Cement is the most common and extensively used adhesive in the construction industry. It is employed on highways, houses, embankments, bridges, commercial establishments, and flyovers. In recent years, the Nigerian cement industry has grown from import dependency to an export-thriving epicentre within Africa. The country possesses the largest cement industry within West Africa, with at least 12 registered companies amounting to a merged cement capacity of 58.9 Mt/yr. Dangote Cement is the largest cement producer in Nigeria and West Africa, manufacturing a combined share of more than 28.5 Mt/yr of cement capacity. Also, LafargeHolcim (through its subsidiary AshakaCem & Lafarge WAPCO) and BUA Group boost 18.9 Mt/yr and 11.5 Mt/yr of integrated cement capacity, respectively.

1. Introduction

The cement manufacturing industry has played a fundamental role in global economic development, with construction, steel, crude oil, iron, and telecommunications, constituting major infrastructural aspects worldwide. Swift commercialization, urban civilization, and the necessity to boost domestic goods production have been the lead cause for the surge in cement production

[1]. In Nigeria, the availability of raw materials has encouraged numerous local productions. As of 2013, annual cement production increased significantly above 1300%, from below 2 million tonnes in 1990 to above 28 million tonnes in 2013

[2]. Cement is a powder-like material comprising lime and mud-clay as fundamental elements, utilized in all kinds of building and civil constructions. The used clay provides silica, iron oxide, and alumina, while the calcined lime principally gives calcium-oxide. As highlighted in

Table 1, raw materials used for cement production are obtained by blasting rock quarries with explosives

[3][4]. The blasted rocks are transported to the plants, where they are crushed into chunks of ½ inch-sized particles. Through the process of prehomogenization, cement is produced depending on the needed proportion of ground clay and limestones. For a pressurized rotatory furnace of around 1400 °C, these unprocessed resources (

Table 1) are calcined to become a clinker

[3][5]. The clinker is then pulverized with some minerals to a powder to produce Portland cement

[4].

Table 1. Raw materials used for clinker production.

| Calcium, Ca |

Limestone involving quick-lime from treating wastewater, caustic-lime |

| Silicon, Si |

Sand such as harnessed mould (silica sand-clay-liquid mixture) |

| Silicon–Aluminium, Si–Al |

Kaolinite, bentonite, and similar forms of terra-cotta clay |

| Iron, Fe |

Iron-based metals, including heated pyrite and adulterated metallic minerals |

| Silicon–Aluminium–Calcium, Si–Al–Ca |

Powdered blast furnace slag such as ashes from fuel combustion ashes, oil-soluble |

| Aluminium, Al |

Raw metallic apparatus constituting recycling salt slag, aluminium hydroxide |

| Sulphur, S |

Non-artificial gypsum such as Natural anhydrite Gypsum from flue gas desulfurization |

Global cement generation was 4.1Bnt in 2020 with a growth rate of 24% from its highest in 2010

[6], with China clearly leading as the world’s largest cement producer, representing 59.31% of overall manufactured cement globally.

Table 2 shows the global cement production, with China producing more than ½ of the world’s cement combined. These recent expansions have been driven by developing countries such as India and China, with a substantial increase in cement manufacturing around Asia, Africa, and South America. As the earth’s population and industrialization boom, universal cement production is bound to surge by at least 12–23% by 2050

[7]. Nigeria possesses the largest cement industry within West Africa, with at least 12 registered companies amounting to a merged cement capacity of 58.9 Mt/yr. Dangote Cement is the largest cement producer in Nigeria and West Africa, manufacturing a combined share of more than 28.5 Mt/yr of cement capacity. Also, LafargeHolcim (through its subsidiary AshakaCem & Lafarge WAPCO) and BUA Group boost 18.9 Mt/yr and 11.5 Mt/yr of integrated cement capacity, respectively

[8]. With the increasing presence of cement manufacturing, the industry poses as one of the most significant CO

2 emitters. Evaluating the risk factors of its spillover impact on public health is inevitable.

Table 2. Global cement production in selected countries (in metric tonnes)

[6].

| Countries |

2018 |

2019 |

| United States |

87,000 |

89,000 |

| Brazil |

53,000 |

55,000 |

| China |

2,200,000 |

2,200,000 |

| Egypt |

81,200 |

76,000 |

| India |

300,000 |

320,000 |

| Indonesia |

75,200 |

74,000 |

| Iran |

58,000 |

60,000 |

| Japan |

55,300 |

54,000 |

| Korea, Republic of |

57,500 |

55,000 |

| Russia |

53,700 |

57,000 |

| Turkey |

72,500 |

51,000 |

| Vietnam |

90,200 |

95,000 |

| Other Countries |

870,000 |

900,000 |

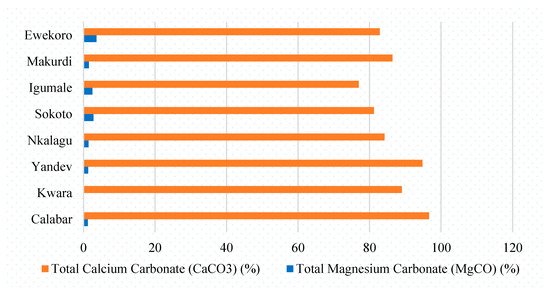

In Nigeria, limestone and marble are the main minerals of cement production. The conversion of this limestone into cement by heat releases carbon dioxide as a waste product. Ndefo

[9] highlighted the deposits of these minerals and their carbon contents in various percentages, as shown in

Figure 1. They are mainly composed of the carbonates of calcium and magnesium. Large deposits of calcium carbonate (CaCO

3) are observed in Calabar, Yandev, and Ukpilla, with Ewekoro having the largest deposit of Magnesium carbonate MgCO. The Nigerian Ministry of Mines and Steel Development reports a total limestone collection of approximately 2.3 TMT, of which 568 MMT stands as proven reserve and 11 MMT is used. Such deposits are endowed unadulterated, mainly across Ebonyi, Cross-River, and Benue cities with large industrial volumes among Gombe, Edo, Sokoto, and Ogun. Nonetheless, the largest enriched West African nation is Nigeria.

Figure 1. Percentage quantity of calcium carbonate and magnesium carbonate in Nigerian Limestone Deposit

[9][10].

In 2018, data from World Health Organization (WHO) indicated that 9 in 10 persons breathe air containing excessive concentrations of toxins beyond the approved threshold stated by WHO. Africa and Asia amass the worst hit with 90% deaths from environmental air contaminants

[11]. During cement production, soot molecules and dusty residues emerge extensively, thereby triggering respiratory ailments across humans. Diverse pulmonic-connected diseases are prevalent mostly to indigenous persons living around cement industries. One cement factory releases massive atmospheric pollution. Given the voluminous process of producing cement, any certain potential environmental impact would be significant. As such, key players must prioritize atmospheric safety and decontamination since this undeniably plays an important role in achieving sustainable development (SDGs) goals 3, 6, 7, 11, 12 and 13.

Higher cement production and usage, switching fuel types, and dirt restriction mechanization influence the quantity and cluster of environmental impurities. Numerous investigations admit that manufacturing cement constitutes the broadest source for PM emission, accounting for 20–30%, which is 40% of the gross industrial emission

[12]. Furthermore, making cement represents 5–6% of total artificial CO

2 discharge, which according to the European Cement Association (ECA), yields at least half a ton of CO

2 for a ton of cement produced. The most common pollutants responsible for air pollution are volatile organic compounds (VOCs), carbon monoxide (CO), particulate matter (PM), sulfur dioxide (SO

2), nitrogen oxides (NOx), and hydrocarbons

[13]. Decarbonation propels off about 50% of the emission, while fuel for kiln firing induces approximately 40% of pollutants. With projected manufacturing spike, cement makers are under pressure to lower or sustain CO

2 outflows. Carbon-neutral biomass amidst other substitute fuels is seeing heightened usage in reducing certain cement-based CO

2 discharge. Cement manufacturing entails severe health constraints; nearly every production phase adversely affects man and its environment. When dismantling rocks, particulate matter is dispersed into the atmosphere, making it harmful to man. Moreover, this disintegration process causes noise pollution. The urban geography might likewise impact the gadgets adopted during this procedure

[12][13]. Diverse equipment is recently employed to mitigate these adverse shortcomings. The equipment helps to limit dusty release, particularly across cement industries. Gas trappers similarly capture extreme toxins, including sulphur, nitrogen oxide, and carbon dioxide, among others

[11][13]. An essential constituent of gas for cement production is carbon dioxide (CO

2). Heating calcium carbonate as the main ingredient produces lime, whereas carbon dioxide is given off as a chemical procedure. Cement production contributes 40% of global CO

2 discharge; 60% of this CO

2 volume comes from Portland cement

[14][15], transforming limestone to lime. Sometimes, weighty metallic minerals spanning across mercury, chromium, thallium, and zinc have proximity to cement factories.

2. The Growing Nigerian Cement Industry

In recent years, the Nigerian cement industry has grown from import-dependency to an export-thriving epicentre within Africa. Cement is still a critical part of developing infrastructures globally as Nigerian cement producers continuously ramp up activities and expand into futuristic times. Given growing demands on infrastructural development, the National Integrated Infrastructure Master Plan (NIIMP) has projected a cumulative investment of approximately $3 trillion for a duration of 3 decades to construct and sustain infrastructures. The Ministry for Mines and Steel Development

[16] estimates Nigeria’s highway system to be at 193,200 km, whereby 28,980 km is paved and about 85% is unpaved. This fact highlights the tremendous pressure on cement manufacturers in meeting the country’s demand for infrastructural development. Environmental health risks are of significant concern with the absence of a greener and more sustainable cement production in Nigeria. Juxtaposing the high degree of deficiency across the residential and structural facilities, particularly regarding the dire need for building properties and roadways, the capacity for expansion in this sector is evidently captivating. Additionally, the currently established amplitude has broadened to exceed projected demand as governmental strategies, including tax-relief schemes, banning imported cement, and similar enacted plans, have facilitated the rapid enlargement of capabilities for proprietary stakeholders

[17]. In the medium term, Nigeria’s concrete industry indicates a likelihood for considerably sustained growth into the next generation, supported by unimpaired cement demand essentials as revealed by multiple measurable benchmarks. Projections place Nigerian cement consumption per capita at about 150 kg falling behind the worldwide average of 561 kg. Over the long term, several factors encompassing enhanced accessibility to construction funds, increased civilization, larger populace, heightened infrastructural and housing investment, political consistency, and economic affluence determine the possibilities for boosting cement demand in Africa’s biggest country.

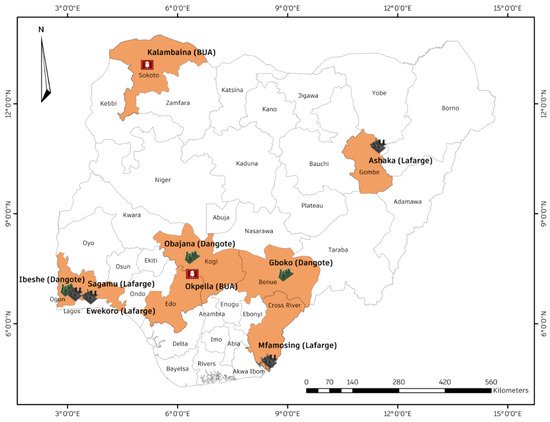

Besides other trivial functions of concrete for building, fascinations exist of using cement in constructing roads due to its resilience and easy preservation. More so, with the current population surge within Nigeria, it is believed that the government and increasing private sector will invest more in furnishing houses for bustling youths and working-class people, particularly inside and at the borders of urban cities. Consequently, to foster this movement, the federal government recently founded the Presidential Infrastructure Development Fund (PFID) in 2018, overseen by the Nigeria Sovereign Investment Authority (NSIA), whose goal is to narrow down the investment to electricity and road schemes nationwide. Hence, cement demand growth in Nigeria is expected to increase local cement production over the following years. Nigeria’s cement sector exhibits oligopolistic tendencies with three major competitors as presented in Figure 2. Dangote Cement Plc, the indisputable biggest producer in Sub-Sahara and Nigeria with an installed capacity of 48.6 Mta and 32.3 Mta respectively, just recently added 3 million tonnes to its capacity in 2020 in the Obajana Cement Plant. Lafarge Africa Plc has a capacity of 10.5 million metric tonnes, accounting for a market share of 21.8%. BUA Group (recently sealed a merger of CCNN and Obu) has an 8.0 million metric tonnes capacity, accounting for a market share of 17.6%. Regardless of the current capabilities, the key manufacturing industrial giants are relentless in diversification strategies. According to their media sources, Dangote Cement has hinted at developing two extra 6MTPA factories in Edo city’s Okpella and Ogun state’s Itori. Additionally, BUA Group (CCNN) intends to extend its Sokoto’s Kalambaina Plant by supplementary 3MMTA. These plants are generally sited close to the raw material to cut the cost of transporting them. With limestone in its abundance, cement production in Nigeria is at its infant stage. Dangote cement further observes that Obajana’s accumulated limestone of 647 MT should stretch for approximately 45 years, Ibese’s 1150 MT should cover 78 years, and Gboko’s 133 MT should surpass three decades.

Figure 2. Major Cement Plants in Nigeria.

Over time, Nigerian cement manufacturers have used domestic cinder and proxy combustibles such as LPFO (Low Pour Fuel Oil—a byproduct of petroleum oil) as an alternative to gas in powering their plants. Dangote Cement, for instance, has tactically reinforced its limekilns to function better with coals. This encompasses Ibese and Obajana industries, which were formerly structured to operate on gas, whereas Benue’s factory previously used LPFO. Dangote group also indicated tendencies to utilize its numerous damaged tyres as energy sources. Similarly, Lafarge Africa Plc has heightened its usage of substitute power, including coal and industrial waste.