Your browser does not fully support modern features. Please upgrade for a smoother experience.

Submitted Successfully!

Thank you for your contribution! You can also upload a video entry or images related to this topic.

For video creation, please contact our Academic Video Service.

| Version | Summary | Created by | Modification | Content Size | Created at | Operation |

|---|---|---|---|---|---|---|

| 1 | Mingzhao Xiong | -- | 1673 | 2023-07-03 16:38:45 | | | |

| 2 | Alfred Zheng | Meta information modification | 1673 | 2023-07-04 04:02:29 | | |

Video Upload Options

We provide professional Academic Video Service to translate complex research into visually appealing presentations. Would you like to try it?

Cite

If you have any further questions, please contact Encyclopedia Editorial Office.

Xiong, M.; Li, W.; Jenny, C.; Wang, P. Financial Inclusion through Digitalization for Industrial Pollution. Encyclopedia. Available online: https://encyclopedia.pub/entry/46359 (accessed on 07 February 2026).

Xiong M, Li W, Jenny C, Wang P. Financial Inclusion through Digitalization for Industrial Pollution. Encyclopedia. Available at: https://encyclopedia.pub/entry/46359. Accessed February 07, 2026.

Xiong, Mingzhao, Wenqi Li, Chenjie Jenny, Peixu Wang. "Financial Inclusion through Digitalization for Industrial Pollution" Encyclopedia, https://encyclopedia.pub/entry/46359 (accessed February 07, 2026).

Xiong, M., Li, W., Jenny, C., & Wang, P. (2023, July 03). Financial Inclusion through Digitalization for Industrial Pollution. In Encyclopedia. https://encyclopedia.pub/entry/46359

Xiong, Mingzhao, et al. "Financial Inclusion through Digitalization for Industrial Pollution." Encyclopedia. Web. 03 July, 2023.

Copy Citation

As an emerging product of the coupling of digital technique and traditional finance, digital inclusive finance (DIF) may play a vital role in alleviating the contradiction between economic growth and environmental contamination. Digital inclusive finance is a significant path to enhance financial inclusion, which has an optimistic effect on economic development and people’s lives.

digital inclusive finance

digital finance

industrial pollution

environmental pollution

1. Introduction

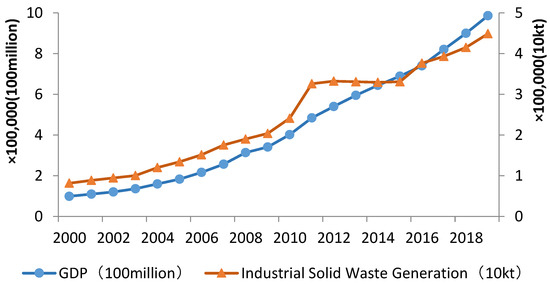

From the end of the 20th century to the present, tremendous advances in global economic and social development have been made. However, the extensive development pattern has also had a serious effect on the natural environment on which human beings depend. Human health problems and economic losses caused by environmental pollution have become the focus of attention worldwide. Therefore, ecological environmental governance has also attracted profound attention from governments and people around the world. China, as the second largest economy in the world, has rapidly advanced its industrialisation process since its reform and opening up and has swiftly transformed from an undeveloped farming country to an industrial country [1]. At the same time, China’s economy grows steadily every year and maintains an average annual growth rate of 9.5%. Such a rapid and sustained increase is rare in the history of human economic development. The remarkable achievements in the process of industrialisation and economic development are inevitably causing serious environmental pollution problems, and industrial pollution is the main source of current environmental pollution [2][3]. According to the “China Environmental Statistical Yearbook” and the data released by the National Bureau of Statistics of China, Figure 1 shows the changes in GDP and industrial solid waste generation in China from 2000 to 2019. It can be seen from Figure 1 that while China has made great achievements in economic development, it is inevitably accompanied by the problem of aggravated industrial pollution. Understanding how to achieve the coordination and unity of economic development and ecological environment is an emerging demand for China’s pollution-reduction work in the new era and the new stage and is also an unavoidable choice for China’s economic transformation and development within the ‘14th Five-Year Plan’ period.

Figure 1. Changes in GDP and industrial solid waste generation in China from 2000 to 2019.

Existing research shows that factors affecting industrial pollution emissions include openness, economic scale, industrial structure, environmental regulation, technological progress, industrial agglomeration and financial development [4][5]. Finance is not only the core element of economic operation and social production but also an important regulatory tool to save energy and reduce emissions from government departments. Consequently, scholars have been studying the association between finance and the environment for a long time. Some scholars believe that the financial system realises the coordination and unity of economic and social development and environmental conservation through the optimisation of allocating resources and technological progress [6]. However, the essential characteristics of traditional finance ‘dislike the poor and love the rich’, and the information dissymmetry between the offer and need sides makes it difficult for startups and other poor groups to obtain financial resources [7], which in turn makes it difficult for the energy-saving and emission-reduction effects of finance to fully play their role. Nonetheless, with the profound coupling of digital technology and traditional finance, DIF has emerged, which has largely improved the limitations of finance on environmental governance. The characteristics of the low cost, wide coverage, and high efficiency of DIF have lowered the financing threshold for startups and overcome the disadvantages of traditional financial transactions such as high transaction costs and insufficient supply of financial resources. At the same time, DIF covers the ‘service blind spots’ of traditional finance, which is conducive to reshaping the economic production pattern; this scenario promotes green technology innovation and offers new possibilities for encouraging the coordinated development of the economy and the environment [8][9][10]. Few studies are related to DIF and industrial pollution. Consequently, studying the relationship between DIF and industrial pollution is significant for promoting environmental governance, building an ecologically civilised society, and promoting economic and social transformation in an environmentally friendly direction.

2. Financial Inclusion through Digitalization for Industrial Pollution

Theoretical research on environmental problems and economic growth began in the 1960s. Owing to the sharp decrease in the stock of earth resources at that time, humanity’s living environment was severely damaged, which triggered two environmental revolutions. In the first environmental revolution, people debated the relationship between ambient quality and economic development. Economists led by Meadows published a report called ‘Limits to Growth’, which found that exponential increases in population growth, food supply, capital investment, environmental pollution, and resource depletion can stall economic growth and that technological progress can only ease the time to reach the limits. The second environmental revolution raised the issue of sustainable development and proposed many reports related to sustainable development, which prompted economists to study and discuss the circumstance for the coordinated development of the economy and environment. The two environmental revolutions encouraged economists to discuss and research the relationship between the economy and the environment on a theoretical level in general. Empirical research comes later than theoretical research. In the early 1990s, some scholars conducted an empirical study on the relationship between the economy and the environment and discovered that the relationship between many environment pollution indicators and income per person showed a reversed ‘U-shaped’ curve; that is, the ambient quality worsened first and then enhanced with economic development [11][12][13]. Panayotou (1993) found that this curve is similar to the Kuznets curve hypothesis proposed by Kuznets (1955); thus, the curve was termed the ‘environment Kuznets curve (EKC) hypothesis’ for the first time. The latter is also known as the EKC curve [14].

Finance was included in environmental-related research, which was also initially developed around the EKC hypothesis [15][16]. With the deepening research, its content gradually reduces the influence of the EKC hypothesis and pays extra attention to the relationship between finance and the environment. Currently, three main viewpoints exist on the correlation between finance and the environment. The first viewpoint is that financial development contributes to enhancing environmental quality. Some scholars believe that finance can enhance environmental quality by promoting technological progress [17], adjusting the industry structure, alleviating the shortage of environmental protection funds for enterprises, optimising the allocation of financial resources [18], improving the conversion rate of deposits and loans [19], and promoting green project investment and financing [20]. The second view is that financial development will aggravate environmental pollution. Some scholars believe that financial development increases energy consumption and pollution emissions by easing corporate financing constraints to expand production capacity [21][22] and easing consumer budget constraints to stimulate commodity consumption [23][24]. The third point of view is that financial growth has a reversed U-shaped non-linear relation with environmental pollution that first promotes and then inhibits it [25][26]. In recent years, with the emergence of inclusive finance, researchers have studied the relationship between finance and the environment from the viewpoint of financial resource equality and found that inclusive finance can affect environmental pollution emissions through economic growth and technological innovation mechanisms [27]. Meanwhile, the research results show that the emission-reduction effect of inclusive finance shows threshold characteristics [28]. As a new financial product formed by the combination of financial technology and inclusive finance, DIF has been around for a short time, and relatively few studies exist on DIF and pollution emissions. However, existing research generally believes that DIF can affect pollution emissions in direct and indirect ways. In terms of direct effects, DIF is an organic integration of advanced digital technology and inclusive finance. Its essence is to transform the traditional financial system with the help of new digital technologies. DIF has realised the innovation of traditional inclusive financial products and services, giving DIF wider coverage, lower service costs, higher service efficiency, and more accurate service targets. According to the transaction cost theory, the renewal of and improvement in transaction methods caused by technological progress have greatly improved transaction efficiency. At the same time, it effectively reduces search costs, negotiation costs, information transmission costs, supervision costs, and breach of contract costs in the transaction process. As a technological revolution in the financial field, DIF has provided many conveniences for enterprises and consumers in terms of reducing transaction costs and breaking through geographical distance restrictions and reducing various inefficient market transactions. Based on the above theoretical logic that DIF can reduce transaction costs, it can be found that DIF itself has green attributes and is environmentally friendly. Some scholars believe that DIF is a significant path to enhance financial inclusion, which has an optimistic effect on economic development and people’s lives [29][30]. DIF has improved green economic benefits by advocating the concept of low-carbon life, raising public consciousness of environmental protection, and building an environmental protection service platform [31]. At the same time, DIF uses digital techniques to effectively alleviate the problem of information asymmetry between the offer and need sides of financial institutions and enterprises, alleviate the misallocation of financial resources, and restrain environmental pollution emissions [32].

In terms of indirect effects, some scholars believe that DIF can reduce pollution emissions through industrial structure upgrades [33], innovation effects [34], and entrepreneurial effects [35]. Specifically, the industrial structure upgrading path of DIF includes three aspects [36]. On the one hand, DIF improves the scope and efficiency of financial services, effectively reduces the problem of financial exclusion, optimises the allocation of resources, and guides the flow of factors to high-productivity industries, thereby encouraging the upgrade of industry structure; on the other hand, DIF promotes the growth of the digital economy, development of logistics, transportation, and other service industries through online consumption and industrial transformation and upgrading. Simultaneously, DIF promotes the upgrade of the consuming structure by easing the consumption budget constraints of low- and middle-income groups, thereby encouraging the upgrade of industry structure. Compared with the secondary industry, the service industries have the peculiarities of low investment and low pollution. Thus, industrial transformation and upgrading can help reduce pollution emissions. Some scholars believe that the innovation effect, the emission reduction path, of DIF occurs by alleviating the external financing constraints of technological innovation enterprises [37] and reducing the financial resource misallocation problem caused by financial exclusion and information asymmetry of startups [38] to promote technological innovation of enterprises and reduce pollution emissions.

References

- Islam, N.; Yokota, K. Lewis growth model and China’s industrialization. Asian Econ. J. 2008, 22, 359–396.

- Siddique, H.M.A. Industrialization, energy consumption, and environmental pollution: Evidence from South Asia. Environ. Sci. Pollut. Res. 2022, 30, 4103.

- Zhou, Y.; Liu, Z.; Liu, S.; Chen, M.; Zhang, X.; Wang, Y. Analysis of industrial eco-efficiency and its influencing factors in China. Clean Technol. Environ. Policy 2020, 22, 2023–2038.

- Nasrollahi, Z.; Hashemi, M.S.; Bameri, S.; Mohamad Taghvaee, V. Environmental pollution, economic growth, population, industrialization, and technology in weak and strong sustainability: Using STIRPAT model. Environ. Dev. Sustain. 2020, 22, 1105–1122.

- Han, C.; Hua, D.; Li, J. A View of Industrial Agglomeration, Air Pollution and Economic Sustainability from Spatial Econometric Analysis of 273 Cities in China. Sustainability 2023, 15, 7091.

- Triki, R.; Kahouli, B.; Tissaoui, K.; Tlili, H. Assessing the Link between Environmental Quality, Green Finance, Health Expenditure, Renewable Energy, and Technology Innovation. Sustainability 2023, 15, 4286.

- Caplan, M.A.; Birkenmaier, J.; Bae, J. Financial exclusion in OECD countries: A scoping review. Int. J. Soc. Welf. 2021, 30, 58–71.

- Hasan, M.M.; Yajuan, L.; Khan, S. Promoting China’s inclusive finance through digital financial services. Glob. Bus. Rev. 2022, 23, 984–1006.

- Sun, Y.; Tang, X. The impact of digital inclusive finance on sustainable economic growth in China. Financ. Res. Lett. 2022, 50, 103234.

- Chopra, S.; Dwivedi, R.; Sherry, A.M. Leveraging technology options for financial inclusion in India. Int. J. Asian Bus. Inf. Manag. 2013, 4, 10–20.

- Grossman, G.M.; Krueger, A.B. Environmental Impacts of a North American Free Trade Agreement; NBER: Cambridge, UK, 1991.

- Shafik, N.; Bandyopadhyay, S. Economic Growth and Environmental Quality: Time Series and Cross Country Evidence; Background Paper for the World Development Report; The World Bank: Washington DC, USA, 1992.

- Yang, R.; Wong, C.W.; Miao, X. Evaluation of the coordinated development of economic, urbanization and environmental systems: A case study of China. Clean Technol. Environ. Policy 2021, 23, 685–708.

- Panayotou, T. The economics of environments in transition. Environ. Dev. Econ. 1999, 4, 401–412.

- Dinda, S. Environmental Kuznets curve hypothesis: A survey. Ecol. Econ. 2004, 49, 431–455.

- Jalil, A.; Feridun, M. The impact of growth, energy and financial development on the environment in China: A cointegration analysis. Energy Econ. 2011, 33, 284–291.

- Hu, Y.; Dai, X.; Zhao, L. Digital finance, environmental regulation, and green technology innovation: An Empirical Study of 278 Cities in China. Sustainability 2022, 14, 8652.

- Gu, B.; Chen, F.; Zhang, K. The policy effect of green finance in promoting industrial transformation and upgrading efficiency in China: Analysis from the perspective of government regulation and public environmental demands. Environ. Sci. Pollut. Res. 2021, 28, 47474–47491.

- Tamazian, A.; Chousa, J.P.; Vadlamannati, K.C. Does higher economic and financial development lead to environmental degradation: Evidence from BRIC countries. Energy Policy 2009, 37, 246–253.

- Shahbaz, M.; Hye, Q.M.A.; Tiwari, A.K.; Leitão, N.C. Economic growth, energy consumption, financial development, international trade and CO2 emissions in Indonesia. Renew. Sustain. Energy Rev. 2013, 25, 109–121.

- Cole, M.A.; Elliott, R.J. FDI and the capital intensity of “dirty” sectors: A missing piece of the pollution haven puzzle. Rev. Dev. Econ. 2005, 9, 530–548.

- Shahbaz, M.; Solarin, S.A.; Mahmood, H.; Arouri, M. Does financial development rEDUce CO2 emissions in Malaysian economy? A time series analysis. Econ. Model. 2013, 35, 145–152.

- Zhang, Y.J. The impact of financial development on carbon emissions: An empirical analysis in China. Energy Policy 2011, 39, 2197–2203.

- Sadorsky, P. The impact of financial development on energy consumption in emerging economies. Energy Policy 2010, 38, 2528–2535.

- Charfeddine, L.; Khediri, K.B. Financial development and environmental quality in UAE: Cointegration with structural breaks. Renew. Sustain. Energy Rev. 2016, 55, 1322–1335.

- Abbasi, F.; Riaz, K. CO2 emissions and financial development in an emerging economy: An augmented VAR approach. Energy Policy 2016, 90, 102–114.

- Lv, J.; Wang, N.; Ju, H.; Cui, X. Influence of green technology, tourism, and inclusive financial development on ecological sustainability: Exploring the path toward green revolution. Econ. Res. 2022, 36, 1–23.

- Jiang, S.; Qiu, S.; Zhou, J. Re-Examination of the Relationship between Agricultural Economic Growth and Non-Point Source Pollution in China: Evidence from the Threshold Model of Financial Development. Water 2020, 12, 2609.

- Risman, A.; Mulyana, B.; Silvatika, B.; Sulaeman, A. The effect of digital Finance on financial stability. Manag. Sci. Lett. 2021, 11, 1979–1984.

- Dwivedi, R.; Alrasheedi, M.; Dwivedi, P.; Starešinić, B. Leveraging financial inclusion through technology-enabled services innovation: A case of economic development in India. Int. J. E-Serv. Mob. Appl. 2022, 14, 1–13.

- Li, G.; Fang, X.; Liu, M. Will Digital Inclusive Finance Make Economic Development Greener? Evidence From China. Front. Environ. Sci. 2021, 9, 452.

- Shi, F.; Ding, R.; Li, H.; Hao, S. Environmental Regulation, Digital Financial Inclusion, and Environmental Pollution: An Empirical Study Based on the Spatial Spillover Effect and Panel Threshold Effect. Sustainability 2022, 14, 6869.

- Wen, H.; Yue, J.; Li, J.; Xiu, X.; Zhong, S. Can digital Finance rEDUce industrial pollution? New evidence from 260 cities in China. PLoS ONE 2022, 17, e0266564.

- Xue, L.; Zhang, X. Can Digital Financial Inclusion Promote Green Innovation in Heavily Polluting Companies? Int. J. Environ. Res. Public Health 2022, 19, 7323.

- Chang, J. The role of digital finance in reducing agricultural carbon emissions: Evidence from China’s provincial panel data. Environ. Sci. Pollut. Res. 2022, 29, 87730–87745.

- Li, F.; Wu, Y.; Liu, J.; Zhong, S. Does digital inclusive finance promote industrial transformation? New evidence from 115 resource-based cities in China. PLoS ONE 2022, 17, e0273680.

- Lin, B.; Ma, R. How does digital finance influence green technology innovation in China? Evidence from the financing constraints perspective. J. Environ. Manag. 2022, 320, 115833.

- Wang, X.; Zhu, Y.; Ren, X.; Gozgor, G. The impact of digital inclusive finance on the spatial convergence of the green total factor productivity in the Chinese cities. Appl. Econ. 2022, 35, 1–19.

More

Information

Subjects:

Environmental Studies

Contributors

MDPI registered users' name will be linked to their SciProfiles pages. To register with us, please refer to https://encyclopedia.pub/register

:

View Times:

660

Revisions:

2 times

(View History)

Update Date:

04 Jul 2023

Notice

You are not a member of the advisory board for this topic. If you want to update advisory board member profile, please contact office@encyclopedia.pub.

OK

Confirm

Only members of the Encyclopedia advisory board for this topic are allowed to note entries. Would you like to become an advisory board member of the Encyclopedia?

Yes

No

${ textCharacter }/${ maxCharacter }

Submit

Cancel

Back

Comments

${ item }

|

More

No more~

There is no comment~

${ textCharacter }/${ maxCharacter }

Submit

Cancel

${ selectedItem.replyTextCharacter }/${ selectedItem.replyMaxCharacter }

Submit

Cancel

Confirm

Are you sure to Delete?

Yes

No