Your browser does not fully support modern features. Please upgrade for a smoother experience.

Submitted Successfully!

Thank you for your contribution! You can also upload a video entry or images related to this topic.

For video creation, please contact our Academic Video Service.

| Version | Summary | Created by | Modification | Content Size | Created at | Operation |

|---|---|---|---|---|---|---|

| 1 | Valentin Marian Antohi | -- | 3422 | 2023-12-12 07:54:14 | | | |

| 2 | Camila Xu | Meta information modification | 3422 | 2023-12-12 08:47:19 | | |

Video Upload Options

We provide professional Academic Video Service to translate complex research into visually appealing presentations. Would you like to try it?

Cite

If you have any further questions, please contact Encyclopedia Editorial Office.

Ionescu, R.V.; Fortea, C.; Zlati, M.L.; Antohi, V.M. Various Monetary Aggregates Impact on the Real Economy. Encyclopedia. Available online: https://encyclopedia.pub/entry/52603 (accessed on 08 February 2026).

Ionescu RV, Fortea C, Zlati ML, Antohi VM. Various Monetary Aggregates Impact on the Real Economy. Encyclopedia. Available at: https://encyclopedia.pub/entry/52603. Accessed February 08, 2026.

Ionescu, Romeo Victor, Costinela Fortea, Monica Laura Zlati, Valentin Marian Antohi. "Various Monetary Aggregates Impact on the Real Economy" Encyclopedia, https://encyclopedia.pub/entry/52603 (accessed February 08, 2026).

Ionescu, R.V., Fortea, C., Zlati, M.L., & Antohi, V.M. (2023, December 12). Various Monetary Aggregates Impact on the Real Economy. In Encyclopedia. https://encyclopedia.pub/entry/52603

Ionescu, Romeo Victor, et al. "Various Monetary Aggregates Impact on the Real Economy." Encyclopedia. Web. 12 December, 2023.

Copy Citation

Monetary policy elements in Romania were adjusted on the basis of volatility indicators for the annual inflation rate, which for August 2022 increased by 0.3% from the previous month’s level (from 13% to 13.3%). On the other hand, the influence of rising inflation through the consumer index and trade shocks was felt at the European level in the euro area, with the inflation rate reaching 10% in September 2022.

monetary policy

monetary dynamic structured model

inflation

1. Introduction

The current financial context at the European level is one influenced by inflation and a higher need for financing based on the rising cost of living, induced by the vulnerabilities of multiple crises triggered by pandemics and geopolitical conflict.

On 8 July 2021, the European Central Bank (ECB) published its new monetary policy strategy with the primary objective of maintaining price stability in the euro area (European Central Bank Strategy 2023). The ECB’s previous strategies have focused on closing the gaps in the effects on inflation and price stability at the European level.

Structural developments in the euro area between 2003 and 2021 have resulted in a reduction in the equilibrium interest rate and economic growth driven by demographic dynamics and an increased demand for liquid assets.

On top of these ambitious targets, the effects of uncertainties during the economic crisis (2008–2012) have manifested themselves, posing real challenges to monetary policy objectives and the maintenance of conventional policies in the face of inflationary shocks. Fluctuating inflation margins in times of crisis have demonstrated the need to implement additional policy instruments.

Another significant moment in the euro area was marked by the sovereign debt crisis of Greece (Bank of Greece Monetary Policy 2023) and Spain (Banco de Espana Monetary Policy 2023), which triggered the need for assistance to maintain the stability of these countries and implement monetary policy measures. Another destabilizing event was the outbreak of the COVID-19 pandemic in Europe, when the European community faced economic slowdown and rising unemployment.

In this extremely challenging financial equation, globalization and digitalization, which have changed the traditional structure of European economies and labor markets, can be mentioned as disruptive factors. Included in the picture of challenges are reforms to support changes in the institutional architecture of the euro area, which has undergone significant transformations and changes during this period.

Romania joined the EU in 2007 and is currently a point of vulnerability as the significant economic progress it has made in the post-accession period has not led to institutional integration into the European architecture, with Romania and Bulgaria still sticking to their national currencies and failing to switch to the euro as other countries such as Croatia, which joined in 2013, have managed to (European Commision Economy and Finance 2023).

2. Studying Differing Impacts of Various Monetary Aggregates on the Real Economy

In the literature, monetary policies are a topic of real interest, both because of their direct relationship with monetary policy indicators and because of their influence on the financial economies of countries with implications for economic entities.

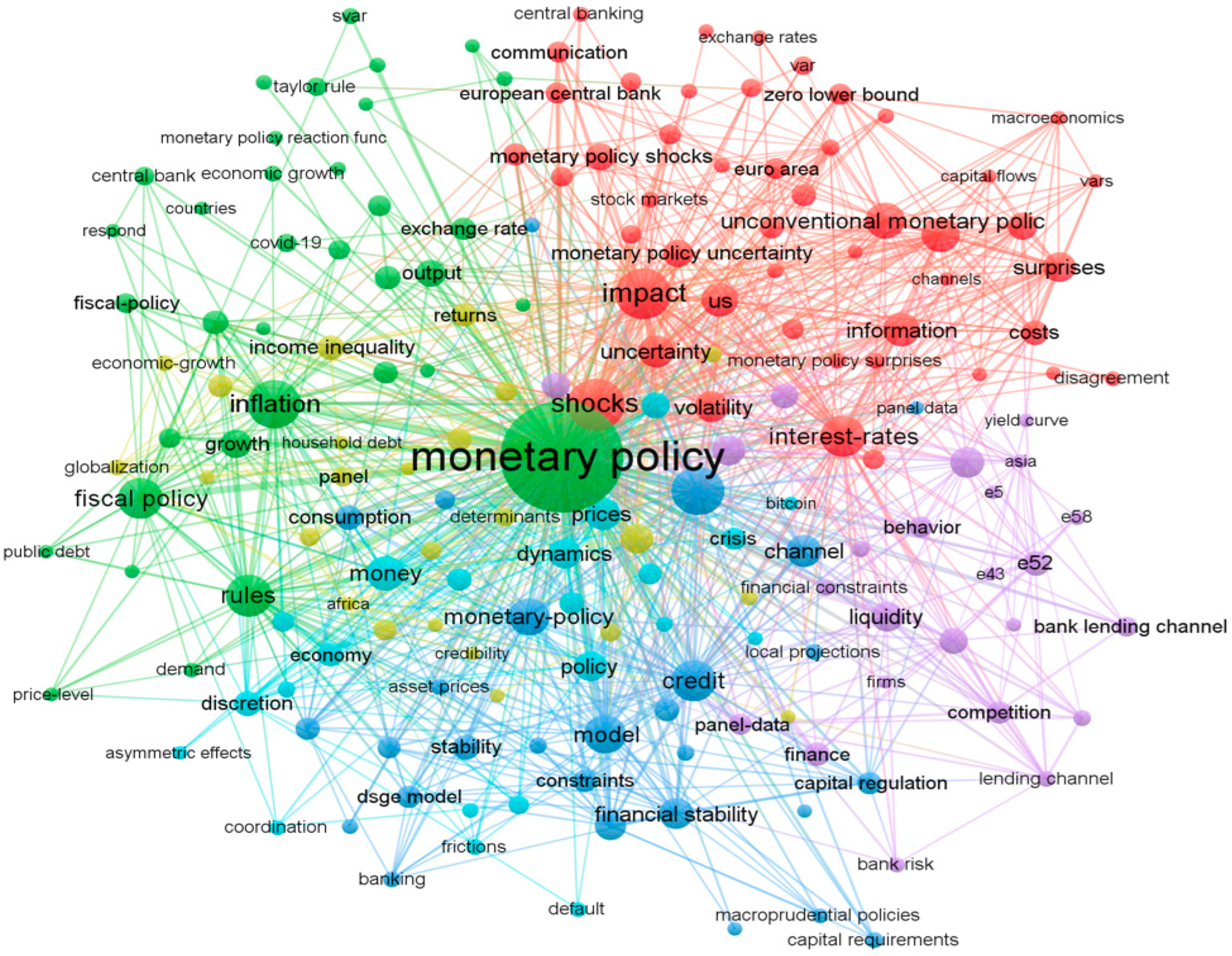

From the analysis of Web of Science publications, researchers observed that of the 6988 articles published in the period 2020–2022 (Figure 1), citations were found at the level of 2.71 papers per article with a corresponding Hirsch index of 43 points, which shows the interest of researchers in financial markets under the impact of risk factors and monetary policies, the role of information shocks in the economy, the impact of monetary policies in pandemics on share prices, the role of central banks, the impact of financial development on some elements of macroeconomic policy, global effects of uncertainty-induced pandemics, monetary policy under the impact of uncertainty, etc. The bibliometrics analysis data were extracted from the Web of Science platform and then integrated and processed in VOSviewer.

Figure 1. Bibliometric analysis of monetary policy. Source: Created by the authors using VOSviewer software 1.6.18.

The paradigm of this discussion is the direction of causality in the monetary aggregates. Is money endogenous or is it exogenous to the overall system? This debate has been a topic of discussion among economists for many years. One point of view argues that money is endogenous, meaning that its supply is determined by the demand for credit and the actions of banks. According to this view, changes in the overall system, such as changes in interest rates or economic conditions, will ultimately impact the money supply.

A second point of view argues that money is controlled by the central bank and is thus exogenous to the system. As a result, changes in the money supply are a deliberate policy tool used by central banks to influence the economy. The direction of causality in monetary aggregates remains a complex and ongoing area of research in economics.

Some of the greatest economists of the world were focused on this issue. Friedman (1990), for example, pointed out that the scholarly discourse surrounding the aims and instruments employed in monetary policy is intrinsically intertwined with the dichotomy between activist and nonresponsive approaches. Nonresponsiveness is a straightforward strategy that entails dealing with particular problems or making the necessary adjustments, whereas activism entails acting in response to the initial conditions or signs of disruptions while following various feedback rules. However, it is worth noting that the nonresponsive rules that have garnered significant attention in the past primarily pertain to endogenous variables such as money rather than exogenous variables that can be directly controlled by the central bank (e.g., nonborrowed reserves). Consequently, the fundamental inquiry revolves around determining the categories of phenomena that warrant a response and those that do not, rather than debating whether or not to respond altogether. The restricted relevance of activist critique policy, which argues that deviating from the no-response or base position generally leads to uncertainty, points out a significant lack of knowledge; such uncertainty may even escalate and result in an increase in the variability of the policy objective rather than its reduction.

A.W. Phillips (1958) analyzed the relationship between inflation and unemployment in an economy. Phillips suggests that there is an inverse relationship between the two variables: when unemployment is low, inflation tends to be high, and vice versa. This concept has been widely debated and studied by economists, as it helps in understanding the dynamics of an economy and formulating monetary policies. According to the author, in situations where demand exceeds supply, the price of a product or service increases, with the increase being proportional to the excess demand. Conversely, when demand is lower than supply, the price decreases, with the decline being more significant when there is a higher disparity between demand and supply. This principle could influence the rate at which money wage rates, representing labor services’ prices, change over time. In periods of high labor demand and low unemployment, wage rates may increase rapidly as companies attract qualified labor from other firms and industries. However, during periods of low labor demand and high unemployment, wages may decline gradually. The correlation between unemployment and pay rate change is expected to be non-linear, with a potential correlation between the rate of change in money wage rates and the rate of change in labor demand, which affects unemployment levels. In a period of increased economic activity with rising labor demand and declining unemployment, employers engage in more competitive bidding for labor services. Conversely, in a year with a decline in business activity and decreased labor demand, employers are less willing to provide wage increases, leaving workers in a disadvantageous position to negotiate for wage increases. The rate of change of retail prices also influences the rate of change of money wage rates, as cost of living adjustments in wage rates can exert a minimal or negligible influence on the rate of change in money pay rates.

In a piece of interesting research, Laidler (2023) considered that contemporary macroeconomics assumes a perpetual equilibrium when analyzing the economy, but two theoretical frameworks, monetarism and the Wicksell connections (Wicksell 1907), argue that information acquisition and coordination by economic agents should be primary concerns. The first approach addresses concerns related to monetary exchange, while the second focuses on inter-temporal issues. Both approaches, particularly within the framework of the dynamic stochastic general equilibrium (DSGE), Schumpeter and Keynes (1936) analysis, consider the coordination of activities among individual economic agents as a fundamental issue for any economy and economists analyzing it. Both approaches also see monetary exchange and financial markets as essential components in adaptation and resilience. The Wicksell connection, on the other hand, emphasizes the challenges associated with coordinating economic activity over time. The existing divide between the two traditions has not been resolved, but it is narrower compared to the significant disparity between them and the mainstream DSGE. The mainstream approach assumes that coordination issues are resolved via assumption before conducting in-depth analysis.

John B. Taylor’s 1993 proposition (Taylor 1993) outlined US monetary policy as an interest rate feedback rule, where the Federal Reserve adjusts the nominal interest rate in response to inflation and output deviations. The central bank aims to achieve economic stability and maintain manageable inflation levels. According to Woodford (2001), Taylor’s proposal has significantly influenced monetary policy discourse. The question is whether or not this rule can establish an equilibrium price level without a target route for monetary aggregates. Critics argue that interest rate rules can lead to the indeterminacy of the equilibrium price level under rational expectations, but this is dependent on the presence of an external trajectory for the short-term nominal interest rate. Determinacy can be achieved through feedback from an endogenous state variable, such as the price level. Many basic optimization models suggest that the Taylor rule includes determinacy feedback, as the operating goal for the funds rate relies on recent inflation and output gap indicators.

From Cagan’s point of view (Cagan and Gandolfi 1969), the time lag between the implementation of monetary policies and their impact on output and employment is a contentious issue in monetary policy. According to the authors, classical research suggests a time delay of two to six quarters or more, with some arguing for a reduced duration due to potential revenue fluctuations. In the context of the money supply, the conduct of monetary policy is entirely encapsulated by the dynamics of the money supply, and the potential time delay between policy measures and their impact is disregarded. One enduring premise in monetary theory is that an expansion in the money supply leads to a decrease in interest rates. This phenomenon may be attributed to the unintended consequences of the growth of the financial system. This effect signifies the functional relationship between money demand and interest rates. The impact of a monetary adjustment on interest rates is transitory and does not endure in the long term. Greater balances and lower interest rates stimulate increased expenditure on consumer and producer capital goods, which in turn leads to an increase in income and counteracts the initial impact of the monetary increase on interest rates. According to the authors, in full employment scenarios, an increase in prices results in a decrease in the actual worth of money balances, raising interest rates. If growth begins with underutilized labor resources, a portion of the rise in income will manifest as an increase in purchasing power, adjusted for inflation. An increase in either nominal or real income generally results in an upward movement in interest rates, although the magnitude of this effect may differ.

An interesting scientific approach realized by Bassetto and Sargent (2020) examines the interplay between monetary and fiscal policies and their impact on equilibrium price levels and interest rates. It critically assesses various theories pertaining to optimal anticipated inflation, optimal unanticipated inflation, and the conditions necessary to establish a nominal anchor, ensuring a singular path for price levels. The former relies on budget-viable sequences of government-issued bonds and money as inputs, while the latter utilizes bond and money strategies expressed as sequences of functions that map time t history into time t government actions. According to the authors’ theoretical perspective, the delineation of power dynamics between a treasury and a central bank can be characterized by ambiguity, opacity, and vulnerability.

Larry Summers (1991) argued that in order to achieve long-term price stability, monetary policy should be based on a flexible inflation target. He emphasized the importance of allowing some level of inflation, as a very low inflation rate can lead to deflationary pressures and hinder economic growth. Summers also highlighted the need for central banks to have independence in setting monetary policy, free from political interference, in order to effectively maintain price stability. Additionally, he proposed the use of forward guidance and communication strategies to enhance transparency and credibility in monetary policy decisions.

Another study (Tobias et al. 2019) examines the impact of relaxed financial conditions on output and fluctuations in output for up to six quarters, resulting in variable levels of risk to the output gap. The effectiveness of monetary policy is dependent on the extent of negative economic consequences on GDP, as it influences individuals’ choices between consumption and savings through the Euler constraint and the state of financial circumstances through the value-at-risk (VaR) constraint. The optimal monetary policy rule demonstrates a notable sensitivity to changes in financial conditions for most nations in the sample. The inclusion of financial circumstances in welfare analysis yields substantial advantages. There has been ongoing debate among economists and policymakers on the extent to which financial factors should be incorporated into monetary policy guidelines. The study proposes that monetary policy makers should not only focus on the conditional mean forecasts of inflation and production but also consider the potential negative outcomes associated with these variables. The empirical evidence shows a substantial relationship between financial conditions and both the conditional mean and conditional volatility of the output gap. As financial conditions worsen, the conditional mean of the output gap decreases while the conditional volatility increases. This leads to a significantly negative unconditional distribution of GDP. These findings are commonly observed in both developed and developing economies. The study fits the real-life connection between money problems and the changing points in the output gap distribution to a simplified version of a New Keynesian model that takes into account the fragility of money. The determination of an intertemporally optimal monetary policy rule reveals that alongside the output gap and inflation, monetary policy should consider financial fragility as a conditioning factor. The benefits derived from this action exhibit substantial welfare gains. The findings indicate that there may be a need to reconsider the policy framework concerning the interplay between monetary policy and financial stability. It is evident that the consideration of financial conditions should be incorporated into monetary policy, even when macroprudential regulation is deemed suitable for addressing significant financial imbalances.

A recent study (Durante et al. 2022) shows that firms’ investment response to monetary policy shocks is heterogeneous along dimensions corresponding to the two monetary policy transmission channels. Thus, young firms are more sensitive to monetary policy shocks and high leverage amplifies these effects, motivating the use of commercial credit as an instrument of monetary policy. Second, the authors show that there is cross-sectional heterogeneity at the industry level, so that firms producing durable goods are sensitive to traditional monetary policy interest rate effects and react more strongly to monetary policy shocks in times of crisis when the consumption of durable goods falls.

Regarding shocks and their responses to monetary policy, the authors (Ocampo and Ojeda-Joya 2022) show that monetary policy in emerging economies is pro-cyclical, especially when it comes to financial openness and exchange rate policy. This stops monetary policy responses that are less pro-cyclical that are caused by a trade-off between exchange rates and income volatility. In this sense, another author (Li 2022) shows that monetary policy is more effective when financial intermediaries have a higher share of equity in total assets. The marginal effect of a monetary policy shock is larger when the leverage ratio is adjusted by one standard deviation below the mean, which is studied in Standard and Poor’s (S&P 500) yields via the impulse responses of real variables to a given monetary policy shock. The authors show that intermediate financial leverage is countercyclical, which is the cause of less effective monetary policy during recessions.

Another researcher (Ahiadorme 2022) examines the role of monetary policy vis à vis inclusive growth, showing that in the short run, low inflation and sustainable economic growth are associated with reduced household income disparities and increased social welfare and inclusion. The effects are maintained over the long term through monetary policies aimed at low inflation and sustainable economic growth. However, in advanced economies, disinflation damages social equity and generates higher unemployment costs, affecting inclusion. Thus, according to the authors, macroeconomic stability through monetary policies should aim at inclusive growth.

Other approaches (Davidescu et al. 2022) targeting economic growth carried out by a team of authors from the University of Economic Studies of Bucharest, the Department of Education of the National Institute for Scientific Research, in collaboration with the Institute for Economic Forecasting of the Romanian Academy, start with the development of first estimates of the effects of the European Structural Investment Fund for the transition to a green economy based on a Leontief input–output model of economic aggregates at the CAEN Rev2 level for the analysis of direct, indirect and induced effects of the fund. The authors show that although it is still in its infancy, in Romania, green finance can be a viable solution if implemented for green industrial development, the effects of investments contributing to the reduction of 1.14 million tons of emissions by 2022 for the funding period 2014–2020, the direct contribution being estimated at 0.16%, the indirect contribution being estimated at 0.18% of total carbon dioxide emissions, and the induced effect accounting for a 0.79% reduction in carbon emissions.

A mathematically instrumented study analyzing (Sepúlveda and Vergara 2022) the effect of bank ownership and deposit insurance on monetary policy transmission in general and the role of precautionary savings in particular brings to attention models of precautionary savings in a consolidated form and competitive equilibrium calculations based on the relationships between capital and loans, savings, and deposits, i.e., using the convex cost management function. The authors show that by applying the prudent person principle, monetary outcomes depend on the relative risk aversion of households. Thus, increasing the degree of risk aversion can be a prerequisite for a more effective monetary policy. If one opts for more explicit deposit insurance, the effectiveness of monetary policy can be increased or decreased depending on the existence of public banks in relation to the level of risk aversion of households. A similar approach is taken by Takaoka and Takahashi (2022), who show the effects of increasing risks through corporate debt and unconventional elements of monetary policy.

Other researchers (Jinjarak et al. 2021; Lepetit and Fuentes-Albero 2022; Yıldırım Karaman 2022; Wang et al. 2022) analyze the effects of uncertainty induced by pandemics or other global events on monetary policy measures. The authors show through their research that the pandemic has increased the level of financial stress in global markets, and as such, in developed economies, central banks have adopted unconventional policies to limit adverse effects and consequences based on market uncertainty.

According to some authors (Fontana and Veronese Passarella 2020), the central bank’s main goal should no longer be price stability but to strengthen banks’ and borrowers’ balance sheets by stabilizing the prices of financial assets. The authors’ proposed change from the baseline model allows a bridging of the gap between the standard macroeconomic theory that central banks should maintain price stability by targeting output gaps and monetary policy rates according to central bank practices, where monetary policies have proven ineffective in terms of price stability.

Another approach (Fiebiger and Lavoie 2021) examines the rationale for unconventional monetary policies adopted by central banks in response to the global crisis, starting from the premise that quantitative easing appears to be a return to monetarist principles. The paradigm study analyzes the behavior of the Bank of England in relation to the Bank of Japan, thus showing that the first monetary model of England emphasizes the causal chain of money supply growth, spending, and inflation, while the Japanese monetary principle emphasizes a theorized relationship between base money and expected inflation.

From a theoretical point of view, monetary policy refers to the actions and measures implemented by a central bank or monetary authority to manage and control the money supply, interest rates, and credit availability in an economy. It is an important tool used to influence and stabilize economic growth, inflation rates, employment levels, and overall financial stability. Through various tools such as open market operations, reserve requirements, and interest rate adjustments, monetary policy aims to strike a balance between stimulating economic activity and maintaining price stability.

References

- European Central Bank Strategy. 2023. Available online: https://www.ecb.europa.eu/mopo/strategy/html/index.en.html (accessed on 28 January 2023).

- Bank of Greece Monetary Policy. 2023. Available online: https://www.bankofgreece.gr/en/main-tasks/monetary-policy (accessed on 27 January 2023).

- Banco de Espana Monetary Policy. 2023. Available online: https://www.bde.es/wbe/en/areas-actuacion/politica-monetaria/ (accessed on 27 January 2023).

- European Commision Economy and Finance. 2023. Available online: https://economy-finance.ec.europa.eu/euro/eu-countries-and-euro/croatia-and-euro_en (accessed on 28 January 2023).

- Friedman, Benjamin M. 1990. Targets and Instruments of Monetary Policy. In Handbook of Monetary Economics. Amsterdam: Elsevier, vol. 2, pp. 1185–230. ISBN 1573-4498.

- Phillips, Alban William Housego. 1958. The Relation between Unemployment and the Rate of Change of Money Wage Rates in the United Kingdom, 1861–1957. Economica 25: 283–99.

- Laidler, David. 2023. 2023-4 Macro’s Missing Link: The Unbridged Gap between Monetarism and the Wicksell Connection. Available online: https://ir.lib.uwo.ca/cgi/viewcontent.cgi?article=1860&context=economicsresrpt (accessed on 28 January 2023).

- Wicksell, Knut. 1907. The Influence of the Rate of Interest on Prices. The Economic Journal 17: 213–20.

- Schumpeter, Joseph A., and John Maynard Keynes. 1936. The General Theory of Employment, Interest and Money. Journal of the American Statistical Association 31: 791.

- Taylor, John B. 1993. Discretion versus Policy Rules in Practice. Carnegie-Rochester Conference Series on Public Policy 39: 195–214.

- Woodford, Michael. 2001. The Taylor Rule and Optimal Monetary Policy. The American Economic Review 91: 232–37.

- Cagan, Phillip, and Arthur Gandolfi. 1969. The Lag in Monetary Policy as Implied by the Time Pattern of Monetary Effects on Interest Rates. The American Economic Review 59: 277–84.

- Bassetto, Marco, and Thomas J. Sargent. 2020. Shotgun Wedding: Fiscal and Monetary Policy. Annual Review of Economics 12: 659–90.

- Summers, Lawrence. 1991. Panel Discussion: Price Stability: How Should Long-Term Monetary Policy Be Determined? Journal of Money, Credit and Banking 23: 625–31.

- Tobias, Adrian, Fernando Duarte, Federico Grinberg, and Tommaso Mancini Griffoli. 2019. Monetary Policy and Financial Conditions: A Cross-Country Study. SSRN 860: 1–22.

- Durante, Elena, Annalisa Ferrando, and Philip Vermeulen. 2022. Monetary Policy, Investment and Firm Heterogeneity. European Economic Review 148: 104251.

- Ocampo, José Antonio, and Jair Ojeda-Joya. 2022. Supply Shocks and Monetary Policy Responses in Emerging Economies. Latin American Journal of Central Banking 3: 100071.

- Li, Zehao. 2022. Financial Intermediary Leverage and Monetary Policy Transmission. European Economic Review 144: 104080.

- Ahiadorme, Johnson Worlanyo. 2022. Monetary Policy in Search of Macroeconomic Stability and Inclusive Growth. Research in Economics 76: 308–324.

- Davidescu, Adriana Ana Maria, Oana Cristina Popovici, and Vasile Alecsandru Strat. 2022. Estimating the Impact of Green ESIF in Romania Using Input-Output Model. International Review of Financial Analysis 84: 102336.

- Sepúlveda, Jean P., and Marcos Vergara. 2022. The Effect of Bank Ownership and Deposit Insurance on Monetary Policy Transmission Revisited: The Role of Precautionary Savings. Finance Research Letters 50: 103255.

- Takaoka, Sumiko, and Koji Takahashi. 2022. Corporate Debt and Unconventional Monetary Policy: The Risk-Taking Channel with Bond and Loan Contracts. Journal of Financial Stability 60: 101013.

- Jinjarak, Yothin, Rashad Ahmed, Sameer Nair-Desai, Weining Xin, and Joshua Aizenman. 2021. Pandemic Shocks and Fiscal-Monetary Policies in the Eurozone: COVID-19 Dominance during January–June 2020. Oxford Economic Papers 73: 1557–1580.

- Lepetit, Antoine, and Cristina Fuentes-Albero. 2022. The Limited Power of Monetary Policy in a Pandemic. European Economic Review 147: 104168.

- Yıldırım Karaman, Seçil. 2022. COVID-19, Sovereign Risk and Monetary Policy: Evidence from the European Monetary Union. Central Bank Review 22: 99–107.

- Wang, Hao, Ning Xu, Haiyan Yin, and Hao Ji. 2022. The Dynamic Impact of Monetary Policy on Financial Stability in China after Crises. Pacific-Basin Finance Journal 75: 101855.

- Fontana, Giuseppe, and Marco Veronese Passarella. 2020. Unconventional Monetary Policies from Conventional Theories: Modern Lessons for Central Bankers. Journal of Policy Modeling 42: 503–19.

- Fiebiger, Brett, and Marc Lavoie. 2021. Central Bankers and the Rationale for Unconventional Monetary Policies: Reasserting, Renouncing or Recasting Monetarism? Cambridge Journal of Economics 45: 37–59.

More

Information

Subjects:

Business, Finance

Contributors

MDPI registered users' name will be linked to their SciProfiles pages. To register with us, please refer to https://encyclopedia.pub/register

:

View Times:

670

Revisions:

2 times

(View History)

Update Date:

12 Dec 2023

Notice

You are not a member of the advisory board for this topic. If you want to update advisory board member profile, please contact office@encyclopedia.pub.

OK

Confirm

Only members of the Encyclopedia advisory board for this topic are allowed to note entries. Would you like to become an advisory board member of the Encyclopedia?

Yes

No

${ textCharacter }/${ maxCharacter }

Submit

Cancel

Back

Comments

${ item }

|

More

No more~

There is no comment~

${ textCharacter }/${ maxCharacter }

Submit

Cancel

${ selectedItem.replyTextCharacter }/${ selectedItem.replyMaxCharacter }

Submit

Cancel

Confirm

Are you sure to Delete?

Yes

No