Your browser does not fully support modern features. Please upgrade for a smoother experience.

Submitted Successfully!

Thank you for your contribution! You can also upload a video entry or images related to this topic.

For video creation, please contact our Academic Video Service.

| Version | Summary | Created by | Modification | Content Size | Created at | Operation |

|---|---|---|---|---|---|---|

| 1 | Zhenzhong Ma | -- | 2058 | 2022-08-05 04:58:16 | | | |

| 2 | Catherine Yang | Meta information modification | 2058 | 2022-08-05 05:21:45 | | |

Video Upload Options

We provide professional Academic Video Service to translate complex research into visually appealing presentations. Would you like to try it?

Cite

If you have any further questions, please contact Encyclopedia Editorial Office.

Ma, Z.; Chen, B.; Yang, X. Fintech and Financial Risks. Encyclopedia. Available online: https://encyclopedia.pub/entry/25878 (accessed on 07 February 2026).

Ma Z, Chen B, Yang X. Fintech and Financial Risks. Encyclopedia. Available at: https://encyclopedia.pub/entry/25878. Accessed February 07, 2026.

Ma, Zhenzhong, Baomin Chen, Xinyun Yang. "Fintech and Financial Risks" Encyclopedia, https://encyclopedia.pub/entry/25878 (accessed February 07, 2026).

Ma, Z., Chen, B., & Yang, X. (2022, August 05). Fintech and Financial Risks. In Encyclopedia. https://encyclopedia.pub/entry/25878

Ma, Zhenzhong, et al. "Fintech and Financial Risks." Encyclopedia. Web. 05 August, 2022.

Copy Citation

Fintech is the combination of the words of finance and technology. It is literally understood as the application of technology in the financial field. As the financial innovation brought by technology, Fintech can change traditional financial markets, financial institutions and financial services, and create emerging business models, applications, processes, and products.

financial technology

fintech

financial risk

commercial bank

1. Fintech Advancement and Financial Risk

Financial risk is a term used to describe possible exposure to monetary loss in financial transactions and further financial institutions’ failure to pay off debts [1][2][3]. Financial risk has four types, including market risk, operational risk, liquidity risk, and credit risk. Market risk occurs when the company encounters an unpredictable loss of equity market, commodity prices, interest rates, and credit spreads [2]. Operational risk is caused by mistakes, damages, or interruptions to the operating process [4]. Liquidity risk is the inability of banks to access cash for funding obligations [2][4]. Credit risk occurs when borrowers and counterparties fail to meet contractual obligations [4]. Possible risks in the banking system include systematic risk and unsystematic risk [4][5]. The systematic risk is inherent to the overall market, reflecting the effect of economic, financial, and geopolitical factors, such as interest rate risk, governance risk, market risk, macroeconomic risk, etc., that cannot be avoided [2][4], whereas the unsystematic risk is associated with specific entities or sectors, such as operational risk, credit risk, liquidity risk, regulatory risk, etc., which can be mitigated by diversification [5].

Early research on fintech suggests that fintech innovation will exacerbate the original information asymmetry problem [6], thereby increasing the probability of financial risks in the market [4]. As fintech is introduced into the financial field, the structure of financial industry becomes highly complex, with traditional banking system, stocks market, and insurance, plus various financial technology companies providing digital currencies, online payment systems, investments, online loans, etc. [4]. Bats and Houben [7] stated that the financial structure can affect financial risk. The emergence of fintech has allowed many technology companies to enter the financial market, thus introducing competition to the financial market [5]. The newly added competitors can, on the one hand, help increase financial stability by encouraging innovations, diversifying products, and increasing efficiency [8]. On the other hand, they can also cause more fragility in the market and increase profits for traditional commercial banks [9].

The growing innovation of fintech companies without proper regulations also amplifies the volatility, contagion, and procyclicality of the financial market. For example, the use of fintech for algorithmic trading in the stock market can magnify the negative consequences, produce information asymmetry, and possibly become a source of contagion in the financial system [10]. The online trading platform with fintech can amplify swings in asset prices and increase the procyclicality in the market [11]. The third-party payment platform provides an optimized funds transfer process which increases the volatility of the banking system as its cost of capitals are influenced. Without proper regulatory body or supervision, the technology company using fintech to conduct financial activities may not be able or may not be willing to price default risk accurately, resulting in high-risk decisions and excessive financial risks [5]. Third-party service providers of fintech have sometimes bypassed the market regulations, posing additional risks to the financial system [5].

In addition, the insurance sector uses fintech to collect a huge amount of personal information and calculate the risk more precisely with an algorithm model [5]. The insurance services provided to the clients are designed and adjusted according to the best of company and personal interest. While the enhanced monitoring program innovated by fintech can provide updated information about clients for insurance companies, fintech also has negative effects in the insurance sector, such as the privacy risk, emerging technological risk, etc. [4] The investment sector, such as foreign exchange trading, may also be affected by fintech through decentralization and digitalization. The stock market or trading system can be affected by fintech through high-frequency trading and e-trading [5]. Fintech has eased the traditional trading complexity, increased the transparency of transactions, and reduced the services fees, which improve trading efficiency and reduce the potential operational risk, but if the use of cryptocurrency in foreign exchange has been widely accepted, it will influence the currency rate in the market, affecting commerce business and generating systemic risks [4]; the high-frequency trading in the stock market may also result in new technological risk and monopoly risk [4]; decentralization in the trading system with fintech may induce money laundering behaviors, resulting in regulatory and compliance risks [4][5].

2. Systemically Important Banks

A systemically important commercial bank is a financial institution that, due to its size, complexity and interconnectedness, would cause significant disruption to the financial system and economy if it encountered a financial crisis [12]. The regulatory requirements of systemically important commercial banks were brought up by the financial crisis in 2008. In order to solve the problem of “too big to fail” for such institutions, the regulatory policy of systemically important banks is proposed with international regulatory bodies.

The Financial Stability Board released the regulatory framework for Global Systemically Important Financial Institutions (G-SIFI) in 2011. Based on this, the People’s Bank of China and the China Banking and Insurance Regulatory Commission jointly developed and released the “Systemically Important Bank Evaluation Method” and “Additional Regulatory Provisions” in 2020 [4]. According to these regulations, there are 19 systemically important banks in China, all of which are large commercial banks.

The systemically important banks are highly intercorrelated with other financial institutions, so their stable operation is associated with the stability of the entire financial system [12]. Being a systemically important bank means that the institution has a higher market influence and more responsibility for preventing potential financial risks. Therefore, higher capital and leverage ratio requirements are conducive to improving loss-absorbing capacity. Reasonable risk defense, recovery, and manageable plans are conducive to solving and preventing potential problems during operation [4]. These requirements are useful in promoting the stable operation and development of systemically important banks, and the increasing adoption of fintech in the systemically important banks will affect these requirements. Therefore, examining the impact of fintech development on these systemically important commercial banks are thus crucial for a nation’s economic growth and stability [13][14].

3. Financial Risk of Commercial Banks in the Early Stage of Fintech Development

In the early stage of fintech development, when the financial regulatory environment is relatively loose, the emerging of various deposit and loan platforms has weakened the intermediary role of traditional commercial banks, diverted commercial banks’ deposit and loan business, and intensified the market competition [4]. The advantages of online financial business are that they have a low entry threshold, a simplified approval process, a fast loan speed, and a low transaction cost [2]. Online financial business has created a new channel of market financing, and its disintermediation characteristic is often favored by original retail loan customers, so it often leads to more competition in the banking industry [2].

In payment and settlement services, previous businesses are dominated by commercial banks. Fintech companies have launched third-party payment platforms based on their technological advantages to provide customers with a faster, lower cost and diversified payment systems, including mobile wallets, peer-to-peer payments, remittance, and foreign exchange transactions [4]. The payment system transcends the limitations of space and time and exempts payment fees, transfer fees, and other transaction fees. User experiences have been greatly improved and the convenience is well received and favored by the public. Thus, fintech-based businesses have challenged the long-term dominant role of commercial banks in the deposit business [2][4]. In the field of wealth management, traditional commercial banks have considerable experience and high security, but also have huge limitations [4]. For example, commercial banks prefer to serve clients with a high value of wealth, and clients with a low value of wealth have been largely neglected. The traditional commercial banks also have restrictions in terms of product benefits, flexibility, and convenience, but fintech companies are capable of launching wealth management products that meet all clients’ individual needs using data collections and big data analysis [2][4].

Overall, fintech has penetrated the traditional territories that are often dominated by commercial banks [15]. Traditional commercial banks will have to employ high-risk services or behaviors to re-attract clients [5]. Considering the huge loss in business profits caused by fintech-based companies, commercial banks will also have to increase their risk tolerance and choose higher risk behaviors in order to maintain a reasonable profit level, such as lowering loan requirements and increasing loan services to high-risk clients like small enterprises and individuals [2]. In addition, as the credit market of traditional commercial banks is also facing the competition from fintech companies, they will have to apply new technology to expand business boundaries, which will bring up hidden financial risks. Although commercial banks may achieve a comparable interest income through expanded services, the potential risks of commercial banks have often been greatly increased [4].

4. Financial Risks in the Middle and Late Stages of Fintech Development

Along with the fast development of fintech, more advanced technologies have appeared. The innovation and adoption of fintech in commercial banks are also significantly improved [2]. The scope of involved businesses is expanding, such as fintech-based consumer finance, robot-advisory, risk control, etc. Furthermore, the highly risky P2P online lending platform has been regulated due to concerns about crisis and supervision issues, which has alleviated the impact of fintech on commercial banks and brought positive changes to the financial sector [2].

The first benefit associated with fintech advancement is reduced customer acquisition costs [2][16]. Traditional commercial banks have been acquiring customers and operating at relatively high costs for a long time, while the emerging of fintech has reduced customer acquisition and operational costs, increased profit margins for commercial banks, and reduced the high-risk preference decisions. Moreover, brick and mortar branch services often require a lot of human resources with uneven qualities of customer service, which affects the efficiency of business process and is not favorable for banks to explore potential customers [2]. With the deep integration of fintech, commercial banks have transformed branches into digital, intelligent, and mobile services. Technology such as big data and artificial intelligence have been widely used to develop financial platforms and products, including mobile banking, online banking, flexible wealth management, funds transfers and transactions, utility payment, salary services, smart community, and other high-quality services. Customers do not need to spend a lot of time queuing for services as the quality and efficiency of financial services are improved [3][16]. Fintech can also facilitate scenario-based customer acquisition channels. Additionally, commercial banks can use fintech to achieve precise market delivery with big data to analyze customer needs, design targeted products and services, and deliver them to the target customer groups at a relatively low cost, which helps achieve quantitative customer acquisition and improve commercial banks’ operational efficiency [16].

The second benefit associated with fintech advancement is reduced operating costs. Using fintech like blockchain technology can establish standardized and intelligent business operation processes, simplify traditional complicated procedures, create a standardized business model, and reduce the cost of each node in the entire operation line [16]. Promoting product innovation based on big data can reduce the costs of human resources and the time required for user surveys, can efficiently analyze and explain product features and match services with the targets, and reduce collection costs, information query costs, and business innovation costs [2]. Using AI technology can promote smart offline branches and basic services such as bank card applications, funds transfer and remittance, deposits and withdrawals [17]. At the same time, AI customer service and robot advisors can replace branch staff to reduce the human resource costs. In addition, fintech can be applied to capital management, budget management, and pricing management to reduce the operational costs of commercial banks [16].

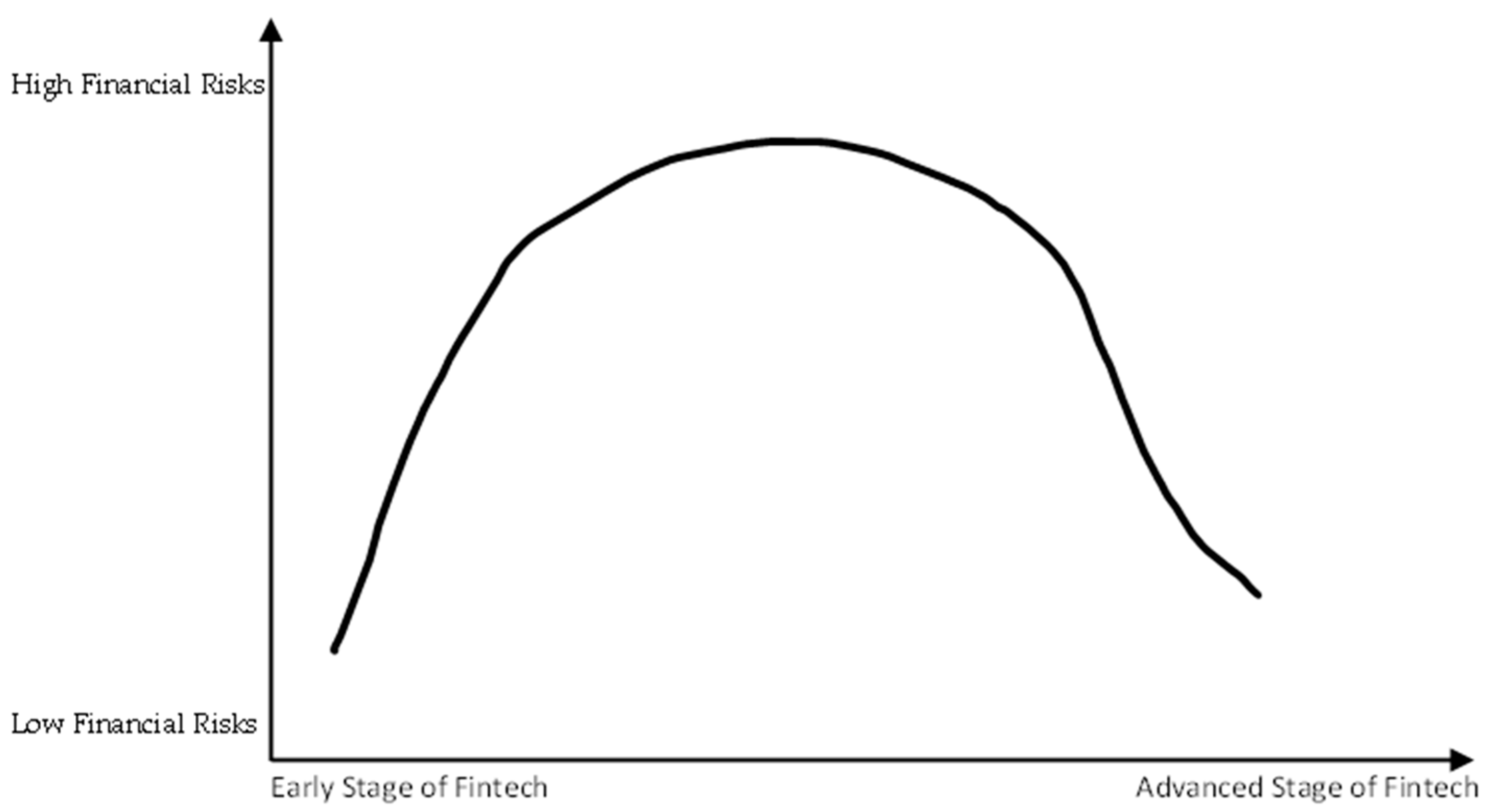

The third benefit associated with fintech advancement is improved risk management [2][4][5][16]. Commercial banks with fintech can use big data and cloud computing to deeply explore customer information and analyze the value of potential customers, and then use artificial intelligence and other technologies to build intelligent analysis models for risk management [16]. Consequently, commercial banks are able to evaluate the credit status of each customer, predict their risk levels, alleviate the effect of information asymmetry between the borrower and the lender, and reduce banks’ financial risks [4]. Fintech can also build a more reliable risk monitoring and warning system for commercial banks to greatly reduce data acquisition and process time, instantly monitor risk changes, promote data sharing and inter-departmental collaboration, and conduct comprehensive and timely risk assessment [2] (please see Figure 1 for the illustrated impact of fintech at different stages).

Figure 1. The Proposed Impact of Fintech Advancement on Financial Risks.

References

- Shang, Q.; Ma, Z.; Wang, X. In search of the best interest rate for group lending: Toward a win-win solution for SMEs and commercial banks in China. Chin. Econ. 2020, 53, 285–299.

- Gu, H.; Yang, L. Internet finance and bank risk-taking: Evidence based on China’s banking industry. World Econ. 2018, 10, 75–100.

- Wang, Y.; Xing, L.; Li, G. The impact of internet finance development on bank liquidity. Financ. Forum 2016, 8, 42–50.

- Guo, P.; Shen, Y. Does internet finance increase the risk-taking of commercial banks? Empirical evidence from China’s banking industry. Nankai Econ. Res. 2015, 4, 82–99.

- Delis, M.D.; Kouretas, G.P. Interest rates and bank risk-taking. J. Bank. Financ. 2011, 35, 840–855.

- Hoeing, T.M.; Wang, S.; Zeng, Z. Maintaining financial stability in a changing financial system: Lessons from history. New Financ. 2008, 1, 17–20.

- Bats, J.V.; Houben, A. Bank-based versus market-based financing: Implications for systemic risk. J. Bank. Financ. 2020, 114, 105776.

- Minto, A.; Voelkerling, M.; Wulff, M. Separating apples from oranges: Identifying threats to financial stability originating from FinTech. Cap. Mark. Law 2017, 12, 428–465.

- Goetz, M.R. Competition and bank stability. J. Financ. 2018, 35, 57–69.

- Kirilenko, A.A.; Lo, A.W. Moore’s law versus Murphy’s law: Algorithmic trading and its discontents. J. Econ. Perspect. 2013, 27, 51–72.

- Gemayel, R.; Preda, A. Does a scopic regime produce conformism? Herding behavior among trade leaders on social trading platforms. Eur. J. Financ. 2018, 24, 1144–1175.

- Pham, T.N.; Powell, R.; Bannigidadmath, D. Systemically important banks in Asian emerging markets: Evidence from four systemic risk measures. Pac.-Basin Financ. J. 2021, 70, 101670.

- Daud, S.; Ahmad, A.; Khalid, A.; Azman-Saini, W. Fintech and financial stability: Threat or opportunity. Financ. Res. Lett. 2021, 102667.

- King, R.G.; Levine, R. Finance, entrepreneurship, and growth: Theory and evidence. J. Monet. Econ. 1993, 32, 513–542.

- Jagtiani, J.; Lemieux, C. Do fintech lenders penetrate areas that are underserved by traditional banks? J. Econ. Bus. 2018, 100, 43–54.

- Guo, P.; Shen, Y. Internet finance, deposit competition and bank risk-taking. Financ. Res. 2019, 8, 58–76.

- Puro, L.; Teich, J.E.; Wallenius, H.; Wallenius, J. Borrower Decision Aid for people-to-people lending. Decis. Support Syst. 2010, 49, 52–60.

More

Information

Subjects:

Business, Finance

Contributors

MDPI registered users' name will be linked to their SciProfiles pages. To register with us, please refer to https://encyclopedia.pub/register

:

View Times:

3.0K

Revisions:

2 times

(View History)

Update Date:

05 Aug 2022

Notice

You are not a member of the advisory board for this topic. If you want to update advisory board member profile, please contact office@encyclopedia.pub.

OK

Confirm

Only members of the Encyclopedia advisory board for this topic are allowed to note entries. Would you like to become an advisory board member of the Encyclopedia?

Yes

No

${ textCharacter }/${ maxCharacter }

Submit

Cancel

Back

Comments

${ item }

|

More

No more~

There is no comment~

${ textCharacter }/${ maxCharacter }

Submit

Cancel

${ selectedItem.replyTextCharacter }/${ selectedItem.replyMaxCharacter }

Submit

Cancel

Confirm

Are you sure to Delete?

Yes

No