It is important to consider the dimension of the e-commerce market within the EU, including more than 500 million consumers and a volume of transaction of USD 602 billion. The average yearly raise rate is about 15% for the domestic commerce and more than 25% for e-commerce between different states (

Fair 2019). “The EU, being the second biggest in the world cross-border buyer of goods, established own e-commerce processes, rules, know-hows and ways for engagement of stakeholders” (

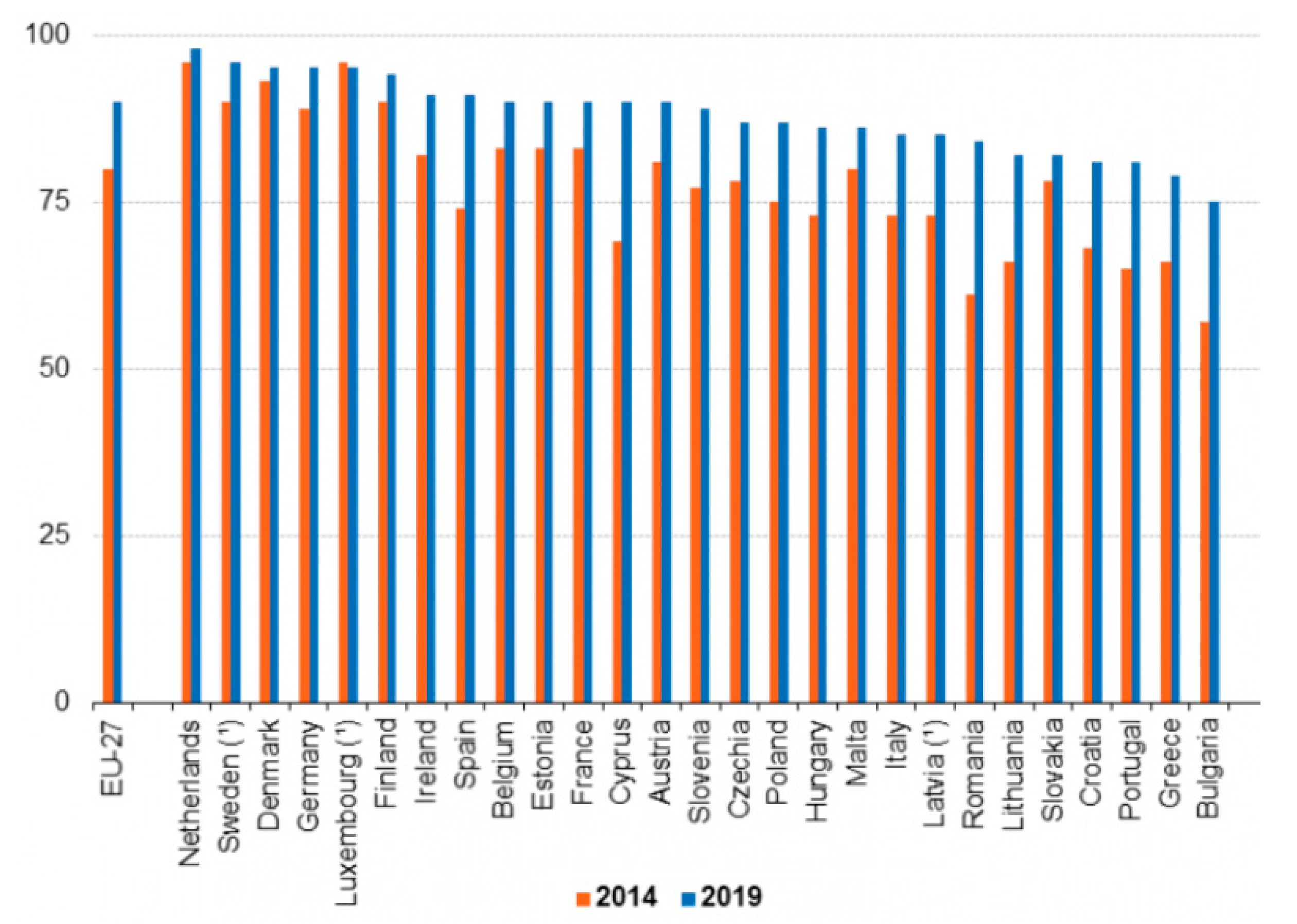

EUFORDIGITAL 2020). In this respect, the EU is in line with the current and perspective demands, the situation being revealed by the number of EU citizens with internet connection (

Figure 1):

Moreover, big differences have been noted between the e-commerce rate in West Europe (83%) and the rate in East Europe (only 36%), which points out a major development opportunity in the eastern part of the EU for all e-commerce activities. The expenses for digital commerce business-to-consumer (B2C) are expanding each year; the volume of EUR 717 billion in 2020 representing more than 5% of the total GDP.

Researchers perspective on the research activity to identify legal constraints for the development, improvement and optimization of e-commerce activity is that there are no identifiable institutional or legislative barriers likely to impede the adoption of future regulation for the proper functioning and further development of e-commerce. The regulatory elements were examined, mainly targeting areas related to e-commerce, proved to be characterized by an optimal level of transposition of the provisions included in the European Union uniform legislation. Where appropriate, the level of coherence between the national normative act corresponding to the identified areas has also been addressed and the research results show a sufficient level of conformity and consistency of national regulation with the European rule of law for the purpose pursued.

On the other hand, rearchers study has revealed a large number of on-going proposals for legislative changes in the case of regulatory areas related to e-commerce. The requirements of the national and European legislation for the implementation of the e-commerce service have been identified, proving the dynamics of this area of regulation, in line with the rapidity of the e-commerce development. A relevant example for the efficiency of the process of adopting new regulation is the recent entry into force of Regulation (EU) 2018/302 of the European Parliament and of the Council on the prevention of unjustified geo-blocking and other forms of discrimination based on citizenship or nationality, domicile or seat of customers in the internal market, amending Regulations (EC) No. 2006/2004 and (EU) 2017/2394 and Directive 2009/22/EC including those related to ensuring the cross-border development of e-commerce. It is research results that the regulatory priorities at the European level include the proposal for a Directive of the European Parliament and of the Council on certain aspects of online sales contracts and other types of distance selling of goods, an act relevant to B2C e-commerce.

In the context of the recent boosting of online transaction in the COVID-19 global pandemic crisis, the proposal in question is not only justified but needed for setting out certain requirements for distance selling contracts concluded between the seller and the consumer, in particular the rules on conformity of goods, remedial measures in the event of non-compliance and the arrangements for exercising such remedial measures.

In the current form of the proposal, researchers study has emphasized the limits of the provisions of this Directive, as it addresses just the e-sale of goods and not the provision of e-services. At the European level, issues related to knowledge of legal obligations towards consumers, knowledge and compliance with consumer protection legislation, as well as views on product safety, consumer complaints and awareness of alternative dispute resolution have been the subject of comprehensive studies by the European Commission, and the legal framework reflects the results of this extended research. The legislative reform needs to respond to the identified challenges of digital activities, further reinforcements being under evaluation and negotiation for uniform European adoption.

The process of regulation in response to the reality of e-commerce development was noted and should conform with the relevant jurisprudence of the Court of Justice of the European Union (“CJEU”). The court established that the imposition by Member States of more restrictive national measures than those provided by the EU directives constitutes a violation of EU law, so the Member States shall not restrict the freedom to provide services, nor shall they restrict the free movement of goods for reasons falling within the scope of regulating e-commerce.

Synthesizing, in summary, some ideas, researchers show that their approach, based on the study of the current European regulatory system correlated with the scope of e-commerce, highlights the fact that the new principles and legal norms bring advantages on several levels: firstly on the level of fiscal control (i.e., VAT regime), secondly on that of remote payments and thirdly on obtaining favorable effects in terms of ensuring consumer protection or protection of personal data. Researchers emphasize that the paper considers the recently established European legal framework, but also the manifestation of the effects of the COVID-19 pandemic crisis that has had a major impact on the European economy and society—obviously, including e-commerce, in the sense of its unexpected expansion; they note that this kind of approach is less common in the works of other authors.

Although they believe that they have added value by including here the challenges for the VAT regime, as they were seen in connection with the jurisprudence of the CJEU, researchers must still mention some limitations of research. Among them, the fact that it assesses a narrow historical framework, targeting the European Union and a specific Member State (Romania), and, in addition, the domination of the descriptive character of the presentation.

For these reasons, researchers intend to have as future lines of research, in a following paper, approaches based on the collection and processing of data from the reality of e-commerce, as they have evolved over a longer period of time (3–5 years), in accordance with the specific regulatory framework, but also with the officially registered results.

In this context, the estimation of the 20% raise in e-commerce in the overall commerce industry till 2022 seems realistic. Altogether, it means that people are in the presence of a huge “new beginning” of the e-commerce era, not only within the EU but all over the world.