| Version | Summary | Created by | Modification | Content Size | Created at | Operation |

|---|---|---|---|---|---|---|

| 1 | Halima Begum | + 1579 word(s) | 1579 | 2022-01-24 07:12:39 | | | |

| 2 | Lindsay Dong | Meta information modification | 1579 | 2022-01-25 02:36:21 | | | | |

| 3 | Lindsay Dong | Meta information modification | 1579 | 2022-01-25 02:46:52 | | |

Video Upload Options

The eruption of COVID-19 has jolted the national and international economy. Pakistan is included, causing millions of people to stay at home, lose their jobs, and suspend or end business operations. Unemployment in Pakistan has reached nearly 25 million people, driving many towards conditions of hunger and poverty as the major economic damage in several sectors is anticipated at around PKR 1.3 trillion. The hardest-affected sectors comprise industries such as tourism and travel, financial markets, entertainment, manufacturing, etc., having a devastating effect on gross domestic product (GDP). It is mainly daily-wage earners and people running small businesses that have been seriously exploited and subjected to a curfew-like situation.

1. Introduction

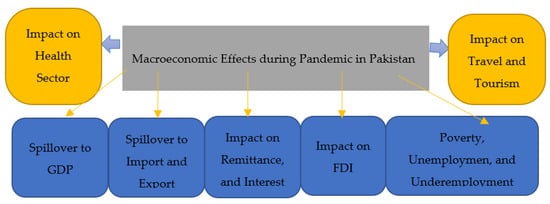

Around the world, Pakistan’s economy is struggling in a severe downturn. COVID-19’s impacts on Pakistan’s economy could result in a sharp drop in GDP growth [2], a skewed current and fiscal balance, disrupted supply chains, and increased unemployment across the board [3]. Several macroeconomic effects are explained in more detail below in Figure 2, considering these issues.

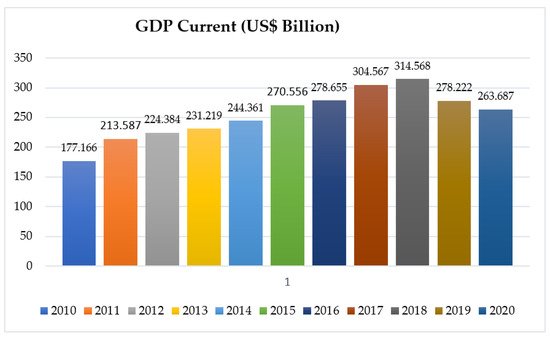

2. Spillover to Gross Domestic Product (GDP)

3. Spillover to Import and Export of Pakistan

4. The Effect on Remittances and Interest Rates

5. Foreign Direct Investment (FDI) Impact

6. Poverty, Unemployment, and Underemployment

7. The Effect on the Travel and Tourism Industry

8. The Effect on the Health Sector

References

- Government of Pakistan COVID-19 Official Portal. Available online: http://covid.gov.pk/stats/pakistan (accessed on 5 August 2020).

- Chohan, U.W. Forecasting the Economic Impact of Coronavirus on Developing Countries: Case of Pakistan (28 March 2020). CASS Working Papers on Economics & National Affairs, Working Paper ID: EC016UC (2020). 2020. Available online: https://ssrn.com/abstract=3563616orhttp://dx.doi.org/10.2139/ssrn.3563616 (accessed on 28 March 2020).

- Salik, K.M. Policy Review Remittances and COVID-19: Is Pakistan Ready for a Likely Decline in Flows? Sustainable Development Policy Institute: Tokyo, Japan, 2020.

- Maliszewska, M.; Mattoo, A.; Van Der Mensbrugghe, D. The Potential Impact of COVID-19 on GDP and Trade: A Preliminary Assessment; The World Bank: Bretton Woods, NH, USA, 2020.

- UNDP. COVID-19: The Looming Crisis in Developing Countries Threatens to Devastate Economies and Ramp Up Inequality. Retrieved 30 April 2020. Available online: https://www.undp.org/content/undp/en/home/news-centre/news/2020/COVID19_Crisis_in_developing_countries_threatens_devastate_economies.html (accessed on 2 May 2020).

- Elgin, C.; Basbug, G.; Yalaman, A. Economic policy responses to a pandemic: Developing the COVID-19 economic stimulus index. Covid Econ. 2020, 1, 40–53.

- Shahbazov, F. China–Pakistan Economic Corridor: An Opportunity for Central Asia? Central Asia-Caucasus Institute. 2017. Available online: http://cacianalyst.org/publications/analytical-articles/item/13449-china-%E2,80 (accessed on 11 November 2020).

- World Bank Group. Pandemic Preparedness Financing-Status Update. June 2019. Commissioned Paper by the GPMB. 2019. Available online: https://www.who.int/gpmb (accessed on 5 November 2020).

- MOC. Ministry of Commerce, Pakistan. 2019. Available online: http://www.commerce.gov.pk/ (accessed on 14 December 2020).

- Nasir, M.; Faraz, N.; Khalid, M. Sectoral analysis of the vulnerably employed: COVID-19 and the Pakistan’s labour market. COVID-19 2020, 50, 90.

- World Bank National Accounts Data, and OECD National Accounts Data Files. Available online: https://data.worldbank.org/indicator/NY.GDP.MKTP.CD?end=2020&locations=PK&start=2010 (accessed on 14 November 2021).

- Hassan, S.A.; Zaman, K. RETRACTED: Effect of oil prices on trade balance: New insights into the cointegration relationship from Pakistan. Econ. Model. 2012, 29, 2125–2143.

- Chohan, U.W.; The Trouble with Economics. Daily Times. 25 January 2020. Available online: https://dailytimes.com.pk/545600/the-trouble-with-economics/ (accessed on 5 December 2020).

- MOPDSI. Ministry of Planning Development & Special Initiatives, Pakistan. 2019. Available online: https://www.pc.gov.pk/ (accessed on 14 December 2020).

- Zhang, D.; Hu, M.; Ji, Q. Financial markets under the global pandemic of COVID-19. Financ. Res. Lett. 2020, 36, 101528.

- Alam, A.S.A.F.; Siwar, C.; Talib, B.; Islam, R. The analysis of international migration towards economic growth. Am. J. Appl. Sci. 2011, 8, 782–788.

- Alam, A.S.A.F.; Siwar, C.; TaliIb, B.; Islam, R. Impacts on international migration and remittances growth. Am. J. Environ. Sci. 2011, 7, 20–25.

- Alam, A.S.A.F.; Siwar, C.; Begum, H.; Er, A.C.; Talib, B.; Elfithri, R. Local Economic Impacts of Human Capital Migration. Mediterr. J. Soc. Sci. 2015, 6, 563–569.

- Amiti, M.; Itskhoki, O.; Konings, J. Importers, exporters, and exchange rate disconnect. Am. Econ. Rev. 2014, 104, 1942–1978.

- SBP. SBP Looks Back on Tough Year for Pakistan. Central Banking Newsdesk. 4 November 2019. Available online: https://www.centralbanking.com/central-banks/economics/macroeconomics/4527276/sbp-looks-back-on-tough-year-for-pakistan (accessed on 4 March 2020).

- Chohan, U.W. Public Value and Budgeting: International Perspectives; Routledge: England, UK, 2019.

- Chohan, U.W. The FATF in the Global Financial Architecture: Challenges and Implications; CASS Working Papers on Economics & National Affairs, EC001UC (2019); SSRN Electronic Journal: Rochester, NY, USA, 2019.

- The World Bank Group. 2020. Available online: https://www.worldbank.org/en/who-we-are/news/coronavirus-covid19 (accessed on 30 March 2020).

- OECD. Global Economy Faces the Gravest Threat Since the Crisis as Coronavirus Spreads. 2 March 2020. Available online: http://www.oecd.org/economy/global-economy-faces-gravest-threat-since-the-crisis-as-coronavirus-spreads.htm (accessed on 19 March 2020).

- Jabbour, C.J.C.; Fiorini, P.D.C.; Wong, C.W.; Jugend, D.; Jabbour, A.B.L.D.S.; Seles, B.M.R.P.; Pinheiro, M.A.; da Silva, H.M.R. First-mover firms in the transition towards the sharing economy in metallic natural resource-intensive industries: Implications for the circular economy and emerging industry 4.0 technologies. Resour. Policy 2020, 66, 101596.

- Abi-Habib, M.; Ur-Rehman, Z.; Mehsud, I.T. God Will Protect Us’: Coronavirus Spreads Through an Already Struggling Pakistan. New York Times. 2020. 26 March 2020, Updated 26 June 2020. Available online: https://www.nytimes.com/2020/03/26/world/asia/pakistan-coronavirus-tablighi-jamaat.html (accessed on 26 March 2020).

- Ahmed, S.H. Pakistan’s Economy Battling a Host of Challenges. Express Tribune. 10 February 2020. Available online: https://tribune.com.pk/story/2153367/pakistans-economy-battling-host-challenges (accessed on 5 July 2020).

- Ahmad, I. COVID-19 and Labour Law: Pakistan. Ital. Labour Law J. 2020, 13.

- Alfaro, L.; Chen, M.X. Surviving the global financial crisis: Foreign ownership and establishment performance. Am. Econ. J. Econ. Policy 2012, 4, 30–55.

- Desai, M.A.; Foley, C.F.; Forbes, K.J. Financial constraints and growth: Multinational and local firm responses to currency depreciations. Rev. Financ. Stud. 2008, 21, 2857–2888.

- Employment Trends Reported by the Pakistan Bureau of Statistics Pakistan Tourism Revenue. 2018. CEIC Data. Available online: https://www.ceicdata.com/en/indicator/pakistan/tourism-revenue (accessed on 5 April 2020).

- Sareen, S. COVID-19 and Pakistan: The economic fallout. Obs. Res. Found. Occas. Pap. No 2020, 251, 8.

- Ministry of Finance, Pakistan. Available online: http://www.finance.gov.pk/ (accessed on 15 March 2020).

- Begum, H.; Er, A.C.; Alam, A.S.A.F.; Sahazali, N. Tourist’s perceptions towards the role of stakeholders in sustainable tourism. Procedia-Soc. Behav. Sci. 2014, 144, 313–321.

- Ozdemir, A.I.; Ar, I.M.; Erol, I. Assessment of blockchain applications in the travel and tourism industry. Qual. Quant. 2020, 54, 1549–1563.

- Israr, M.; Shafi, M.M.; Ahmad, N.; Khan, N.; Baig, S.; Khan, Z.H. Eco tourism in Northern Pakistan and challenges perspective of stakeholders. Sarhad J. Agric. 2009, 25, 113–120.

- Asgary, A.; Anjum, M.I.; Azimi, N. Disaster recovery and business continuity after the 2010 flood in Pakistan: Case of small businesses. Int. J. Disaster Risk Reduct. 2012, 2, 46–56.

- Saqlain, M.; Abbas, Q.; Lee, J.Y. A Deep Convolutional Neural Network for Wafer Defect Identification on an Imbalanced Dataset in Semiconductor Manufacturing Processes. IEEE Trans. Semicond. Manuf. 2020, 33, 436–444.

- Waris, A.; Khan, A.U.; Ali, M.; Ali, A.; Baset, A. COVID-19 outbreak current scenario of Pakistan. New Microbes New Infect. 2020, 35, 100681.

- Sethi, B.A.; Sethi, A.; Ali, S.; Aamir, H.S. Impact of Coronavirus disease (COVID-19) pandemic on health professionals. Pak. J. Med. Sci. 2020, 36, S6.

- Raza, S.; Rasheed, M.A.; Rashid, M.K. Transmission potential and severity of COVID-19 in Pakistan. Preprints 2020.