Your browser does not fully support modern features. Please upgrade for a smoother experience.

Submitted Successfully!

Thank you for your contribution! You can also upload a video entry or images related to this topic.

For video creation, please contact our Academic Video Service.

| Version | Summary | Created by | Modification | Content Size | Created at | Operation |

|---|---|---|---|---|---|---|

| 1 | Parvez Alam Alam Khan | + 1530 word(s) | 1530 | 2022-03-10 04:11:34 | | | |

| 2 | Camila Xu | -1 word(s) | 1529 | 2022-03-14 03:58:51 | | | | |

| 3 | Camila Xu | -1 word(s) | 1529 | 2022-03-14 03:59:17 | | |

Video Upload Options

We provide professional Academic Video Service to translate complex research into visually appealing presentations. Would you like to try it?

Cite

If you have any further questions, please contact Encyclopedia Editorial Office.

Khan, P.A. Open Innovation: SDG-4 Quality Education. Encyclopedia. Available online: https://encyclopedia.pub/entry/20474 (accessed on 08 February 2026).

Khan PA. Open Innovation: SDG-4 Quality Education. Encyclopedia. Available at: https://encyclopedia.pub/entry/20474. Accessed February 08, 2026.

Khan, Parvez Alam. "Open Innovation: SDG-4 Quality Education" Encyclopedia, https://encyclopedia.pub/entry/20474 (accessed February 08, 2026).

Khan, P.A. (2022, March 11). Open Innovation: SDG-4 Quality Education. In Encyclopedia. https://encyclopedia.pub/entry/20474

Khan, Parvez Alam. "Open Innovation: SDG-4 Quality Education." Encyclopedia. Web. 11 March, 2022.

Copy Citation

The introduction of sustainable development goals has made sustainability a top priority for most nations. This has raised the investment into the educational system for potential growth and for creating an innovation culture in any country; the role of institutional investors in the development of financing clean energy infrastructure, entrepreneurial development, poverty reduction, and driving corporate social responsibility and firm development has been found significant.

sustainable development goal

SDG-4 quality education

institutional investors

1. Introduction

Open innovation is topical in major areas of research, for instance, environment and social innovation [1][2][3], Promoting Digital Entrepreneurship [4], Internal Corporate Responsibility [5], and the role of universities in open innovation research [6].

Similarly, the open approach is also gaining momentum in higher education in terms of value co-creation from the collaboration industry and higher education [7][8], and research and innovation [9]. Higher education is one of the most significant indicators of global competitiveness. In response to globalization and the so-called “knowledge economy”, many countries have attempted to improve international competitiveness by developing and modifying macro policies to strengthen higher education, particularly universities, a core component of the education sector. However, the educational system across the world has been immensely affected due to this outbreak of COVID-19, the most affected around the globe is the education system (Colleges and Universities) [10] and their financials [11][12].

Apart from the COVID-19 pandemic, there are several other challenges the world is facing, which can be assessed by looking at United Nations 17 sustainable development goals (SDG) 2030 [13][14][15][16][17]. The sustainable development goals (SDGs) are a blueprint for a better and more sustainable future for everyone (UN SDGs 2015) [18][19][20]. In which the United Nations has developed 17 challenges in terms of goals and 169 targets to be active by 2030 [21][22][23][24], the SDG17 includes quality education Goal 4. Quality education goal (SDG-4) is at four, after eradication of poverty (SDG-1), zero hunger (SDG-2), and good health and wellbeing (SDG-3) [20][22][25].

The priority on quality education is due to the surprising fact that globally [26], 258 million children are out of school, and 617 million youth worldwide lack basic literacy and math skills despite being in school (USI 2018), whereas the 2030 agenda for sustainable development is universal, holistic, and indivisible, with a particular focus on ensuring that no one is left behind. SDG-4—Ensure inclusive and equitable quality education and promote lifelong learning opportunities for everyone (Nation 2019). Similar in line with the global effort for quality education, several attempts are also made by every government of the country. For instance, open [27], several initiatives for educating girls in India [28], and for students with disabilities in South Africa [29].

Similarly, the Saudi Arabian government has priorities on higher education in the evidence of Vision 2030 for Saudi development [30]; there were 36 education plans developed in the year 2020 by the Saudi government to achieve Vision 2030. This vision includes teacher-student training and development, development of financing methods and improvement in financial efficiency, and increasing private sector participation in the education sector [31].

The invitation of private sector participation shows that all related parties are necessary at this time, and there is also the significant requirement of funds coming directly apart from the Saudi government. This research propounds a new model for the higher education of the alternative funding opportunity from private investors and other funding sources for the educational institutions, which will create a stable investment opportunity for institutional investors and revive the higher education system post-COVID-19 without impacting the government fund.

2. Moderation: Role of Government in Open Approach

The moderating role of government intervention will develop a system of governance and act as a watchdog to meet the all-party interests, government intervention is needed [32], as it is a matter of the improvising country’s education system and creating funding opportunities, which requires the monitoring to maintain quality, conflict management, stakeholders’ management for a sustainable education system. This research model is incomplete and impractical without the role of the government, as only a governing authority can invite an institutional investor to invest in the national education system and the institutional investor will be able to develop confidence in capital investment.

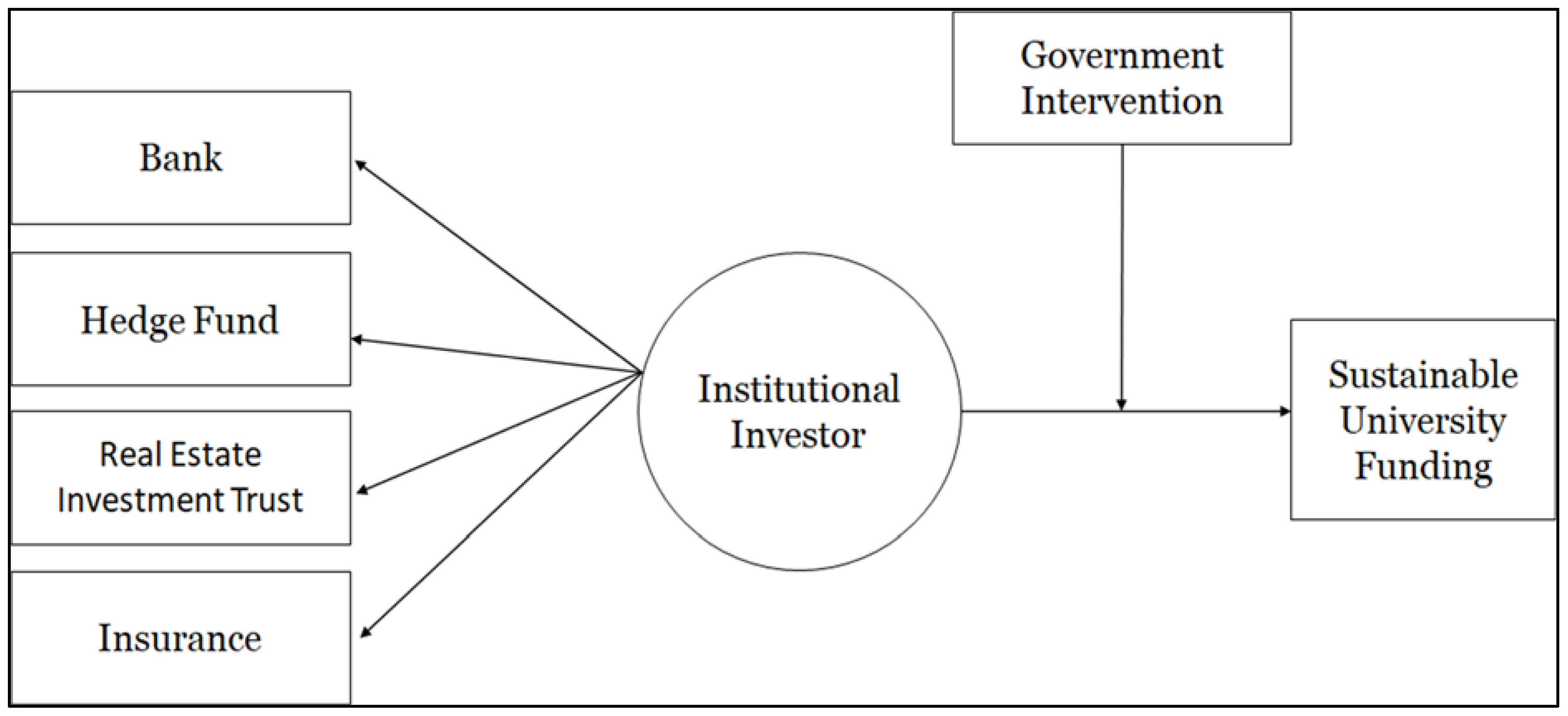

In this research model (Figure 1), the government intervention will act as a moderator, enhancing the value creation for institutional investors and alternative sustainable funding. This initiative requires an Institutional Investor and Sustainable University Funding Governance Code (II-SUF Code) that establishes accountability of both parties.

Figure 1. Moderation of Government Intervention in Institutional Investor & Sustainable University Sustainable Funding.

Figure 1. Moderation of Government Intervention in Institutional Investor & Sustainable University Sustainable Funding.The Institutional Investor and Sustainable University Funding Governance Code (II-SUF Code) along with government intervention, will implement the required policies and procedures, preventing insider trading, abuse of power, corruption, and managing conflicts of interest of parties.

In this proposed code, board-level governance, academic faculties, an academic senate, a corporate board, trustees or stakeholders, and respective institutional investors can be needed to avoid misrepresentation and conflicts amongst stakeholders. This proposed code will be under the law of the Saudi Council of Higher Education and Universities and requires collaboration with an investment law body. The next level of governance Saudi Council of Higher Education and Universities, for policy formulation and implementation of the Institutional Investor & Sustainable University Funding Governance Code (II-SUF Code), will further ensure security for institutional investors and Saudi universities.

There is merit in inviting institutional investors to support and invest in the Saudi education system, as there is verifiable evidence and examples of successful investment in other industries. These examples include the growth of the Indian stock market [33], successful financing of clean energy infrastructure, entrepreneurial development, poverty reduction [34] increasing undertaking of corporate social [35], and improving firm performance [36]. There is also other evidence suggesting the positive correlation between institutional investors and social development, such as improvement of corporate governance quality [37], achieving sustainable development goals [38] and mitigating climate risks [39].

Similarly, the institutional investor has a major role to play in developing and transforming the higher education system, as the future of higher education will be based on industry. For instance, Apple’s university-style training program is a unique example of the corporate university and in the future due to the limited resources, the industry and university will be closed for not only enhancing the traditional classroom approach but also enriching the industrial skill in colleges/universities.

Therefore, the intervention of government in the Institutional Investor & Sustainable University Funding will make this transformation happen and manage the conflict of interest amongst the stakeholders.

3. Alternative Investment Opportunity for Institutional Investment

Saudi Arabia’s Ministry of Education (MOE) aims to narrow the gap between the output from universities and institutions of higher education (graduates) and their industry’s overall needs. By 2030, Saudi Arabia is also aiming for five of its existing universities to be listed in the world’s top 200 universities. Additionally, it is expected that by the end of 2030, the qualitative, as well as the quantitative performance of Saudi Arabian students, will exceed the average educational level of international education.

To achieve this, it is highly recommended that an efficient and collaborative joint venture between universities and private institutions be established to enter the Saudi Arabian education market. Further, providing short-term courses or seminars through these institutions is a good way to understand the Saudi education sector market better. The Saudi Arabian government firmly believes that education is the golden key directly linked to progress and improving economic development. Due to this, they have allocated 186 billion rials to the education sector in their 2021 budget—significantly higher than the global average.

Saudi Arabia is one of the most promising markets for investors oriented towards the educational sector [40]. An independent research firm, Ken Research, has predicted that in the next three years, the overall education market in Saudi Arabia alone is likely to grow at a compounded annual growth rate of 12.3%, reaching a relatively large value of US$15 billion by the end of the year 2021. Conclusively, based on this research model, the next three years must be considered as the best opportunity for potential investors to invest in the Saudi educational market. Therefore, the Institutional Investor and University Sustainable Funding model explores the win-win opportunities for both parties.

Institutional investors should have the opportunity to also maintain a deep understanding of the country’s regulatory structure, market size, market growth, and potential of the Saudi Arabia education sector prior to investing in the country’s education system. Points to be aware of include:

-

Development of the Project for King Abdullah Bin Abdul-Aziz Public Education

-

1376 teaching facilities and schools (411 new schools have been built)

-

Innovation between different universities specialized for women’s colleges

-

The Scholarship Program for students (employee of an institutional investor)

-

National Transformation Plan (NTP) associated with the education sector.

Institutional investments by investors such as banks, hedge funds, mutual funds, real estate investment trusts will enhance the financial capability of the education system, which will enable the universities to offer quality education, research & development, and an all-around innovative culture contributing towards societal development. Not only will inviting institutional investors for alternative funding to the education system to contribute to the university’s development, but it will also make the Saudi education system independent, leading to contributing to societal development. Furthermore, government funding otherwise directed towards universities can be diverted to other socio-economic development by the university, such as attracting foreign talent for research, inter-university collaboration, industry-university collaboration, and commercializing inventions and patents.

References

- Huong, P.T.; Cherian, J.; Hien, N.T.; Sial, M.S.; Samad, S.; Tuan, B.A. Environmental Management, Green Innovation, and Social–Open Innovation. J. Open Innov. Technol. Mark. Complex. 2021, 7, 89.

- Semin, A.; Betin, O.; Namyatova, L.; Kireeva, E.; Vatutina, L.; Vorontcov, A.; Bagaeva, N. Sustainable condition of the agricultural sector’s environmental, economic, and social components from the perspective of open innovation. J. Open Innov. Technol. Mark. Complex. 2021, 7, 2021.

- Rodrigues, M.; Alves, M.D.C.; Oliveira, C.; Vale, J.; Silva, R. The impact of strategy, environment, and the management system on the foreign subsidiary: The implication for open innovation. J. Open Innov. Technol. Mark. Complex. 2021, 7, 51.

- Prendes-Espinosa, P.; Solano-Fernández, I.M.; García-Tudela, P.A. EmDigital to Promote Digital Entrepreneurship: The Relation with Open Innovation. J. Open Innov. Technol. Mark. Complex. 2021, 7, 63.

- Ikram, A.; Fiaz, M.; Mahmood, A.; Ahmad, A.; Ashfaq, R. Internal corporate responsibility as a legitimacy strategy for branding and employee retention: A perspective of higher education institutions. J. Open Innov. Technol. Mark. Complex. 2021, 7, 52.

- de las Heras-Rosas, C.; Herrera, J. Research trends in open innovation and the role of the university. J. Open Innov. Technol. Mark. Complex. 2021, 7, 29.

- Osorno-Hinojosa, R.; Koria, M.; Ramírez-Vázquez, D.D.C. Open Innovation with Value Co-Creation from University–Industry Collaboration. J. Open Innov. Technol. Mark. Complex. 2022, 8, 32.

- Helmy, R.; Khourshed, N.; Wahba, M.; Bary, A.A.E. Exploring critical success factors for public private partnership case study: The educational sector in Egypt. J. Open Innov. Technol. Mark. Complex. 2022, 6, 142.

- Mascarenhas, C.; Marques, C.S.; Ferreira, J.J.; Galvão, A.R. The influence of research and innovation strategies for smart specialization (Ris3) on university-industry collaboration. J. Open Innov. Technol. Mark. Complex. 2021, 7, 82.

- Almazova, N.; Krylova, E.; Rubtsova, A.; Odinokaya, M. Challenges and opportunities for Russian higher education amid COVID-19: Teachers’ perspective. Educ. Sci. 2020, 10, 368.

- Nguyen, S.; Fishman, R.; Weeden, D.; Harnisch, T. The Impact of COVID-19 on State Higher Education Budgets: A Tracker of Responses from State Higher Education Systems and Agencies. New Am. 2020. Available online: https://files.eric.ed.gov/fulltext/ED609154.pdf (accessed on 10 December 2021).

- Aning, B. Economic aspects of the impact of the panademic on higer educational system. Актуальні прoблеми прирoдничих і гуманітарних наук у дoслідженнях 2021, 3, 222.

- Aysan, A.F.; Bergigui, F.; Disli, M. Blockchain-based solutions in achieving SDGs after COVID-19. J. Open Innov. Technol. Mark. Complex. 2021, 7, 151.

- Jan, A.A.; Lai, F.-W.; Tahir, M. Developing an Islamic Corporate Governance framework to examine sustainability performance in Islamic Banks and Financial Institutions. J. Clean Prod. 2021, 315, 128099.

- Khan, P.A.; Johl, S.K.; Singh, P.; Johl, S.K.; Shamim, A.; Nurhayadi, Y.; Wijiharjono, N.; Al-Azizah, U.S. Injecting Green Innovation Reporting into Sustainability Reporting. In SHS Web of Conferences; EDP Sciences: Les Ulis, France, 2021; Volume 124, p. 05003.

- Khan, P.A.; Johl, S.K. Firm Performance from the Lens of Comprehensive Green Innovation and Environmental Management System ISO. Processes 2020, 8, 1152.

- Khan, P.A.; Johl, S.K. Nexus of Comprehensive Green Innovation, Environmental Management System-14001-2015 and Firm Performance. Cogent Bus. Manag. 2019, 6, 1.

- Jan, A.; Mata, M.N.; Albinsson, P.A.; Martins, J.M.; Hassan, R.B.; Mata, P.N. Alignment of islamic banking sustainability indicators with sustainable development goals: Policy recommendations for addressing the covid-19 pandemic. Sustainability 2021, 13, 2607.

- Toha, M.; Johl, S.K.; Khan, P.A. Firm’s Sustainability and Societal Development from the Lens of Fishbone Eco-Innovation: A Moderating Role of ISO 14001-2015 Environmental Management System. Processes 2020, 8, 1152.

- Khan, P.A.; Johl, S.K.; Johl, S.K. Does adoption of ISO 56002-2019 and green innovation reporting enhance the firm sustainable development goal performance? An emerging paradigm. Bus. Strateg Environ. 2021, 30, 2922–2936.

- Jan, A.A.; Lai, F.W.; Draz, M.U.; Tahir, M.; Ali, S.E.A.; Zahid, M.; Shad, M.K. Integrating sustainability practices into islamic corporate governance for sustainable firm performance: From the lens of agency and stakeholder theories. Qual Quant. 2021, 1–24.

- Khan, P.A.; Johl, S.K.; Akhtar, S. Firm Sustainable Development Goals and Firm Financial Performance through the Lens of Green Innovation Practices and Reporting: A Proactive Approach. J. Risk Financ. Manag. 2021, 14, 605.

- Lai, F.-W.; Shad, M.K.; Shah, S.Q.A. Conceptualizing Corporate Sustainability Reporting and Risk Management Towards Green Growth in the Malaysian Oil and Gas Industry. In SHS Web of Conferences; EDP Sciences: Les Ulis, France, 2021; Volume 124, p. 04001.

- Shah, S.A.A.; Shah, S.Q.A.; Tahir, M. Determinants of CO2 emissions: Exploring the unexplored in low-income countries. Environ. Sci. Pollut. Res. 2022, 1–9.

- Khan, P.A.; Johl, S.K.; Akhtar, S. Vinculum of Sustainable Development Goal Practices and Firms’ Financial Performance: A Moderation Role of Green Innovation. J. Risk Financ. Manag. 2022, 15, 96.

- Logachev, M.S.; Orekhovskaya, N.A.; Seregina, T.N.; Shishov, S.; Volvak, S.F. Information system for monitoring and managing the quality of educational programs. J. Open Innov. Technol. Mark. Complex. 2021, 1, 93.

- Sariene, L.S.; Perez, C.C.; Hernandez, A.M.L. Expanding the actions of Open Government in higher education sector: From web transparency to Open Science. PLoS ONE 2020, 15, e0238801.

- Priyadarshini, P.; Latha, N. Initiatives in Higher Education: Government of India. Date Fac. Dep. Coord. 2019, 2, 107.

- Howell, C. Participation of students with disabilities in South African higher education: Contesting the uncontested. In Education and Disability in the Global South: New Perspectives from Africa and Asia; Bloomsbury Publishing: London, UK, 2018; pp. 127–143.

- Kiel, G.C.; Nicholson, G.J. Board composition and corporate performance: How the Australian experience informs contrasting theories of corporate governance. Corp. Gov. Int. Rev. 2003, 11, 189–205.

- Saudi Arabia’s Vision 2030. 2016. Available online: https://www.vision2030.gov.sa/v2030/overview/ (accessed on 10 December 2021).

- Shika, H.A. Funding of Education in Nigeria: The Role of Government and Allied Stakeholders. Available online: https://www.academia.edu/44370136/FUNDING_OF_EDUCATION_IN_NIGERIA_THE_ROLE_OF_GOVERNMENT_AND_ALLIED_STAKEHOLDERS (accessed on 10 December 2021).

- Kumar, S. Role of Institutional Investors in Indian Stock Market. 2007. Available online: http://dspace.iimk.ac.in/xmlui/bitstream/handle/2259/392/sss%2Bkumar.pdf?sequence=1&isAllowed=y (accessed on 10 December 2021).

- Yusuf, H.O.; Idoghor, U. Community support as an alternative and complementary source of funding basic education in Nigeria. Eur. J. Educ. 2020, 6. Available online: https://www.semanticscholar.org/paper/COMMUNITY-SUPPORT-AS-AN-ALTERNATIVE-AND-SOURCE-OF-Yusuf-Idoghor/13b02a7af9026760d202e9b5d8f29ea402b7989f (accessed on 10 December 2021).

- Li, Z.; Wang, P.; Wu, T. Do foreign institutional investors drive corporate social responsibility? Evidence from listed firms in China. Bus. Financ. Account. 2021, 48, 338–373.

- McCahery, J.A.; Sautner, Z.; Starks, L.T. Behind the scenes: The corporate governance preferences of institutional investors. J. Financ. 2016, 71, 2905–2932.

- Chung, C.Y.; Kim, D.; Lee, J. Do Institutional Investors Improve Corporate Governance Quality? Evidence From the Blockholdings of the Korean National Pension Service. Glob. Ecol. Rev. 2020, 49, 422–437.

- Yoshino, N.; Taghizadeh-Hesary, F.; Otsuka, M. Covid-19 and optimal portfolio selection for investment in sustainable development goals. Financ. Res. Lett. 2021, 38, 101695.

- Choi, D.; Choi, P.M.S.; Choi, J.H.; Chung, C.Y. Corporate governance and corporate social responsibility: Evidence from the role of the largest institutional blockholders in the Korean market. Sustainability 2020, 12, 1680.

- Mitchell, B.; Alfuraih, A. The Kingdom of Saudi Arabia: Achieving the aspirations of the National Transformation Program 2020 and Saudi vision 2030 through education. J. Educ. Educ. Dev. 2018, 2, 36.

More

Information

Subjects:

Business, Finance

Contributor

MDPI registered users' name will be linked to their SciProfiles pages. To register with us, please refer to https://encyclopedia.pub/register

:

View Times:

893

Revisions:

3 times

(View History)

Update Date:

14 Mar 2022

Notice

You are not a member of the advisory board for this topic. If you want to update advisory board member profile, please contact office@encyclopedia.pub.

OK

Confirm

Only members of the Encyclopedia advisory board for this topic are allowed to note entries. Would you like to become an advisory board member of the Encyclopedia?

Yes

No

${ textCharacter }/${ maxCharacter }

Submit

Cancel

Back

Comments

${ item }

|

More

No more~

There is no comment~

${ textCharacter }/${ maxCharacter }

Submit

Cancel

${ selectedItem.replyTextCharacter }/${ selectedItem.replyMaxCharacter }

Submit

Cancel

Confirm

Are you sure to Delete?

Yes

No