| Version | Summary | Created by | Modification | Content Size | Created at | Operation |

|---|---|---|---|---|---|---|

| 1 | Saeed Solaymani | + 2834 word(s) | 2834 | 2021-07-07 07:49:56 | | | |

| 2 | Dean Liu | + 64 word(s) | 2898 | 2021-07-26 06:00:27 | | |

Video Upload Options

The National Renewable Energy Policy can be introduced as an important step in increasing the investment and extraction of renewable energy in the total energy mix. Furthermore, to increase the use of local renewable energy sources, increasing the share of renewable energy in the composition of electricity generation can be achieved through facilitating the growth of the renewable industry, ensuring the reasonable cost of renewable energy production and creating public awareness of the importance of sustainable energy and clean technology.

1. Introduction

The close and high relationship between production growth and energy consumption growth in the economy refers to the dependence of the economy on energy [1]. Thus, the economy is not only sensitive to energy supply and price shocks, but any initiative to conserve energy can have an impact on the performance of the economy.

However, the dependency on oil has declined with time in Iran as well as other countries due to the use of other energy sources, such as natural gas and renewable energies. While oil consumption has declined and been substituted by natural gas, the share of oil in total consumption is still high and the use of renewable energy resources is low due to low production. The share of renewable energy consumption in total final energy demand declined from 1.5% in 1980 to 0.58% in 2018. However, the country needs to achieve the diversity of energy resources and energy security, which are essential steps toward sustainable economic growth and social development.

To predict the energy mix, which includes all kinds of fossil fuel resources and available renewable options, it is necessary to take into account current and future energy demand and key figures relating to current energy resources. This study aims to review the status and current trends in potential resources and to investigate main policies in Iran to suggest some solutions to help the government to achieve its sustainable energy security goals. These suggestions can simplify the application of sustainable inventions, and formally examines how biomass can contribute to the structure of the energy mix in Iran.

The contribution of this study is that it investigates all kinds of energy sources in Iran, which compare to other studies that focus on renewable energy sources or specific energy. Along with reviewing current trends and policies, it estimates the relationship between energy demand and economic growth using an econometric model. Therefore, it makes a significant contribution to the literature as an in-depth study of all kinds of renewable energy sources and their policies since the late 1940s.

2. Current Energy Supply

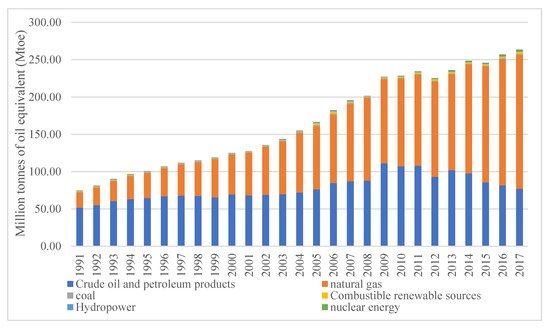

In terms of energy supply, Figure 1 represents the main component of the primary energy supply of various types of energy used in Iran. Natural gas has remained the largest contributor to Iran’s total final energy consumption since 2003, followed by crude oil. Interestingly, as a result of the abundance of fossil fuels in the country, the share of renewable energy sources in the same decade increased by 131.9% from 1.17 Mtoe (0.01 × 109 GJ) in 2008 to 2.7 Mtoe (0.12 × 109 GJ) in 2017. This may occur because of rising world crude oil prices, high concerns about the adverse environmental effects of fossil fuels or more use of these resources in remote areas of Iran.

In spite of various oil and energy laws and regulations, there is still no integrated, comprehensive, purposeful, long-term and coordinated study for the entire country. In this regard, Ghasemi et al. [2] stress the design of a new energy development mechanism, reducing political and economic risks to oil companies, establishing a system for monitoring and evaluating national energy information and the legal mechanism for negotiations, and finally, a specific fiduciary with the ability to pool resources to implement the strategies.

Despite several changes and revisions to energy policies in various documents, there has been a steady trend in economic growth, albeit with some challenges. In subsequent years, with the exception of negative growth rates in 2012, 2013 and 2015, real GDP growth (based on 2011 constant prices) fluctuated between 4% (in 2011) and 6.6% (in 2016) and in 2017 reached 3.5% [3]. , an increasing trend can be observed in the energy demand of four major energy consumers (residential, public and commercial, industry, transport and agriculture). While over the past few decades the transport sector has contributed more to total energy consumption than that of other sectors, the overall increase in the energy demand in recent years occurred with the increase in the share of the industrial sector relative to the other sectors.

As of March 2017, Iran’s total reserves of extractable liquid hydrocarbons, including crude oil and gas condensate, were estimated to be 160.1 billion barrels, an increase of 2.9% from the previous year, and the country’s natural gas reserves in 2017 were estimated at 33.3 trillion cubic meters, a decrease of 1.2% from the previous year. Besides this, in December 2017, total international oil reserves, including crude oil and gas condensate, were estimated at 1696.6 billion barrels [4].

The Ministry of Petroleum’s strategies in the production and supply of crude oil in the horizon of 2041 can be mentioned as follows: (1) increasing the recovery factor for the country’s oil fields using over-harvesting and conservation production methods, (2) maximum development and exploitation of all oil and gas fields, (3) the expansion of oil and gas exploration to support the country’s oil and gas production, (4) increasing capacity and maintaining the share of oil production in OPEC and the global market and (5) collecting and converting the associated crude oil gases at maximum capacity, taking into account economic and environmental considerations [5]. Moreover, the efforts of the National Oil Company and the Ministry of Petroleum should be to strengthen its global position in international markets so that it can play an important role in the international arena under appropriate circumstances. With regards to unconventional energy sources, scientific studies show that success in this area requires very close cooperation between national and international companies and the training of the labor force.

Iran’s most active oil and gas exploration and production areas are located in the south and west of the country. Most of the discovered fields are in the Zagros and the Persian Gulf regions (southwest of the country). Iran has 20 joint oil fields with neighboring countries, including five with Iraq, four with Saudi Arabia, one with Qatar, one with Oman, seven with the UAE, one with Turkmenistan and one with Kuwait [6]. The country needs the local and international capital and technology to use these enormous oil and gas resources.

The actions taken by the National Iranian Oil Company to supply crude oil to the energy stock market are a big step towards the maximum participation of private investors in the upstream oil and gas industries. The first shipment of Iranian light crude oil was offered in the international energy stock exchange ring in November 2017, and according to the plans, the gradual and regular supply of this valuable shipment of hydrocarbon was provided in the stock exchange [7].

Iran—taking advantage of its geographic location, being among the top oil and gas producers in the region, with the existence of a vast market for energy consumption and long and important transport pipelines that connect the southwest of the county and Persian Gulf (in the south) to the Caspian Sea and neighboring countries in the north, such as Russia and Turkey, and southwest to the east—is becoming an important regional storage and trade center, and can also use existing local resources to reduce its dependency on foreign distillates. The capacity of crude oil, petroleum products and gas condensate storage tanks at refineries across the country at the end of 2017 equaled 18,951, 45,058 and 5147 thousand barrels, respectively.

The country’s practical refining capacity is about 1.8 million barrels per day (bbl/d) in the 10 largest refineries. This capacity will increase with the completion of two projects of 0.4 million barrels per day at the Persian Gulf Star in the south and 0.2 million barrels per day in the Kermanshah province. It is projected to increase the capacity of current refineries by 0.5 million barrels per day or to improve the quality of their products in the future [4].

We can conclude that Iran has a significant potential capacity for crude oil and natural gas reserves, its transport and storage. It can increase the weak flexibility of the energy system by constructing more transition lines and braking swap with its neighbors [8]. This makes a significant contribution to the export and transport of crude oil regionally and internationally.

As of December 2017, 22 onshore and offshore gas fields were active, including 18 onshore and four offshore gas fields [9]. The natural gas transmission system plays a decisive role in the supply of gas to consumers. The main components of this system are gas transmission lines, gas pressure-raising and reducing facilities and distribution networks [10]. At the end of 2017, more than 38.4 thousand kilometers of gas transmission lines have been constructed and 288 turbochargers are operating in 81 gas pressure boosting stations in the country [11].

According to the country’s energy policy, efforts have been made to use natural gas in power plants because of ease of operation, lower maintenance costs and less adverse environmental effects [10]. The largest consumer of natural gas is the residential sector (39.1%), followed by industry (24.9%) and petrochemical (21.8%) [9]. The Iranian share of the field is 14 trillion cubic meters of in situ gas and 18 billion barrels of gas condensate (9 billion barrels of recoverable gas), which represents 50% of Iran’s proven natural gas reserves and 8% of the world’s gas reserves [9]. In this regard, Iran has been exporting gas to neighboring countries for many years, having enough gas for domestic consumption and export.

This leads us to the conclusion that natural gas is a major contributor to final energy consumption. Due to the lack of storage possibilities for renewable energy, natural gas, as the least polluting fossil fuel, fills the gaps in the renewable energy supply [12]. The country with high reserves from this source can be one of the world’s leading exporters of natural gas. If the country wants to be effective in the international natural gas market, despite the use of advanced technologies and more investment, it must provide clear policies in this industry and try to reduce its barriers at the regional and international levels.

Iran’s total definite coal reserves measured by 203 mines in 2017 were 1143 million tons with a majority of coking coal [4]. Despite the relatively large coal resources in Iran, coal mining is unfortunately weak and coal imports are therefore high. This is due to the lack of an appropriate mining strategy, old mining technology, the lack of public sector support to these mines for the equipment and modernization of machines and the use of modern technologies [11]. These challenges have reduced the attractiveness of investment in the mining sector, particularly in coal mines.

Due to the abundance of oil and gas resources in Iran and its general policies, there is no desire to establish and invest in the construction of coal-fired power plants. The only coal-fired power plant project is underway in Tabas and its implementation and operation For this reason, from an energy perspective, coal has not been more considered in Iran, and the main use of coking coal is attributed only to the Isfahan steel plant, where steel and steel products are produced using the blast furnace method. Therefore, coal as an abundant and relatively reliable source with a stable price in the country can play the most important role in achieving this goal.

We can deduce that while the country’s oil and gas resources are high, it makes no sense to import coal from other countries with a high inventory of coal resources. Therefore, there is a need to amend the upstream energy documents to include coal sources in these documents in order to develop sustainable and effective policies for this industry.

Wind energy is produced by generating electrical energy from wind or airflow, which occurs naturally in the earth’s atmosphere, with windmills or wind turbines. Regarding wind energy potential, 1.3% of Iran’s land (2.1 million hectares) has an average annual wind speed of 8 m per second and above, which makes these areas capable of exploiting this energy source [13]. According to the Atlas of the Renewable Energy and Energy Efficiency Organization (SATBA), the amount of wind energy that can be extracted in the country is estimated at 18,000 MW in all surveyed areas [14]. The provinces with strong wind energy potential in the country are Gilan, Southern Khorasan (especially Doruh and Khaf regions), Sistan and Balochistan (especially the northern region of Zabol), Semnan and Qazvin, where most of the country’s wind farms have been built so far [9].

This will not only make it possible to use alternative gas (or liquefied petroleum gas) in other applications that have higher economic benefits, but also contribute to improved air quality in large cities. The future of Iran’s economy can be planned based on recognized and predictable electricity costs because that electricity comes from indigenous energy and is free from all the security, political, economic and environmental problems associated with oil and gas. The economic growth and population rise show that energy demand is increasing rapidly in Iran. It is estimated that approximately 10 million watts of energy are continually available in the world’s wind [15] while the total installed global capacity was 60.4 GW in 2019, an increase of 19% from 2018 [16].

Currently, the Ministry of Energy is offering a 20-year Feed-in-Tariff (FIT) contract for renewable energy at rates higher than the selling price of electricity to end consumers. In other words, for power plants with a capacity of less than 10 MW, the rate for wind energy is IRR 7644 per kilowatt-hour, IRR 8918 per kilowatt-hour for solar and geothermal energy and an average of IRR 6930 per kilowatt-hour for various biomass power plants [13]. In recent years, local and foreign investors have installed approximately 350 MW of renewable energy in Iran through the electricity purchase agreement mechanism, while several other energy farms with a total capacity of approximately 700 MW are in various stages of development [13].

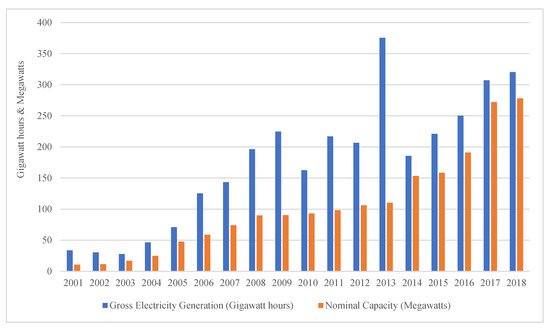

Figure 2 represents the trends of wind energy generation and the capacity of wind power plants in Iran. In recent years, there has been significant growth in wind energy production: 186 GWh in were produced in 2014, 223 GWh in 2015, 250 GWh in 2016, 308 GWh in 2017 and 320 GWh in 2018. Achieving an acceptable share of the expected target (4 GW by 2021) requires extensive research and significant operational action, and extensive research has been conducted on various dimensions of wind energy in Iran.

We can conclude that Iran’s electricity capacity is high and this can help to increase the share of wind energy in the total primary supply of energy. To achieve long-term electricity targets, it is necessary to provide incentives to private investors and to put in place clear and stable policies. The country’s electricity demand is growing rapidly due to economic and population growth. Therefore, Iran must make an important decision for the future of the country’s environment and electricity generation, particularly through the use of renewable energy resources.

With average rainfall one-third of the global average, Iran is one of the top arid and semi-arid countries in the world [4]. Accordingly, the inadequate temporal and spatial distribution of rainfall is perhaps the most important reason to build dams in Iran. For this reason, hydropower cannot be considered a reliable and sustainable source of electricity generation in the country—but hydropower plants play an effective role in controlling the frequency of the grid.

Hydroelectric facilities in Iran are more than centers for producing renewable energy. Hydroelectric dams also play an important role in socio-economic development, such as irrigating agricultural fields, providing adequate water supply, especially during drought seasons, controlling the situation during the monsoon period and the improvement of major waterways. Currently, electricity is the only renewable energy that is commercially available on a large scale in Iran. The hydropower resources and potential are estimated at 26,000 MW, most of which is provided by the Karun, Karkheh and Dez rivers [18].

Hydroelectricity accounts for about 98.8% of total renewable energy in the country [10]. As of 2017, a total of 15,329.1 GWh of hydropower was generated, which has a share of 5% of total electricity generated and 0.30% of the total energy supply in the country, while on the global scale, hydropower contributes 16.6% of the total energy produced [11]. Table 1 shows total electricity generation and its share of total energy supply in Iran and selected countries and regions in 2016. As can be seen, Iran derives a small portion of its electricity from hydropower compared to other countries and regions.

| Country/Region | Total Generation | Hydropower | Share (%) |

|---|---|---|---|

| Iran | 308.3 | 15.4 | 5 |

| Turkey | 274.4 | 67.2 | 24.5 |

| Pakistan | 114 | 36.6 | 32.1 |

| Europe | 4941.5 | 823.1 | 16.7 |

| Asia | 9796.9 | 1587.9 | 16.2 |

| Middle East | 1147.2 | 21.2 | 1.9 |

| United States of America | 4322 | 292.1 | 6.8 |

| World | 25,082 | 4170 | 16.6 |

The amount of electricity production by hydropower is not stable and depends on the amount of annual rainfall. Therefore, it is used only to help the system in peak times. Since Iran is a country with an abundance of fossil fuels, the choice of the type of power plant seems to be based only on the primary investment and the availability of its primary inputs, which is pointed out in some studies. For example, based on various indicators, Manzoor and Rahimi [19] showed that Iran’s priorities for construction and investment in electricity generation and power plants in the future include, in order, wind energy, hydropower, photovoltaic energy, combined-cycle power plants, nuclear power plants and thermal power plants.

References

- Ministry of Energy. Energy Balance 2017; Ministry of Energy: Tehran, Iran, 2020.

- Ministry of Energy. Energy Statistics and Charts of Iran and the World 2017; Ministry of Energy: Tehran, Iran, 2020.

- Central Bank of Iran. National Accounts; Central Bank of Iran: Tehran, Iran, 2020.

- Ministry of Energy. Energy Balance 2017; Ministry of Energy: Tehran, Iran, 2020.

- Vice President of Legal Affairs. Resolution of the High Energy Council Regarding the National Document of the Country’s Energy Strategy; Vice President of Legal Affairs: Tehran, Iran, 2016.

- Ghaedizadeh, N.; Khalili Dizaji, H. Status of Iran’s Common Oil and Gas Reservoirs from the Perspective of International Law. Mon. Oil Gas Explor. Prod. 2014, 110, 3–8.

- National Iranian Oil Company. Supply of 6 Million Barrels of Crude Oil and Gas Condensate in the Energy Exchange; National Iranian Oil Company: Tehran, Iran, 2019; Available online: (accessed on 25 June 2021).

- Dudlák, T. After the sanctions: Policy challenges in transition to a new political economy of the Iranian oil and gas sectors. Energy Policy 2018, 121, 464–475.

- Ministry of Energy. Energy Statistics and Charts of Iran and the World 2017; Ministry of Energy: Tehran, Iran, 2020.

- Ministry of Energy. An Overview of 30 Years of the Country’s Energy Statistics; Ministry of Energy: Tehran, Iran, 2020.

- Ministry of Energy. Time Series for Iran’s Energy Balances; Ministry of Energy: Tehran, Iran, 2020.

- Sadik-Zada, E.R.; Gatto, A. Energy Security Pathways in South East Europe: Diversification of the Natural Gas Supplies, Energy Transition, and Energy Futures. In From Economic to Energy Transition. Energy, Climate and the Environment; Mišík, M., Oravcová, V., Eds.; Palgrave Macmillan: Cham, Switzerland, 2021.

- Azadi, P.; Nezam Sarmadi, A.; Shirvani, T. The Outlook for Natural Gas, Electricity, and Renewable Energy in Iran; The Stanford Iran 2040 Project, Working Paper No. 3; Stanford University: Stanford, CA, USA, 2017.

- Renewable Energy and Energy Efficiency Organization (SATBA). Annual Report on Renewable Energy and Employment-2018; SATBA: Tehran, Iran, 2020.

- Najafi, G.; Ghobadian, B. LLK1694-wind energy resources and development in Iran. Renew. Sustain. Energy Rev. 2011, 15, 2719–2728.

- Global Wind Energy Council. Annual Global Wind Report (2019); Global Wind Energy Council: Brussels, Belgium, 2020.

- Skandari Shabani, S.; Maki, S.V. Hydropower plants. In Proceedings of the 3rd International Conference on Science and Engineering, Istanbul, Turkey, 2 June 2016; Available online: (accessed on 25 June 2021).

- Manzoor, D.; Rahimi, A. Prioritization of power plants in Iran using multidisciplinary decision models. Iran. J. Energy Econ. 2015, 4, 191–215.