A depreciating currency theoretically supports exports. A weak currency means that domestic goods are cheaper abroad. Therefore, it increases both exports and stock prices, as more businesses raise their capital through the securities market, pushing up the stock price.

1. Introduction

The triple regime-switching model was developed for examining whether the depreciation of the Vietnam dong (VND) to the US dollar (USD) could lead to an increase in future export turnover and stock price in Vietnam. Over the period from 31 July 2000 to 31 December 2020, empirical results show that the depreciation of VND most effectively promotes export growth in a moderate-growth state to which the group of agricultural products, raw materials, and unprocessed goods belong. The high-growth state where the depreciation of VND negatively affects exports should belong to the FDI sector, where export prices do not depend much on the exchange rate in the short term. Meanwhile, the effect on the stock market is generally negative. Empirical results contradict the usual wisdom of “high risk, high return” in the stock market of Vietnam.

2. Empirical Method

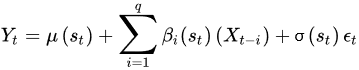

The Markov switching dynamic regression (MSDR) of Hamilton (1989), namely, the regime-switching model, is one of the most popular nonlinear time-series models. It involves multiple structures that can characterize the dynamic behaviors of data under different regimes. The basic model with switching intercept is as follows:

where

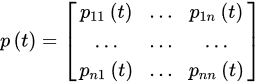

Where element ab represents the probability of transitioning from regime a in the period t -1 to regibe b in the pperiod t.

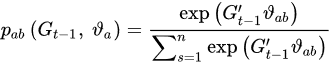

Following Hamilton’s (1989), probabilities can be parameterized in terms of a multinomial logit. As each row of the transition matrix specifies a complete set of conditional probabilities, a separate multinomial specification for each row a of the matrix is as follows:

where a=1, ., n. b=1,.,n,

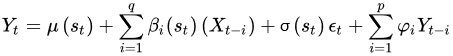

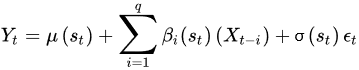

The basic switching model can be extended to the Markov switching dynamic regression to allow for dynamics in the form of lagged exogenous variables:

The basic switching model can be extended to the Markov switching dynamic regression to allow for dynamics in the form of lagged exogenous variables:

3. Conclusions

This entry developed a triple regime-switching model in which low-, medium-, and high-growth regimes play roles in explaining a substantially detailed relationship between exchange rates, and export turnover and stock returns. The proposed model allows for multistate phenomena to better capture the time-varying aspect of the effect of exchange rates. Applications of the proposed model on the effect of exchange rates suggest that the depreciation of VND most effectively promotes export growth in a moderate-growth state to which the group of agricultural products, raw materials, and unprocessed goods belong. The high-growth state where the depreciation of VND negatively affects exports should belong to the FDI sector where export prices do not depend much on the exchange rate in the short term. Meanwhile, the effect on the stock market is generally negative. Empirical results contradict the usual wisdom of “high risk, high return” in the stock market of Vietnam.

In the context that the USD is depreciating sharply compared to other currencies in the world, the slight appreciation of VND against USD not only does not harm the competitiveness of export businesses, but could also stimulate investment capital flow into Vietnam, reduce the burden of foreign debt payment, lower the trade imbalance between the US and Vietnam, and be the key to escaping from being labeled a currency manipulator by the US Treasury. This policy adjustment of the State Bank is necessary.

where

is iid standard normally distributed, and standard deviation

is regime-dependent.

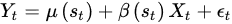

For testing the relationship between variables, the autoregressive AR(p) process was added to the model for capturing the remained autocorrelation of residuals:

The basic switching model can be extended to the Markov switching dynamic regression to allow for dynamics in the form of lagged exogenous variables:

The basic switching model can be extended to the Markov switching dynamic regression to allow for dynamics in the form of lagged exogenous variables:

is iid standard normally distributed, and standard deviation

is iid standard normally distributed, and standard deviation