Your browser does not fully support modern features. Please upgrade for a smoother experience.

Submitted Successfully!

Thank you for your contribution! You can also upload a video entry or images related to this topic.

For video creation, please contact our Academic Video Service.

| Version | Summary | Created by | Modification | Content Size | Created at | Operation |

|---|---|---|---|---|---|---|

| 1 | Emily Schwartz | + 1498 word(s) | 1498 | 2022-03-16 07:23:58 |

Video Upload Options

We provide professional Academic Video Service to translate complex research into visually appealing presentations. Would you like to try it?

Cite

If you have any further questions, please contact Encyclopedia Editorial Office.

Schwartz, E. Lower Adopted Technologies in US Residential Building Sector. Encyclopedia. Available online: https://encyclopedia.pub/entry/20941 (accessed on 08 February 2026).

Schwartz E. Lower Adopted Technologies in US Residential Building Sector. Encyclopedia. Available at: https://encyclopedia.pub/entry/20941. Accessed February 08, 2026.

Schwartz, Emily. "Lower Adopted Technologies in US Residential Building Sector" Encyclopedia, https://encyclopedia.pub/entry/20941 (accessed February 08, 2026).

Schwartz, E. (2022, March 23). Lower Adopted Technologies in US Residential Building Sector. In Encyclopedia. https://encyclopedia.pub/entry/20941

Schwartz, Emily. "Lower Adopted Technologies in US Residential Building Sector." Encyclopedia. Web. 23 March, 2022.

Copy Citation

The United States (US) building sector is responsible for 40% of the national energy demand and 40% of national CO2 emissions, according to the US Energy Information Administration (EIA). These levels represent the largest energy and CO2 contributions of any sector. In particular, residential buildings account for 21% of US energy consumption, with over 60% attributed to space and water heating end-uses. The high energy demand, in tandem with the growing climate crisis, growth in population, and increase in global access to reliable power, is causing an energy supply crisis.

adoption rate

energy efficiency

green certifications

net zero energy buildings

1. Smart Windows

Multiple glazing types, such as tinting and reflective, are common and accessible on the market. The global window market was worth approximately USD 153 billion in 2020 [1]. However, even with these glazing types, thermal losses through windows remain significant resulting in as much as 10% to 25% of the home’s overall energy loss [2]. Instead, smart windows are equipped with tunable chromogenic glazing types that allow, block, or contain certain radiation wavelengths dependent on if the residence needs heating or cooling. In 2020, smart windows reached a global market value of USD 3.6 billion, 2.4% of the USD 153 billion global window market’s worth [3]. The market is growing but is curtailed by the lack of knowledge by the general public, no implementation requirements by codes and standards, and higher initial costs.

Despite the saving potential, the technology has a low adoption rate. The smart windows are currently manufactured using complex processes and, thus, cost more than any non-smart windows. Smart windows need more research and development to bring down the cost, paired with more widespread marketing to educate the general population on their abilities, benefits, and purposes [4].

2. Electric Vehicles

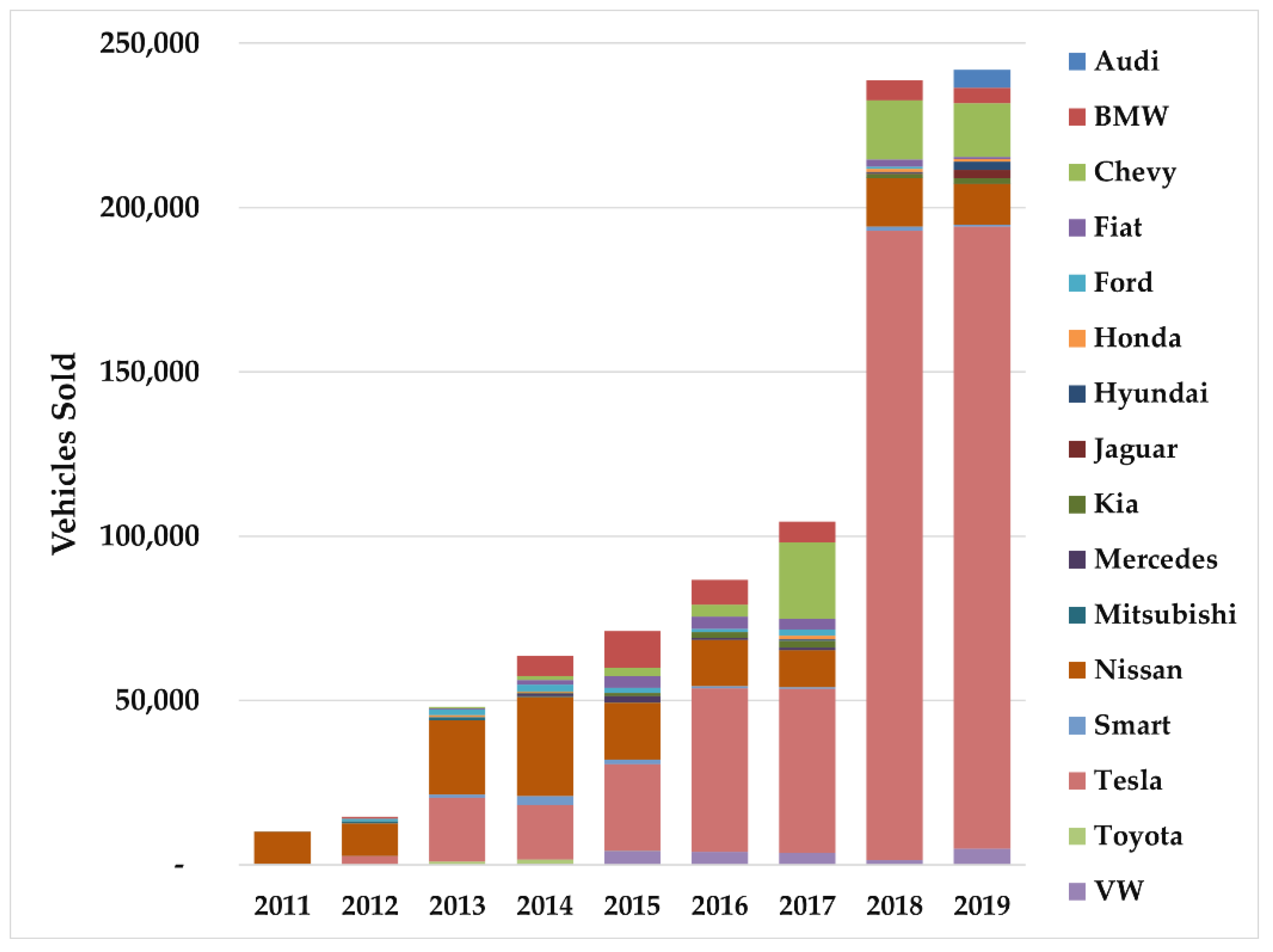

According to the US DOE’s Alternative Fuels Data Center, 879,320 electric vehicles (EVs) have been sold since 2011, with 241,912 being made in 2019 alone. However, the EV stock represents only 1.4% of the total 16.9 million vehicles sold during 2019 in the US [5]. Figure 1 shows the number of EVs sold each year, by EV automaker. This does not include plug-in hybrid vehicles [6]. While there are more options with higher capabilities at lower prices each year, EVs still remain more expensive and have fewer driving capabilities than their fuel-powered equivalents. EVs are often charged in residential buildings, significantly affecting their overall electrical loads. In addition, some states such as California have added EV charging station requirements to their building code, but other states are slower to enact these mandates [7]. EVs have the potential to lower carbon emissions as well as help offset peak loads and reduce the disparities between power production and demand.

Figure 1. Electric vehicles sold by manufacturer and year. Number of EVs sold is broken down by manufacturer name. This chart does not include plug-in hybrid electric vehicles (data source: [6]).

More steps need to be taken in order for EVs to reach the status of “higher adopted” technologies, as Li et al. [8] and Jang and Choi [9] outline. Li claims that EVs needs more funding in order to reach standards comparable to their fuel-powered equivalent. This funding is required both to enhance EV research and development, and to subsidize the cost of electricity required to power the EVs. The next hurdle is the social influence to convince consumers to buy EVs. An increase in [10]. Jang and Choi study the potential demographic characteristics that could influence the purchase of EVs. In the end, the consumers’ demographics of gender, age, region, and income weighed the car’s characteristics of fuel type, price, body type, driving range and time, and autonomous driving differently. In order to incorporate a larger audience, they made three conclusions: First, the cost of EVs must be lowered to be competitive with fuel-powered vehicles. Second, there needs to be investment in research and development to improve EV performance and charging stations. Finally, EVs need to be marketed better to the demographics that are not currently being reached, such as lower income households or those that believe they prefer specific fuel-type characteristics over EVs [9].

EV has the capacity to grow and serve as a vital step towards complete electrification, lowering personal carbon footprints, and alleviating the discrepancy of grid energy production and demand.

3. Storage Solutions

Load balancing is challenging because of the inter-connectivity between technology and human factors. A perfectly accurate load balancing model is impossible to make due to the uncertain human factors, so instead the solution is to invest in electrical, chemical, or thermal storage. Storage helps flatten the curve and disparity between energy supply and demand. Energy storage, if economically feasible, would allow for flexibility, proper optimization, and less energy waste [11]. As of 2019, the US has 402 MW of small-scale and 1022 MW of large-scale total battery energy storage capacities [12][13]. Compared to the US’ 97.2 GW of solar power capacity, the total energy storage capacity represents 1.5%. However, energy storage remains currently an expensive technology and only considered when the residence has onsite renewable power generation sources.

Surveys completed during 2020 indicate that most consumers (69%) want energy storage for added resiliency as a backup solution. The most popular vendors for energy storage batteries suitable for backup power in buildings are LG Energy Solutions and Tesla, with Tesla being the cheapest option by 3% compared to Generac, 19% compared to Eguana Technologies, and 32% compared to LG Energy Solutions [14]. However, the prices for these batteries remain rather high, typically above USD 10,500 for 13.5 kWh capacity, including installation and not including tax incentives or rebates [15]. Luckily, more energy storage solutions are entering the market each year and driving the price down steadily.

4. Heat Pumps

Heat pumps are not a new technology, but they are slow to be adopted as common options for heating residential buildings. The EIA reports that only 12.1 million households use heat pumps out of the 139 million households (8.7%) in the US [16]. Currently there are no building code requirements for adopting heat pumps, so unless builders seek to achieve certificate requirements (i.e., LEED, electrification, or other labeling standards), there is no motivation to specify these systems. Heat pumps have higher initial costs compared to gas or oil heating systems and require more specialized knowledge to install. In addition, heat pumps are not suitable for all climates.

However, they offer large potential for energy savings. According to the US DOE, heat pumps can reduce electricity by approximately 50%, in comparison to their electric heating systems [17]. Geothermal heat pumps could reduce heating energy usage by 30% to 60% in US homes, if they have access to geothermal sources [17]. Wu and Skye of the National Institute of Standards and Technology (NIST) state that Ground Source Heat Pumps (GSHPs) can save between 24.3% and 39.2% of energy in heating-dominated regions, depending on the specific climate zone [18]. A case study in California showed a 50% reduction in household carbon emissions when switching from natural gas to heat pumps for both domestic hot water and space heating [19]. Another case study in United Kingdom residences showed a savings of 37% in both cost and emissions when switching from a natural gas boiler to a heat pump [20]. When heat pumps are used for domestic hot water heating, they are two to three times more efficient than standard electric water heaters [17].

Heat pumps driven by renewable power can achieve even higher energy savings compared to conventional heating and cooling systems. Liang et al. [21] investigated solar-powered heat pumps that can provide both electricity from the solar panels and heat from the solar rays. They estimated that these systems can provide up to 24% additional savings [21].

Karytas et al. [22] surveyed subjects in Greece, Spain, and Portugal specifically about domestic hot water (DHW) systems that utilize GSHPs, solar solutions, and thermal energy storage. Through a questionnaire, they gauged interest, willingness to adopt, willingness to pay, and acceptable payback periods, as well as the subjects’ demographic characteristics. They concluded that while there is sufficient interest and willingness to accept, the technology needs to be cheaper and have a shorter payback period compared to the non-renewable competitors. They estimated that the technology needs to be as low as EUR 6000 with a 5-year payback period for users to readily adopt it [22].

5. Geothermal Systems

Geothermal plants only produce 0.4% of the US’ utility-scale electricity generation [23] suitable for space heating, cooling, DHW systems, and electricity generation. Geothermal energy could provide as much as 75% savings when compared to traditional heating and cooling systems [24]. However, geothermal systems may not be economically feasible for all US climates, as Neves et al. assessed [25].

Reber et al. proposed an alternate geothermal heating solution using centralized enhanced geothermal systems (EGS) [26]. These EGS use terra heat from bedrock, as opposed to relying on geothermal ground water, which is only available in certain locations. The EGS provide a more efficient approach to heating air and water and are available in more locations than traditional geothermal systems. The main concern is economic feasibility, depending on the bedrock conditions. Currently, this system could cost as high as 22.30 USD/MMBtu, but with more research, this cost could be reduced to 12.00 USD/MMBtu [26]. Generally, geothermal systems require large capital investments, but with a large-scale deployment and reduced transportation distances, geothermal energy could become accessible to more homeowners [26].

References

- Windows and Doors Market Size to Exceed $225 BN by 2027 . GMI. Retrieved 2022-3-16

- Cannavale, A.; Ayr, U.; Fiorito, F.; Martellotta, F.; Smart Electrochromic Windows to Enhance Building Energy Efficiency and Visual Comfort. Energies 2020, 13, 1449, https://doi.org/10.3390/en13061449.

- Reportlinker. Global Smart Windows Market to Reach $6.8 Billion by 2026. Globe News Wire, 25 June 2021.

- Tan, X.Y.; Wang, H.; Kim, T.G.. Electrochromic Smart Windows: An Energy-Efficient Technology. In Composite Materials: Applications in Engineering, Biomedicine and Food Science; Siddiquee, S., Gan Jet Hong, M., Mizanur Rahman, M., Eds.; Springer International Publishing: Cham, Switzerland, 2020; pp. 213-230.

- Statista Number of Cars Sold in the U.S. per Year 1951–2020 . Statista. Retrieved 2022-3-16

- Alternative Fuels Data Center: Maps and Data—U.S. Plug-in Electric Vehicle Sales by Model . EIA. Retrieved 2022-3-16

- NC Clean Energy Technology Center DSIRE . DSIRE. Retrieved 2022-3-16

- Jingjing Li; Jianling Jiao; Yunshu Tang; Analysis of the impact of policies intervention on electric vehicles adoption considering information transmission—based on consumer network model. Energy Policy 2020, 144, 111560, 10.1016/j.enpol.2020.111560.

- Jang, S.; Choi, J.Y.; Which consumer attributes will act crucial roles for the fast market adoption of electric vehicles?: Estimation on the asymmetrical & heterogeneous consumer preferences on the EVs. Energy Policy 2021, 156, 112469, https://doi.org/10.1016/j.enpol.2021.112469.

- Jingjing Li; Jianling Jiao; Yunshu Tang; Analysis of the impact of policies intervention on electric vehicles adoption considering information transmission—based on consumer network model. Energy Policy 2020, 144, 111560, 10.1016/j.enpol.2020.111560.

- Solar Energy in the United States . DOE. Retrieved 2022-3-16

- Tronchin, L.; Manfren, M.; Nastasi, B.; Energy efficiency, demand side management and energy storage technologies—A critical analysis of possible paths of integration in the built environment. Energy Rev. 2018, 95, 341-353, https://doi.org/10.1016/j.rser.2018.06.060.

- EIA. Battery Storage in the United States: An Update on Market Trends; EIA: Washington, DC, USA, 2021.

- SolarMarketplace Intel Report H1-H2. 2020 . EnergySage. Retrieved 2022-3-16

- Powerwall . Tesla. Retrieved 2022-3-16

- U.S. Households’ Heating Equipment Choices Are Diverse and Vary by Climate Region . EIA. Retrieved 2022-3-16

- Heat Pump Systems . DOE. Retrieved 2022-3-16

- Wu, W.; Skye, H.M.; Net-zero nation: HVAC and PV systems for residential net-zero energy buildings across the United States. Energy Convers. Manag. 2018, 177, 605-628, https://doi.org/10.1016/j.enconman.2018.09.084.

- Brockway, A.M.; Delforge, P.; Emissions reduction potential from electric heat pumps in California homes. Elecr. J. 2018, 31, 44-53, https://doi.org/10.1016/j.tej.2018.10.012.

- Gaur, A.S.; Fitiwi, D.Z.; Curtis, J.; Heat pumps and our low-carbon future: A comprehensive review.. Energy Res. Soc. Sci. 2021, 71, 101754, https://doi.org/10.1016/j.erss.2020.101764.

- Liang, C.; Zhang, X.; Li, X.; Zhu, X.; Study on the performance of a solar assisted air source heat pump system for building heating. Energy Build 2011, 43, 2188-2196, https://doi.org/10.1016/j.enbuild.2011.04.028.

- Spyridon Karytsas; Olympia Polyzou; Constantine Karytsas; Factors affecting willingness to adopt and willingness to pay for a residential hybrid system that provides heating/cooling and domestic hot water. Renewable Energy 2019, 142, 591-603, 10.1016/j.renene.2019.04.108.

- Use of Geothermal Energy . EIA. Retrieved 2022-3-16

- Geothermal Energy Factsheet . University of Michigan Center for Sustainable Systems. Retrieved 2022-3-16

- Neves, R.; Cho, H.; Zhang, J.; State of the nation: Customizing energy and finances for geothermal technology in the United States residential sector. Renew. Sustain. Energy Rev. 2021, 137, 110463, https://doi.org/10.1016/j.rser.2020.110463.

- Timothy J. Reber; Koenraad F. Beckers; Jefferson W. Tester; The transformative potential of geothermal heating in the U.S. energy market: A regional study of New York and Pennsylvania. Energy Policy 2014, 70, 30-44, 10.1016/j.enpol.2014.03.004.

- Neves, R.; Cho, H.; Zhang, J.; State of the nation: Customizing energy and finances for geothermal technology in the United States residential sector. Renew. Sustain. Energy Rev. 2021, 137, 110463, https://doi.org/10.1016/j.rser.2020.110463.

- Timothy J. Reber; Koenraad F. Beckers; Jefferson W. Tester; The transformative potential of geothermal heating in the U.S. energy market: A regional study of New York and Pennsylvania. Energy Policy 2014, 70, 30-44, 10.1016/j.enpol.2014.03.004.

More

Information

Subjects:

Construction & Building Technology

Contributor

MDPI registered users' name will be linked to their SciProfiles pages. To register with us, please refer to https://encyclopedia.pub/register

:

View Times:

506

Revision:

1 time

(View History)

Update Date:

28 Mar 2022

Notice

You are not a member of the advisory board for this topic. If you want to update advisory board member profile, please contact office@encyclopedia.pub.

OK

Confirm

Only members of the Encyclopedia advisory board for this topic are allowed to note entries. Would you like to become an advisory board member of the Encyclopedia?

Yes

No

${ textCharacter }/${ maxCharacter }

Submit

Cancel

Back

Comments

${ item }

|

More

No more~

There is no comment~

${ textCharacter }/${ maxCharacter }

Submit

Cancel

${ selectedItem.replyTextCharacter }/${ selectedItem.replyMaxCharacter }

Submit

Cancel

Confirm

Are you sure to Delete?

Yes

No