| Version | Summary | Created by | Modification | Content Size | Created at | Operation |

|---|---|---|---|---|---|---|

| 1 | Ruijun Duan | + 2181 word(s) | 2181 | 2021-09-15 10:13:18 |

Video Upload Options

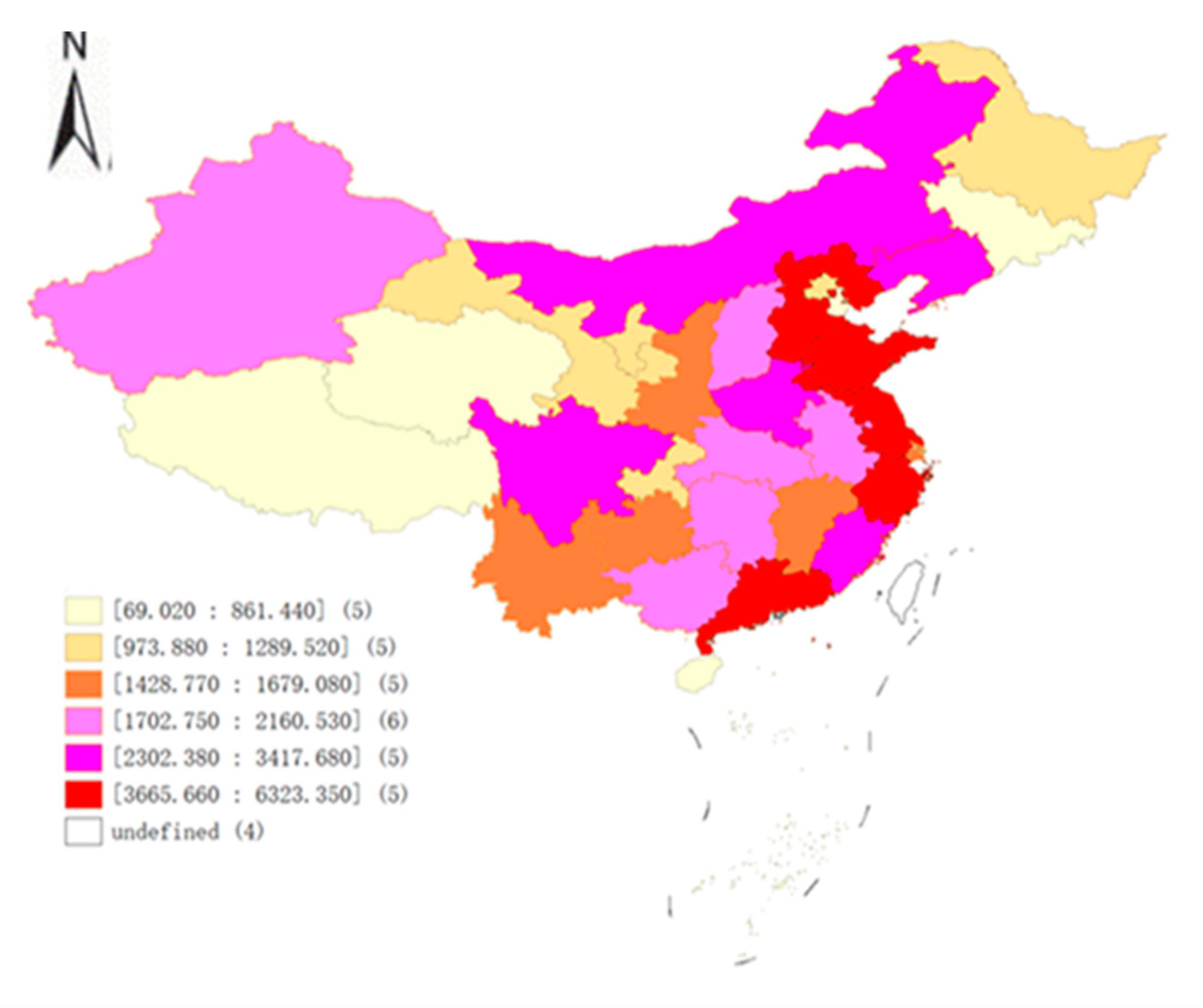

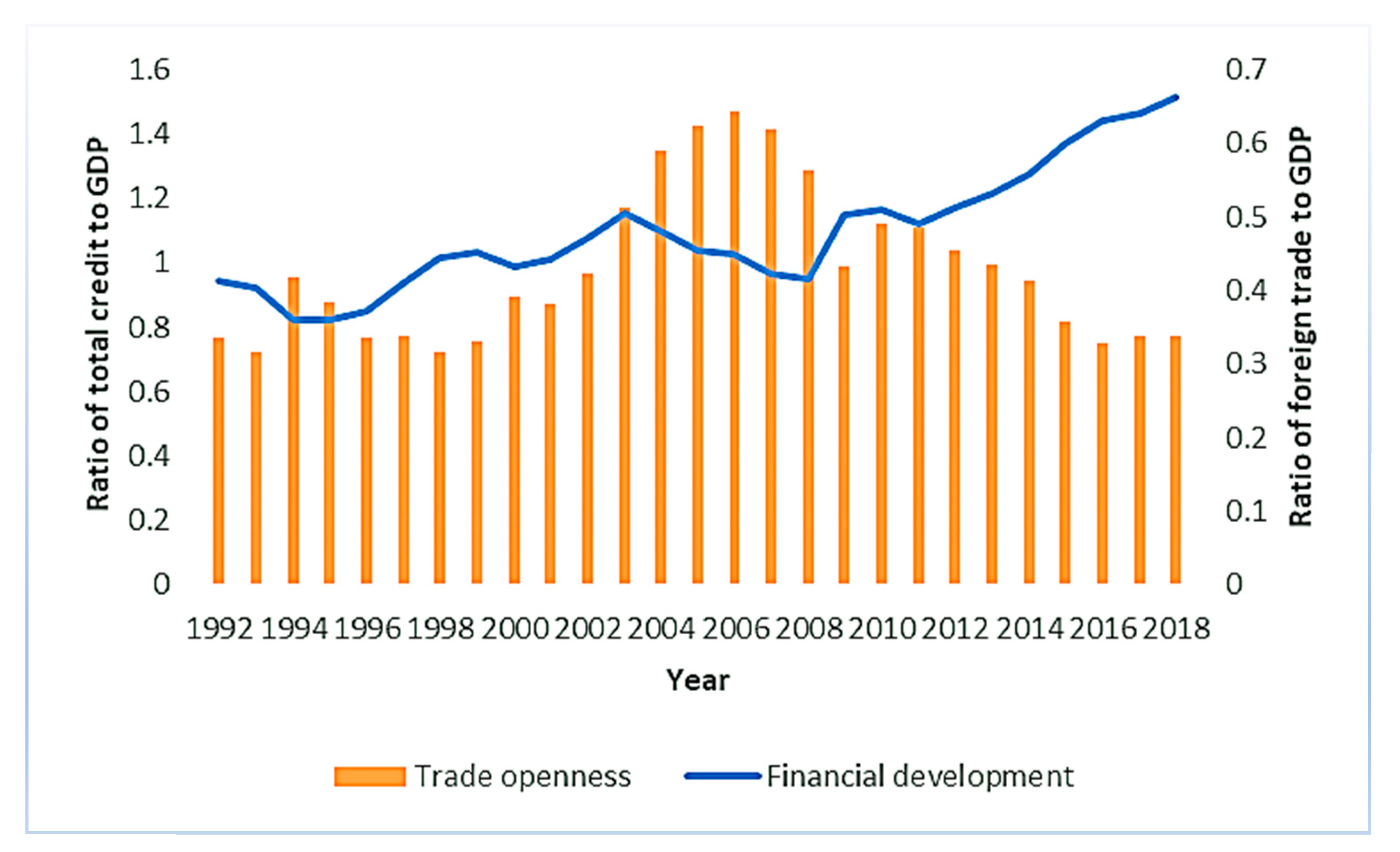

China’s electricity consumption presents a significant spatial spill over effect, and the spatial agglomeration of electricity consumption in local regions is mainly HH clusters. A 1% positive change in financial development causes an increase of 0.089% in electricity consumption, but a 1% rise in financial development reduces electricity consumption of neighboring regions by 0.051%. A 1% positive change in trade openness decreases electricity consumption by 0.051%, while the spatial spillover effect of trade openness is not significant. It is also found that financial development has a long-term promoting effect on electricity consumption, while trade openness has a long-term inhibiting effect on electricity consumption.

1. Introduction

2. The Effects of Financial Development and Trade Openness on Electricity Consumption

3. Conclusions and Policy Implications

References

- IEA. World Energy Outlook 2019; International Energy Agency: Paris, France, 2019; Available online: https://www.iea.org/reports/world-energy-outlook-2019 (accessed on 14 August 2021).

- Lin, B.; Li, Z. Is more use of electricity leading to less carbon emission growth? An analysis with a panel threshold model. Energy Policy 2020, 137, 111121.

- IEA. Data-CO2 Emissions; International Energy Agency: Paris, France, 2021; Available online: https://www.iea.org/data-and-statistics (accessed on 7 August 2021).

- Zhou, G.; Chung, W.; Zhang, Y. Measuring energy efficiency performance of China’s transport sector: A data envelopment analysis approach. Expert Syst. Appl. 2014, 41, 709–722.

- Sadorsky, P. The impact of financial development on energy consumption in emerging economies. Energy Policy 2010, 38, 2528–2535.

- Liu, S.; Li, H. Does Financial Development Increase Urban Electricity Consumption? Evidence from Spatial and Heterogeneity Analysis. Sustainability 2020, 12, 7011.

- Gregori, T.; Tiwari, A.K. Do urbanization, income, and trade affect electricity consumption across Chinese provinces? Energy Economics 2020, 89, 104800.

- Sbia, R.; Shahbaz, M.; Hamdi, H. A contribution of foreign direct investment, clean energy, trade openness, carbon emissions and economic growth to energy demand in UAE. Econ. Model. 2014, 36, 191–197.

- An, H.; Xu, J.; Ma, X. Does technological progress and industrial structure reduce electricity consumption? Evidence from spatial and heterogeneity analysis. Struct. Chang. Econ. Dyn. 2020, 52, 206–220.

- Sadorsky, P. Information communication technology and electricity consumption in emerging economies. Energy Policy 2012, 48, 130–136.

- Shahbaz, M.; Feridun, M. Electricity consumption and economic growth empirical evidence from Pakistan. Qual. Quant. 2012, 46, 1583–1599.

- Salahuddin, M.; Alam, K. Internet usage, electricity consumption and economic growth in Australia: Time series evidence. Telemat. Inform. 2015, 32, 862–878.

- Al-Bajjali, S.K.; Shamayleh, A.Y. Estimating the determinants of electricity consumption in Jordan. Energy 2018, 147, 1311–1320.

- Kumari, A.; Sharma, A.K. Causal relationships among electricity consumption, foreign direct investment and economic growth in India. Electr. J. 2018, 31, 33–38.

- Lin, B.; Wang, Y. Inconsistency of economic growth and electricity consumption in China: A panel VAR approach. J. Clean. Prod. 2019, 229, 144–156.

- Taale, F.; Kyeremeh, C. Drivers of households’ electricity expenditure in Ghana. Energy Build. 2019, 205, 109546.

- Benjamin, N.I.; Lin, B. Influencing factors on electricity demand in Chinese nonmetallic mineral products industry: A quantile perspective. J. Clean. Prod. 2019, 243, 118584.

- Zhang, M.; Chen, Y.; Hu, W.; Deng, N.; He, W. Exploring the impact of temperature change on residential electricity consumption in China: The ‘crowding-out’ effect of income growth. Energy Build. 2021, 245, 111040.

- Rafindadi, A.A.; Ozturk, I. Effects of financial development, economic growth and trade on electricity consumption: Evidence from post-Fukushima Japan. Renew. Sustain. Energy Rev. 2016, 54, 1073–1084.

- Sbia, R.; Shahbaz, M.; Ozturk, I. Economic growth, financial development, urbanisation and electricity consumption nexus in UAE. Econ. Res.-Ekon. Istraživanja 2017, 30, 527–549.

- Faisal, F.; Tursoy, T.; Berk, N. Linear and non-linear impact of Internet usage and financial deepening on electricity consumption for Turkey: Empirical evidence from asymmetric causality. Environ. Sci. Pollut. Res. Int. 2018, 25, 11536–11555.

- Solarin, S.A.; Shahbaz, M.; Khan, H.N.; Razali, R.B. ICT, Financial Development, Economic Growth and Electricity Consumption: New Evidence from Malaysia. Glob. Bus. Rev. 2019, 22, 941–962.

- Adom, P.K. Financial depth and electricity consumption in Africa: Does education matter? Empir. Econ. 2020, 1–55.

- Lin, B.; Omoju, O.E.; Okonkwo, J.U. Factors influencing renewable electricity consumption in China. Renew. Sustain. Energy Rev. 2016, 55, 687–696.

- Ohlan, R. The relationship between electricity consumption, trade openness and economic growth in India. OPEC Energy Rev. 2018, 42, 331–354.

- Ghazouani, T.; Boukhatem, J.; Yan Sam, C. Causal interactions between trade openness, renewable electricity consumption, and economic growth in Asia-Pacific countries: Fresh evidence from a bootstrap ARDL approach. Renew. Sustain. Energy Rev. 2020, 133, 110094.

- Sahoo, M.; Sethi, N. Does remittance inflow stimulate electricity consumption in India? An empirical insight. South Asian J. Bus. Stud. 2020. ahead-of-print.

- Anselin, L.; Rey, S.J. Introduction to the Special Issue on Spatial Econometrics. Int. Reg. Sci. Rev. 1997, 20, 1–7.

- Jiang, L.; Ji, M. China’s Energy Intensity, Determinants and Spatial Effects. Sustainability 2016, 8, 544.

- Wu, H.; Xia, Y.; Yang, X.; Hao, Y.; Ren, S. Does environmental pollution promote China’s crime rate? A new perspective through government official corruption. Struct. Chang. Econ. Dyn. 2021, 57, 292–307.