Your browser does not fully support modern features. Please upgrade for a smoother experience.

Submitted Successfully!

Thank you for your contribution! You can also upload a video entry or images related to this topic.

For video creation, please contact our Academic Video Service.

| Version | Summary | Created by | Modification | Content Size | Created at | Operation |

|---|---|---|---|---|---|---|

| 1 | Edoardo Beretta | + 4076 word(s) | 4076 | 2021-12-15 03:44:35 | | | |

| 2 | Bruce Ren | Meta information modification | 4076 | 2021-12-23 01:38:05 | | | | |

| 3 | Bruce Ren | Meta information modification | 4076 | 2021-12-23 01:38:23 | | |

Video Upload Options

We provide professional Academic Video Service to translate complex research into visually appealing presentations. Would you like to try it?

Cite

If you have any further questions, please contact Encyclopedia Editorial Office.

Beretta, E. Liquid versus Solid Consumption. Encyclopedia. Available online: https://encyclopedia.pub/entry/17465 (accessed on 07 February 2026).

Beretta E. Liquid versus Solid Consumption. Encyclopedia. Available at: https://encyclopedia.pub/entry/17465. Accessed February 07, 2026.

Beretta, Edoardo. "Liquid versus Solid Consumption" Encyclopedia, https://encyclopedia.pub/entry/17465 (accessed February 07, 2026).

Beretta, E. (2021, December 22). Liquid versus Solid Consumption. In Encyclopedia. https://encyclopedia.pub/entry/17465

Beretta, Edoardo. "Liquid versus Solid Consumption." Encyclopedia. Web. 22 December, 2021.

Copy Citation

Sharing economy is nowadays a particularly important facet of modern society. It is driven by digitalization that allows firms to interact with their customers on a daily basis by the need of reducing the environmental impact of both companies and individual actions and by the growing consciousness for environment that consumers are developing day by day. New models of consumption, such as the liquid one, are becoming very frequent, shaping countries’ productive systems and consumers’ habits.

consumption

liquid

sharing economy

solid

sustainability

1. Introduction

At the individual level, the advent of sharing economy brings changes and different approaches on consumption habits and choices. In the modern society, often described as liquid [1][2], the rise of sharing economy drives consumption decisions that are based on the access model rather than on the ownership model. In this scenario, the concept of liquid versus solid consumption [3][4] emerges. Liquid consumption, grounded on an access-based model, is becoming a very frequent approach for consumers. Scholarly works have so far concentrated their attention on explaining the contextual determinants of this phenomenon, overlooking the individual and psychological characteristics at the individual level that might induce consumers to engage into a more solid versus liquid consumption approach. This work tries to contribute exactly to this research gap. By means of a cluster analysis on seven psychological characteristics, four different segments associated with different consumer behavior, grounded on the solid versus liquid continuum, are identified. Each of the customer profiles identified highlights specific characteristics of the individuals, providing a more detailed framework for assessing and interacting with consumers in the liquid society.

2. Macroeconomic Justifications of the Sharing Economy and the Antecedent of Liquid Consumption in a European Perspective

In order to grasp the scientific relevance of the researchers empirical findings, the researchers contextualize consumption trends within an economically broader, macroeconomic perspective. If Gross Domestic Product (GDP)—namely, “the value added created through the production of goods and services in a country during a certain period “measuring” the income earned from that production, or the total amount spent on final goods and services (less imports)” [5]—remains despite providing nearly no information on non-economic well-being and nonvaluable activities [6][7], “the” economic measure par excellence, consumption represents another facet of production. In fact, “any act of production is a production-consumption, a wave” [8]. Neither economies nor (even) trade would exist without production. Any newly created added value has the sole purpose of being spent, namely either consumed or invested. In this specific regard, even financial saving implies spending economic resources and buying securities. More interestingly, for the sake of the following analysis, any consumption, but also investment expenditure, implies that a share of production and its added value is “finally” spent. Final consumption expenditure is, therefore, tightly related to GDP where new economic needs, trends etc. affect it conversely. Monetarily speaking, “the final purchase of the product takes place by debiting the income holders and crediting the company. Since the income is identified with the product, this operation also constitutes an absolute exchange. However, while during the payment of wages money and product give life to income, after its final expenditure the product gets rid of its monetary essence to be once again turned into a simple set of physical objects” [own translation] [9]. While added value goes hand in hand with production, so does consumption with GDP.

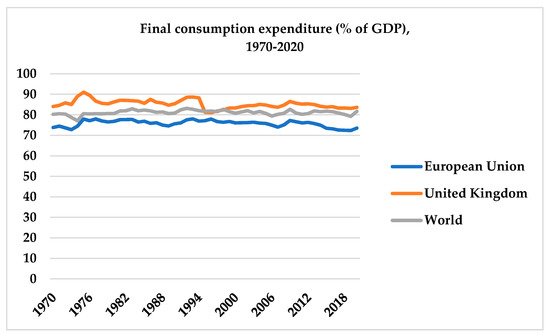

Final consumption expenditure as compared to GDP must, therefore, represent the starting point of the researchers introductory macroeconomic analysis. If the researchers take the United Kingdom and the European Union for the sake of coherence with the following cluster analysis, the British final consumption expenditure has been particularly high in the Seventies and Eighties—respectively, at 86.7% and 86.4% of GDP on average—while it plummeted in the middle of the Nineties (1996) to 81.1%. In more recent years (2015–2020), instead, it stabilized rather at 83–84% [10].

Moreover, as pointed out in Figure 1, final consumption expenditure in the European Union (27 countries) and in the world (195 countries) has been lower—respectively, at 75.8% and 81.1% of GDP on average [11]—than in the United Kingdom. In addition to the causal relation between final consumption expenditure and future production trends, indebtedness of private individuals also matters. For instance, the researchers already know from the economic literature that “the decline in consumption following the Crisis was greater in areas that had higher outstanding loan-to-value ratios prior to the Crisis” [12]. Although final consumption expenditure is on average significantly lower than GDP—however, some small, often low-income countries like Liberia (130.9%), Kiribati (150.7%) or Somalia (172.6%) have been even net borrowers between 2018 and 2020 to finance their excess purchases—link with macroeconomic variables affecting consumers such as the gross debt-to-income ratio of households is likely too. Moreover, “policy-makers and the mainstream economic literature largely neglect the role of private debt developments in causing financial crises and subsequent prolonged recessions” [13]. Although this is not the focus of the researchers paper, macroeconomic interconnections also at the basis of sharing economy remain fundamental to be explored. Moreover, it should not be forgotten that according to [14], “throughout the industrialized world, more and more enterprises are focusing on their internal competences and operations, outsourcing all noncore competences to external suppliers or network partners”. The well-known practice of outsourcing the production of goods and services is nothing else than a cost- and/or infrastructure-saving way of sharing. Servitization is, in fact, nowadays a major trend in the context of sustainability business models. Finally, another trend worth mentioning regards Product Service Systems (PSSs), which involve the development of “both tangible characteristics of the product and intangible ones related to the services surrounding the product, e.g., maintenance services and end-of-life recovery schemes, aiming to provide an integrated offering” [15]. As the researchers will see, the sharing economy represents a multifaceted area of research and is characterized by several—both micro and macroeconomic—elements of interest affecting both the consumption as well as the production side of economic activities.

Figure 1. Final consumption expenditure (% of GDP), 1970–2020 based on [11].

2.1. The Macroeconomic Nexus between Consumption, Economic Wellbeing of Consumers and the Sharing Economy

If the researchers agree that final consumption expenditure and GDP influence each other, the researchers are bound to conclude that (over-)indebtedness of the private sector, namely of the driving force of final consumption expenditure, affects consumer trends too. In fact, “negative long-run effects on consumption tend to intensify as the household debt-to-GDP ratio exceeds 60%” [16]. Moreover, the gross debt-to-income ratio of households might, macroeconomically speaking, “nudge” consumers to adapt consumption patterns to tighter financial boundaries. Within this context, the concept of sharing economy (or collaborative economy) itself is not new—in fact, “Marcus Felson and Joe L. Spaeth, in their study “Community Structure and Collaborative Consumption”, introduced the term economy of sharing in 1978” [17], but the term has only recently gained relevance among the general public. Moreover, “given that the terms [sharing economy] and [collaborative consumption] are relatively new, a misunderstanding of their meaning prevails in the literature, as well as among consumers and service providers” [18], which is however a not necessarily to be introduced distinction. If the size of the sharing economy is plausibly influenced by factors like the local number of—and, even, accessibility to—companies supplying “shared” goods and services or the degree of openness to more sustainable consumption models [19], macroeconomic variables like the debt level of the private sector (and, especially, of households) represent a motivation to rearrange the local economy in the medium–long run so that consumer needs are still matched despite financial tightness. If economic resources are becoming limited, consumers might decide to adjust a part of their final consumption expenditure and share specific goods and services with other individuals instead of purchasing them. More generally, the worsening of the economic situation of consumers can be an incentive for the sharing economy as further confirmed by [20], who finds that “consumers are more strongly driven by economic motives, especially those who are more educated and trusting. Finally, providers with lower household income, who are more educated and innovative, are more likely to be driven by economic motives”. In line with the researchers preliminary conclusion, ref. [21] also find that “economic interests are holding back the purchase of people with a low level of education, a low standard of living, and a short-term budget planning period”.

- (1)

-

The gross debt-to-income ratio of households influences the average number of individuals having used websites/apps to arrange an accommodation or a transport service from another individual. By calculating the average number of consumers sharing an accommodation or a transport service—respectively, 18.8 (cf. accommodation) and 10.1 (cf. transport service)—the researchers find that countries with individuals using websites/apps to arrange an accommodation or a transport service from another individual above the average have a higher gross debt-to-income ratio of households—respectively, 108.0 (cf. accommodation) and 105.4 (cf. transport service). Instead, countries with individuals using websites/apps to arrange an accommodation or a transport service from another individual below the average have a lower gross debt-to-income ratio of households—respectively, 87.8 (cf. accommodation) and 96.2 (cf. transport service). This result confirms the researchers previous claim, according to which (over-)indebtedness of the private sector is an incentive to the sharing economy;

- (2)

-

The price dynamic within the specific economic sector—respectively, for accommodation and transport services—is less relevant than the gross debt-to-income ratio of households. While countries with individuals using websites/apps to arrange an accommodation or a transport service from another individual above the average have recorded lower increases of the Harmonized Indices of Consumer Prices (HICP)—respectively, 111.9 (cf. accommodation) and 99.3 (cf. transport service)—countries with individuals using websites/apps to arrange an accommodation or a transport service from another individual below the average have presented higher increases of the HICP—respectively, 114.7 (cf. accommodation) and 106.9 (cf. transport service). Not surprisingly, price variations display their impact on consumption expenditure only if the economic wellbeing of households is at risk. Otherwise stated, the gross debt-to-income ratio of households represents a sufficient macroeconomic “brake” to excessive spending and an incentive to share certain goods and services. Upward trends of the HICP are already “incorporated” in the gross debt-to-income ratio of households because—if consumers are already indebted above the average—they will not additionally care about price increases. In the meantime, consumers will have adjusted their consumption patterns.

2.2. Macroeconomic Considerations about the Status Quo of the Sharing Economy in Europe

For sake of the present paper, it suffices to remark that production, final consumption expenditure and private debt trends are macroeconomically inter-related. At the same time, “[t]o recover from the COVID-19 crisis, Europe needs to unlock new economic activity” [22] with the concept of “sharing economy” likely gaining relevance in the near future. Moreover, European countries will have to face the fact that “the EU appears to be lagging behind the US when it comes to digitalization” [23]. Although individuals using the Internet in the European Union in 2020 have been 87.9 percent of the total population [24], this figure is not far from the United States (89.4 percent) [25], and this is not a sufficiently precise indicator. On the one hand, it is not only the access to the Internet, which makes sharing of goods and services possible, because “[d]igital platforms are [rather] the key element of the collaborative economy” [26]. Moreover, according to [27], “[m]anagement technologies could be of significant value-added, while strategic collaboration via digital hubs could help share knowledge with more advanced organizations, gather community, engage society, and create the desired synergy effect among stakeholders”. A part of the economic literature also reminds us that European countries treat the sharing economy—more precisely, they draw the line between professional and nonprofessional providing of goods and services—in an often significantly different way than their neighbors [28]. While individuals make more or less frequent use of shared goods and services, the European economy as a whole has not yet been able to generate a truly incentivizing environment for investing companies. While some goods and services are shareable from consumers to consumers (C2C), the most relevant opportunities in terms of contribution to GDP are represented by those from businesses to consumers (B2C) [29]. According to [30], in 2016 more than 275 companies belonging to the “collaborative economy” have been founded across nine major European countries. Although the United Kingdom and France counted more than 50 organizations, Germany, Spain and the Netherlands ranked at more than 25 companies while countries like Belgium, Italy, Poland and Sweden counted only less than 25 organizations. Among the reasons for the growth of targeted platforms, there is “flexibility, smartphones; a shift from valuing ownership to renting; and growing digital trust, lax regulations [and] operational efficiency” [31]. This has caused a rapid increase of revenues in the European Union from approximately € 1 bn. to € 3.6 bn. in the time period 2013–2015 [32]. As more specifically outlined by [33], “the sustainable development of car-sharing services is influenced not only by operators, but also by local authorities and local market conditions”.

Furthermore, such structural characteristics have to be considered also from a public policy perspective. If “[h]ousehold consumption is the largest element of expenditure across the economy” [34], but as the main GDP component it is subject to new patterns and characterized by different typologies of consumers, governments should care too. For instance, it has to be questioned whether public incentivizing and/or subsidizing the purchase of specific goods and services—let us mention, for sake of simplicity, cars (including e-cars [35]) are still adequate both in terms of consumption paradigms and sustainability. The COVID-19-pandemic has caused a partial, exogenous stop to the sharing economy, which has been due to lockdowns and psychological fears deriving from contagion risks [36][37][38][39]. While taking a public transport service before February/March 2020 was considered a cheap way to reduce the environmental footprint of individuals, after worldwide contagions, taking his/her own car was perceived as “safe” while the sustainability-related aspect became secondary. Will this be an enduring trend? Probably not because macroeconomic variables affecting consumer trends and concerns about the environmental sustainability of traditional consumption patterns will prevail. However, the sharing economy has to be explored in its complexity due to heterogeneous and emergent ways of consumption in digitally advanced eras. The next section is, therefore, dedicated to the in-depth analysis of these paradigms.

2.3. Liquid and Solid Consumption in the Sharing Economy

Advantages and opportunities for individuals brought by the sharing economy are often paired with another trend in consumption: liquid modernity [2]. In this context of modernization and digitalization, consumers adopt a slightly different approach to consumption that [4] defined “liquid”. Liquid consumption is ephemeral, access-based and dematerialized. Liquid consumption is opposed to solid consumption that is enduring, ownership-based and tangible. Ownership is strictly connected with use, control, and the possibility to convey the good to others [40]. Ownership communicates meanings and is frequently used by consumers to build their identity [41] as well as a signaling mechanism for success and wealth. Moreover, ownership leads to consumer responsibility and commitment: maintenance, storage, and divestiture of unwanted goods [42] as well as obsolescence or a value decrease are just examples of the negative side of ownership.

Conceptually opposed to consumption models based on ownership, the liquid one is traditionally an access-based model. In fact, consumers in the access-based model pay for access to goods instead of buying those goods and prefer to pay a price for temporarily having the access to the goods [3]. The access-based consumption model is more and more popular nowadays for individuals; in most cases, it is more profitable and convenient for consumers to pay for temporary access to product (e.g., renting) rather than owning it [43]. More specifically, as [3] pointed out, the two models of consumption (ownership versus access-based) differ for two characteristics: (1) the nature of the object–self relationship and (2) the rules regulating such relationships. When consumers adopt an access-based model, they are aware that their disposal of the good is limited in time and connected to specific consumption situations. On the contrary, when adopting the ownership model, individuals embrace a long-term orientation planning how to dispose of the object over time. In terms of how the relationship with the object is regulated, individuals choosing the access-based consumption option cannot regulate the access to it preventing other consumers from (over)using it. This, on the opposite, is a privilege that only owners enjoy.

The access-based consumption model has recently gained in popularity: in the past decades, it was considered inferior as compared to the more traditional property model. This perception was due to the idea that consumers not able to buy and own a good would prefer to rent it. These consumers were socially stigmatized and considered not capable of saving and allocating their expenditures and therefore not worth the social power intrinsically tight to ownership. Today, on the contrary, access-based models of consumption are very popular thanks also to a shift in the paradigm and public opinion. Firms, thanks to digitalization, guarantee access to their products on a daily basis, while the development of a liquid society [1] fostered this change. In this scenario, liquid consumption emerges [4]. Liquid consumption is a more comprehensive paradigm than the access-based, which does not substitute solid consumption. More specifically, consumption is conceptualized as a continuum of alternatives faced by consumers ranging from pure solid to pure liquid. Therefore, solid and liquid consumption are two extreme poles of a spectrum [4]. Among the conditions that foster one form of consumption over the other, the same scholars identify: relevance to the self, nature of social relationship, accessibility to mobility and the nature of precarity.

Specifically, authors posit that, when relevance to the self is high, consumption will be more solid. It is the identification with the good which drives the relevance for the self. In those cases in which the good contributes to the formation of the consumer identity (e.g., extended self as in [44][45]), then consumers will prefer the ownership option while consumption will be more solid. Such a relationship is based on a long-term attachment with a product or brand [46], thus emphasizing the relevance of brand loyalty in predicting the position of individuals in the solid–liquid continuum. On the contrary, when the identification of the item is not fundamental for the consumers, they will prefer a more liquid mode of consumption. Although this is not good-specific, it varies with individuals and the level of importance, which the good has for them. For example, in the music industry, there are collectors very passionate about owing the CD or the vinyl of their favorite bands, so they would identify with a typical solid consumption model; at the same time, there are thousands of consumers, who have switched completely to streaming options for music. These consumers enjoy the benefits of online platforms such as Spotify and prefer to pay a subscription fee, which is in turn typical of a liquid consumption model.

The second characteristic driving a solid versus liquid consumption mode is the nature of social relationships. Whenever relationships are strong, consumption is supposed to be more solid. This is the case, for example, of brand communities [4] in which consumers sometimes even embody their brands. However, the relationship between brand loyalty and liquid consumption is already under debate. Access-based consumption, as a component of the liquid side, allows consumers to test new products and trends avoiding the barriers of ownership and commitment to a specific style or brand. Moreover, even if brand loyalty represents a deterrent to access-based consumption because of a lack of past experience, this could become a new way to determine exactly their preferences and to regulate them in a context qualified by high level of product variety. Moreover, trust towards providers of functions or services—as providers of goods in the liquid side of consumption—has been seen as a critical element in forming attitudes towards this form [47][48]. Under this perspective, liquid consumption could be positively associated with brand loyalty, being an alternative route to product and brand loyalty [49].

Access-based consumption is associated with a higher degree of environmental consciousness. Frequently linked to a cheap and easy way to access expensive products, the access-based model is considered a way to be environmentally friendly [50]. Indeed, as [43] suggests, this consumption model is one of the main components of a more sustainable and responsible consumption. In addition, policymakers also support access-based model of consumption because of its positive impact on the environment, thus highlighting the link between more liquid consumption and benefits for the environment [47].

Another driver of consumption models are mobility systems, which are organized in cities around the mechanisms and allow people to circulate in different spaces at different speeds. These networks, which are highly de-territorialized, are common in global cities. When consumers have access to these networks, consumption can be liquid; when access to mobility networks is instead limited, consumption is mostly solid. This is the typical example of car sharing. In global cities, car sharing is a very frequent and common method of moving across the city; moreover, it allows citizens to have the possibility to access to a car (e.g., liquid consumption) rather than owning it (e.g., solid consumption).

The last factor is precarity and represents the extent to which individuals feel insecure, instable and uncertain. When individuals perceive high levels of precarity, they tend to use consumption as a way to restore certainty. Therefore, they prefer to engage in solid purchases. When the situation and context they experience in their daily lives are relatively stable, individuals do not feel the need to restore any level of certainty and stability. Therefore, they are more prone to engage in liquid consumption.

So far, previous research contributions [3][4][49][51][52][53] have highlighted the contextual and situational factors having an influence in driving individuals towards solid versus liquid form of consumption. To the extent of the researchers knowledge, little is known about the individual motivations that drive consumers’ choice.

Grounding on the characteristics of solid and liquid consumption, this study aims at shedding lights on psychological and behavioral characteristics at the individual level that can foster a more solid versus more liquid form of consumption. More specifically, if solid and liquid consumption are the two extremes of a spectrum, what are the psychological characteristics inducing individuals to engage more in a consumption form over the other?

According to Agenda 2030 goals, the rise of environmental consciousness represents a key goal for the success of the whole program. Indeed, as recent research conducted by [54] has highlighted that “the majority (73%) of global consumers say they would definitely or probably change their consumption habits to reduce their impact on the environment”. Such environmental consciousness is an antecedent of environmentally friendly behaviors [55][56], and access-based consumption, as one of the possible facets of liquid consumption, could represent the right solution for consumers characterized by a high level of environmental consciousness. Access-based products offer consumers the opportunity to adopt practices that are more environmentally friendly, targeting those individuals that are motivated mostly by an efficient resource’s exploitation and the willingness to contribute to waste reduction.

Focusing on shared mobility, previous research finds an unclear role of environmental consciousness for consumers’ decision to engage in car sharing having [57] found that sustainable concerns were not among the priorities of consumers engaging in B2C carsharing services. However, a fast change in consumer habits has been recently noted. According to [58], “[t]he image of carsharing in general is “greener” thus showing how environmental concerns affect the decision to engage in P2P service over B2C services. Recently, ref. [59] finds that environmentalism has a positive effect on providers’ and users’ propensity to participate in peer-to-peer shared mobility services. To this purpose, investigating the psychological characteristics that might lead individuals to engage in more liquid consumption is fundamental to identify was to incentive a more sustainable consumption. Emotions and especially happiness can have a strong influence over choice too. Indeed, being in a positive mood affects individuals’ cognitive processing, thus influencing the types of choices individuals make. Under this perspective, individuals that are in a positive mood are more likely to engage in heuristic processing [60] or to develop an optimistic view over the future [61], or to evaluate people and objects more favourably [62]. Positive mood influences choice, leading individuals to choose less risky options [63] and greater variety among different choices. Moreover, when an individual lays in a positive mood condition tend to make healthier choices both in terms of food, lifestyle, and professional life. A positive mood increases the perception of value for items owned both actually or potentially. Such an effect occurred in judgments about both actual and potential possessions, suggesting that people tend to overestimate the value given to their material possession depending on how they are feeling in that time.

References

- Bauman, Z. Consuming Life; Polity Press: Oxford, UK, 2007.

- Bauman, Z. Liquid modernity revisited. Die Zwischengesellschaft. Aufbrüche Zwischen Tradit. Und Mod. 2016, 10, 11–22.

- Bardhi, F.; Eckhardt, G.M. Access-based consumption: The case of car sharing. J. Consum. Res. 2012, 39, 881–898.

- Bardhi, F.; Eckhardt, G.M. Liquid consumption. J. Consum. Res. 2017, 44, 582–597.

- Organization for Economic Co-operation and Development. Gross Domestic Product (GDP). Available online: https://data.oecd.org/gdp/gross-domestic-product-gdp.htm (accessed on 14 October 2021).

- Grishin, V.I.; Ustyuzhanina, E.V.; Komarova, I.P. Main problems with calculating GDP as an indicator of economic health of the country. Int. J. Civil. Eng. Technol. 2019, 10, 1696–1703.

- Brooking Institution. GDP as a Measure of Economic Well-Being. Available online: https://www.brookings.edu/research/gdp-as-a-measure-of-economic-well-being (accessed on 14 October 2021).

- Schmitt, B. Inflation, Unemployment and Capital Malformations; Routledge: London, UK; New York, NY, USA, 2021; p. 33.

- Cencini, A. Elementi Di Macroeconomia Monetaria; CEDAM: Padova, Italy, 2008; pp. 34–35.

- The World Bank. Final Consumption Expenditure (% of GDP)—United Kingdom. Available online: https://data.worldbank.org/indicator/NE.CON.TOTL.ZS?locations=GB (accessed on 14 October 2021).

- The World Bank. Final Consumption Expenditure (% of GDP). Available online: https://data.worldbank.org/indicator/NE.CON.TOTL.ZS (accessed on 14 October 2021).

- VoxEU.org. Household Debt and Spending in the UK. Available online: https://voxeu.org/article/household-debt-and-spending-uk (accessed on 14 October 2021).

- Manison, L.G.; Savvides, S.C. Neglect private debt at the economy’s peril applying balance sheet recession analysis to the post bail-in Cyprus economy. Camb. Resour. Int. Inc. Dev. Discuss. Pap. 2007, 6, 1–13.

- Sakao, T.; Sandström, G.Ö.; Matzen, D. Framing research for service orientation of manufacturers through PSS approaches. J. Manuf. Technol. Manag. 2009, 20, 754–778.

- Haber, N.; Fargnoli, M. Sustainable product-service systems customization: A case study research in the medical equipment sector. Sustainability 2021, 13, 6624.

- Lombardi, M.; Mohanti, M.; Shim, I. The real effects of household debt in the short and long run. BIS Work. Pap. 2017, 607, 1–40.

- Jemielniak, D.; Przegalinska, A. Collaborative Society; The MIT Press: Cambridge, MA, USA; London, UK, 2020; p. 6.

- Minami, A.; Ramos, C.; Bruscato Bortoluzzo, A. Sharing economy versus collaborative consumption: What drives consumers in the new forms of exchange? J. Bus. Res. 2021, 128, 124–137.

- Geisinger, A.; Laurell, C.; Öberg, C.; Sandström, C. How sustainable is the sharing economy? On the sustainability connotations of sharing economy platforms. J. Clean. Prod. 2019, 206, 419–429.

- Angelovska, J. The influence of demographics, attitudinal and behavioural characteristics on motives to participate in the sharing economy and expected benefits of participation. In Becoming a Platform in Europe: On the Governance of the Collaborative Economy; Teli, M., Bassetti, C., Eds.; Now Publishers Inc.: Boston, MA, USA; Delft, The Netherlands, 2021; pp. 35–58.

- Karginova-Gubinova, V.; Volkov, A.; Tishkov, S.; Shcherbak, A. The impact of economic interests on eco-consumption: The case of the Russian Arctic Zone of Karelia. Entrep. Sustain. Issues 2021, 8, 68–84.

- Centre for European Policy Studies (CEPS). EUROPE’s COLLABORATIVE ECONOMY—Charting a Constructive Path Forward. Available online: https://www.ceps.eu/ceps-events/europes-collaborative-economy-charting-a-constructive-path-forward (accessed on 14 October 2021).

- Munkøe, M.M. Regulating the European sharing economy: State of play and challenges. Intereconomics Rev. Eur. Econ. Policy 2017, 52, 38–44.

- The World Bank. Individuals Using the Internet (% of Population)—United States. Available online: https://data.worldbank.org/indicator/IT.NET.USER.ZS?locations=US (accessed on 14 October 2021).

- The World Bank. Individuals Using the Internet (% of Population)—European Union. Available online: https://data.worldbank.org/indicator/IT.NET.USER.ZS?locations=EU (accessed on 14 October 2021).

- Bock, A.K.; Bontoux, X.; Figueiredo do Nascimento, S.; Szczepanikova, A. The Future of the EU Collaborative Economy. Using Scenarios to Explore Future Implications for Employment; Publications Office of the European Union: Luxembourg, 2016; p. iii.

- Laužikas, M.; Miliūtė, A. Liaisons between culture and innovation: Comparative analysis of South Korean and Lithuanian IT companies. Insights Into Reg. Dev. 2020, 2, 523–537.

- Petropoulos, G. An economic review of the collaborative economy. Bruegel Policy Contrib. 2017, 5, 1–17.

- PricewaterhouseCoopers. Sharing or Paring? Growth of the Sharing Economy; PricewaterhouseCoopers: Budapest, Hungary, 2015; p. 7.

- Vaughan, R.; Daverio, R. Assessing the Size and Presence of the Collaborative Economy in Europe; European Commission: Brussels, Belgium, 2016; p. 15.

- Yaraghi, M.; Ravi, S. The current and future state of the sharing economy. Brook. India IMPACT 2017, 032017, 1–34.

- World Bank Blogs. Who Shares in the European Sharing Economy? Available online: https://blogs.worldbank.org/digital-development/who-shares-european-sharing-economy (accessed on 14 October 2021).

- Turón, K. Social barriers and transportation social exclusion issues in creating sustainable car-sharing systems. Entrep. Sustain. Issues 2021, 9, 10–22.

- UK Parliament—House of Commons Library. Components of GDP: Key Economic Indicators. Available online: https://commonslibrary.parliament.uk/research-briefings/sn02787/ (accessed on 14 October 2021).

- German Federal Ministry for Economic Affairs and Energy. Regulatory Environment and Incentives for Using Electric Vehicles and Developing a Charging Infrastructure. Available online: https://www.bmwi.de/Redaktion/EN/Artikel/Industry/regulatory-environment-and-incentives-for-using-electric-vehicles.html (accessed on 14 October 2021).

- Batool, M.; Ghulam, H.; Hayat, M.A.; Naeem, M.Z.; Ejaz, A.; Imran, Z.A.; Spulbar, C.; Birau, R.; Gorun, T.H. How COVID-19 has shaken the sharing economy? An analysis using Google trends data. Econ. Res.-Ekon. Istraživanja 2020, 34, 2374–2386.

- Buheji, M. Sharing economy and communities attitudes after COVID-19 pandemic—Review of possible socio-economic opportunities. Am. J. Econ. 2020, 10, 395–406.

- Hossain, M. The effect of the Covid-19 on sharing economy activities. J. Clean. Prod. 2021, 280, 124782.

- Vinod, P.P.; Sharma, D. COVID-19 impact on the sharing economy post-pandemic. Australas. Account. Bus. Financ. J. 2021, 15, 37–50.

- Demsetz, H. The structure of ownership and the theory of the firm. J. Law Econ. 1983, 26, 375–390.

- Belk, R. Third world consumer culture. In Marketing and Development: Towards Broader Dimensions; Kumku, E., Firat, A.F., Eds.; JAI Press: Greenwich, CT, USA, 1988; pp. 103–127.

- Berry, L.L.; Maricle, K.E. Consumption without ownership: Marketing opportunity for today and tomorrow. MSU Bus. Top. 1973, 21, 33–41.

- Lyaskovskaya, E.; Khudyakova, T. Sharing economy: For or against sustainable development. Sustainability 2021, 13, 11056.

- Belk, R. Why not share rather than own? Ann. Am. Acad. Political Soc. Sci. 2007, 611, 126–140.

- Leung, E.W.L.; Cito, M.C.; Paolacci, G.; Puntoni, S. Preference for material products in identity-based consumption. Mark. Sci. Inst. Work. Pap. Ser. 2020, 20, 1–22.

- Fournier, S.; Lee, L. Getting brand communities right. Harv. Bus. Rev. 2009, 87, 105–111.

- Catulli, M.; Lindley, J.; Reed, N.; Green, A. What is mine is not yours: Further insight on what access-based consumption says about consumers. Res. Consum. Behav. 2013, 15, 185–208.

- Schmidt, D.M.; Bauer, P.; Mörtl, M. Product-service systems for influencing customer barriers and customer acceptance. J. Econ. Bus. Manag. 2015, 3, 990–993.

- Lawson, S.J.; Gleim, M.R.; Perren, R.; Hwang, J. Freedom from ownership: An exploration of access-based consumption. J. Bus. Res. 2016, 69, 2615–2623.

- Edbring, E.G.; Lehner, M.; Mont, O. Exploring consumer attitudes to alternative models of consumption: Motivations and barriers. J. Clean. Prod. 2016, 123, 5–15.

- Guttentag, D.; Smith, S.; Potwarka, L. Why tourists choose Airbnb: A motivation-based segmentation study. J. Travel Res. 2017, 57, 342–359.

- Hellwig, K.; Morhart, F.; Girardin, F.; Hauser, M. Exploring different types of sharing: A proposed segmentation of the market for “sharing” businesses. Psychol. Mark. 2015, 32, 891–906.

- Tussyadiah, I.P.; Zach, F. Identifying salient attributes of peer-to-peer accommodation experience. J. Travel Tour. Mark. 2017, 34, 636–652.

- Nielsen. Sustainable shoppers. Buy the Change They Wish to See in the World. Available online: https://www.nielsen.com/wp-content/uploads/sites/3/2019/04/global-sustainable-shoppers-report-2018.pdf (accessed on 25 November 2021).

- Gleim, M.; Lawson, S. Spanning the gap: An examination of the factors leading to the green gap. J. Consum. Mark. 2014, 31, 503–514.

- Hartmann, P.; Apaolaza-Ibáñez, V. Consumer attitude and purchase intention toward green energy brands: The roles of psychological benefits and environmental concern. J. Bus. Res. 2012, 65, 1254–1263.

- Exploring car sharing usage motives: A hierarchical means-end chain analysis. Transp. Res. Part A: Policy Pract. 2013, 47, 69–77.

- Hartl, B.; Sabitzer, T.; Hofmann, E.; Penz, E. “Sustainability is a nice bonus” the role of sustainability in carsharing from a consumer perspective. J. Clean. Prod. 2018, 202, 88–100.

- Prieto, M.; Stan, V.; Baltas, G. New insights in peer-to-peer carsharing and ridesharing participation intentions: Evidence from the “provider-user” perspective. J. Retail. Consum. Serv. 2022, 64, 102795.

- Schwarz, N.; Clore, G.L. Mood, misattribution, and judgments of well-being: Informative and directive functions of affective states. J. Personal. Soc. Psychol. 1983, 45, 513–523.

- Wright, W.F.; Bower, G.H. Mood effects on subjective probability assessment. Organ. Behav. Hum. Decis. Process. 1992, 52, 276–291.

- Forgas, J.P.; Ciarrochi, J. On being happy and possessive: The interactive effects of mood and personality on consumer judgments. Psychol. Mark. 2001, 18, 239–260.

- Isen, A.M.; Means, B. The influence of positive affect on decision-making strategy. Soc. Cogn. 1983, 2, 18–31.

More

Information

Subjects:

Others; Behavioral Sciences

Contributor

MDPI registered users' name will be linked to their SciProfiles pages. To register with us, please refer to https://encyclopedia.pub/register

:

View Times:

4.6K

Revisions:

3 times

(View History)

Update Date:

23 Dec 2021

Notice

You are not a member of the advisory board for this topic. If you want to update advisory board member profile, please contact office@encyclopedia.pub.

OK

Confirm

Only members of the Encyclopedia advisory board for this topic are allowed to note entries. Would you like to become an advisory board member of the Encyclopedia?

Yes

No

${ textCharacter }/${ maxCharacter }

Submit

Cancel

Back

Comments

${ item }

|

More

No more~

There is no comment~

${ textCharacter }/${ maxCharacter }

Submit

Cancel

${ selectedItem.replyTextCharacter }/${ selectedItem.replyMaxCharacter }

Submit

Cancel

Confirm

Are you sure to Delete?

Yes

No