Your browser does not fully support modern features. Please upgrade for a smoother experience.

Submitted Successfully!

Thank you for your contribution! You can also upload a video entry or images related to this topic.

For video creation, please contact our Academic Video Service.

| Version | Summary | Created by | Modification | Content Size | Created at | Operation |

|---|---|---|---|---|---|---|

| 1 | Muhammad Faisal Majid | -- | 2139 | 2022-06-10 10:59:29 | | | |

| 2 | Dean Liu | -15 word(s) | 2124 | 2022-06-13 03:15:36 | | |

Video Upload Options

We provide professional Academic Video Service to translate complex research into visually appealing presentations. Would you like to try it?

Cite

If you have any further questions, please contact Encyclopedia Editorial Office.

Majid, M.; Meraj, M.; , . Role of Environmental Accounting. Encyclopedia. Available online: https://encyclopedia.pub/entry/23912 (accessed on 08 February 2026).

Majid M, Meraj M, . Role of Environmental Accounting. Encyclopedia. Available at: https://encyclopedia.pub/entry/23912. Accessed February 08, 2026.

Majid, Muhammad, Muhammad Meraj, . "Role of Environmental Accounting" Encyclopedia, https://encyclopedia.pub/entry/23912 (accessed February 08, 2026).

Majid, M., Meraj, M., & , . (2022, June 10). Role of Environmental Accounting. In Encyclopedia. https://encyclopedia.pub/entry/23912

Majid, Muhammad, et al. "Role of Environmental Accounting." Encyclopedia. Web. 10 June, 2022.

Copy Citation

Environmental accounting (EA) can be a way toward solving the issue of environmental degradation and shifting toward sustainable solutions. One of the significant reasons for EA is the role of industrial and commercial activities in environmental contamination.

environmental accounting disclosures

sustainability

1. Environmental Contamination

Environmental contamination originates either from nature or from humans. Environmental contamination by nature refers to natural calamities or nonhuman interventions, such as volcanic eruptions, salt spray from the ocean, gases from animals, and plant deterioration [1]. The second type of contamination is caused by humans, and it involves all the residuals that are related to the consumption and production of gases and particles from the chemical wastes of manufacturing processes. The literature further emphasizes that industrialization has caused a large portion of environmental contamination on the earth, and it induces the global community to take initiatives for reducing the harmful effects [1][2][3][4][5]. A study conducted by [3] on sulfur dioxide emissions in Falconbridge, which is a company in Canada, depicts the harmful impact of the company’s activities on the environment. The aforementioned claim reveals that environmental contamination is a matter of greater concern, and that it should be given much attention given the harmful effects on nature and society. Appropriate measures and accountability for environmental contamination, which has become a worldwide problem, are necessary. Global organizations, such as the UN, the World Bank, the UNCED, and the OECD, have been playing their role to manage and ensure environmental accountability because industrialization has created harmful impacts, from one country to another, through globalization [6][7].

2. Environmental Pollution Is a Global Issue

The author of [8] argue that environment-related issues have been broadening from domestic-pollution problems to a worldwide issue. He also highlights the robust worldwide movements to pinpoint the distant and instant causes of environmental contamination and the impairment that it has caused to society, nature, and the earth. The authors of [1] emphasize that the world has become more attentive to environmental contamination and to the implications of environmental degradation that is caused by corporate activities. The majority of GHG emissions have originated from developed countries, which has been a major factor in climate change in recent years [9], and which has created harmful effects from developed to developing/emerging countries. By the end of the 20th century, the Kyoto Protocol agreement was signed by 160 countries to regulate GHG emissions at a certain level for the avoidance of the environmental contamination that was a significant threat to human life [10]. Environmental-contamination issues are no longer restricted to the borders of countries but have become a global issue that needs consideration at the local and global levels. Industrialization and corporate manufacturing processes (particularly PSOs) are substantial suppliers of environmental contamination [1][3][6][9]. All these show the significance of evaluating the responsibility of corporations in environmental management and accountability.

3. The Role of Corporations in Worldwide Environmental Pollution

Globalization has made PSOs into multinational corporations (MNCs), which cleverly obtain control and occupy the key resources of developing countries [11]. That most of the MNCs are richer than many countries of the world, and especially some developing countries, is an eye-opener. These MNCs are taking advantage of their influence [11][12]. The authors of [11] claim that “Corporations constituted 50 of the world’s biggest economies. Their turnover exceeds the gross national product of many nation-states …. the turnover of companies, such as Ford, General Motors, or Wal-Mart, is bigger than the Gross Domestic Product (GDP) of Greece, Poland, Hong Kong, or South Africa.” Furthermore, these MNCs have become so powerful that they can dictate their terms in the politics and economies of many developing and developed countries, and especially those of emerging economies that rely on them [13].

EA research reveals the increased number of environmental calamities that can be directly attributed to environmental degradation. The increased frequency and ferocity of storms, the rise in the global temperature, and more frequent wildfires have shaken humanity. There is an increased concern on the global stage.

According to [14] reports, 24% of the global disease burden, and 23% of all deaths, can be attributable to environmental factors. According to [15], Asia is the fastest growing economy on the globe. It is also home to some poor developing countries, and to some of the richest. Although many people are lifted out of poverty, half of this region is poor. The development of economies has its own cost. Fast growth, the maintenance of a prosperous lifestyle, and increased demand for resources create mounting pressure on the natural resources in the region. Although some countries come up with innovative policies and directions, such as Bhutan’s national happiness, Thailand’s sufficient economy, and China’s quality growth model, most countries are unaware of the sensitivity of the issue. In Asia, the most affected countries due to pollution are China, India, Pakistan, Indonesia, and Bangladesh [16]. Furthermore, [17] reveals that the emissions of CO2 from the manufacturing and POL industries are liable for 1.6 million deaths each year around the globe in developing countries, such as those in Asia. The largest CO2 emitter on the globe is the Asia Pacific, where 17.27 billion metric tons of CO2 were emitted in 2019. China alone produced approximately 28.8% of the global fossil-fuel and CO2 emissions [15].

4. Environmental Practice

4.1. Corporate Environmental Responsibility

In this era, when globalization, capitalism, and liberalism are trending, the corporate sector has obtained influence over society; therefore, it is responsible for its actions on society and it must be held accountable. However, corporations are presumed responsible for the management of their environmental activities in society, and they are answerable for their actions. This is what can be perceived of as accountability [18]. Accounting scholars view this act of responsibility as a way of safeguarding ecofriendly sustainability. To safeguard ecofriendly sustainability, [19] argues that corporations ought to play a positive role in society in ecojustice, ecoefficiency, and eco-effectiveness. He further defined ecojustice as the equality between people and generations toward environmental resources. Ecoefficiency is expressed as less utilization of environmental resources per unit of production. Eco-effectiveness is achieved when a reduction in the overall environmental footprint is considerable. To show the responsibility of the corporate sector, corporations must safeguard the needs of the current generation in terms of an ecofriendly environment, without sacrificing those of coming generations [20].

4.2. Corporate Accountability Regarding the Environment

Accountability involves reporting and analyzing financial and nonfinancial environment-related disclosures. It also gives stakeholders information on the cost-and-benefit analyses of business activities that affect the environment [21]. The corporate sector must be accountable for reporting a consequence. According to [21], accountability is a process in which penalty and reward are granted on the basis of approval or blame. The corporate sector becomes accountable for the assurance of environment-related matters. There should be a framework/mechanism for the accountability of corporations with regard to environment-related activities.

Organizations’ rewards and punishments depend on compliance and noncompliance with corporate environmental accountability [21]. He further explains that accountability becomes more useful with the concept of reward and punishment by default. Corporations are then led to report their practices as a responsibility of their accountability. Furthermore, ref. [22] argues that corporations’ reporting should reflect business ethics and social and environmental practices, rather than corporate profitability reporting (financial accountability) only. The reporting practices of corporations tend to be focused on the maximization of shareholders’ wealth (sustainable profits); rather, they should focus on the sustainability of the environment. Various stakeholders, and especially environmental activists, NGOs, regulatory bodies, and research scholars, have shown their concerns. To attain this, corporate reporting should reflect environmental sustainability [23][24]. From the above discussion, that corporations (PSOs) must be bound to comply with their environment-related commitments and be accountable for their activities. One of the ways of conducting this is through environmental reporting.

4.3. Environmental Accounting/Reporting as a Medium of Accountability Practice

Environmental accounting/reporting practices take the form of accountability [25]. He further emphasizes this as the “publication of an environmental policy statement”. This reporting practice becomes one of the parts of companies’ annual reports to present the corporate-sector environmental performance and impacts on the environment. He further argues that environmental reporting is the practice of disclosing the environmental performance to the society, be it an exclusive report related to environmental disclosures, or a part of the annual report. The method of publishing environmental issues becomes effective because the environment-related disclosures are available to all of the relevant stakeholders.

4.4. EA Disclosures

The environmental cost is the amount that is paid by a company to conduct the environmental-protection process. EA is also used as a proxy by different researchers in the case of environmental costs [26][27][28][29]. The environmental enactments of companies associated with ecologically delicate businesses can attract the attention of associated people that represent the associates of the civilization that are specifically involved with the firms’ environmental enactments for adjacent communities, environmentalists, or regulative organizations [30][31][32].

4.5. Environmental Accounting/Reporting and IFRS

For the stakeholders’ need for specific information, what should be included in EA and reporting must be clarified. EA includes the costs to clean up or remediate contaminated sites, environmental fines, penalties and taxes, purchases of pollution-prevention technologies, and waste-management costs [33]. The examination of the international financial-reporting standards shows that no global customary entity is solely responsible for the provisions of such data. Nonetheless, researchers find remarks, directly and indirectly, on the subject of environmental reporting within the IFRS.

Numerous studies are dedicated to volunteering environmental-revelation data, but much less consideration is given to the environment-related-disclosure needs set by the accounting standards, ordinarily, and the IFRS, especially. The authors of [34] analyzed the state of the literature on the company and environmental reporting from various methods and theoretical points of view. The authors of [35] determined 200+ articles, beginning from 1965 to 2005 (which is the calendar year when the international financial-reporting standards were executed in European countries), that are associated with global accounting coordination. These studies claim that, so far, no specific research has combined environmental reporting with the method of the global accounting standards.

In the absence of the accounting standards that solely incorporate the ecological/environmental matters into the company’s yearly documents/annual accounts, there are isolated or overlapping IAS/IFRS clauses, such as IFRIC 3; IFRS 6, 7, and 8; and IAS 16, 32, 37, 38, and 39. However, specific international accounting and auditing standards are lacking [36][37]. Before going into details on the global initiatives already taken, researchers go through the literature to show how the evolution of EA and reporting has evolved over the decades.

5. Relations between Environmental Accounting and Performance

FP may be affected by EA and reporting. Firms that are not concerned about the environment may face high costs of capital because external stakeholders want high-risk premiums. There are numerous environmental and energy taxes in the United Kingdom, such as the landfill tax. Attracting international investors has also stimulated the FP [38], and the sustainability disclosures of companies significantly affect their growth and size [39]. Corporations with high gearing/leverage tend to report disclosures regarding the environment and social accountability [40]. The key gauge of a firm’s profitability is the size of the firm [41][42][43]. Some studies show that the disclosure of the environmental performance is positively related to the ROE and ROA which measures the FP of the firm [44][45] and it is considered as proxies in the study as shown in Table 1 below. On the other hand, the study of [46][47] found an inverse relationship between EA and the financial performances of firms.

Table 1. Measurement of independent variables.

| Code | Dependent Variables | Measurements |

|---|---|---|

| Size | Firm Size | Log (total assets) |

| Pro | Profitability | ROA and ROE |

| ES | Interactive Variable Environmental Sustainability |

The measure of environment, social, and governance disclosures |

| Independent Variables | ||

| Audtq | Audit Quality | 1 for big 4 firms, or 0 |

| EA | Environmental-Accounting Disclosure | Environmental cost |

6. Theoretical Explanations

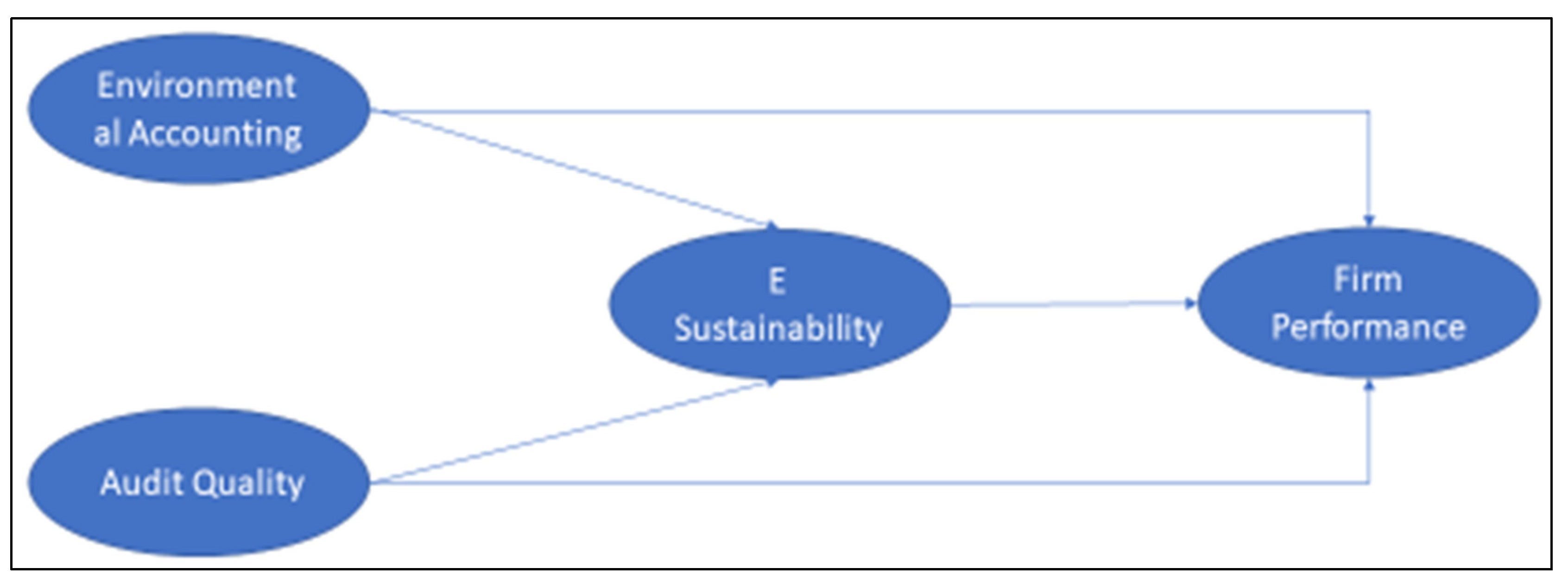

The literature provides knowledge about the theories developed in the area of EA. Among the renowned theories are stakeholder theory, agency cost theory, legitimacy theory, accountability theory, institutional theory, resource-dependency theory, and media-agenda-setting theory [3][48][49][50][51]. The collection of relevant theories such as legitimacy theory, stakeholder theory, and institutional theory supports the study in the context of the development of the social agreement between the firm and the society where it is operational. These theories provide the basis for how and why corporations interact with external pressures, and how such interventions create an impact on their environmental-accountability practices. These theories lend more support to EA practices. In particular, as it emphasizes the supremacy of the corporations as vital associates of society [49][52][53][54]. Finally, John Elkington, the pioneer of the triple-bottom-line theory, suggests that the corporation’s accounting profit should include the social and environmental impacts, unless the “multidimensional profits” of all of the related entities are calculated to accurately evaluate the benefit for the society or societies involved in the businesses or investments [55]. The TBL framework is very useful in this study, as it provides a framework for reporting environment-related disclosures that also concern the economic and social aspects. After reviewing the empirical studies and the theoretical background of the area, researchers developed the following conceptual framework Figure 1:

Figure 1. Conceptual framework.

References

- Callan, S.J.; Thomas, J.M. Environmental Economics and Management: Theory, Policy, and Applications, 2nd ed.; Cengage Learning: Boston, MA, USA, 2013.

- Gray, R. Is Accounting for Sustainability Actually Accounting for Sustainability and How Would We Know? An Exploration of Narratives of Organisations and the Planet. Account. Organ. Soc. 2010, 35, 47–62.

- Buhr, N. Environmental Performance, Legislation and Annual Report Disclosure: The Case of Acid Rain and Falconbridge. Account. Audit. Account. J. 1998, 11, 163–190.

- Dierkes, M.; Preston, L.E. Corporate Social Accounting Reporting for the Physical Environment: A Critical Review and Implementation Proposal. Account. Organ. Soc. 1977, 2, 3–22.

- Mathews, M.R. Twenty-Five Years of Social and Environmental Accounting Research: Is There a Silver Jubilee to Celebrate? Account. Audit. Account. J. 1997, 10, 481–531.

- Boutros-Ghali, B. Opening Speech on Environment and Development; Diane Publishing co.: Rio de Janeiro, Brazil, 1992.

- Clapp, J. Global Environmental Governance for Corporate Responsibility and Accountability. Glob. Environ. Politics 2005, 5, 23–34.

- Darabaris, J. Corporate Environmental Management; CRC Press/Taylor and Francis Group: Boca Raton, FL, USA, 2007.

- Corfee-Morlot, J.; Kamal-Chaoui, L.; Donovan, M.G.; Cochran, I.; Robert, A.; Teasdale, P.-J. Cities, Climate Change and Multilevel Governance; OECD: Paris, France, 2009.

- Jagger, N. Environmental Careers and Environmental Scientists. In The Environment, Employment and Sustainable Development; Routledge: London, UK, 2002; pp. 116–122.

- Mitchell, A.V.; Sikka, P. Taming the Corporations; Association for Accountancy & Business Affairs Basildon: 2005. Available online: https://www.yumpu.com/en/document/read/50923267/taming-the-corporations-it-works (accessed on 29 March 2022).

- Anderson, S.; Cavanagh, J. Report on the Top 200 Corporations. In Inst. Policy Stud.; 2000; Available online: https://www.iatp.org/sites/default/files/Top_200_The_Rise_of_Corporate_Global_Power.pdf (accessed on 29 March 2022).

- Sikka, P. Accounting for Human Rights: The Challenge of Globalization and Foreign Investment Agreements. Crit. Perspect. Account. 2011, 22, 811–827.

- World Health Organization; Regional Office for the Eastern Mediterranean. World Health Organization Annual Report 2019 WHO Country Office Lebanon: Health for All. 2020. Available online: https://apps.who.int/iris/bitstream/handle/10665/333249/9789290223214-eng.pdf (accessed on 29 March 2022).

- United Nations Environment Programme. Emissions Gap Report 2020; United Nations Environment Programme: Nairobi, Kenya, 2020; Available online: https://www.unep.org/emissions-gap-report-2020 (accessed on 29 March 2022).

- Hasnat, G.T.; Kabir, M.A.; Hossain, M.A. Major Environmental Issues and Problems of South Asia, Particularly Bangladesh. In Handbook of Environmental Materials Management; 2018; pp. 1–40. Available online: https://www.researchgate.net/publication/323264078_Major_Environmental_Issues_and_Problems_of_South_Asia_Particularly_Bangladesh (accessed on 29 March 2022).

- United Nation Environment Programme. UNEP 2011 Annual Report; United Nation Environment Programme: Nairobi, Kenya, 2011; p. 116. ISBN 978-92-807-3244-3.

- Gray, R.; Owen, D.; Adams, C. Accounting & Accountability: Changes and Challenges in Corporate Social and Environmental Reporting; Prentice Hall: Hoboken, NJ, USA, 1996; ISBN 978013175860. Available online: https://eprints.gla.ac.uk/95486/ (accessed on 29 March 2022).

- Gray, R.; Bebbington, J. Accounting for the Environment; Sage: London, UK, 2001; ISBN 9780761971368. Available online: http://eprints.gla.ac.uk/33528/ (accessed on 29 March 2022).

- Brundtland, G.H. Report of the World Commission on Environment and Development: “Our Common Future”; UN: New York, NY, USA, 1987; pp. 1–300.

- Stewart, J.D. The Role of Information in Public Accountability. Issues Public Sect. Account. 1987. Available online: https://sswm.info/sites/default/files/reference_attachments/UN%20WCED%201987%20Brundtland%20Report.pdf (accessed on 29 March 2022).

- Adams, C.A. The Ethical, Social and Environmental Reporting-Performance Portrayal Gap. Account. Audit. Account. J. 2004, 17, 731–757.

- Belal, A.R.; Cooper, S.M.; Khan, N.A. Corporate Environmental Responsibility and Accountability: What Chance in Vulnerable Bangladesh? Crit. Perspect. Account. 2015, 33, 44–58.

- Brophy, M.; Starkey, R. Environmental Reporting. Corp. Environ. Manag. 1 Syst. Strategy. 1998, 175–196.

- Noah, A.O. Accounting for the Environment: The Accountability of the Nigerian Cement Industry. Ph.D. Thesis, University of Essex, Essex, UK, 2017.

- Adams, C.A.; Hill, W.-Y.; Roberts, C.B. Corporate Social Reporting Practices in Western Europe: Legitimating Corporate Behaviour? Br. Account. Rev. 1998, 30, 1–21.

- Bagur-Femenías, L.; Perramon, J.; Amat, O. Impact of Quality and Environmental Investment on Business Competitiveness and Profitability in Small Service Business: The Case of Travel Agencies. Total Qual. Manag. Bus. Excell. 2015, 26, 840–853.

- Bhattarai, B.; Beilin, R.; Ford, R. Gender, Agrobiodiversity, and Climate Change: A Study of Adaptation Practices in the Nepal Himalayas. World Dev. 2015, 70, 122–132.

- Makori, D.M.; Jagongo, A. Environmental Accounting and Firm Profitability: An Empirical Analysis of Selected Firms Listed in Bombay Stock Exchange, India. Int. J. Humanit. Soc. Sci. 2013, 3, 248–256.

- Cormier, D.; Gordon, I.M.; Magnan, M. Corporate Environmental Disclosure: Contrasting Management’s Perceptions with Reality. J. Bus. Ethics 2004, 49, 143–165.

- Neu, D.; Warsame, H.; Pedwell, K. Managing Public Impressions: Environmental Disclosures in Annual Reports. Account. Organ. Soc. 1998, 23, 265–282.

- Oliveira, J.; Rodrigues, L.L.; Craig, R. Risk-Related Disclosures by Non-Finance Companies: Portuguese Practices and Disclosure Characteristics. Manag. Audit. J. 2011, 26, 817–839.

- Kamal, Y.; Deegan, C. Corporate Social and Environment-Related Governance Disclosure Practices in the Textile and Garment Industry: Evidence from a Developing Country. Aust. Account. Rev. 2013, 23, 117–134.

- Camacho-Gingerich, A.; Branco-Rodriguez, S.; Pitteri, R.; Javier, R. Psychological Adjustment, Cultural, and Legal Issues. In Handbook of Adoption: Implications for Researchers, Practitioner, and Families; Sage: Thousand Oaks, CA, USA, 2007; pp. 149–159.

- Baker, C.R.; Barbu, E.M. Evolution of Research on International Accounting Harmonization: A Historical and Institutional Perspective. Socio-Econ. Rev. 2007, 5, 603–632.

- Holthausen, R.W. Accounting Standards, Financial Reporting Outcomes, and Enforcement. J. Account. Res. 2009, 47, 447–458.

- Kvaal, E.; Nobes, C. International Differences in IFRS Policy Choice: A Research Note; 2010. Available online: https://www.jstor.org/stable/25548027 (accessed on 29 March 2022).

- Soufeljil, M.; Sghaier, A.; Kheireddine, H.; Mighri, Z. Ownership Structure and Corporate Performance: The Case of Listed Tunisian Firms. J. Bus. Financ. Aff. 2016, 5, 1–8.

- Lucia, L.; Panggabean, R.R. The Effect of Firm’s Characteristic and Corporate Governance to Sustainability Report Disclosure. SEEIJ (Soc. Econ. Ecol. Int. J.) 2018, 2, 18–28.

- Eyigege, A.I. Influence of Firm Size on Financial Performance of Deposit Money Banks Quoted on the Nigeria Stock Exchange. Int. J. Econ. Financ. Res. 2018, 4, 297–302.

- Babalola, Y.A. The Effect of Firm Size on Firms Profitability in Nigeria. J. Econ. Sustain. Dev. 2013, 4, 90–94.

- Hall, M.; Weiss, L. Firm Size and Profitability. Rev. Econ. Stat. 1967, 49, 319–331.

- Marcus, M. Profitability and Size of Firm: Some Further Evidence. Rev. Econ. Stat. 1969, 51, 104–107.

- Chiu, T.-K.; Wang, Y.-H. Determinants of Social Disclosure Quality in Taiwan: An Application of Stakeholder Theory. J. Bus. Ethics 2015, 129, 379–398.

- Roberts, R.W. Determinants of Corporate Social Responsibility Disclosure: An Application of Stakeholder Theory. Account. Organ. Soc. 1992, 17, 595–612.

- Ezeagba, C. Financial Reporting in Small and Medium Enterprises (SMEs) in Nigeria. Challenges and Options. Int. J. Acad. Res. Account. Financ. Manag. Sci. 2017, 7, 1–10.

- Şimsek, H.; Ozturk, G. Evaluation of the Relationship between Environmental Accounting and Business Performance: The Case of Istanbul Province. Green Financ. 2021, 3, 46–58.

- Barley, S.R.; Tolbert, P.S. Institutionalization and Structuration: Studying the Links between Action and Institution. Organ. Stud. 1997, 18, 93–117.

- Greening, D.W.; Gray, B. Testing a Model of Organizational Response to Social and Political Issues. Acad. Manag. J. 1994, 37, 467–498.

- Jamil, C.Z.M. The Moderating and Mediating Effect of the Environmental Management Control Systems on Environmental Performance: The Case of Malaysian Hotel Sector; Bangor University: Bangor, UK, 2008. Available online: https://etd.uum.edu.my/4929/ (accessed on 29 March 2022).

- Ahmed, M.; Mubarik, M.S.; Shahbaz, M. Factors affecting the outcome of corporate sustainability policy: A review paper. Environ. Sci. Pollut. Research. 2021, 28, 10335–10356.

- Adhikari, P.; Kuruppu, C.; Matilal, S. Dissemination and Institutionalization of Public Sector Accounting Reforms in Less Developed Countries: A Comparative Study of the Nepalese and Sri Lankan Central Governments. Account. Forum 2013, 37, 213–230.

- Carpenter, V.L.; Feroz, E.H. Institutional Theory and Accounting Rule Choice: An Analysis of Four US State Governments’ Decisions to Adopt Generally Accepted Accounting Principles. Account. Organ. Soc. 2001, 26, 565–596.

- Guerreiro, M.S.; Rodrigues, L.L.; Craig, R. Voluntary Adoption of International Financial Reporting Standards by Large Unlisted Companies in Portugal–Institutional Logics and Strategic Responses. Account. Organ. Soc. 2012, 37, 482–499.

- Hidayati, N.D. Pattern of Corporate Social Responsibility Programs: A Case Study. Soc. Responsib. J. 2011, 7, 104–117.

More

Information

Subjects:

Business, Finance

Contributors

MDPI registered users' name will be linked to their SciProfiles pages. To register with us, please refer to https://encyclopedia.pub/register

:

View Times:

2.8K

Revisions:

2 times

(View History)

Update Date:

15 Jun 2022

Notice

You are not a member of the advisory board for this topic. If you want to update advisory board member profile, please contact office@encyclopedia.pub.

OK

Confirm

Only members of the Encyclopedia advisory board for this topic are allowed to note entries. Would you like to become an advisory board member of the Encyclopedia?

Yes

No

${ textCharacter }/${ maxCharacter }

Submit

Cancel

Back

Comments

${ item }

|

More

No more~

There is no comment~

${ textCharacter }/${ maxCharacter }

Submit

Cancel

${ selectedItem.replyTextCharacter }/${ selectedItem.replyMaxCharacter }

Submit

Cancel

Confirm

Are you sure to Delete?

Yes

No