| Version | Summary | Created by | Modification | Content Size | Created at | Operation |

|---|---|---|---|---|---|---|

| 1 | HONGXIA CHEN | -- | 1565 | 2022-10-17 05:53:28 | | | |

| 2 | HONGXIA CHEN | + 537 word(s) | 2102 | 2022-10-17 06:15:40 | | | | |

| 3 | Catherine Yang | Meta information modification | 2102 | 2022-10-17 07:40:29 | | | | |

| 4 | Catherine Yang | + 1 word(s) | 2103 | 2022-10-19 08:36:51 | | |

Video Upload Options

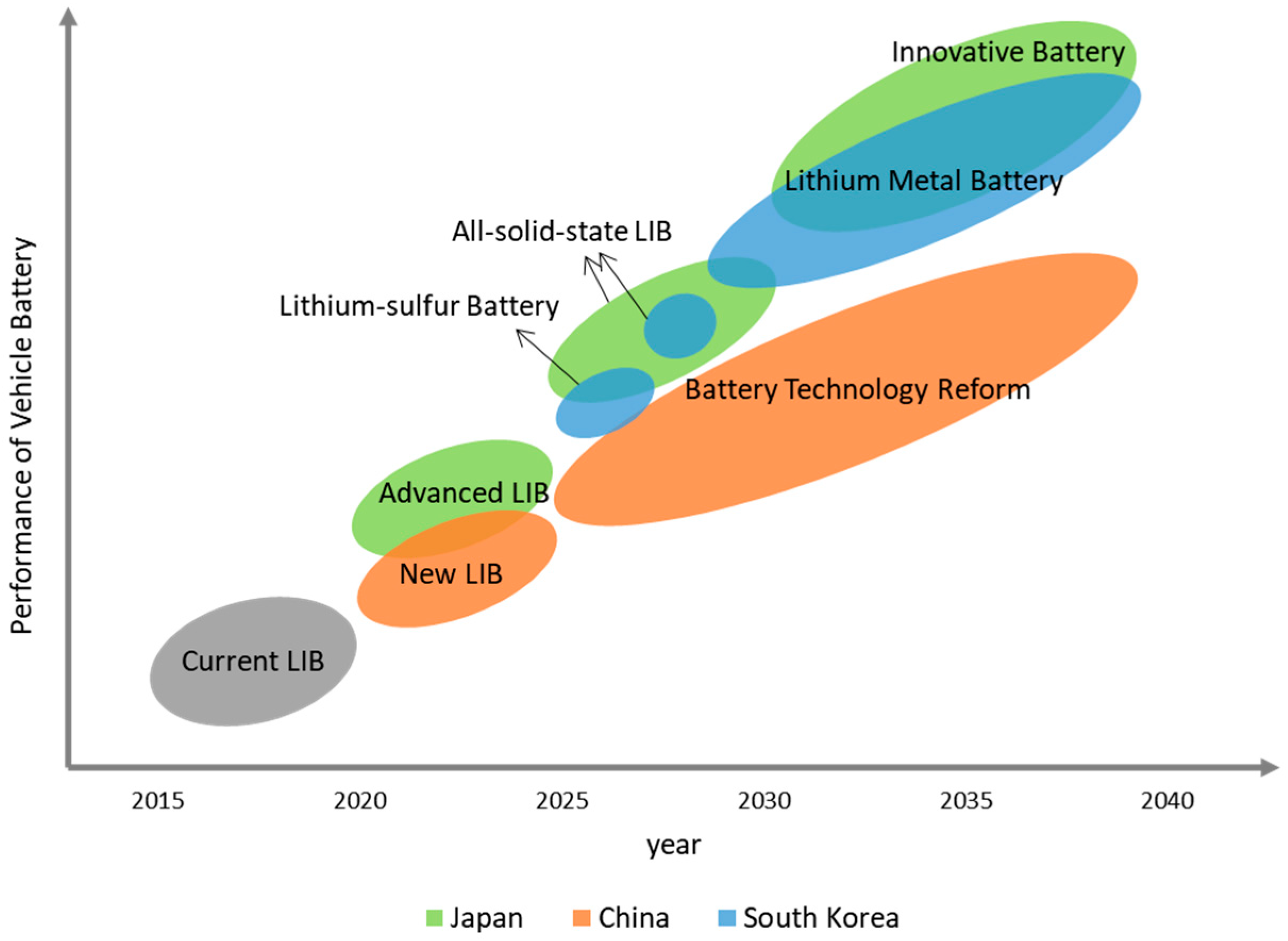

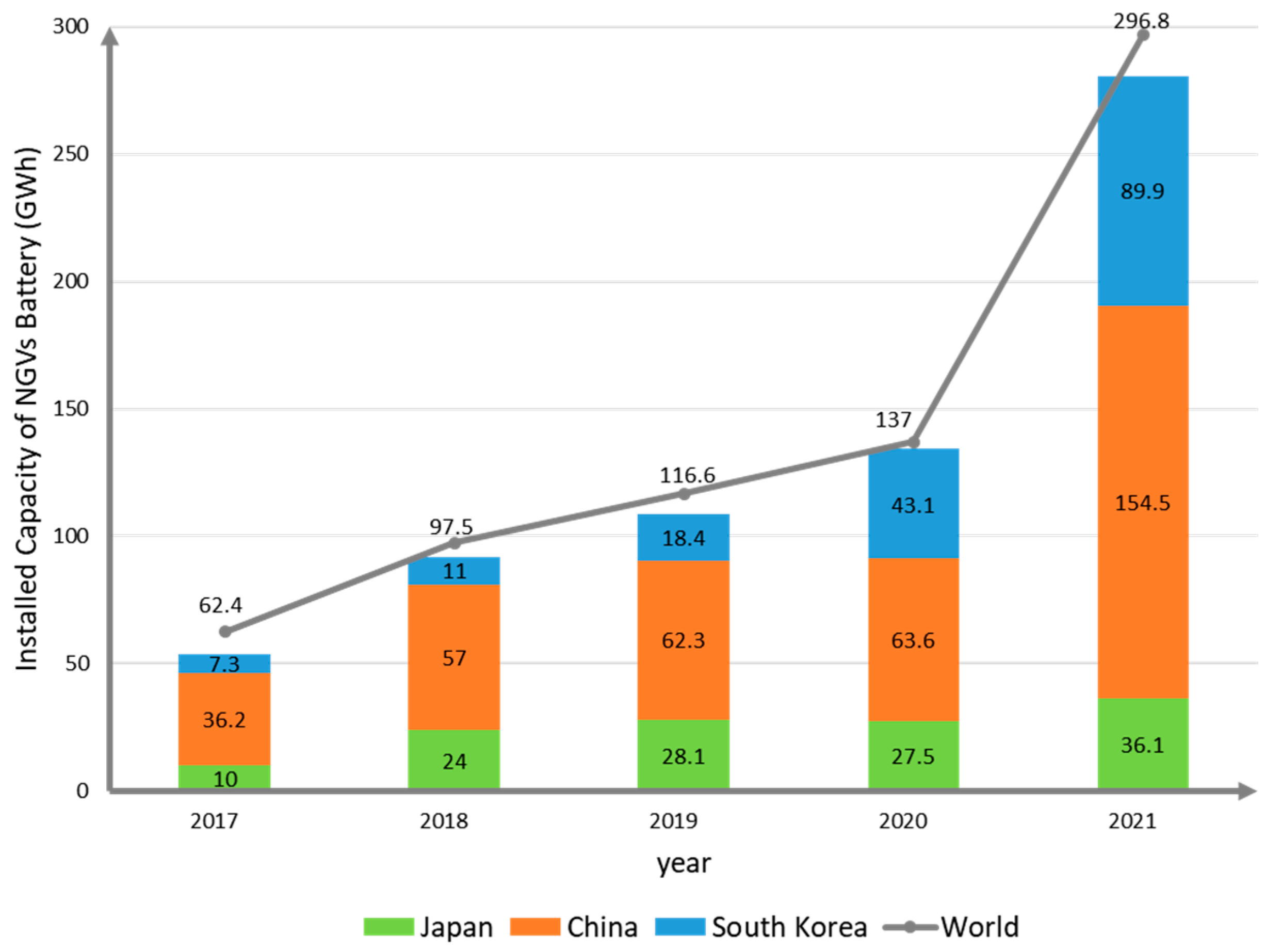

In recent years, with the rapid spread of next-generation vehicles (NGVs), China, Japan, and South Korea (CJK) have been leading the development of vehicle batteries. For NGV batteries, higher energy density, higher safety, and longer lifespan are important issues in the future. Along with the construction of recycling and reuse systems, it is expected that the vehicle battery market will further expand in countries around the world in respect to their own characteristics of specific development strategies and policy trends.

1. Technology Trends

2. Policy Trends

| Country | Year | Policy Name | Policy Feature |

|---|---|---|---|

| Japan | 2018 | Long-term Goal | Development Goal |

| 2020 | Green Growth Strategy for 2050 Carbon Neutral | Development Strategy | |

| 2021 | Development of Next-generation Batteries and Next-Generation Motors | Development Strategy | |

| China | 2017 | Automotive Industry Medium- to Long-term Development Plan | Development Plan |

| 2020 | New Energy Vehicle Industry Development Plan (2021–2035) | Resource Recovery System | |

| 2021 | New Energy Vehicle Battery Secondary Use Management Measures | Resource Recovery Strategy | |

| South Korea |

2018 | Notice Concerning the Return of EV Batteries | Recycling Regulation |

| 2019 | NGVs Industry Development Strategy | Development Strategy | |

| 2021 | K-Battery Development Strategy | Development Strategy |

3. Market Trends

|

Country |

Year |

Vehicle (Million) |

NGVs (Hundred Thousand) |

Main NGVs Type (Hundred Thousand) |

NGVs/Vehicle |

|

China |

2018 |

28.1 |

12.6 |

EV (9.8) |

4.5% |

|

2019 |

25.8 |

12.1 |

EV (9.7) |

4.7% |

|

|

2020 |

25.3 |

13.7 |

EV (11.2) |

5.4% |

|

|

Japan |

2018 |

5.3 |

15.0 |

HV (14.6) |

28.5% |

|

2019 |

5.2 |

14.8 |

HV (14.4) |

28.4% |

|

|

2020 |

4.6 |

13.8 |

HV (13.5) |

30.0% |

|

|

South Korea |

2018 |

1.8 |

2.9 |

HV (1.9) |

15.9% |

|

2019 |

1.8 |

3.7 |

HV (2.3) |

20.6% |

|

|

2020 |

1.6 |

4.4 |

HV (2.5) |

27.1% |

References

- Munakata, Y.; Kanamura, K. Development Trends, Issues, and Future Prospects of Next-Generation Secondary Batteries; AndTech: Kanagawa, Japan, 2021; pp. 1–17.

- Ishikawa, T. Development Trends, Issues, and Future Prospects of Next-Generation Secondary Batteries; AndTech: Kanagawa, Japan, 2021; pp. 131–140.

- Hu, G.; Huang, P.; Bai, Z.; Wang, Q.; Qi, K. Comprehensively analysis the failure evolution and safety evaluation of automotive lithium ion battery. eTransportation 2021, 10, 100140.

- Nikkei, Successive EV fires that never go out, batteries reburn without cooling. Nihon Keizai Shimbun, 30 September 2021; 1–2.

- Hayashi, K.; Sakuta, A. About the development status of all-solid-state batteries. Inst. Electr. Eng. Jpn. 2021, 141, 579–582.

- NEDO, Advanced Technical Development Business of Lithium-Ion Battery Application · Practicality-Basic Plan; Smart Community Department: Kanagawa, Japan, 2016.

- Fuji Keizai Group. Survey Results of the Global Market for Next-Generation Batteries; Fuji Keizai Co., Ltd.: Tokyo, Japan, 2020.

- NEDO. Toward the Formulation of Technology Strategies in the Field of Vehicle Batteries; Technology Strategy Center: Kawasaki, Japan, 2015.

- Lee, D.; Kim, K. Research and Development Investment and Collaboration Framework for the Hydrogen Economy in South Korea. Sustainability 2021, 13, 10686.

- Mike, W.; Young, C.C. The Hydrogen Economy South Korea-Market Intelligence Report; The UK’s Department for International Trade (DIT). 2021. Available online: https://www.intralinkgroup.com/Syndication/media/Syndication/Reports/Korean-hydrogen-economy-market-intelligence-report-January-2021.pdf (accessed on 5 September 2022).

- Song, Y.; Zhang, X.; Xu, S.; Guo, X.; Wang, L.; Zheng, X.; Huang, W.; He, Y.; Liu, R.; Yan, X.; et al. International Hydrogen Energy Policy Summary and Chinese Policy Analysis. In Proceedings of the 2020 IEEE 4th Conference on Energy Internet and Energy System Integration (EI2), Wuhan, China, 30 October–1 November 2020; pp. 3552–3557.

- Joint Ministries. NGVs Industry Development Strategy-2030 National Roadmap-; Joint Ministries: Seoul, Korea, 2019.

- METI. Interim Arrangement (Draft) Supplementary Material of the Automotive New Era Strategies; Ministry of Economy, Trade and Industry: Tokyo, Japan, 2018.

- MIIT. Action Plan for Promoting the Development of Automobile Power Battery Industry; Ministry of Industry and Information Technology: Beijing, China, 2017.

- Diaz, L.A.; Strauss, M.L.; Adhikari, B.; Klaehn, J.R.; McNally, J.S.; Lister, T.E. Electrochemical-assisted leaching of active materials from lithium ion batteries. Resour. Conserv. Recycl. 2020, 161, 104900.

- Hua, Y.; Liu, X.; Zhou, S.; Huang, Y.; Ling, H.; Yang, S. Toward Sustainable Reuse of Retired Lithium-ion Batteries from Electric Vehicles. Resour. Conserv. Recycl. 2021, 168, 105249.

- Harper, G.; Sommerville, R.; Kendrick, E.; Driscoll, L.; Slater, P.; Stolkin, R.; Walton, A.; Christensen, P.; Heidrich, O.; Lambert, S.; et al. Recycling lithium-ion batteries from electric vehicles. Nature 2019, 575, 75–86.

- Wu, X.; Wang, J.; Tian, W.; Zuo, Z. Application-derived safety strategy for secondary utilization of retired power battery. Energy Storage Sci. Technol. 2018, 7, 1094.

- Zhang, L.; Liu, Y.; Zhang, L.; Pang, B. Commercial Value of Power Battery Echelon Utilization in China’s Energy Storage Industry. J. Beijing Univ. Technol. 2018, 20, 34–44.

- Wang, S.; Yu, J. Life-Cycle Assessment on Nickel-Metal Hydride Battery in Hybrid Vehicles: Comparison between Regenerated and New Battery. Investig. Linguist. 2019, 43, 57–79.

- Wang, S.; Yu, J. Evaluating the electric vehicle popularization trend in China after 2020 and its challenges in the recycling industry. Waste Manag. Res. 2020, 39, 818–827.

- Wang, S.; Yu, J.; Okubo, K. Scenario Analysis on the Generation of End-of-Life Hybrid Vehicle in Developing Countries—Focusing on the Exported Secondhand Hybrid Vehicle from Japan to Mongolia. Recycling 2019, 4, 41.

- Wang, S.; Yu, J.; Okubo, K. Life cycle assessment on the reuse and recycling of the nickel-metal hydride battery: Fleet-based study on hybrid vehicle batteries from Japan. J. Ind. Ecol. 2021, 25, 1236–1249.

- Mahmood, K.; Gutteridge, F. EV batteries remanufacturing: BORG automotive challenge-Team 33. In Reman Challenge BORG June 2019; pp. 1–24. Available online: https://strathprints.strath.ac.uk/69631/ (accessed on 5 September 2022).

- Nguyen, T.P.; Easley, A.D.; Kang, N.; Khan, S.; Lim, S.-M.; Rezenom, Y.H.; Wang, S.; Tran, D.K.; Fan, J.; Letteri, R.A.; et al. Polypeptide organic radical batteries. Nature 2021, 593, 61–66.

- Hu, X. Development status and optimization suggestions of electric vehicles in China and Japan. Guangxi Qual. Superv. Guide 2019, 6, 2.

- METI. Green Growth Strategy for 2050 Carbon Neutral; Ministry of Economy, Trade and Industry: Tokyo, Japan, 2020.

- METI. Development of Next-Generation Batteries and Next-Generation Motors; Manufacturing Industries Bureau: Tokyo, Japan, 2021.

- MIIT. New Energy Vehicle Industry Development Plan (2021–2035); Ministry of Industry and Information Technology: Beijing, China, 2020.

- MIIT. New Energy Vehicle Battery Secondary Use Management Measures; Ministry of Industry and Information Technology: Beijing, China, 2021.

- Li, Z.; Li, Y. Research on laws and regulations of power battery recycling in developed countries. Automob. Accessories 2019, 19, 3.

- Yoneyama, K. Vehicle Batteries, Mandatory Recovery and Accelerated Reuse; ARC WATCHING: Tokyo, Japan, 2018.

- Ministry of Environment. Notice Concerning the Return of EV Batteries; Ministry of Environment: Sejong, Korea, 2018.

- Joint Ministries. 2030 Secondary Battery Industry (K-Battery) Development Strategy; Joint Ministries: Seoul, Korea, 2021.

- Martins, L.S.; Guimaraes, L.F.; Botelho Junior, A.B.; Tenorio, J.A.S.; Espinosa, D.C.R. Electric car battery: An overview on global demand, recycling and future approaches towards sustainability. J. Environ. Manag. 2021, 295, 113091.

- Wang, Z.; Li, X. Demand Subsidy versus Production Regulation: Development of New Energy Vehicles in a Competitive Environment. Mathematics 2021, 9, 1280.

- Zhang, J. Both Production and Sales of New Energy Vehicles Grow Rapidly. China’s Foreign Trade Engl. Version 2021, 1–28.

- Wang, S.; Yu, J. A Bibliometric Research on Next-Generation Vehicles Using CiteSpace. Recycling 2021, 6, 14.

- Luo, Y.; Wu, Y.; Li, B.; Mo, T.; Li, Y.; Feng, S.-P.; Qu, J.; Chu, P.K. Development and application of fuel cells in the automobile industry. J. Energy Storage 2021, 42, 103124.

- Miao, Y.; Liu, L.; Zhang, Y.; Tan, Q.; Li, J. An overview of global power lithium-ion batteries and associated critical metal recycling. J. Hazard. Mater. 2022, 425, 127900.

- Rajaeifar, M.A.; Heidrich, O.; Ghadimi, P.; Raugei, M.; Wu, Y. Sustainable supply and value chains of electric vehicle batteries. Resour. Conserv. Recycl. 2020, 161, 104905.

- Coffin, D.; Horowitz, J. The supply chain for electric vehicle batteries. J. Int. Commer. Econ. 2018, 1, 1–21.

- Duarte Castro, F.; Cutaia, L.; Vaccari, M. End-of-life automotive lithium-ion batteries (LIBs) in Brazil: Prediction of flows and revenues by 2030. Resour. Conserv. Recycl. 2021, 169, 105522.

- Jones, B.; Elliott, R.J.R.; Nguyen-Tien, V. The EV revolution: The road ahead for critical raw materials demand. Appl. Energy 2020, 280, 115072.