随着下一代汽车(In recent years, with the rapid spread of next-generation vehicles (NGV)的迅速普及,中国、日本和韩国(CJK)一直引领着汽车电池的发展。对于NGV电池,更高的能量密度,更高的安全性和更长的使用寿命是未来的重要问题。随着回收再利用体系的建设,预计汽车电池市场将根据自身特点在各国的具体发展战略和政策趋势上进一步扩大。s), China, Japan, and South Korea (CJK) have been leading the development of vehicle batteries. For NGV batteries, higher energy density, higher safety, and longer lifespan are important issues in the future. Along with the construction of recycling and reuse systems, it is expected that the vehicle battery market will further expand in countries around the world in respect to their own characteristics of specific development strategies and policy trends.

1. Technology Trends

In order to build a sustainable society, it is important to improve the energy efficiency and reduce carbon dioxide, a task for which secondary batteries with higher performance and functions are required. Although LIBs have been used in many fields, this does not mean that LIBs are the most suitable. In any case, it is necessary to develop batteries from various viewpoints, such as the battery energy density, input/output characteristic, safety, heat resistance, and elemental strategy [

27].

Currently, the energy density of LIB on the market is 100 Wh/kg and 150 Wh/L, while that of gasoline is 10,000 Wh/kg and 10,000 Wh/L, which is 100 times the unit mass and 67 times the unit volume of LIB. The energy density of the high-pressure hydrogen used in the fuel cell vehicle in the 35 MPa high-pressure tank is 10 times the unit mass of LIB, showing that the energy density of LIB is too low compared with other fuels. The energy density of an all-solid-state battery and a lithium–oxygen battery, which are called next-generation LIBs, is only about 1000 Wh/kg and 2000 Wh/kg respectively, and, thus improving the energy density is a major issue. Moreover, there are also problems with the temperature, such as that energy cannot be released, and the output cannot be determined at a low temperature. Additionally, the swing amount of the state of charge (SOC) of the battery is closely related to the lifespan. If the SOC value is close to the full charge, it tends to reduce the battery’s lifespan when placed in a high-temperature place. In this way, the lifespan will vary greatly depending on the actual application, the used method in the system, and the environment [

28]. In addition, safety is a concern because the organic liquid of electrolyte in a LIB may ignite under high temperature or severe impact [

29,

30]. On the other hand, since the electrolyte of an all-solid-state battery uses inorganic materials, such as oxide or sulfide, excellent safety can be maintained without catching fire. As a result, the all-solid-state battery is considered to be the mainstream of technical development in the future [

31,

32]. According to the research report of the Fuji Keizai Group, the market for all-solid-state batteries will exceed 2 trillion yen (about 14.4 billion US dollars) in 2035 [

33]. As with the LIB or all-solid-state battery, however, as long as it relies on rare metals, such as lithium and cobalt, it will be difficult to reduce production costs. Therefore, innovative batteries that do not require rare metals are also an important research subject in the future, but they are still in the basic research stage, and the practical application of innovative batteries is expected to be realized after 2030 [

34].

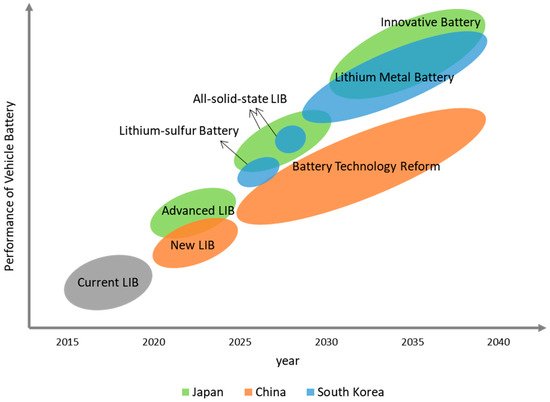

Globally, vehicle batteries are evolving toward enhanced performance, but the technical development schedules and specific strategies of each country are different. As shown in

Figure 1, CJK have each formulated development goals for vehicle batteries in the next 10 to 20 years, mapping out the technological path for the realization of the NGV society strategy. Japan began to develop advanced LIBs on the basis of current LIBs in 2020, mainly aiming at increasing energy density and cutting production costs. It will start the development of all-solid-state LIB from 2025, and will achieve universal popularization of it by 2030. Furthermore, from 2030, Japan will start to realize the practicality of an innovative battery, which is based on the chemical reaction of lithium–oxygen, lithium–sulfur and sodium–sulfur, or the intercalation reaction of multivalent ions, aiming at creating EVs with a cruising range comparable to that of gasoline vehicles. As for South Korea, it will successively develop a lithium–sulfur battery, all-solid-state battery, and lithium metal battery from 2025. In addition, Japan and South Korea are also vigorously investing in the development of fuel cells, especially South Korea, which aims to increase the number of FCVs to 5.9 million by the end of 2040 [

35,

36,

37]. In China, compared to Japan and South Korea, the development goals of vehicle battery proposed by the Ministry of Industry and Information Technology (MIIT) are relatively vague. Indeed, the MIIT did not even give a clear definition of “new battery” and “battery technology change” in the goals and, thus, it is difficult to accurately grasp the direction of its development.

Figure 1. Technical development goals for vehicle batteries in CJK [

38,

39,

40].

In addition to the technical development of material and performance improvement, the research on the resource recovery of used batteries is also underway. Firstly, at present, rare metals are recovered from cathode materials mainly by three methods, namely direct recycling, pyrometallurgy, and hydrometallurgy [

41,

42]. Then, in the waste management hierarchy, it was pointed out that reuse is preferable to recycling [

43]. From the business perspective, it is important to reuse the used vehicle batteries in other fields, such as automotive replacement batteries, electric bikes, and ESS, in order to extend the lifespan of the batteries [

44,

45]. In order to promote the development of recycling and the reuse of vehicle batteries, the estimation of the number of used batteries, and the environmental life cycle assessment of the usage conditions and recycling methods are also being actively conducted [

46,

47,

48,

49]. However, battery recycling and reuse are still in their early stage, and many technical issues must be overcome [

50]. On the other hand, the development of batteries that do not require rare metals is also one of the strategies for the securing of resources. In 2021, Nguyen et al. from Texas A&M University used redox polypeptides as battery electrodes, which showed excellent stability and degradability [

51]. Batteries that do not require rare metals are still in the experimental stage, but their practical application is worth the wait.

2. Policy Trends

Although CJK have adopted different policies and strategies in the development of vehicle batteries, they continue to make minor adjustments with the changes in NGVs and the battery industry. This leads to a great impact on the technical development and market trends of batteries all over the world. Table 1 briefly summarizes the policies related to NGV battery in CJK in recent years. It can be noted that policies pertaining to the vehicle battery have primarily focused on technology development goals or strategies, while, in China, it is more focused on policies of resource recovery.

Table 1. Vehicle battery-related policies in CJK.

In Japan, the Ministry of Economy, Trade, and Industry (METI) put forward a “Long-Term Goal” at the Automotive New Era Conference in 2018, and presented the basic policies and concrete actions regarding the electrification of Japanese automobiles [

39]. From the perspective of the goal of vehicle batteries in the “Long-Term Goal”, as an important five year plan starting in 2018, it is clearly stated that the industry–academia–government technical development of next-generation batteries, including all-solid-state batteries and innovative batteries, will be officially promoted [

52]. In addition, the “Green Growth Strategy for 2050 Carbon Neutral” promulgated in 2020 further emphasized the practical application of all-solid-state batteries and innovative batteries, and formulates specific action plans for lowers prices and R&D/technical demonstration for practical use [

53]. Furthermore, in the “Development of Next-Generation Batteries and Next-Generation Motors” promulgated in 2021, aiming for 100% electric vehicle sales by 2035, more specific battery R&D, recycling, and reuse promotion strategies were put forward [

54].

In China, environmental regulations have become stricter since 2010, and EVs have been promoted as a national policy. In recent years, however, China has accelerated the construction of a system for battery recycling and reuse to deal with the large number of used vehicle batteries generated by the rapid popularization of EVs. In particular, the recent “New Energy Vehicle Industry Development Plan (2021–2035)” and “New Energy Vehicle Battery Secondary Use Management Measures” further emphasized the battery recycling responsibility of relevant enterprises, and promoted the establishment of a resource recovery system for used batteries [

55,

56]. China has established a preliminary battery recycling and reuse policy system based on the principle of extended producer responsibility, but the legal enforcement and relevant penalties are so weak that the actual effect of implementation is doubtful [

57,

58].

On the other hand, South Korea’s vehicle batteries recycling policy is slightly behind those of China and Japan. The “Notice Concerning the Return of EV Batteries” promulgated in 2018 set the detailed rules of recycling used vehicle batteries for the first time [

59]. In addition, according to the “NGVs Industry Development Strategy” issued in 2019, South Korea will focus on the development and popularization of LIBs and fuel cells among the NGV batteries in the future [

38]. In particular, the “K-Battery Development Strategy” promulgated in 2021 is regarded as a national strategy of South Korea, which is ready to promote the development and popularization of vehicle batteries in earnest [

60].

3. Market Trends

In this battle for the supremacy of NGV batteries, Japanese capital has occupied the initial market with technical superiority. In recent years, however, due to technical development and policy changes in CJK, the market of NGVs and vehicle batteries in these three countries has ushered in a new phase.

根据表According to Table 2,虽然中国, although the proportion of new vehicle sales of NGV

新车销量占比逐年增加,但由于现有汽油车数量众多,我国NGV整体占比仍然较低,而NGV在韩国汽车市场的销量份额正在迅速增加s in China is increasing year by year, the whole proportion of NGVs in China is still low due to a number of existing gasoline vehicles, while the sales share of NGVs in the Korean automobile market is rapidly increasing [

61,,62,,63]

。另一方面,. On the other hand, the sales volume of NGV

在日本的销量正在逐渐下降,其在新车销量中的份额保持在30%左右。此外,三国还以特定NGV为主要发展目标。中国主要关注电动汽车,而日本和韩国主要关注HV和FCVs in Japan is gradually declining, the share in new car sales of which remains at about 30%. In addition, the three countries take specific NGVs as the main development targets. China mainly focuses on EVs, while Japan and South Korea mainly focus on HVs and FCVs [

64]

。与电动汽车不同,高压电池大多是镍氢电池. Unlike EVs, HV batteries are mostly nickel-metal hydride batteries [

46]

。因此,与汽车销量大、电动汽车数量急剧增加的中国相比,. Therefore, compared with China, where the number of vehicle sales is large and the number of EVs is increasing dramatically, the penetration rate of LIB

在日本和韩国的渗透率有限。s in Japan and South Korea is limited.

表Table 2. Vehicle sales in CJK from 2018

-2020年中日韩汽车销量 to 2020 [

61,,62,,63]

。.

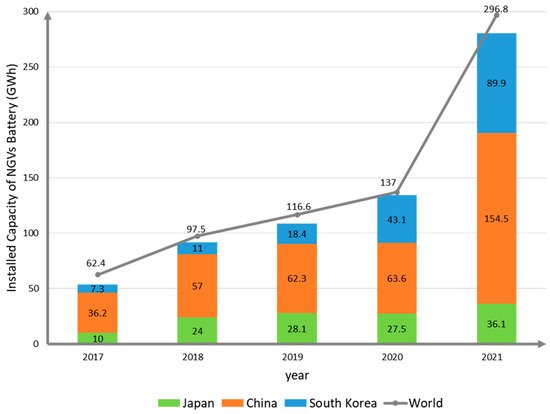

如图As shown in Figure 2所示,近年来中日韩汽车电池销量的变化与, the changes in the sales volume of vehicle batteries in CJK in recent years are consistent with the sales situation of NGV

的销售情况一致s [

65,,66]

。自. Since 2017

年以来,韩国汽车电池的装机容量几乎呈指数级增长,特别是在2020年和2021年,在此期间增长率超过100%。到2020年,中国装机容量增长率一直很低,但到2021年,这一增长率达到143%,占全球装机容量的52%。相比之下,日本的汽车电池装机容量一直停滞不前,近年来甚至萎缩。可以看出,日本的汽车电池市场正处于停滞状态。相比之下,中国和韩国在汽车电池方面具有优越的市场前景。从2017年到2021年,中国和韩国的汽车电池装机容量平均增长率分别为90%和53%,其中韩国的增长率较高。, the installed capacity of a vehicle battery in South Korea has increased practically exponentially, especially in 2020 and 2021, during which the growth rates exceeded 100%. China’s growth rate of installed capacity has been low until 2020, but in 2021 the growth rate reached 143%, representing 52% of the worldwide installed capacity. In contrast, Japan’s installed capacity of vehicle batteries has been stagnant and has even contracted in recent years. It can be seen that the Japan’s vehicle battery market is in a stagnation state. In contrast, China and South Korea have a superior market prospect for vehicle batteries. From 2017 to 2021, the average growth rate of installed capacity of vehicle batteries in China and South Korea was 90% and 53%, respectively, of which South Korea has a higher growth rate. Therefore, we assume that the vehicle battery market in China and South Korea is likely to grow further in the future, and it is likely that China’s global market share will be surpassed by South Korea.

图

Figure 2. Sales trend of vehicle batteries in CJK from 2017

-2021年中日韩汽车电池销售趋势 to 2021 [

65,,66]

。.

另一方面,随着

On the other hand, with the rapid expansion of the NGV

市场的快速扩张,电池制造需要巨大的资源投资 market, an enormous resource investment is required for battery manufacturing [

67]

。对镍的需求将从. The demand for nickel will increase from 100,000 tons in 2020

年的10万吨增加到2030年的100万吨,而对钴的需求将在2025年增加到22万吨,届时钴的供需缺口预计将达到20% to 1 million tons in 2030, while the demand for cobalt will increase to 220,000 tons in 2025, when the supply–demand gap of cobalt is expected to reach 20% [

68,,69]

。此外,由于原材料消费的快速增长而导致的供应链中断将阻碍. Furthermore the supply chain disruptions due to the rapid consumption growth of raw materials will hinder the popularization of NGV

的普及s [

70]

。因此,二手车电池的回收、再循环、再利用,以及电池替代材料(新材料)的开发都非常重要。. Therefore, the recovery, recycling, and reuse of used vehicle batteries, as well as the development of substitute materials (new materials) for batteries are very important.