| Version | Summary | Created by | Modification | Content Size | Created at | Operation |

|---|---|---|---|---|---|---|

| 1 | Sirius Huang | -- | 1877 | 2022-11-10 01:39:01 |

Video Upload Options

Qualifying Investor Alternative Investment Fund or QIAIF is a Central Bank of Ireland regulatory classification established in 2013 for Ireland's five tax-free legal structures for holding assets. The Irish Collective Asset-management Vehicle or ICAV is the most popular of the five Irish QIAIF structures, and was designed in 2014 to rival the Cayman Island SPC; it is the main tax-free structure for foreign investors holding Irish assets. In 2018, the Central Bank of Ireland expanded the Loan Originating QIAIF or L–QIAIF regime which enables the five tax-free structures to be used for closed-end debt instruments. The L–QIAIF is Ireland's main Debt–based BEPS tool as it overcomes the lack of confidentiality and tax secrecy of the Section 110 SPV. It is asserted that many assets in QIAIFs and LQIAIFs are Irish assets being shielded from Irish taxation. Irish QIAIFs and LQIAIFs can be integrated with Irish corporate base erosion and profit shifting ("BEPS") tax tools to create confidential routes out of the Irish tax system to Ireland's main Sink OFC, Luxembourg. In March 2019, the UN identified Ireland's "preferential tax regimes" for foreign funds on Irish assets as affecting the human rights of tenants in Ireland.

1. Features

Irish QIAIFs are subject to the EU Alternative Investment Fund Managers Directive 2011 (“AIFMD”) which lays out detailed rules on the process of constructing (e.g. diversification, leverage), managing (e.g. AIFM approved managers), and marketing (e.g. qualifying investors) of QIAIFs in Europe. However, the following are considered the most important features specific to Irish QIAIFs:[1][2][3]

- Irish domiciled: All of the legal wrappers in the QIAIF regime are Irish domiciled structures and subject to Irish law and Irish tax codes;

- Tax–free: QIAIFs are exempt from all Irish taxation, including VAT and duties, and can make distributions to non–Irish residents free of any Irish withholding tax;[4]

- Tax secrecy: Four of the five QIAIF wrappers do not file Irish CRO public accounts, and the reports they file with the Central Bank of Ireland cannot be shared with the Irish Revenue;[5][6]

- No restriction on assets: There are no restrictions on the assets the QIAIF can hold;

- Closed and open-ended options: Irish QIAIFs can be open-ended (e.g. must meet daily liquidity requirements) or closed-ended (e.g. the L–QIAIF);[7]

- Fast authorisation: The Central Bank runs a "fast track" 24–hour approval process where it doesn't review documents but relies on confirmations from Directors and Irish advisors;

- Light-touch regulation: Irish advisory firms openly market the QIAIF regulatory regime as "light-touch",[8] which has been confirmed from other sources.[9][10][11][12]

As at 2016, €435 billion in alternative assets were held in Irish QIAIFs. Ireland is the 4th largest domicile for Alternative Investment Funds ("AIF") in the EU with 9.9% of the €4.4 trillion EU AIF market, behind Germany (31.7%), France (21.3%) and Luxembourg (13%).[3] It is asserted that a material amount of QIAIF assets (or AIF assets) are Irish assets being shielded from Irish taxation.[13][14][15][16]

2. ICAV

Each of the five QIAIF legal wrappers have attributes designed for different uses. However, outside of entities that need the specific attributes of a trust law (and will use the Unit Trust QIAIF), or can only use a full company structure (and will use a VCC QIAIF), the ICAV is expected to be the dominant QIAIF wrapper.[17]

- ICAV (or Irish Collective Asset-management Vehicle). Launched in 2014 for U.S. investors to avoid both U.S. tax and Irish tax on Irish investments;[5] ICAVs became the most popular Irish structure for avoiding Irish taxes on Irish assets;[13] ICAVs meet the U.S. “check-the-box” entity criteria (i.e. the ICAV is shielded from U.S. tax);[4] ICAV filings are confidential to the Central Bank (e.g. no public CRO filings; even the Irish Revenue cannot see the filings); ICAV governance rules are the weakest of all wrappers and having their own legal identity exempts them from Irish and EU company law; ICAVs are shown to be superior tax avoidance wrappers to the Cayman Island SPCs,[18] and there are provisions to migrate from Cayman/BVI wrappers;[19] most new Irish QIAIFs are structured as ICAVs.[17]

- Variable Capital Company ("VCC") (or Investment Company or PLC). An Irish company subject to Irish and EU company law; must have asset diversification; cannot "check-the-box" for U.S. investors (which makes it ineffective for U.S. investors holding Irish assets compared to an ICAV); requires substantive governance procedures and reporting requirements; required to file public CRO accounts (and can be scrutinised by the Irish financial media); the VCC is less popular since the introduction of ICAVs in 2014 and is rarely used for new Irish QIAIFs.[2][17]

- Unit Trust. Dates from 1990 and offers similar features to the ICAV (e.g. U.S. "check-the-box" functionality, no risk spreading, light governance); unlike an ICAV, it cannot be self-managed and must have an AIFM; Irish trust law has complex tax planning features (e.g. separation of legal and beneficial ownership) which are attractive to individual investors and specific jurisdictions (e.g. U.K. and Japan).[2]

- Common Contractual Fund ("CCF"). Established in 2003 for pensions funds to comingle, or pool, assets but maintain full legal segregation of the assets; it is an unincorporated body with no legal identity whose existence is the contract between its investors and the manager; the Irish equivalent of the fonds commun de placement ("FCF") structure in Luxembourg.[20][21]

- Investment Limited Partnership ("ILP"). Primarily aimed at private equity–type structures with a General Partner ("GP")/Limited Partner ("LP") system; dates from the 1994 Investment Limited Partnerships Act; like a unit trust or CCF, the ILP is a contract and not a separate legal identity; the ICAV is more popular for private equity funds in Ireland.[22]

3. L-QIAIF

Ireland is considered by some academic studies to be a major tax haven, and offshore financial centre, with a range of base erosion and profit shifting ("BEPS") tools.[25][26] Ireland's main Debt–based BEPS tool was the Section 110 SPV. However, Irish public tax scandals in 2016 concerning the use of this BEPS tool – involving artificial Irish children's charities – by U.S. distressed funds, assisted by the leading Irish tax-law firms, to avoid billions in Irish taxes damaged its reputation (see Section 110 abuses).[26]

In late 2016, the Central Bank of Ireland began a consultation process to upgrade the little-used L–QIAIF regime.[27][28] In February 2018, the Central Bank of Ireland changed its AIF "Rulebook" to allow L–QIAIFs hold the same assets that Section 110 SPVs could own. However, the upgraded L-QIAIFs offered two specific improvements over the Section 110 SPV which make L–QIAIFs a superior Debt–based BEPS tool:[7][29]

- Tax secrecy. Unlike the Section 110 SPV, the L–QIAIFs are not required to file public accounts (this was how the Section 110 tax abuses were uncovered), but file confidential accounts with the Central Bank of Ireland, that are protected under the 1942 Central Bank Secrecy Act;[6]

- No need for Profit Participating Notes ("PPN"). Another weakness of Section 110 SPVs was their reliance on artificial PPNs to execute the BEPS movement. L–QIAIFs do not require PPNs, and are thus more robust from an OECD compliance perspective.

Three months after the Irish Central Bank updated its AIF "Rulebook", the Irish Revenue Commissioners issued new guidance in May 2018 on Section 110 SPV taxation which would further reduce their attractiveness as a mechanism to avoid Irish taxes on Irish assets.[30] In June 2018, the Central Bank of Ireland reported that €55 billion of U.S.-owned distressed Irish assets, equivalent to almost 25% of Irish GNI*, moved out of Section 110 SPVs.[31][32][33] The L-QIAIF, and the ICAV wrapper, in particular, is expected to become an important structure for managing Irish tax on Irish assets in a confidential manner.[34][35]

Ireland has Irish Real Estate Funds (IREFs) for holding direct Irish property which are not tax-free, their holdings relate to Irish quoted REITs (e.g. Green REIT plc), and insurance assets. The investments by US distressed debt funds in Irish property are via loan acquisitions and thus use L-QIAIFs.[32][35] In addition, foreign investors in Irish property can still use the L-QIAIF by holding via structured loans domiciled abroad, thus also avoiding Irish taxes in a confidential manner.[36][37]

4. Abuses

The QIAIF regime has contributed to making the International Financial Services Centre (IFSC) one of the largest fund domiciling and shadow banking locations in Europe.[26] Many asset managers, and particularly alternative investment managers, use Irish QIAIF wrappers in structuring funds. However, fund structuring is a competitive market and other corporate tax havens such as Luxembourg offer equivalent products. It is asserted that many of the assets in Irish QIAIFs are Irish assets, and particularly from the sale of over €100 billion in distressed assets by the Irish State from 2012–2017.[15][16][38]

Irish QIAIFs have been used in tax avoidance on Irish assets.[14][39][40][41] It transpired that the regulator of Irish QIAIFs, the Central Bank of Ireland, was paying rent to a U.S. entity using an Irish QIAIF ICAV to avoid Irish taxes on the rent.[42] Irish QIAIFs have been used to circumvent international regulations,[43] on avoiding tax laws in the EU and the U.S.[44][45] Irish QIAIFs can be combined with Irish corporate BEPS tools (e.g. the Orphaned Super–QIF),[46] to create confidential routes out of the Irish corporate tax system to other tax havens such as Luxembourg,[47] the main Sink OFC for Ireland.[46][48][49]

QIAIFs link Ireland's strength as a corporate-focused tax haven, with the world's largest corporate BEPS tools,[25] to more traditional tax haven type activities (why Cayman SPCs are re-domiciling as Irish ICAVs).[50] The launch of the Irish ICAV was widely covered, and praised, by the leading offshore magic circle law firms,[5] the largest of which, Maples and Calder, claimed to have been one of its chief architects.[4]

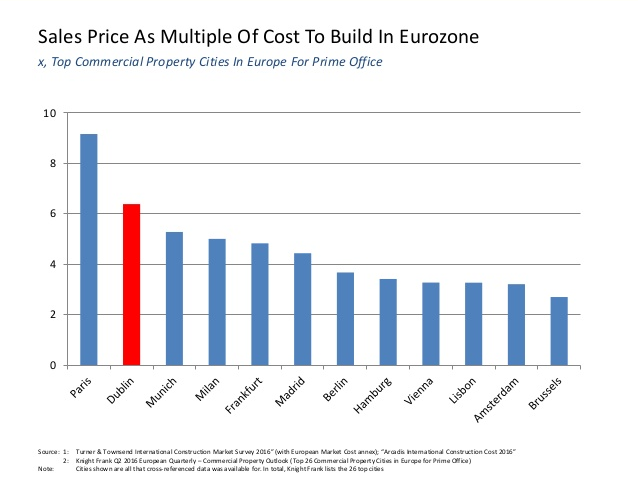

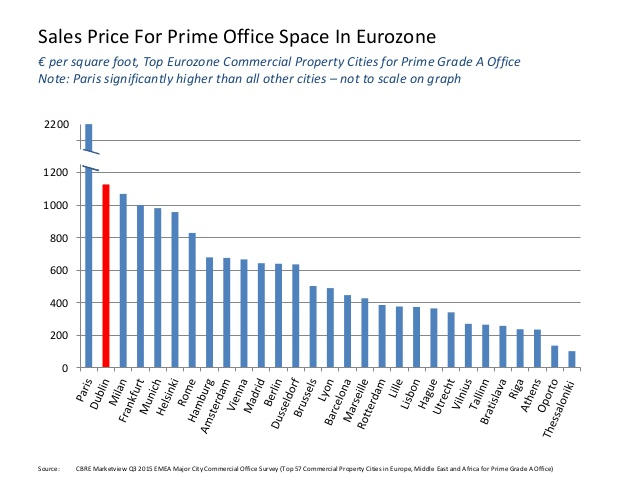

The ability of foreign institutions to use QIAIFs and the ICAV wrapper, to avoid Irish taxes on Irish assets, has been linked to the bubble in Dublin commercial property, and by implication, the Dublin housing crisis.[23][24][26] Despite Dublin's housing crisis, and issues of housing affordability, foreign landlords (also called "cuckoo funds") operate in Ireland on a tax-free basis.[38][51] It is asserted that property development, and over-inflation of property prices via tax incentives, are favoured historical economic strategies of the two main Irish political parties, Fianna Fáil and Fine Gael.[52][53]

This risk of QIAIFs was highlighted in 2014 when Central Bank of Ireland consulted the European Systemic Risk Board ("ESRB") after initial, and unsuccessful, lobbying by IFSC tax-law firms to expand the L–QIAIF regime, so as to remove Irish taxation from Irish loan investments.[54][55]

In March 2019, the UN Special Rapporter on housing, Leilani Farha, formally wrote to the Irish Government on behalf of the UN, regarding its concerns regarding "preferential tax laws" for foreign investment funds on Irish assets which were compromising the human rights of tenants in Ireland.[51][56]

In April 2019, Irish technology entrepreneur Paddy Cosgrave launched a Facebook campaign to highlight abuses of QIAIFs and L-QIAIFs, stating: "The L-QIAIF runs the risk of being a weapon of mass destruction".[26][57]

References

- "A guide to Qualifying Investor AIFs". Dillon Eustace. 2015. http://www.dilloneustace.com/uploads/files/A20Guide20to20Qualifying20Investor20AIFs202nd20Edition.PDF.

- "Establishing a Qualifying Investor AIF in Ireland". Matheson (law firm). October 2017. https://www.matheson.com/images/uploads/publications/Establishing_a_Qualifying_Investor_Fund_in_Ireland_October_2017.PDF.

- "QIAIFs – Ireland's Regulated Alternative Fund Product". KPMG Ireland. November 2015. https://assets.kpmg.com/content/dam/kpmg/pdf/2016/05/ie-qiaif-nov-2015-2.pdf.

- "The ICAV – Maples and Calder Checks the Box". Maples and Calder. March 2016. https://www.maplesandcalder.com/news/article/the-icav-maples-and-calder-checks-the-box-1256/. "Since then we have retained our position as the leading Irish counsel on ICAVs and to date have advised on 30% of all ICAV subfunds authorised by the Central Bank, which is nearly twice as many as our nearest rival."

- "New Irish Fund Vehicle to Facilitate U.S. Investment – the ICAV". Walkers (law firm). 2015. https://www.walkersglobal.com/index.php/publications/99-advisory/209-new-irish-fund-vehicle-to-facilitate-us-investment-the-icav.

- "Powerful Central Bank secrecy laws limit public disclosure of key documents". Irish Times. January 2016. https://www.irishtimes.com/news/politics/central-bank-secrecy-law-will-limit-public-disclosure-of-key-documents-1.2079188.

- "Irish Loan Originating Funds (L–QIAIFs): An Introduction". William Fry Law Firm. February 2018. https://www.williamfry.com/docs/default-source/articles-insights-william-fry-news-pdfs/loan-originating-funds.pdf?sfvrsn=0.

- "TRINITY COLLEGE DUBLIN: Ireland, Global Finance and the Russian Connection". Professor Jim Stewart Cillian Doyle. 27 February 2018. p. 21. https://www.tasc.ie/download/pdf/ireland_global_finance_and_the_russian_connection.pdf. "Regulation has been described as light touch regulation/unregulated"

- "A third of Ireland's shadow banking subject to little or no oversight: A report published on Wednesday by the Swiss-based Financial Stability Board.". The Irish Times. 10 May 2017. https://www.irishtimes.com/business/financial-services/a-third-of-ireland-s-shadow-banking-subject-to-little-or-no-oversight-1.3077931?mode=sample&auth-failed=1&pw-origin=https%3A%2F%2Fwww.irishtimes.com%2Fbusiness%2Ffinancial-services%2Fa-third-of-ireland-s-shadow-banking-subject-to-little-or-no-oversight-1.3077931.

- "Former Irish Central Bank Deputy Governor says Irish politicians mindless of IFSC risks". The Irish Times. 5 March 2018. https://www.irishtimes.com/business/financial-services/former-regulator-says-irish-politicians-mindless-over-ifsc-russian-risks-1.3414779?mode=sample&auth-failed=1&pw-origin=https%3A%2F%2Fwww.irishtimes.com%2Fbusiness%2Ffinancial-services%2Fformer-regulator-says-irish-politicians-mindless-over-ifsc-russian-risks-1.3414779. "Irish politicians are “mindlessly in favour” of growing the International Financial Services Centre (IFSC), according to a former deputy governor of the Central Bank"

- "TRINITY COLLEGE DUBLIN: 'Section 110' Companies. A Success story for Ireland?". Professor Jim Stewart Cillian Doyle. 12 January 2017. p. 20. https://www.tasc.ie/download/pdf/seminar_on_section_110_12th_jan_2017.pdf. "The same source in comparing different investment vehicles states that :- Another positive of the Section 110 Company is that there are no regulatory restrictions regarding lending as is the case with a QIF (Qualifying Investor Fund)."

- "IMF queries lawyers and bankers on hundreds of IFSC SPV boards". The Irish Times. 30 September 2016. https://www.irishtimes.com/business/financial-services/imf-queries-lawyers-and-bankers-on-hundreds-of-ifsc-boards-1.2811754. "The International Monetary Fund (IMF) has raised concerns about instances where individual bankers and lawyers were appointed to hundreds of boards of unregulated special-purpose vehicles in Dublin’s International Financial Services Centre."

- "ICAV structure rivals Section 110s in popularity, say Central Bank stats". Irish Independent. 31 July 2016. https://www.independent.ie/business/irish/icav-structure-rivals-section-110s-in-popularity-say-central-bank-stats-34925142.html. "Concerns have been raised that ICAVs, which are fully exempt from tax on income and profits, are being used by foreign and domestic investors to avoid paying tax on rental income in this country."

- Cianan Brennan (10 September 2016). "There are yet more Irish laws that allow foreign property investors to operate here tax-free". TheJournal.ie. http://www.thejournal.ie/tax-laws-ireland-qiaif-icav-2971661-Sep2016/. "Certain funds in operation here are seeing foreign property investors paying no tax on income. The value of property owned in these QIAIFs is in the region of €300 billion."

- "Fears over tax leakage via investors' ICAV vehicles". Sunday Times. 26 February 2017. https://www.thetimes.co.uk/article/fears-over-tax-leakage-via-investors-vehicles-cpnxcl72k. "Internal Department of Finance briefing documents reveal that officials believe there has been “extremely significant” tax leakage due to investors using special purpose vehicles."

- "How foreign firms are making a killing in buying Irish property". Irish examiner. 22 August 2016. https://www.irishexaminer.com/business/how-foreign-firms-are-making-a-killing-in-buying-irish-property-417038.html. "The Irish Collective Asset-management Vehicle was a nifty little tax structure introduced last year. Designed to primarily facilitate the transfer of U.S. funds into Dublin, it allows foreign investors to channel their investments through Ireland while paying no tax."

- "The ICAV: Irish Collective Asset-management Vehicle". A&L Goodbody Law Firm. March 2014. https://www.algoodbody.com/media/ICAVWebinarMarch20141.pdf. "The ICAV is now the most popular QIAIF in Ireland and set up take over from the Investment Company"

- "IRISH FUNDS ASSOCIATION: ICAV Breakfast Seminar New York". Irish Funds Association. November 2015. p. 16. https://files.irishfunds.ie/1447891863-NY-Nov-2015.pdf. "ANDREA KELLY (PwC Ireland): "We expect most Irish QIAIFs to be structured as ICAVs from now on and given that ICAVs are superior tax management vehicles to the to Cayman Island SPCs, Ireland should attract substantial re-domiciling business"

- "Conversion of a BVI or Cayman Fund to an Irish ICAV". William Fry Law Firm. 1 October 2015. https://www.williamfry.com/newsandinsights/news-article/2015/10/01/conversion-of-a-bvi-or-cayman-fund-to-an-irish-icav.

- "Pension Pooling and Asset Pooling in Ireland: Establishing a Common Contractual Fund in Ireland". Matheson (law firm). March 2017. https://www.matheson.com/images/uploads/publications/Establishing_a_Common_Contractual_Fund_in_Ireland_November_2017.PDF.

- "CCFs and Asset Pooling". Dillon Eustace Law Firm. 2010. http://www.dilloneustace.com/uploads/files/CCFs-and-Asset-Pooling.pdf.

- "Establishing a Private Equity Fund in Ireland". Matheson (law firm). March 2017. https://www.matheson.com/images/uploads/brochures/AMG_Private_Equity_Fund_Guide_March_17.pdf.

- "Tax breaks for commercial property will fuel bubble". Irish Independent. 6 November 2016. https://www.independent.ie/business/commercial-property/tax-breaks-for-commercial-property-will-fuel-bubble-35189754.html. "They'll do this by making commercial property investment, mainly by large foreign landlords, entirely tax-free. This will drive up commercial rents, suppress residential development, put Irish banks at risk, and deprive the State of much-needed funds."

- "Finance Bill Could Turn Commercial Property Bubble into next Crash". Stephen Donnelly T.D.. 6 November 2016. http://stephendonnelly.ie/finance-bill-could-turn-commercial-property-bubble-into-next-crash/.

- "Ireland is the world's biggest corporate 'tax haven', say academics". Irish Times. 13 June 2018. https://www.irishtimes.com/business/economy/ireland-is-the-world-s-biggest-corporate-tax-haven-say-academics-1.3528401?mode=sample&auth-failed=1&pw-origin=https%3A%2F%2Fwww.irishtimes.com%2Fbusiness%2Feconomy%2Fireland-is-the-world-s-biggest-corporate-tax-haven-say-academics-1.3528401. "New Gabriel Zucman study claims State shelters more multinational profits than the entire Caribbean"

- Aidan Regan (25 April 2019). "Ireland is a tax haven — and that's becoming controversial at home". Washington Post. https://www.washingtonpost.com/politics/2019/04/25/ireland-is-tax-haven-thats-becoming-controversial-home/?noredirect=on. Retrieved 25 April 2019.

- "CENTRAL BANK OF IRELAND: Enhancements to the L-QIAIF regime announced". Matheson (law firm). 29 November 2016. https://www.matheson.com/news-and-insights/article/enhancements-to-irish-loan-originating-funds-regime-announced.

- "Update on Changes to Loan Originating Qualifying Investor AIF Regime". Author Cox Law Firm. December 2016. http://www.arthurcox.com/wp-content/uploads/2016/12/Update-on-Changes-to-Loan-Originating-Qualifying-Investor-AIF-Regime.pdf.

- "Central Bank of Ireland publishes notice of intention to amend the requirements for Loan Origination Qualifying Investor AIF". Dillon Eustace Law Firm. February 2018. http://www.dilloneustace.com/uploads/files/L-QIAIF20CBI20Update202018.pdf.

- "Section 110: entitlement to treatment". Revenue Commissioners. May 2018. https://www.revenue.ie/en/tax-professionals/tdm/income-tax-capital-gains-tax-corporation-tax/part-04/04-09-01.pdf.

- Mark Paul (28 June 2018). "Tax-free funds once favoured by 'vultures' fall €55bn: Regulator attributes decline to the decision of funds to exit their so-called 'section 110 status'". Irish Times. https://www.irishtimes.com/business/economy/tax-free-funds-once-favoured-by-vultures-fall-55bn-1.3546101. Retrieved 26 April 2019. "Regulator attributes decline to the decision of funds to exit their so-called ‘section 110 status’"

- Jack Horgan-Jones (29 July 2018). "Vulture funds in new move to slash tax bills and escape regulation". Sunday Business Post. https://www.businesspost.ie/business/vulture-funds-new-move-slash-tax-bills-escape-regulation-422098. Retrieved 26 April 2019. "Fianna Fáil claims that funds have discovered a "new nirvana". Documents also reveal new strategy to avoid regulation."

- Michael McAleer (29 July 2018). "Seen & heard: Tax avoiding Vulture funds and TransferMate's deal with ING". Irish Times. https://www.irishtimes.com/business/economy/seen-heard-tax-avoiding-vulture-funds-and-transfermate-s-deal-with-ing-1.3579778. Retrieved 19 April 2019. "Vulture funds are putting in place new strategies to avoid tax and regulation, the Sunday Business Post reports. Citing a letter from Fianna Fail TD Stephen Donnelly to the Minister for Finance, it says the funds have moved substantial sums from the controversial Section 110 companies and into other entities called L-QIAIFs (loan-originating qualifying alternative investment funds). These do not file public accounts."

- As of March 2019, a large proportion of Irish assets and real estate assets are still held via loan securities as a result of the sale of over EUR100 billion in Irish loan balances (sold for cash proceeds of EUR35 billion) by the Irish National Asset Management Agency (NAMA), as well as tens of billions in additional loan balances by other Irish banks, to US distressed debt funds from 2013 to 2019; by reference, 2017 Irish GNI was EUR181 billion. The Irish Real Estate Funds (IREF), which are not tax-free, are largely confined to owners of Irish property via Irish quoted REIT assets.[3]

- Gayle Bowen; Aongus McCarthy (9 May 2018). "New loan origination QIAIF regime - finally a viable option?". https://www.privateequitywire.co.uk/2018/05/09/264045/new-loan-origination-qiaif-regime-finally-viable-option. Retrieved 19 April 2019. "However, the new rules combined with the strong legal and regulatory environment in Ireland, the settled and transparent requirements applicable to L-QIAIFs and the fast track authorisation process have already attracted increasing interest in L-QIAIFs among asset managers."

- "Alternative Investment Funds 2018: Chapter 21 IRELAND". Dillon Eustace Law Firm. 2018. https://www.dilloneustace.com/uploads/files/ICLG_AIF18_Chapter-21_Ireland.pdf. Retrieved 28 April 2019.

- "Lending to Irish Regulated Funds". Author Cox Law. http://www.arthurcox.com/publications/lending-to-irish-regulated-funds/. "QIAIFs are not permitted to carry on a trading business, with the exception of private equity and venture capital funds, but can establish a property fund structure. This structure consists of a Property Holding Company (“PropCo”) which is established as a subsidiary of the QIAIF. An Operating Company (“OpCo”) is also often established and a declaration of trust over the shares in favour of the QIAIF is common. As a result, the OpCo gets the benefit of a tax exemption for QIAIFs."

- Fiona Redden (12 June 2019). "How big landlords in Ireland minimise their tax bills on rental properties". Irish Times. https://www.irishtimes.com/business/personal-finance/how-big-landlords-in-ireland-minimise-their-tax-bills-on-rental-properties-1.3917078?mode=sample&auth-failed=1&pw-origin=https%3A%2F%2Fwww.irishtimes.com%2Fbusiness%2Fpersonal-finance%2Fhow-big-landlords-are-minimising-their-tax-bills-on-rental-properties-1.3917078. Retrieved 12 June 2019.

- "Kennedy Wilson firm pays no tax on its €1bn Irish property assets with QIAIFs". Irish Independent. 6 August 2016. https://www.independent.ie/business/commercial-property/kennedy-wilson-firm-pays-no-tax-on-its-1bn-irish-property-assets-34942829.html.

- "Clerys owner exploits tax avoidance loophole: Majority of shuttered Dublin store owned by collective asset vehicle (ICAV)". Irish Times. 4 October 2016. https://www.irishtimes.com/business/commercial-property/clerys-owner-exploits-tax-avoidance-loophole-1.2816212. "Icavs were introduced last year following lobbying by the funds industry, to tempt certain types of offshore fund business to Ireland. It has since emerged, however, that the structures have been widely utilised to avoid tax on Irish property."

- "Nothing to see here". Broadsheet.ie. 18 April 2016. http://www.broadsheet.ie/2016/04/18/nothing-to-see-here-35/.

- "Central Bank landlord a vulture fund paying no Irish tax using a QIF, says SF". Irish Independent. 28 August 2016. https://www.irishtimes.com/news/ireland/irish-news/central-bank-landlord-a-vulture-fund-paying-no-irish-tax-says-sf-1.2771263.

- "Tax 'trickery' in Ireland: A safe haven you can bank on". Irish Times. 29 May 2013. https://www.irishtimes.com/business/economy/tax-trickery-in-ireland-a-safe-haven-you-can-bank-on-1.1409039. "Ireland is a wonderful, special country in many ways. But when it comes to providing foreigners with lax financial regulation or tax trickery, it is a goddamned rogue state"

- "'Strong evidence' Ireland aiding EU banks' tax-avoidance schemes". Irish Independent. 28 March 2017. https://www.independent.ie/business/irish/strong-evidence-ireland-aiding-eu-banks-taxavoidance-schemes-35569517.html. ""The massive profitability levels of European banks in Ireland suggests that large profits may be reported in Ireland as a tax-avoidance strategy,""

- "Irish 'tax haven' benefits from offshore asset shifts, reports New York Federal Reserve". Irish Independent. 13 May 2018. https://www.businesspost.ie/news/irish-tax-haven-benefits-offshore-asset-shifts-ny-fed-416529. ""The massive profitability levels of European banks in Ireland suggests that large profits may be reported in Ireland as a tax-avoidance strategy,""

- "Ireland as a location for Distressed Debt: Orphaned Super QIF Example". Davy Stockbrokers. 2014. https://www.scribd.com/document/321040583/Ireland-as-a-Location-for-Distressed-Debt-Section-110-QIF-Super-QIF-Davy-Stockbokers.

- "Ireland:Selected Issues". International Monetary Fund. June 2018. p. 20. https://www.imf.org/en/Publications/CR/Issues/2018/06/28/Ireland-Selected-Issues-46027. "Figure 3. Foreign Direct Investment - Over half of Irish outbound FDI is routed to Luxembourg"

- "Irish SPV Taxation". Grant Thornton. 30 September 2015. https://www.grantthornton.ie/globalassets/1.-member-firms/ireland/insights/publications/grant-thornton---spv-taxation.pdf. "Irish withholding tax on transfers to Luxembourg can be avoided if structured as a Eurobond"

- "Mason Hayes and Curran:Silver Linings from Ireland's Financial Clouds with QIAIFs and Section 110 SPVs". Mason Hayes & Curran Law. May 2016. https://www.mhc.ie/uploads/Silver_Linings_Daragh_Bohan.pdf.

- "Irish Collective Asset-management Vehicle (ICAV) and Cayman SPCs". Maples and Calder. 2016. https://www.maplesandcalder.com/expertise/investment-funds/eu-regulated-funds/irish-collective-asset-management-vehicles/. "Across our global funds practice, we see many ICAVs being set up as parallel funds to the Cayman Islands and British Virgin Islands structures for managers looking to offer leading offshore and onshore fund solutions to their investors. We have advised on some pairing of onshore and offshore vehicles in combined structures."

- Kevin Doyle; Donal O'Donovan (19 April 2019). "Threat to tax 'cuckoo funds' as FG feels the heat on housing crisis". Irish Independent. https://www.independent.ie/business/personal-finance/property-mortgages/threat-to-tax-cuckoo-funds-as-fg-feels-the-heat-on-housing-crisis-38030843.html. Retrieved 19 April 2019. "The funds pay no corporation tax, no income tax and no capital gains tax in most cases."

- David Gardner (15 May 2010). "How bankers brought Ireland to its knees". Financial Times. https://www.ft.com/content/67ae51e2-5e35-11df-8153-00144feab49a. Retrieved 25 April 2019.

- As discussed in Modified gross national income, the high levels of BEPS tools in Ireland's economy means that its GDP is artificially inflated (e.g. in 2018, Irish GDP was 163% of Irish GNI*); academics have noted that the Irish State has traditionally bridged the gap to the distorted Irish GDP, by increasing the level of credit in the economy, and may have used property debt as the main tool for this.[53]

- "Loan Origination QIAIFs – Central Bank Consults". Dillon Eustace Law Firm. 14 July 2014. https://docplayer.net/31887836-Loan-origination-qiaifs-central-bank-consults.html. "ESRB: Nonetheless, if not subject to adequate macro and micro–prudential regulation, this activity could grow rapidly and introduce new sources of financial stability risk. It could also raise the financial system’s vulnerability to runs, contagion, excessive credit growth and pro-cyclicality."

- As discussed earlier in relation to Irish Section 110 SPVs, at the time Irish Section 110 SPVs were being used to avoid Irish taxation on Irish loan investments, however Section 110 SPVs had to file Irish public accounts, which led to a public scandal in 2016 when the level of Irish taxes being avoided by U.S. funds was revealed

- Christina Finn (27 March 2019). "UN says Ireland applies 'preferential tax laws' to vultures funds and it 'cannot continue'". TheJournal.ie. https://www.thejournal.ie/un-ireland-vultures-funds-tax-4563403-Mar2019/. Retrieved 29 March 2019. "A UN SPECIAL Rapporteur on housing has sent a letter to the Irish government noting that they have facilitated housing financing through “preferential tax laws and weak tenant protections among other measures”."

- Gavin Daly (21 April 2019). "Paddy Cosgrave, a weird press conference and €1,000 cash in brown envelopes". The Sunday Times. https://www.thetimes.co.uk/article/paddy-cosgrave-a-weird-press-conference-and-1-000-cash-in-brown-envelopes-7vj8tgtg9. Retrieved 26 April 2019.