Your browser does not fully support modern features. Please upgrade for a smoother experience.

Submitted Successfully!

Thank you for your contribution! You can also upload a video entry or images related to this topic.

For video creation, please contact our Academic Video Service.

| Version | Summary | Created by | Modification | Content Size | Created at | Operation |

|---|---|---|---|---|---|---|

| 1 | Favourate Y Mpofu | -- | 6669 | 2022-09-28 00:56:22 | | | |

| 2 | Sirius Huang | Meta information modification | 6669 | 2022-09-28 04:41:31 | | |

Video Upload Options

We provide professional Academic Video Service to translate complex research into visually appealing presentations. Would you like to try it?

Cite

If you have any further questions, please contact Encyclopedia Editorial Office.

Mpofu, F.Y. Green Taxes in Africa. Encyclopedia. Available online: https://encyclopedia.pub/entry/27741 (accessed on 08 February 2026).

Mpofu FY. Green Taxes in Africa. Encyclopedia. Available at: https://encyclopedia.pub/entry/27741. Accessed February 08, 2026.

Mpofu, Favourate Y.. "Green Taxes in Africa" Encyclopedia, https://encyclopedia.pub/entry/27741 (accessed February 08, 2026).

Mpofu, F.Y. (2022, September 27). Green Taxes in Africa. In Encyclopedia. https://encyclopedia.pub/entry/27741

Mpofu, Favourate Y.. "Green Taxes in Africa." Encyclopedia. Web. 27 September, 2022.

Copy Citation

Environmental or green taxation has been increasingly seen as a productive economic instrument to generate incentives to stimulate more environmentally friendly consumption and production choices and trends. Growing attention to environmental challenges such as the lack of optimum, effective, and responsible usage of natural resources, health concerns from the use of some energy resources, environmental degradation, and climate change have driven the implementation of green taxes. These taxes have been used by various countries, regions and continents on variegated areas and driven by an array of motives. The African continent has also put in place environmental taxes as evidenced in various countries.

green taxes

environment

sustainability

1. Introduction

Globally and within domestic contexts, tax policymakers are paying significant attention to environmental or green issues. For example, the United Nations [1] states that “Climate change is an existential threat. Countries are facing dramatic impacts of global warming. Given the substantial costs associated with climate change, jurisdictions are increasingly adopting ambitious and sophisticated policy instruments to support climate mitigation, especially market-based policies such as carbon pricing” and environmental taxes. Different green tax measures have been constructed and implemented by various counties around the world. Green taxes are defined as taxes with an environmental orientation. In response, social actors such as companies are working on measures to minimize their contribution to environmentally unfriendly activities such as carbon emissions and pollution [2]. The social actors are continuously assessing the potential climate change risks, sharing information with various stakeholders such as employees, investors, customers, and regulators on how to reduce emissions and mitigating the greenhouse emission effects. Green taxes are employed to control the negative effect on the environment. These taxes normally come in the form of energy taxes, transport, pollution taxes and natural resources taxes. The pivotal objective is to discourage unfriendly ecological activities and actions by companies and citizens as well as to stimulate environmental sensitivity among individuals and corporate citizens. The green taxes have gained high priority in fiscal agendas. They are at high levels of implementation in some countries and in some countries at early adoption, while others are still struggling to put them in place [3]. Researchers table that green taxes lead to ecologically sustainable actions, provide an opportunity to address current and future environmental problems, enhance the efficiency of tax systems, generate revenue, and promote the equity of tax systems [4]. These possible outcomes remain contested.

2. Definition of Green Taxes

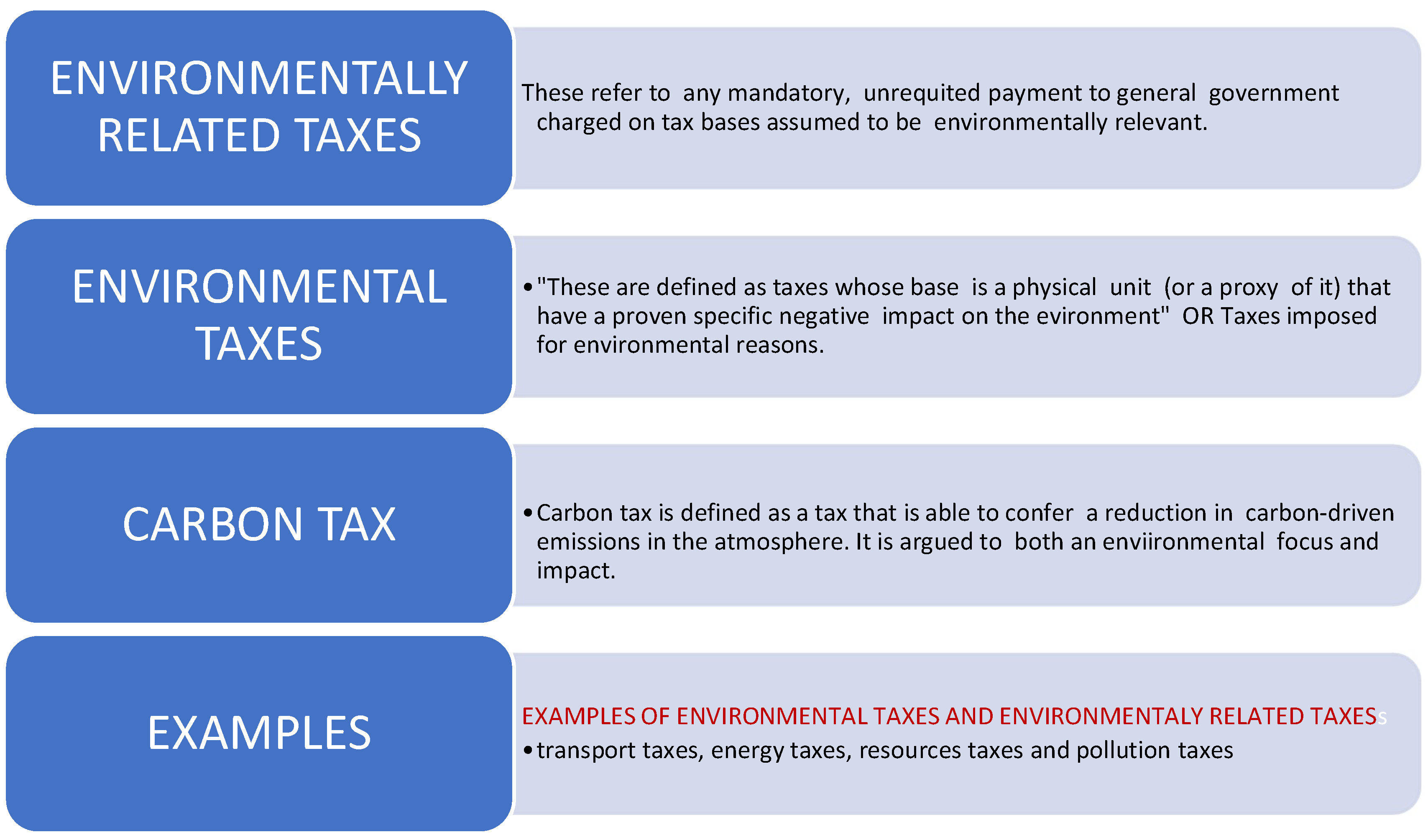

There is no consensus among researchers on the definition of green taxes. This points to the newness, unfamiliarity and controversy surrounding the concept. The understanding and definition of green taxes is linked to contexts. The term green taxes describe environmental taxes or taxes levied with the objective of protecting the natural environment. These can be referred to as taxes to control the negative effect of certain activities and products on the environment. The idea is to dissuade certain ecologically harmful activities and actions by citizens and companies, thus encouraging environmentally sensitive decisions and actions. Environmentally taxes are such that the cost of the negative externalities or unfavorable impact in the economy is incorporated in the prices to ensure production and consumption decisions that are ecologically friendly. These taxes include transport taxes, pollution taxes, carbon taxes energy taxes and natural resources taxes [5]. For example, energy taxes encompass those charged on products used in the transport sector and the generation of electricity such as natural gases and fossil fuels, among others. As part of policy initiatives, green taxes target the fulfillment of certain environmental goals, such as encouraging the adoption of cleaner and cost-effective energy sources, promoting sustainable industry and greener initiatives and behaviors as well as discouraging the use of certain energy sources. Green taxes can help foster support for sustainable growth and generate more tax revenue for the economy, thus giving relief to other tax heads such as income tax, employment tax, corporate tax and value-added tax. Incomes from other tax heads dwindled due to the reduced economic activity, company closures, and retrenchments as well lockdown restrictions during the COVID-19 pandemic; therefore, green taxes can boost revenue mobilization to fund government expenditure, reboot economies and achieve the SDGs.

The green taxes are normally divided into two groups, environmental taxes and environmentally related taxes, although the distinction is blurred as other scholars group them under the one blanket of environmental taxes or just green taxes. ATAF [3] distinguishes between the two groups. Figure 1 illustrates the definitions of environmental taxes and environmentally related taxes.

Principles Guiding Environmental Taxes

Environmental taxes are guided by four principles that are outcomes of various discussions of climate change issues as well as environmental protection. These principles are summarized in Table 1.

Table 1. Principles relating to the implementation of environmental taxes.

| Principle | Explanation |

|---|---|

| The polluter pays principle | This principle relates to the quantification of positive and negative impacts. The principal advocates for internalization and calls for accounting for pollution through the fiscal and economic approach. In this case, the tax cost must reflect the internalized cost of the environmental damage linked to an economic activity. The principle calls for the environmental costs that are not only borne by society (through social impacts) and governments (through costs to redress the degradation) but also by the polluter through taxation in the case of green taxes. |

| The principle of prevention | This principle advocates for the protection of the environment. The idea is to ensure that as companies and individuals exploit resources for their economic development and profit maximization, they do not cause damage to the environment. Green taxes are one such economic measure for prevention of the environment through policies that protect the environment and ensure environmental sustainability. |

| The precautionary principle | This principle is founded on the desire to protect the environment from potential risks or harm. The harm might be currently unassessed, unquantified, or unaccounted for, but there is a possibility of estimating it justifiably (hypothetical risk). Environmental taxes can help mitigate future risks and protect the environment. |

| The principle of common but differentiated responsibilities | The principle is based on countries having a shared responsibility for protecting the environment against degradation and pollution although with differentiated engagement levels. Environmental taxes could provide a common ground that is differentiated by the nature of the green taxes, the tax rates as well as the tax administration. |

3. Theoretical Framework

According to Shahzad [9], “the role of environmental taxes is ambiguous and demands more in-depth investigation”. To understand the nature of environmental taxes in Africa, as well as their influence on energy consumption, conservation, and efficiency as well as on environmental quality, deterioration, preservation and management, this study is built on theoretical underpinnings of the double dividend (DD) theory on environmental taxes. This research is guided by this theory that informs the motives for the implementation of environmental taxes and the envisaged outcomes of these taxes. These rationalizations and possible consequences hinge on behavior modification, improved manufacturing processes and increased tax collections (the revenues are anticipated to decrease in the long run as the expected behavior change benefits are reaped).

3.1. The Double Dividend Theory or Hypothesis

The attainment of the DD is a contested topic among researchers, and its growing importance in tax and environmental preservation debates has gained renewed focus due to green taxes and greater focus on climate change discussion. In explaining the role of green taxes, others refer to the internalization of the external costs or the costs of environmental damages [10][11] and use resources from the environmental taxes to reduce other taxes (migrating from highly economic distortive taxes to less distortive ones) [12] and the contribution of environmental protection using environmental taxes [3]. Goulder [13] breaks the DD into two forms: the strong and weak DD. The former is linked to the welfare improvements emerging from the implementation of environmental taxes and the use of the revenues generated from environmental taxes to minimize the distortionary effects of other taxes, irrespective of whether environmental conditions are improved. The latter presupposes that “recycling environmental tax revenues through lowering distortionary taxes leads to cost savings relative to the case where revenues are returned via lump-sum transfers” [14]. Baumol et al. [15] and Baumol and Oates [16] submit that environmental tax can set as: t = MD (tax = marginal cost of social damages due to pollution or other environmental damaging action). Lee and Misiolek [17] argue that cost of the damage or pollution must exceed the marginal cost of damages (MD); therefore, t = MD + RE (which represents the revenue effect). There is a general no consensus on the existence of the DD; some question the existence of the weak dividend in the face of multiple distortions, while some affirm its validity [18]. Bovenburg and Goulder [19] allude to the ability of green taxes to result in an employment dividend, which is a third dividend in addition to the normally discussed two: the environmental quality and the economic efficiency. Some economists such as Babiker, Metcalf and Reilly [20] only accept one dividend, the reduction in environment-damaging activities and behavior, and they reject the argument on the likely reduction in distortionary taxes and the possibility of an employment dividend.

Evaluative Discussion of the Double Dividend Theory

While the environmental dividend or advantages emanating from levying climate taxes or green taxes is acceptable to researchers, the economic development dividend from these taxes remains an issue of disagreement among researchers. It is a controversial and contested matter. Sustainable development in most countries is influenced by an array of factors. Problems surrounding sustainable development coalesce around facilitating stable economic, creating employment, regulating energy use and ensuring the use of cleaner and environmental friendly energy sources to ensure environmental sustainability [21]. While some researchers theoretically and empirically support the existence of a double dividend [14]), other researchers found no empirical support for the double dividend [22], and others have disputed the possibility of such a dividend existing [23]. Zhou et al. [24] states that the DD theory “on environmental tax is invalid”. Economists disagree on the existence of the DD. They point out that the capacity of environmental taxes to yield the DD is influenced by the design and implementation of the green taxes, the structure of the economy where they are implemented, the socio-political context of the country as well as consumer preferences in that country. Wesseh and Lin [21] argue that green taxes could effectively influence customers to reduce the consumption of polluting as well as stimulate investment in pollution-reducing measures by companies. This points to the attainment of the environmental dividend as environment quality is improved. The researchers argue that contrastingly, when environmental taxes increase, economic facets such household incomes, employment generation and economic growth are negatively affected. Therefore, the researchers refute the existence of the second dividend ‘the economic or non-environmental’ dividend. Two opposing effects emerge: substitution for cleaner sources of energy is stimulated on the one hand, while on the other hand, total household consumption levels and incomes are reduced [25]. This points to the affirmation of the first dividend, environmental dividend, and the refutation of the second dividend. De Mooiji [26] states that “whereas the second dividend may be in doubt, the first dividend (i.e., cleaner environment) remains a powerful reason for the introduction of pollution taxes”.

Driving sustainable growth, investment in health and education, and enhancing poverty reduction efforts to improve the welfare of citizens are governments’ major objectives. Therefore, to attain the DD, the levying of green taxes must improve economic efficiency (economic growth, incomes, and employment creation) and enhance environmental quality concomitantly. According to Glomm et al. [27], how the revenue mobilized from green taxes is recycled is the key question in addressing the fruition of the second dividend. The OECD [6] tables that where the revenue was used to reduce the social security contributions, GDP increases in response to the environmental tax reforms; however, the case was different where the green tax revenues were used to reduce individual incomes taxes. Piciu and Trică [28] portend that it is important to discuss green taxes in relation to the economic efficiency dividend with respect to the costs of environmental taxes, allocation of resources and how these green taxes uphold the vertical and horizontal equity principle in the distribution of income and wealth. Glomm et al. [27] assert that it is also vital to assess the magnitude of revenue contribution from these taxes and their efficiency in terms of administrative efficiency and economy (reduction or increase in administration costs, operating and tax compliance costs as well as costs of substitution). The fruition of the economic dividend is discussed in relation to the effect on incomes, economic growth, the tax burden and employment or impact on labor.

Existing Taxes and the DD Theory

Nerudova and Dobranschi [11] posit that the environmental economics that explains the interaction between newly introduced environmental taxes and already existing distortionary taxation framework is complicated; hence, it cannot be simply explained by the fact that introducing green taxes reduces the distortionary impact of current taxes. The researchers contend that the attainment of the DD, especially the economic efficiency one based on tax interaction and revenue recycling, is highly uncertain. “The idea of the introduction of costless green taxes that will not increase the burden of already existent distortionary taxes is very appealing”, but the practicality of it is a matter of debate [11]. The DD hypothesis supposes the tax revenue neutrality effect of environmental taxes, implying “the reduction in the revenue of existing taxes is commensurate with the increase in revenue from environmental taxes, thus a ‘tax swap’ or green tax reform” [4]. Goulder [29] questions the possibility of having revenue-neutral taxes and zero-cost taxes. Porteba and Rotemberg [30] allude to the regressivity associated environmental taxes especially carbon taxes in developing economies. Contrary to leading to the reduction in the tax burden emanating from pre-existing taxes, environmental taxes may further heighten the burden of existing tax systems. The justification of levying environmental taxes founded on the revenue recycling benefit is challenged, while others posit that with this argument, rationalizing the implementation of environmental taxes on the angle of environmental quality efficiency improvement and gains may be less fundamental, yet it must be the core of the environmental tax policy. To fully understand the controversy surrounding the attainment of the economic dividend, it important to consider the use of tax revenues and the nature of distortionary taxes as they influence the size of the environmental taxation costs. Goulder [13] states that environmental taxes reduce the non-environmental welfare as well as the spending power of consumers on other goods, thus culminating in distortions in labor and commodity markets and erosion of the tax base for other tax heads.

Employment or Labor and the DD Theory

Jaeger [4] adduces that the relationship between green taxes and the current taxes is intricate and research on the interactions between these taxes has remained, controversial, opaque, and contested for a long period of time. The impact of environmental taxes on the attainment of the DD with respected to labor is mixed. Bovenberg [31] dispute the materialization of the economic efficiency dividend. According to Wesser and Lin [21], the effect of environmental taxes on the demand of labor supports the attainment of the DD on employment. The researchers further state that a closer assessment of the impact of environmental taxes on the supply of labor concludes that environmental taxes negatively affect employment, thus negating the DD effect on employment. Environmental taxes fail to finance the labor reduction driven by reduced economic activity that is linked to polluting activities such as manufacturing or environmental unfriendly activities such as mining. Bayindir, Upmann and Raith [32] submit that in circumstances where labor markets are distorted, replacing labor taxes with green taxes would enhance employment creation and output and eventually lead to unfavorable effects on the environment. Jaeger [4] argues that green taxes might affect labor, productivity, income, and tax revenue mobilization. The researcher submits that if environment degradation unfavorably influences productivity, green taxes might be justifiable as a corrective tool, but they can negatively affect the tax base by resulting in a reduction in the level of taxable income. An illustration being where pollution due to manufacturing leads to health changes for the workforce, labor supply might be negatively affected due to mortality and morbidity. Pollution tax in this case might curb polluting activities and increase the labor force and enlarge the employment tax base. Reduced health challenges might also lead to minimized spending on health care.

The Tax Burden and the DD Theory

The DD is also a contested topic based on the impact of environmental taxes on the tax burden, especially on the possible regressivity and progressiveness of the taxes as well on inequality [33]. Poterba and Rotemberg [30] portend that if the proportion of household income spent by low income-earning families on fuel is higher that used by high income-earning or wealthy families, then environmental taxes are deemed to be regressive, hence leading to the disputation of the DD with respect to the tax burden. Chan [34], while focusing on environmental tax sustainability, contends that irrespective of the dimensions the impact of environmental taxes on distribution is viewed from (whether vertical welfare distribution or horizontal income distribution), environmental taxes tend to benefit the richer more than the poor, thus aggravating income inequality. Some researchers argue that when it comes to the impact of environmental taxes on income or wealth distribution, the DD effect does not exist [35][36]. The researchers point out that environmental taxes undoubtedly result in an unfair distribution of income and wealth among citizens.

4. Green/Environmental Taxation in African Countries

The implementation of green taxes has been pinpointed as a possible option to mobilizing domestic revenue to revive the economy post COVID-19 pandemic. The COVID-19 pandemic put significant pressure on government resource globally, stretching them to the maxim and beyond; hence, identifying new sources of revenue is important to boost the economic recovery from the COVID-19-induced economic problems and other general problems. African countries were heavily affected, as they are highly dependent on taxes and natural resources for funding public expenditure. Despite the high dependence on tax revenues, domestic revenue mobilization is weak in the African continent due to the presence of a huge informal sector that is contributing insignificantly to the tax basket [37][38]. Tax bases are narrow, and tax avoidance and evasion by multinational operating in the continent is high [39]. Compounding the challenges of weak domestic revenue mobilization is the fact that legal and institutional frameworks are weak, tax compliance is very low and that tax morale is low also due to lack of transparency and accountability [40][41]. Green taxes have therefore become more important than ever as a source of more revenue. Many African countries are moving toward ‘greening their budgets’ by shifting taxes from labor and capital to the environment and natural resources. Ideally, for environmental taxes to be effective, the tax charged must be commensurate with the environmental damage caused. For example, in relation to carbon taxes or pollution taxes, tax must be levied based on per unit tax on emissions such that the tax forces companies to internalize the negative externality by investing in more research and development on and implementation of environmentally friendly technology and production processes. Companies are compelled to adopt green technologies, and this has an influence on production and pricing decisions as well as competition [42]. As the tax cost declines through better consumption and production, environmental protection and sustainability are enhanced, thus killing two birds with one stone.

5. Types of Green/Environmental Taxes Levied by African Counties/Strategies of Levying Green Taxes

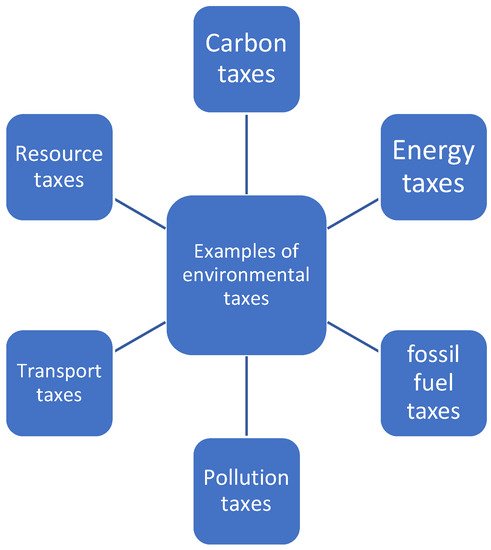

In African countries such as Nigeria, South Africa and Egypt are among the largest users of energy. Algeria, South Africa, Nigeria, Egypt, Morocco, and Libya are identified as the biggest contributors to African emissions from fossil fuel. Even though emissions are low in Africa, they are steadily growing over time, hence the need to try to ensure that the future consumption of fossil fuels takes place within the context of minimized carbon emissions and environmentally friendly development trajectories [43][44]. Measures to promote cleaner energy usage, reduce adverse outcomes and promote more favorable economic and social development activities such as environmental taxes are encouraged [45]. Policies such as green taxes must be implemented but accompanied by detailed assessments and understanding of consumer behaviors, consumption patterns and the availability of alternatives. A detailed assessment is key, because for some countries that are dependent on these fuels, they constitute key sources of revenue, contributing 50–80% of government revenues. These countries include Libya, Angola, and Nigeria [46]. Therefore, the question is: if green taxes discourage use, what is the envisaged impact on revenue reduction due to usage and revenue increase from the taxes? Countries need to analyze this trade-off. In cases where demand for the taxing product is inelastic, consumers fail to respond to the price change due to the tax cost. Increasing taxes leads to reduced economic welfare for some parts of the population—mostly the low-income earners. In designing effective green taxes based on comprehensive evaluations, African countries face challenges of high capital needs, lack of finance and expertise, policy constraints, monitoring and enforcement challenges, information gaps as well as social and cultural challenges. While “Ideally, for tax to be environmentally friendly, the proposed tax rate should equal the social marginal damages from producing an additional unit of emissions or more or less equivalently, the social marginal benefit of abating a unit of emissions” [3]. In Africa, while some countries levy carbon taxes, how these are estimated or designed is fraught with challenges and does not reflect the cost of emissions or the impact to society. An array of environmental taxes is available to the tax authorities in Africa. Examples of these taxes are shown in Figure 2.

Figure 2. Types of Green Taxes.

While the focus of environmental taxes in Africa is on transport (usage of vehicles), fossil fuels, manufacturing and natural resource extraction-driven pollution, energy usage and carbon emissions, other countries have begun to pay attention to the implication of environmental management, pollution and energy usage associated with cryptocurrency mining [47][48]. Pollution driven by cryptocurrency mining could be significant due to the high consumption of electricity. The adoption of these currencies could pose challenges in Africa, and African countries could consider the implications for energy usage and environmental sustainability of cryptocurrency mining.

6. Motives for Levying Green Taxes/Environmental Taxes in African Countries

ATAF [3] submits that African countries have three main objectives in introducing green taxes. These are to (i) mobilize revenue to fund the fiscal budget, (ii) assist in transition toward sustainable economic growth and affordable clean energy, and (iii) fulfill fundamental environmental gains with the potential for economic as well as social advantages. While discussing the desirability, utility, and likelihood of achieving sustainable development in Africa through carbon taxes, Ezenagu [44][49] argues that Africa is a country that is highly dependent on natural resources, and their extraction leads to environmental degradation (mining) and pollution (oils and gases); thus, green taxes are desirable to ensure revenue generation and environmental sustainability. The objectives of green taxes vary from country to country, and their nature and structure are largely influenced by the type of resources exploited and energy sources used in each country. Heine and Black [50] refer to benefits of environmental taxes going beyond the mitigation of the climate effects to include the fiscal benefits. While countries such as Nigeria and Angola are highly dependent on oil and gas, others such as Zimbabwe, Botswana and Namibia are dependent on minerals. Generally, Africa is dependent on a polluting source of energy due to the lack of resources, adequate technology, and poor infrastructure. Polluting activities and those that lead to degradation generally come in the form of cement and chemical manufacturing, industrial and domestic waste disposal, urban developments, gas and oil exploitation and exploration, mining, general manufacturing processes, motor vehicle usage, deforestation and over grazing. George and Steven [51] add sand extraction as another activity that leads to environmental degradation in Zimbabwe. Illegal gold panning is one other activity that is environmentally damaging. Some of the motives for introducing environmental taxes in Africa are presented in the few selected studies on environmental taxation in different African countries (Table 2).

Table 2. Summary of selected studies on environmental taxes in Africa.

| Studies (Authors) | Country | Methodology | Findings |

|---|---|---|---|

| Ellawule and Balewa [52] | Nigeria | Review of legislation | Nigeria could benefit from the implementation of environmental taxes and achieve the double dividend hypothesis. Researchers recommended the imposition of carbon taxes on carbon emissions. |

| Garba et al. [53] | Nigeria | Survey | Air pollution is harmful to the health and well-being of citizens, and environmental taxes might help alleviate environmental-polluting activities if the polluter is made to pay. |

| Oyedokun et al. [54] | Nigeria | Descriptive survey design | Environmental taxes and accounting may not have resulted in the anticipated mitigation of environmental challenges. |

| Okubor [55] | Nigeria | Literature Review | The imposition of environmental taxes led to a significant increase in revenue collections to fund government expenditure and green taxes. |

| Omodero et al. [56] | Nigeria | Regression analysis (2010 to 2020 data) | To promote clean water and air (SDG6) and sustainable energy use (SDG 7), environmental taxes are key. The taxes include gas exploration tax, gas flaring penalties and petroleum tax. |

| Kombat and Watzold [43] | Ghana | Assessing environmental taxes (taxes on plastics, old vehicles and petroleum) using | Environmental taxes contribute to reducing environmental problems. The taxes have a potential to significantly mitigate environmental damages if supported by effective tax administration (which is the biggest weakness of African countries due to fragile capacities). |

| Degirmenci and Aydin [57] | Cameroon, Mali, South Africa, Ivory Coast and Uganda | Assessing the validity of the double dividend theory using panel integration and longrun estimates | Environmental taxes fueled environmental degradation and unemployment in Cameroon, Ivory Coast and Mali. In South Africa and Uganda, these taxes led to environmental restoration and employment, respectively. The research concluded that in general, the double dividend is not valid for African countries. |

| Garba [58] | Nigeria | Survey (close ended questions) | Political acceptance, value benefits, trust and ethical beliefs are the key factors in explaining environmental policy acceptance levels in Nigeria. |

| Tonderayi [59] | Zimbabwe | Literature review | Carbon taxes are not delivering their objectives of environmental protection and preservation possibly due to financial, human, and technical challenges. In Zimbabwe, the carbon tax has lost its deterrence effect. The fact that it is incorporated in fuel makes it hidden and not felt by motorists. There are no clear scientific computations to support the emission estimates or the charge. The taxes are more of a revenue-generating tool than environmental protection measure. |

From the studies above and other literature, two main objectives of green taxes are evident. These are:

- (1)

-

Environmentally protection and sustainability

As an ecological fiscal reform, green taxes can help minimize environmentally damaging behavior. To fulfill this objective, the green taxes must be high enough and prohibitive enough; otherwise, low taxes or awarding of various exemptions and deductions will render the tax system ineffective and fail to achieve this fundamental objective. A good example of environmentally related taxes that have been considered ineffective because of being too low and not felt by consumers is the levy on plastic bags.

- (2)

-

Revenue mobilization

Green taxes are argued to be seen in most countries more as a revenue mobilization tool and less as a measure toward ensuring a reduction in environmental harmful actions. Where the fundamental objective is revenue collection, high tax rates that are prohibitive and stimulate behavior modification can reduce revenue mobilization. Therefore, depending on which goal the country considers to be the primary objective, there is a need to structure and continuously review the green tax policy in line with the fundamental objective.

7. Challenges of Levying Green Taxes in Africa

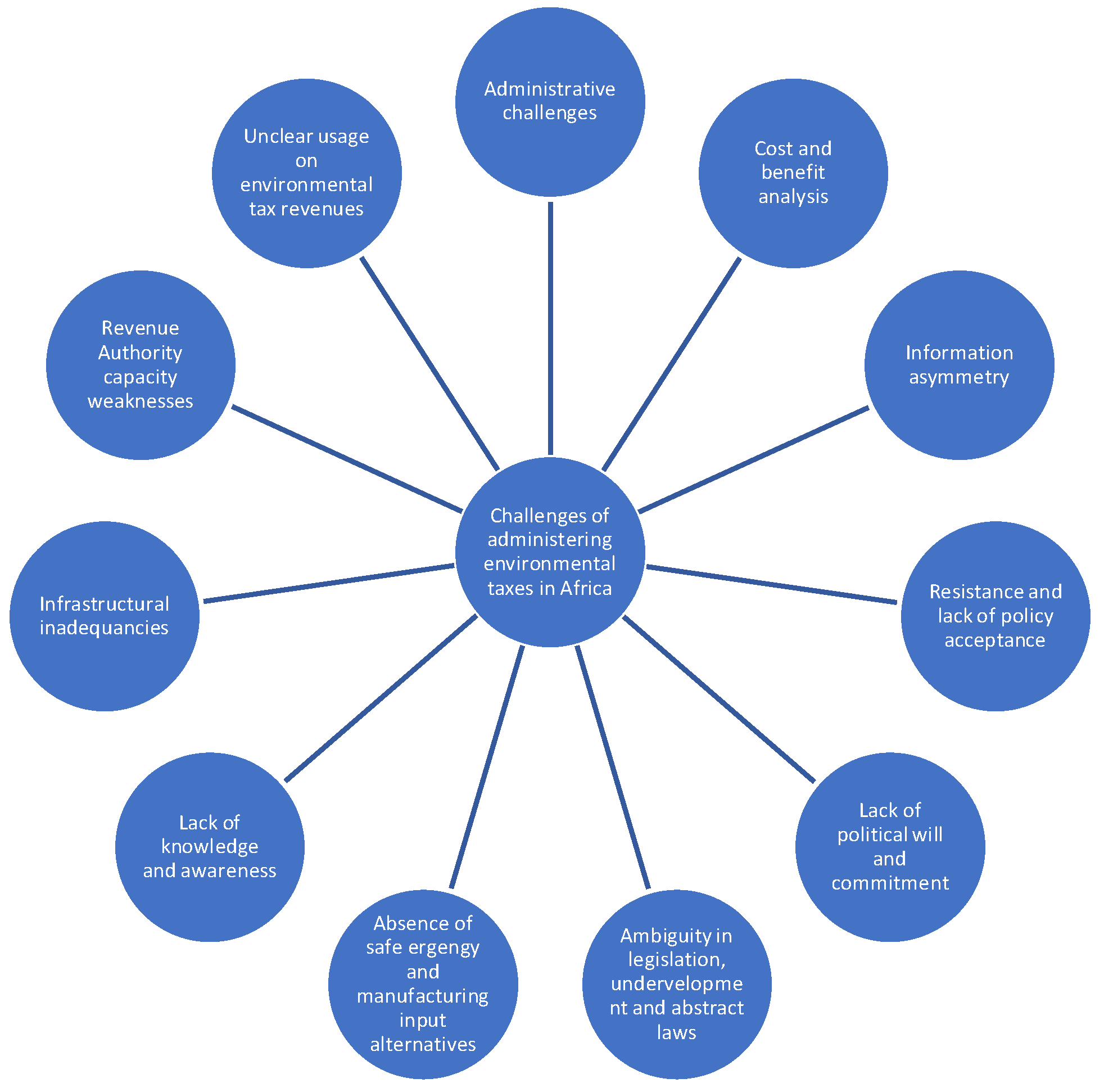

Figure 3 foregrounds the discussion on the problems faced in levying green taxes in African countries. Belletti [45] argues that the implementation and effectiveness of environmental taxes in African countries is unfavorably affected by the lack of adequate infrastructure and administration capacity, weak institutions, and public perceptions on political institutions. The researcher further alludes to factors such as regressivity possibilities due to high inequality and poverty, possibilities of negative effects on economic development and the likelihood of investment flight, tensions with respect to environmental policy and economic development, low administration capacity and lack of resources as well as the high dependence on fossil fuels.

Figure 3. Challenges of levying green taxes. Source: Own compilation.

Garba [58] states that people generally lack trust in government and hence the resistance to tax policy including environmental tax policy. Sebele-Mpofu [37][38] alludes to resistance to policy due to poor governance quality and low tax morale in Zimbabwe. Garba [58] tables that resistance to environmental taxes can be minimized by creating trust between a government and its citizens as well as by repairing the fracture implicit social contact through transparent and accountable spending [38][40][41]. The need for transparency and accountability is key, as lack of trust in government spending and corruption both lower tax morale. Awareness campaigns and the actual usage of environmental tax revenue for supporting environmental initiatives such decarbonization and other green energy initiatives would improve the acceptance of green tax policy.

While focusing on Namibia, Amesho [60] states that financing renewable energy is one of the fundamental challenges to achieving SDG7 on access to reliable, affordable, and sustainable clean and modern energy. This therefore leaves citizens with no other alternative fuel sources, thus impeding the promotion of sustainable environmental management and protection efforts. Instead of environmental taxes lowering polluting energy usage, they burden the poor and low-income earners in African countries who cannot afford other energy sources.

8. Green Taxes, Environmental Sustainability and Protection, Revenue Mobilization and Sustainable Development

In the 2030 Agenda for Sustainable Development held in Addis Ababa Ethiopia, countries shared a vision on peace and prosperity for the people and planet currently and in the future. According to ATAF [3], the countries agreed that they are:

“Determined to protect the planet from degradation, including through sustainable consumption and production, sustainably managing its natural resources and take urgent action on climate change, so that it can support the needs of the present and future generations”.

The 2030 Agenda for Sustainable Development centered on people, the planet and prosperity. The agenda is built on 17 SDGs and I69 targets to expand on the achievement of the Millennium Development Goals (MDGs). At the core of the agenda are the 17 SDGs, which call on both developing and developed countries to urgently work together in global partnership. The partnership should focus on the eradication of poverty and other deprivations while ensuring that the initiatives are inclusive of strategies toward the improvement of health and education, reduction in inequality and driving economic growth while addressing climate change and preserving oceans and forests. Ezenagu [44][49] points out that green taxes, especially carbon taxes, can be used as an economic measure to stimulate sustainable development in developing countries.

The challenge facing countries in relation to 2030 SDGs is how to develop and foster sustainable development efforts that balance the need to improve the well-being of the environment and at the same time reap social and economic advantages. How to bring an equilibrium between minimizing environmental risks and advancing the resilience of society and that of the environment is problematic. How to ensure that the environmental perspective of sustainable development promotes socio-economic development is a pressing matter. The 17 SDGs are indivisible and integrated; therefore, there is a need to strike an equilibrium between the three facets of sustainable development. These are social, economic, and environmental dimensions.

Table 3 presents a brief overview of the 17 SDGs.

Table 3. Summary of the 17 UN 2030 SDGs.

| SDG | Description |

|---|---|

| 1 | Poverty eradication |

| 2 | No hunger |

| 3 | Promoting good health and well-being |

| 4 | Providing inclusive and equitable quality education |

| 5 | Ensuring gender equality and empowerment of women and girls |

| 6 | Provision of clean water and sanitation to facilitate economic development and improve the quality of life |

| 7 | Ensuring access to affordable and clean energy |

| 8 | Provision of decent work and promoting sustainable and inclusive economic growth |

| 9 | Promoting sustainable and inclusive industrialization, increased research and innovation and development of resilient infrastructure |

| 10 | Ensuring a reduction in inequalities |

| 11 | Building sustainable, inclusive, resilient, and safe cities and communities |

| 12 | Fostering responsible consumption and production |

| 13 | Taking action to address climate change and its impact |

| 14 | Preservation and protection of life below water |

| 15 | Preservation and protection of life on the land |

| 16 | Promoting peace, justice, and strong institutions |

| 17 | Building partnerships to achieve the goals |

Source: Adapted from UN [61].

Liyanage, Netswera and Motsumi [62] argue that seven of the 17 SDGs (SDG 1, 2, 3, 4, 5, 7, 11 and 16) are centered on society, while four of the 17 SDGs focus on promoting sustainability and preservation of the ‘biosphere’(SDG 6, 13, 14 and 15), whereas four of the remaining five SDGs anchor on the economy (SDGs 8, 9, 10 and 12), and SDG 17 is the thread that connects all the SDGs.

The environment perspective is a critical dimension of sustainable development that directly encompasses 10 of the 17 SDGs and indirectly touches on the other remaining 7, with SDG13 specifically focusing on dealing with climate change. The 10 SDGs directly related to environmental sustainability and protection include SDG11, making cities and human settlements, safe inclusive, resilient, and sustainable, SDG 12, ensuring sustainable consumption and production trends and SDG 8 (8.4), which speaks to the provision of decent work. This paragraph speaks to increasing global resource efficiency in consumption and production and to endeavor to decouple economic growth from environmental degradation. In addition, the other remaining ones include SDG 13, that calls for countries to urgently address climate change, combat climate changes and their impacts, SDG 14, calling for the conservation and sustainable usage of the seas, marines and ocean resources for sustainable development and SDG 15, which focuses on protection, restoration and the promotion of sustainable usage of terrestrial ecosystems and sustainable management of forests, combating diversification and to reverse land degradation and stop the loss of biodiversity. Furthermore, the last four of the 10 encompass SDG 7 on the use of clean energy, SDG 6 on clean water and sanitation, SDG 3 on good health and SDG 9, focusing on innovation and infrastructure development.

The other seven SDGs that are indirectly related to environmental management and the use of benefits derived from the environment include SDG1, eradication of poverty, SDG2, reducing hunger, SDG 10, reduced inequalities, SDG 5 on promoting gender equality, SDG 16 focusing on peace, justice and strong institutions, SDG 4, quality education and SDG 17 calling for partnerships. The SDGs are interdependent and interlinked. This is evident in cases such as SDG7 in relation to most developing countries’ access to energy will point to energy sources such as coal, fossil fuels, hydroelectricity and wood, and these energy sources have implications on SDGs 3, 13, 14 and 15. There is a possibility of heightening climate change, acidifying oceans, polluting the environment, and leading to deforestation and environmental degradation [63][64][65]. Le Blanc [66], while focusing on SDG 12 (production and consumption that is sustainable) and SDG 10 (on reduced inequality) argues that the SDGs are interconnected. The researcher tables that SDG 12 is connected to 14 other SDGs (for example, SDG 10, SDG 6 that calls for clean water and sanitation provision as well as SDG 2 on eradication of hunger, SDG 1 on poverty alleviation, and SDG 3 on good health). According to Kluza et al. [67] the natural environment is a part of all SDGs, and the environmental indicators are literally present in all SDGs, perhaps except for SDG 10, which is horizontally linked to social, economic, and environmental factors. The achievement of environmentally objectives is viewed as a positive externality driving the attainment of economic, developmental, and social policies. Kluza et al. [67] allude to a positive influence of environmental innovation strategy and firm performance as well as a positive effect of the increase in research and development on carbon dioxide emission reductions on business performance. When looking at this interconnectedness, environmental management and preservation is key, together with revenue generation to fund the budgets to address the SDGs. To achieve good health, the air, the soils and the water need to be clean, consumption and production processes need to promote a clean and sustainable environment, resource utilization needs to be sustainable and revenue mobilization efforts need to be effective. It is also fundamental to note that the interdependence between the SDGs can also result in negative correlations in the attainment of the SDGs (tradeoffs as opposed to synergies). Pradhan et al., 2017 demonstrate a negative correlation with respect to SDG 7, 8, 9 and 15.

Considering the discussion on SDGs, there is a need for countries to have adequate revenues to deliver on the SDGs. The 2030 Sustainable Development Agenda emphasizes that countries need resources need to mobilize resources to facilitate the development and meet the SDGs. The COVID-19 pandemic-driven recessionary environment has heightened the need for countries to mobilize more resources while ensuring sustainable economic growth consistent with climate responsibilities that countries have taken up, considering the capacities and limitations (resource constraints). Fiscal approaches have thus become instrumental, especially green taxes to enable governments to tap into new sources of domestic revenue and drive consumption that is environmentally friendly to achieve overall envisaged environmental gains. In affirmation, Piciu and Trică [28] adduce “Fiscal tools should reflect the current needs of the world including environmental issues”. The researchers further show a link between environmental taxes and the objective of domestic revenue mobilization to achieve the SDGs and overall sustainable economic development. They posit that “Environmental taxes are an important field of future fiscality for countries of the world having the main objective of environmental protection as well as stimulating a healthy economy, simultaneously rising budget for the country funds and economic involvement” [28]. This is affirmed by Ziolo et al. [68], who portend that to achieve the SDGs, financing is crucial and suggestions of financing for SDGs recommend increasing tax revenues, overhauling the global tax legislation, improving the effectiveness and allocation of financial resources as well as the introduction of environmental taxes.

8.1. Sustainability, Environmental Sustainability and Protection

In relation to sustainability, Kluza et al. [67] refer to it as the risk of non-financial issues such as social, environmental and governance risks. The environmental risk is becoming pivotal in discussions of climate change and environmental management. According to Dovgal et al. [69], “the concept of environmental protection emerged as a result of the recognition in many world countries that need to take into account environmental factors due to the deep destabilization of the environment, the enormous load increase in ecosystems, the qualitative changes in the relationship between nature and society as a result of gigantic development of productive forces and the growth of the population”.

8.2. Sustainable Development

Sustainable development is a crucial part of the contemporary global agenda [70][71][72]. The 17 SDGs formulated by the UN in 2015 aim to address social, economic, and environmental matters that affect the world and to champion the concept of sustainability. The SDGs are interlinked. While for example, SDG 8 on promoting decent work and economic growth, SDG 12 that advocates for responsible consumption and production as well as SDG 9 anchoring on innovation, industry and infrastructure have an economic focus, SDG 4 on education and SDG 11 on building sustainable cities and communities have a social orientation. On the other hand, SDG 13 on climate change and SDG 7 on clean energy have an environmental inclination [72]. Therefore, to fully articulate sustainable development even in relation to green taxes, it is fundamental to do so taking into cognizance the various SDGs and their inextricable connection.

Dogval et al. [69] state that: “Sustainable development is crucial for determining the strategic priorities for the development of global economic systems, which necessitate implementing complex institutional changes that should contribute to ensuring economic growth in the context of limited natural resources and the need to solve global environmental problems”.

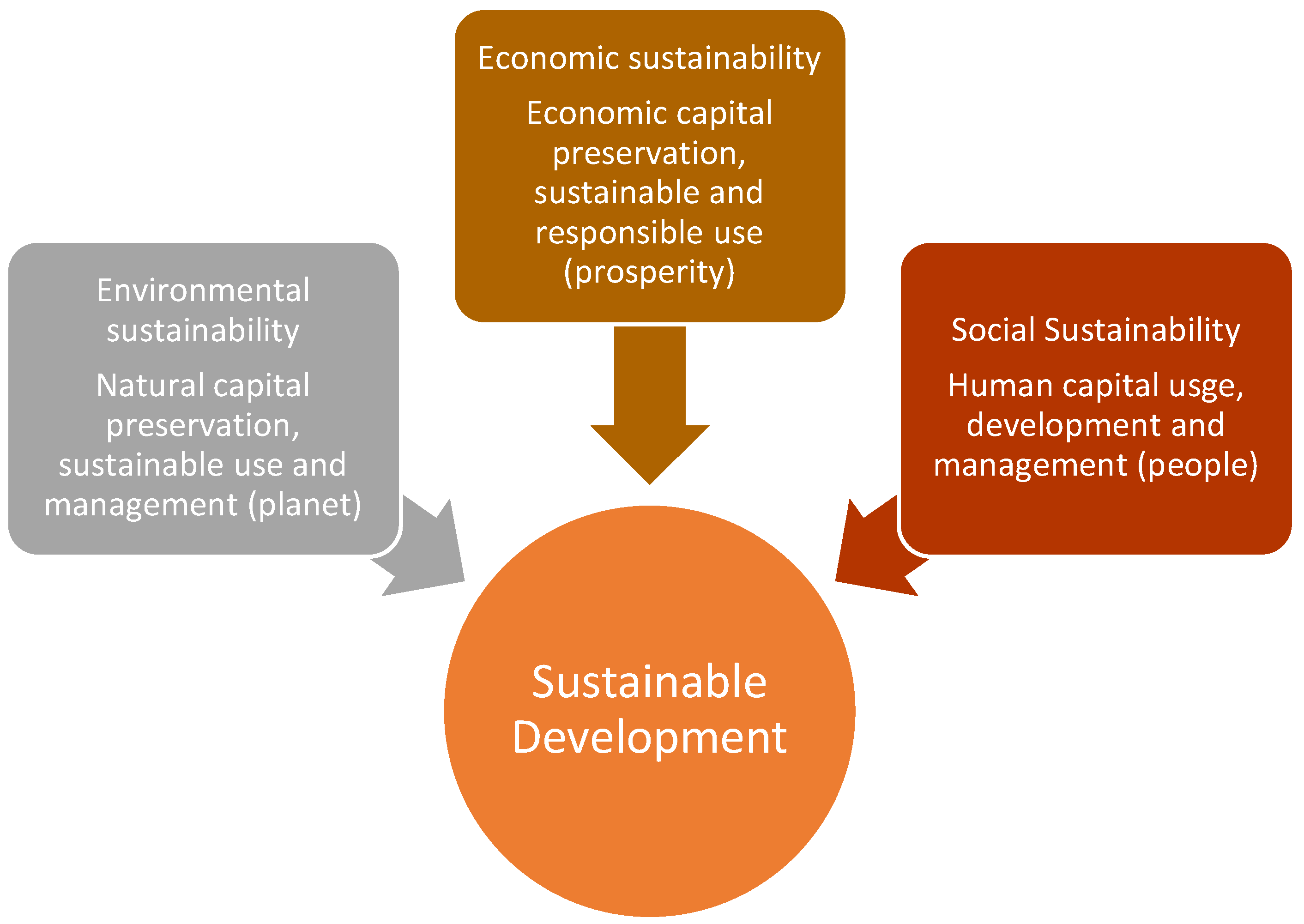

Citing the World Commission on Environment and Development [73], Halkos and Gkampoura [70] define sustainable development as “the development that meets the needs of the present generation without compromising the ability of future generation to meet their own needs”. Sustainable development anchors on ensuring environmental protection while facilitating economic development and social welfare improvement to both the current and future generations. Sustainable is therefore pivoted on three pillars that must be considered in decision making to achieve social, economic and environment development that is both inclusive, sustainable, and responsible [74][75]. The three cornerstones of sustainable development are presented in Figure 4.

Figure 4. Three Pillars of Sustainable Development. Source: Compiled from UN (71) and Halkos and Gkampoura [70].

The issue of sustainability has been at the center of discussions globally and has gained extensive focus from governments, policy makers, academics, economic and environmental experts. Sustainable development is not only an economic issue as well. The idea is to address economic, social, and environmental challenges to achieve sustainable development and fulfill the SDGs [61][63].

References

- United Nations. United Nations Handbook on Carbon Taxation for Developing Countries; United Nations: New York, NY, USA, 2021.

- Rotimi, O. Environmental Tax and Pollution Control in Nigeria. KIU Interdiscip. J. Humanit. Soc. Sci. 2021, 2, 280–301.

- African Tax Administration Forum. Environmental Taxes Defined. 2021. Available online: https://events.ataftax.org/includes/preview.php?file_id=143&language=en_US (accessed on 20 June 2022).

- Jaeger, W.K. Double dividend. In Encyclopedia of Energy, Natural Resource, and Environmental Economics, 1st ed.; Elsevier Science: Amsterdam, The Netherlands, 2013; pp. 37–40.

- Villar-Rubio, E.; Morales, M.D.H. Energy, transport, pollution and natural resources: Key elements in ecological taxation. Econ. Policy Energy Environ. 2016, 58, 111–122.

- OECD. Glossary of Statistical Terms: Environmental Taxes. 2004. Available online: https://stats.oecd.org/glossary/detail (accessed on 15 June 2022).

- OECD. Environmental Fiscal Reform: Progress, Prospects and Pitfalls. 2017. Available online: https://www.oecd.org/tax/environment-fiscal-reform-progress-prospects-and-ptfalls.htm (accessed on 20 June 2022).

- OECD. Taxing Energy for Sustainable Development. 2021. Available online: https://www.oecd.org/tax/tax-policy/taxing-energy-use-for-sustainable-development.pdf (accessed on 20 June 2022).

- Shahzad, U. Environmental taxes, energy consumption, and environmental quality: Theoretical survey with policy implications. Environ. Sci. Pollut. Res. 2020, 27, 24848–24862.

- Pigou, A.C. The Effect of Reparations on the Ratio of International Interchange. Econ. J. 1932, 42, 532–543.

- Nerudova, D.; Dobransch, M. Double dividend hypothesis: Can it occur when tackling carbon emissions? Procedia Econ. Financ. 2014, 12, 472–479.

- Pearce, D. The Role of Carbon Taxes in Adjusting to Global Warming. Econ. J. 1991, 101, 938–948.

- Goulder, L.H. Environmental taxation and the double dividend: A reader’s guide. Int. Tax Public Financ. 1995, 2, 157–183.

- Freire-González, J. Environmental taxation and the double dividend hypothesis in CGE modelling literature: A critical review. J. Policy Model. 2018, 40, 194–223.

- Baumol, W.J.; Baumol, W.J.; Oates, W.E.; Bawa, V.S.; Bawa, W.S.; Bradford, D.F.; Baumol, W.J. The Theory of Environmental Policy; Cambridge University Press: Cambridge, UK, 1988.

- Baumol, W.J.; Oates, W.E. Economics, Environmental Policy, and the Quality of Life; Gregg Revivals: Upper Saddle River, NJ, USA, 1993.

- Lee, D.R.; Misiolek, W.S. Substituting pollution taxation for general taxation: Some implications for efficiency in pollutions taxation. J. Environ. Econ. Manag. 1986, 13, 338–347.

- Bohm, P. Environmental Taxation and the Double Dividend: Fact or Fallacy; Earthscan: London, UK, 1997; pp. 106–124.

- Bovenberg, A.L.; Goulder, L.H. Green Tax Reforms and the Double Dividend: An Updated Reader’s Guide. In Environmental Policy Making in Economies with Prior Tax Distortions; Edward Elgar Publishing: Cheltenham, UK; Northampton, MA, USA, 2002.

- Babiker, M.H.; Metcalf, G.E.; Reilly, J. Tax distortions and global climate policy. J. Environ. Econ. Manag. 2003, 46, 269–287.

- Wesseh, P.K., Jr.; Lin, B. Environmental policy and ‘double dividend’ in a transitional economy. Energy Policy 2019, 134, 110947.

- Li, P.; Lin, Z.; Du, H.; Feng, T.; Zuo, J. Do environmental taxes reduce air pollution? Evidence from fossil-fuel power plants in China. J. Environ. Manag. 2021, 295, 113112.

- Goulder, L.H. Climate change policy’s interactions with the tax system. Energy Econ. 2013, 40, S3–S11.

- Zhou, Z.; Zhang, W.; Pan, X.; Hu, J.; Pu, G. Environmental tax reform and the “double dividend” hypothesis in a small open economy. Int. J. Environ. Res. Public Health 2020, 17, 217.

- Slunge, D.; Sterner, T. Environmental Fiscal Reform in East and Southern Africa and Its Effects on Income Distribution. In Environmental Taxes and Fiscal Reform; Palgrave Macmillan: London, UK, 2012; pp. 93–122.

- De Mooij, R.A. Green Tax Reform in an Endogenous Growth Model. In Environmental Taxation and the Double Dividend; Emerald Group Publishing: Bingley, UK, 2000.

- Glomm, G.; Kawaguchi, D.; Sepulveda, F. Green taxes and double dividends in a dynamic economy. J. Policy Model. 2008, 30, 19–32.

- Piciu, G.C.; Trică, C.L. Trends in the Evolution of Environmental Taxes. Procedia Econ. Finance 2012, 3, 716–721.

- Goulder, L.H. Environmental Policy Making in Economies with Prior Tax Distortions; Edward Elgar Publishing: Cheltenham, UK, 2002.

- Poterba, J.M.; Rotemberg, J.J. Environmental taxes on intermediate and final goods when both can be imported. Int. Tax Public Financ. 1995, 2, 221–228.

- Bovenberg, A. Green tax reforms and the double dividend: An updated reader’s guide. Int. Tax Public Financ. 1999, 6, 421–443.

- Bayındır-Upmann, T.; Raith, M.G. Should high-tax countries pursue revenue-neutral ecological tax reforms? Eur. Econ. Rev. 2003, 47, 41–60.

- Klenert, D.; Schwerhoff, G.; Edenhofer, O.; Mattauch, L. Environmental taxation, inequality and Engel’s law: The double dividend of redistribution. Environ. Resour. Econ. 2018, 71, 605–624.

- Chan, Y.T. Optimal Environmental Tax Rate in an Open Economy with Labor Migration—An E-DSGE Model Approach. Sustainability 2019, 11, 5147.

- Clinch, J.P.; Dunne, L.; Dresner, S. Environmental and wider implications of political impediments to environmental tax reform. Energy Policy 2006, 34, 960–970.

- Gao, X.; Zheng, H.; Zhang, Y.; Golsanami, N. Tax Policy, Environmental Concern and Level of Emission Reduction. Sustainability 2019, 11, 1047.

- Sebele-Mpofu, F.Y. Governance quality and tax morale and compliance in Zimbabwe’s informal sector. Cogent Bus. Manag. 2020, 7, 1794662.

- Sebele-Mpofu, F.Y. The Informal Sector, the “implicit” Social Contract, the Willingness to Pay Taxes and Tax Compliance in Zimbabwe. Account. Econ. Law Conviv. 2021, 20200084.

- Sebele-Mpofu, F.Y.; Mashiri, E.; Korera, P. Transfer Pricing Audit Challenges and Dispute Resolution Effectiveness in Developing Countries with Specific Focus on Zimbabwe. Account. Econ. Law Conviv. 2021, 000010151520210026.

- Mpofu, F.Y.S. Informal Sector Taxation and Enforcement in African Countries: How plausible and achievable are the motives behind? A Critical Literature Review. Open Econ. 2021, 4, 72–97.

- Mpofu, F.Y.S. Taxing the informal sector through presumptive taxes in Zimbabwe: An avenue for a broadened tax base, stifling of the informal sector activities or both. J. Account. Tax. 2021, 13, 153–177.

- Shen, B.; Li, Q. Green Technology Adoption in Textile Supply Chains with Environmental Taxes: Production, Pricing, and Competition. IFAC-PapersOnLine 2019, 52, 379–384.

- Kombat, A.M.; Wätzold, F. The emergence of environmental taxes in Ghana—A public choice analysis. Environ. Policy Gov. 2018, 29, 46–54.

- Ezenagu, A. Carbon Taxation as a Tool for Sustainable Development in Africa: Evaluation of Potentials, Paradoxes and Prospects. Paradoxes and Prospects. 2016. Available online: https://www.researchgate.net/profile/Alexander-Ezenagu/publication/318009315_Carbon_Taxation_as_a_Tool_for_Sustainable_Development_in_Africa_Evaluation_of_Potentials_Paradoxes_and_Prospects/links/59f7ff550f7e9b553ebef4a7/ (accessed on 30 June 2022).

- Belletti, E. Environmental Taxation in Sub-Saharan Africa: Barriers and Policy Options. In Economic Instruments for a Low-Carbon Future; Edward Elgar Publishing: Cheltenham, UK, 2020; pp. 186–203.

- Zalik, A. Subjects of Extraction: Social Regulation, Corporate Aid and Petroleum Security in the Nigerian Delta and the Mexican. Master’s Thesis, Gulf. Cornell University, Ithaca, NY, USA, 2006.

- Náñez Alonso, S.L.; Jorge-Vázquez, J.; Echarte Fernández, M.Á.; Reier Forradellas, R.F. Cryptocurrency mining from an economic and environmental perspective. Analysis of the most and least sustainable countries. Energies 2021, 14, 4254.

- Putranti, I.R. Crypto Minning: Indonesia Carbon Tax Challenges and Safeguarding International Commitment on Human Security. Int. J. Bus. Econ. Soc. Dev. 2022, 3, 10–18.

- Ezenagu, A. Carbon Taxation as a Tool for Sustainable Development in the MENA Region: Potentials and Future Directions. In Climate Change Law and Policy in the Middle East and North Africa Region; Routledge: London, UK, 2021; pp. 187–203.

- Heine, D.; Black, S. Benefits Beyond Climate: Environmental Tax Reform. In Fiscal Policies for Development and Climate Action, 1st ed.; World Bank: Washington, DC, USA, 2019.

- George, M.; Steven, J. An Assessment of Sand Extraction Environmental Externalities as a Source of Market Failure in Gweru District of Zimbabwe. Am. Res. J. Humanit. Soc. Sci. 2022, 5, 37–53.

- Ellawule, A. Carbon Emissions and the Prospect of Double Dividend of Environmental Taxation in Nigeria. Afr. J. Sustain. Agric. Dev. 2021, 2, 2714–4402.

- Garba, I.; Jibir, A.; Bappayaya, B.; Bello, A. Externalities from air pollution and its health consequences. Does environmental tax matter? Int. Econ. Commer. Manag. 2018, 5, 805–822.

- Akintoye, I.R.; Oyedokun, G.E.; Agboola, H.T. 4th ICAN International Academic Conference Proceedings; Institute of Chartered Accountants of Nigeria (ICAN): Lagos, Nigeria, 2018; p. 487.

- Okubor, C.N. Legal Issues on Environmental Taxation. Ajayi Crowther Univ. Law J. 2017, 1. Available online: https://www.aculj.acuoyo.net/index.php/lj/article/viewFile/17/17 (accessed on 20 June 2022).

- Omodero, C.O.; Okafor, M.C.; Nmesirionye, J.A.; Abaa, E.O. Environmental Taxation and CO2 Emission Management. Environ. Ecol. Res. 2022, 10, 1–10.

- Degirmenci, T.; Aydin, M. The effects of environmental taxes on environmental pollution and unemployment: A panel co-integration analysis on the validity of double dividend hypothesis for selected African countries. Int. J. Financ. Econ. 2021.

- Garba, I. Community perception of implementation of environment taxation for sustainable development in Nigeria. India J. Econ. Dev. 2017, 5, 1–9.

- Tonderayi, D. Combating Greenhouse Gas Emissions in a Developing Country: A Conceptualisation and Implementation of Carbon Tax in Zimbabwe. J. Soc. Dev. Afr. 2012, 27, 163.

- Amesho, K.T. Financing renewable energy in Namibia: A fundamental key challenge to the sustainable development goal 7: Ensuring access to affordable, reliable, sustainable and modern energy for all. Int. J. Energy Econ. Policy 2019, 9, 442–450.

- United Nations. Global Indicator Framework for Sustainable Development Goals and Targets of the 2030 Agenda for Sustainable Development. In Work of the Statistical Commission Pertaining to the 2030 Agenda for Sustainable Development; United Nations: New York, NY, USA, 2019; pp. 1–21.

- Liyanage, S.I.H.; Netswera, F.G.; Motsumi, A. Insights from EU Policy Framework in Aligning Sustainable Finance for Sustainable Development in Africa and Asia. Int. J. Energy Econ. Policy 2020, 11, 459–470.

- George, T.E.; Karatu, K.; Edward, A. An evaluation of the environmental impact assessment practice in Uganda: Challenges and opportunities for achieving sustainable development. Heliyon 2020, 6, e04758.

- Nilsson, C.; Aradottir, A.L.; Hagen, D.; Halldórsson, G.; Høegh, K.; Mitchell, R.J.; Raulund-Rasmussen, K.; Svavarsdóttir, K.; Tolvanen, A.; Wilson, S.D. Evaluating the process of ecological restoration. Ecol. Soc. 2016, 21, 41.

- Nilsson, M.; Chisholm, E.; Griggs, D.; Howden-Chapman, P.; McCollum, D.; Messerli, P.; Neumann, B.; Stevance, A.-S.; Visbeck, M.; Stafford-Smith, M. Mapping interactions between the sustainable development goals: Lessons learned and ways forward. Sustain. Sci. 2018, 13, 1489–1503.

- Le Blanc, D. Towards Integration at Last? The Sustainable Development Goals as a Network of Targets. Sustain. Dev. 2015, 23, 176–187.

- Kluza, K.; Ziolo, M.; Postula, M. Climate Policy Development and Implementation from United Nations Sustainable Development Goals Perspective. 2022. Available online: https://assets.researchsquare.com/files/rs-1352892/v1/7b10d329-e983-432a-b98f-8f14a1929a61.pdf?c=1653323758 (accessed on 20 June 2022).

- Ziolo, M.; Bak, I.; Cheba, K. The Role of Sustainable Finance in Achieving Sustainable Development Goals: Does it Work? Technol. Econ. Dev. Econ. 2021, 27, 45–70.

- Dovgal, O.; Goncharenko, N.; Reshetnyak, O.; Dovgal, G.; Danko, N.; Shuba, T. Sustainable Ecological Development of the Global Economic System. The Institutional Aspect. J. Environ. Manag. Tour. 2020, 11, 728–740.

- Halkos, G.; Gkampoura, E.-C. Where do we stand on the 17 Sustainable Development Goals? An overview on progress. Econ. Anal. Policy 2021, 70, 94–122.

- Halkos, G.; Gkampoura, E.C. Reviewing the 17 Sustainable Development Goals: Importance and Progress. 2021. Available online: https://mpra.ub.uni-muenchen.de/105329/ (accessed on 15 June 2022).

- Halkos, G.E.; Gkampoura, E.-C. Coping with Energy Poverty: Measurements, Drivers, Impacts, and Solutions. Energies 2021, 14, 2807.

- World Commission on Environment and Development. Our Common Future (Report on World Commission on Environment and Development); Oxford University Press: Oxford, UK; New York, NY, USA, 1987.

- Hansmann, R.; Mieg, H.A.; Frischknecht, P. Principal sustainability components: Empirical analysis of synergies between the three pillars of sustainability. Int. J. Sustain. Dev. World Ecol. 2012, 19, 451–459.

- Purvis, B.; Mao, Y.; Robinson, D. Three pillars of sustainability: In search of conceptual origins. Sustain. Sci. 2019, 14, 681–695.

More

Information

Subjects:

Green & Sustainable Science & Technology

Contributor

MDPI registered users' name will be linked to their SciProfiles pages. To register with us, please refer to https://encyclopedia.pub/register

:

View Times:

3.0K

Revisions:

2 times

(View History)

Update Date:

28 Sep 2022

Notice

You are not a member of the advisory board for this topic. If you want to update advisory board member profile, please contact office@encyclopedia.pub.

OK

Confirm

Only members of the Encyclopedia advisory board for this topic are allowed to note entries. Would you like to become an advisory board member of the Encyclopedia?

Yes

No

${ textCharacter }/${ maxCharacter }

Submit

Cancel

Back

Comments

${ item }

|

More

No more~

There is no comment~

${ textCharacter }/${ maxCharacter }

Submit

Cancel

${ selectedItem.replyTextCharacter }/${ selectedItem.replyMaxCharacter }

Submit

Cancel

Confirm

Are you sure to Delete?

Yes

No