Your browser does not fully support modern features. Please upgrade for a smoother experience.

Submitted Successfully!

Thank you for your contribution! You can also upload a video entry or images related to this topic.

For video creation, please contact our Academic Video Service.

| Version | Summary | Created by | Modification | Content Size | Created at | Operation |

|---|---|---|---|---|---|---|

| 1 | Xin Wang | -- | 1324 | 2022-07-19 15:20:42 | | | |

| 2 | Beatrix Zheng | + 3 word(s) | 1327 | 2022-07-20 03:44:12 | | |

Video Upload Options

We provide professional Academic Video Service to translate complex research into visually appealing presentations. Would you like to try it?

Cite

If you have any further questions, please contact Encyclopedia Editorial Office.

Fan, Q.; Wang, X.; Yuan, J.; Liu, X.; Hu, H.; Lin, P. Key Technologies for Offshore Wind Power in China. Encyclopedia. Available online: https://encyclopedia.pub/entry/25284 (accessed on 07 February 2026).

Fan Q, Wang X, Yuan J, Liu X, Hu H, Lin P. Key Technologies for Offshore Wind Power in China. Encyclopedia. Available at: https://encyclopedia.pub/entry/25284. Accessed February 07, 2026.

Fan, Qixiang, Xin Wang, Jing Yuan, Xin Liu, Hao Hu, Peng Lin. "Key Technologies for Offshore Wind Power in China" Encyclopedia, https://encyclopedia.pub/entry/25284 (accessed February 07, 2026).

Fan, Q., Wang, X., Yuan, J., Liu, X., Hu, H., & Lin, P. (2022, July 19). Key Technologies for Offshore Wind Power in China. In Encyclopedia. https://encyclopedia.pub/entry/25284

Fan, Qixiang, et al. "Key Technologies for Offshore Wind Power in China." Encyclopedia. Web. 19 July, 2022.

Copy Citation

Offshore Wind Power (OWP) has gained prominence in China’s national energy strategy. However, the levelized cost of electricity (LCoE) of wind power must be further reduced to match the average wholesale price. The cost-cutting and revenue-generating potential of offshore wind generation depends on technological innovation.

offshore wind power

levelized cost of electricity

integrated structure design

intelligent O&M

OWP value creation

1. China’s R&D Efforts in Offshore Wind Industry

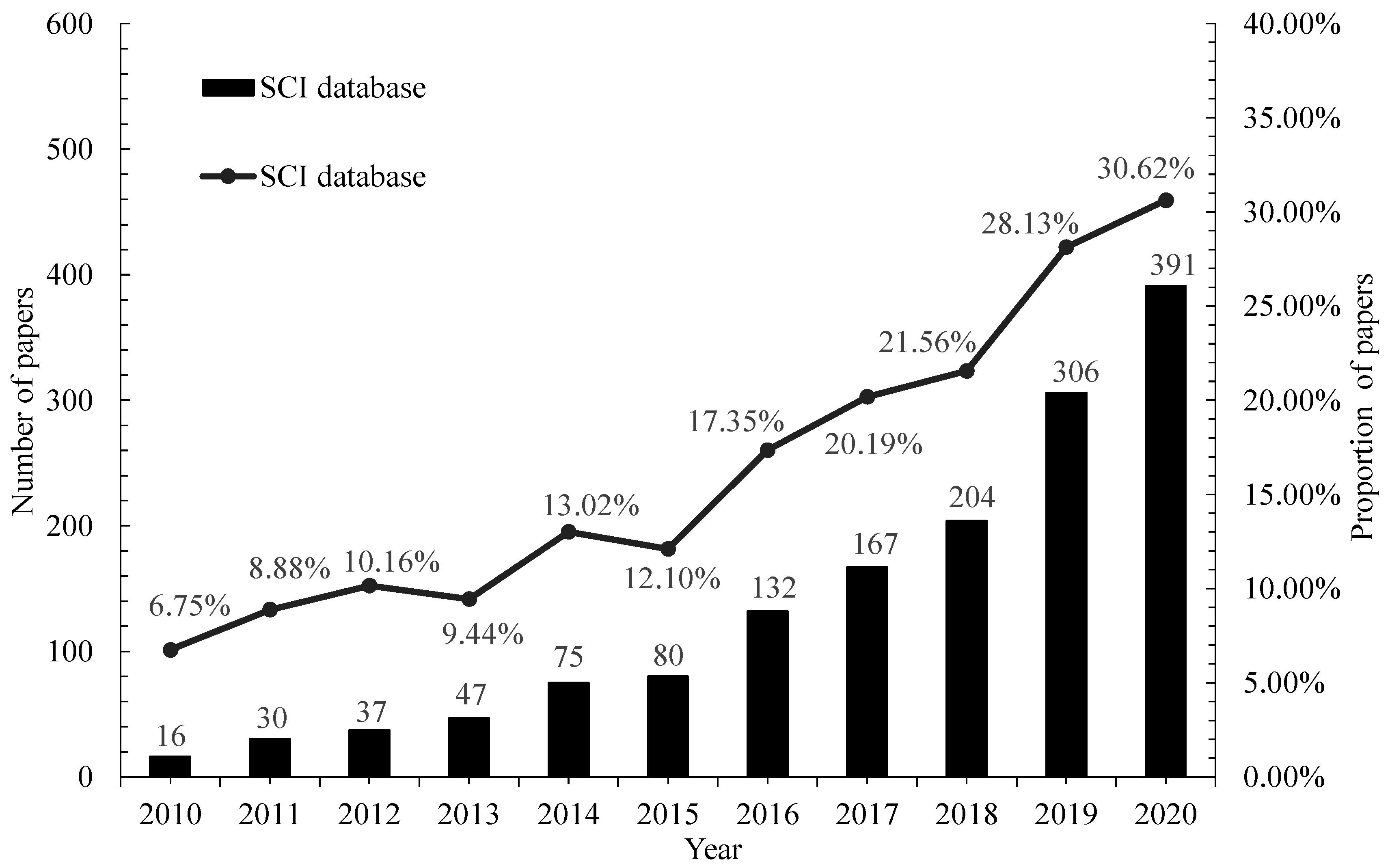

From 2010 to 2020, the SCI database collected 7573 articles in Offshore Wind Power (OWP) (search term: offshore wind), including 1485 articles published by Chinese scholars. Figure 1 shows that the articles by Chinese scholars both increased in quantity and percentage, at a peak of 391 articles or 30.6% in 2020. Research focuses include wind resource assessment, blade design, monitoring technology, structural dynamic response analysis, integrated design, etc., demonstrating China’s efforts in exploration and innovation in these aspects. China’s influence and international academic standing in the OWP industry have grown.

Figure 1. Chinese scholar articles collected in the SCI database.

China has made advanced achievements in the wind power industry, such as control technology, large-scale wind turbine design, coordinated control technology of wind farm clusters, and friendly grid connection of wind power. Other technologies such as offshore engineering equipment and high voltage flexible DC transmission are also in tremendous progress. From 2016 to 2020, the National Natural Science Foundation of China has funded 73 projects related to OWP, which is over four times higher than that during between 2012 and 2016. Table 1 summarize the key technologies developed in China from 2010 to 2020. These research projects and the national R&D plan mainly focus on the R&D and testing technology of large-capacity offshore wind turbines, support structure optimization, floating structure design, offshore wind farm group planning, friendly grid connection technology, OWP intelligent operation, and maintenance technology, etc. As the investments of the state, developers, enterprises, and universities put into the OWP industry are increasing yearly, the related theoretical and achievements and technologies will also show a good growth trend.

Table 1. Key technologies for wind power developed in China from 2010 to 2020.

| Technology | Technical Points | Research Projects [1] | National R&D | Importance | |

|---|---|---|---|---|---|

| 1 | Refined assessment of offshore wind resources |

|

3 | Important | |

| 2 | Floating foundation design |

|

12 | Very important | |

| 3 | Intelligent operation and maintenance |

|

8 | Very important | |

| 4 | Structural design |

|

49 | Extremely important | |

| 5 | Generator design |

|

8 | 3 | Very important |

| 6 | Blade design |

|

3 | 1 | Important |

| 7 | Power system |

|

22 | 2 | Extremely important |

| 8 | Engineering geological survey |

|

0 | Important | |

| 9 | Construction technology |

|

1 | 1 | Important |

2. Standardization of OWP in China

Since the late 1980s, the IEC/TC88 Technical Committee has begun to organize the preparation of international standards for wind turbines. IEC published the first offshore wind turbine standard in 2009. IEC regularly updates original standards and adds new standards based on the application of standards and the growth of the wind power industry. Currently, major OWP markets such as Denmark, Germany, and the UK use the IEC 61400 series wind turbine standards, which include wind turbine design requirements, blade testing, power characteristic testing, load measurement, etc. They have combined IEC 61400 with their national standards to further optimize and supplement their national standards.

The National Standardization Management Committee in China published the construction specifications for OWP projects in 2010 and outlined technical requirements for construction, transportation, infrastructure requirements, power generation equipment installation and project management, etc. The first national standard for offshore wind farms (GB/T 51308-2019), published by China Energy Construction Group Planning and Design Co., Ltd., has been in effect since 1 October 2019, following nearly ten years of development. Regarding the OWP certification system, the construction of the testing and certification system for OWP equipment has always been highly valued as a crucial component of quality assurance in Denmark and Germany, and relevant standards such as IEC WT01 are set for certification. However, China still needs to establish a complete set of “technology R&D, testing certification, manufacturing, operation feedback” systems [2].

China should promote the creation of national standards that reflect local regional conditions and enhance the testing and certification process. Meanwhile, China needs to actively engage in the creation of international OWP standards to integrate its standards with those of other countries and lead the development of OWP globally.

3. Parity Process of China’s Offshore Wind Industry

China’s OWP pricing has experienced the approved-price stage from 2008 to 2014. Since then, a number of government bodies have announced numerous new pricing rules in conjunction with the revival of the OWP business. The newly approved OWP guidance price was changed to 0.8 yuan per kWh in 2019 and to 0.75 yuan per kWh in 2020. This price is part of the annual management of financial subsidies. China’s OWP has entered the competitive age of bidding with the determination of the feed-in tariff for newly approved OWP projects, which shall not be higher than the above guidance price.

In January 2020, the government issued “several opinions on promoting the healthy development of non-hydropower renewable energy power generation”, which clearly pointed out that new OWP projects will not be eligible for national financial subsidies from 2020; instead, local governments will provide support. Offshore wind farm projects that have been approved (put on record) according to regulations or have all wind turbines connected to the grid before 31 December 2021 will be incorporated into the national financial subsidies in accordance with the corresponding price policy. However, per the status quo and existing industrial development policies, China’s OWP will obtain no subsidies after 2025. This legislative change will speed up China’s transition to parity in the offshore wind sector and provide significant obstacles for the overall sector. To ensure the healthy development of China’s OWP, it is crucial to figure out how to obtain local government subsidies and quicken technology advancements to attain parity.

4. Future Development of China’s Offshore Wind Industry

Thanks to independent innovation and references from the experience of global OWP development, China has steadily realized the autonomy of technology, and its OWP development intensity has surpassed that of the rest of the world. Even though China is making technological strides, some crucial technologies, such as large-capacity wind turbine manufacturing, floating structure design, and OWP hydrogen production technology, are still behind some other countries. The following technologies are important to achieve significant cost reduction: (1) accurate analysis and optimal utilization of wind resource exploitation; (2) customized wind farm development and wind turbine; (3) integrated design of (floating) large-capacity wind turbines; (4) integration of OWP system; (5) intelligent construction and O&M in the full life cycle.

Full life cycle asset management is one of the practical solutions for intelligent construction and O&M. The characteristics of offshore wind farm assets include poor accessibility, strong correlation, high operation and maintenance costs, and long operating life. Based on the management concept of asset-centered full life cycle, closed-loop, feedback, and intelligent management, the OWP enterprises should develop an asset management tool and confirm the project asset management goals and index systems, along with WBS (Work Breakdown Structure) and CBS (Cost Breakdown Structure), in order to build an offshore wind project ABS (Asset Breakdown Structure). The ABS decomposes the work tasks of assets of each full life cycle stage into a minimum work unit that can be evaluated, with schedule plan, resource requirement, cost budget, and risk management plan, ensuring the practical implementation of asset management in the entire life cycle of OWP projects. By using the ABS-WBS-CBS coupling structure, managers could integrate the work task effects of each stage to evaluate the performance of assets via earned value analysis, net present value bias analysis, and risk analysis so as to optimize the asset management decision and enhance the capacity for asset value creation.

References

- National Natural Science Foundation of China. National Natural Science Foundation of China Big Data Knowledge Management Service Portal. Available online: https://kd.nsfc.gov.cn/finalProjectInit (accessed on 20 November 2021).

- Cao, Y.; Tu, L.; Nie, J.; Zhou, Y. European experience on standardization of offshore wind power and its enlightenment to China. South. Power Syst. Technol. 2019, 13, 3–11.

More

Information

Subjects:

Engineering, Marine

Contributors

MDPI registered users' name will be linked to their SciProfiles pages. To register with us, please refer to https://encyclopedia.pub/register

:

View Times:

1.0K

Revisions:

2 times

(View History)

Update Date:

20 Jul 2022

Notice

You are not a member of the advisory board for this topic. If you want to update advisory board member profile, please contact office@encyclopedia.pub.

OK

Confirm

Only members of the Encyclopedia advisory board for this topic are allowed to note entries. Would you like to become an advisory board member of the Encyclopedia?

Yes

No

${ textCharacter }/${ maxCharacter }

Submit

Cancel

Back

Comments

${ item }

|

More

No more~

There is no comment~

${ textCharacter }/${ maxCharacter }

Submit

Cancel

${ selectedItem.replyTextCharacter }/${ selectedItem.replyMaxCharacter }

Submit

Cancel

Confirm

Are you sure to Delete?

Yes

No