Your browser does not fully support modern features. Please upgrade for a smoother experience.

Submitted Successfully!

Thank you for your contribution! You can also upload a video entry or images related to this topic.

For video creation, please contact our Academic Video Service.

| Version | Summary | Created by | Modification | Content Size | Created at | Operation |

|---|---|---|---|---|---|---|

| 1 | Dario Atzori | -- | 3814 | 2023-12-19 14:27:15 | | | |

| 2 | Camila Xu | Meta information modification | 3814 | 2023-12-20 02:10:40 | | |

Video Upload Options

We provide professional Academic Video Service to translate complex research into visually appealing presentations. Would you like to try it?

Cite

If you have any further questions, please contact Encyclopedia Editorial Office.

Atzori, D.; Tiozzo, S.; Vellini, M.; Gambini, M.; Mazzoni, S. Sectors of the Glass Industry. Encyclopedia. Available online: https://encyclopedia.pub/entry/52935 (accessed on 14 January 2026).

Atzori D, Tiozzo S, Vellini M, Gambini M, Mazzoni S. Sectors of the Glass Industry. Encyclopedia. Available at: https://encyclopedia.pub/entry/52935. Accessed January 14, 2026.

Atzori, Dario, Simone Tiozzo, Michela Vellini, Marco Gambini, Stefano Mazzoni. "Sectors of the Glass Industry" Encyclopedia, https://encyclopedia.pub/entry/52935 (accessed January 14, 2026).

Atzori, D., Tiozzo, S., Vellini, M., Gambini, M., & Mazzoni, S. (2023, December 19). Sectors of the Glass Industry. In Encyclopedia. https://encyclopedia.pub/entry/52935

Atzori, Dario, et al. "Sectors of the Glass Industry." Encyclopedia. Web. 19 December, 2023.

Copy Citation

The glass industry is highly diverse, both in terms of products and production processes, making articles ranging from artistic handmade glass goblets to large flat glass plates for the construction and automotive sectors.

glass

CO2 emission

furnace

decarbonization

industry

1. Introduction

One of the European Union’s most important policies covers the focus on fighting climate change. The recent European Green Deal introduced a series of measures aimed at making the Union’s economy sustainable, promoting the efficient use of resources and reducing pollution. The European Union intends to reach climate neutrality in 2050 and, to achieve this goal, it envisages the decarbonization of its industrial sectors [1]. The Commission’s proposal for the first European climate law [2], promoted by the President of the European Commission, Ursula Von Der Leyen, is part of the Green Deal. The proposal aims at making the European Union’s goal of climate neutrality law by 2050, focusing mainly on the reduction in greenhouse gas emissions and investments in “green” technologies. Specifically, the European Commission, on the basis of a global impact assessment, has proposed to raise the emission reduction target for 2030, compared to 1990 levels, from 40% to 55%. The aim is to achieve the above target through the revision of the European Emissions Trading System mechanism [3] and all relevant policy instruments. A new mechanism has also been discussed, namely the Carbon Border Adjustment Mechanism [4], which aims at considering the carbon contained in goods imported from non-European Union countries. The objective is to defend borders and the internal market, thus reducing the risk of carbon leakage for companies. The Carbon Border Adjustment Mechanism’s measure was proposed in 2021 and will become effective in 2023, according to the Commission’s timeline.

In compliance with the Paris Agreement [5], European Union countries are developing long-term strategies [6] consistent with their national energy and climate plans. They must also include total reductions in gas emissions related to the greenhouse effect, long-term investment estimates and related research, development and innovation strategies.

Moreover, in the European Union, the problem of energy costs and CO2 emissions has always been relevant, especially for countries like Italy, which have no large fossil fuel reserves and depend on foreign energy supplies. This issue has recently become even more critical because of the significant increase in energy costs due, on one hand, to the COVID-19 pandemic, and, on the other hand, to geopolitical instability.

The glass industry is highly diverse, both in terms of products and production processes, making articles ranging from artistic handmade glass goblets to large flat glass plates for the construction and automotive sectors. Production processes vary from the small electric furnace used in the glass wool sector to the huge furnaces used for the production of bottles, jars or flat glass, which can melt over 1000 tons of glass per day.

The main environmental challenges for the glass industry are polluting emissions and energy consumption. Glass melting is an “energy intensive” process that reaches high temperatures (around 1550–1600 °C) and emits considerable amounts of CO2, NOx and SOx into the atmosphere. Despite the different types of production and technologies adopted, the most used energy vector is natural gas, followed by electricity. Most of the energy is consumed in the melting furnaces, characterized by very long service lives, which can even reach 20 years for flat glass plants. Due to such long service lives, 2050 is only two to three furnace reconstructions away from the present. Moreover, with present energy prices, even in the short term, the glass industries would strongly benefit from even a partial reduction in their energy consumption and emissions. These reasons determine the current excitement in the scientific world, as well as in the industrial sector. There are very few authoritative publications about the maturity of the technologies/solutions required to decarbonize this sector, especially regarding the in-research or test-phase ones: the main existing solution is the Best Available Techniques (BAT) reference document, or “Glass BREF” [7], in which the various glass sectors and technologies are deeply examined based on a global and impartial vision. However, the aforementioned publication dates back to 2013. Another publication exists on this subject, but it presents a partial geographical vision and little depth relating to technologies in favor of the great development of forecasting and a roadmap for its implementation [8].

2. Sectors of the Glass Industry

In 2005, the worldwide production of different types of glass was about 130 million tons; the three largest producers were the European Union with about 33 million tons, followed by China with 32 million tons and the USA with 20 million tons [9]. The overall quantity of glass produced in the world has not increased significantly in the last decade, since in 2020, a paper estimated the global production to be still around 130 million tons [10]. Europe is still the world’s largest producer of glass with plants producing different types of glass products. Currently, more than 35 million tons of glass are produced each year and consequently, more than 10 million tons of CO2 are emitted [11]. Glass Alliance declared 39.53 million tons were produced by all sectors in Europe27 + the United Kingdom in 2022. The number of employees for all sectors in 2022 was 181.500, including the processor sector (companies that transform raw flat glass into insulating windows, architectural and structural units, laminated and toughened glass, etc.) [12]. In the European Union, Italy is the second largest producer of glass after Germany.

The glass industry can be divided into eight sectors:

-

Hollow glass, also called “container glass”.

-

Flat glass.

-

Glass fibers.

-

Tableware.

-

Special glass.

-

Mineral wool: glass and rock wool.

-

High-temperature insulation wool.

-

Glass frits.

The most challenging issues for the glass industry are energy consumption and polluting emissions; all the production processes of the eight sectors are highly energy intensive—high temperatures have to be reached to melt the glass mixture—and as a result, nitrogen, carbon and sulfur oxides are emitted. Also, dust is emitted mainly due to volatilization and re-condensation of the volatile materials of the batch [7].

It is important to specify that, for most sectors of origin (obviously excluding extreme cases of special glass such as glass for the conditioning of hazardous or nuclear waste, and the like), glass waste is hardly considered an environmental issue; on the contrary, it is a precious secondary resource. Since glass, being a permanent material, is 100% recyclable countless times, glass cullet (after a pre-treatment that removes impurities coming from non-idealities in post-consumer collection logistics) can typically be returned to the production cycle, in the melting furnace. This is particularly important and extensively exploited for the hollow and flat glass, or glass wool sectors, because it has the advantage, as reported below, of reducing energy consumption and avoiding CO2 emissions from chemical reactions of carbonate raw materials. Alternatively, glass waste can be downcycled to applications that are still environmentally very positive such as the filling of roadbeds [13] or for the production of geopolymers [14].

2.1. The Container Glass Sector

The hollow glass sector is a primary industry, with products sold to other industries (B2B—business to business); glass products are sold to other companies that use them as packaging for their goods, e.g., consumer products such as wine, beer and food, or more valuable goods like perfumes, cosmetics and pharmaceuticals. Glass production is a capital-intensive activity: only large companies with large capital reserves can enter into the market. There is a long investment cycle: container glass furnaces can last up to 15 or more years; after this period, a partial or complete reconstruction of the structure is required. A simple furnace reconstruction can cost around EUR 3–5 million (for a furnace that can produce 250 tons/day); the construction of the entire industrial site dimensioned for a 200 tons/day production, costs around EUR 40–50 million.

In the European Union, the container glass sector is the largest among the various glass sectors, with more than 50–60% of total production. The term “container” refers to all packaging containers: bottles (about 75% of the market, considering tons sold), food jars (20% of the market), and containers for perfumes, cosmetics, and the pharmaceutical and technical sectors (5% of the market). In 2005, production in the European Union-25 was 20 million tons. A single production site typically produces around 300–600 tons per day. Glass Alliance declared 24.50 million tons for the container sector in 2022, produced in Europe27 + the United Kingdom [12].

Although exposed to international competition, especially for alternative materials like plastic or aluminum, the hollow glass industry is typically characterized by a short-range market with the production sites strategically positioned “close” to their largest customers; except for the perfume sector, most of the products are sold within 500 km from the production site. This is due to the high cost of transporting empty containers, linked mainly to the high specific weight of the material; sales prices would not otherwise compensate for such transport costs because of this, imports and exports of empty bottles tend to be limited, unlike glass packaged goods, which are exported in large quantities because of the high added value of their content.

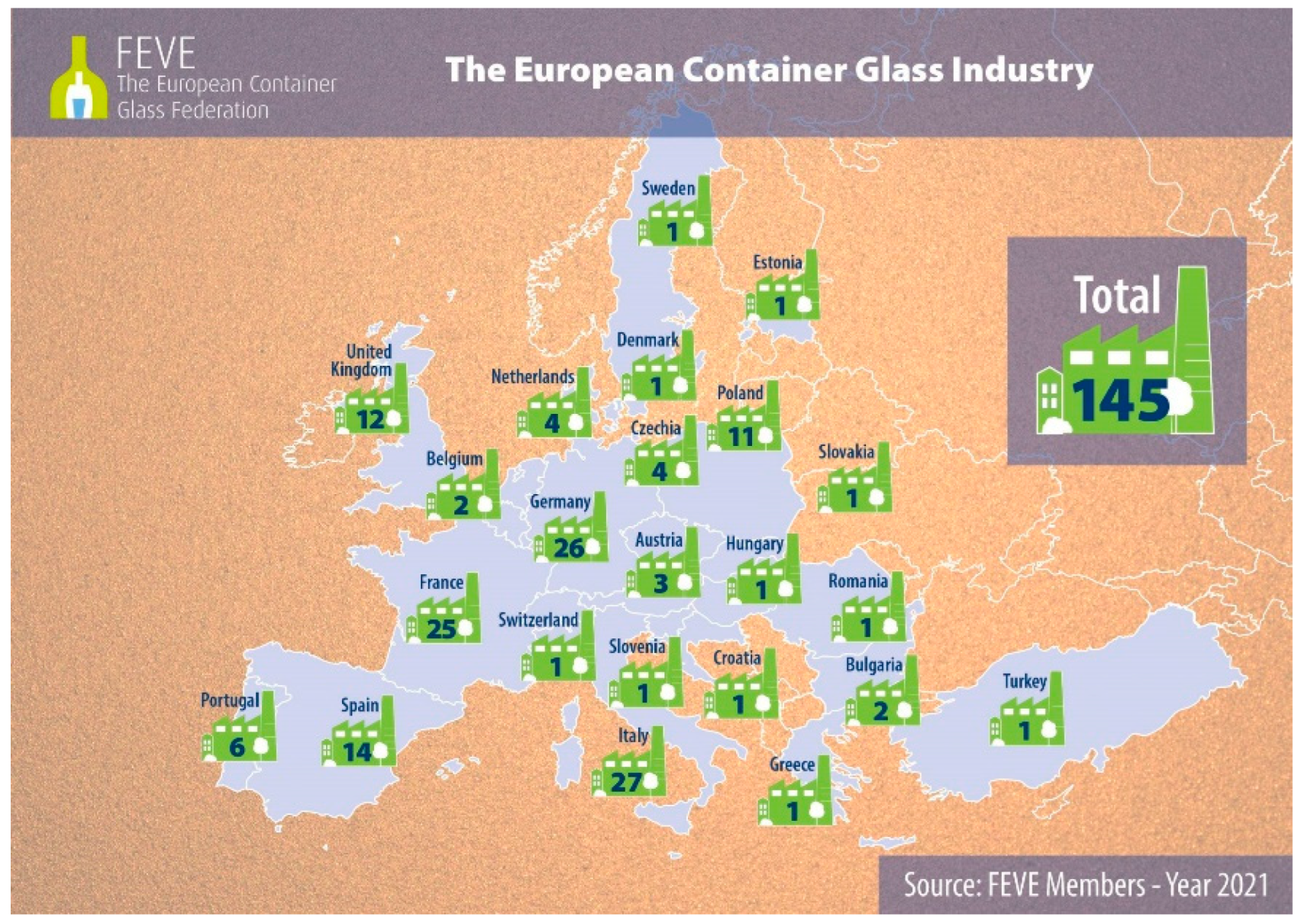

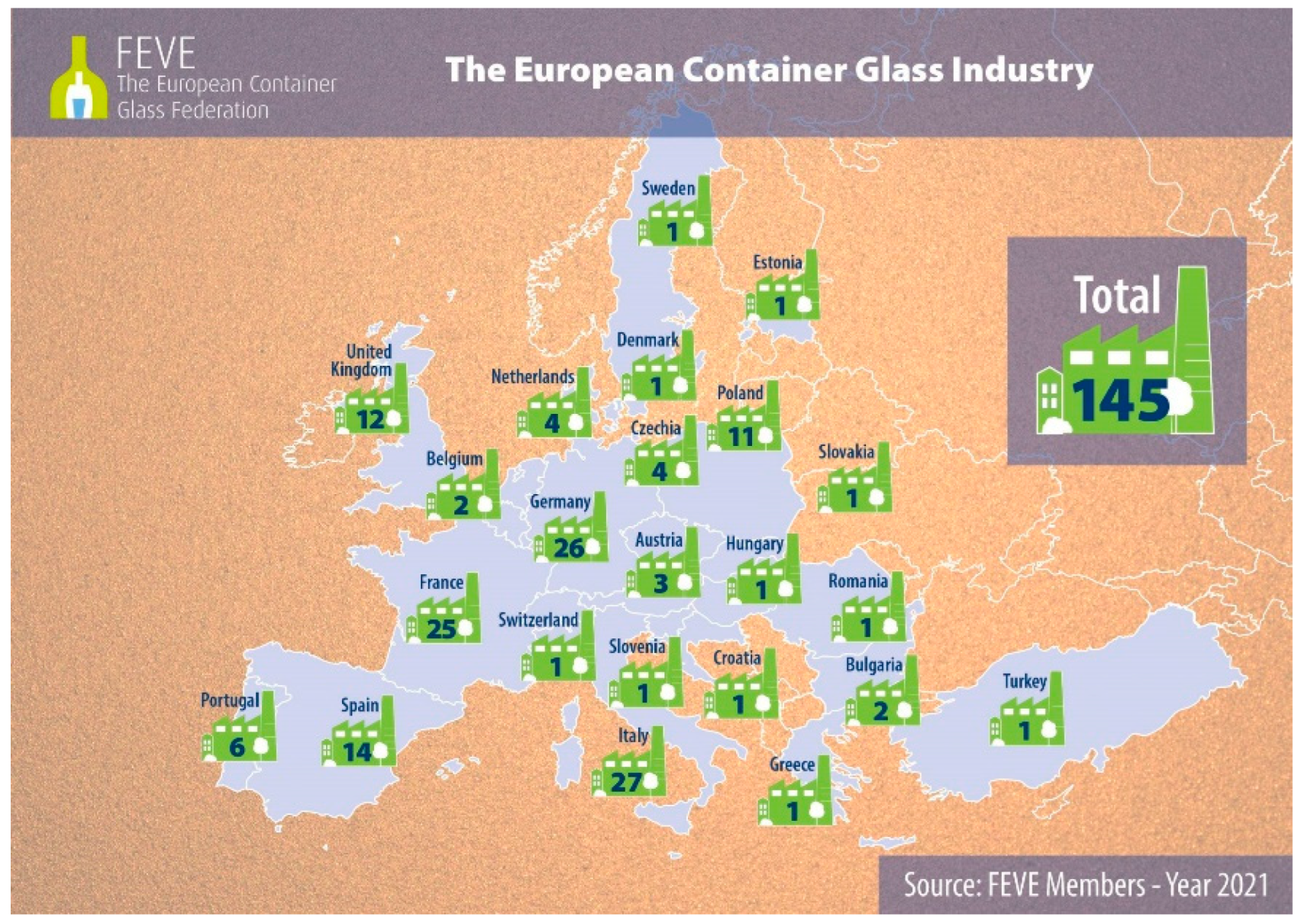

In Europe, there are currently 145 glass production sites for container glass; the highest number of factories is located in Italy, with 27 plants, as shown in Figure 1 [15].

Figure 1. Hollow glass industries in the European Union.

European manufacturers of glass containers for food and beverages, and bottles for perfumery, cosmetics and pharmaceutical markets—members of the European Federation of Glass for Containers (FEVE)—produce 22 million tons, equivalent to over 80 billion containers per year. Their almost 150 production plants are located in 23 European countries. They generate 125,000 jobs across Europe of which 44,000 are direct jobs in the glass industry. For each direct job, 1.9 indirect jobs are created. Glass production generates about 6100 jobs per million tons of glass produced. The industry invests around 610 million euros each year to decarbonize its plants. The European hollow glass industry emits about 11 million tons of CO2 annually out of the total 2 billion tons declared with the European Emissions Trading System, representing 0.5% of all European CO2 emissions.

The glass production process begins with the preparation of the batch mixture, consisting of:

-

a mixture of virgin raw materials consisting of quarry minerals (silica sand, feldspar sand, dolomite, marble) and inorganic chemical synthesis products (soda Solvay, sodium sulfate);

-

glass cullet, partly from the plant’s quality control-rejected production (internal cullet), partly purchased from external suppliers, that acquire raw glass waste coming from the separate collection of municipal solid waste (which cannot be recycled directly in glass plants) and then the main contaminants are removed, such as fragments of ceramics, plastics, metals, lead glass, glass ceramics, etc., in dedicated treatment plants, thus producing a secondary raw material called “furnace ready” cullet.

For both the hollow and flat glass sectors, the so-called soda lime silicate glass is produced. Table 1 gives typical ranges for the various components of its chemical composition, expressed as constituent oxides. Knowing the yield factor, which is the ratio between the weight of the produced glass and the weight of the raw materials and cullet mixture, whose value is lower than 1 due to the release of CO2 from some raw materials (namely soda ash, limestone and dolomite) through the chemical reactions that take place in the melting phase, it is possible to obtain the precise composition for the particular cases [16].

Table 1. Range of the components of soda lime silicate glass, used for the production of hollow and flat glass (source: authors).

| SiO2 | Na2O | CaO | MgO | Al2O3 | K2O | |

|---|---|---|---|---|---|---|

| Weight percentage | 70.0–73.0% | 12.0–14.0% | 8.5–12.0% | 0.0–5.0% | 1.0–3.0% | 0.0–1.5% |

The compositions in terms of element weight percentages, limited to flat glass, are shown in Table 2.

Table 2. Magnitude of the proportions by mass of the constituents of soda-lime silicate flat glass [17]; the complement to 100% is Oxygen.

| Silicon (Si) | Calcium (Ca) | Sodium (Na) | Magnesium (Mg) | Aluminum (Al) | Others | |

|---|---|---|---|---|---|---|

| Constituents | 32–35% | 3.5–10.1% | 7.4–11.9% | 0.0–3.7% | 0.0–1.6% | <5.0% |

The mixture of minerals and cullet is called “batch” and is prepared on-site in large mixers. It is distinguished between “raw batch”, meaning the mixture of only virgin raw materials, and “mixed batch” when it also includes cullet. The batch can be humidified with water or caustic soda to reduce particle segregation during transport via conveyor belts from the mixer to the furnace. The batch preparation is an all-electric phase that consumes about 4 percent of the total energy required by the plant [18]. In the melting phase, the batch is fed into the so-called melting tank. There, temperatures over 1500 °C are reached by burning fuel and using electric boosting via electrodes submerged in the melt. After the mixture is melted and homogenized, the refining phase takes place (elimination of the gas bubbles trapped inside the melt). The final molten glass comes out of the furnace at a temperature of around 1350 °C from a submerged duct called the “throat”, which connects the melting basin with the “working-end” (or forehearth).

The working end has the task of pre-conditioning the glass before it enters the channels: the molten glass is cooled gradually and homogeneously to achieve the correct working viscosity. To ensure an optimal gradient, the glass temperature is detected with special immersion probes, connected to the automatic regulation system, and several small burners are installed along the walls of the forehearth; submerged electrodes are sometimes also used for heating purposes. Like the working end, channels and feeders are also equipped with burners for heating and air-cooling systems (chimneys with adjustable dampers, fans for forced cooling, etc.) for cooling. In the terminal part of the channels, the system responsible for the formation of the glass gobs is installed, and suspended from above. It consists of a pair of concentric cylindrical components called the tube and plunger, made in refractory material, immersed in the glass bath: the tube is a rotating cylinder driven by an electric motor, which mechanically stirs the molten glass near the outlet orifice (called the spout), making the temperature profile homogeneous; the plungers are refractory punches (one per spout) pushing/extruding the vitreous mass through one or more spouts at the base of the channel. Below the spout, the glass gob is cut by mechanically driven metal shears. The forming process can be blow–blow or press–blow. Currently, the most commonly used automatic forming machines are of the IS type (with independent “individual sections”). The manufacturing process for a single section and each gob in the blow–blow case can be outlined as follows:

-

The gob is cut from the shears and falls into the gob distributor, the lubro-refrigerated system that directs the drops to almost zero friction towards the various sections of the forming machine;

-

The drop falls by gravity to the bottom of the mold;

-

During settling time, the container mouth/finish is formed;

-

A punch opens a first small cavity inside the mouth, then retracts, and compressed air is blown inside, thus forming the blank by blowing;

-

The blank mold opens and the blank is transferred by overturning to the finishing mold;

-

The finishing mold closes, the blank undergoes temperature homogenization and the blowing head is positioned;

-

The blank is blown with compressed air until the final shape is obtained;

-

The mold opens and the container is placed by push-outs onto the exit conveyor.

The blank and the finishing mold are cooled with forced air from a dedicated fan system. To prevent the glass from sticking to the molds, the molds are generally lubricated using an oxyacetylene flame in oxygen defect, which develops carbon black on the contact surface; if necessary, the molds can also be manually lubricated with graphite oil using specific swabbing tools.

Subsequently, the containers undergo a hot-end treatment, annealing and a cold-end treatment: the still red, hot hollow glass products formed by the IS machines pass first through the hot treatment hood. Here, they are invested by a spray of SnCl4 or mono-butyl-tin–tri-chloride, to cover the outer surfaces with a thin film of SnO clusters. It acts as a “primer of adhesion” for the protective anti-friction treatment (cold treatment), deposited later. The hot-end-treated products are then fed by a cross-conveyor inside the annealing tunnel (or lehr), where they are kept for an appropriate period at a temperature regime sufficient to relax the thermal stresses generated by the inhomogeneous and sudden cooling imparted by the molds. Then, they are allowed to cool in a controlled manner up to about 100 °C, the temperature at which they exit the tunnel. The annealing furnace is divided into zones, each one characterized by a specific temperature. The section with the highest temperature is located at the entrance. The annealing furnace is heated by natural gas combustion. Depending on the furnace, the burners are blown air or venturi type. The oxidizing air is taken directly from the working environment. The combustion gases leaving the annealing furnace are dispersed in the environment.

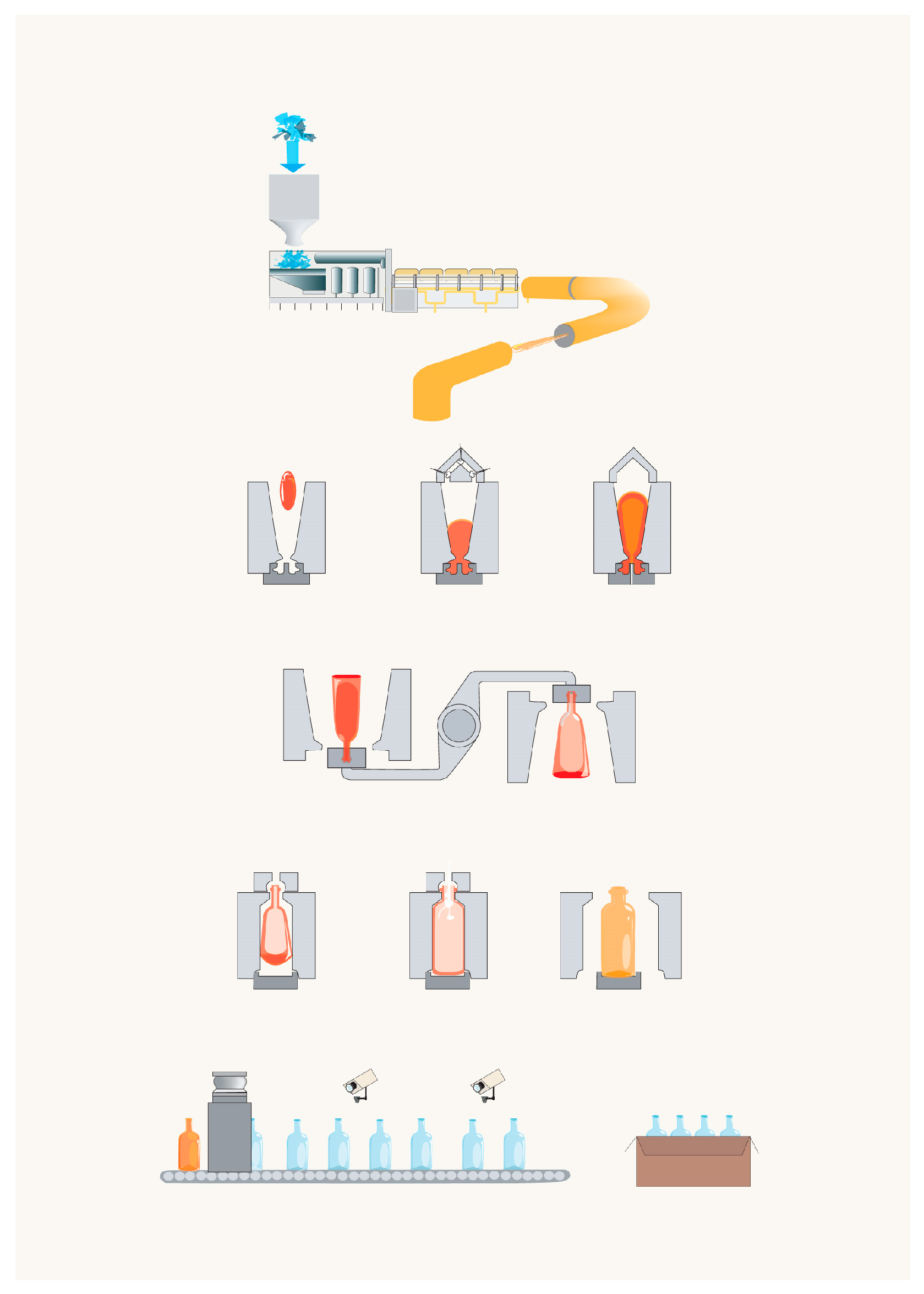

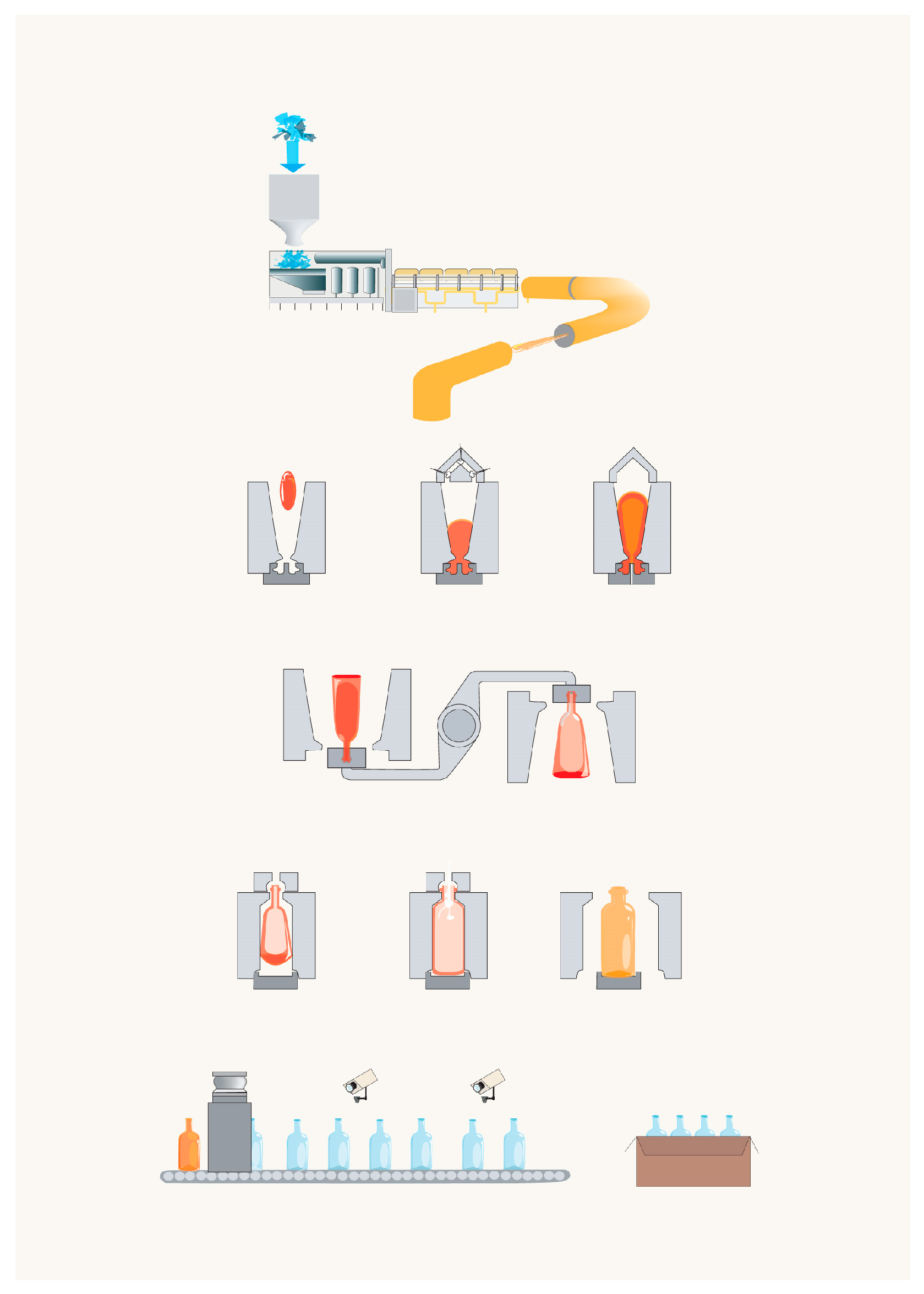

Downstream of the annealing lehr exit, auxiliary cooling fans are installed. Then, the external surfaces of the products are sprayed with an aqueous dispersion of an organic compound (usually polyethylene derivatives), called cold end treatment It clings to the clusters of SnO deposited by the hot treatment and forms an anti-friction film; it has the function of reducing the friction between the products (or with foreign surfaces) in the subsequent stages of the life of the container, with the ultimate aim of preserving the surfaces as much as possible from scratches and cracks, which would impair their mechanical strength. When the product is cold, an accurate automatic in-line quality control is carried out to verify the conformity of the container to the product specifications. The containers not considered suitable are eliminated from the line and consequently recycled in the same production process, to be re-molten as internal cullet. In the end, products are packaged and stored. The process is schematized in Figure 2.

Figure 2. Container glass process.

According to data extracted from energy diagnosis by ENEA [19], the process energy consumption is divided as follows:

-

Preparation of the batch mixture: <5%.

-

Melting: >60%.

-

Fabrication (working end, conditioning channels, forming, hot end treatment, annealing and cold end treatment): >10%.

-

Final phases: <5%

-

Auxiliary services (compressors, fans, pumps, chillers, pollution control system, etc.): >10%

-

General services (lighting, winter heating, summer cooling, etc.) <5%.

It is evident how, in order to decarbonize the process, it is necessary to focus on the melting phase, more precisely on the melting furnace.

2.2. The Flat Glass Sector

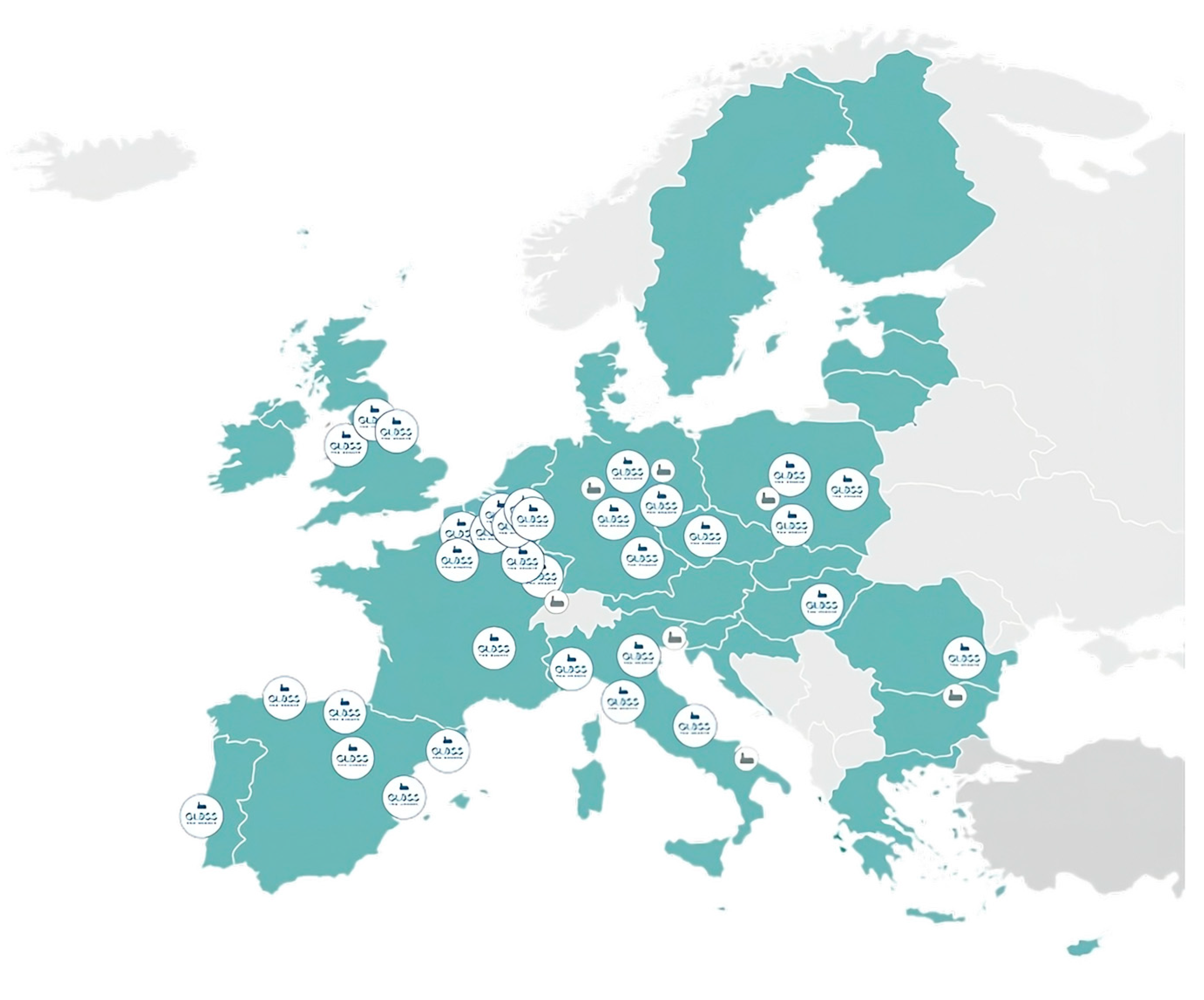

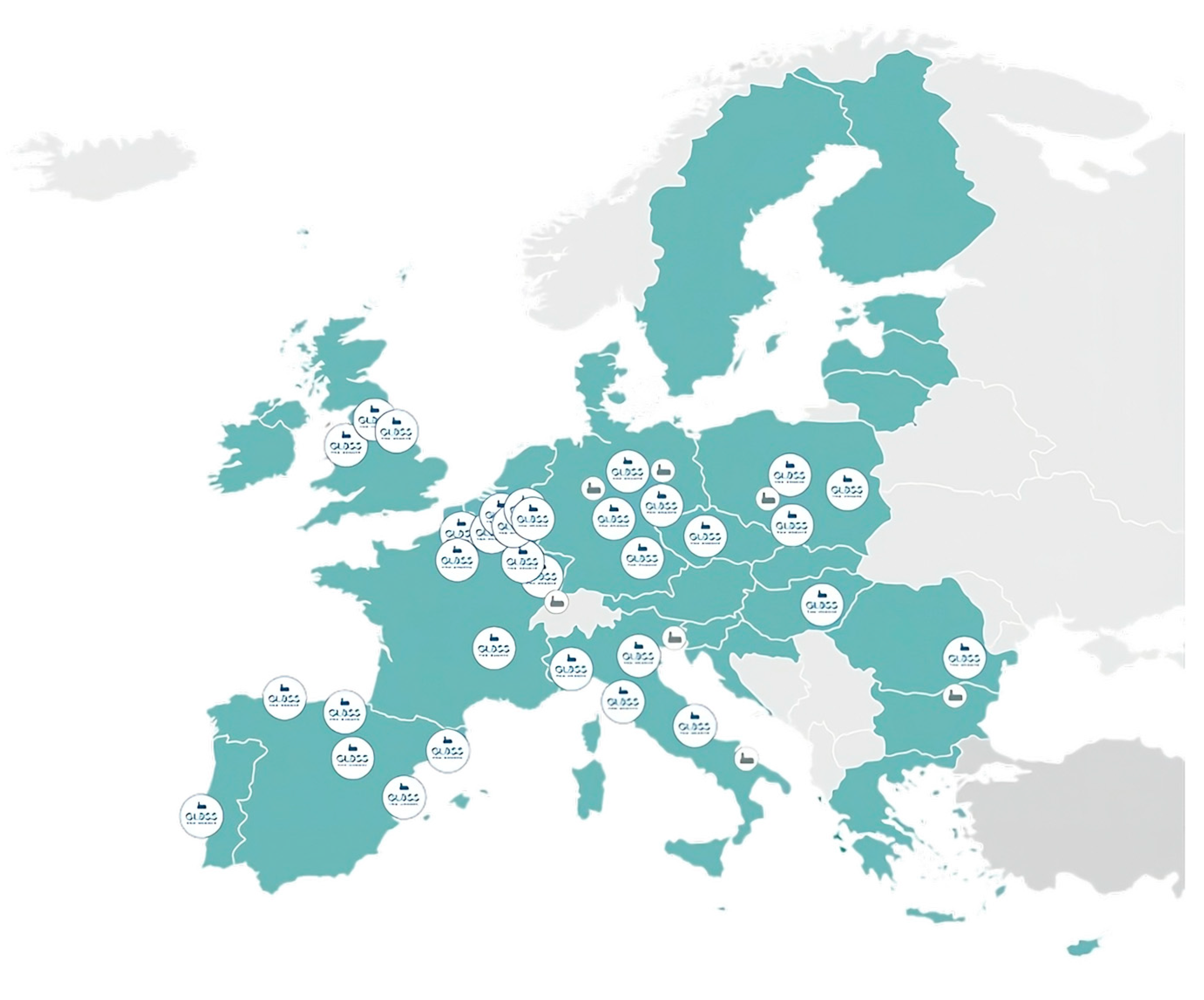

The flat glass sector is also a primary business-to-business industry. The products are basic glass sheets, that most of the time are transformed into final products through downstream processes: for example, they may be thermally toughened, laminated, or assembled with other products. Flat glass is mainly used in the construction and automotive sectors. Similarly, to the container glass sector, flat glass production is a capital-intensive activity; the same reasoning is valid both for the presence on the market exclusively of large companies with large capital availability and for the long investment cycle. Flat glass furnaces can last up to 20 years; after this period, a partial or complete reconstruction of the structure is required. A simple furnace reconstruction costs EUR 30–50 million, the entire float line with 500 tons per day of production costs EUR 100–150 million. The production sites produce on average between 400 and 700 tons of glass per day. Flat glass also has high transport costs; therefore, it should be processed and sold in the proximity of the production plant. In the European Union, the flat glass sector is the second largest sector in glass production. Currently, about six major companies with over 60 production sites, almost all associated with the Italian Federation Glass for Europe (Figure 3), produce about 10 million tons of flat glass each year. If, in addition to flat glass production plants, processing plants are also considered, the number of companies involved increases to more than 1000, for an equivalent of 100,000 direct employees and over 500,000 indirect employees. Over EUR 100 million are invested in the research and development field of this sector [23]. Glass Alliance Europe declared 11 million tons for the basic flat glass sector in 2022, produced in Europe27 + the United Kingdom [12].

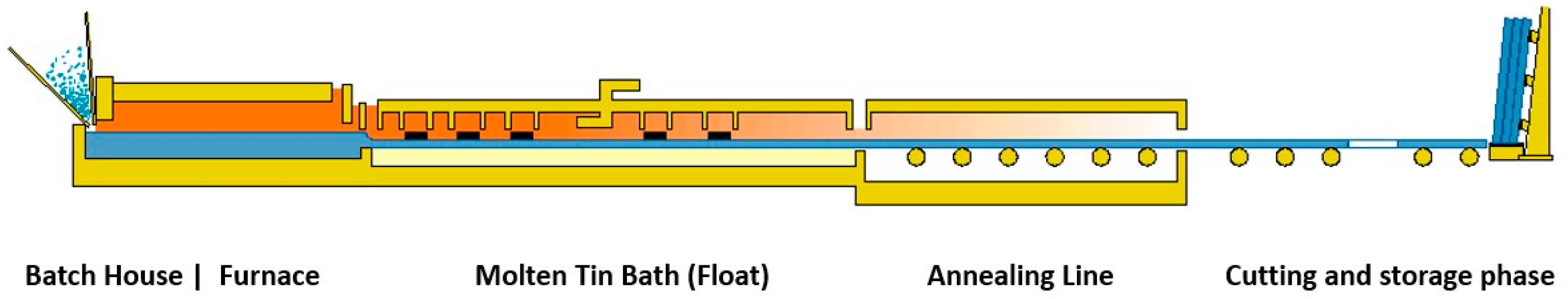

Figure 3. Flat glass industries in the European Union.

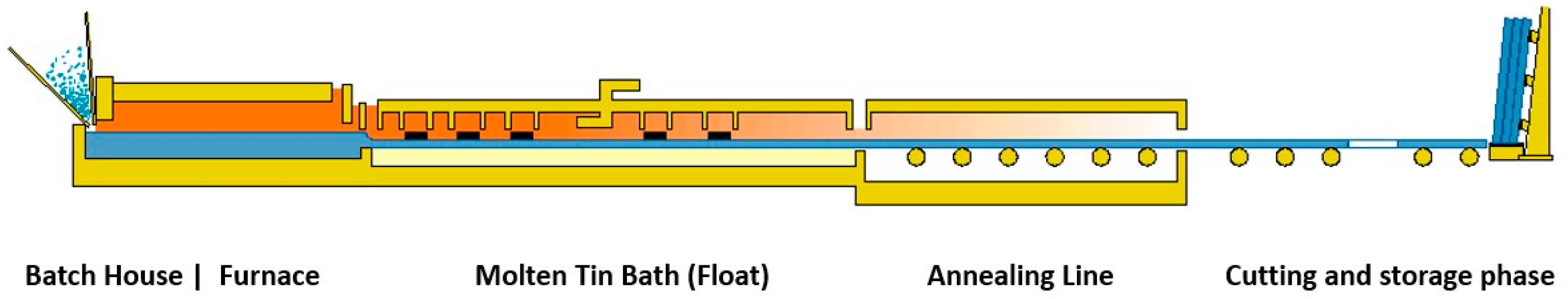

Flat glass is made using the so-called “float process”, invented by Sir. A. Pilkington in the 1950s. After the raw materials are melted in furnaces conceptually similar to those of the container glass sector but typically larger in size and production capability, the melt is poured by a specially designed “lip” onto a molten tin bath, above which it “floats” (having a lower density). It forms a perfectly flat and “polished” ribbon with plane parallel faces and minimum surface defects or textures (mirror-like appearance). The use of molten tin is motivated by the fact that it is the only viable material liquid at a temperature range centered around 600 °C. The tin bath is surrounded by an atmosphere of nitrogen and hydrogen to prevent oxidation of the bath itself. The floating molten glass is distributed on the tin bath by suitable rollers that mechanically pull the glass to ensure that the output glass ribbon achieves the desired thickness and width. Float glass can be made between 3 and 19 mm thick. The glass then enters the annealing phase, which consists of heating and cooling the glass in a controlled manner within a tunnel heated by radiating electrical elements (no burners), to remove the residual stresses that could impair mechanical properties in service life. The glass is cut to the desired sizes at the end of the annealing process. Relative to the energy consumption of the flat glass production process, experts say that the melting phase involves about 80–90% of the total consumption of the production process. Similarly to the hollow glass production, in order to decarbonize the process, it is thus necessary to focus on the melting furnace. The process is showed in Figure 4.

Figure 4. Flat glass process.

2.3. Industrial Production

The global recession of 2008 and the COVID-19 emergency influenced the production volumes of all glass sectors.

Hollow glass is the most important of the eight sectors reported, in terms of production. In 1996, in the European Union (15 Member States), container glass accounted for 60% of total production, followed by the flat glass sector with 22%. Surveys dating back to 2005 on European Union25 confirmed the trend, with values of 53% (20 million tons) and 24.8% (9.37 million tons), respectively. Among the remaining glass sectors, the mineral wool sector is the next most important in terms of production volume [7].

Glass Alliance Europe has reported an updated overview of European production over the years for the various sectors annually. As already reported in the previous paragraph, in 2022, Glass Alliance EU declared for Europe27 + the United Kingdom 11 million tons of production for the flat glass production sector (not accounting for secondary transformation into products such as laminated glass, windows, etc.) and 24.50 million tons for the container sector in 2022 [12].

Regarding Italian production, relying on ISTAT’s data, for 2020, 5.34 million tons of molten glass were produced, equivalent to 15.4% of the European production. The Italian supply chain consists of 32 large production companies, 60 factories and over 300 flat glass secondary processing companies, generating about EUR 6 billion in turnover [24].

According to ISTAT data reported in Assovetro’s annual reports, the trend of Italian production is reported in Table 3:

| Years | ||||||||

|---|---|---|---|---|---|---|---|---|

| 2014 | 2015 | 2016 | 2017 | 2018 | 2019 | 2020 | 2021 | |

| Hollow glass production (ton) | 3,626,376 | 3,936,885 | 4,061,931 | 4,177,711 | 4,287,283 | 4,485,190 | 4,429,110 | 4,702,984 |

| Flat glass production (ton) | 793,211 | 838,019 | 887,125 | 870,440 | 1,054,763 | 1,034,244 | 965,859 | 1,190,251 |

References

- Un Green Deal Europeo. Available online: https://commission.europa.eu/strategy-and-policy/priorities-2019-2024/european-green-deal_it (accessed on 11 June 2023).

- European Climate Law. Available online: https://climate.ec.europa.eu/eu-action/european-green-deal/european-climate-law_en (accessed on 25 October 2022).

- Emission Trading Europeo. Available online: https://www.isprambiente.gov.it/it/servizi/registro-italiano-emission-trading/contesto/emission-trading-europeo (accessed on 11 June 2023).

- Carbon Border Adjustment Mechanism. Available online: https://taxation-customs.ec.europa.eu/carbon-border-adjustment-mechanism_en (accessed on 11 June 2023).

- Accordo di Parigi. Available online: https://climate.ec.europa.eu/eu-action/international-action-climate-change/climate-negotiations/paris-agreement_it (accessed on 21 September 2022).

- National Long-Term Strategies. Available online: https://commission.europa.eu/energy-climate-change-environment/implementation-eu-countries/energy-and-climate-governance-and-reporting/national-long-term-strategies_en (accessed on 11 June 2023).

- European Commission, Joint Research Centre, Institute for Prospective Technological Studies. Best Available Techniques (BAT) Reference Document for the Manufacture of Glass: Industrial Emissions Directive 2010/75/EU: Integrated Pollution Prevention and Control; Publications Office: Luxembourg, 2013.

- Griffin, P.W.; Hammond, G.P.; McKenna, R.C. Industrial Energy Use and Decarbonisation in the Glass Sector: A UK Perspective. Adv. Appl. Energy 2021, 3, 100037.

- International Energy Agency. Tracking Industrial Energy Efficiency and CO2 Emissions; OECD: Paris, France, 2007; ISBN 978-92-64-03016-9.

- Sengupta, P. Refractories for Glass Manufacturing. In Refractories for the Chemical Industries; Springer International Publishing: Berlin/Heidelberg, Germany, 2020.

- Cattaneo, E. LIFE SUGAR PROJECT—The Idea of Total Recovery Glass Furnace. Hydrogen in Glass Making. 15 June 2021. Available online: https://www.glass-international.com/hydrogen-in-glass-manufacturing/view-the-presentations (accessed on 8 January 2022).

- Assovetro. Relazione Annuale Assovetro 2023; Assovetro: Rome, Italy, 2023.

- Ojovan, M.I.; Yudintsev, S.V. Glass, Ceramic, and Glass-Crystalline Matrices for HLW Immobilisation. Open Ceram. 2023, 14, 100355.

- Siddika, A.; Hajimohammadi, A.; Mamun, M.A.A.; Alyousef, R.; Ferdous, W. Waste Glass in Cement and Geopolymer Concretes: A Review on Durability and Challenges. Polymers 2021, 13, 2071.

- FEVE Plants. Available online: https://feve.org/feve-plants/ (accessed on 8 January 2022).

- Ceola Introductory Training Course for Glass Producers—SSV—1° Day. Venice. Available online: https://www.spevetro.it/corsi-formazione/ (accessed on 24 November 2021).

- CEN/TC 129; EN 572 Glass in Building—Basic Soda-Lime Silicate Glass Products. Glass for Europe: Brussels, Belgium, 2012.

- Pellegrino, J.; Greenman, M.; Ross, C.P. Energy and Environmental Profile of the U.S. Glass Industry; Office of Industrial Technologies Energy Efficiency and Renewable Energy, U.S Department of Energy: Washington, DC, USA, 2002.

- ENEA. Quaderni Dell’efficienza Energetica—VETRO; Martini, C., Martini, F., Salvio, M., Toro, C., Eds.; ENEA: Rome, Italy, 2021; p. 170. ISBN 978-88-8286-413-2.

- Hubert, M. IMI-NFG Course on Processing in Glass: Lecture 3: Basics of Industrial Glass Melting Furnaces; Celsian Glass & Solar: Eindhoven, The Netherland, 2015.

- Shelby, J.E. Introduction to Glass Science and Technology; Royal Society of Chemistry: London, UK, 2005; ISBN 978-0-85404-639-3.

- Beerkens, R.G.; van der Schaaf, J. Gas Release and Foam Formation During Melting and Fining of Glass. J. Am. Ceram. Soc. 2006, 89, 24–35.

- Key Data—Flat Glass Market. Glass Eur. Available online: https://glassforeurope.com/the-sector/key-data/ (accessed on 10 June 2023).

- Assovetro. L’industria Del Vetro in Italia—Sfide Ed Opportunità per Un Materiale al Centro Della Transizione Ecologica; Assovetro: Rome, Italy, 2021.

- Assovetro. Relazione Annuale Assovetro 2014; Assovetro: Rome, Italy, 2014.

- Assovetro. Relazione Annuale Assovetro 2015; Assovetro: Rome, Italy, 2015.

- Assovetro. Relazione Annuale Assovetro 2016; Assovetro: Rome, Italy, 2016.

- Assovetro. Relazione Annuale Assovetro 2017; Assovetro: Rome, Italy, 2017.

- Assovetro. Relazione Annuale Assovetro 2018; Assovetro: Rome, Italy, 2018.

- Assovetro. Relazione Annuale Assovetro 2019; Assovetro: Rome, Italy, 2019.

- Assovetro. Relazione Annuale Assovetro 2020; Assovetro: Rome, Italy, 2020.

- Assovetro. Relazione Annuale Assovetro 2021; Assovetro: Rome, Italy, 2021.

- Assovetro. Relazione Annuale Assovetro 2022; Assovetro: Rome, Italy, 2022.

More

Information

Subjects:

Engineering, Industrial

Contributors

MDPI registered users' name will be linked to their SciProfiles pages. To register with us, please refer to https://encyclopedia.pub/register

:

View Times:

2.3K

Revisions:

2 times

(View History)

Update Date:

20 Dec 2023

Notice

You are not a member of the advisory board for this topic. If you want to update advisory board member profile, please contact office@encyclopedia.pub.

OK

Confirm

Only members of the Encyclopedia advisory board for this topic are allowed to note entries. Would you like to become an advisory board member of the Encyclopedia?

Yes

No

${ textCharacter }/${ maxCharacter }

Submit

Cancel

Back

Comments

${ item }

|

More

No more~

There is no comment~

${ textCharacter }/${ maxCharacter }

Submit

Cancel

${ selectedItem.replyTextCharacter }/${ selectedItem.replyMaxCharacter }

Submit

Cancel

Confirm

Are you sure to Delete?

Yes

No