Your browser does not fully support modern features. Please upgrade for a smoother experience.

Submitted Successfully!

Thank you for your contribution! You can also upload a video entry or images related to this topic.

For video creation, please contact our Academic Video Service.

Video Upload Options

We provide professional Academic Video Service to translate complex research into visually appealing presentations. Would you like to try it?

Cite

If you have any further questions, please contact Encyclopedia Editorial Office.

Luo, Y. Commercialization of Electric Vehicles. Encyclopedia. Available online: https://encyclopedia.pub/entry/19279 (accessed on 07 February 2026).

Luo Y. Commercialization of Electric Vehicles. Encyclopedia. Available at: https://encyclopedia.pub/entry/19279. Accessed February 07, 2026.

Luo, Yang. "Commercialization of Electric Vehicles" Encyclopedia, https://encyclopedia.pub/entry/19279 (accessed February 07, 2026).

Luo, Y. (2022, February 09). Commercialization of Electric Vehicles. In Encyclopedia. https://encyclopedia.pub/entry/19279

Luo, Yang. "Commercialization of Electric Vehicles." Encyclopedia. Web. 09 February, 2022.

Copy Citation

Electric Vehicles (EVs) are a promising alternative to internal combustion engine vehicles as the city is transitioning to clean energy.

electric vehicles

commercialization

decommissioning of batteries

1. Global Electric Vehicles (EV) Markets

1.1. “Top Seven” EV Markets

In descending order of market penetration, the top five EV countries are the Kingdom of Norway, the Netherlands, the Kingdom of Sweden, the French Republic, and the United Kingdom. Since the ownership of EVs in mainland China and the United States accounts for about 45% and 22% of the global market share (International Energy Agency, 2019).

Norway led the pack in terms of the EV adoption rate in 2019 as a result of incentives from the government [1][2]. The collaborative efforts of charging facility producers, power companies, and charging station owners has led to the emergence of the electric mobility value chain[3]. The Netherlands is one of the countries with the highest penetration rate of EVs in the world, which is mainly driven by incentives including carbon-dioxide-based tax rebates for vehicles emitting less than 50 g of carbon dioxide per kilometer, consequently spurring substantial growth of the EV market [4]. Sweden’s infrastructure is already adequate, and people can easily use EV chargers[5]. The French government vigorously promoted EVs to achieve the goal of 2 million EVs on the road by 2020[6] . French automakers such as Renault, Peugeot S.A., and Bolloré SE released their first EVs in 2012, and BMW chose France as the test site for its new electric model Mini. In addition, the Renault–Nissan–Mitsubishi Alliance partnership is working on a fully electric powertrain system with a rated power between 15 kW and 100 kW. The United Kingdom strongly supports EVs through incentives and subsidies[1], and consequently, the United Kingdom’s EV market share is rapidly expanding, especially in private cars and charging infrastructures [7]. Mainland China has the biggest EV industry in the world [8], and in 2019, approximately 821,000 pure EVs and 203,000 plug-in hybrid vehicles were sold. Sales of new energy vehicles increased by 3% compared to those in 2018, and mainland China accounted for almost half of the global EV stock in 2019 [9]. At the same time, the United States is one of the top players. In 2019, the United States accounted for about a quarter of the global total number of EVs, behind only China, and the “green” priority of President Joe Biden is going to further accelerate the development and acceptance of EVs in the United States.

1.2. Phasing out Internal Combustion Engine (ICE) Vehicles in Various Countries

Some countries are planning to prohibit the selling of ICEVs in the near future in order to reduce emissions from vehicle exhaust. Norway, as the country with the largest EV penetration, has set a clear goal: by 2025, all new passenger vehicles sold must have zero emissions [10]. The French government has recently announced that it will stop selling gasoline and diesel vehicles by 2040 in order to abide by the Paris Climate Agreement[11]. The United Kingdom will also ban the sale of new gasoline and diesel vehicles by 2040 as part of the highly anticipated Clean Air Plan[12]. The Netherlands plans to ban the use of diesel and gasoline vehicles by 2025, while Germany plans to phase them out starting in 2030 [13]. India is also planning to phase out gasoline and diesel vehicles [13], and by 2040, most of the vehicles in India will likely be electric.

1.3. Actions of Automakers

In response to the policies implemented by various countries, major automakers are stepping up EV production and sales. Starting in 2020, all new models released by Volvo will be fully or partially driven by batteries [14], pointing to the “historical end” of ICEVs. From 2019 to 2021, Volvo introduced five 100% pure EV models, and following in the footsteps of Volvo, Jaguar Land Rover has also announced new models with pure ICEs, and from 2020, all their new models will be fully electric or hybrid. In terms of electrification of the automotive product line, Daimler is one of the most ambitious, planning to market 10 new EV models and upgrading ~20% of other models to be powered by batteries by 2022 [15]. Volkswagen has announced that by 2030, the company will invest more than USD 24 billion to produce EVs similar to Mercedes-Benz. Volkswagen has set a goal of launching 80 new EVs by 2025, and plans to upgrade its 300 existing models to become electric by 2030 [16][31].

2. Decommissioning of Batteries and EVs

2.1. Recycling of EV Accessories

EVs still contain many useful parts after they are decommissioned. Lithium-ion (Li-ion) batteries are the costliest components in EVs and have the greatest value for recycling [17][18]. Other vehicle accessories such as plastic bumpers, tires, metal bodies, and motors can also be recycled. Ease of disassembly must be considered to facilitate recycling, and in fact, the convenience of recycling after decommissioning has been considered when some EVs are produced[19][20]. Recycling companies need to dismantle the vehicle and sort the parts according to the materials prior to crushing for further recycling.

2.2. Battery Recycling

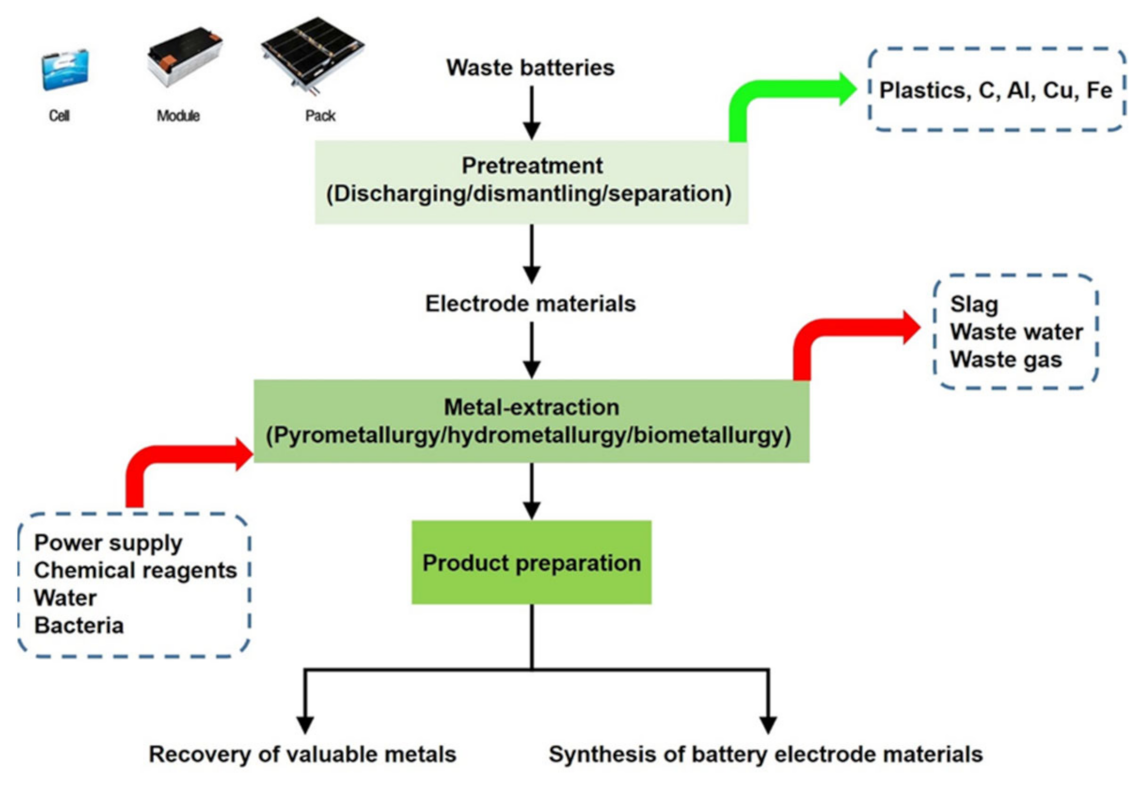

The first-generation EVs are mainly hybrid vehicles, and their batteries are mostly nickel–metal hydride (NiMH) batteries. The service life of NiMH batteries of the first generation of EVs is nearing the end, and the end of life of Li-ion batteries for second-generation EVs will also come. Valuable metals such as Ni, Co, Al, and Li in NiMH batteries and Li-ion batteries can be sorted and recycled[21][22]. In order to recover useful metals from Li-ion batteries, recycling companies usually need to disassemble battery parts and grind them into powder. The materials are first sorted by physical processes and then chemically treated, for example, by using pyrometallurgical[23], hydrometallurgical [24], or biometallurgical technologies[25] to extract the rare metals. The general waste-battery recycling process is shown in Figure 1. It was noted that the recycling technology for Li-ion batteries still needs improvement, which was also claimed in Lv et al.’s review.

Figure 1. Second-life batteries.

2.3. Second-Life Batteries

EVs have a high demand for battery performance. The battery should be replaced when the capacity drops to 70–80% of the initial value, depending on different standards[26][27][28]. However, the decommissioned battery from EVs still has some charging–discharging cycles for energy-storage applications. The second-life application can extend the life cycle of batteries to benefit solar and wind energy storage, UPS power supply, and so on[29][30]. Before the battery is used, it is necessary to check the health of the battery with the corresponding battery management system (BMS)[31]. Inspection and classification of decommissioned batteries should be standardized to match the designed second-life application. The health of batteries depends on the substances they have been in contact with and the treatment during service. The health of the battery pack depends on the health of each battery module, and the health of each battery module depends on the health of the individual battery cell. Second-life applications of EV batteries require standardized analysis of the battery quality and corresponding procedures to ensure safety.

Second-life batteries constitute a new concept, and the relevant technology and business model are still being explored. Although second-life batteries have a large market potential, the application faces many challenges, including:

-

Difficulties in accurately determining the chemical composition of individual batteries;

-

Lack of industry standards for safe disassembly of battery packages;

-

Lack of detailed information and expertise on battery-specific electronics;

-

Fluctuation of the metal contents in the battery and the price of recycled metals.

Recycling companies and vehicle manufacturers should jointly improve the developing second-life battery industry. Using models to collect and classify battery packs can minimize the workload of identifying different battery components. The US commercial standard UL 1974 has already been established to guide the development of second-life battery applications. China has also formulated four national standards (specifically GB/T33598-2017, GB/T34013-2017, GB/T34014-2017, and GB/T34015-2017) to regulate the dismantling of EV batteries, standardize battery codes during manufacturing, track battery usage history, standardize battery pack size, and standardize inspection steps for decommissioned batteries in order to promote their second-life applications. The state of charge (SOC) and state of health (SOH) of batteries can be checked based on these criteria.

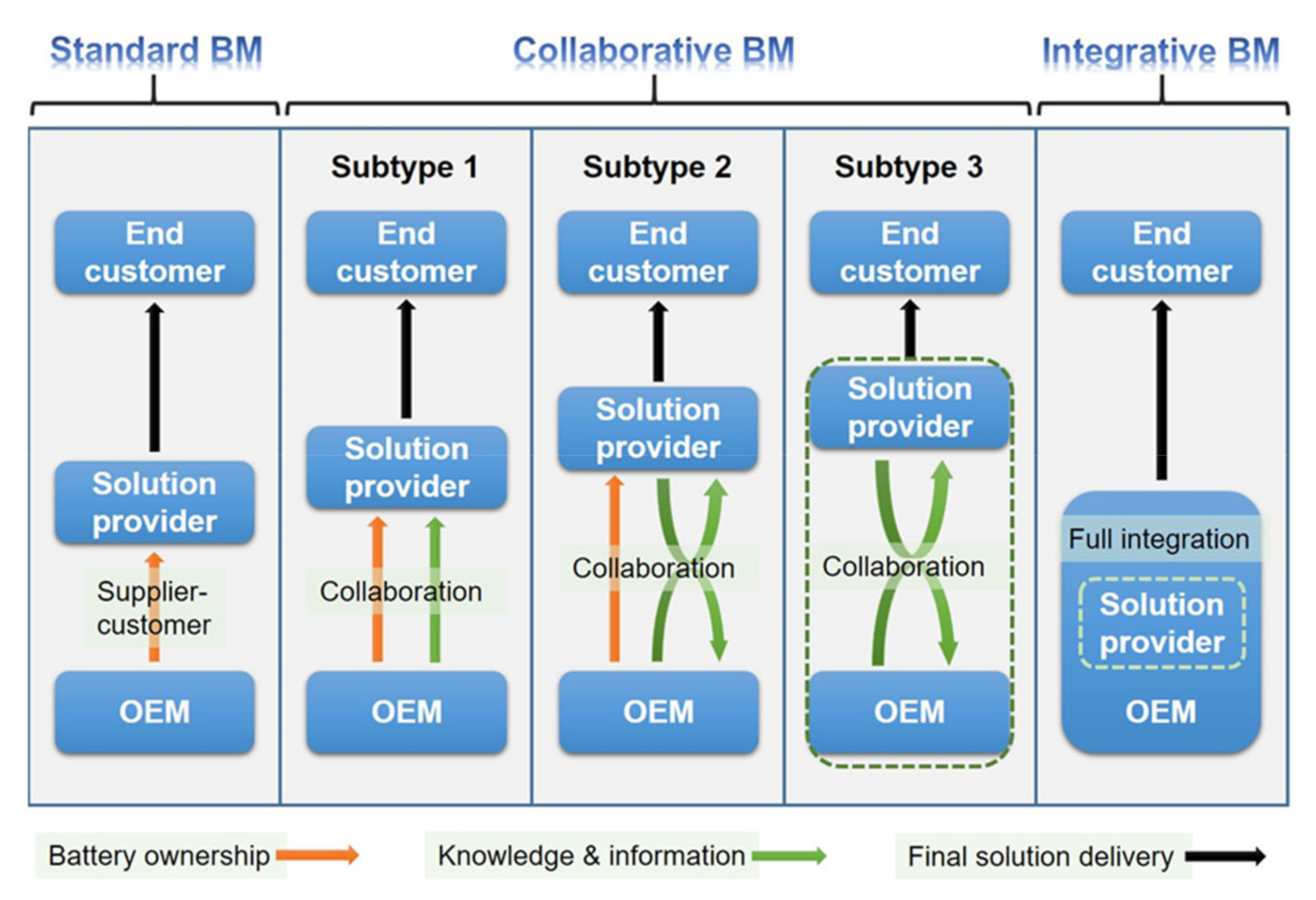

The design of business models of different EV stakeholders can facilitate second-life battery application. The business models of second-life batteries can be classified into three categories, namely the standard business model (BM), collaborative BM, and integrative BM[32][33][34]. The key stakeholder in the energy sector that provides the final solution to the end customers can be called the “solution provider”. The three categories correspond to the different relationships between cross-departmental stakeholders, which are the pure supplier–customer relationship, collaboration relationship, and full integration of solution provider within the original equipment manufacturer (OEM), as shown in Figure 2. The integration degree enhances from standard BM to collaborative BM and further to integrative BM. The collaborative BM can be subdivided into three subcategories based on the integration degree and relative dominance of stakeholders in the development of the final solution.

Since second-life batteries are used products, the BM plays a significant role in their business. A good BM can help second-life battery applications overcome cost disadvantages. Many case studies show that customers do not care about whether the batteries are new or old; they only care about whether the batteries can provide satisfactory power or capacity services [32]. The traditional logic of “buying and selling” may no longer apply to second-life batteries. Second-life battery service providers should pay more attention to the solutions to customer needs rather than simply selling batteries. In the early stage of the development of second-life batteries, solution providers can provide energy-storage services without selling any physical products. In this case, customers do not care if the batteries are old or new, since they do not own battery assets. However, whether the batteries can provide satisfactory solutions to customers is more important. It reduces the risk for customers, and makes it easier and faster for second-life batteries to enter the market. In addition to selling batteries, the OEMs can also provide consulting services and benefit from these consulting services. If the OEMs provide energy-storage services instead of selling physical products, and the solution providers are in charge of finding suitable customers and delivering the final solution to the customers, then stakeholders can continuously obtain value from the batteries during their entire second-life cycle by meeting the diversified market demand for batteries, as claimed in [32][33].

Economic efficiency is the key to the commercialization of EV second-life battery applications. At present, the cheaper price of second-life batteries compared to that of new batteries is the main driving force for many companies to develop a second-life battery business. However, with the advancement of battery technologies, the ever-decreasing price of new batteries will be one of the main challenges for second-life battery applications. In order to ensure the attractiveness of the low cost of second-life batteries, the OEMs are actively developing methods to reduce the cost of second-life battery applications, such as directly utilization of the entire decommissioned battery pack, to avoid the cost of dismantling the battery pack. In addition, the initial design of batteries has a great influence on their reuse. At present, EV OEMs only consider vehicle application when designing and preparing batteries. If the BMS does not accurately collect the usage data and SOH of the EV batteries, the retired EV batteries must be handed over to a third party for testing, which adds additional transportation and testing costs. In addition, if the accessories of batteries, such as the BMS, do not match with other secondary applications, extra costs will be required to customize the new BMS. Naturally, the OEMs prioritize optimizing the batteries’ first lifespan. However, if the OEMs actively cooperate with battery refurbishers, second-life battery customers, and battery recyclers from the beginning, it would be possible to simplify the batteries’ second-life application and recycling processes, allowing OEMs to profit by participating in the entire value chain of batteries[35]. The cooperation of the entire value chain will make the health data and material composition of batteries more transparent throughout the whole life cycle so that every stakeholder can realize the greatest benefit.

In terms of policy, policymakers should fully understand the value of second-life batteries in the energy market, and treat battery storage in the same way as other storage and power-generation businesses to support the development of future smart grids. At present, in most markets, only subsidies for new batteries exist, and there are no subsidies for second-life batteries [32]. Second-life batteries should be included in the scope of subsidies as soon as possible to promote their healthy development. In the future mature stage of the battery market, policymakers can also regulate the price of battery raw materials to maintain the price advantage of second-life batteries, to maintain the sustainable development of society.

2.4. Global Status of Battery Recycling and Second-Life Applications

North America: The international collaboration organization between Canada, Mexico, and the United States, called Commission for Environmental Cooperation (CEC), has been actively promoting EVs in the North American region. In the past 10 years, the North American EV market has grown substantially, and the number of decommissioned EV batteries is expected to increase continually. The major enterprises in North America with technologies for recycling EV batteries include Inmetco, Retrieve, RMC, and Glencore/Xstrata. The above-mentioned UL 1974 standard for second-life battery applications may be upgraded and developed into a US national standard to guide the safety and performance testing of secondary life batteries.

Europe: Europe leads the world in battery recycling legislation. In 1991, the European Battery Directive issued clear targets for the collection and recycling of various types of batteries. The Belgian enterprise Umicore has already carried out many battery recycling projects in Europe. SNAM, located in France, recycles more than 300 tons of decommissioned Li-ion batteries each year. Another French company, EuroDieuze Industrie, specializes in the recycling of batteries and lithium, and Recupyl in France uses hydrometallurgical processes to treat waste batteries. European solar grid parity has been basically achieved. Recycling companies can repackage the decommissioned batteries for use in residential solar storage systems, and in addition to integration with photovoltaic systems, decommissioned batteries can be integrated with industrial sectors or winnowers to store wind energy [36].

Japan: A joint venture of Nissan and Sumitomo, called 4R ENERGY, has been established to specialize in the development and testing of second-life applications of decommissioned Li-ion batteries. The name “4R ENERGY” means “reuse, remanufacture, resell, and recycle”. The goal is to increase the use of renewable energy to improve sustainability and improve the value chain in the global market. In addition, Sumitomo Metal Mining (SMM) cooperates with Toyota to recycle NiMH batteries after decommissioning hybrid vehicles. Honda obtained a license for the recycling of EV batteries in the Japanese market in 2017, and is developing a new process to extract rare earth metal oxides from NiMH batteries in cooperation with Japan Metal and Chemicals (JMC).

Mainland China: China has the largest number of EVs in the world, and recycling of decommissioned EV batteries will be a grand challenge in the future. The Chinese government has been actively promoting the reuse and recycling of decommissioned EV batteries, and has issued a series of national GB standards that provide guidance to battery recycling companies to examine decommissioned batteries and package them for second-life applications. Representative enterprises such as GEM, Brunp, CATL, Sound Group, and Technology Highpower have recycled Li-ion batteries commercially. At present, the majority of recycling businesses only focus on extracting valuable metals in waste batteries. A few companies have begun to develop second-life battery applications. OptimumNano, for example, is trying to construct a 3 MW energy-storage grid using decommissioned EV batteries.

Hong Kong: Reuse and recycling of decommissioned batteries are also highly regarded in Hong Kong. According to the “Waste Disposal (Chemical Waste) (General) Regulations” of the Environmental Protection Department, battery recycling enterprises must obtain chemical waste collection permits and comply with the relevant regulations on collecting, sorting, storage, packaging, labeling, and transportation. Currently, there are only four local companies that are licensed to dispose of decommissioned batteries from EVs. However, due to the lack of land in Hong Kong to build large chemical waste recycling and treatment facilities, decommissioned battery-collecting companies can only send the collected batteries to mainland China, Japan, Singapore, South Korea, and other places for further processing. Nonetheless, Hong Kong should focus on developing and promoting second-life battery applications for sustainable development.

References

- Yan, S. The economic and environmental impacts of tax incentives for battery electric vehicles in Europe. Energy Policy 2018, 123, 53–63. [Google Scholar] [CrossRef]

- Figenbaum, E. Perspectives on Norway’s supercharged electric vehicle policy. Environ. Innov. Soc. Transp. 2017, 25, 14–34. [Google Scholar] [CrossRef]

- Ingeborgrud, L.; Ryghaug, M. The role of practical, cognitive and symbolic factors in the successful implementation of battery electric vehicles in Norway. Transp. Res. Part A Policy Pract. 2019, 130, 507–516. [Google Scholar] [CrossRef]

- Santos, G.; Davies, H. Incentives for quick penetration of electric vehicles in five European countries: Perceptions from experts and stakeholders. Transp. Res. Part A Policy Pract. 2020, 137, 326–342. [Google Scholar] [CrossRef]

- Egnér, F.; Trosvik, L. Electric vehicle adoption in Sweden and the impact of local policy instruments. Energy Policy 2018, 121, 584–596. [Google Scholar] [CrossRef]

- Morganti, E.; Browne, M. Technical and operational obstacles to the adoption of electric vans in France and the UK: An operator perspective. Transport Policy 2018, 63, 90–97. [Google Scholar] [CrossRef]

- Palmer, K.; Tate, J.E.; Wadud, Z.; Nellthorp, J. Total cost of ownership and market share for hybrid and electric vehicles in the UK, US and Japan. Appl. Energy 2018, 209, 108–119. [Google Scholar] [CrossRef]

- Lin, B.; Wu, W. Why people want to buy electric vehicle: An empirical study in first-tier cities of China. Energy Policy 2018, 112, 233–241. [Google Scholar] [CrossRef]

- Yang, S.; Zhang, D.; Fu, J.; Fan, S.; Ji, Y. Market cultivation of electric vehicles in China: A survey based on consumer behavior. Sustainability 2018, 10, 4056. [Google Scholar] [CrossRef]

- Norway Government, Norway’s Low Emissions Policy. 2018. Available online: https://www.regjeringen.no/en/aktuelt/norways-low-emissions-strategy/id2607245/ (accessed on 16 January 2022).

- Reuters. France to Uphold Ban on Sale of Fossil Fuel Cars by 2040. 2019. Available online: https://www.reuters.com/article/us-france-autos/france-to-uphold-ban-on-sale-of-fossil-fuel-cars-by-2040-idUSKCN1TC1CU (accessed on 16 January 2022).

- BBC News. New Diesel and Petrol Vehicles to be Banned From 2040 in UK. 2017. Available online: https://www.bbc.com/news/uk-40723581 (accessed on 16 January 2022).

- The Guardian. France to Ban Sales of Petrol and Diesel cars by 2040. 2017. Available online: https://www.theguardian.com/business/2017/jul/06/france-ban-petrol-diesel-cars-2040-emmanuel-macron-volvo (accessed on 16 January 2022).

- The Guardian. All Volvo Cars to be Electric or Hybrid From 2019. 2017. Available online: https://www.theguardian.com/business/2017/jul/05/volvo-cars-electric-hybrid-2019 (accessed on 16 January 2022).

- Electrek. Daimler Announces Acceleration of Electric Car Plans by 3 Years, will Spend $11 Billion on 10 Models by 2022. 2017. Available online: https://electrek.co/2017/03/29/daimler-accelerate-electric-car-plan-2022/ (accessed on 16 January 2022).

- Engadget. Volkswagen wants 300 EV Models by 2030. 2017. Available online: https://www.engadget.com/2017/09/11/volkswagen-wants-300-ev-models-by-2030/ (accessed on 16 January 2022).

- Tran, M.K.; Rodrigues, M.-T.F.; Kato, K.; Babu, G.; Ajayan, P.M. Deep eutectic solvents for cathode recycling of Li-ion batteries. Nat. Energy 2019, 4, 339–345. [Google Scholar] [CrossRef]

- Zeng, X.; Li, M.; Abd El-Hady, D.; Alshitari, W.; Al-Bogami, A.S.; Lu, J.; Amine, K. Commercialization of lithium battery technologies for electric vehicles. Adv. Energy Mater. 2019, 9, 1900161. [Google Scholar] [CrossRef]

- Gu, H.; Liu, Z.; Qing, Q. Optimal electric vehicle production strategy under subsidy and battery recycling. Energy Policy 2017, 109, 579–589. [Google Scholar] [CrossRef]

- Wang, L.; Wang, X.; Yang, W. Optimal design of electric vehicle battery recycling network–From the perspective of electric vehicle manufacturers. Appl. Energy 2020, 275, 115328. [Google Scholar] [CrossRef]

- Chen, M.; Ma, X.; Chen, B.; Arsenault, R.; Karlson, P.; Simon, N.; Wang, Y. Recycling end-of-life electric vehicle lithium-ion batteries. Joule 2019, 3, 2622–2646. [Google Scholar] [CrossRef]

- Harper, G.; Sommerville, R.; Kendrick, E.; Driscoll, L.; Slater, P.; Stolkin, R.; Walton, A.; Christensen, P.; Heidrich, O.; Lambert, S. Recycling lithium-ion batteries from electric vehicles. Nature 2019, 575, 75–86. [Google Scholar] [CrossRef] [PubMed]

- Makuza, B.; Tian, Q.; Guo, X.; Chattopadhyay, K.; Yu, D. Pyrometallurgical options for recycling spent lithium-ion batteries: A comprehensive review. J. Power Sources 2021, 491, 229622. [Google Scholar] [CrossRef]

- Lv, W.; Wang, Z.; Cao, H.; Sun, Y.; Zhang, Y.; Sun, Z. A critical review and analysis on the recycling of spent lithium-ion batteries. ACS Sustain. Chem. Eng. 2018, 6, 1504–1521. [Google Scholar] [CrossRef]

- Sethurajan, M.; Gaydardzhiev, S. Bioprocessing of spent lithium ion batteries for critical metals recovery–A review. Resour. Conserv. Recycl. 2021, 165, 105225. [Google Scholar] [CrossRef]

- Zhu, J.; Mathews, I.; Ren, D.; Li, W.; Cogswell, D.; Xing, B.; Sedlatschek, T.; Kantareddy, S.N.R.; Yi, M.; Gao, T. End-of-life or second-life options for retired electric vehicle batteries. Cell Rep. Phys. Sci. 2021, 2, 100537. [Google Scholar] [CrossRef]

- Li, J.; Qiao, Z.; Simeone, A.; Bao, J.; Zhang, Y. An activity theory-based analysis approach for end-of-life management of electric vehicle batteries. Resour. Conserv. Recycl. 2020, 162, 105040. [Google Scholar] [CrossRef]

- Maharajan, S.; Jana, M.; Basu, S. Handling of the end of life electric vehicle batteries for stationary storage applications. In Proceedings of the 2019 IEEE Transportation Electrification Conference (ITEC-India), Bengaluru, India, 17–19 December 2019; pp. 1–5. [Google Scholar]

- Casals, L.C.; Barbero, M.; Corchero, C. Reused second life batteries for aggregated demand response services. J. Clean. Prod. 2019, 212, 99–108. [Google Scholar] [CrossRef]

- Song, Z.; Feng, S.; Zhang, L.; Hu, Z.; Hu, X.; Yao, R. Economy analysis of second-life battery in wind power systems considering battery degradation in dynamic processes: Real case scenarios. Appl. Energy 2019, 251, 113411. [Google Scholar] [CrossRef]

- Hossain, E.; Murtaugh, D.; Mody, J.; Faruque, H.M.R.; Sunny, M.S.H.; Mohammad, N. A comprehensive review on second-life batteries: Current state, manufacturing considerations, applications, impacts, barriers & potential solutions, business strategies, and policies. IEEE Access 2019, 7, 73215–73252. [Google Scholar]

- Jiao, N.; Evans, S. Business models for repurposing a second-life for retired electric vehicle batteries. In Behaviour of Lithium-Ion Batteries in Electric Vehicles; Springer: Berlin/Heidelberg, Germany, 2018; pp. 323–344. [Google Scholar]

- Jiao, N.; Evans, S. Business models for sustainability: The case of repurposing a second-life for electric vehicle batteries. In Proceedings of the International Conference on Sustainable Design and Manufacturing, Bologna, Italy, 26–28 April 2017; pp. 537–545. [Google Scholar]

- Jiao, N.; Evans, S. Business models for sustainability: The case of second-life electric vehicle batteries. Procedia CIRP 2016, 40, 250–255. [Google Scholar] [CrossRef]

- Olsson, L.; Fallahi, S.; Schnurr, M.; Diener, D.; Van Loon, P. Circular business models for extended EV battery life. Batteries 2018, 4, 57. [Google Scholar] [CrossRef]

- Olatunde, O.; Hassan, M.Y.; Abdullah, M.P.; Rahman, H.A. Hybrid photovoltaic/small-hydropower microgrid in smart distribution network with grid isolated electric vehicle charging system. J. Energy Storage 2020, 31, 101673. [Google Scholar] [CrossRef]

More

Information

Contributor

MDPI registered users' name will be linked to their SciProfiles pages. To register with us, please refer to https://encyclopedia.pub/register

:

View Times:

1.8K

Revisions:

2 times

(View History)

Update Date:

10 Feb 2022

Notice

You are not a member of the advisory board for this topic. If you want to update advisory board member profile, please contact office@encyclopedia.pub.

OK

Confirm

Only members of the Encyclopedia advisory board for this topic are allowed to note entries. Would you like to become an advisory board member of the Encyclopedia?

Yes

No

${ textCharacter }/${ maxCharacter }

Submit

Cancel

Back

Comments

${ item }

|

More

No more~

There is no comment~

${ textCharacter }/${ maxCharacter }

Submit

Cancel

${ selectedItem.replyTextCharacter }/${ selectedItem.replyMaxCharacter }

Submit

Cancel

Confirm

Are you sure to Delete?

Yes

No