Your browser does not fully support modern features. Please upgrade for a smoother experience.

Submitted Successfully!

Thank you for your contribution! You can also upload a video entry or images related to this topic.

For video creation, please contact our Academic Video Service.

| Version | Summary | Created by | Modification | Content Size | Created at | Operation |

|---|---|---|---|---|---|---|

| 1 | Fanlong Bai | -- | 2442 | 2022-12-06 15:48:29 | | | |

| 2 | Jessie Wu | Meta information modification | 2442 | 2022-12-07 06:43:49 | | | | |

| 3 | Jessie Wu | Meta information modification | 2442 | 2022-12-07 06:51:43 | | | | |

| 4 | Jessie Wu | -3 word(s) | 2439 | 2022-12-07 06:54:47 | | |

Video Upload Options

We provide professional Academic Video Service to translate complex research into visually appealing presentations. Would you like to try it?

Cite

If you have any further questions, please contact Encyclopedia Editorial Office.

Zhao, F.; Bai, F.; Liu, X.; Liu, Z. Challenges to Renewable Energy Transition in China. Encyclopedia. Available online: https://encyclopedia.pub/entry/38130 (accessed on 04 March 2026).

Zhao F, Bai F, Liu X, Liu Z. Challenges to Renewable Energy Transition in China. Encyclopedia. Available at: https://encyclopedia.pub/entry/38130. Accessed March 04, 2026.

Zhao, Fuquan, Fanlong Bai, Xinglong Liu, Zongwei Liu. "Challenges to Renewable Energy Transition in China" Encyclopedia, https://encyclopedia.pub/entry/38130 (accessed March 04, 2026).

Zhao, F., Bai, F., Liu, X., & Liu, Z. (2022, December 06). Challenges to Renewable Energy Transition in China. In Encyclopedia. https://encyclopedia.pub/entry/38130

Zhao, Fuquan, et al. "Challenges to Renewable Energy Transition in China." Encyclopedia. Web. 06 December, 2022.

Copy Citation

Climate change and energy issues have become the prominent global challenge and a major concern of China. China’s energy sector, which heavily relies on fossil energy, especially coal, is the largest contributor to China’s carbon emissions. According to the International Energy Agency (IEA), China’s energy consumption accounts for nearly 90% of China’s total CO2 emissions in 2020. The carbon neutrality target poses a huge challenge to China’s energy system, causing energy transition to be the key to the overall decarbonization of China’s economy and society.

renewable energy

power system

carbon neutrality

1. Great Transition Urgency and Pressure

The energy transition is key to achieving carbon neutrality. Since nearly 90% of China’s greenhouse gas emissions come from its energy sector [1], the mitigation task for the energy sector is especially heavy. Before the carbon peak and carbon neutral targets were proposed, the targets for renewable energy development were relatively modest. As proposed in the 13th Five-Year Plan in 2016, the targets for the share of non-fossil energy consumption were set at 15% in 2020 and 20% in 2030 [2]. However, in October 2021, the “Carbon Peaking Action Plan before 2030” was issued by the State Council of China [3]. It proposed that the proportion of non-fossil energy must reach more than 20% in 2025. Now the 2030 target proposed in 13th Five-Year Plan has been brought forward to 2025. The target share of wind and solar power generation in total power generation was set at 20.14%, an increase of 10.60 percentage points over 2020 [3]. During the 14th Five-Year Plan period, wind and solar power generation are supposed to exceed the sum of the 10 years from 2010 to 2020, indicating a more aggressive growth than before. The energy sector must realize a structural transformation to achieve carbon neutrality. It means that the energy structure will shift from fossil-based to renewable-based [4]. A renewable-dominated power sector is generally viewed as the foundation and the most important technological tool in achieving the carbon neutrality target.

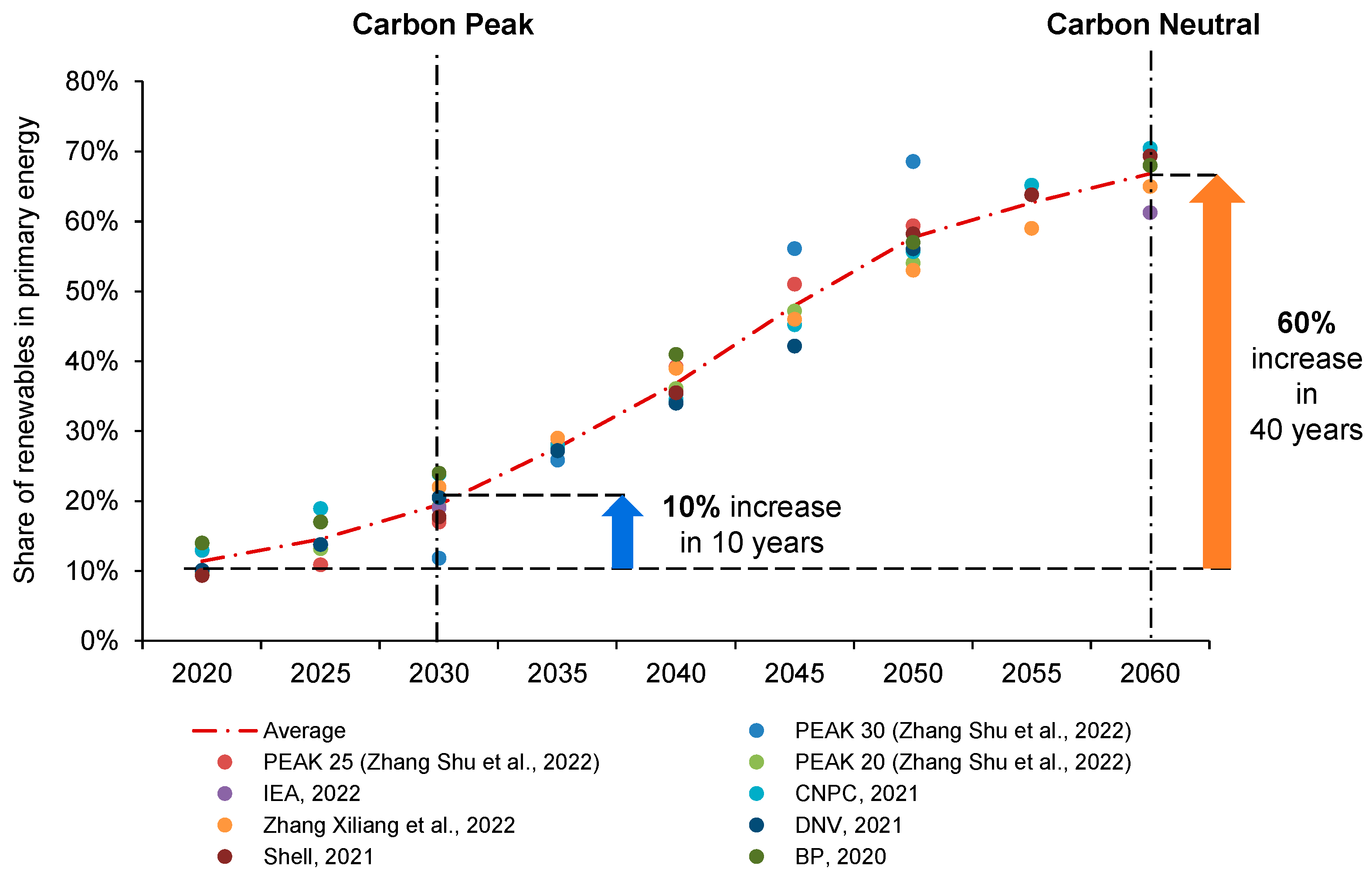

Under the carbon neutral scenario, most institutions and scholars predicted that the proportion of renewable energy in primary energy would increase from about 10% in 2020 to about 70% in 2060. Figure 1 shows the prediction of different scholars. Zhang et al. predicted that renewable energy will account for more than 65% in China’s 2060 primary consumption [5]. Zhang et al. calculated that under the 2030 carbon peak scenario, China’s renewable energy will account for more than 68% of primary energy in 2050 [6]; the China National Petroleum Corporation (CNPC) predicts that by 2030 and 2060, China’s renewable energy will account for 23.87% and 70.44%, respectively [7]. Researchers calculate the average of prediction data from these institutions and scholars. The results show that by 2030 and 2060, the proportion of renewable energy in the primary energy in China will reach 20% and 66%, respectively. To achieve a carbon peak, the share of China’s renewable energy in primary energy needs to achieve a 10% growth in 10 years, which means a 1 percentage increase per year. Compared with the task of peaking carbon, it is more difficult and urgent to achieve carbon neutrality. The share of renewable energy needed to achieve carbon neutrality will increase by 60% over 40 years, which is a 1.5 percentage increase per year. This implies faster and more aggressive growth between 2030 and 2060 than between 2020 and 2030. In addition, such a high share of variable energy will pose serious challenges to China’s relevant infrastructure, such as power transmission, power distribution, and energy storage.

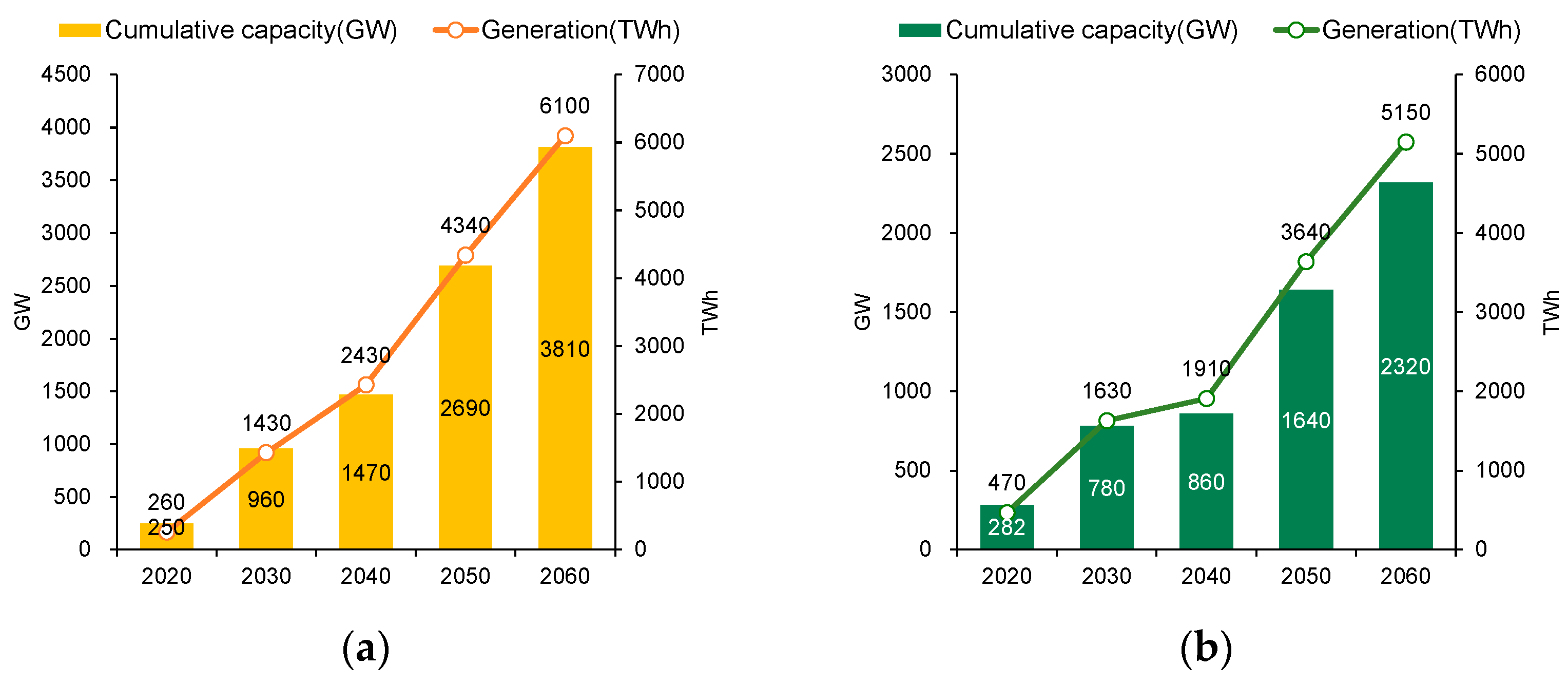

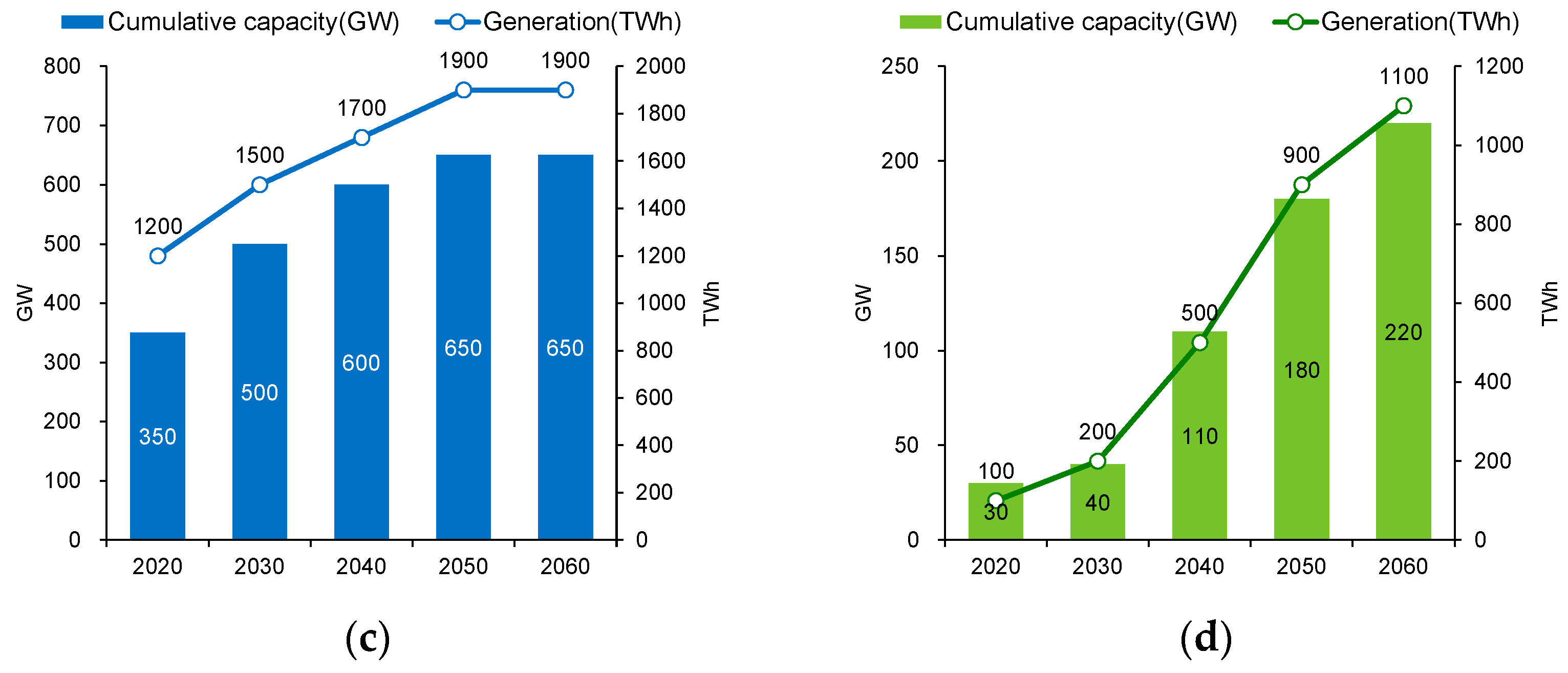

Among all renewables, the large-scale development of wind and solar PV are the two most important contributors to achieving carbon neutrality. According to data from the CNPC, as detailed in Figure 2, between 2030 and 2060, the average annual increase in installed solar PV and wind power is expected to be 95 GW and 51 GW, respectively, with most of them being built in the resource-rich regions, e.g., North and West China [7]. The installed solar PV and wind capacity are expected to reach 3810 GW and 2320 GW in 2060, 15 and 8 times more than in 2020, respectively. It is expected that the total wind and solar power generation will reach 11.2 trillion kWh in 2060, accounting for 60.7% of total power generation. Since wind and solar PV are both strongly volatile energy sources. Such rapid growth rates and large expansions in wind and solar energy would place a higher demand on the flexibility of energy systems, the improvement of grid regulation capabilities, and the evolution of power markets.

Figure 2. Predicted capacity and generation of China’s renewables: (a) solar PV; (b) wind; (c) hydropower; (d) bio-energy [7].

Compared with wind and solar PV, the growth of hydropower is supposed to be relatively stable and slow. Its proportion of total electricity generation will gradually decrease in the future, from 16% in 2020 to 10% in 2060. For hydropower, major attention will be paid to energy storage and peak shaving to support the construction of a smart power system.

Biomass power generation has a special but important role. It can replace industrial coal-fired boilers and rural bulk coal combustion, which will be the main scenario for biomass energy to facilitate decarbonization. From 2030, in combination with carbon capture, utilization, and storage (CCUS) technology, biomass will serve as a negative emission source for the energy system [11]. It is expected that power generation from biomass energy will reach 1100 TWh by 2050, achieving emission reductions of over 2000 Mt CO2e in an optimistic scenario.

It can be seen from the above that to achieve carbon neutrality, renewable energy bears great transition urgency and pressure. A comprehensive technology strategy and policy support are the foundation for achieving these goals. However, at this stage, it is difficult for China’s renewable energy to support the transformation goal in terms of technology and policy system. There are still many challenges and difficulties in the technology foundation and policy mechanism. Technically, it faces difficulties in consumption, instability in the industrial chain, high costs, and demanding natural conditions. In terms of policy, due to the current transition from subsidy-driven to market-driven, there is still a lack of corresponding market mechanisms and appropriate incentives.

2. Consumption Challenges and Technology Flaws

The first and most important technology challenge facing China’s renewables is to promote renewable energy consumption. It has attached great attention from the Chinese government and industry. In March 2021, the State Grid Corporation of China released the “carbon peak, carbon neutral” action plan, improving the consumption of renewable energy was said to be a crucial task [12]. On 1 June 2022, the NDRC issued the 14th Five-year plan for renewable energy development. The Plan set a target of 18% of non-hydro RPS in 2025, compared with 11.4% in 2020 [13]. The challenges in consumption mainly come from two aspects. On the one hand, the volatility and intermittency of renewable energy cause it to be difficult to connect to the grid and result in a low utilization rate [14]. Therefore, energy storage is required to reduce the abandonment of wind and solar energy. The current generation cost of photovoltaic and wind power has already become remarkably competitive, but its utilization cost is still high, mainly due to curtailment and additional costs. In 2020, wind power curtailment and solar power curtailment reached 16.61 billion KWh and 5.26 billion kW, respectively. The curtailment rate of renewable energy in Xinjiang, Qinghai, Tibet, Gansu, and other western regions even exceeds 10% [15]. Part of the renewables is either abandoned or stored in the energy storage system, while the energy storage system can increase the cost of renewables by 30–60% on average and even double for projects with high construction costs [16][17][18]. On the other hand, China’s renewable energy-rich area is in the west, while the load center is in the east. Therefore, energy storage and UHV transmission are needed to balance the uneven distribution of energy. For example, in the first half of 2022, the newly installed renewable capacity in Northern and Western China accounted for 72.5% [19], but the power consumption center lies in the coastal Eastern China [20][21]. The curtailment of renewable in Southwest China is the most serious due to insufficient local consumption and limited grid dispatch capacity [22]. For example, the curtailment rate of Tibet remains at nearly 20%, ranking first in China [23]. This demands an enhanced transmission network to balance energy supply and demand between the east and west of China, which can further promote the consumption of renewable energy. Thus far, whether the power system has sufficient “storage and adjustment” capacity is a key factor determining the consumption of renewable energy [24].

The second technology challenge comes from the industrial supply chain. The rapid development of renewable energy has greatly increased the long-term demand for critical materials. Unlike traditional fossil energy power generation, photovoltaics and wind turbines require more lithium, nickel, cobalt, manganese, and other metal materials [25]. China relies heavily on imports for these materials, which brings huge impact and uncertainty to the industrial chain under the current international upheaval and epidemic [26][27]. The scale-up of renewable energy and rapid technological iteration put forward higher requirements for parts and components process and raw material attributes [28]. In the future, technological innovation will be more difficult to bring down renewable energy costs than in the past.

The third one is renewables’ low land-use efficiency and higher natural condition requirements. Wind energy and solar energy are energy forms with low energy density. To replace fossil energy, more land areas need to be occupied or affected. Taking a common 4 × 600 MW thermal power plant as an example, according to national standards, its maximum required area is about 330 hectares, while the construction area of a wind farm of the same scale is about 50 times that. A hydropower station normally has a more complex structure and occupies a larger area relative to wind and solar stations, it has higher requirements for natural conditions [29]. Recent climate change has threatened the reliability of the water supply, posing huge challenges to the hydropower project [30]. Additionally, the developed hydropower resource in China already accounts for 57% of the total exploitable value [29][31][32][33]. Further development is hindered by many problems such as demanding transportation, difficult construction, and huge capital investment. So, improving efficiency and fully utilizing renewables’ value has become more and more important in the future.

3. Policy Challenges

In the past 10 years, China’s policies and incentives have dominated the development of renewable energy and have achieved remarkable results in reducing curtailment rates and increasing installed capacity [34][35]. The national wind curtailment rate has been reduced from more than 15% in 2017 to less than 5% in 2020 [36]. By the end of 2021, the total installed capacity of wind power and PV connected to the grid totaled 670 million kW, nearly 90 times that of 2012. However, the Chinese government is under enormous fiscal pressure for this. It is estimated that by the end of 2021, the accumulated arrears of renewable energy power generation subsidies will be around RMB 400 billion [37].

China’s policy-driven renewable development needs to be transformed into market-driven development, which will pose severe challenges to its growth. A well-structured policy mix plays a crucial role in promoting new installations of renewable energy and mitigating the curtailment of renewable energy generation. While China’s current policy infrastructure on the development of renewable energy is still well suited for the transformation.

First of all, the value of renewable energy in the electricity market has not been fully reflected. China’s current electricity market is immature for adopting variable renewable energy. It is composed of medium- and long-term electricity trading, a badly framed spot electricity market, and an imperfect auxiliary service market [38]. Under such an electricity market system, nearly all power suppliers’ revenue comes from electric energy trading. This not only makes power suppliers unwilling to improve the peak regulating capacity and build peak regulating power units but also discourages power suppliers with strong peak regulating capacity to provide full play to peak shaving ability.

Since the peak shaving capability of the power system is a key capability for the connection of renewables to the grid. The inadequate market could reduce the space for renewable energy consumption in the grid. In addition, if the scale of renewable energy increases exponentially, the current peak-shaving cost sharing may lead to a severe loss of coal-fired power units and force them to suspend. This will further weaken the stability of the power supply. In addition, green power supply is mainly concentrated in Northwestern China, while the major power demand is in the eastern coastal region. Due to the space mismatch, it is very difficult to translocate green power across provinces and regions, which makes it difficult for enterprises to meet their green power needs or pay high costs. Moreover, the uncertain transaction timing, complicated process, complicated contract, and lack of willingness to power delivery by the sending province affected by the assessment of the responsibility of renewable energy electricity consumption have brought challenges to the inter-provincial green power transaction. Regarding the GEC, the original goal of adopting GEC in China was to partially replace the subsidy scheme. However, for a GEC transaction, the associated subsidy is deducted from its market price. This would reduce energy suppliers’ desire to apply and sell GEC [39]. Renewable energy suppliers strive to bring the GEC price as close as possible to the subsidy, resulting in an overall high price for GEC in China, which is also difficult for purchasers to accept.

In addition, the green certificate market has failed to form a price that fully reflects renewable energy’s environmental benefits. It cannot have a significant impact on electricity market prices. The penalties for market participants who do not meet the renewable energy consumption target are not strong. Another drawback is that GEC is not connected to the emission trading system (ETS) [40]. China’s national carbon emission trading market was officially launched in July 2021. At present, the power generation industry has been included in the implementation cycle of the national carbon emission market. China also requires key emitters in the petrochemical, chemical, building materials, steel, nonferrous metals, papermaking, and civil aviation industries to verify and submit their greenhouse gas emissions [39][41]. However, in the current national accounting guidelines for these eight industries, there is no clear regulation on how to reduce carbon emissions from the use of green power [42]. Consequently, the emission reduction through the consumption of renewable energy cannot be reflected in the accounting of greenhouse gas emissions. Due to the lack of a direct connection between the GEC market and the carbon emission market, green power consumption cannot accurately reflect the company’s efforts to reduce carbon emissions. It is challenging for green power usage to become the preferred solution for companies. The majority of companies that purchase green certificates do so to increase their influence and brand’s social standing. The intrinsic desire to actively engage in green certificate trades is insufficient. These flaws lead to the weak market liquidity of GECs. For GEC buyers, the purchase of green certificates is voluntary and does not provide substantial benefits to the business.

References

- IEA. An Energy Sector Roadmap to Carbon Neutrality in China; IEA: Paris, France, 2021.

- Fan, J.-L.; Wang, J.-X.; Hu, J.-W.; Wang, Y.; Zhang, X. Optimization of China’s provincial renewable energy installation plan for the 13th five-year plan based on renewable portfolio standards. Appl. Energy 2019, 254, 113757.

- State Council of the People’s Republic of China. Carbon Peaking Action Plan before 2030. Available online: http://www.gov.cn/zhengce/content/2021-10/26/content_5644984.htm (accessed on 17 September 2022).

- Niu, Z.; Xiong, J.; Ding, X.; Wu, Y. Analysis of China’s Carbon Peak Achievement in 2025. Energies 2022, 15, 5041.

- Zhang, X.; Huang, X.; Zhang, D. Research on the Pathway and Policies for China’s Energy and Economy Transformation toward Carbon Neutrality. J. Manag. World 2022, 38, 35–66.

- Zhang, S.; Chen, W. Assessing the energy transition in China towards carbon neutrality with a probabilistic framework. Nat. Commun. 2022, 13, 87.

- China National Petroleum Corporation. World and China Energy Outlook 2060; CNPC: Beijing, China, 2021.

- Shell. Achieving a Carbon-Neutral Energy System in China by 2060; Shell: Beijing, China, 2022.

- DNV. Energy Transition Outlook 2021 Great China Regional Forecast; Det Norske Veritas: Bærum, Norway, 2021.

- British Petroleum. Energy Outlook 2022. Available online: https://www.bp.com.cn/content/dam/bp/country-sites/zh_cn/china/home/reports/bp-energy-outlook/2022/energy-outlook-2022-edition-cn.pdf (accessed on 17 September 2022).

- Kang, Y.; Yang, Q.; Bartocci, P.; Wei, H.; Liu, S.S.; Wu, Z.; Zhou, H.; Yang, H.; Fantozzi, F.; Chen, H. Bioenergy in China: Evaluation of domestic biomass resources and the associated greenhouse gas mitigation potentials. Renew. Sustain. Energy Rev. 2020, 127, 109842.

- Ibrahim, R.L. Post-COP26: Can energy consumption, resource dependence, and trade openness promote carbon neutrality? Homogeneous and heterogeneous analyses for G20 countries. Environ. Sci. Pollut. Res. 2022, 1–12.

- National Development and Reform Commission. 14th Five-year Plan for Renewable Energy Development. Available online: https://www.ndrc.gov.cn/xxgk/zcfb/ghwb/202206/P020220602315308557623.pdf (accessed on 19 June 2022).

- Harjanne, A.; Korhonen, J.M. Abandoning the concept of renewable energy. Energy Policy 2019, 127, 330–340.

- National Development and Reform Commission. Clean Energy Consumption Plan (2018–2020). Available online: https://www.ndrc.gov.cn/xxgk/zcfb/ghxwj/201812/W020190905495739358481.pdf (accessed on 23 June 2022).

- Zhang, Y.; Xu, Y.; Guo, H.; Zhang, X.; Guo, C.; Chen, H. A hybrid energy storage system with optimized operating strategy for mitigating wind power fluctuations. Renew. Energy 2018, 125, 121–132.

- Li, J.; Chen, S.; Wu, Y.; Wang, Q.; Liu, X.; Qi, L.; Lu, X.; Gao, L. How to make better use of intermittent and variable energy? A review of wind and photovoltaic power consumption in China. Renew. Sustain. Energy Rev. 2021, 137, 110626.

- Zhang, Y.; Xu, Y.; Zhou, X.; Guo, H.; Zhang, X.; Chen, H. Compressed air energy storage system with variable configuration for accommodating large-amplitude wind power fluctuation. Appl. Energy 2019, 239, 957–968.

- National Energy Administration. In the First Half of the Year, the Newly Installed Capacity of Renewable Energy Power Generation Accounted for 80% of the National Total. Available online: http://www.gov.cn/xinwen/2022-08/06/content_5704430.htm (accessed on 27 September 2022).

- Zhang, R.; Shimada, K.; Ni, M.; Shen, G.Q.; Wong, J.K. Low or No subsidy? Proposing a regional power grid based wind power feed-in tariff benchmark price mechanism in China. Energy Policy 2020, 146, 111758.

- Dong, F.; Shi, L. Regional differences study of renewable energy performance: A case of wind power in China. J. Clean. Prod. 2019, 233, 490–500.

- Huang, T.; Wang, S.; Yang, Q.; Li, J. A GIS-based assessment of large-scale PV potential in China. Energy Procedia 2018, 152, 1079–1084.

- Song, X.; Huang, Y.; Zhao, C.; Liu, Y.; Lu, Y.; Chang, Y.; Yang, J. An approach for estimating solar photovoltaic potential based on rooftop retrieval from remote sensing images. Energies 2018, 11, 3172.

- Amrouche, S.O.; Rekioua, D.; Rekioua, T.; Bacha, S. Overview of energy storage in renewable energy systems. Int. J. Hydrogen Energy 2016, 41, 20914–20927.

- Wang, Y.W. Carbon peaking, carbon neutrality targets and China’s new energy revolution. Soc. Sci. Digest. 2022, 1, 5–7.

- Guo, X.; Zhang, J.; Tian, Q. Modeling the potential impact of future lithium recycling on lithium demand in China: A dynamic SFA approach. Renew. Sustain. Energy Rev. 2021, 137, 110461.

- Sun, X.; Hao, H.; Zhao, F.; Liu, Z. The dynamic equilibrium mechanism of regional lithium flow for transportation electrification. Environ. Sci. Technol. 2018, 53, 743–751.

- Zhang, H.; Nai, J.; Yu, L.; Lou, X.W.D. Metal-organic-framework-based materials as platforms for renewable energy and environmental applications. Joule 2017, 1, 77–107.

- Sibtain, M.; Li, X.; Bashir, H.; Azam, M.I. Hydropower exploitation for Pakistan’s sustainable development: A SWOT analysis considering current situation, challenges, and prospects. Energy Strategy Rev. 2021, 38, 100728.

- Duan, K.; Caldwell, P.V.; Sun, G.; McNulty, S.G.; Zhang, Y.; Shuster, E.; Liu, B.; Bolstad, P.V. Understanding the role of regional water connectivity in mitigating climate change impacts on surface water supply stress in the United States. J. Hydrol. 2019, 570, 80–95.

- Cheng, C.; Liu, B.; Chau, K.-W.; Li, G.; Liao, S. China’s small hydropower and its dispatching management. Renew. Sustain. Energy Rev. 2015, 42, 43–55.

- Ugwu, C.O.; Ozor, P.A.; Mbohwa, C. Small hydropower as a source of clean and local energy in Nigeria: Prospects and challenges. Fuel Commun. 2022, 10, 100046.

- Sun, L.; Niu, D.; Wang, K.; Xu, X. Sustainable development pathways of hydropower in China: Interdisciplinary qualitative analysis and scenario-based system dynamics quantitative modeling. J. Clean. Prod. 2021, 287, 125528.

- Luo, G.-l.; Li, Y.-l.; Tang, W.-j.; Wei, X. Wind curtailment of China’s wind power operation: Evolution, causes and solutions. Renew. Sustain. Energy Rev. 2016, 53, 1190–1201.

- Chen, X.; Kang, C.; O’Malley, M.; Xia, Q.; Bai, J.; Liu, C.; Sun, R.; Wang, W.; Li, H. Increasing the flexibility of combined heat and power for wind power integration in China: Modeling and implications. IEEE Trans. Power Syst. 2014, 30, 1848–1857.

- Xia, F.; Lu, X.; Song, F. The role of feed-in tariff in the curtailment of wind power in China. Energy Econ. 2020, 86, 104661.

- Jinnan, Y. Ministry of Finance: To Promote the Solution of Renewable Energy Generation Subsidies Funding Gap. China Energy Newsp. 2022, 321, 8.

- Zhang, G.; Zhu, Y.; Xie, T.; Zhang, K.; He, X. Wind Power Consumption Model Based on the Connection between Mid-and Long-Term Monthly Bidding Power Decomposition and Short-Term Wind-Thermal Power Joint Dispatch. Energies 2022, 15, 7201.

- Yu, X.; Dong, Z.; Zhou, D.; Sang, X.; Chang, C.-T.; Huang, X. Integration of tradable green certificates trading and carbon emissions trading: How will Chinese power industry do? J. Clean. Prod. 2021, 279, 123485.

- Yang, D.-x.; Jing, Y.-q.; Wang, C.; Nie, P.-y.; Sun, P. Analysis of renewable energy subsidy in China under uncertainty: Feed-in tariff vs. renewable portfolio standard. Energy Strategy Rev. 2021, 34, 100628.

- Liu, S.; Bie, Z.; Lin, J.; Wang, X. Curtailment of renewable energy in Northwest China and market-based solutions. Energy Policy 2018, 123, 494–502.

- Dong, F.; Shi, L.; Ding, X.; Li, Y.; Shi, Y. Study on China’s renewable energy policy reform and improved design of renewable portfolio standard. Energies 2019, 12, 2147.

More

Information

Subjects:

Green & Sustainable Science & Technology

Contributors

MDPI registered users' name will be linked to their SciProfiles pages. To register with us, please refer to https://encyclopedia.pub/register

:

View Times:

4.6K

Revisions:

4 times

(View History)

Update Date:

07 Dec 2022

Notice

You are not a member of the advisory board for this topic. If you want to update advisory board member profile, please contact office@encyclopedia.pub.

OK

Confirm

Only members of the Encyclopedia advisory board for this topic are allowed to note entries. Would you like to become an advisory board member of the Encyclopedia?

Yes

No

${ textCharacter }/${ maxCharacter }

Submit

Cancel

Back

Comments

${ item }

|

More

No more~

There is no comment~

${ textCharacter }/${ maxCharacter }

Submit

Cancel

${ selectedItem.replyTextCharacter }/${ selectedItem.replyMaxCharacter }

Submit

Cancel

Confirm

Are you sure to Delete?

Yes

No