| Version | Summary | Created by | Modification | Content Size | Created at | Operation |

|---|---|---|---|---|---|---|

| 1 | Aiman Albatayneh | -- | 3951 | 2023-04-24 15:12:17 | | | |

| 2 | Sirius Huang | Meta information modification | 3951 | 2023-04-25 03:53:43 | | |

Video Upload Options

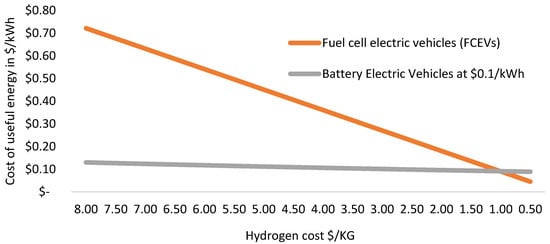

The negative consequences of toxic emissions from internal combustion engines, energy security, climate change, and energy costs have led to a growing demand for clean power sources in the automotive industry. Developing eco-friendly vehicle technologies, such as electric and hydrogen vehicles, has increased. The researchers investigate whether hydrogen vehicles will replace electric vehicles in the future. The results showed that fuel-cell cars are unlikely to compete with electric cars. This is due to the advancements in electric vehicles and charging infrastructure, which are becoming more cost-effective and efficient. Additionally, the technical progress in Battery Electric Vehicles (BEVs) is expected to reduce the market share of Fuel-Cell Electric Vehicles (FCEVs) in passenger vehicles. However, there are significant investments in hydrogen cars. Many ongoing investments seem to follow the sunk cost fallacy, where decision-makers continue to invest in an unprofitable project due to the already invested resources. Furthermore, even with megawatt charging, fuel-cell trucks cost more than battery-powered electric trucks. The use cases for fuel-cell electric trucks are also much more limited, as their running expenses are higher compared to electric cars. Hydrogen vehicles may be beneficial for heavy transport in remote areas. However, it remains to be seen if niche markets are large enough to support fuel-cell electric truck commercialization and economies of scale. In summary, researchers believe hydrogen vehicles will not replace electric cars and trucks, at least before 2050.

1. Electric vs. Hydrogen Automobile

2. Comparison between Fuel-Cell Electric Vehicles (FCEVs) and Battery Electric Vehicles (BEVs)

Fuel cell electric vehicles (FCEVs), sometimes called passenger cars, no longer play as significant a role in the passenger transportation sector as they previously did due to technological improvements. Many present investments in hydrogen autos appear to be directed by the sunk cost fallacy, which claims that we have already spent a substantial amount of money creating this technology. However, because economies of scale are already in place for batteries and electric vehicles, and charging infrastructure will get cheaper and better soon, it is doubtful that fuel cell cars will be able to compete.

The cost of owning a fuel-cell truck would be higher than that of a battery-powered car that can be charged at a high capacity. Moreover, truck operational expenses are more critical than cars, making a case for fuel-cell electric vehicles even weaker. Despite this, hydrogen-powered vehicles may be advantageous for transporting heavy loads in sparsely populated areas. The challenge lies in determining whether these specialized markets are large enough to drive the commercialization and cost-effectiveness of fuel-cell electric trucks and the required supporting infrastructure. By 2030, carbon-neutral biofuels or renewable synthetic fuels may be an option for powering such applications, depending on the market demand for these niche areas. Such vehicles will never be able to compete in the market for low-carbon road transportation until truck manufacturers begin mass-producing fuel cell trucks as soon as feasible to reduce production costs. Politicians and business leaders need to decide as soon as possible if the market for fuel-cell electric trucks is big enough to justify more research and development into hydrogen technology or if it is time to give up and focus on something else.

The need for clean power sources in-vehicle technology is increasing due to the negative consequences of toxic emissions from internal combustion engines. Electric and hydrogen vehicles are the two leading eco-friendly automobile technologies being developed. The researchers investigated whether hydrogen vehicles will replace electric vehicles. The results showed that fuel-cell cars are unlikely to compete with electric cars due to the cost reductions and performance improvements in electric vehicles and charging infrastructure. However, hydrogen vehicles may be helpful for heavy transport in remote areas. However, the market for fuel-cell electric trucks is limited, and their use cases are much more limited compared to battery-powered electric trucks. In conclusion, hydrogen vehicles will not replace electric vehicles before 2050.

References

- Wang, Y.; Cheng, X. Advantages and challenges of hydrogen fuel cell vehicles. Energy Convers. Manag. 2016, 121, 19–26.

- Bridle, I.; Hoekstra, R.; Junginger, M. A review of the current status and future prospects of electric vehicles. Renew. Sustain. Energy Rev. 2019, 107, 401–416.

- Lammert, M.; Bøhmer, T.; Fjellestad, J. Hydrogen fuel cell electric vehicles: Current state and future prospects. Renew. Sustain. Energy Rev. 2018, 82, 816–833.

- Kenny, J.K.; Breske, S.; Singstock, N.R. Hydrogen-powered vehicles for autonomous ride-hailing fleets. Int. J. Hydrogen Energy 2022, 47, 9422–9427.

- Brunet, J.; Kotelnikova, A.; Ponssard, J.P. The deployment of BEV and FCEV in 2015. Ph.D. Thesis, Department of Economics, Ecole Polytechnique, CNRS, Palaiseau, France, 2015.

- Battery Electric vs. Hydrogen—Which Is the Future for Electric Vehicles? Available online: https://www.lexology.com/library/detail.aspx?g=1bf1cbf0-ac2f-4b39-a3de-2df77a9a515e (accessed on 5 December 2022).

- Gnann, T.; Plötz, P.; Kühn, A.; Wietschel, M. How to decarbonise heavy road transport. Accessed Novemb. 2017, 16, 2020.

- Chakraborty, S.; Kumar, N.M.; Jayakumar, A.; Dash, S.K.; Elangovan, D. Selected Aspects of Sustainable Mobility Reveals Implementable Approaches and Conceivable Actions. Sustainability 2021, 13, 12918.

- Birol, F. The Future of Hydrogen: Seizing Today’s Opportunities; IEA Report Prepared for the G; IEA: Paris, France, 2019; p. 20.

- Council, H. IEA Hydrogen TCP refocuses on hydrogen use, wider collaboration. Fuel Cells Bull. 2020, 2020, 14.

- Steward, D.; Ramsden, T.; Zuboy, J. H2A Production Model, Version 2 User Guide; National Renewable Energy Laboratory (NREL): Golden, CO, USA, 2008.

- Bloomberg, N.E.F. Battery Prices and Market Development. 2020. Available online: https://www.energy-storage.news/bloombergnef-average-battery-pack-prices-to-drop-below-us100-kwh-by-2024-despite-near-term-spikes/ (accessed on 27 January 2023).

- Martin, J. Fueling a Clean Transportation Future: Smart Fuel Choices for a Warming World. Union of Concerned Scientists. 2016. Available online: https://www.ucsusa.org/sites/default/files/attach/2016/02/Fueling-Clean-Transportation-Future-full-report.pdf (accessed on 27 March 2023).

- Beaudet, A.; Larouche, F.; Amouzegar, K.; Bouchard, P.; Zaghib, K. Key challenges and opportunities for recycling electric vehicle battery materials. Sustainability 2020, 12, 5837.

- National Renewable Energy Laboratory. The Cost of Automotive Fuel Cell Stacks for Transportation. 2020. Available online: https://www.nrel.gov/docs/fy21osti/79617.pdf (accessed on 27 January 2023).

- Minutillo, M.; Perna, A.; Forcina, A.; Di Micco, S.; Jannelli, E. Analyzing the levelized cost of hydrogen in refueling stations with on-site hydrogen production via water electrolysis in the Italian scenario. Int. J. Hydrogen Energy 2021, 46, 13667–13677.

- Dash, S.K.; Ray, P.K. Photovoltaic tied unified power quality conditioner topology based on a novel notch filter utilized control algorithm for power quality improvement. Trans. Inst. Meas. Control 2019, 41, 1912–1922.

- Ala, G.; Castiglia, V.; Di Filippo, G.; Miceli, R.; Romano, P.; Viola, F. From electric mobility to hydrogen mobility: Current state and possible future expansions. In Proceedings of the 2020 IEEE 20th Mediterranean Electrotechnical Conference (MELECON), Palermo, Italy, 16–18 June 2020; IEEE: Piscataway, NJ, USA, 2020; pp. 1–6.

- Fuel Cell Technologies Office. Fuel Cells 2015. Available online: https://www.energy.gov/eere/fuelcells/articles/fuel-cell-technologies-office-2015-recap-and-year-ahead (accessed on 5 December 2022).

- EU Commission. European Commission Press Release 2018 Database. Available online: https://ec.europa.eu/commission/presscorner/detail/en/IP_18_3708 (accessed on 5 December 2022).

- Albatayneh, A.; Assaf, M.N.; Alterman, D.; Jaradat, M. Comparison of the overall energy efficiency for internal combustion engine vehicles and electric vehicles. Rigas Teh. Univ. Zinat. Raksti 2020, 24, 669–680.

- Moro, A.; Lonza, L. Electricity carbon intensity in European Member States: Impacts on GHG emissions of electric vehicles. Transp. Res. Part D Transp. Environ. 2018, 64, 5–14.

- Harrison, G.; Gómez Vilchez, J.J.; Thiel, C. Industry strategies for the promotion of E-mobility under alternative policy and economic scenarios. Eur. Transp. Res. Rev. 2018, 10, JRC107869.

- Hydrogen or Battery? A Clear Case, Until Further Notice. Volkswagen Website. 2019. Available online: https://www.volkswagenag.com/en/news/stories/2019/08/hydrogen-or-battery--that-is-the-question.html (accessed on 4 December 2022).

- RP. Hydrogen Trucks ‘Unable to Compete’ on Cost with Fully-Electric in Race to Decarbonise Road Freight, Recharge. 2022. Available online: https://www.rechargenews.com/energy-transition/hydrogen-trucks-unable-to-compete-on-cost-with-fully-electric-in-race-to-decarbonise-road-freight/2-1-1298414 (accessed on 29 January 2023).

- Schoots, K.; Ferioli, F.; Kramer, G.J.; Van der Zwaan, B.C. Learning curves for hydrogen production technology: An assessment of observed cost reductions. Int. J. Hydrogen Energy 2008, 33, 2630–2645.

- Schmidt, O.; Hawkes, A.; Gambhir, A.; Staffell, I. The future cost of electrical energy storage based on experience rates. Nat. Energy 2017, 6, 17110.

- Jaradat, M.; Alsotary, O.; Juaidi, A.; Albatayneh, A.; Alzoubi, A.; Gorjian, S. Potential of Producing Green Hydrogen in Jordan. Energies 2022, 15, 9039.

- Hydrogen Insights A Perspective on Hydrogen Investment, Market Development (No Date). Available online: https://hydrogencouncil.com/en/hydrogen-insights-2021/ (accessed on 29 January 2023).

- Visualizing the Freefall in Electric Vehicle Battery Prices, M.I.N.I.N.G.C.O.M. 2021. Available online: https://www.mining.com/web/visualizing-the-freefall-in-electric-vehicle-battery-prices/#:~:text=According%20to%20Wright’s%20Law%2C%20also,cumulative%20doubling%20of%20units%20produced (accessed on 29 January 2023).

- Shahan, B.Z. Chart: Why Battery Electric Vehicles Beat Hydrogen Electric Vehicles without Breaking a Sweat, CleanTechnica. 2021. Available online: https://cleantechnica.com/2021/02/01/chart-why-battery-electric-vehicles-beat-hydrogen-electric-vehicles-without-breaking-a-sweat/ (accessed on 30 January 2023).

- Hydrogen Economy Outlook—Data.Bloomberglp.Com (No Date). Available online: https://data.bloomberglp.com/professional/sites/24/BNEF-Hydrogen-Economy-Outlook-Key-Messages-30-Mar-2020.pdf?__ac_lkid=5394-618-c9f4-d98175ba2ab2c7 (accessed on 30 January 2023).

- Aguilar, P.; Groß, B. Battery electric vehicles and fuel cell electric vehicles, an analysis of alternative powertrains as a mean to decarbonise the transport sector. Sustain. Energy Technol. Assess. 2022, 53, 102624.

- Wipke, K.; Sprik, S.; Kurtz, J.; Ramsden, T.; Ainscough, C.; Saur, G. National Fuel Cell Electric Vehicle Learning Demonstration Final Report; NREL: Golden, CO, USA, 2012.

- Offer, G.J.; Howey, D.; Contestabile, M.; Clague, R.; Brandon, N.P. Comparative analysis of battery electric, hydrogen fuel cell and hybrid vehicles in a future sustainable road transport system. Energy Policy 2010, 38, 24–29.

- Feng, Y.; Yang, J.; Dong, Z. Fuel selections for electrified vehicles: A well-to-wheel analysis. World Electr. Veh. J. 2021, 12, 151.

- Cox, B.; Bauer, C.; Beltran, A.M.; van Vuuren, D.P.; Mutel, C.L. Life cycle environmental and cost comparison of current and future passenger cars under different energy scenarios. Appl. Energy 2020, 269, 115021.

- Liu, Z.; Song, J.; Kubal, J.; Susarla, N.; Knehr, K.W.; Islam, E.; Nelson, P.; Ahmed, S. Comparing total cost of ownership of battery electric vehicles and internal combustion engine vehicles. Energy Policy 2021, 158, 112564.

- IEA. Global EV Outlook 2020. 2020. Available online: https://www.iea.org/reports/global-ev-outlook-2020 (accessed on 27 January 2023).

- KPMG. Electric Vehicle Outlook 2020; KPMG: Amsterdam, The Netherlands, 2020.

- Liu, Y.; Li, Y.; Li, Z. A review of hydrogen fuel cell vehicles: Current status and future prospects. Energy 2021, 214, 118611.

- Wang, X.; Cheng, L. Hydrogen fuel cell vehicles: A review of technical challenges and research progress. Renew. Sustain. Energy Rev. 2020, 140, 110491.