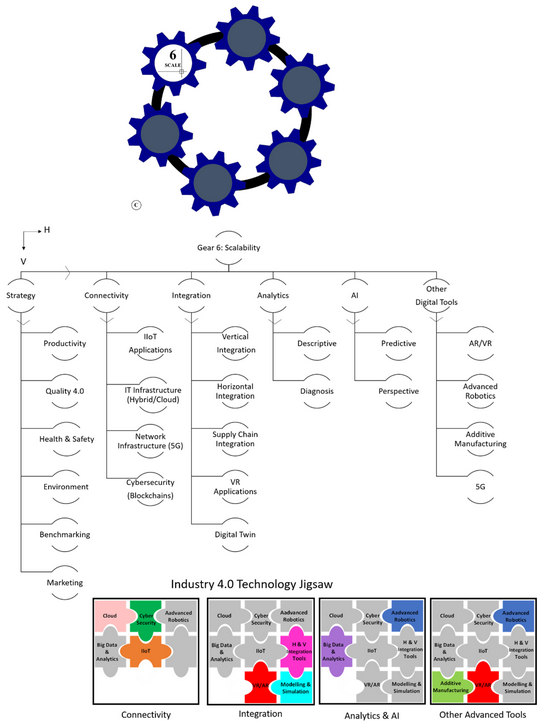

Figure 12 shows an overview of different options available to scale the stages of the roadmap together with showcasing key building blocks of the technologies associated with each stage. The roadmap can be scaled horizontally and/or vertically to show the different opportunities available for manufacturing SMEs to capitalize upon. The horizontal path represents the options to scale any stage of the roadmap together with an additional option that represents other key Industry 4.0 technologies that have potential in smart manufacturing. The vertical path on the other hand represents the option with further deep dive into each stage of the roadmap.

Figure 12. Gear 6—scalability stage and Industry 4.0 technology jigsaws (primary technologies represented in colour, secondary technologies represented in grey).

3.6.1. Scaling the Roadmap Gears

Strategy phase scaling can be achieved by adding new business cases and initiating projects within the company related to processors and procedures optimization within manufacturing. Quality 4.0 is an example of a strategic theme associated with digitalization and automation of the quality management activities to align with the Industry 4.0 strategy and the company’s business case. Quality 4.0 builds upon traditional quality methods and is further enabled by Industry 4.0 technologies [94]. For example, connecting measurement equipment and gauging tools with IIoT enabled gateways provide measurement data that can be logged in real-time. The quality management team can utilize such data to monitor and inspect critical measurement features during production. Analytical predictive techniques such as statistical process control (SPC) can also be applied to the measurement data to provide alerts for immediate intervention to reduce potential scrap. Environmental monitoring is another example of scaling the use of IIoT connected devices in the plant to better understand effects of the environmental conditions on productivity and performances of the factory. Data could possibly suggest ways on how to best optimize operations to increase efficiencies, productivity and reduce carbon emissions. Health and Safety strategy can focus on the wellbeing of the workforce by improving safety and control methods by the application of AI- enabled systems in the factory [85]. Benchmarking activities against similar industries on the Industry 4.0 journey, and, digital marketing applications using Industry 4.0 technologies (e.g., virtual reality applications, digital twins, etc.) are other possible strategies and business cases that can be adopted along the journey.

Connectivity stage scaling can be achieved by adding IIoT connected devices and applications across the factory and linking it up with the smart factory architecture, to gain more insights into the manufacturing processes and operations that are aligned with business strategy and objectives. IT infrastructure can be scaled by enhancing the in-house datacenter or considering a full cloud/hybrid migration to cope with the growing amount of data and the computing requirements for the Industry 4.0 applications [41]. Network infrastructure scaling can be achieved by enhancing the factory floor communication, network capability and performance by using emerging wireless communication technologies such as 5G for rapid and reliable communication, Wi-Fi, LTE, ZigBee, LoRa and LoRaWAN for cost effective and rapid deployment. Wireless Sensor Networks (WSNs) systems that deploy wireless communication technologies and IoT connectivity architecture have been widely applied in various applications such as in smart cities [95], in agriculture and environment monitoring [96][97][98], in transportation [99] and in food manufacturing [100]. These applications can be transferred and widely adapted in manufacturing to enable further data-driven smart manufacturing applications.

Cybersecurity can be scaled by incorporating blockchain technologies for increased security and enhanced traceability. Blockchain is a collection of a record keeping database technologies that stores information in a chain using cybersecurity algorithms and digital threads to digitally authenticate data for electronic exchange and processing [101]. Blockchain save time, cost and reduce the risk of human errors to prevent issues of fraud and counterfeiting, which are used mainly in financial transactions [101]. An example of the application of blockchain technology in smart manufacturing is to allow digitized manufacturing instructions to be authenticated and safely transmitted during the product lifecycle without the risk of manipulation, and, to prevent cyberattacks during supply chain collaboration [101][102]. This enables trust and make the supply chain more secure and transparent. Other applications may include the use of blockchain technologies in conjunction with blockchain-based platforms and Industry 4.0 technologies (e.g., Big Data and AI) that can be used to develop marketing strategies, determine future trends and customer demands, utilizing both data and social media platforms to enable data driven marketing [103].

Integration stage can be scaled by integrating o IT and OT systems within and across the organization. Such integration includes further vertical integration within the manufacturing operation layers, as well as, horizontal integration with other IT systems (e.g., modelling and simulation applications) across the production facility and external systems such as IT systems in the supply chain. Supply chain systems integration (upstream and downstream) can provide information insights into every part of the customer/supply chain, thus enabling awareness, visibility, responsiveness, and resilience. This provides manufacturing companies with enormous opportunities to capitalize upon in order to remain competitive, and to meet customer demands of tighter deadlines and ever-increasing cost pressures [104].

An example of integrating modelling and simulation tools into smart manufacturing include the application of virtual reality (VR) technologies to support real-time human interaction with computer generated or simulated 3D environments. VR is a suite of technologies that simulates communication and collaboration across the product life cycle by incorporating visual environments and auditory/sensory feedback to represent an imaginary world (i.e., digital footprint) that corresponds to the real world.

A virtual digital twin of a plant, factory, process, or a product is used to bridge the gap between the physical and digital worlds. A digital twin system is a cyber digital model of a physical component, product, or a system created to simulate their behaviours in real-word environments and is capable to provide a comprehensive physical and functional description in a mirrored digital environment. This paves the path for cyber physical integration in smart manufacturing [105]. It consists of three components, the physical entity, the virtual model and the data that connects the two together [106]. Digital twins can be created and applied in three stages. Firstly, in the system design stage by enabling efficient virtual validation of system’s performance of a current manufacturing process. It predefines different scenarios, give early discovery of performance and deficiencies and provide an opportunity for rapid design optimizations until satisfactory planning is confirmed before the physical processes are developed [106]. Secondly, in the system configuration stage by enabling virtual models to update and reconfigure themselves based on the real-time data from the actual manufacturing operations and AI based self-learning models. This allows to achieve system flexibility and rapid optimization of the manufacturing performance. Thirdly, in the system operation stage by enabling feedback on adjustments instructions from the digital model to the physical systems, controlling the physical output through CPS-for interactive and parallel control [107]. Examples of the application of digital twins in the aerospace manufacturing industry includes improvements in lean-management methods such as value stream mapping. This constitutes the use of factory simulation to design a physical factory layout to improve material/products flow. Other areas may include a zero defects strategy achievement and ‘right-first-time’ in manufacturing, which reduce waste and quality issues associated with new product development. This subsequently results in the demand for high quality standards and increase in market agility [107].

Scaling the Analytics and the AI stages involve utilization of big data available (structured, unstructured and time series data), the appropriate analytical methods (descriptive, diagnostics, predictive and prescriptive) and machine learning/deep learning tools for deeper and wider applications that aligns with the business strategy and adds value to the SMEs manufacturing process.

3.6.2. Other Advanced Technologies for Smart Manufacturing

Augmented Reality (AR) is an interactive experience with the real world that enables the user to incorporate things (visual, haptic, auditory, etc.) that reside in the digital world into the real world to enhance its overall experience. It is deployed based upon a collection of technologies enriched by computer-generated text, 2D/3D virtual digital content. AR applications in manufacturing are used to improve methods to guide workers in maintenance and training applications [108][109]. AR technology enables workers to get relevant visual information around the process or the physical thing in real-time by overlaying text, image, video, etc. onto a view of the physical world through camera enabled devices (e.g., smartphone, tablet, AR/VR headset). AR applications can be more powerful when integrated with other Industry 4.0 technologies such as IIoT and digital twin applications to enable real-time monitoring and efficient planning of the operation and process [80]. Current AR applications focus on sharing simple statistical data of machine/product operation, but in the future, it is expected to be extended to combine advanced analytics and AI- based modules to share additional insights about various products and recommended services [108].

Robotics with advanced AI-based intelligence and automation control enable CPS applications in manufacturing. Collaborative Robots (Cobots) are a new generation of advanced robots that are being rapidly embraced in manufacturing. Cobots are integrated with AI, connectivity and automation control features that allows collaboration with humans in a safe, autonomous and reliable environment. Cobots enable new capabilities in smart manufacturing that improves quality, maximize productivity and reduces operational costs [110].

Additive Manufacturing is a technology that builds digital objects into physical objects using a layer-by-layer building process with the aid of 3D printer machines and advanced materials. It is a flexible production model that bridges the gap between the digital and the physical world without the need of specialized tools. Additive manufacturing is currently used in high end and high value manufacturing when quickly prototyping affordable parts and in the production of tooling such as making jigs and fixtures to reduce the tooling costs and to allow for more flexibility, especially in the aerospace industry [111].

5G is a fifth-generation wireless communication technology that supports reliable, high speed and high coverage communication. It is a technology that enables advanced connectivity and increased data availability that can be used in industrial environments to further enable and support current and future data-driven smart manufacturing applications. It supports and enhances the adoption of IIoT, CPS, digital twins, edge computing and the implementation of AI and AR in Industry 4.0 applications to achieve their full potential [51]. A use case of 5G in aerospace manufacturing is the collection of high-speed data for real-time monitoring in different operational conditions to update digital twin systems to subsequently improve the jet engine manufacturing process [112].

4.Other Challenges of Digital Transformation for Manufacturing SMEs

4.1. Finance

The cost of implementing an Industry 4.0 project remains one of the top adoption barriers for manufacturing SMEs [113]. This is because of the lack of clear mechanisms and awareness of funding schemes [24][113], limited access to funding to support investments [16] and limited data available to demonstrate the ROI [31]. Government funded schemes are key to support and encourage SMEs to adopt Industry 4.0. The UK Made Smarter program [114] is an example of a leading scheme in the UK designed to boost manufacturing productivity and growth with dedicated programs and co-funding opportunities to assist the adoption of industrial digital technologies and digital transformation. In addition, because of the nature of Industry 4.0 projects that often require custom implementations based upon readiness level, integration needs and application requirements, research and development activities and system design activities are crucial prior to implementation. SMEs can capitalize on the RandD tax credits relief from the government since such projects encourage economic growth.

4.2. Managing Change

Digital transformation is associated with change, therefore, resistance is expected because people do often resist procedures outside the norm. Understanding and accepting change and effectively managing it within the organization is key to the successful transition into a smart factory [113]. Manufacturing SMEs need to get the buy-in from the whole organization, have stakeholders on board, build communication lines, address any raised concern (e.g., fear of unknown, no personal reward, job security, untrustworthiness in the technology, etc.) and establish cross functional teams to help achieve and equip themselves for the change [8][28][29][40].

4.3. Skills

Increasing digitalization, automation and Industry 4.0 technologies are forcing workforce in production facilities to change how they work on ordinary tasks and to allow them to spend more time on high-value activities dealing with what if scenarios such as monitoring datasets for preventative maintenance [16][85]. The main skill gaps are associated with digital skills, using the technology and managing it especially for an aging workforce. Manufacturing companies must be prepared to support this development making sure that their existing workforce has the required level of digital skills together with other soft skills such as problem solving, creativity and critical thinking in order to help existing employees get up-to-speed with new technologies in addition to recruiting people who already have the digital and technical skills [16][115][108]. Access to technical skills when introducing Industry 4.0 technologies to the company is essential for faster adoption. This can be achieved by outsourcing specialist skills in the field, collaborating with technology providers or creating partnership with external organizations such as academic institutes, digital catapults and innovation hubs for access to knowledge transfer, route for acquiring skills and talent recruitment [28].

References

- PlatformIndustrie4.0. Digitization of Industrie Platform Industrie 4.0; Federal Ministry for Economic Affairs and Energy (BMWi): Berlin, Germany, 2016.

- Al-Hassani, S.T.S. 1001 Inventions Muslim Heritage in Our World, 2nd ed.; The Foundation for Science, Technology and Civilization (FSTC): Manchester, UK, 2006; ISBN 978-0-9552426-1-8.

- Schroeder, W. Germany’s Industry 4.0 Strategy, Rhine Capitalism in the Age of Digitisation; Friedrich-Ebert-Stiftung (FES): London, UK, 2016.

- Bassett, R. The Dangers of DIY Connectivity. In How An Integrated IIoT Suite Supports Digital Transformation, Automation.com; International Society of Automation: Research Triangle Park, NC, USA, 2020.

- Rüßmann, M.; Lorenz, M.; Gerbert, P.; Waldner, M.; Justus, J.; Engel, P.; Harnisch, M. Industry 4.0: The Future of Productivity and Growth in Manufacturing Industries; The Boston Consulting Group (BCG): Boston, MA, USA, 2015.

- Ghobakhloo, M. The future of manufacturing industry: A strategic roadmap toward Industry 4.0. J. Manuf. Technol. Manag. 2018, 29, 910–936.

- Lee, J.; Bagheri, B.; Kao, H.-A.A. Cyber-Physical Systems architecture for Industry 4.0-based manufacturing systems. Manuf. Lett. 2015, 3, 18–23.

- Burke, R.; Mussomeli, A.; Laaper, S.; Hartigan, M.; Sniderman, B. The Smart Factory-Responsive, Adaptive, Connected Manufacturing; Deloitte University Press: New York, NY, USA, 2017.

- Hughes, A. Smart Manufacturing-Smart Companies Have Made Smart Manufacturing the Center of the Enterprise; LNS Research: Cambridge, MA, USA, 2017.

- Mittal, S.; Khan, M.A.; Romero, D.; Wuest, T. Smart manufacturing: Characteristics, technologies and enabling factors. J. Eng. Manuf. 2019, 233, 1342–1361.

- Ahuett-Garza, H.; Kurfess, T. A brief discussion on the trends of habilitating technologies for Industry 4.0 and Smart manufacturing. Manuf. Lett. 2018, 15, 60–63.

- Buer, S.V.; Strandhagen, J.O.; Chan, F.T.S. The link between Industry 4.0 and lean manufacturing: Mapping current research and establishing a research agenda. Int. J. Prod. Res. 2018, 56, 2924–2940.

- Angel, M. How Industry 4.0 is Transforming Lean Manufacturing. 2015. Available online: (accessed on 10 March 2020).

- Klitou, D.; Conrads, J.; Rasmussen, M.; CARSA.; Probst, L.; Pedersen, B.; PwC. Germany Industrie 4.0; European Commission Directorate Digital Transformation Monitor, European Commission: Brussels, Belgium, 2017.

- Schuh, G.; Anderl, R.; Dumitrescu, R.; Krüger, A.; Hompel, M.T. Industrie 4.0 Maturity Index-Managing the Digital Transformation of Companies; Acatech STUDY: Munich, Germany, 2020.

- Made Smarter Review. In HM UK Government: Industrial Strategy Green Paper, 2017; Department for Business, Energy & Industrial Strategy: London, UK, 2017.

- Kennedy, S. Made in China 2025; Centre For Strategic & International Studies (CSIS): Washington, DC, USA, 2015; Available online: (accessed on 22 May 2019).

- America Makes. Available online: (accessed on 22 May 2019).

- Eun-Ha, J. Smart Industry Korea. Netherlands Enterprise Agency, 2015. Available online: (accessed on 22 May 2019).

- Schröder, C. The Challenges of Industry 4.0 for Small and Medium-Sized Enterprises; Friedrich-Ebert-Stiftung (FES): London, UK, 2017.

- Walters, R. Robotics Answers: Japan Out to Lead The next Industrial Revolution. ACCJ J. 2015. Available online: (accessed on 28 September 2020).

- Schönfuß, B.; McFarlane, D.; Athanassopoulou, N.; Salter, L.; de Silva, L.; Ratchev, S. Prioritising Low Cost Digital Solutions Required by Manufacturing SMEs: A Shoestring Approach. In Proceedings of the Service Oriented, Holonic and Multiagent Manufacturing Systems for Industry of the Future, SOHOMA 2019, Valencia, Spain, 3–4 October 2019; Springer: Cham, Switzerland, 2020; pp. 290–300.

- CBI. From Ostrich to Magpie-Increasing Business Take-Up of Proven Ideas and Technologies; CBI: New Delhi, India, November 2017; Available online: (accessed on 10 March 2020).

- IndustryWeek. Manufacturing Operations-Getting Ready for the Next Normal. Industry Insight, September 2020. Available online: (accessed on 10 March 2020).

- Pwc. Industry 4.0: Building the Digital Enterprise Aerospace, Defence and Security Key Findings; Global Industry 4.0 Survey—Industry Key Findings. Pwc, 2016. Available online: (accessed on 10 March 2020).

- BDO. Industry 4.0 Report. BDO, June 2016. Available online: (accessed on 10 March 2020).

- Fettrman, P. Manufacturing Metrices: Driving Operational Performance; LNS Research: Cambridge, MA, USA, 2018.

- Sensorcity. 2020 Guide to IoT Adoption. Sensor City, 2020; Available online: (accessed on 12 January 2020).

- FESTO. Practical Tips for Industry 4.0 Implementation; FESTO, 2019; Available online: (accessed on 3 March 2019).

- Industry 4.0 in Aeronautics - IoT Applications . European Commission . Retrieved 2021-5-11

- Wójcicki, J. Industry 4.0: The Future of Smart Manufacturing. Industry 4.0 Magazine, 16 February 2018; p. 13. Available online:(accessed on 1 January 2019).

- Data-Driven Manufacturing . Modern Machine Shop. Retrieved 2021-5-11

- Frank, A.G.; Dalenogare, L.S.; Ayala, N.F. Industry 4.0 technologies: Implementation patterns in manufacturing companies. Int. J. Prod. Econ. 2019, 210, 15–26.

- Vasja Roblek; Maja Meško; Alojz Krapež; A Complex View of Industry 4.0. SAGE Open 2016, 6, ., 10.1177/2158244016653987.

- Hsi-Peng Lu; Chien-I Weng; Smart manufacturing technology, market maturity analysis and technology roadmap in the computer and electronic product manufacturing industry. Technological Forecasting and Social Change 2018, 133, 85-94, 10.1016/j.techfore.2018.03.005.

- Digital Transformation . Digital Transformation: Aerospace Technology Institute (ATI). Retrieved 2021-5-11

- A practical roadmap for the implantation of Industry 4.0 . Bosch Rexroth Group. Retrieved 2021-5-11

- ATI. Digital Transformation: Aerospace Technology Institute (ATI). February 2017. Available online: (accessed on 20 October 2020).

- Savani, S. Industry Focus- Aerospace- How Organisations in the Sector can Capitalise on Industry 4.0. Industry 4.0 Magazine, 16 August 2018. Available online: (accessed on 1 January 2019).

- ABIresearch. Five Steps to Master Digital Transformation; ABI Research: New York, NY, USA, 2018; Available online: (accessed on 10 March 2020).

- Wright, J. Roadmap to Industry 4.0 Laying Stable Foundations. Six Degrees: The Manufacturer. 2020. Available online: (accessed on 10 March 2020).

- Cisco. The Ultimate Guide to Smart Manufacturing; Cisco, 2018; Available online: (accessed on 3 March 2019).

- Schaeffer, E. Industry X. 0: Realizing Digital Value in Industrial Sectors, 1st ed.; Kogan Page: London, UK, 2017; ISBN 9783868816549.

- Perry, M.J. Evaluation and Choosing an IoT Platform, 1st ed.; O’Reilly: Sebastopol, CA, USA, 2016; ISBN 978-1-491-95203-0.

- Pittman, K. The IIoT in a Nutshell. In Advanced Manufacturing, Engineering. 2017. Available online: (accessed on 1 May 2019).

- (IIC PUB:G1:V1.80:20170131). The Industrial Internet of Things Volume G1: Reference Architecture. 2017.

- Weyrich, M.; Ebert, C. Reference Architectures for the Internet of Things. IEEE Softw. 2016, 33, 112–116.

- BMWI. Reference Architectural Model Industrie 4.0 (RAMI4.0) In A Reference Framework For. Digitalisation Platform Industrie 4.0 Berlin, Germany. 9 August 2018.

- (ISO/IEC 30141:2018). Internet of Things (IoT)–Reference Architecture. 2018.

- Papakostas, N.; O’Connor, J.; Byrne, G. Internet of Things in Manufacturing-Applications Areas, Challenges and Outlook. In Proceedings of the International Conference on Information Society (i-Society), Dublin, Ireland, 10–13 October 2016; pp. 126–131.

- Sabella, R.; Thuelig, A.; Carrozza, M.C.; Ippolito, M. Industrial Automation enabled by Robotics, Machine Intelligence and 5G.; ERICSSON Technology Review. ERICSSON, February 2018. Available online: (accessed on 10 March 2020).

- Hawkridge, G.; Hernandez, M.P.; Silva, L.d.; Terrazas, G.; Tlegenov, Y.; McFarlane, D.; Thorne, A. Trying Together Solutions for Digital Manufacturing: Assessment of Connectivity Technologies & Approaches. In Proceedings of the 4th IEEE International Conference on Emerging Technologies and Factory Automation (ETFA), Zaragoza, Spain, 10 September 2019; pp. 1383–1387.

- Bonneau, V.; Copigneaux, B.; IDATE; Probst, L.; Pedersen, B.; Lonkeu, O.-K. European Commission Directorate: Digital Transformation Monitor. 2017. Available online: (accessed on 31 May 2019).

- Gulliford, S. We Need to Talk about this IoT. Genserv, 2018. Available online: (accessed on 5 May 2019).

- (EU 2016/679). General Data Protection Regulation (GDPR); EU: Brussels, Belgium, 2016.

- Network & Information Systems (NIS) Guidance. 2018. Available online: (accessed on 3 March 2019).

- Department for Digital, Culture Media & Sport. Secure by Design: Improving the Cyber Security of Consumer Internet of Things Report; Department for Digital, Culture Media & Sport: London, UK, 2017.

- (IIC PUB:G4:V1.0:PB:20160926). The Industrial Internet of Things Volume G4: Security Framework. 2016.

- Gurela, T. Industry 4.0 and the Factory Network. I4.0 Today (1) February 2018. Available online: (accessed on 1 May 2019).

- Cisco. The Journey to IoT Value (Challenges, Breakthroughs, and Best Practices); Connected Futures-Executive Insights. 2017. Available online: (accessed on 1 May 2019).

- Barnes, B. Cisco Partners with Mazak and MEMEX to Connect Machines; Cisco, 2015; Available online: (accessed on 31 May 2019).

- Stock, T.; Seliger, G. Opportunities of Sustainable Manufacturing in Industry 4.0. Procedia CIRP 2016, 40, 536–541.

- Schuldenfrei, M. Horizontal and Vertical Integration in Industry 4.0. Manufacturing Business Technology: Business Intelligence. 2019. Available online: (accessed on 10 April 2020).

- (ANSI/ISA-95). The International Society of Automation (ISA), 2010.

- Davidson, M.; Goodwin, G. The Evolution of Manufacturing Software Platforms: Past, Present, and Future; LNS Research: Cambridge, MA, USA, 2013; Available online: (accessed on 5 May 2020).

- Radovilsky, Z. Enterprise Resource Planning (ERP). In The Internet Encyclopedia; Hossein, B., Ed.; John Wiley & Sons: Hoboken, NJ, USA, 2004; Volume 1, p. 707. ISBN 9780471222026.

- Fetterman, P. Plant Data and Connectivity-Strategic Building Blocks for Industrial Transformation; LNS Research, ptc. August 2019. Available online: (accessed on 5 May 2020).

- Rathmann, C. Industrial Internet of Things (IOT) and Digital Transformation–IoT, Digital Transformation and the Role of Enterprise Software; IFS World: Linköping, Sweden, 2017; Available online: (accessed on 20 October 2020).

- Lav, Y. Industry 4.0: Harnessing the Power of ERP and MES Integration. Industry Week, 2017. Available online: (accessed on 1 August 2019).

- Lu, Y. Industry 4.0: A survey on technologies, applications and open research issues. J. Ind. Inf. Integr. 2017, 6, 1–10.

- Cline, G. The Challenges and Opportunities of OT & IT Integration. Aberdeen, October 2017. Available online: (accessed on 1 August 2019).

- Relayr. Build vs Buy. Relayr, 2019. Available online: (accessed on 2 May 2020).

- Immerman, G. Optimizing Equipment Utilization-A case study Interview with Wiscon Products. Machinnemetrics, 2019. Available online: (accessed on 2 May 2020).

- Forcam. GKN Aerospace 20% Reduction In Operation Time. Forcam GmnH, 2020. Available online: (accessed on 2 May 2020).

- Inray_Industriessoftware. OPC Router-The communication Middleware. Available online: (accessed on 15 April 2020).

- MAC-Solutions. KEPServerEX by Kepware: The World’s Best-Selling OPC Server. Available online: (accessed on 15 April 2020).

- PTC. Woodward’s Digital Transformation, PTC: Thingworks case studies. 2018. Available online: (accessed on 5 June 2020).

- InVima. Coflax. Available online: (accessed on 15 April 2020).

- Marr, B. Big Data: The 5 vs Everyone Must Know. Linkedin, 2014. Available online: (accessed on 14 April 2020).

- Hughes, A. Analytics Really Do Matter-Driving Digital Transformation and the Smart Manufacturing Enterprise; LNS Research: Cambridge, MA, USA, 2018; Available online: (accessed on 21 October 2020).

- Cisco. Kinetic Edge & Fog Processing Module White Paper. Cisco, 2018. Available online: (accessed on 5 June 2019).