Your browser does not fully support modern features. Please upgrade for a smoother experience.

Submitted Successfully!

Thank you for your contribution! You can also upload a video entry or images related to this topic.

For video creation, please contact our Academic Video Service.

| Version | Summary | Created by | Modification | Content Size | Created at | Operation |

|---|---|---|---|---|---|---|

| 1 | Le Zhao | + 1812 word(s) | 1812 | 2021-11-22 03:26:34 | | | |

| 2 | Le Zhao | -4 word(s) | 1808 | 2021-11-30 16:16:18 | | | | |

| 3 | Conner Chen | Meta information modification | 1808 | 2021-12-01 09:48:48 | | |

Video Upload Options

We provide professional Academic Video Service to translate complex research into visually appealing presentations. Would you like to try it?

Cite

If you have any further questions, please contact Encyclopedia Editorial Office.

Zhao, L. The Evolution of U.S. Equity Trading Venues. Encyclopedia. Available online: https://encyclopedia.pub/entry/16573 (accessed on 07 February 2026).

Zhao L. The Evolution of U.S. Equity Trading Venues. Encyclopedia. Available at: https://encyclopedia.pub/entry/16573. Accessed February 07, 2026.

Zhao, Le. "The Evolution of U.S. Equity Trading Venues" Encyclopedia, https://encyclopedia.pub/entry/16573 (accessed February 07, 2026).

Zhao, L. (2021, November 30). The Evolution of U.S. Equity Trading Venues. In Encyclopedia. https://encyclopedia.pub/entry/16573

Zhao, Le. "The Evolution of U.S. Equity Trading Venues." Encyclopedia. Web. 30 November, 2021.

Copy Citation

The modern U.S. equity market has been evolving from floor trading by brokers who read the ticker tape and bid on offer to purely electric trading coded into computer algorithms. This entry briefly overviews the evolution of the U.S. equity venues and discusses the consequences of market fragmentation from theoretical and empirical perspectives.

Trading Venues

Stock

US Equity Market

1. The Evolution of U.S. Equity Trading Venues

The modern U.S. equity market has been evolving from floor trading by brokers who read the ticker tape and bid on offer to purely electric trading coded into computer algorithms. Table 1 presents the timeline in the evolution of U.S. equity national exchanges. Notably, the electronic communications network (ECN) was developed in the 1990s to allow direct-matched trading between buyer and seller without an intermediary. The big ECNs, such as Archipelago and Instinet, started gaining popularity as alternative trading systems.

Table 1. Timeline of the evolution for U.S. equity national exchanges.

| Year | Timeline |

|---|---|

| 1790 | Philadelphia Stock Exchange founded (PHLX) |

| 1817 | New York Stock and Exchange Board (NYSE) was officially founded |

| 1835 | Boston Stock Exchange (BEX) founded |

| 1882 | San Francisco Stock Exchange founded Chicago Stock Exchange (CHX) founded |

| 1885 | Cincinnati Stock Exchange founded (renamed as National Stock Exchange in 2003) |

| 1899 | Los Angeles Oil Exchange founded |

| 1924 | The New York Curb Market created (renamed as New York Cub Exchange in 1929, and renamed as American Stock Exchange in 1953) |

| 1956 | Pacific Coast Stock Exchange was created by the merge of San Francisco Stock Exchange and Los Angeles Oil Exchange (rename as Pacific Stock Exchange in 1973) |

| 1971 | Nasdaq founded |

| 1996 | Archipelago created |

| 2005 | Bats Global Markets (BATS) founded Archipelago purchased Pacific Stock Exchange (PCX) |

| 2006 | Archipelago was acquired by NYSE and the exchange renamed as NYSE Arca |

| 2007 | Boston Stock Exchange (BSE) was acquired by Nasdaq and renamed as Nasdaq OMX BX Philadelphia Stock Exchange (PHLX) was acquired by Nasdaq and renamed as Nasdaq PHLX |

| 2008 | American Stock Exchange (AMEX) was acquired by NYSE and renamed as NYSE American BATS launched BZX exchange |

| 2010 | Direct Edge launched EDGA and EDGX exchanges BATS launched BYX Exchange |

| 2014 | BATS merged with Direct Edge |

| 2016 | Cboe acquired Bats Global Markets Investors Exchange launched |

| 2017 | National Stock Exchange (NSX) was acquired by NYSE and renamed as NYSE National |

| 2018 | Chicago Stock Exchange (CHX) was acquired by NYSE and renamed as NYSE Chicago |

| 2020 | Members Exchange (MEMX) launched MIAX Peral’s Exchange (MIAX) launched Long-term Stock Exchange (LTSE) launched |

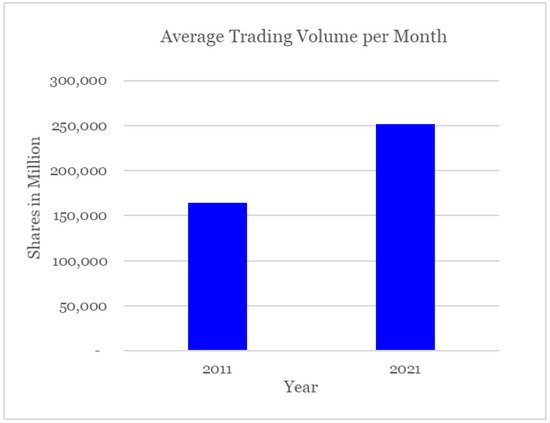

Market participants benefit from the evolution of the technology. First, the stock trading process became much easier with the proliferation of the internet and personal computer. Second, the reduction in the brokerage commission due to enhanced competition also incentivized traders to participate in the equities market. Figure 1 shows the changes in total equities trading volume (in a million shares) in the U.S. market from 2011 to 2021. The average trading volume in the U.S. equities market increased by half, from 160 billion shares per month in 2011 to 250 billion shares per month in 2021.

Figure 1. Change in trading volume in 2011 vs. 2021. This figure plots the average number of shares executed in the overall market per month in 2011 and 2021. The data was taken from the CBOE’s U.S. Equities Market Volume Summary (https://www.cboe.com/us/equities/market_share, accessed date: 20 August 2021).

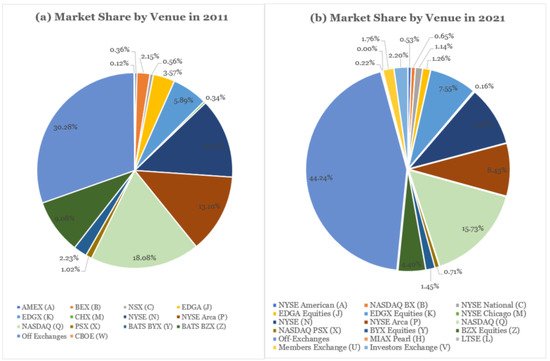

Moreover, equity trading volume steadily increased by greater participation from retail investors induced by zero brokerage commissions and the widely adopted “working from home” policy under the Coronavirus disease (COVID-19) pandemic. In consequence, the market makers in off-exchange such as Citadel and Virtu gained significant volume share. Figure 2 depicts the change in the market share from 2011 to 2021 in the U.S. equity market. Combined with the increased trading volume shown in Figure 1, it is clearly implicit that the volume in the U.S. equity market has significantly increased in the past ten years, while the markets also have become highly fragmented. Moreover, Figure 2 suggests two trends in terms of fragmentation: first, the competition among exchanges intensified as the number of securities exchanges increased from 13 to 16 within ten years. The merger and acquisition activity has blown in the past ten years, as many regional exchanges such as Boston Stock Exchange (BEX) and Chicago Exchange (CHX) were acquired by the big national exchange groups. In addition, other new independent exchanges, such as the Investors Exchange, MIAX Pearl exchange and Members exchanges, and the Long-Term Stock Exchange, were launched in recent years to increase the competition. Second, the off-exchange trading gained a significant proportion (increased from 30.28% to 44.24%), while the volume share for traditional primary exchanges steadily decreased during the past two years. For example, the market share for NYSE and NASDAQ dropped 3.64% and 2.35%, respectively.

Figure 2. The average market share by venue in 2011 vs. 2021. This figure presents the changes in the market share by venue in 2011 (panel a) vs. 2021 (panel b). The market share is calculated as the volume executed on a particular market venue divided by the total volume on all venues. The volume data by the exchange is obtained from the CBOE’s U.S. Equities Market Volume Summary (https://www.cboe.com/us/equities/market_share, accessed date: 20 August 2021).

2. The Consequences of the Market Fragmentation

The equilibrium in the early theoretical market microstructure studies does not incorporate the multiple venue consideration. Early theoretical studies, such as the multi-markets strategic trading model by Chowdhry and Nanda (1991) and the limit order auction markets model by Glosten (1994), assume that the liquidity supply is competitive. Therefore, combined with the order matching system and large tick size, these models imply that a fragmented market should not affect the quotes. However, many empirical studies in the same period disagreed with the theoretical suggestions. For instance, Easley et al. (1996) and Hasbrouck (1995) observe that different markets obtain significant differences in information contents of order flow, hence arguing that the market fragmentation impacts market quality. Still, the theoretical predictions and empirical findings on market fragmentation are mixed. The conclusions about fragmentation on market quality are diverse and differ according to the factors considered.

The directive consequence of market fragmentation is the intensified competition across trading venues. Several studies suggest that the competition that raised from the fragmentation can improve the market quality by reducing fees, promoting innovation, and hence improving quality (Chao et al. 2017). For example, Macey and O’Hara (1997) suggest that the multi-venues environment allows traders to have a chance to compare the execution quality under each venue, and ultimately the trader could achieve the best execution. Biais et al. (2000) theoretically examine competition among liquidity suppliers and limit order trading in a decentralized market. Their model assumes that market makers are risk-neutral, and the model predicts that the trading volume increases under a high decentralized market. Furthermore, Buti et al. (2017) analyze competition between a limit order book and a dark pool. Their model implies that the introduction of a dark pool increases trading volume. Overall, both Biais et al. (2000) and Buti et al. (2017) predict that the fragmentation could increase overall market volume.

Nevertheless, there is still an ongoing debate on whether market fragmentation improves or harms liquidity. The supporters who discuss the impact of fragmentation on liquidity mainly focus on the competition perspective, given that the fragmented market increase the competition, hence it could push the exchanges to lower their fee, thus promote the liquidity (see the theorical prediction by Colliard and Foucault (2012); Pagnotta and Philippon (2018), and empirical supports by Boehmer and Boehmer (2003); De Fontnouvelle et al. (2003); Nguyen et al. (2007); O’Hara and Ye (2011); Menkveld (2013); He et al. (2015); Foucault and Menkveld (2008)). Conversely, the negative view of the impact of fragmentation on liquidity stresses the information asymmetry perspective. A fragmented market increases adverse selection, hence harms liquidity. The theories were developed by Chowdhry and Nanda (1991) and Dennert (1993) and supported empirical studies can be found in Bessembinder and Kaufman (1997b); Amihud et al. (2003); Hendershott and Jones (2005); and Bennett and Wei (2006). For instance, recent theoretical work by Baldauf and Mollner (2021) examines the market relegation effects by allowing exchanges to adjust the trading fees in responding to competition and adverse selection, and their empirical tests in the Australian market support theoretical predictions that fragmentation increases the arbitrage opportunities, hence increases adverse selection. In addition, a theoretical model by Yin (2005) postulates that increased search costs due to fragmentation decrease competition among liquidity providers and harm liquidity and price discovery.

Alongside the two contradictory views above, several studies argue that the relationship between fragmentation and liquidity should be U-shaped. Degryse et al. (2015) suggest that market fragmentation improves the liquidity in lit-exchanges while harming liquidity in off-exchanges3. Gresse (2017) empirically tests whether positive or negative effects dominate the fragmentation on liquidity. The results show the spreads substantially decrease in both lit fragmentation and dark trading venues after the implementation of MiFID in Europe4, suggesting the benefits from market competition outweigh the negative effect from information asymmetry. Wittwer (2021) studies the welfare effects of connecting the disconnected markets and the model predicts that market fragmentation decreases market depth. Chen and Duffie (2021) extend Wittwer’s model by increasing the number of exchanges in the equilibrium. Chen and Duffie (2021) confirm Wittwer’s (2021) prediction and further show that market fragmentation also alters trader’s strategy to submit a more aggressive order, hence increasing allocative efficiency. Ultimately, overall price informativeness increases.

To sum up, there are exhaustive discussions about the impact of fragmentation on liquidity. However, as suggested by Barardehi et al. (2019), traditional liquidity measures may underestimate the liquidity provision under the current fast-trading environment. Therefore, to better estimate trading cost and understanding the impact of the liquidity under the fragmented market, it is still worthy to compare the liquidity among lit- and off-exchanges by using the new liquidity measures, such as the average per-dollar price impacts of fixed-dollar volume that was proposed by Barardehi et al. (2019).

Alongside liquidity, market volatility by fragmentation is another important dimension that is worth emphasizing. Prices under fragmented markets are more disposed to order imbalances, while increase transitory volatility. The Biais (1993) model conducts theoretical research comparing centralized and fragmented markets and provides two predictions: first, the fragmented markets should increase stock price volatility since the information is fragmented. Second, the spread should be less volatile in fragmented market. Easley et al. (1996) and Bessembinder and Kaufman (1997a) assume heterogeneous information in the model and show that trading fragmentation leads to information fragmentation, which in turn results in higher volatility and wider spreads. Ultimately, both of the works suggest that fragmentation leads to cream-skimming effects and harms markets. In empirical tests, Madhavan (2012) examines the Flash Crash and finds that more fragmented stocks had a more significant negative impact during the Flash Crash in 2010. By contrast, Boneva et al. (2016) empirically tests the effect of fragmentation on volatility for the London Stock Exchange and finds that fragmentation lowers overall volatility. In addition, Boneva et al. (2016) further separates the overall fragmentation into dark trading and visible fragmentation and suggests that the effects of dark trading and visible fragmentation on market quality are different. For further discussion towards venue competition under a fragmented trading environment, readers may refer to a literature survey by Gomber et al. (2017), who review the literature that focus on examining the economic arguments and motivations underlying market fragmentation.

References

- Chowdhry, Bhagwan, and Vikram Nanda. 1991. Multimarket Trading and Market Liquidity. Review of Financial Studies 4: 483–511.

- Glosten, Lawrence R. 1994. Is the electronic open limit order book inevitable? The Journal of Finance 49: 1127–61.

- Easley, David, Nicholas M. Kiefer, and Maureen O’Hara. 1996. Cream-skimming or profit-sharing? The curious role of purchased order flow. The Journal of Finance 51: 811–33.

- Hasbrouck, Joel. 1995. One Security, Many Markets: Determining the Contributions to Price Discovery. The Journal of Finance 50: 1175–99.

- Chao, Yong, Chen Yao, and Mao Ye. 2017. Discrete Pricing and Market Fragmentation: A Tale of Two-Sided Markets. The American Economic Review 107: 196–99.

- Macey, Jonathan R., and Maureen O’Hara. 1997. The law and economics of best execution. Journal of Financial Intermediation 6: 188–223.

- Biais, Bruno, David Martimort, and Jean-Charles Rochet. 2000. Competing Mechanisms in a Common Value Environment. Econometrica 68: 799–837.

- Buti, Sabrina, Barbara Rindi, and Ingrid M. Werner. 2017. Dark pool trading strategies, market quality and welfare. Journal of Financial Economics 124: 244–65.

- Colliard, Jean-Edouard, and Thierry Foucault. 2012. Trading Fees and Efficiency in Limit Order Markets. Review of Financial Studies 25: 3389–421.

- Pagnotta, Emiliano S., and Thomas Philippon. 2018. Competing on Speed. Econometrica 86: 1067–115.

- Boehmer, Beatrice, and Ekkehart Boehmer. 2003. Trading your neighbor’s ETFs: Competition or fragmentation? Journal of Banking & Finance 27: 1667–703.

- De Fontnouvelle, Patrick, Raymond P. H. Fishe, and Jeffrey H. Harris. 2003. The behavior of bid-ask spreads and volume in options markets during the competition for listings in 1999. The Journal of Finance 58: 2437–63.

- Nguyen, Vanthuan, Bonnie F. Van Ness, and Robert R. Van Ness. 2007. Inter-market competition for exchange traded funds. Journal of Economics and Finance 31: 251–67.

- O’Hara, Maureen, and Mao Ye. 2011. Is market fragmentation harming market quality? Journal of Financial Economics 100: 459–74.

- Menkveld, Albert J. 2013. High frequency trading and the new market makers. Journal of Financial Markets 16: 712–40.

- He, William Peng, Elvis Jarnecic, and Yubo Liu. 2015. The determinants of alternative trading venue market share: Global evidence from the introduction of Chi-X. Journal of Financial Markets 22: 27–49.

- Foucault, Thierry, and Albert J. Menkveld. 2008. Competition for Order Flow and Smart Order Routing Systems. The Journal of Finance 63: 119–58.

- Dennert, Jürgen. 1993. Price competition between market makers. The Review of Economic Studies 60: 735–51.

- Bessembinder, Hendrik, and Herbert M. Kaufman. 1997b. A cross-exchange comparison of execution costs and information flow for NYSE-listed stocks. Journal of Financial Economics 46: 293–319.

- Amihud, Yakov, Beni Lauterbach, and Haim Mendelson. 2003. The value of trading consolidation: Evidence from the exercise of warrants. Journal of Financial and Quantitative Analysis 38: 829–46.

- Hendershott, Terrence, and Charles M. Jones. 2005. Island Goes Dark: Transparency, Fragmentation, and Regulation. Review of Financial Studies 18: 743–93.

- Bennett, Paul, and Li Wei. 2006. Market structure, fragmentation, and market quality. Journal of Financial Markets 9: 49–78.

- Baldauf, Markus, and Joshua Mollner. 2021. Trading in fragmented markets. Journal of Financial and Quantitative Analysis 56: 93–121.

- Yin, Xiangkang. 2005. A comparison of centralized and fragmented markets with costly search. The Journal of Finance 60: 1567–90.

- Degryse, Hans, Frank De Jong, and Vincent van Kervel. 2015. The Impact of Dark Trading and Visible Fragmentation on Market Quality. Review of Finance 19: 1587–622.

- Gresse, Carole. 2017. Effects of lit and dark market fragmentation on liquidity. Journal of Financial Markets 35: 1–20.

- Wittwer, Milena. 2021. Connecting Disconnected Financial Markets? American Economic Journal: Microeconomics 13: 252–82.

- Chen, Daniel, and Darrell Duffie. 2021. Market Fragmentation. The American Economic Review 111: 2247–74.

- Barardehi, Yashar H., Dan Bernhardt, and Ryan J. Davies. 2019. Trade-Time Measures of Liquidity. The Review of Financial Studies 32: 126–79.

- Biais, Bruno. 1993. Price formation and equilibrium liquidity in fragmented and centralized markets. The Journal of Finance 48: 157–85.

- Bessembinder, Hendrik, and Herbert M. Kaufman. 1997a. A comparison of trade execution costs for NYSE and NASDAQ-listed stocks. Journal of Financial and Quantitative Analysis 32: 287–310.

- Madhavan, A. 2012. Exchange-Traded Funds, Market Structure, and the Flash Crash. Financial Analysts Journal 68: 20–35.

- Boneva, Lena, Oliver Linton, and Michael Vogt. 2016. The Effect of Fragmentation in Trading on Market Quality in the UK Equity Market. Journal of Applied Econometrics 31: 192–213.

- Gomber, Peter, Satchit Sagade, Erik Theissen, Moritz Christian Weber, and Christian Westheide. 2017. Competition between Equity Markets: A Review of The Consolidation Versus Fragmentation Debate. Journal of Economic Surveys 31: 792–9814.

More

Information

Subjects:

Business, Finance

Contributor

MDPI registered users' name will be linked to their SciProfiles pages. To register with us, please refer to https://encyclopedia.pub/register

:

View Times:

1.6K

Revisions:

3 times

(View History)

Update Date:

01 Dec 2021

Notice

You are not a member of the advisory board for this topic. If you want to update advisory board member profile, please contact office@encyclopedia.pub.

OK

Confirm

Only members of the Encyclopedia advisory board for this topic are allowed to note entries. Would you like to become an advisory board member of the Encyclopedia?

Yes

No

${ textCharacter }/${ maxCharacter }

Submit

Cancel

Back

Comments

${ item }

|

More

No more~

There is no comment~

${ textCharacter }/${ maxCharacter }

Submit

Cancel

${ selectedItem.replyTextCharacter }/${ selectedItem.replyMaxCharacter }

Submit

Cancel

Confirm

Are you sure to Delete?

Yes

No