Your browser does not fully support modern features. Please upgrade for a smoother experience.

Submitted Successfully!

Thank you for your contribution! You can also upload a video entry or images related to this topic.

For video creation, please contact our Academic Video Service.

| Version | Summary | Created by | Modification | Content Size | Created at | Operation |

|---|---|---|---|---|---|---|

| 1 | Chokri Kooli | -- | 2465 | 2023-12-21 17:14:13 | | | |

| 2 | Jessie Wu | -1 word(s) | 2464 | 2023-12-22 07:44:45 | | |

Video Upload Options

We provide professional Academic Video Service to translate complex research into visually appealing presentations. Would you like to try it?

Cite

If you have any further questions, please contact Encyclopedia Editorial Office.

Kooli, C.; Son, M.L. Impact of COVID-19 on Mergers and Acquisitions Activity. Encyclopedia. Available online: https://encyclopedia.pub/entry/53042 (accessed on 07 February 2026).

Kooli C, Son ML. Impact of COVID-19 on Mergers and Acquisitions Activity. Encyclopedia. Available at: https://encyclopedia.pub/entry/53042. Accessed February 07, 2026.

Kooli, Chokri, Melanie Lock Son. "Impact of COVID-19 on Mergers and Acquisitions Activity" Encyclopedia, https://encyclopedia.pub/entry/53042 (accessed February 07, 2026).

Kooli, C., & Son, M.L. (2023, December 21). Impact of COVID-19 on Mergers and Acquisitions Activity. In Encyclopedia. https://encyclopedia.pub/entry/53042

Kooli, Chokri and Melanie Lock Son. "Impact of COVID-19 on Mergers and Acquisitions Activity." Encyclopedia. Web. 21 December, 2023.

Copy Citation

The term mergers and acquisition (M&A) is used to refer to the financial transaction by which two or more different entities consolidate in view of creating synergies that can be exemplified by gains in operational efficiency and/or increased capabilities. More particularly, the term “mergers” entails the joining of two comparable sized companies in view of creating a new entity, while the term “acquisitions” describes the absorption of a company by a (typically) larger one. While all M&A proceedings are all unique in value and type, they all aim at supporting the strategic mission and vision of the parties involved.

mergers and acquisitions

COVID-19

1. Mergers and Acquisition (M&A) Activity during the COVID-19 Pandemic

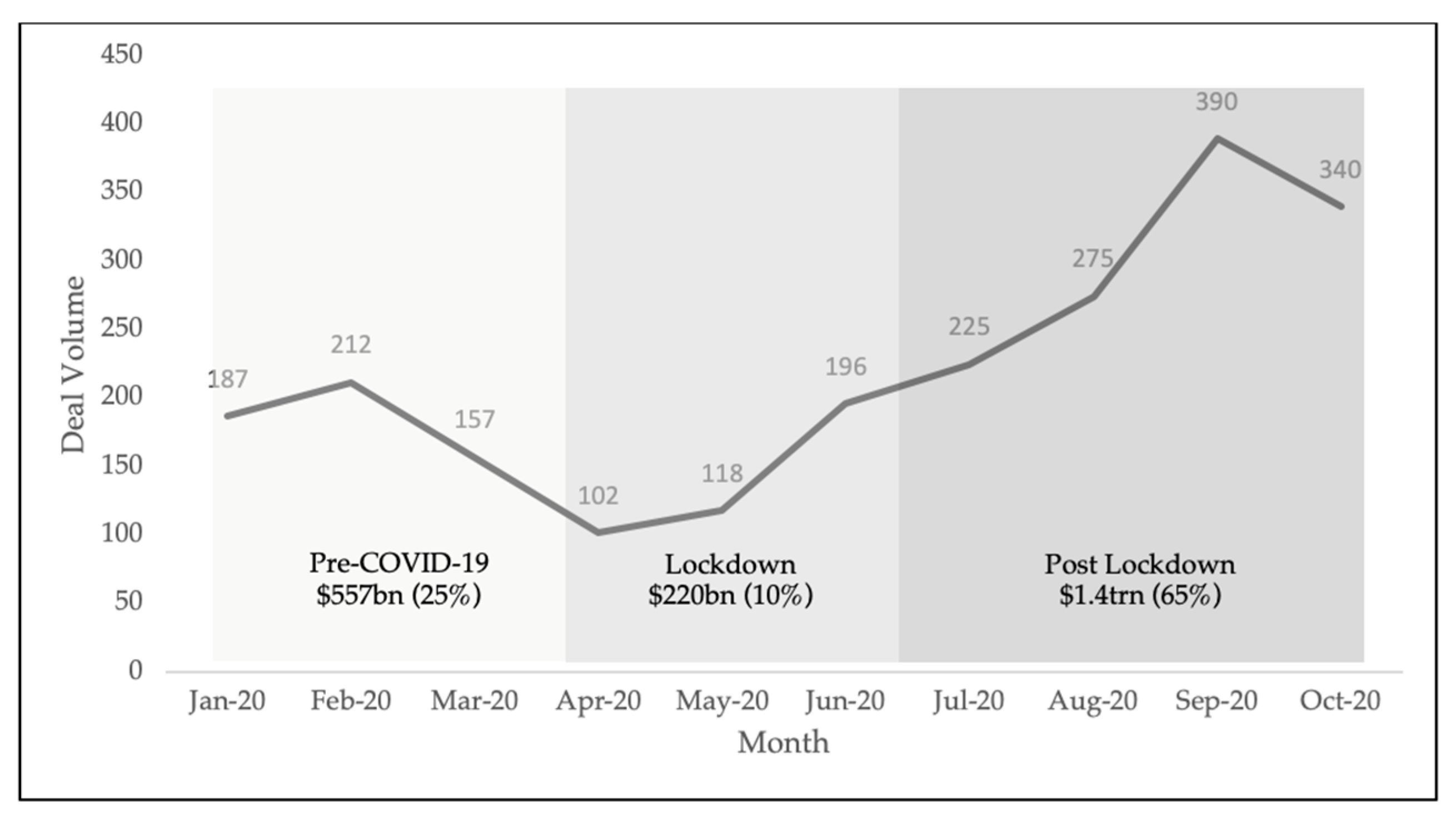

1.1. Deal Volume in the Different Waves of the Pandemic

As observed in Figure 1, when the World Health Organization declared a world outbreak, the global volume of M&A deals experienced a sharp decline of about 50% as of mid-February 2020. The unpredictable business environment characterized by stay-at-home orders, competing for new government policies, and unclear projections of the scale of the COVID-19 virus caused this sharp downward slope [1]. In the following months, the slow easing of lockdown measures, as well as vaccine announcements, gave momentum to M&A proceedings. Therefore, in those unprecedented times, the total value of disclosed deals from January 2020 to October 2020 amounted to a value of USD 2.2 trillion [2].

Figure 1. Deal Volume: Breakdown by Phases (Source: Data collected from Deloitte).

In the last two quarters of 2020, in addition to the reduction in the virus-inflicted uncertainty, hope for geopolitical stability following a Biden-Harris win and the willingness of financiers to make up for lost time at the beginning of the year led to V-shape recovery for the deal market. The fourth quarter of 2020 was designated the “third strongest for M&A in two decades.” According to the Financial Times, “since the start of October, $612bn of deals have been agreed, up from $461bn during the same period in 2019 and $491bn in 2018” [3].

1.2. Deal by Industry

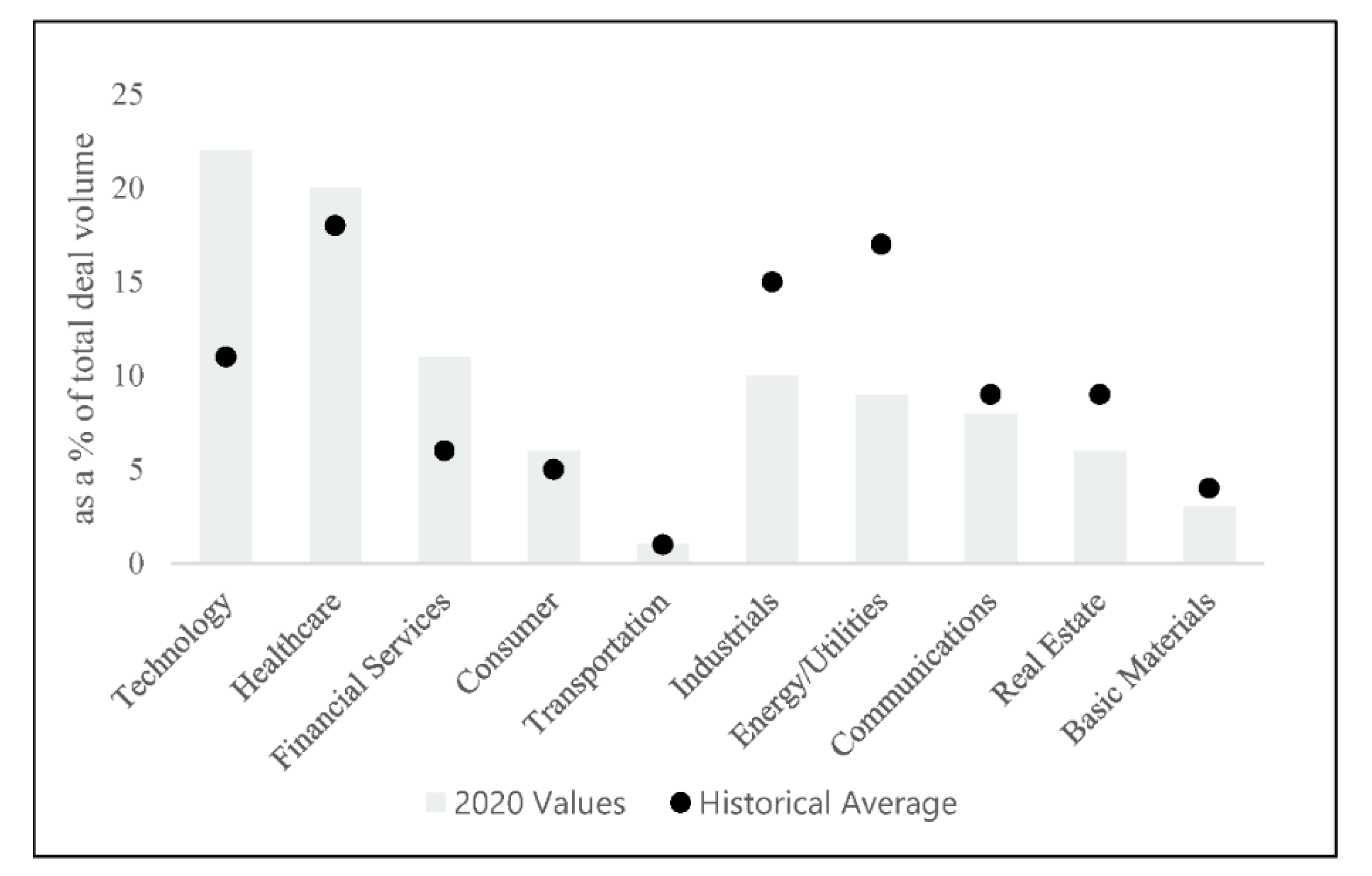

Compared to previous economic downturns that stemmed from the financial system itself, the 2020 economic crisis was a global health tragedy intertwined with supply and demand suppressions. As such, its impact has been non-uniform on the different industries. Shortages of toilet paper on store shelves, the rapid adoption of telehealth, and limited long-haul travel are illustrations of how the pandemic has deeply altered consumer behavior. Through the “valley of death” of the pandemic [4], a new normal is emerging. Industries that were once resilient and considered essential may no longer be considered so and they are being challenged by new business models.

In light of those transitions, as indicated in Figure 2, the industries least impacted by COVID-19—those that were either considered “essential” or those that were able to rapidly adapt to the new normal—were more active in the M&A sphere. For instance, the technology and healthcare sectors saw strong adoption during the crisis and outperformed their historical average number of deals as companies continued to grow organically through M&A. However, many industries that were historically resilient with strong M&A deal volumes were affected by restrictions brought by the pandemic. They experienced a lower M&A deal volume in 2020. Therefore, the predictability and outlook of the industries were crucial factors that determined the M&A playbook.

Figure 2. M&A Activity by Industry (Source: Data collected from Refinitiv).

1.3. Deal size

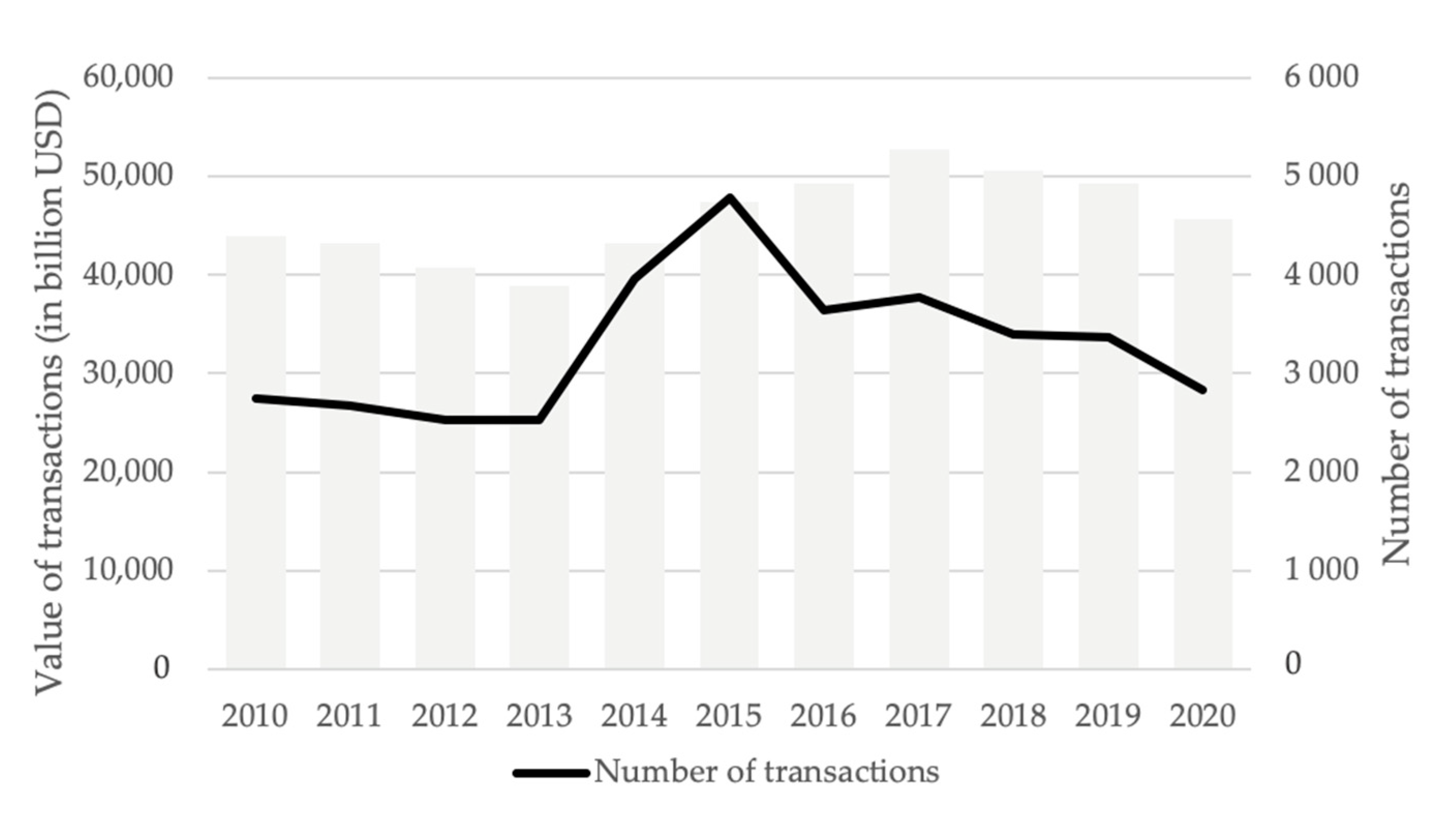

The year-over-year change in deal volume decreased by about 7.5% in 2020, whereas the total value of transactions decreased by 16% [5]. More particularly, insights gathered by PwC on the Global M&A Industry trends, as illustrated in Figure 3, show that despite the sharp decline in the first half of 2020, the global deal value and volume increased by 94% and 18% respectively, which were both superior to the last two quarters of 2019. The number of megadeals in the last two quarters amounted to 56 megadeals in 2020 compared to 27 megadeals in 2019.

Figure 3. Mergers & Acquisitions Worldwide (Source: Data collected from IMAA).

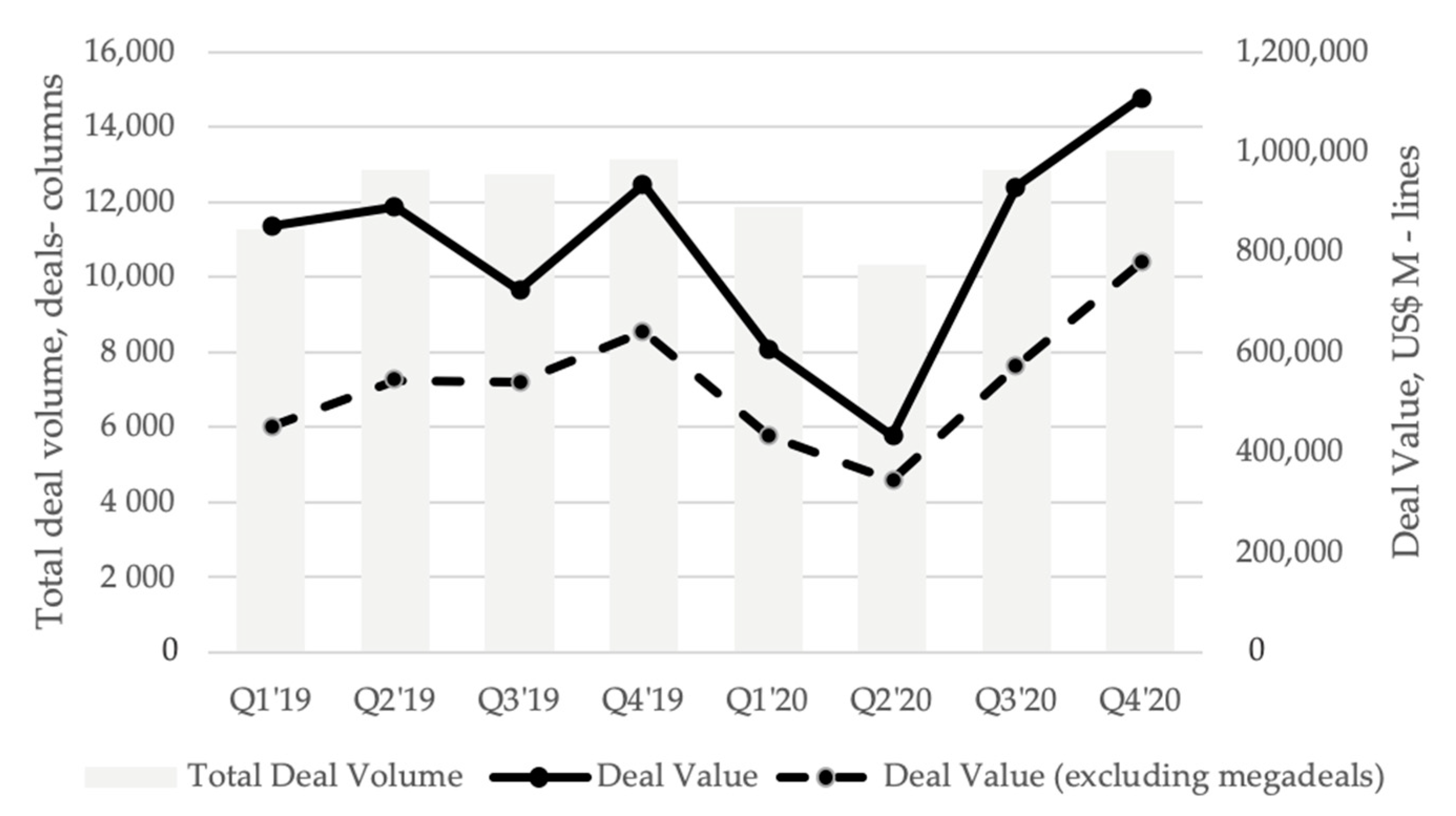

As showcased by Figure 4, the surge in deal value may be attributed to an increase in the number of megadeals (that is, deals that are greater than USD 5 billion). Those megadeals occurred more particularly in the technology and telecom sectors where M&A activity was up in value by 118% and 300%, respectively. The surge in megadeals in the third and fourth quarter of 2020 exemplifies the ambition of companies to profit from the favorable interest rates and to “scale during the downturn” [6].

Figure 4. Global Deal Volumes and Values (Source: Data collected from Refinitiv, Dealogic & PwC Analysis).

2. Impact of COVID-19 on Mergers and Acquisition Activity

The commonality between the previous financial crises and the one that incepted in late 2019 and early 2020 is that they all inflicted unprecedented financial turmoil. As the research presented by Andriuškevičius [7] mentions, events of economic uncertainty highlight the capacity of M&A activity to create value for companies looking to grow strategically, innovate, and/or adjust in light of changing socio-economic conditions.

Unlike precedent financial crises, the interruption caused to deal volume during the COVID-19 crisis was not solely a consequence of the downgrading of economic factors. It was more so an amalgam of environmental and financial determinants. Therefore, overnight, unlike other downturns, the industry was forced to transform its strategies, processes, and traditional methodologies to account for the new reality that encompassed more than financial constraints.

2.1. Impact on strategic focus

The pandemic has tested the viability of firms in an evolving competitive landscape where the “essential nature” of the firm, the delivery method of products or services, or the firm’s place in the value chain have been reexamined. The virus has thus revealed the weaknesses of corporate structures and presented an opportunity for businesses to transform and innovate, and to realign their strategic paths to address the current mismatch between the firm’s value proposition and the evolving needs of its business environment [8].

- (i).

-

M&A to stimulate inorganic growth

In response to the health crisis, there is a group of companies that have looked towards M&A for the “upgrading and updating of resources and capabilities in a timely manner to avert environmental shift, rendering the current strategy obsolete” [9]. Faced with the unpredictable limitations of the pandemic, corporate executives were compelled to consider more attentively the strategic fit of M&A, and the capacity of M&A to stimulate inorganic growth and profitability in a slowing economy. For example, during the pandemic, Well Technologies (a company traded on the Toronto Stock Exchange) completed about 10 acquisitions in 2020 to fulfill their corporate strategy of expanding their market share and product portfolio. Acquisitions such as that of Circle Medical Health in November of 2020 were aimed at growing its operations in the United States, whereas the acquisition of DoctorCare was intended to increase their product offering by expanding direct billing services for doctors.

- (ii).

-

Opportunistic M&A to address future concerns

Many would agree that the COVID-19 pandemic caused companies from all industries to undergo a digital transformation that would have otherwise taken about 10 years. Overnight, businesses were pressed to adopt new business models to adapt to the new social distancing measures. This situation gave organizations an insight as to what their present weaknesses were, and what are the gaps they would need to fill to adapt to the future state of their businesses. Opportunistic companies [10] like Accenture, with strong cash positions, seized the low-interest rate and cheaper valuations to acquire companies that would allow them to acquire proprietary technologies or acquire talent (which was difficult during the pandemic) to stay ahead of the upcoming demands of their clients and employees. Moreover, Accenture, as one of the most acquisitive companies, acquired numerous cybersecurity companies or companies specializing in innovative technologies like blockchain and artificial intelligence to acquire the skills and knowledge that their clients would require in the coming years [11]. Furthermore, in December 2020, Salesforce announced the acquisition of Slack Technologies. The goal of this acquisition was to reinforce Salesforce’s ecosystem of software applications by combining the technologies of one of the most advanced enterprise-grade communication software to its enterprise offering, in view of getting ahead of their clients’ needs in an all-virtual work environment.

- (iii).

-

Corporate restructuring for survival

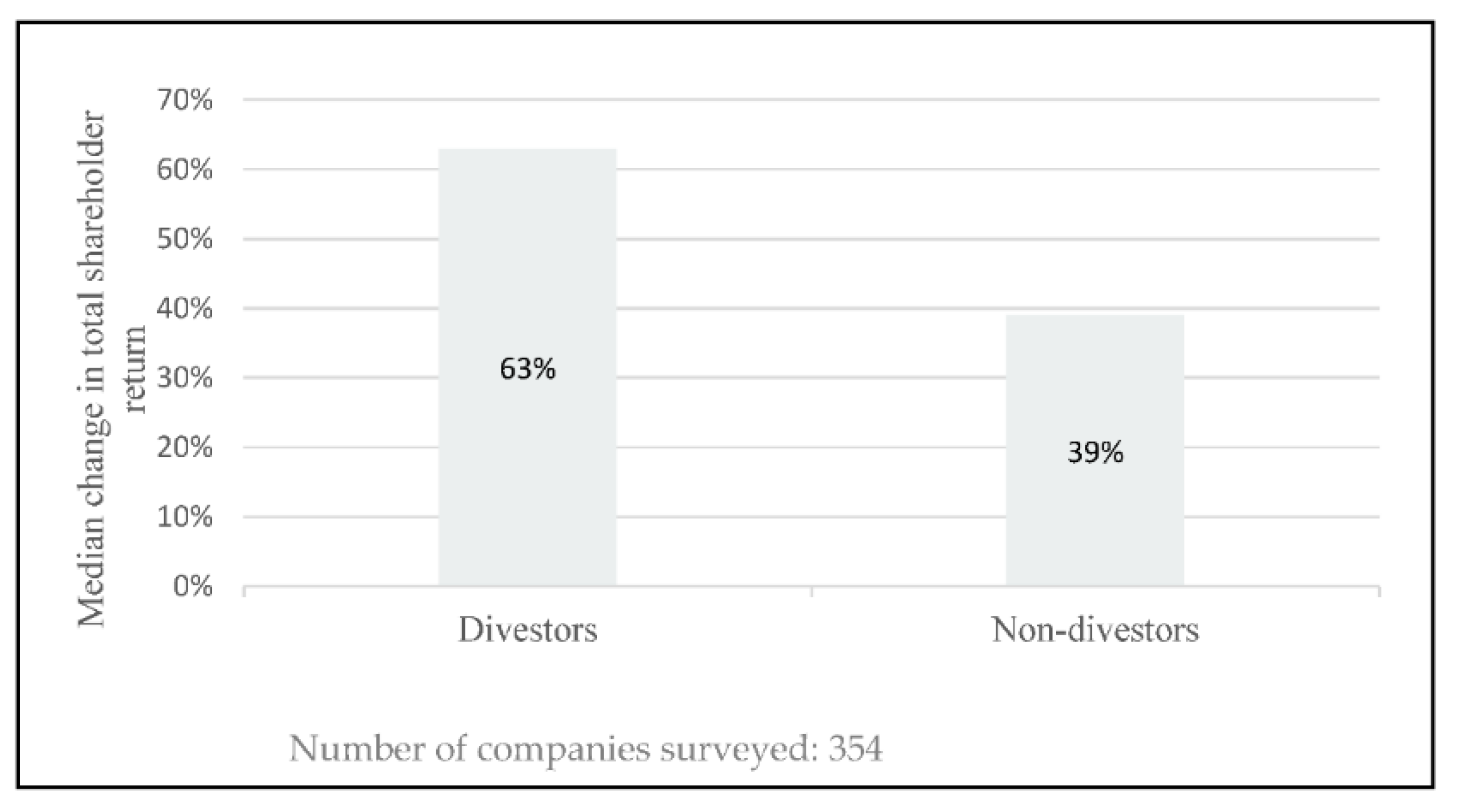

The EY 2020 Global Corporate Divestment Study [12] illustrated how divestments increase the likelihood of companies’ resilience in a slowing economy. For example, following the 2008 downturn, companies who were bold enough to transform their businesses through divestitures had median shareholder returns that were 61.5% greater than companies that did not divest (see Figure 5: Median change in total shareholder return (2010–2018) for divestments completed in years 2008–2010). Consequently, amid the COVID-19 crisis, companies have once again had recourse to divestitures to raise capital for reinvestment, optimize their portfolio, and focus on profitable core operations [13]. For example, in October 2020, IBM announced that it was separating from its core legacy operations to focus on cloud computing services that yield higher margins [14] (Vengattil, 2020). This strategy would imply the creation of a separate entity, NewCo, that would absorb the IT Infrastructure Services Unit of IBM and have a separate managing team. Ergo, in times of an economic slowdown as was the case in the COVID-19 outbreak, some companies have had to transform their businesses by divesting, whether through a spin-off, split-off, or carve-out to survive.

Figure 5. Median change in total shareholder return (2010–2018) for divestments completed in years 2008–2010 (Source: Data collected from EY Analysis, S&P Capital IQ).

3. Impact of COVID-19 on Mergers and Acquisition Process

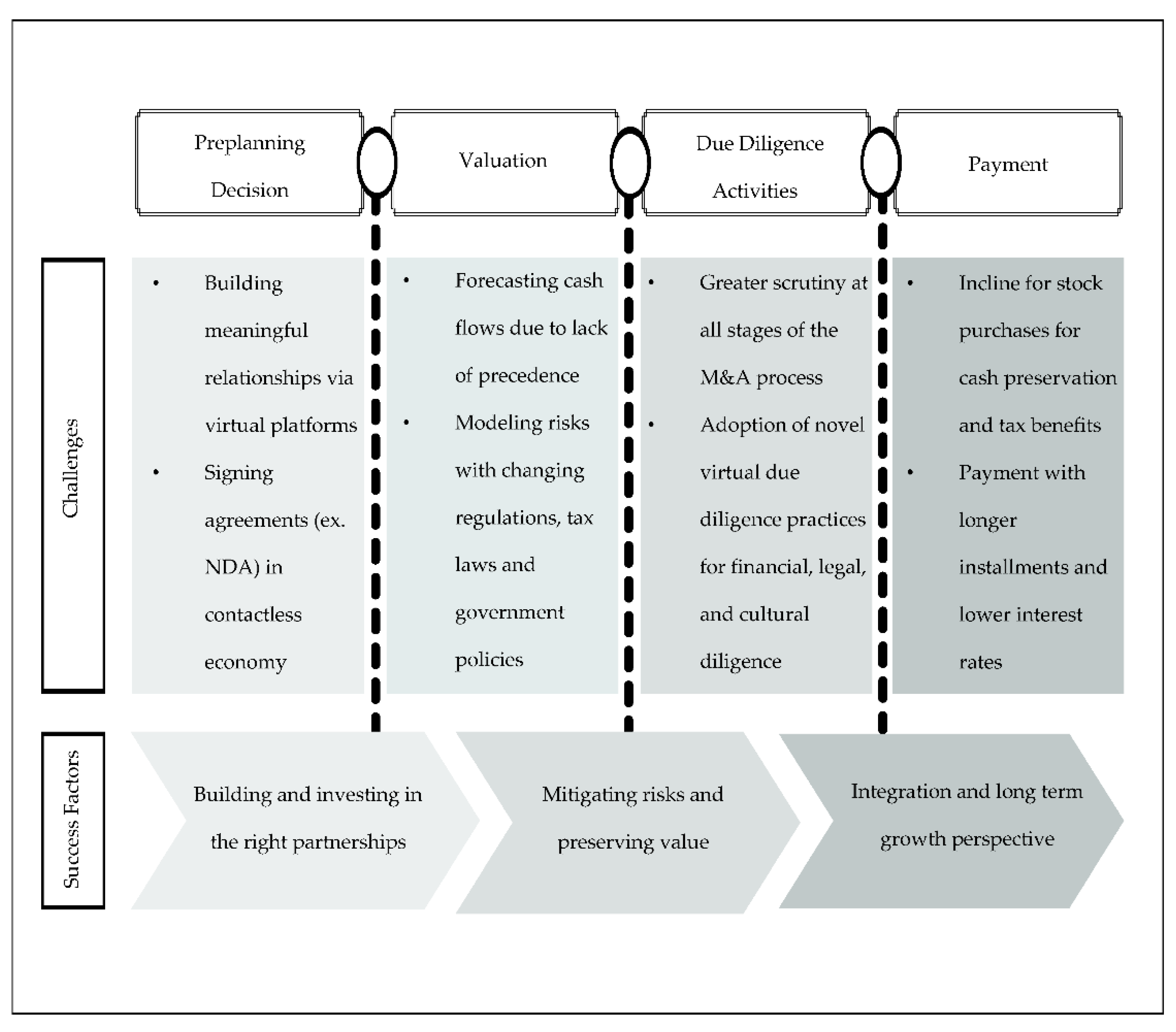

In an all-virtual environments, together with uncertain economic expectations, the M&A process—from planning to deal closure and integration—has had to evolve to match the needs of both buyers and sellers. Figure 6 summarises four distinct processes that have undergone the greatest transformation with the adverse events of the 2020 pandemic.

Figure 6. Impact of COVID-19 on the Different Phases of M&A.

- (i).

-

Preplanning—Relationship building

Prior to the COVID-19 pandemic, businesses relied heavily on traditional physical experiences; notably, face-to-face meetings, coffee chats, and business conferences to build their deal pipeline, and close deals [15]. With new health guidelines, physical interactions between parties had to be virtualized. One of the major hurdles of having virtual interactions is that it is even more challenging to grasp social cues and to discuss topics that would have otherwise been more fluid in a live setting. Moreover, the contactless economy has given rise to the need for the digitalization of key agreements such as disclosure agreements and non-competing contracts [16]. Subsequently, during the COVID-19 pandemic, there has been the rapid adoption of new tools such as e-signing applications that aim to increase operational agility and reduce the cost of paper and pen transactions [17]. During the pandemic alone, Adobe Sign (an e-signature platform) experienced an increased usage of 200% by the financial sector [18].

- (ii).

-

Valuation gap

The pandemic’s main characteristic is its unpredictability. This key attribute implied that the main economic actors also responded in ways that are not necessarily captured in the math traditionally used in valuation. Therefore, from the onset of the pandemic, the main issue faced by analysts was to accurately forecast the cashflows as pre-existing historical financials did not reflect the short-to-medium-term outlook. Besides, with diverging predictions about the evolution of the pandemic from world leaders, markets acted irrationally, and it became arduous to formulate scenarios. Accordingly, financial leaders had to focus on building models with different durations (18–48 months) to better understand the intrinsic value of firms and to add more flexibility to their models [19]. Stress testing revenues and expenses were also crucial to better define short-term, mid-term, and long-term performances [20]. Additionally, valuation was rendered more complex with government instituted relief loans such as the Paycheck Protection Loan in the United States, as well as significant tax law changes in response to the pandemic [21]. Therefore, in a rapidly evolving environment with no historical precedence, the analysts’ job of forecasting cash flows and constructing discount rates that would reflect the reality of the firms required extra diligence. As directed by the dean of valuation, Damodaran, in the context of this global crisis it was thus crucial to “go back to basics and the fundamentals and be willing to live with uncertainty” [22].

- (iii).

-

Due diligence

The pandemic exposed the flaws in the supply chains, technological preparedness, and effectiveness of companies in dealing with external shocks. With all those vulnerabilities out in the open, acquirers were compelled to more thoroughly complete due diligence at all stages of the M&A to have an accurate picture of the impact short-term and long-term impact of the pandemic on the target’s viability and resilience [21]. Acquirers and sellers have also been compelled to use more advanced data analysis methods and advanced technologies to consolidate the due diligence process in this virtual and socially distant society. For instance, “P&G was able to conduct virtual plant tours when it was divesting, with the buyers being able to ask questions of those conducting the tour” [23].

Furthermore, key regulatory institutions running at a lowered capacity have posed additional roadblocks in the due diligence process. For example, “in mid-March, the Department of Justice announced there would be a 30-day delay in addition to the typical three- to six-month due diligence process for it to review mergers in their final stages,” [1]. In addition to lengthy processes of financial and legal diligence [24], the pandemic has posed unique challenges in the accurate cultural due diligence of target companies—a crucial step for the proper integration of the target to the acquiring entity. All virtual working environments have presented logistical issues in understanding the organizational dynamic and corporate culture of the target firms; aspects that would, under normal circumstances, be assessed through site visits, employee interviews, and face-to-face interactions [25].

- (iv).

-

Payment methods

An emerging trend during the COVID-19 pandemic is a preference for stock-for-stock purchases. Stock purchases allow acquirers and buyers to go further in the deal process by focusing on relative valuation rather than trying to agree on a purchase price [26][27]. Moreover, this strategy was frequent amongst buyers that operate in industries hit hard by the pandemic and where financing was unreachable during the downturn. Furthermore, amidst the persistent uncertainty in the economy, stock-for-stock purchases allowed acquirers to preserve their cash reserves for rainy days. Nonetheless, stock purchases increase the tax breaks for acquirers as opposed to the increased tax liabilities of cash purchases [28].

With conflicting valuations, target companies were more inclined to negotiate payments that would run for an extended duration and with lower interest rates [20]. Acquires armed themselves with more complex post-closure price adjustment mechanisms such as earnouts that are contingent upon achieving specific financial milestones or earnouts that are paid on a sliding scale [21]. Similar to the due diligence process, acquirers and buyers risk aversion was reflected in the payment methods employed.

References

- Jacobs, B. COVID-19 Uncertainties Slam Brakes on M&A Activity. Rochester Bus. J. Available online: https://rbj.net/2020/04/07/covid-19-uncertainties-slam-brakes-on-ma-activity/ (accessed on 7 April 2021).

- Macmillan, I.; Purowitz, M. M&A and COVID-19: Charting New Horizons. Deloitte. Available online: https://www2.deloitte.com/content/dam/Deloitte/global/Documents/About-Deloitte/COVID-19/gx-COVID-19-Mergers-Acquisitions-Charting-New-Horizons.pdf (accessed on 8 June 2021).

- Massoudi, A. Global M&A Recovers on Vaccine Hopes and US Political Stability. Financial Times. Available online: https://www.ft.com/content/b1935f10-d1b2-4920-ab76-0a2dff670556 (accessed on 17 November 2020).

- Strauss, S. Some emerging hypotheses on the economic opportunities and challenges of the post-pandemic world. SSRN Electron. J. 2020.

- IMAA. M&A by Industries. Institute for Mergers, Acquisitions and Alliances (IMAA). 2020. Available online: https://imaa-institute.org/m-and-a-by-industries/ (accessed on 30 June 2021).

- Wittmer, C.; Potter, J.; Marshall, J. Deals Industry Insights. PwC. Available online: https://www.pwc.com/us/en/services/deals/industry-insights.html (accessed on 30 June 2021).

- Andriuškevičius, K. Opportunities and challenges of value creation through merger and acquisitions in cyclical economies. Procedia Soc. Behav. Sci. 2015, 213, 764–769.

- Seetharaman, P. Business models shifts: Impact of Covid-19. Int. J. Inf. Manag. 2020, 54, 102173.

- Amankwah-Amoah, J.; Khan, Z.; Wood, G. COVID-19 and business failures: The paradoxes of experience, scale, and scope for theory and practice. Eur. Manag. J. 2021, 39, 179–184.

- Baker, H.K.; Dutta, S.; Saadi, S.; Zhu, P. Are good performers bad acquirers? Financ. Manag. 2012, 41, 95–118.

- Seal, T. Accenture’s Tech Push Makes It World’s Most Acquisitive Firm. 2021. Available online: https://www.bloomberg.com/news/articles/2021-03-02/accenture-s-tech-push-makes-it-world-s-most-acquisitive-company (accessed on 30 June 2021).

- Jenkinson, D. Global Corporate Divestment|2020 Study. EY Canada, 2020. Available online: https://www.ey.com/en_ca/divestment-study (accessed on 30 June 2021).

- Tze-Liang, C.; Perkins, B.; Murphy, P.; Mills, R. How Portfolio Rebalancing in a Downturn Helps Companies Recover Stronger. EY, 2020. Available online: https://www.ey.com/en_gl/divestment-study/how-portfolio-rebalancing-in-a-downturn-helps-companies-recover-stronger (accessed on 30 June 2021).

- Vengattil, M. IBM to Break Up 109-Year Old Company to Focus on Cloud Growth. U.S. Available online: https://www.reuters.com/article/ibm-divestiture-idUSKBN26T1V1 (accessed on 9 October 2020).

- Deckert, A. Despite global pandemic, M&A deals were still carried out. Rochester Bus. J. 2021, 36, 11. Available online: https://rbj.net/2021/04/06/despite-global-pandemic-ma-deals-were-still-carried-out/ (accessed on 30 June 2021).

- Harroch, R.; Lipkin, D.; Smith, R. The Impact of the Coronavirus Crisis on Mergers and Acquisitions. Forbes. Available online: https://www.forbes.com/sites/allbusiness/2020/04/17/impact-of-coronavirus-crisis-on-mergers-and-acquisitions/?sh=388b2f7a200a (accessed on 17 April 2020).

- Insights Team. Agree to Automate: How Digitizing the Agreement Process Can Move Your Business Forward. Forbes. Available online: https://www.forbes.com/sites/insights-docusign/2020/10/08/agree-to-automate-how-digitizing-the-agreement-process-can-move-your-business-forward/?sh=684884d11608 (accessed on 19 November 2020).

- Abramso, R. E-Signatures Are Still Spreading in the Financial Industry, But Not Really Maturing. Tearsheet. Available online: https://tearsheet.co/modern-banking-experience/e-signatures-are-still-spreading-in-the-financial-industry-but-not-really-growing/ (accessed on 31 March 2021).

- Macmillan, I.; Sriram, P.; Purowitz, M.; Turner, I. In the Coming Economy, M&A Strategies Emerging as a Big Deal. Deloitte South Africa. Available online: https://www2.deloitte.com/za/en/pages/finance/articles/cfo-insights-preparing-for-the-next-virtual-financial-close.html (accessed on 30 June 2021).

- Patel, A. M&A activity post COVID-19. Los Angeles Bus. J. 2020, 42, 17.

- Crowell, B.M. Mergers and Acquisitions during the COVID-19 Pandemic. The Tax Adviser. Available online: https://www.thetaxadviser.com/issues/2020/aug/mergers-acquisitions-covid-19-pandemic.html (accessed on 1 August 2020).

- Hammond, J.C. Aswath Damodaran on Valuations amid COVID-19: “Go Back to Basics.” CFA Institute Enterprising Investor. Available online: https://blogs.cfainstitute.org/investor/2020/05/29/aswath-damodaran-on-valuations-amid-COVID-19-go-back-to-basics/ (accessed on 17 April 2021).

- Leach, J.; Kaske, E. How the COVID-19 Pandemic Affects M&A Transaction Execution. EY—US. Available online: https://www.ey.com/en_us/strategy-transactions/how-the-covid-19-pandemic-affects-m-a-transaction-execution (accessed on 11 September 2020).

- Smith, G.C.; Coy, J.M.; Spieler, A.C. Cross-border transactions, mergers and the inconsistency of international reference points. J. Behav. Exp. Financ. 2019, 22, 14–21.

- Siebecker, M.; Lozano, I. Cultural due dilligence and M&A in the wake of a pandemic. OSLJ Online 2020, 81, 239–252. Available online: http://hdl.handle.net/1811/92248 (accessed on 30 June 2021).

- Gerritsen, D.F.; Weitzel, U. Security analyst target prices as reference point and takeover completion. J. Behav. Exp. Financ. 2017, 15, 1–14.

- Dutta, S.; Saadi, S.; Zhu, P. Does payment method matter in cross-border acquisitions? Int. Rev. Econ. Financ. 2013, 25, 91–107.

- Manfredi, R. Gibson Dunn|Stock-for-Stock Mergers during the Coronavirus (COVID-19) Crisis—A Potential Strategic Solution. Gibson Dunn. Available online: https://www.gibsondunn.com/stock-for-stock-mergers-during-the-coronavirus-COVID-19-crisis-a-potential-strategic-solution/ (accessed on 5 October 2020).

More

Information

Subjects:

Health Policy & Services

Contributors

MDPI registered users' name will be linked to their SciProfiles pages. To register with us, please refer to https://encyclopedia.pub/register

:

View Times:

1.6K

Revisions:

2 times

(View History)

Update Date:

22 Dec 2023

Notice

You are not a member of the advisory board for this topic. If you want to update advisory board member profile, please contact office@encyclopedia.pub.

OK

Confirm

Only members of the Encyclopedia advisory board for this topic are allowed to note entries. Would you like to become an advisory board member of the Encyclopedia?

Yes

No

${ textCharacter }/${ maxCharacter }

Submit

Cancel

Back

Comments

${ item }

|

More

No more~

There is no comment~

${ textCharacter }/${ maxCharacter }

Submit

Cancel

${ selectedItem.replyTextCharacter }/${ selectedItem.replyMaxCharacter }

Submit

Cancel

Confirm

Are you sure to Delete?

Yes

No