Video Upload Options

The dual land system that resulted from the 1982 land reform makes the Chinese land situation unique. A dichotomy has existed between the state ownership of urban land and public ownership of rural land ever since. Urbanization in China often takes place by penetrating spatially into rural villages, where land is collectively owned. Urban villages are often regarded as temporary entities with undesirable urban planning and governance. Combined with the negative social externalities that urban villages emit, the Chinese government has implemented large-scale urban village redevelopment projects (UVRPs) in recent years to replace shabby entities with formal urban neighbourhoods. This phenomenon is in line with Kochan’s argument that urban planners will ultimately eradicate urban villages in urbanization. UVRPs have stimulated rapid urban development, which plays a great role in economic growth and modernization.

1. Introduction

2. Urban Village Redevelopment Projects

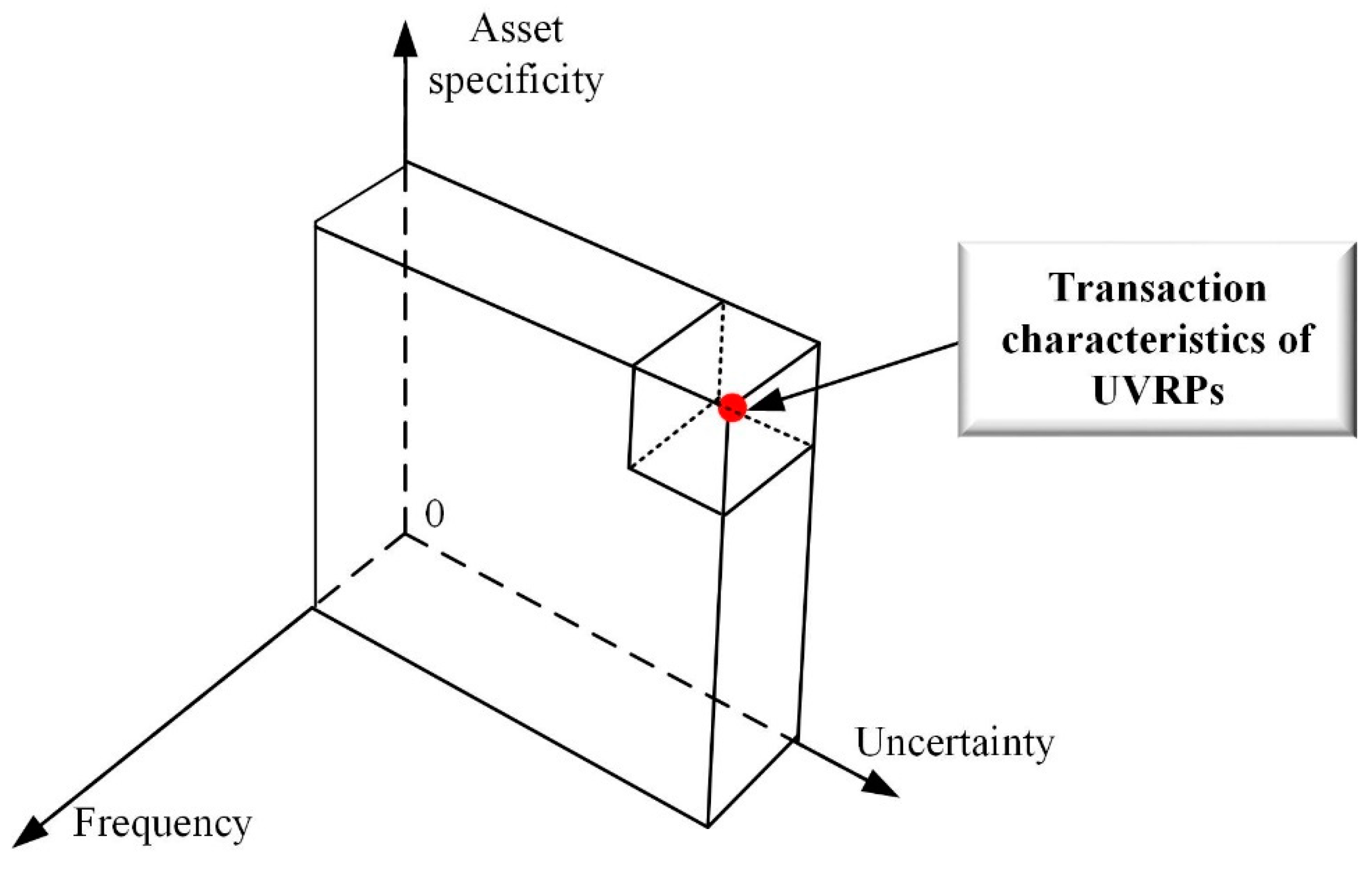

3. Transaction Characteristics of UVRPs in China

References

- Lai, S.-K.; Liu, H.-L.; Lan, I.C. Planning for urban redevelopment: A transaction cost approach. Int. J. Urban Sci. 2022, 26, 53–67.

- Eggertsson, Þ. Economic Behavior and Institutions: Principles of Neoinstitutional Economics; Cambridge University Press: Cambridge, UK, 1990.

- Alchian, A.A.; Demsetz, H. The property right paradigm. J. Econ. Hist. 1973, 33, 16–27.

- Furubotn, E.G.; Pejovich, S. Property rights and economic theory: A survey of recent literature. J. Econ. Lit. 1972, 10, 1137–1162.

- Ullrich, F. Relationships, Services and the Question of Ownership. In Proceedings of the 16th IMP Conference, Bath, UK, 7–9 September 2000; 2002.

- North, D.C. Institutions, Institutional Change and Economic Performance; Cambridge University Press: New York, NY, USA, 1990.

- Tian, L.; Zhu, J. Clarification of collective land rights and its impact on non-agricultural land use in the Pearl River Delta of China: A case of Shunde. Cities 2013, 35, 190–199.

- Choy, L.H.T.; Lai, Y.; Lok, W. Economic performance of industrial development on collective land in the urbanization process in China: Empirical evidence from Shenzhen. Habitat Int. 2013, 40, 184–193.

- Johnson, D.G. Property Rights in Rural China; Working paper; University of Chicago: Chicago, IL, USA, 1995.

- He, S.; Liu, Y.; Wu, F.; Webster, C. Social Groups and Housing Differentiation in China’s Urban Villages: An Institutional Interpretation. Hous. Stud. 2010, 25, 671–691.

- Liu, S.; Zhang, Y. Cities without slums? China’s land regime and dual-track urbanization. Cities 2020, 101, 102652.

- Smith, N.R. Beyond top-down/bottom-up: Village transformation on China’s urban edge. Cities 2014, 41, 209–220.

- Yuan, D.; Yau, Y.; Bao, H.; Lin, W. A Framework for Understanding the Institutional Arrangements of Urban Village Redevelopment Projects in China. Land Use Policy 2020, 99, 104998.

- Yuan, D.; Bao, H.; Yau, Y.; Skitmore, M. Case-Based Analysis of Drivers and Challenges for Implementing Government-Led Urban Village Redevelopment Projects in China: Evidence from Zhejiang Province. J. Urban Plann. Dev. 2020, 146, 05020014.

- Li, L.H.; Li, X. Redevelopment of urban villages in Shenzhen, China—An analysis of power relations and urban coalitions. Habitat Int. 2011, 35, 426–434.

- Cho, C.J. An analysis of the housing redevelopment process in Korea through the lens of the transaction cost framework. Urban Stud. 2011, 48, 1477–1501.

- Williamson, O.E. The Economic Institutions of Capitalism Firms Markets Relational Contracting; Free Press: New York, NY, USA, 1985.

- Alexander, E.R. Governance and transaction costs in planning systems: A conceptual framework for institutional analysis of land-use planning and development control—the case of Israel. Environ. Plan. B Plan. Des. 2001, 28, 755–776.

- Coase, R.H. The nature of the firm. Economica 1937, 4, 386–405.

- Demsetz, H. Toward a theory of property rights. Am. Econ. Rev. 1967, 57, 347–359.

- Barzel, Y. Economic Analysis of Property Rights; Cambridge University Press: Cambridge, UK, 1989.

- McCann, L.; Colby, B.; Easter, K.W.; Kasterine, A.; Kuperan, K.V. Transaction cost measurement for evaluating environmental policies. Ecol. Econ. 2005, 52, 527–542.

- Holloway, G.; Nicholson, C.; Delgado, C.; Staal, S.; Ehui, S. Agroindustrialization through institutional innovation Transaction costs, cooperatives and milk-market development in the east-African highlands. Agric. Econ. 2000, 23, 279–288.

- Bromley, D. Environment and Economy; Blackwell: Oxford, UK, 1991.

- Matthews, R. The economics of institutions and the sources of growth. Econ. J. 1986, 96, 903–918.

- Furubotn, E.G.; Richter, R. The New Institutional Economics: A Collection of Articles from the Journal of Institutional and Theoretical Economics; Mohr Siebeck: Tubingen, Germany, 1991.

- Ruiter, D.W.P. Is transaction cost economics applicable to public governance? Eur. J. Law Econ. 2005, 20, 287–303.

- Musole, M. Property rights, transaction costs and institutional change: Conceptual framework and literature review. Prog. Plan. 2009, 71, 43–85.

- Reeves, E. The practice of contracting in public private partnerships: Transaction costs and relational contracting in the Irish schools sector. Public Adm. 2008, 86, 969–986.

- Hastings, E.M.; Adams, D. Facilitating urban renewal: Changing institutional arrangements and land assembly in Hong Kong. Prop. Manag. 2005, 23, 110–121.

- Shahab, S.; Clinch, J.P.; O’Neill, E. Accounting for transaction costs in planning policy evaluation. Land Use Policy 2018, 70, 263–272.

- Williamson, O.E. The Mechanisms of Governance; Oxford University Press: New York, NY, USA, 1996.

- Lai, Y.; Tang, B. Institutional barriers to redevelopment of urban villages in China: A transaction cost perspective. Land Use Policy 2016, 58, 482–490.

- Yuan, D.; Yau, Y.; Bao, H.; Liu, Y.; Liu, T. Anatomizing the Institutional Arrangements of Urban Village Redevelopment: Case Studies in Guangzhou, China. Sustainability 2019, 11, 3376.

- Yuan, D.; Yau, Y.; Hou, H.; Liu, Y. Factors Influencing the Project Duration of Urban Village Redevelopment in Contemporary China. Land 2021, 10, 707.

- Dawkins, C.J. Transaction costs and the land use planning process. J. Plan. Lit. 2000, 14, 507–518.

- Dudkin, G.; Välilä, T. Transaction costs in public-private partnerships: A first look at the evidence. EIB Econ. Financ. Rep. 2005, 3, 2–44.

- Ball, M. Institutions in British property research: A review. Urban Stud. 1998, 35, 1501–1517.

- Buitelaar, E. A transaction-cost analysis of the land development process. Urban Stud. 2004, 41, 2539–2553.

- Zerbe Jr, R.O.; McCurdy, H. The end of market failure. Regulation 2000, 23, 10–14.

- Zhao, Y.Q.; An, N.; Chen, H.L.; Tao, W. Politics of urban renewal: An anatomy of the conflicting discourses on the renovation of China’s urban village. Cities 2021, 111, 10.

- Zhang, Z.T.; Liu, Y.; Liu, G.W. Rethinking growth coalition in urban village redevelopment: An empirical study of three villages in Zhuhai, China. Habitat Int. 2022, 121, 10.

- Arrow, K.J. The organization of economic activity: Issues pertinent to the choice of market versus nonmarket allocation. Anal. Eval. Public Expend. PPB Syst. 1969, 1, 59–73.

- Williamson, O.E. Transaction cost economics: How it works; Where it is headed. De Economist 1998, 146, 23–58.

- Buitelaar, E. The Cost of Land Use Decisions: Applying Transaction Cost Economics to Planning & Development; Blackwell: Oxford, UK, 2007.

- Williamson, O.E. The economics of organization: The transaction coas approach. Am. J. Sociol. 1981, 87, 548–577.

- Carr, J.B.; LeRoux, K.; Shrestha, M. Institutional ties, transaction costs, and external service production. Urban Aff. Rev. 2009, 44, 403–427.

- Zhuang, T.; Qian, Q.K.; Visscher, H.J.; Elsinga, M.G. An analysis of urban renewal decision-making in China from the perspective of transaction costs theory: The case of Chongqing. J. Hous. Built Environ. 2020, 35, 1177–1199.

- Rorstad, P.K.; Vatn, A.; Kvakkestad, V. Why do transaction costs of agricultural policies vary? Agric. Econ. 2007, 36, 1–11.

- Coggan, A.; Buitelaar, E.; Whitten, S.; Bennett, J. Factors that influence transaction costs in development offsets: Who bears what and why? Ecol. Econ. 2013, 88, 222–231.

- Simon, H. Administrative Behaviour; MacMillan: New York, NY, USA, 1957.

- Carson, S.J.; Madhok, A.; Wu, T. Uncertainty, opportunism, and governance: The effects of volatility and ambiguity on formal and relational contracting. Acad. Manag. J. 2006, 49, 1058–1077.

- Ali, Z.; Zhu, F.; Hussain, S. Identification and Assessment of Uncertainty Factors that Influence the Transaction Cost in Public Sector Construction Projects in Pakistan. Buildings 2018, 8, 157.