Your browser does not fully support modern features. Please upgrade for a smoother experience.

Please note this is an old version of this entry, which may differ significantly from the current revision.

Subjects:

Environmental Studies

As an emerging product of the coupling of digital technique and traditional finance, digital inclusive finance (DIF) may play a vital role in alleviating the contradiction between economic growth and environmental contamination. Digital inclusive finance is a significant path to enhance financial inclusion, which has an optimistic effect on economic development and people’s lives.

- digital inclusive finance

- digital finance

- industrial pollution

- environmental pollution

1. Introduction

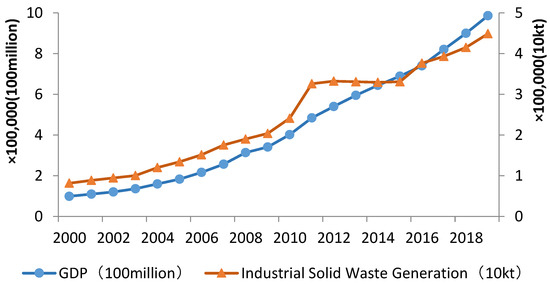

From the end of the 20th century to the present, tremendous advances in global economic and social development have been made. However, the extensive development pattern has also had a serious effect on the natural environment on which human beings depend. Human health problems and economic losses caused by environmental pollution have become the focus of attention worldwide. Therefore, ecological environmental governance has also attracted profound attention from governments and people around the world. China, as the second largest economy in the world, has rapidly advanced its industrialisation process since its reform and opening up and has swiftly transformed from an undeveloped farming country to an industrial country [1]. At the same time, China’s economy grows steadily every year and maintains an average annual growth rate of 9.5%. Such a rapid and sustained increase is rare in the history of human economic development. The remarkable achievements in the process of industrialisation and economic development are inevitably causing serious environmental pollution problems, and industrial pollution is the main source of current environmental pollution [2,3]. According to the “China Environmental Statistical Yearbook” and the data released by the National Bureau of Statistics of China, Figure 1 shows the changes in GDP and industrial solid waste generation in China from 2000 to 2019. It can be seen from Figure 1 that while China has made great achievements in economic development, it is inevitably accompanied by the problem of aggravated industrial pollution. Understanding how to achieve the coordination and unity of economic development and ecological environment is an emerging demand for China’s pollution-reduction work in the new era and the new stage and is also an unavoidable choice for China’s economic transformation and development within the ‘14th Five-Year Plan’ period.

Figure 1. Changes in GDP and industrial solid waste generation in China from 2000 to 2019.

Existing research shows that factors affecting industrial pollution emissions include openness, economic scale, industrial structure, environmental regulation, technological progress, industrial agglomeration and financial development [4,5]. Finance is not only the core element of economic operation and social production but also an important regulatory tool to save energy and reduce emissions from government departments. Consequently, scholars have been studying the association between finance and the environment for a long time. Some scholars believe that the financial system realises the coordination and unity of economic and social development and environmental conservation through the optimisation of allocating resources and technological progress [6]. However, the essential characteristics of traditional finance ‘dislike the poor and love the rich’, and the information dissymmetry between the offer and need sides makes it difficult for startups and other poor groups to obtain financial resources [7], which in turn makes it difficult for the energy-saving and emission-reduction effects of finance to fully play their role. Nonetheless, with the profound coupling of digital technology and traditional finance, DIF has emerged, which has largely improved the limitations of finance on environmental governance. The characteristics of the low cost, wide coverage, and high efficiency of DIF have lowered the financing threshold for startups and overcome the disadvantages of traditional financial transactions such as high transaction costs and insufficient supply of financial resources. At the same time, DIF covers the ‘service blind spots’ of traditional finance, which is conducive to reshaping the economic production pattern; this scenario promotes green technology innovation and offers new possibilities for encouraging the coordinated development of the economy and the environment [8,9,10]. Few studies are related to DIF and industrial pollution. Consequently, studying the relationship between DIF and industrial pollution is significant for promoting environmental governance, building an ecologically civilised society, and promoting economic and social transformation in an environmentally friendly direction.

2. Financial Inclusion through Digitalization for Industrial Pollution

Theoretical research on environmental problems and economic growth began in the 1960s. Owing to the sharp decrease in the stock of earth resources at that time, humanity’s living environment was severely damaged, which triggered two environmental revolutions. In the first environmental revolution, people debated the relationship between ambient quality and economic development. Economists led by Meadows published a report called ‘Limits to Growth’, which found that exponential increases in population growth, food supply, capital investment, environmental pollution, and resource depletion can stall economic growth and that technological progress can only ease the time to reach the limits. The second environmental revolution raised the issue of sustainable development and proposed many reports related to sustainable development, which prompted economists to study and discuss the circumstance for the coordinated development of the economy and environment. The two environmental revolutions encouraged economists to discuss and research the relationship between the economy and the environment on a theoretical level in general. Empirical research comes later than theoretical research. In the early 1990s, some scholars conducted an empirical study on the relationship between the economy and the environment and discovered that the relationship between many environment pollution indicators and income per person showed a reversed ‘U-shaped’ curve; that is, the ambient quality worsened first and then enhanced with economic development [11,12,13]. Panayotou (1993) found that this curve is similar to the Kuznets curve hypothesis proposed by Kuznets (1955); thus, the curve was termed the ‘environment Kuznets curve (EKC) hypothesis’ for the first time. The latter is also known as the EKC curve [14].

Finance was included in environmental-related research, which was also initially developed around the EKC hypothesis [15,16]. With the deepening research, its content gradually reduces the influence of the EKC hypothesis and pays extra attention to the relationship between finance and the environment. Currently, three main viewpoints exist on the correlation between finance and the environment. The first viewpoint is that financial development contributes to enhancing environmental quality. Some scholars believe that finance can enhance environmental quality by promoting technological progress [17], adjusting the industry structure, alleviating the shortage of environmental protection funds for enterprises, optimising the allocation of financial resources [18], improving the conversion rate of deposits and loans [19], and promoting green project investment and financing [20]. The second view is that financial development will aggravate environmental pollution. Some scholars believe that financial development increases energy consumption and pollution emissions by easing corporate financing constraints to expand production capacity [21,22] and easing consumer budget constraints to stimulate commodity consumption [23,24]. The third point of view is that financial growth has a reversed U-shaped non-linear relation with environmental pollution that first promotes and then inhibits it [25,26]. In recent years, with the emergence of inclusive finance, researchers have studied the relationship between finance and the environment from the viewpoint of financial resource equality and found that inclusive finance can affect environmental pollution emissions through economic growth and technological innovation mechanisms [27]. Meanwhile, the research results show that the emission-reduction effect of inclusive finance shows threshold characteristics [28]. As a new financial product formed by the combination of financial technology and inclusive finance, DIF has been around for a short time, and relatively few studies exist on DIF and pollution emissions. However, existing research generally believes that DIF can affect pollution emissions in direct and indirect ways. In terms of direct effects, DIF is an organic integration of advanced digital technology and inclusive finance. Its essence is to transform the traditional financial system with the help of new digital technologies. DIF has realised the innovation of traditional inclusive financial products and services, giving DIF wider coverage, lower service costs, higher service efficiency, and more accurate service targets. According to the transaction cost theory, the renewal of and improvement in transaction methods caused by technological progress have greatly improved transaction efficiency. At the same time, it effectively reduces search costs, negotiation costs, information transmission costs, supervision costs, and breach of contract costs in the transaction process. As a technological revolution in the financial field, DIF has provided many conveniences for enterprises and consumers in terms of reducing transaction costs and breaking through geographical distance restrictions and reducing various inefficient market transactions. Based on the above theoretical logic that DIF can reduce transaction costs, it can be found that DIF itself has green attributes and is environmentally friendly. Some scholars believe that DIF is a significant path to enhance financial inclusion, which has an optimistic effect on economic development and people’s lives [29,30]. DIF has improved green economic benefits by advocating the concept of low-carbon life, raising public consciousness of environmental protection, and building an environmental protection service platform [31]. At the same time, DIF uses digital techniques to effectively alleviate the problem of information asymmetry between the offer and need sides of financial institutions and enterprises, alleviate the misallocation of financial resources, and restrain environmental pollution emissions [32].

In terms of indirect effects, some scholars believe that DIF can reduce pollution emissions through industrial structure upgrades [33], innovation effects [34], and entrepreneurial effects [35]. Specifically, the industrial structure upgrading path of DIF includes three aspects [36]. On the one hand, DIF improves the scope and efficiency of financial services, effectively reduces the problem of financial exclusion, optimises the allocation of resources, and guides the flow of factors to high-productivity industries, thereby encouraging the upgrade of industry structure; on the other hand, DIF promotes the growth of the digital economy, development of logistics, transportation, and other service industries through online consumption and industrial transformation and upgrading. Simultaneously, DIF promotes the upgrade of the consuming structure by easing the consumption budget constraints of low- and middle-income groups, thereby encouraging the upgrade of industry structure. Compared with the secondary industry, the service industries have the peculiarities of low investment and low pollution. Thus, industrial transformation and upgrading can help reduce pollution emissions. Some scholars believe that the innovation effect, the emission reduction path, of DIF occurs by alleviating the external financing constraints of technological innovation enterprises [37] and reducing the financial resource misallocation problem caused by financial exclusion and information asymmetry of startups [38] to promote technological innovation of enterprises and reduce pollution emissions.

This entry is adapted from the peer-reviewed paper 10.3390/su151310203

This entry is offline, you can click here to edit this entry!