Your browser does not fully support modern features. Please upgrade for a smoother experience.

Submitted Successfully!

Thank you for your contribution! You can also upload a video entry or images related to this topic.

For video creation, please contact our Academic Video Service.

| Version | Summary | Created by | Modification | Content Size | Created at | Operation |

|---|---|---|---|---|---|---|

| 1 | Pranjal Barman | -- | 3736 | 2023-06-29 17:53:11 | | | |

| 2 | Rita Xu | Meta information modification | 3736 | 2023-06-30 03:46:14 | | |

Video Upload Options

We provide professional Academic Video Service to translate complex research into visually appealing presentations. Would you like to try it?

Cite

If you have any further questions, please contact Encyclopedia Editorial Office.

Barman, P.; Dutta, L.; Azzopardi, B. Electric Vehicle Battery Supply Chain. Encyclopedia. Available online: https://encyclopedia.pub/entry/46233 (accessed on 01 March 2026).

Barman P, Dutta L, Azzopardi B. Electric Vehicle Battery Supply Chain. Encyclopedia. Available at: https://encyclopedia.pub/entry/46233. Accessed March 01, 2026.

Barman, Pranjal, Lachit Dutta, Brian Azzopardi. "Electric Vehicle Battery Supply Chain" Encyclopedia, https://encyclopedia.pub/entry/46233 (accessed March 01, 2026).

Barman, P., Dutta, L., & Azzopardi, B. (2023, June 29). Electric Vehicle Battery Supply Chain. In Encyclopedia. https://encyclopedia.pub/entry/46233

Barman, Pranjal, et al. "Electric Vehicle Battery Supply Chain." Encyclopedia. Web. 29 June, 2023.

Copy Citation

Electric vehicles (EVs) have been garnering wide attention over conventional fossil fuel-based vehicles due to the serious concerns of environmental pollution and crude oil depletion.

battery

electric vehicle

lithium ion

nickel chemistry

1. Introduction

In recent years, the demand for electric vehicles (EVs) has accelerated to fulfill worldwide demands of an eco-friendly transportation system [1][2]. EV sales in 2021 surpassed more than fourfold compared to their market share in 2019. China is the global leader in EV sales, followed by Europe and the USA. China tripled its sales by 2020 [3]; Europe increased its EV sales to 2.3 million by 2021 [4]; and the USA contributed about 10% of EV sales globally until the end of 2021. Going forward, as per the industry’s estimation, 7% of the global automotive industry will be EVs by 2030, which is currently only 0.2%. In the Indian subcontinent, the ambition to deploy mass numbers of EV-2-wheelers, auto-rickshaws, 4-wheelers, and buses is notable [5]. The transition of the transportation sector from engines powered by fossil fuels to battery-powered systems will reduce greenhouse gas emissions by reducing the carbon footprint [6][7]. However, specific inherent challenges associated with mining and sourcing raw materials for batteries must be resolved as they restrict their manufacturing to fulfill the ever-rising demand for EV batteries. At present, the demand and supply chain are yet to evolve to maintain a sustainable flow of raw materials to battery manufacturers.

Lead-acid, nickel-metal hydride (NiMH), and most versatile lithium-ion batteries (LBs) are among the existing battery types that have demonstrated their superiority in EVs [8][9][10]. In addition, several alternate battery technologies such as metal-air, sodium-ion, etc., have evolved; however, they are yet to reach their full potential [11][12]. Initially, NiMH batteries were preferred for HEVs, nevertheless, due to the superior performance demonstrated by LBs over other technologies; they are expected to replace the existing NiMH-based EVs [13]. Since BEVs and PHEVs will control the majority of the EV market, LBs will probably be a significant component of the future generation of EVs [14][15].

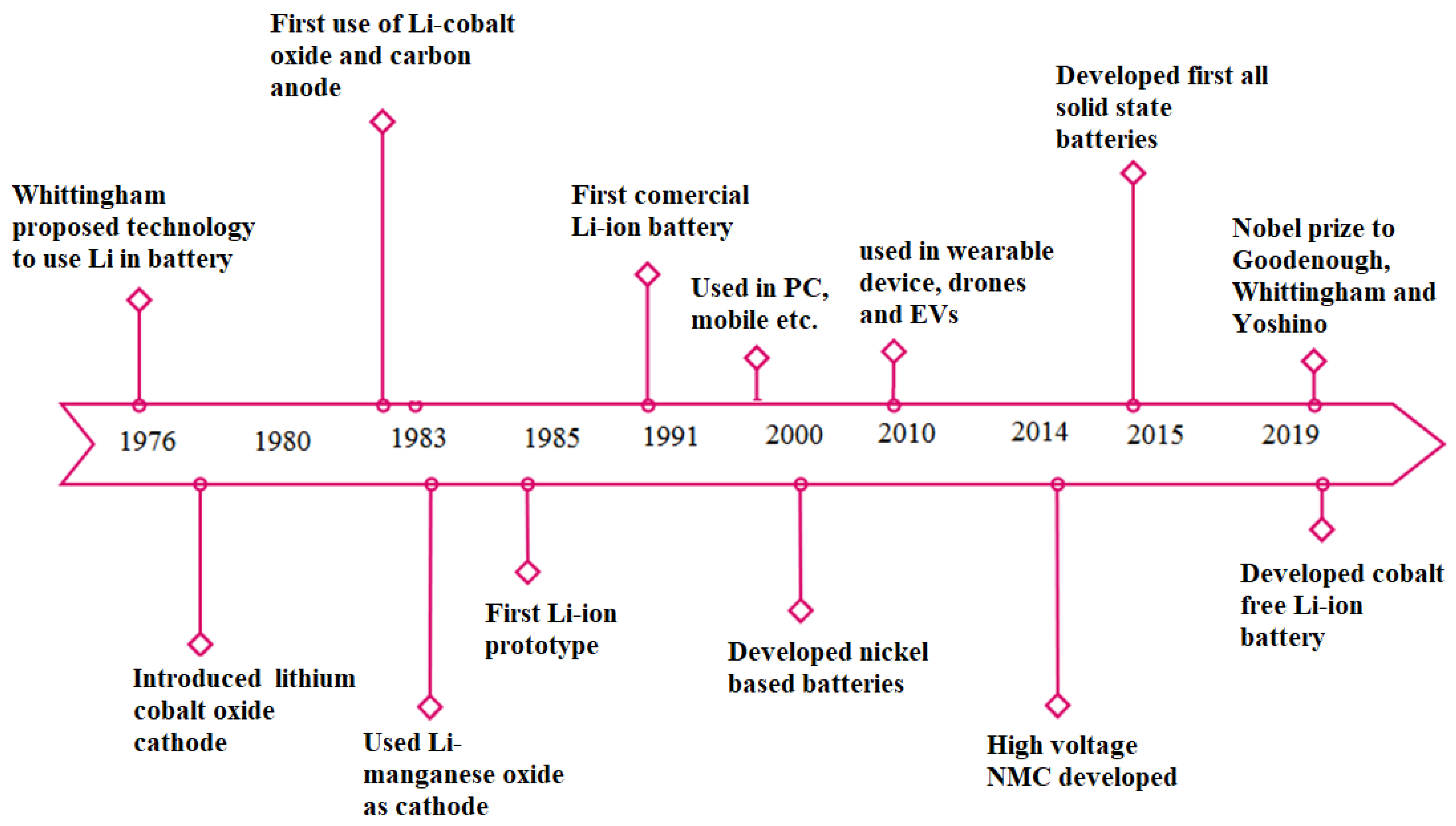

LBs were first intended to power portable consumer gadgets such as computers, cameras, power banks, cell phones, and other similar devices. Nonetheless, they have emerged as the top choice in a wide range of applications because of their superior quality attributes and promising performance, such as high-power density, longevity, and reduced memory effect [16][17][18][19]. This prompted a substantial boosting of battery production to meet the market’s need in the past decade. Consequently, the consumption of LBs escalated more than forty folds, from 11 GWh in 2015 to 460 GWh in 2023. By the end of 2025, the total LB capacity is anticipated to exceed 800 GWh [20]. The utilization of LBs in EVs and HEVs started from 2010 onwards, diminishing the market share of NiMH [21]. On a global scale, the use of LBs in EVs has outpaced other technologies with a market share of 51%. LBs in light- and heavy-duty vehicles are predicted to expand significantly over the next ten years, reaching a startling share of 77% in 2030. Records reveal that a significant number of LBs were sold on the Chinese market over the past ten years, constituting 49% of global sales in 2019, preceded by Europe and the USA. The major breakthroughs in LBs and its related technologies are elaborated in Figure 1.

Figure 1. Major breakthroughs in LBs and its related technologies.

Industry experts have estimated that the initial cost of an EV will be equivalent to that of an ICEV by 2025. This can dramatically transform EV adoption in the near future. Furthermore, the total cost per kilometer of an EV has a favorable economics for better utilization. Presently the cost of batteries accounts for approximately one-third of the entire expense of an EV. However, the price of battery packs fell by more than 70% over the last six years. Continuous research and innovation in battery technology accompanied by an increased production scale drive the consistent decline of battery prices. As per the survey, battery prices could fall to 73 USD/kWh by 2030 as compared to today’s 240 USD/kWh. Battery prices may fall even faster than this projection if the ambitions of developed countries such as France, the UK, Norway, or China are to replace ICEVs with EVs completely. Considering the global EV deployment statistics, the global demand for EV batteries could be fulfilled by at least 30 giga-factories by 2030 [3]. It requires an investment of more than 120 billion dollars solely for battery manufacturing. As per the scale of the Tesla giga-factory, it has a total manufacturing capacity of 35 GWh yearly [4].

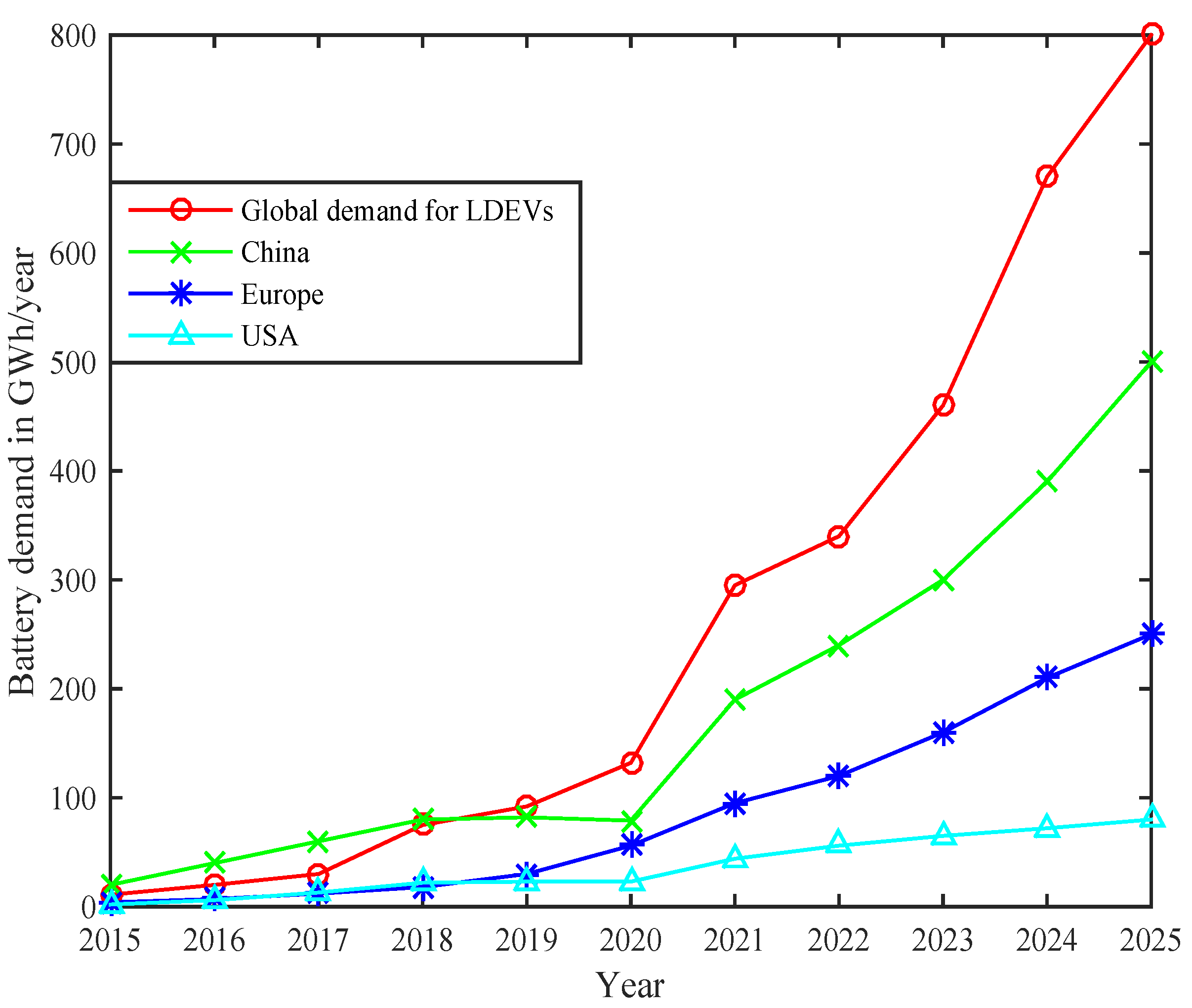

The current demand for LBs is more than 350 GWh which is more than two times the demand in 2020. The surge in battery demand is proportional to the number of newly registered electric cars. A BEV requires an average of a 55kWh battery capacity, and a PHEV requires a 14kWh capacity. The capacity needed for medium and heavy-duty vehicles is usually larger than light-duty vehicles. The average battery capacity differs in various countries. China is the leading EV battery consumer with a market requirement of 200 GWh in 2021. Furthermore, battery demands in Europe increased by 70% in the last six years. The USA has also seen impressive demand growth that doubled in 2021. The primary reason behind this rapid demand is the capacity expansion of the battery industry. The global demand for batteries in Light Duty Electric Vehicles (LDEVs) with a comparison of leading battery manufacturing nations is represented in Figure 2 [22]. It can be seen that China is leading in the battery demand for LDEVs followed by Europe and the USA.

Figure 2. Global demand of batteries in Light Duty Electric Vehicles (LDEVs) and region-wise battery demands.

It is indeed challenging to cover every facet of battery supply dynamic. However, the currently available literature raises several important issues, including forecasting material demands, trade problems, regulatory frameworks, and logistics. Rajaeifar et al. comprehensively discussed resources and energy flows among various supply and value chains of EV batteries [23]. Olivetti et al. critically emphasized the cathode chemistry and cathode materials while concentrating solely on supply components in LBs [24]. Lai et al. provided a review that was limited to the life cycle evaluation of LBs’ fundamental framework, categories, benchmarks, methodologies, and technological difficulties [25]. A thorough study on the state of recycled Li-ion batteries was presented by Shahjalal et al., and the new developments in LB second-life applications [26] were also analyzed in detail. Miao et al. in [27] presented an overview of the state of the power of LBs worldwide, focusing on various approaches to handling the spent power of LBs and the types of materials they are linked to. Eftekhari focused on lithium supplies as an economical element for sustainability practices considering the supply situation and strategic plan of LBs for automobiles [28]. In [29], a detailed analysis of commercial and industrial aspects of lithium is presented with a compilation of the various geolocation of lithium sources worldwide. The pertinent LB recycling technology, methods, environmental impact, and products were compiled by Huang et al. [30]. Heidari et al. addressed the anode and cathode materials, the power storage mechanism, and the strategies and difficulties encountered by LB researchers [31].

2. Cathode Chemistry of Li-Ion Battery

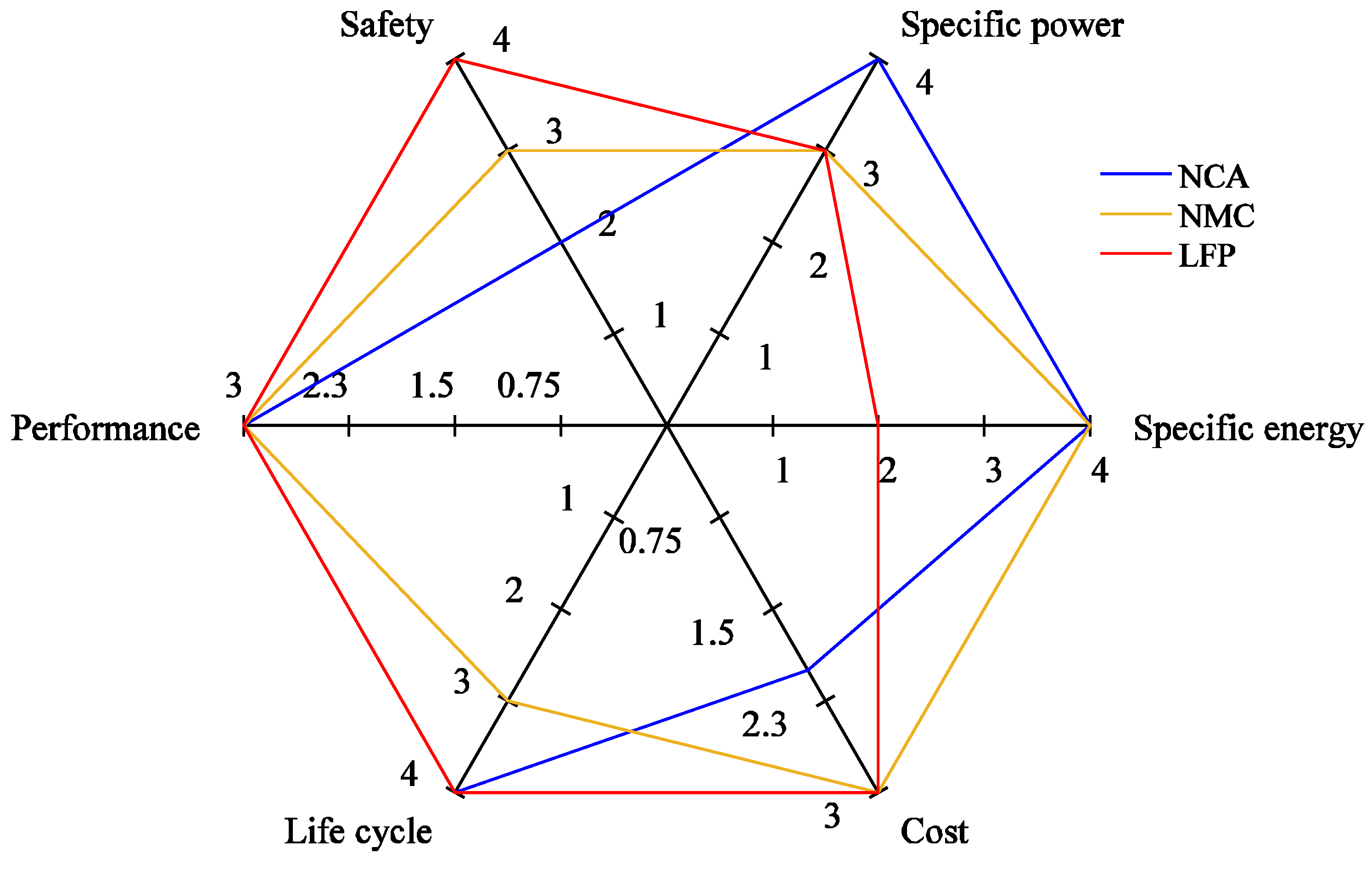

A crucial distinguishing factor of a battery is the cathode chemistry, which governs its performance, so the availability of cathode material becomes decisive in adopting a battery in the long run. Nowadays, three types of cathode chemistries are primarily favored in the automotive industry: lithium nickel manganese cobalt oxide (NMC); lithium nickel cobalt aluminum oxide (NCA); and lithium iron phosphate (LFP), as illustrated in Figure 3 [32], in which their respective performance parameters are demonstrated in the form of a spider diagram.

Figure 3. Performance parameters of various battery chemistries.

2.1. Nickel-Based Cathode Chemistry

LB manufacturers used cobalt significantly in their older generation of batteries [33]. However, the emergence of nickel decreased the utilization of cobalt in LBs as nickel-based batteries achieved higher energy densities at a lower cost [34]. With the ever-increasing battery demand, the requirement for battery cathode and anode materials also elevated in 2021. The cathode demand more than doubled compared to the demand of 2020. The battery cell requires a high amount of cathode materials to compensate for the higher energy density of a graphite anode [35]. Therefore, the cathode chemistry is crucial to determining battery performance and material requirements. Due to the high nickel content in NMC and NCA cathodes, they have a high energy density and thus dominate in the EV market [36]. However, the foreseen difficulty in integrating nickel as a cathode material is labor-intensive and complex. NCA batteries are seldom used in present day applications. However, they are still common in long range Tesla variants and electric SUVs. Nickel-based chemistries were vital in the EV market during 2021, with a more than 75% market share of cathode materials due to their superior driving range. The NMC and NCA batteries’ market is forecasted to grow significantly between 2022 and 2028.

2.2. Iron-Based Cathode Chemistry

LFP is a cobalt-free battery chemistry that is relatively inexpensive, less likely to catch fire, and has a long-life cycle [37]. LFP typically has a less than 35% energy density compared to NMC batteries, so a significant research focus is devoted to increasing its energy density. As a result, when using LFP, EV manufacturers must make an unavoidable trade-off between energy density and safety. Recently evolved technological improvements of LFP lead to its resurgence, occupying nearly 25% of the total market share, primarily in China. The notable feature of LFP is its long lifecycle, which makes it an excellent candidate for heavy duty use with repeated charging. LFP chemistry is commonly used in medium and heavy-duty EV batteries [38]. The Chinese government promotes LFP chemistry due to its cost advantage and rigorous use in LDVs. In addition to that, the newly emerging Cell-to-Pack (CTP) technology improves the volumetric energy density, thereby decreasing the dead weight of LPF batteries [39]. The pioneering work on CTP technology and its efficacy were demonstrated by BYD on blade batteries, after which its superior variations were released. The third generation of CTP significantly increases the volumetric energy density of LFP batteries, which will seemingly compete with NMC batteries in the near future. Apart from the Chinese counterpart, major global EV manufacturers including Tesla and Volkswagen are launching high volume EV models based on LFP chemistries. During 2022, almost 50% of the EVs manufactured by Tesla used LFP batteries. EV manufacturers in Europe and the US have gradually planned to incorporate LFP batteries to meet the ever-increasing demand for safe and less expensive EV batteries. The profound limitation of LFP batteries, however, is recycling, as recycling produces iron and phosphorous, which are relatively inexpensive compared to precious metals such as the nickel and cobalt produced during the recycling of NMC batteries. Moreover, toxic off-gassing and recycling costs further add to the woes of the LFP.

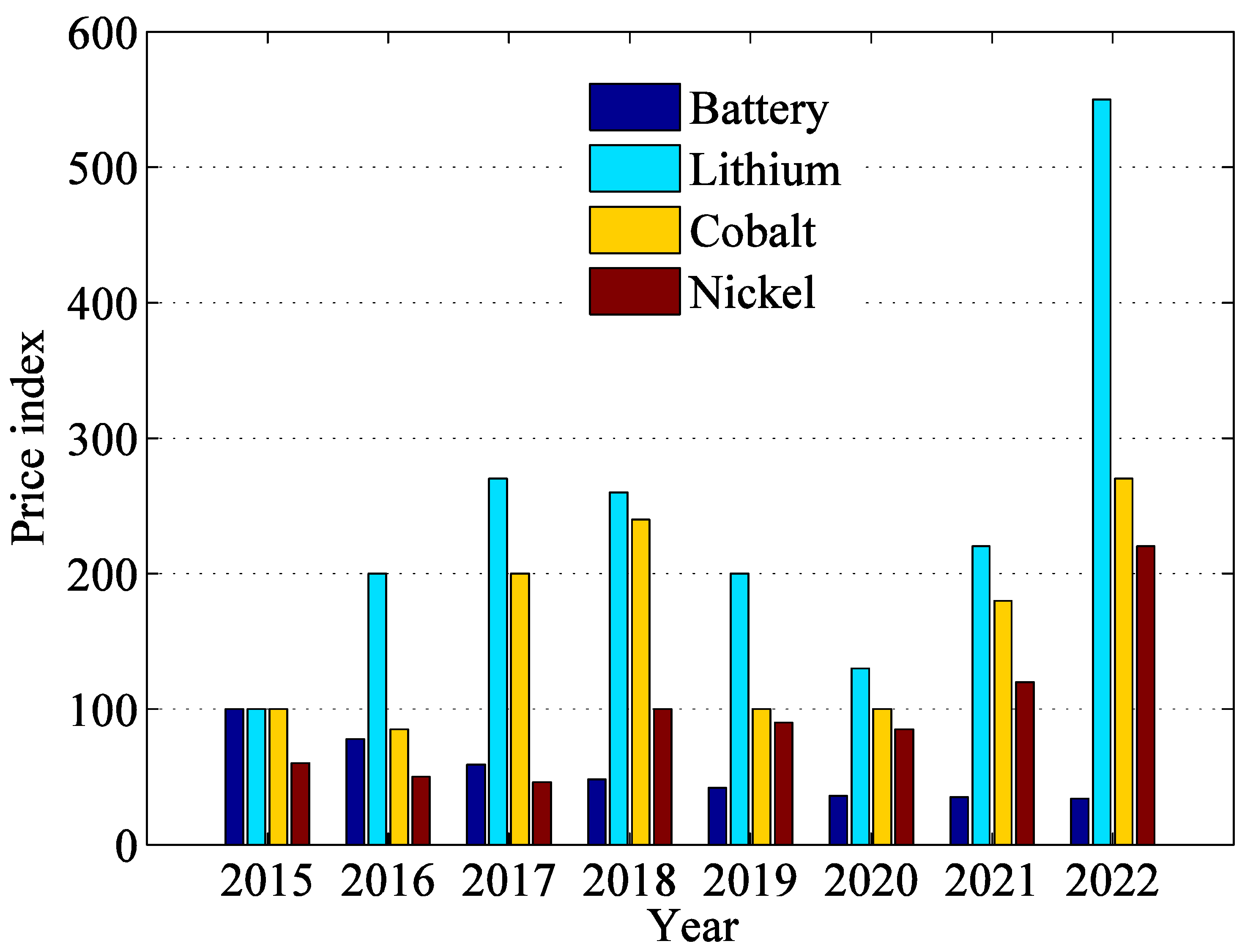

3. Battery-Grade Commodity Price Appreciation

The high demand for batteries impelled the requirement for crucial battery-grade metals. Lithium prices increased dramatically from the first quarter of 2021 to the second quarter of 2022; likewise, cobalt and nickel prices doubled. This price hike is justified by excessive demand and escalating pressure on supply chains because of shrinking supplies [40]. Production challenges due to the COVID-19 pandemic and the war between Russia–Ukraine disrupted the supply chain of core material production. The commodity price surge depends on the production and supply of the new mines and the expansion of existing ones. However, the high price of a commodity may offer some long-term benefits, such as increasing supply investments to expand the industry capacity [41]. Figure 4 shows the battery and critical battery metal price appreciation over last five years. It shows that there is an unprecedented demand of lithium followed by nickel and cobalt. Therefore, it will be difficult to further depreciate battery prices as it has been seen in 2021.

Figure 4. Battery metal price appreciation and battery price depreciation over the last eight years.

4. EV Battery Supply Chain

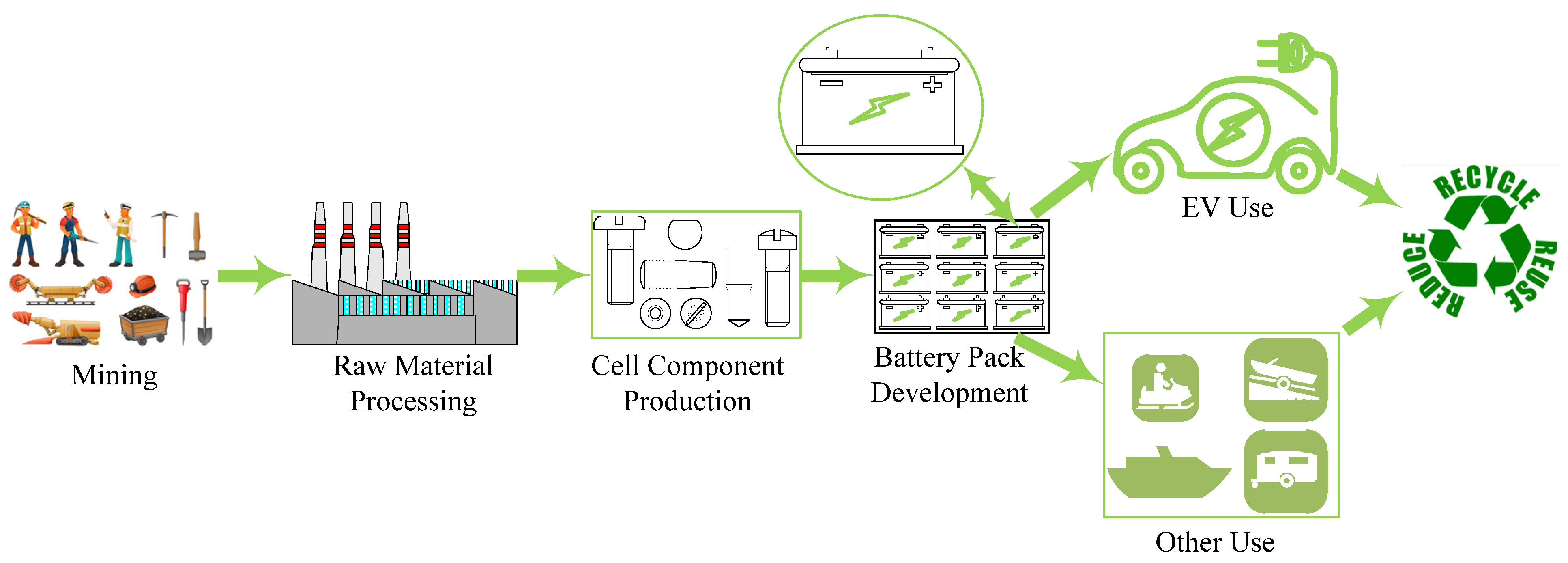

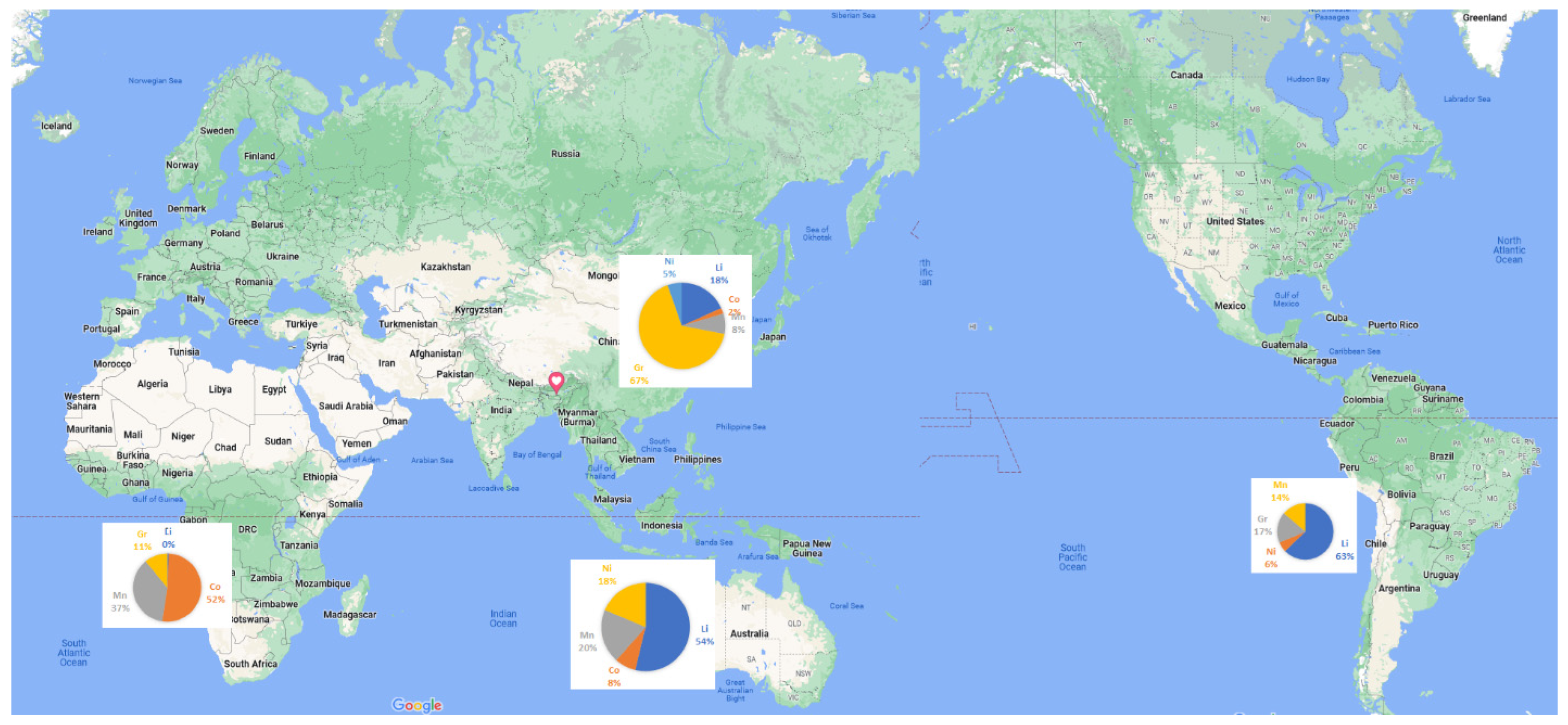

The manufacturing process of EV batteries comprises several stages, where communication with each stage is through a supply chain. The supply chain consists of the steps starting from extracting the necessary mineral ores, refining, materials’ synthesis, battery cell production, and recycling [42]. In order to comprehend the futuristic possibilities of EV batteries, it is crucial to have knowledge of the various intermediate phases in the supply chain dynamics. Figure 5 depicts the schematic representation of the process flow of EV battery manufacturing. Figure 6 illustrates the geographically concentrated material required for the EV supply chain.

Figure 5. EV battery supply chain schematic.

Figure 6. Geographical concentration of critical battery materials.

4.1. Material Mining

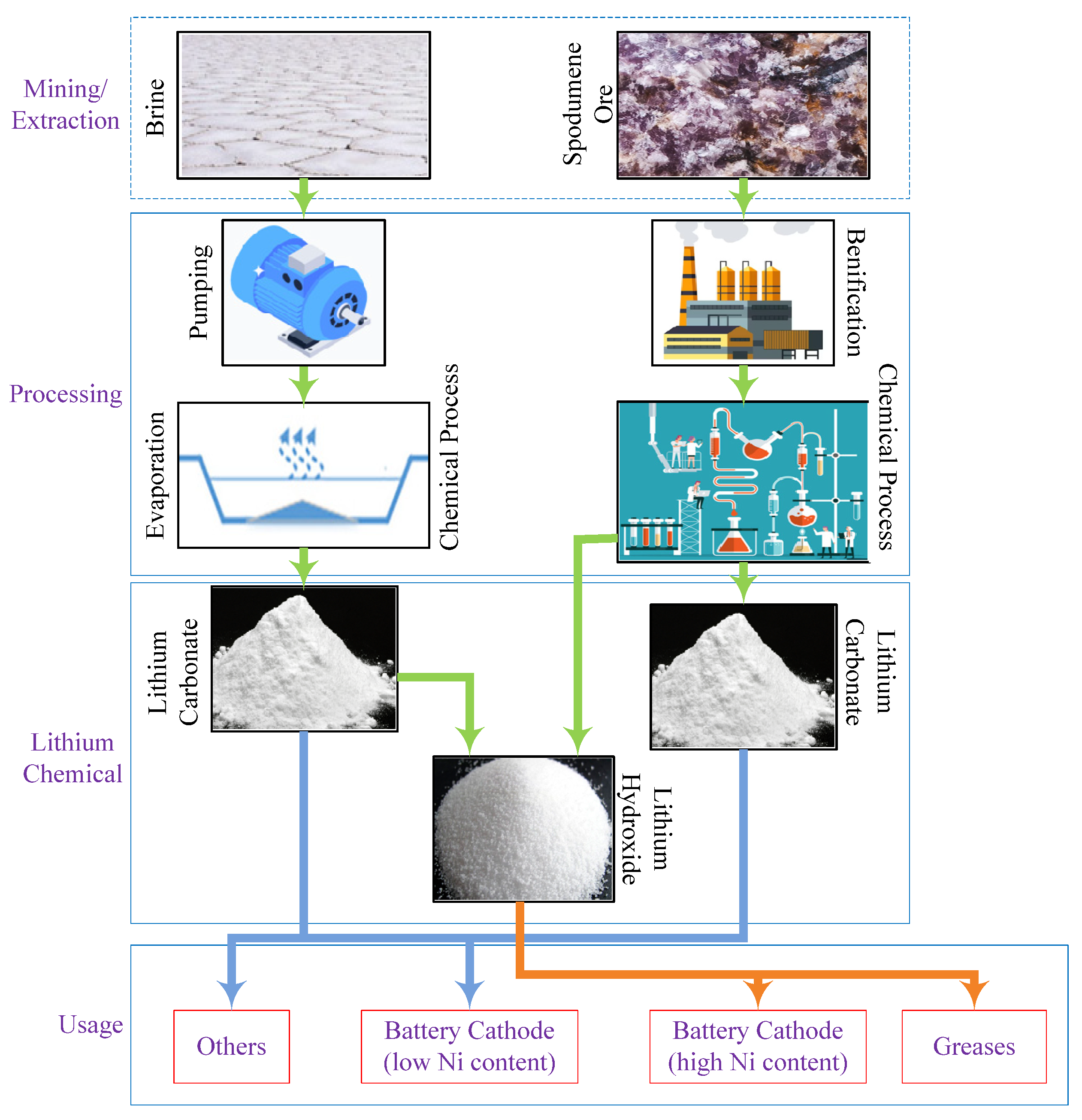

Lithium, nickel, cobalt, graphite, and manganese are the five indispensable materials required to manufacture LBs. Lithium is produced mainly from brine and hard-rock deposits (spodumene); both are used to extract specific products with differing values [43][44]. The countries rich in lithium brines are Bolivia, Argentina, and Chile. Brine deposits often contain hefty quantities of sodium, potassium, magnesium, and boron. These elements offset the costs of brine pumping and processing. The manufacturing process is divided into three distinct steps: (i) solar evaporation in shallow ponds, which takes several months to complete in order to collect lithium in the range of 1–6%; (ii) the removal of byproducts such as boron and manganese by dint of chemical processing; and (iii) the extraction of lithium carbonate. Lithium carbonate is popularly used as a primary material to design battery cathodes, targeted cathodes having a low percentage of nickel content. Lithium hydroxide is an additional essential lithium product produced by incorporating an extra process that involves heating a mixture of lithium carbonate and salt lime. Australia has the major mine fields for lithium hard rock, which is composed of lithium and aluminum. In the recent past, brine was the primary source of lithium; however, the demand surge of lithium has driven spodumene mines to accelerate recently. Lithium extraction requires a specialized mining process for mining industries. The lithium supply chain is shown in Figure 7.

Figure 7. Lithium supply chain.

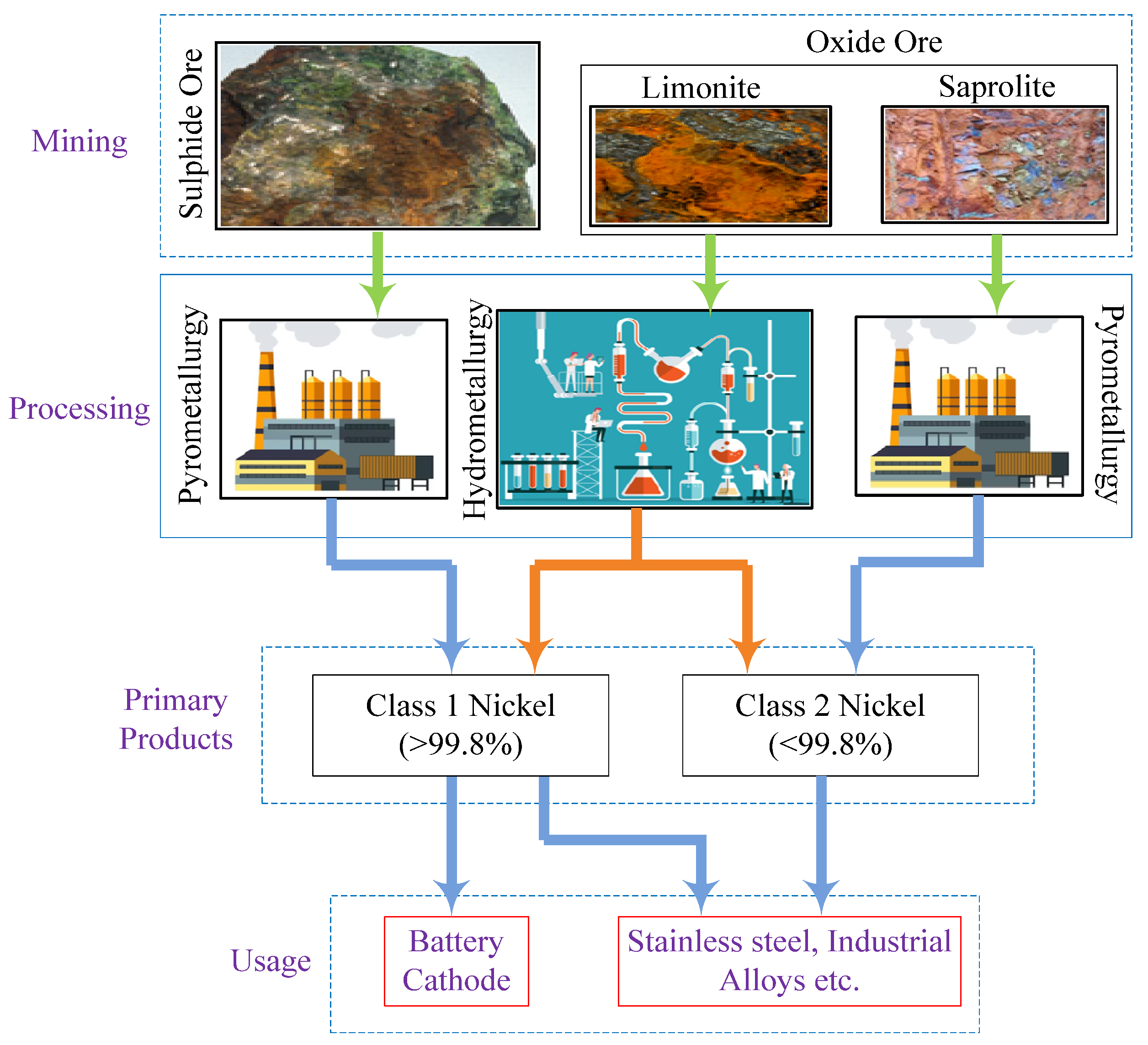

Two distinct nickel deposits are found in nature, namely: sulfide and laterite [45]. Russia, Canada, and Australia have huge sulfide deposits from which high-grade nickel can be extracted. The class-1 battery grade nickel can be quickly processed. Laterite, however, contains low-grade nickel that requires energy-intensive process steps to realize battery-grade nickel. Indonesia, the Philippines, and New Caledonia are the primary laterite sources. Unlike lithium, nickel production is relatively less concentrated. Hence, a few companies supply half of the global nickel production. Over the last five years, nickel production on a global scale has climbed by 20%, primarily due to nickel-favoring project initiatives in the Asia Pacific. Indonesia and the Philippines have implemented nickel policies, accounting for more than 45% of the global nickel production. Figure 8 illustrates the supply chain associated with the global nickel production.

Figure 8. Nickel supply chain.

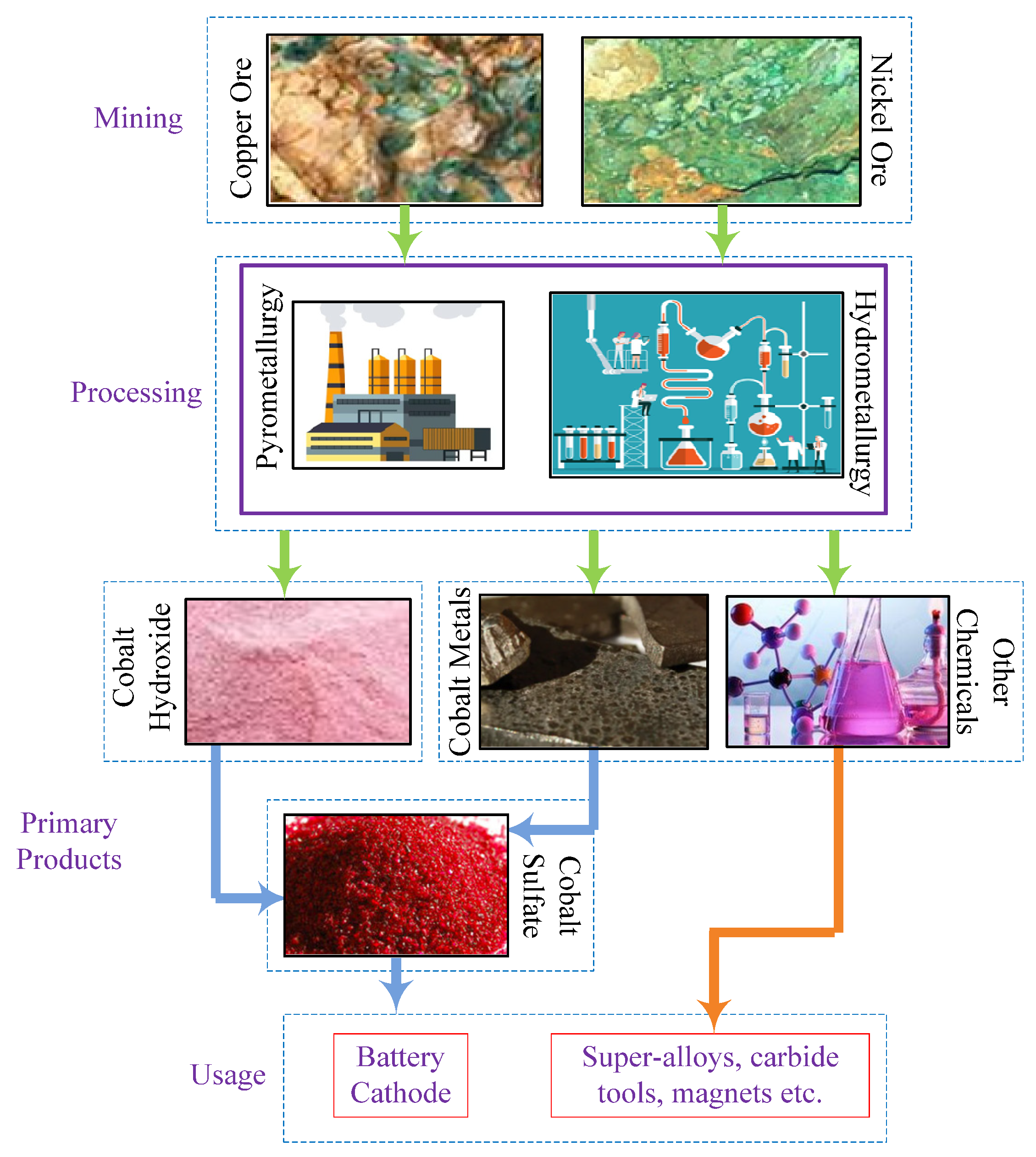

Cobalt was previously employed in constructing super-alloys, catalysts in petrochemical industries, magnets, and magnetic recording media. However, with the increasing production of EVs and nations adopting policies for sustainable mobility by transforming the automotive industry from ICEVs to EVs, a sudden surge in cobalt demand has resulted in an escalation of cobalt prices in the market. During nickel and copper mining, 60.7% and 29.3% of the cobalt used worldwide is found as a by-product [46]. The Democratic Republic of Congo and Switzerland are the primary cobalt producers, with over 70% of the world’s cobalt production being sourced from these two countries. China is the leading exporter of cobalt, processing more than 70% of the global cobalt supply, mainly imported from the Democratic Republic of Congo. Finland, Belgium, and Canada are also some of the notable cobalt producers. The supply chain involved in cobalt is illustrated in Figure 9.

Figure 9. Supply chain of cobalt.

Graphite is the dominant battery anode material; China dominates the market with 80% global supply. Some other countries, including Tanzania, Mozambique, Canada, and Madagascar, also share graphite production shares. Manganese is widely disseminated across the world compared to other battery-grade metals and is believed to meet the global supply demand. Therefore, it can be extracted at a relatively low cost. The dominant manganese ore manufacturers are South Africa, Australia, Gabon, and China.

4.2. Raw Material Processing

In order to achieve highly purified battery materials, various energy intensive processing steps are indispensable. The refining process involves an intense industrial process with heat and chemical treatment to transform raw ore into chemicals such as lithium carbonate, lithium hydroxide, or cobalt and nickel sulphate [47]. Battery-grade material processing further involves an additional process complexity. Lithium carbonate has a wide use in various lithium demands; however, it is not suitable for LBs. Lithium hydroxide is indeed more desirable for high-nickel chemistries, and it can be effortlessly extracted from hard rocks. The nickel process technology involves the method of high-pressure acid leaching (HPAL), which can produce class-1 nickel from lower-grade laterite resources [48]. Another nickel source named nickel matte can be produced from laterite resources. However, it suffers from a high level of pollution as compared to the conventional process. The raw material processing industries are highly concentrated in some geographical regions. Five companies contribute 75% of the global production of any EV battery material. Mining companies more often undertake their refining, but they may occasionally outsource it to a third party. Manganese, on the other hand, is widely spread across various geographies. China is the leading manganese supplier, accounting for about 90% of the global production capacity. Australia, Europe, Indonesia, and the USA have recently started plants to extract battery-grade manganese.

4.3. Battery Cell Components Manufacturing

A battery comprises individual components such as a cathode, an anode, electrolytes, and separators [49]. To produce these elements, sophisticated chemical processing of several materials and process engineering is required. Active battery materials need the most complex processing steps; for example, lithium hydroxide and nickel sulphate undergo multiple processes using specialized syntheses for manufacturing active cathode materials. More than 55% of cathode materials manufactured worldwide are owned by seven firms, among which Sumitomo (Tokyo, Japan), Tianjin B&M Science and Technology (Tianjin, China), Shenzhen Dynanonic (Shenzhen, China), and Ningbo Shanshan (Ningbo, China) are the major players. Unlike cathodes, graphite anode material processing is more mature and recognized. Adding small and increasing silicon fractions into the graphite anode improves the anode performance [50]. Graphite is the leading material used in anodes and can be procured naturally or developed synthetically in a laboratory. It is pertinent to mention herein that graphite involves sophisticated processing; however, it is still the preferred anode material. Natural graphite found as flakes are transformed into spherical forms to maintain homogeneity in the anode, whereas refinement of hydrocarbons is done to make synthetic graphite. Synthesis of anode materials is even more intensely focused, with four companies holding 50% of the global production. Six companies, all based in China, contribute more than 65% of the anode materials made globally. Separators are microporous membranes engineered from polyethylene or polypropylene [51]. They are often coated with ceramic to improve the safety of EVs. Separator production is also a centralized business, accounting for half of the world’s capacity. Electrolytes consist of salts and solvents, both requiring synthesis and mixing. The existing cellular component manufacturing industry is highly specialized and oriented toward producing specific components.

4.4. Battery Pack Production

There are two major stages of producing battery cells: electrode manufacturing and cell fabrication. Out of those, the cell fabrication technology is well established [52]. The process requires a highly controlled clean room to avoid unwanted impurities, thus becoming more energy intensive. Another critical aspect of these processes is to take care of pollution. Typically, low-carbon sources of electricity are used to drop emission levels during cell production. Manufactured cells are housed in a module frame, which is then integrated into a battery pack. Finally, the batteries, control system, electronic circuit system, and sensors system are encapsulated in the housing structure. The battery production industry is highly concentrated since cell production and development require a considerable capital investment. China, Korea, and Japan were the top three battery cell producers in 2021. Recently, Europe and North America have been involved in the cell manufacturing process, although mostly they are in conceptual stages.

Most cell producers in Japan and Korea are well-established corporations with years of expertise in producing batteries for consumer devices. Chinese businesses such as CATL and BYD started making cells for consumer devices in the early nineteen-nineties before making batteries for electric vehicles. Although policies for manufacturing batteries have been enacted in Europe and North America, most are currently in the planning stages. In order to meet their demands for batteries, EV manufacturing firms such as Tesla and CATL have most recently been actively engaged in mining and producing raw materials.

4.5. Battery Re-Use

In order to reuse or recycle a battery, manufacturers will need to refurbish the battery for other uses in a second life. Mainly, a battery’s second life applications involve stationary storage [53]. Typically, a used EV battery has more than 80% of its usable capacity for reuse in secondary applications [54]. It offers an added value to the battery’s materials. During refurbishing, a battery needs to disassemble from the battery pack, the module needs to be reassessed, and it needs to be repackaged for new applications. The principal cost entailed in the reuse process is the logistics involved in collecting, testing, disassembling, and repacking. Despite having an additional value, reuse faces issues from reliability, economy, regulatory, and competitive advantages [55]. Conventional retired power (RP) LBs constitute iron or aluminum; an admixture of graphite, conductor, binder, and electrolyte is layered on copper foils to serve as the retired LBs’ anode substance [56]. Aluminum foils embedded with cathode materials, conductors, polyvinylidene fluoride binders, and fluoride salts are typically used as the cathodes in RP LBs. Short contacts between the opposite electrodes are also averted using the cathode–anode separator element [57]. The recycling of retired LBs has a multitude of advantages which can be categorized into three perspectives: sustainability—it will significantly decrease resource utilization; economical—it minimizes the expense of raw material procurement; political—it lessens reliance on imports, which has protracted geopolitical implications [58]. The echelon utilization of retired LBs has recently become a focus of study. The problem of echelon utilization of large-scale RP LBs can be resolved, which has enormous benefits for the economy and the environment. The worldwide RP is predicted to surpass 600 kt by the end of 2025 [59]. If retired LBs are deserted, considering their enormous numbers, they will pollute the ecosystem, and a tremendous amount of materials will be wasted. This contravenes the 4R concept: recycle, reuse, reduce, and recover [60][61]. On the other hand, echelon utilization is thought to be one of the best options for treating RP LBs and is anticipated to become more common in the coming years of study [62]. Grid energy storage and 5G base stations are two examples of echelon utilization that can completely utilize the leftover energy in RP LBs [63].

References

- Ma, T.; Osama, A.M. Optimal charging of plugin electric vehicles for a car- park infrastructure. IEEE Trans. Ind. Appl. 2014, 50, 2323–2330.

- Barman, P.; Brian, A. Energy efficient torque allocation design emphasis on payload in a light-duty distributed drive electric vehicle. IEEE Access 2021, 9, 118684–118695.

- Martins, L.S.; Guimarães, L.F.; Junior, A.B.B.; Tenório, J.A.S.; Espinosa, D.C.R. Electric car battery: An overview on global demand, recycling and future approaches towards sustainability. J. Environ. Manag. 2021, 295, 113091.

- Bibra, E.M.; Connelly, E.; Dhir, S.; Drtil, M.; Henriot, P.; Hwang, I.; Le Marois, J.-B.; McBain, S.; Paoli, L.; Teter, J. Global EV Outlook 2022: Securing Supplies for an Electric Future; International Energy Agency: Paris, France, 2022; pp. 134–191.

- NITI Aayog and Rocky Mountain Institute. ‘India’s Energy Storage Mission: A Make-in-India Opportunity for Globally Competitive Battery Manufacturing. 2017. Available online: https://www.rmi.org/Indias-Energy-Storage-Mission (accessed on 12 March 2023).

- Daniel, C. Materials and processing for lithium-ion batteries. JOM 2008, 60, 43–48.

- Zackrisson, M.; Avellán, L.; Orlenius, J. Life cycle assessment of lithium-ion batteries for plug-in hybrid electric vehicles–Critical issues. J. Clean. Prod. 2010, 18, 1519–1529.

- Bleischwitz, R. International economics of resource productivity–Relevance, measurement, empirical trends, innovation, resource policies. Int. Econ. Econ. Policy 2010, 7, 227–244.

- Wang, H.; Xu, H.; Jones, A.K. Crucial issues in logistic planning for electric vehicle battery application service. In Proceedings of the 2010 International Conference on Optoelectronics and Image Processing, Haikou, China, 11–12 November 2010; Volume 1, pp. 362–366.

- Wadia, C.; Albertus, P.; Srinivasan, V. Resource constraints on the battery energy storage potential for grid and transportation applications. J. Power Sources 2011, 196, 1593–1598.

- Wanger, T.C. The Lithium future—Resources, recycling, and the environment. Conserv. Lett. 2011, 4, 202–206.

- Wray, P. Lithium Lowdown. Am. Ceram. Soc. Bull. 2009, 88, 17–24.

- Majeau-Bettez, G.; Hawkins, T.R.; Strømman, A.H. Life cycle environmental assessment of lithium-ion and nickel metal hydride batteries for plug-in hybrid and battery electric vehicles. Environ. Sci. Technol. 2011, 45, 4548–4554.

- Paul, W.G.; Medina, P.A.; Keoleian, G.A.; Kesler, S.E.; Everson, M.P.; Wallington, T.J. Global Lithium Availability. J. Ind. Ecol. 2011, 15, 760–775.

- Bruno, S.; Garche, J. Lithium Batteries: Status, Prospects and Future. J. Power Sources 2010, 195, 2419–2430.

- Hua, Y.; Zhou, S.; Huang, Y.; Liu, X.; Ling, H.; Zhou, X.; Zhang, C.; Yang, S. Sustainable value chain of retired lithium-ion batteries for electric vehicles. J. Power Sources 2020, 478, 228753.

- Mossali, E.; Picone, N.; Gentilini, L.; Rodrìguez, O.; Pérez, J.M.; Colledani, M. Lithium-ion batteries towards circular economy: A literature review of opportunities and issues of recycling treatments. J. Environ. Manag. 2020, 264, 110500.

- Martyushev, N.V.; Malozyomov, B.V.; Sorokova, S.N.; Efremenkov, E.A.; Qi, M. Mathematical Modeling of the State of the Battery of Cargo Electric Vehicles. Mathematics 2023, 11, 536.

- Martyushev, N.V.; Malozyomov, B.V.; Khalikov, I.H.; Kukartsev, V.A.; Kukartsev, V.V.; Tynchenko, V.S.; Tynchenko, Y.A.; Qi, M. Review of Methods for Improving the Energy Efficiency of Electrified Ground Transport by Optimizing Battery Consumption. Energies 2023, 16, 729.

- Melin, H.E. The Lithium-Ion Battery Life Cycle Report 2021; Circular Energy Storage: London, UK, 2021.

- Melin, H.E. The Lithium-Ion Battery End-Of-Life Market 2018–2025; Circular Energy Storage: London, UK, 2018.

- EV-Volumes’. Available online: https://www.ev-volumes.com/ (accessed on 2 August 2022).

- Rajaeifar, M.A.; Ghadimi, P.; Raugei, M.; Wu, Y.; Heidrich, O. Challenges and recent developments in supply and value chains of electric vehicle batteries: A sustainability perspective. Resour. Conserv. Recycl. 2022, 180, 106144.

- Olivetti, E.A.; Ceder, G.; Gaustad, G.G.; Fu, X. Lithium-ion battery supply chain considerations: Analysis of potential bottlenecks in critical metals. Joule 2017, 1, 229–243.

- Lai, X.; Chen, Q.; Tang, X.; Zhou, Y.; Gao, F.; Guo, Y.; Bhagat, R.; Zheng, Y. Critical review of life cycle assessment of lithium-ion batteries for electric vehicles: A lifespan perspective. eTransportation 2022, 12, 100169.

- Shahjalal, M.; Roy, P.K.; Shams, T.; Fly, A.; Chowdhury, J.I.; Ahmed, M.R.; Liu, K. A review on second-life of Li-ion batteries: Prospects, challenges, and issues. Energy 2022, 241, 122881.

- Miao, Y.; Liu, L.; Zhang, Y.; Tan, Q.; Li, J. An overview of global power lithium-ion batteries and associated critical metal recycling. J. Hazard. Mater. 2022, 425, 127900.

- Eftekhari, A. Lithium batteries for electric vehicles: From economy to research strategy. ACS Sustain. Chem. Eng. 2019, 7, 5602–5613.

- Kavanagh, L.; Keohane, J.; Garcia Cabellos, G.; Lloyd, A.; Cleary, J. Global lithium sources—Industrial use and future in the electric vehicle industry: A review. Resources 2018, 7, 57.

- Huang, B.; Pan, Z.; Su, X.; An, L. Recycling of lithium-ion batteries: Recent advances and perspectives. J. Power Sources 2018, 399, 274–286.

- Kamali-Heidari, E.; Kamyabi-Gol, A.; Heydarzadeh Sohi, M.; Ataie, A. Electrode materials for lithium ion batteries: A review. J. Ultrafine Grained Nanostructured Mater. 2018, 51, 1–12.

- Bhowmick, S. A Detailed Comparison of Popular Li-ion Battery Chemistries used in Electric Vehicles. 11 April 2022. Available online: https://circuitdigest.com/article/a-detailed-comparision-of-popular-li-ion-battery-chemistries-used-in-evs (accessed on 12 January 2023).

- Xianlai, Z.; Li, J.; Shen, B. Novel approach to recover cobalt and lithium from spent lithium-ion battery using oxalic acid. J. Hazard. Mater. 2015, 295, 112–118.

- Unlocking Growth in Battery Cell Manufacturing for Electric Vehicles. Available online: https://www.mckinsey.com/business-functions/operations/our-insights/unlocking-growth-in-battery-cell-manufacturing-for-electric-vehicles (accessed on 2 August 2022).

- Du, Z.; Dunlap, R.A.; Obrovac, M.N. High energy density calendered Si alloy/graphite anodes. J. Electrochem. Soc. 2014, 161, A1698.

- Brand, M.; Gläser, S.; Geder, J.; Menacher, S.; Obpacher, S.; Jossen, A.; Quinger, D. Electrical safety of commercial Li-ion cells based on NMC and NCA technology compared to LFP technology. World Electr. Veh. J. 2013, 6, 572–580.

- Shchurov, N.I.; Dedov, S.I.; Malozyomov, B.V.; Shtang, A.A.; Martyushev, N.V.; Klyuev, R.V.; Andriashin, S.N. Degradation of lithium-ion batteries in an electric transport complex. Energies 2021, 14, 8072.

- Wang, M.; Liu, K.; Dutta, S.; Alessi, D.S.; Rinklebe, J.; Ok, Y.S.; Tsang, D.C. Recycling of lithium iron phosphate batteries: Status, technologies, challenges, and prospects. Renew. Sustain. Energy Rev. 2022, 163, 112515.

- Wang, H.; Xu, H.; Zhao, Z.; Wang, Q.; Jin, C.; Li, Y.; Du, Z.; Feng, X. An experimental analysis on thermal runaway and its propagation in Cell-to-Pack lithium-ion batteries. Appl. Therm. Eng. 2022, 211, 118418.

- Supply Chain Intelligence. Available online: https://www.spglobal.com/marketintelligence/en/ (accessed on 2 August 2022).

- Available online: https://about.bnef.com/blog/battery-pack-prices-fall-to-an-average-of-132-kwh-but-rising-commodity-prices-start-to-bite/ (accessed on 2 August 2022).

- Rajaeifar, M.A.; Heidrich, O.; Ghadimi, P.; Raugei, M.; Wu, Y. Sustainable supply and value chains of electric vehicle batteries. Resour. Conserv. Recycl. 2020.

- Tadesse, B.; Makuei, F.; Albijanic, B.; Dyer, L. The beneficiation of lithium minerals from hard rock ores: A review. Miner. Eng. 2019, 131, 170–184.

- Jiankang, L.; Tianren, Z.; Xifang, L.; Denghong, W.; Xin, D. The metallogenetic regularities of lithium deposits in China. Acta Geol. Sin. 2015, 89, 652–670.

- Mudd, G.M. Global trends and environmental issues in nickel mining: Sulfides versus laterites. Ore Geol. Rev. 2010, 38, 9–26.

- Ryu, H.H.; Sun, H.H.; Myung, S.T.; Yoon, C.S.; Sun, Y.K. Reducing cobalt from lithium-ion batteries for the electric vehicle era. Energy Environ. Sci. 2021, 14, 844–852.

- Kelly, J.C.; Wang, M.; Dai, Q.; Winjobi, O. Energy, greenhouse gas, and water life cycle analysis of lithium carbonate and lithium hydroxide monohydrate from brine and ore resources and their use in lithium ion battery cathodes and lithium ion batteries. Resour. Conserv. Recycl. 2021, 174, 105762.

- Guo, X.Y.; Shi, W.T.; Dong, L.I.; Tian, Q.H. Leaching behavior of metals from limonitic laterite ore by high pressure acid leaching. Trans. Nonferrous Met. Soc. China 2011, 21, 191–195.

- Saariluoma, H.; Piiroinen, A.; Unt, A.; Hakanen, J.; Rautava, T.; Salminen, A. Overview of optical digital measuring challenges and technologies in laser welded components in ev battery module design and manufacturing. Batteries 2020, 6, 47.

- Wu, J.; Cao, Y.; Zhao, H.; Mao, J.; Guo, Z. The critical role of carbon in marrying silicon and graphite anodes for high-energy lithium-ion batteries. Carbon Energy 2019, 1, 57–76.

- Liang, X.; Yang, Y.; Jin, X.; Cheng, J. Polyethylene oxide-coated electrospun polyimide fibrous seperator for high-performance lithium-ion battery. J. Mater. Sci. Technol. 2016, 32, 200–206.

- Tagawa, K.; Brodd, R.J. Production processes for fabrication of lithium-ion batteries. In Lithium-Ion Batteries; Springer: New York, NY, USA, 2009; pp. 181–194.

- Ahmadi, L.; Young, S.B.; Fowler, M.; Fraser, R.A.; Achachlouei, M.A. A cascaded life cycle: Reuse of electric vehicle lithium-ion battery packs in energy storage systems. Int. J. Life Cycle Assess. 2017, 22, 111–124.

- Wang, N.; Garg, A.; Su, S.; Mou, J.; Gao, L.; Li, W. Echelon Utilization of Retired Power Lithium-Ion Batteries: Challenges and Prospects. Batteries 2022, 8, 96.

- Faessler, B. Stationary, second use battery energy storage systems and their applications: A research review. Energies 2021, 14, 2335.

- Wakihara, M. Recent developments in lithium ion batteries. Mater. Sci. Eng. R Rep. 2001, 33, 109–134.

- Zhang, T.; He, Y.; Wang, F.; Ge, L.; Zhu, X.; Li, H. Chemical and process mineralogical characterizations of spent lithium-ion batteries: An approach by multi-analytical techniques. Waste Manag. 2014, 34, 1051–1058.

- Gaines, L.; Richa, K.; Spangenberger, J. Key issues for Li-ion battery recycling. MRS Energy Sustain. 2018, 5, 12.

- Li, C.; Wang, N.; Li, W.; Li, Y.; Zhang, J. Regrouping and echelon utilization of retired lithium-ion batteries based on a novel support vector clustering approach. IEEE Trans. Transp. Electrif. 2022, 8, 3648–3658.

- Yu, K.; Gong, Y. Exploration on Ecological Restoration Model for the Improvement of Ecosystem Services of Yellow River Flood plains—A Case Study of Zhengzhou Yellow River Floodplain Park Planning and Design. Landsc. Archit. Front. 2021, 9, 86–97.

- Zhang, X.; Li, L.; Fan, E.; Xue, Q.; Bian, Y.; Wu, F.; Chen, R. Toward sustainable and systematic recycling of spent rechargeable batteries. Chem. Soc. Rev. 2018, 47, 7239–7302.

- Cusenza, M.A.; Guarino, F.; Longo, S.; Mistretta, M.; Cellura, M. Reuse of electric vehicle batteries in buildings: An integrated load match analysis and life cycle assessment approach. Energy Build. 2019, 186, 339–354.

- Wang, L.; Wang, X.; Yang, W. Optimal design of electric vehicle battery recycling network—From the perspective of electricvehicle manufacturers. Appl. Energy 2020, 275, 115328.

More

Information

Subjects:

Engineering, Electrical & Electronic

Contributors

MDPI registered users' name will be linked to their SciProfiles pages. To register with us, please refer to https://encyclopedia.pub/register

:

View Times:

2.3K

Revisions:

2 times

(View History)

Update Date:

30 Jun 2023

Notice

You are not a member of the advisory board for this topic. If you want to update advisory board member profile, please contact office@encyclopedia.pub.

OK

Confirm

Only members of the Encyclopedia advisory board for this topic are allowed to note entries. Would you like to become an advisory board member of the Encyclopedia?

Yes

No

${ textCharacter }/${ maxCharacter }

Submit

Cancel

Back

Comments

${ item }

|

More

No more~

There is no comment~

${ textCharacter }/${ maxCharacter }

Submit

Cancel

${ selectedItem.replyTextCharacter }/${ selectedItem.replyMaxCharacter }

Submit

Cancel

Confirm

Are you sure to Delete?

Yes

No