| Version | Summary | Created by | Modification | Content Size | Created at | Operation |

|---|---|---|---|---|---|---|

| 1 | Jui-Ning Chang | -- | 1464 | 2023-01-04 10:25:34 | | | |

| 2 | Jui-Ning Chang | + 211 word(s) | 1675 | 2023-01-04 10:34:28 | | | | |

| 3 | Catherine Yang | -9 word(s) | 1666 | 2023-01-05 02:25:26 | | | | |

| 4 | Catherine Yang | -9 word(s) | 1666 | 2023-01-05 02:25:40 | | | | |

| 5 | Catherine Yang | + 2 word(s) | 1668 | 2023-01-05 02:26:06 | | |

Video Upload Options

By 2020, there were 30 countries that had already implemented or were scheduled to implement a carbon tax, including South Africa and Singapore, both of which began to implement their carbon tax in 2019. At the end of 2019, the European Union (EU) adopted the European Green Deal. The EU aims to achieve a legally binding target of net zero greenhouse gas (GHG) emissions by 2050 through the adoption of the European Climate Law. The EU is also introducing the Carbon Border Adjustment Mechanism (CBAM) to prevent carbon leakage from other countries into the EU and encourage carbon taxation in other countries. The research retrospectively analyzed the structural path dependence and other difficulties that were faced during Taiwan’s attempted transitions toward a low-carbon economy. In combination with the common issues among developmental states, the technocratic decision-making in East Asia and the high-carbon industries have shaped the carbon lock-in effect to a certain degree. Additionally, the case of Taiwan illustrates how long-term low energy prices and wages are structured. Our study analysis showed that a brown economy reinforces the carbon lock-in effect and delays low-carbon transitions, resulting in the stagnation of attempts for sustainable economic transformation. Unless major external forces that are sufficient to break the deadlock are introduced, genuine low-carbon reforms seem unlikely.

1. Introduction

Transitions away from pre-existing social systems face challenges in path dependence. These challenges range from cognitive and institutional issues to technical and economic problems. These complicated and persistent barriers to change are deeply embedded within society. They hinder social and economic transitions and keep nations locked onto specific tracks. With the challenges of technological bias, dominated networks, and administrative agency in play, social transformations and technological innovations become hampered[1][2].

This study mainly aimed to explore what kind of industrial, social, and political factors caused the three windows of opportunity that emerged in Taiwan to fail and illuminate their structural difficulties, including the low-carbon transition challenges that are faced in Taiwan. Under this framework, this study first analyzed the development of high-carbon industries in Taiwan since the late 1990s, especially the petrochemical industry, which drove the increase in Taiwan’s carbon emissions from 1996 to 2017 and established its high-carbon economic structure. Secondly, this study investigated how high-carbon industries and the brown economy have inherently generated institutional, cognitive, and techno-institutional complex (TIC) lock-ins under the combination of the government, industry, and the Chinese National Federation of Industries (CNFI), which has resulted in path dependence and has locked Taiwan into its current development track and hindered its transformation. Thirdly, this study analyzed the contexts and problems of the three windows of opportunity for energy taxation, examined the fundamental challenges of the low-carbon transition, and reflected on the similar challenges that are faced by newly industrialized/industrializing countries from a broad perspective.

2. The Impact of High carbon regime on Taiwan’s energy transitions

Unruh explored how post-industrial economies could be locked into dependency on fossil fuel energy via the techno-institutional complex (TIC) [3]. The TIC comprises the systemic interactions between the elements of large and complex technological systems and powerful institutions. In turn, this kind of path dependence cements the carbon lock-in effect. Large-scale technical systems, such as the electricity system, are deeply embedded in both public and private organizations and create, deploy, and expand interests derived from the TIC. Once the TIC is established, this kind of complex becomes difficult to disengage from, leading societies to reject even the possibility of transition.

Seto et al.[4] similarly suggested that the carbon lock-in effect could be attributed to the intertwined nature of technology, organizations, and behavior patterns. The interplay between these factors has enabled public and private organizations to construct basic infrastructures and technologies that have a long history of high carbon emissions. They have achieved this through large-scale investments, scientific research efforts, and policy support. In turn, the constant increases in returns on these investments have consolidated the high-carbon system and the resulting inertia has only made actors in the system even more unwilling to initiate low-carbon transitions.

Moreover, lock-in effects are mutually reinforcing, and systemic inertia is not individual but collective. The carbon lock-in effect does not exist autonomously, but rather it is strengthened by systemic interactions within the TIC. Therefore, identifying and breaking away from the carbon lock-in effect is fundamentally time-consuming. However, it is still possible to drive transitions toward carbon lock-out if enabling environments are created and external pressure is applied [5][6]. The enabling environments need large-scale in-vestments and flexible policies. The application of external pressure requires attentive and motivated stakeholders and the creation of a window of opportunity [4] .

Aghion et al.[7] mainly focused on analyzing path dependence in innovation processes. Powerful network effects and high switching costs create path dependence and delay the deployment and adoption of clean technologies. Therefore, institutions should ideally be capable of designing policy instruments that can limit lobbying, rent-seeking, and the control of governments by high-carbon industries.

Pierson [8] argued that the combination of the central role of change-resistant institutions, the use of political authority to magnify power asymmetries, and the ambiguities that arise in political processes and outcomes could produce power consolidation in and increase returns to the dominant system. More fundamentally, Rotmans and Loorbach [9] suggested that breaking through systemic malfunctions requires the reorganization of social systems coupled with the reconfiguration of social development and values before transition opportunities can be realized.

Carbon-intensive industries tend to form tight policy communities that aim to influence carbon taxation policies. Kasa [10] compared institutionalized networks, the degree of internal consensus, balanced power resources, and mutual economic interests between two different groups of carbon-intensive industries. He concluded that the greatest influence on Norway’s carbon tax was the political power of interest groups rather than their individual contributions to the GDP.

Even when some interest groups support carbon taxation, it may still be impossible to circumvent the lobbying power of carbon-intensive industries. Svendsen[11] analyzed the power of opposition lobbying by carbon-intensive industries in OECD countries. They found that lobbying in support of carbon-intensive industries remains fierce, even though these same carbon-intensive industries pay six times less for their carbon emissions than normal households. In fact, in the case of Norway, despite having already acquired re-bates on their carbon tax, the strength and influence of the lobbyists’ opposition maintain these unfair tax differentials.

Although there is disagreement about the potential efficiency of carbon taxation, the impacts are relatively focused. Such a focus may allow carbon-intensive industries to join together in a unified position, which would enable them to benefit from the policies that determine the taxation system to be adopted [12].

3. Methods

The high-carbon regime includes GHG emissions, which are dominated by energy intensive manufacturers and the brown economy complex. These are shaped by long-term subsidies for electricity, water, and labor. The high-carbon regime has been recognized in the energy policy literature and the gray literature. In addition, our analysis of institutional, cognitive, and techno-institutional lock-ins included insights gained from stakeholders, independent experts, and focus groups.

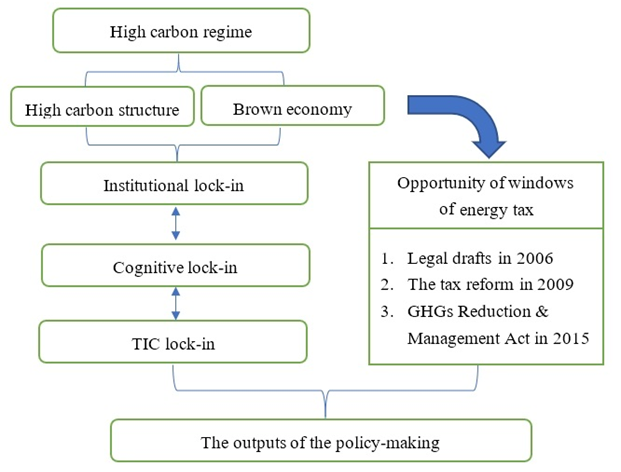

Using these methods, this study further characterized and explained the three failed policy windows for introducing an energy tax. Figure 1 shows the structure of our analytical approach, which centered on the high-carbon brown economy and its generation of environmental externalities and dependence on subsidies. These forces have consolidated the high-carbon path dependence and have explicitly blocked three policy opportunity windows for the implementation of an energy tax.

Figure 1. The three windows of opportunity that were undermined by the high-carbon economic and political regime of Taiwan. Source: made by authors.

Firstly, using this analytical approach, this study outlined the deep linkages between the high-carbon regime and the institutional, cognitive, and TIC lock-ins, which are characterized by contextual and close interest relationships. Secondly, through this approach, this study further explored the complicated developments of the three windows of opportunity for energy tax implementation. Accordingly, these factors resulted in the delay of a low-carbon transition due to structural path dependence.

4. Discussion and Conclusions

Our analysis highlighted Taiwan’s long-term path dependence on its high-carbon regime, which includes high-carbon infrastructures and a brown economy. This path dependence ensures that the Taiwanese economy and society remain locked onto their existing development tracks. This regime is quite complicated and produces entangled relationships between the economic bureaucracy and industry. The state, carbon-intensive industries, and the CNFI co-established the brown economy complex and have entrenched institutional, cognitive, and technological carbon lock-ins. In this sense, the system of production factors is full of reasonable discourse around low electricity, water, and labor prices and subsidies. In terms of economic development, the “five lacks” have be-come the common language of the CNFI, industry, and the economic bureaucracy. Overall, the TIC is heavily involved in energy and economic policies.

This carbon lock-in effect has blocked the sustainable transformation of Taiwan’s economy to some extent. Under the influence of international climate conventions, proposals from the Taiwanese Parliament and Ministry of Finance, green tax reforms, and the GHG Reduction and Management Act, three windows for the establishment of energy taxation opened. However, during each window of opportunity, the conservatism of the economic and fiscal bureaucracy, which was hesitant to pursue policies, and inconsistent stances on energy taxation ensured that Taiwan continued to be enmeshed in its brown economy. Carbon-intensive industries and the CNFI engaged in high-profile lobbying against energy taxation. They also mobilized their internal political and economic net-works to block energy taxation on the grounds that it would damage Taiwanese industrial competitiveness.

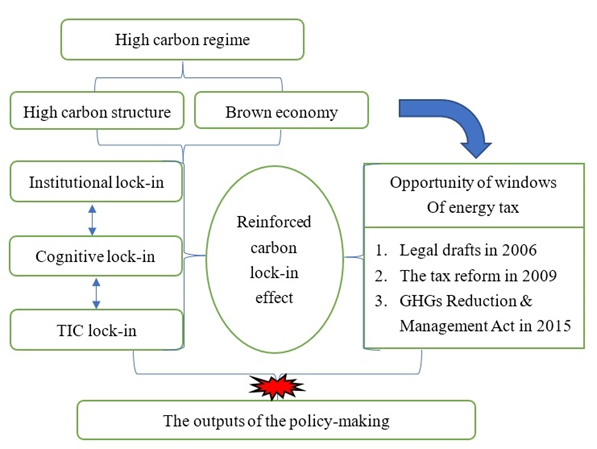

The cases of Norway and OECD countries have confirmed that manufacturing industries can have considerable lobbying power within manufacturing-dependent economies that have high carbon emissions. When this influence is linked to a brown economy with low electricity and water prices, low wages, and a powerful TIC dominated by nu-clear and coal power, the carbon lock-in effect is reinforced (Figure 2). This kind of entrenched carbon lock-in effect, where political actors and bureaucrats are enmeshed with powerful industries, is seen in Taiwan.

Figure 2. The reinforced carbon lock-in effect in Taiwanese carbon taxation legislation. Source: made by authors.

References

- Voß, J.P.; Kemp, R.; Bauknecht, D. Reflexive Governance for Sustainable Development; Voß, J.P.; Kemp, R.; Bauknecht, D, Eds.; Elgar: Cheltenham, UK, 2006; pp. 419–437.

- Rip, A. A co-evolutionary approach to reflexive governance—And its ironies; Voß, J.P.; Kemp, R.; Bauknecht, D, Eds.; Elgar: Cheltenham, UK, 2006; pp. 82–100.

- Unruh, G.C; Understanding carbon lock-in. Energy Policy 2000, 28, 817-830, https://doi.org/10.1016/S0301-4215(00)00070-7 .

- Seto, K.C.; Davis, S.J.; Mitchell, R.B.; Stokes, E.C.; Unruh, G.; Ürge-Vorsatz, D.; Carbon lock-in: Types, causes, and policy implications. Annu. Rev. Environ. Resour 2016, 41, 425-452, https://doi.org/10.1146/annurev-environ-110615-085934.

- Lehmann, P.; Creutzig, F.; Ehlers, M.H.; Friedrichsen, N.; Heuson, C.; Hirth, L.; Pietzcker, R.; Carbon lock-out: Advancing renewable energy policy in Europe. Energies 2012, 5, 232-354, https://doi.org/10.3390/en5020323.

- Unruh, G.C.; Escaping carbon lock-in. Energy Policy 2002, 30, 317-325, https://doi.org/10.1016/S0301-4215(01)00098-2.

- Path Dependence, Innovation and the Economics of Climate Change . Policy Paper. Retrieved 2023-1-4

- Pierson, P; Increasing returns, path dependence, and the study of politics. Am. Political Sci. Rev 2000, 94, 251-267, https://doi.org/10.20901/pp.7.1-2.05.

- Rotmans, J.; Loorbach, D.. Towards a Better Understanding of Transitions and Their Governance: A Systemic and Reflexive Approach; Grin, J., Rotmans, J., & Schot, J., Eds.; Routledge: NY, USA, 2010; pp. 105-199.

- Kasa, S.; Policy networks as barriers to green tax reform: The case of CO2‐taxes in Norway.. Environ. Politics 2000, 9, 104-122, https://doi.org/10.1080/09644010008414553.

- Svendsen, G.T.; Daugbjerg, C.; Hjøllund, L.; Pedersen, A.B.; Consumers, industrialists and the political economy of green taxation: CO2 taxation in OECD. Energy Policy 2001, 29, 489-497, https://doi.org/10.1016/S0301-4215(00)00145-2.

- 16. Klenert, D.; Mattauch, L.; Combet, E.; Edenhofer, O.; Hepburn, C.; Rafaty, R.; Stern, N.; Making carbon pricing work for citizens. Nat. Clim. Change 2018, 8, 669-677, https://doi.org/10.1038/s41558-018-0201-2.