Your browser does not fully support modern features. Please upgrade for a smoother experience.

Submitted Successfully!

Thank you for your contribution! You can also upload a video entry or images related to this topic.

For video creation, please contact our Academic Video Service.

| Version | Summary | Created by | Modification | Content Size | Created at | Operation |

|---|---|---|---|---|---|---|

| 1 | ALESSIO FACCIA | + 1036 word(s) | 1036 | 2021-08-11 05:32:10 | | | |

| 2 | Vicky Zhou | -6 word(s) | 1030 | 2021-08-11 07:50:01 | | |

Video Upload Options

We provide professional Academic Video Service to translate complex research into visually appealing presentations. Would you like to try it?

Cite

If you have any further questions, please contact Encyclopedia Editorial Office.

Faccia, A. Corporate Financial Statements. Encyclopedia. Available online: https://encyclopedia.pub/entry/13042 (accessed on 14 January 2026).

Faccia A. Corporate Financial Statements. Encyclopedia. Available at: https://encyclopedia.pub/entry/13042. Accessed January 14, 2026.

Faccia, Alessio. "Corporate Financial Statements" Encyclopedia, https://encyclopedia.pub/entry/13042 (accessed January 14, 2026).

Faccia, A. (2021, August 11). Corporate Financial Statements. In Encyclopedia. https://encyclopedia.pub/entry/13042

Faccia, Alessio. "Corporate Financial Statements." Encyclopedia. Web. 11 August, 2021.

Copy Citation

Corporate financial statements address multiple stakeholders’ needs. International Financial Reporting Standards (IFRSs), among others, allow two different classifications, “by function of expense” and “by nature of expense”, for the statement of profit and loss and other comprehensive income for the period (from now on, also identified in short as “Income Statement”, or “IS”). XBRL standards ensure compliance and consistency in financial statements’ drafting and filing. XBRL taxonomies reflect the Income Statement IFRS disclosure requirement in the {310000} and {320000} codifications, respectively.

XBRL

ESG reporting

value-added

sustainable financial disclosure

IFRS

sustainability

income statement

statement of comprehensive income

EU Taxonomy Climate Delegated Act

Non-Financial Reporting Directive (NFRD)

1. Introduction

ESG disclosure is becoming increasingly regulated and essential to the stakeholders, more aware and sensitive to Environmental, Social, and Governance perspectives. Corporations play a significant role in the communities in which they operate [1][2][3]. Therefore, their accountability [4][5] should be considered, measured, and systematically disclosed to ensure transparency, comparability, and stakeholders’ awareness [6][7]. Attempts to measure and inform sustainability outcomes and financial performances have led to autonomous Sustainability Reports, discretionarily presented by the companies [8][9].

Structured financial statement disclosure, unlike ESG reporting, is enforced and highly regulated by laws, accounting standards, and other regulations [10][11][12]. EU law enforces large companies (“public-interest entities exceeding on their balance sheet dates the criterion of the average number of 500 employees during the financial year”, Directive 2014/95/EU. This requirement integrates the previous Directive 2013/34/EU) “to disclose information on the way they operate and manage social and environmental challenges” [13], while all the other entities are likely to be soon expected to meet extended mandatory ESG reporting, according to the recent EU proposal [1][2].

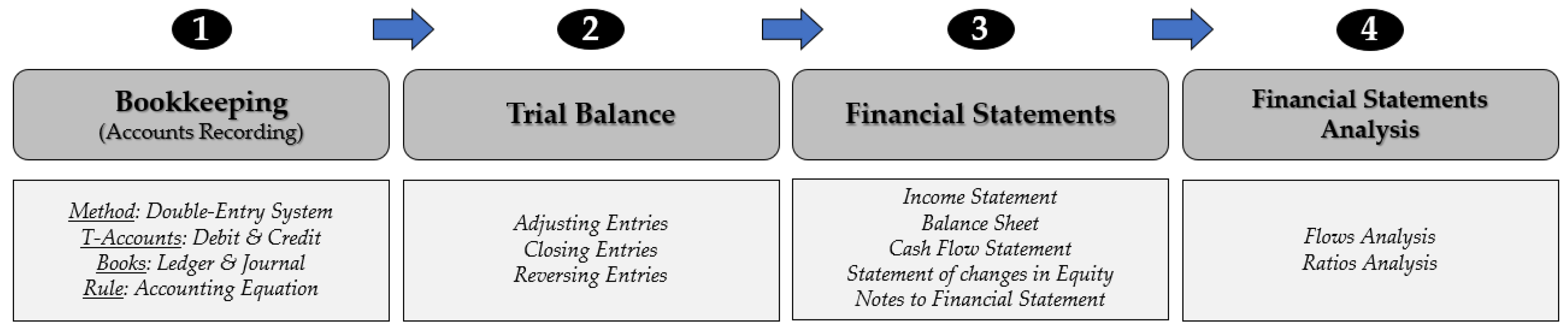

The accounting process (see Figure 1) starts from (1) bookkeeping of companies’ transactions, followed by (2) trial balance, (3) financial statement disclosure, and (4) financial statement analysis [14]. While sole traders and unincorporated entities are usually only expected to comply with the first two steps of the accounting process, incorporated companies must provide additional disclosure through structured, standardised financial statements that many stakeholders analyse through flows and ratios [15].

Figure 1. The accounting process.

International Financial Reporting Standards (IFRSs) issued by the International Accounting Standard Board (IASB) apply to listed corporations of European countries and many others worldwide, resulting in the most popular accounting standards, followed by the US GAAPs (Generally Accepted Accounting Principles), along with many other accounting standards issued by national/local accounting professional bodies [16].

The eXtensible Business Reporting Language (XBRL) is the “open international standard for digital business reporting” [17]. Incorporated entities in most countries should submit their annual report to public registers (i.e., Companies Houses in the UK, SEC’s Edgar database in the US) codified according to this standardised language and file extension (XBRL) [18].

These standards aim to ensure accuracy (through formal mistakes avoidance and accounting equation balance), data processing automation, consistency, and comparability. Although the XBRL taxonomy was initially applied to the annual report schemes to better classify structured data, its application was progressively extended to the notes to include unstructured (text) data [19][20][21].

Corporate financial disclosure is essential to ensure transparency and accountability, and its filing according to the XBRL taxonomies is worldwide required. However, these standards still do not include any specific reference to the ESG disclosure. Therefore, this study traces the path to a further extension of the XBRL application to a standardised Sustainability Report. Although some attempts have been carried out to integrate financial and non-financial reporting [22] or to unify the XBRL reporting, using a “twin-track approach” [23], the configuration of a new XBRL Income Statement suitable for ESG purposes has never been considered so far.

2. Mandatory ESG Reporting and XBRL Taxonomies Combination: ESG Ratings and Income Statement, a Sustainable Value-Added Disclosure

Increased awareness in corporate social responsibility progressively leads to enhanced regulation extending the enforcement of non-financial disclosure previously only voluntarily prepared.

ESG reporting has been considered thus far as an additional non-financial source of information to be disclosed as a separate document outside the XBRL framework. Financial statements more often already include some pieces of ESG information. However, they can be only and eventually disclosed through unstructured or semi-structured textual forms in the residual code “{880000} Notes—Additional Information”.

The authors identified the need for a structured, regulated, and quantitative ESG-based statement in the form of a Value-Added Income Statement.

Income Statement re-stated in a Value-Added perspective has already been considered and successfully presented by relevant literature in the past to serve CSR purposes. The VAIS is further developed and matched with weighted ESG scores consistently assigned to financial and non-financial stakeholders according to their relevance in the proposed model.

Two additional items in the XBRL (IFRS-based) structure are suggested, leading to the introduction of one fully structured statement, “{330000}—Statement of comprehensive income, profit or loss, by Added Value, ESG based” and a semi-structured “{814000}—Notes—ESG Ratings and Reporting”, to better discuss and disclose the assumptions and results of the ESG Statement.

According to the authors, given its complexity, the development, weighting choice, and preparation of ESG-based-VAIS should be delegated to independent external entities (such as Sustainalytics or MSCI), as in the case of the credit-risk rating agencies. These entities should be accredited by the EU commission, demonstrate independence, and ensure high-quality shared standards.

Although this is an expensive option that will charge an additional economic burden to the companies, it can be considered the best alternative to ensure transparency and avoid green-washing practices.

Combining mandatory ESG reporting and XBRL can be considered the natural and necessary subsequent step to ensure and enforce fair and comparable CSR disclosure. Therefore, this research addresses three complementary research questions and follows a modelling methodology to track the path for future shifts in the regulatory framework.

The model ensures compliance to different challenging needs as it is, at the same time:

- -Flexible enough, in the weighting attribution;

- -Structured to ensure comparability and consistency;

- -XBRL-based to enforce its preparation according to an international standard;

- -Scoring-oriented to provide a systematic uniform result.

Compared to the previous literature [22][23] that suggested combining existing integrated sustainability reporting, this research presents a feasible model to integrate and fit the ESG disclosure into a weighted, rating-oriented Income Statement. Empirical analyses using the proposed module will be separately demonstrated in future research (under development and almost completed).

References

- EU–Press Release. Commission Welcomes Provisional Agreement on the European Climate Law. Available online: https://ec.europa.eu/commission/presscorner/detail/en/ip_21_1828 (accessed on 21 April 2021).

- EU Extends Mandatory Sustainability Reporting to 50,000 Companies. Available online: https://www.esgtoday.com/eu-extends-mandatory-sustainability-reporting-to-50000-companies/ (accessed on 6 August 2021).

- Hoang, T. The role of the integrated reporting in raising awareness of environmental, social and corporate governance (ESG) performance. In Stakeholders, Governance and Responsibility. Emerald Publishing Limited; Emerald Publishing Limited: Bingley, UK, 2018.

- Escrig-Olmedo, E.; Muñoz-Torres, M.J.; Fernandez-Izquierdo, M.A. Socially responsible investing: Sustainability indices, ESG rating and information provider agencies. Int. J. Sustain. Econ. 2010, 2, 442–461.

- Du Rietz, S. Information vs knowledge: Corporate accountability in environmental, social, and governance issues. Account. Audit. Account. J. 2018, 31, 586–607.

- Băndoi, A.; Bocean, C.G.; Del Baldo, M.; Mandache, L.; Mănescu, L.G.; Sitnikov, C.S. Including sustainable reporting practices in corporate management reports: Assessing the impact of transparency on economic performance. Sustainability 2021, 13, 940.

- Dye, J.; McKinnon, M.; Van der Byl, C. Green gaps: Firm ESG disclosure and financial institutions’ reporting Requirements. J. Sustain. Res. 2021, 3.

- Landrum, N.E.; Ohsowski, B. Identifying worldviews on corporate sustainability: A content analysis of corporate sustainability reports. Bus. Strategy Environ. 2018, 27, 128–151.

- Rosati, F.; Faria, L.G. Addressing the SDGs in sustainability reports: The relationship with institutional factors. J. Clean. Prod. 2019, 215, 1312–1326.

- Diouf, D.; Boiral, O. The quality of sustainability reports and impression management. Account. Audit. Account. J. 2017, 30, 643–667.

- Hoitash, R.; Hoitash, U.; Morris, L. eXtensible Business reporting language: A review and directions for future research. XBRL Res. 2020, 1, 1–56.

- Beretta, V.; Demartini, M.C.; Lico, L.; Trucco, S. A tone analysis of the non-financial disclosure in the automotive industry. Sustainability 2021, 13, 2132.

- Corporate Sustainability Reporting. Available online: https://ec.europa.eu/info/business-economy-euro/company-reporting-and-auditing/company-reporting/corporate-sustainability-reporting_en (accessed on 6 August 2021).

- Faccia, A.; Manni, F. Financial Accounting: Text and Cases; Aracne Editrice: Rome, Italy, 2019.

- Mohana, R.P. Financial Statement Analysis and Reporting; PHI Learning Pvt. Ltd.: New Delhi, India, 2011.

- DeGennaro, M. An economic comparison of US GAAP and IFRS. J. Int. Bus. Law 2017, 16, 7.

- An Introduction to XBRL. Available online: https://www.xbrl.org/the-standard/what/an-introduction-to-xbrl/ (accessed on 11 June 2020).

- Apostolou, A.K.; Nanopoulos, K.A. Interactive financial reporting using XBRL: An overview of the global markets and Europe. Int. J. Discl. Gov. 2009, 6, 262–272.

- Weglarz, G. Two worlds of data unstructured and structured. Inf. Manag. 2004, 14, 19.

- O’Riain, S.; Curry, E.; Harth, A. XBRL and open data for global financial ecosystems: A linked data approach. Int. J. Account. Inf. Syst. 2012, 13, 141–162.

- Tsui, E.; Wang, W.M.; Cai, L.; Cheung, C.F.; Lee, W.B. Knowledge-based extraction of intellectual capital-related information from unstructured data. Expert Syst. Appl. 2014, 41, 1315–1325.

- Efimova, O.; Rozhnova, O.; Gorodetskaya, O. Xbrl as a tool for integrating financial and non-financial reporting. In The 2018 International Conference on Digital Science; Springer: Cham, Switzerland, 2019; pp. 135–147.

- Seele, P. Digitally unified reporting: How XBRL-based real-time transparency helps in combining integrated sustainability reporting and performance control. J. Clean. Prod. 2016, 136, 65–77.

More

Information

Subjects:

Business, Finance

Contributor

MDPI registered users' name will be linked to their SciProfiles pages. To register with us, please refer to https://encyclopedia.pub/register

:

View Times:

1.2K

Revisions:

2 times

(View History)

Update Date:

11 Aug 2021

Notice

You are not a member of the advisory board for this topic. If you want to update advisory board member profile, please contact office@encyclopedia.pub.

OK

Confirm

Only members of the Encyclopedia advisory board for this topic are allowed to note entries. Would you like to become an advisory board member of the Encyclopedia?

Yes

No

${ textCharacter }/${ maxCharacter }

Submit

Cancel

Back

Comments

${ item }

|

More

No more~

There is no comment~

${ textCharacter }/${ maxCharacter }

Submit

Cancel

${ selectedItem.replyTextCharacter }/${ selectedItem.replyMaxCharacter }

Submit

Cancel

Confirm

Are you sure to Delete?

Yes

No