| Version | Summary | Created by | Modification | Content Size | Created at | Operation |

|---|---|---|---|---|---|---|

| 1 | André Quites Ordovás Santos | + 2835 word(s) | 2835 | 2021-05-19 08:54:58 | | | |

| 2 | Nora Tang | Meta information modification | 2835 | 2021-06-18 06:08:27 | | |

Video Upload Options

With the current worsening of climate change-associated risks, the transition to low-carbon energy sources has become a global priority. In this context, the advances in the implementation of smart grids, which, in addition to greater efficiency and resilience, also allow greater penetration of renewable distributed energy resources, are becoming increasingly important. However, the necessary investments will be colossal. Many specialists see the process of opening up the electric energy markets as essential to boosting these new technologies. Greater decentralization of the decision-making process can potentially promote greater scalability. However, not all liberalization reforms have led to good results. Several researchers have been evaluating experiences in different countries. Brazil, a country with continental dimensions and peculiar characteristics, already counts with a mostly renewable electric energy generation mix. In recent decades, however, it has become increasingly dependent on fossil fuel sources. Brazil has been conducting a process of opening the electric energy market since the 1990s. This process has faced a series of barriers. This article presents a critical bibliographic review of the Brazilian Power System history and its ongoing opening process, its possible successes and errors, as well as its perspectives and challenges.

1. Introduction

With the growing concerns regarding the global environmental crises, the international pressure for greater energy efficiency, and the transition to energy sources with lower Greenhouse Gases (GHG) emissions are growing expressively. This transition, although already underway, will still require huge investments, and the resolution of technological, regulatory, and political barriers (Wallace-Wells 2019) [1][2][3][4][5][6][7].

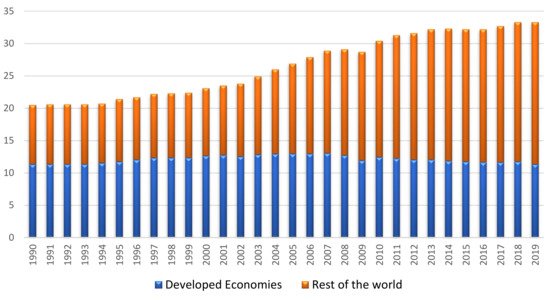

By the year 2019, data from the International Energy Agency (IEA) show that global emissions have been growing. Although it has been reduced in developed countries, as shown in Figure 1, in developing countries, the growth in demand is still essential for improving the living conditions of low-income populations. As a result, it is estimated that there will be a large increase in the demand for Electric Energy in the coming decades, which naturally requires accelerating transitions to sources with low emissions [1][8][9].

Figure 1. CO2 emissions for power generation in Giga Tons (Source: IEA (2020), Global CO2 emissions in 2019, IEA, Paris https://www.iea.org/articles/global-co2-emissions-in-2019 as modified by the authors. All rights reserved) [10].

The transition to renewable sources with low emissions is a major challenge, since, currently, fossil fuel sources still dominate the world electric energy mix. Brazil, despite its dimensions and its enormous electrical system, already has renewable sources in more than 80% of its electrical energy mix. The country still has great untapped potential in terms of renewable sources with low emissions, such as hydroelectric, solar, and wind power, being considered the country with greater renewable energy density [11][12][13][14][15][16][17][18][19][20][21].

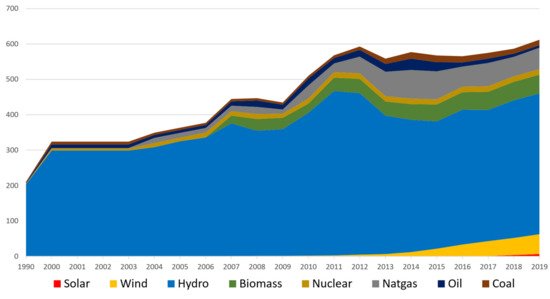

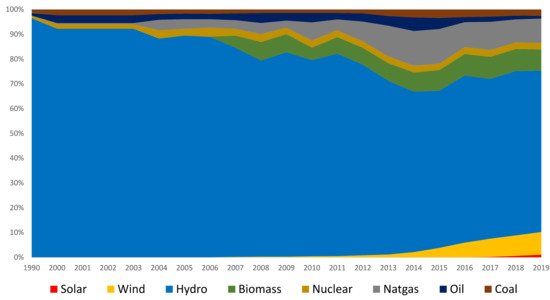

However, paradoxically, the Brazilian electric energy mix, since the 1990s, has shown strong growth in thermoelectric plants with fossil fuel sources, as can be seen in Figure 2 and Figure 3. Hydro generation, which corresponded to 82.9% of the national electricity generation in the 1990s, fell to just over 60% in 2019, fortunately, compensated, in part, by the strong and surprising growth of wind generation since 2007. Furthermore, solar sources, although inexpressive, have been growing exponentially. Studies point to a series of political and regulatory barriers as a cause for this growth of fossil fuel sources. In the last decade, there were also periods when the Brazilian electric energy tariff was among the highest in the world, despite the low marginal costs of the Hydroelectric Plants (HPP), still prevalent in the Brazilian Power System (BPS) [11][14][22][23][24][25][26][27][28][29].

Figure 2. Brazilian electricity generation—composition (TWh).

Figure 3. Brazilian electricity generation—percentage composition (%).

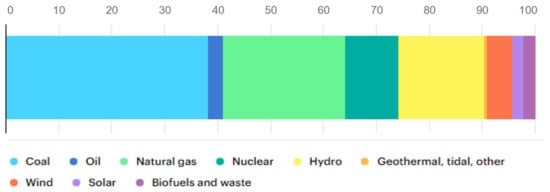

In the world electrical generation mix, as shown by Figure 4, fossil fuel sources still have a large predominance, making it essential to invest in new alternatives, such as solar and wind sources. In Brazil, with the increasing difficulties in building large HPPs, with reservoirs, investment in these new sources is also essential. However, in addition to the high installation costs (costs in rapid decline), the fact that they are intermittent sources, the generation of which depends on meteorological variables, makes the significant increase in the penetration of such sources a major technical, economic, and regulatory challenge. Challenges can only be overcome with the modernization of the electrical system, with the consolidation of the so-called Smart Grids (SG). In addition to the huge financial investments, SG consolidation also involves considerable technical and, above all, regulatory challenges [4][5][7][9][14][30][31][32][33][34][35][36][37].

Figure 4. World gross electricity production, by source, 2018 (Source: IEA (2020), World gross electricity production, by source, 2018, IEA, Paris https://www.iea.org/reports/electricity-information-overview as modified by the authors. All rights reserved) (adapted from [38]).

The energy market has spent almost the entire 20th century being considered a natural monopoly, or a set of verticalized natural monopolies, within the parameters established by Samuel Insull [4][39][40]. The great complexity of managing future SGs is increasingly demanding the design of new business models, especially seeking greater decentralization and flexibility. The first reforms of the electric energy market started in the last decades of the last century, highlighting the successful experiences of the Chilean and especially the British reform [14][22][41][42][43][44].

In Brazil, the first liberalizing reforms began in the 1990s, at a time of great crisis in the BPS. With the state with no financial resources to invest and the system at serious risk of collapse, the privatization and the partial liberalization of the BPS proved to be important alternatives for attracting investments. However, several mistakes were made, with the reform being considered an unfinished reform, creating supply risks and culminating in 2001 rationing [14][42][45][46][47][48].

In the following 20 years, some important adjustments were carried out. These adjustments, however, proved insufficient, and, in some cases, created additional complex distortions. There have also been some setbacks in the liberalization process, which have brought even more complexities. The liberalization process that started in the 1990s is still ongoing, with the implementation of the retail electric energy market scheduled for 2024 [14][22][24][48][49][50].

According to the 10-Year Energy Expansion Plan (PDE) 2029 [11], a report authored by the Energy Planning Enterprise (EPE), an organization that provides research services to the Brazilian Ministry of Mines and Energy (MME) in order to subsidize the planning of the energy sector, the efficient insertion of Distributed Energy Resources (DERs) in the BPS, together with the digitalization of the sector, has revolutionary potential. Moreover, the opening of the free energy market is considered the centerpiece for making this revolution possible [11][51].

This article presents a brief history of the BPS, evaluating its diverse singularities and its evolution until the reforms underway, also discussing its perspectives, and making comparisons with international experiences. Section 2 briefly describes the history of the BPS, until the beginning of liberalizing reforms. In Section 3, the ongoing reforms in BPS are described and analyzed in more detail. The current challenges, weaknesses, and strengths of the ongoing reform are discussed in Section 4. The applicability of reform initiatives from other countries to the BPS is also assessed. Finally, Section 5 presents the final considerations.

2. The Brazilian Electric Sector and Its Evolution

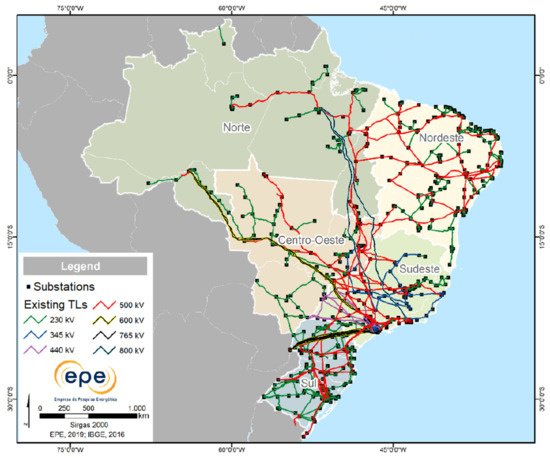

In contrast to the world electrical energy mix, as already mentioned, Brazil already has a predominance of renewable sources, although this predominance has weakened in the latest two decades. BPS is already almost all interconnected, forming the so-called National Interconnected System (NIS). Only about 2% of the BPS is not yet integrated into the NIS, especially in the Amazon rainforest region. Since its first decades, BPS has always had a predominance of hydroelectric power sources. Many HPPs built between the 1970s and 1990s have large associated reservoirs, providing BPS with good storage capacity. Several of these HPPs are cascaded. Sometimes, what would constitute the optimal for a single HPP could negatively impact the performance of others. Thus, the synergy considerations in the optimal use of water are essential. Some old studies estimate there can be an energy production surplus of up to 20% in the country as a whole, due to the coordinated operation of the generation plants, compared to individualized operations (although some specialists have recently questioned these figures) [14]. All large HPPs are already interconnected with each other and with consumer markets through one of the largest high voltage transmission networks in the world. The BPS is also known for its continental dimensions, with its large number of interdependent HPPs extending over different hydrographic basins, covering a great diversity of rainfall and river regimes. The Figure 5 shows the NIS map, with data from 2019 [11][12][14][47][48].

Figure 5. Brazilian National Interconnected System (NIS) Map 2019 (adapted from [11]).

To have an idea of the dimensions of the BPS, the total value of energy sales to consumers of all classes, by companies in the sector’s productive chain in 2016, in regulated and free markets, without taxes, reached approximately R$190.00 billion (US$54.44 billion, using the 2016 average exchange rate). Including taxes, BPS’s gross revenue would be R$250 billion (US$71.63 billion, again using the 2016 average exchange rate). This figure came to represent about 4% of the country’s GDP. In November 2020, BPS had an installed capacity of approximately 174 GW, with a total of 9012 generation plants, of which 222 are HPPs with more than 30 MW, in addition to 1290 smaller HPPs with less than 30 MW [14][52].

The electricity sector, as we know it today, initially structured at the beginning of the 20th century, is still predominantly composed of large generating units, generally distant from the consumption locations, with energy transported through long transmission lines. The entire business chain was usually monopolized by energy companies or electric utilities. Such companies typically either belonged to national governments, or were public companies managed by private investors, or regulated public concessions, owned by private investors, being considered strategic assets of the country’s infrastructure. This verticalized, monopolized, and strongly regulated market model promoted enormous growth in the world electrical system for decades, with generally satisfactory results, although with great variation between countries. Its performance was generally much better in developed countries [22][43][44][45][53].

Brazil, like other developing countries, has been investing in the modernization of the power system, already counting on pilot projects for SGs. However, the development of these networks has been slower than in developed countries, and the challenges posed by the huge investments required depend largely on the restructuring of the electric energy market. To better understand the complexity and particularities of this challenge, the understanding of the historical context of the BPS is valuable, which will be briefly summarized below [14][54][55].

BPS was initially developed, until the 1930s, under private capital, especially foreign capital, in the phase known as the Good Old Years. The foreign presence started as early as 1879, with the first public experience of electric lamps in Rio de Janeiro promoted by scientist Thomas Edison. At that time, there was no national regulation for the activity [22][47][54].

Between the 1930s and 1980s, the State maintained an almost exclusive participation in the BPS. The nationalization process started in 1931, with the decree 20.395 of 15 September drafted, consolidated later with the entry into force of the so-called Water Code in 1934. The nationalization of energy supply ventures became a priority, including the nationalization of foreign companies. This period has been called the Developmentalist or Nationalist Period. In the period of the so-called Brazilian Miracle alone, between 1969 and 1973, the BPS grew by around 200%, with vertical monopolies and tariffs regulated by the cost of the service. The centralized coordination in this period allowed to take advantage of economies of scale. However, there was no competition, and the tariff policy did not encourage efficiency [22][47][48][54].

Despite problems related to inflationary corrections in some periods and the low quality and efficiency frequently observed, this model worked reasonably well for decades, self-financing and expanding, until 1979 when the crisis of the second oil shock occurred. In an attempt to mitigate its effects, the state chose to use the infrastructure segment as an instrument of economic policy. Measures were adopted, such as freezing tariffs to contain inflation. Although their costs rose dramatically, state-owned energy companies were not allowed to raise their tariffs. The situation worsened with the difficulty of attracting external resources. As a result, from 1985 on, there was a chain of cases of default in the BPS [14][22][47].

The consequences were not more severe only due to the great recession in which the country plunged, which significantly reduced the energy demand [22].

In the 1990s, with BPS’s companies accumulating debts totaling 50 billion dollars, it was clear that they were no longer able to finance themselves, and neither would the state. With the new social and economic order established with the re-democratization of the country, the process of restructuring the BPS began with a liberal bias based on article one hundred and seventy of the then-new Federal Constitution, which was founded upon the “valorization of human work and free enterprise”. The reforms started out guided by three basic principles: (1) Privatization; (2) unbundling; and (3) efficiency. This was intended to create a favorable environment for private investments in the sector, through the concession regime [22][45][47].

Thus, the objective was to reduce the economic weight of the State, allowing a greater focus on areas such as education, health, and security. In this way, the public administration would start to focus on inspection and regulation activities [22].

In 1995, the Brazilian government developed a plan to restructure the BPS through a reform guided by an international consultancy with experience in other countries, financed by the World Bank. The winning proposal was that of the British consultancy Coopers & Lybrand. Studies carried out by the consultancy together with Brazilian experts produced a whole diagnosis of the sector, identifying activities that admitted competition and those that, because they are natural monopolies, did not. The latest included transmission and distribution activities, which, because they consist of industries that depend on large networks, would require the duplication of a whole infrastructure to allow competition, a phenomenon Samuel Insull had identified a century before. The generation and commercialization activities did not present any impediments to competition. Although the reform followed many good practices from internationally successful models, several shortcomings were later identified. Above all, specialists usually point out the insufficient planning of the reform and the excessive confidence in the determinations of a foreign consultancy, accustomed to another reality of electrical system, to the detriment of the local technicians. That opinion is shared not only by Brazilian specialists [14][23][45], but also by scholars of other countries, like Joskow [42]. The models implemented have received criticism for not adequately considering the peculiarities of a predominantly hydroelectric system, with plants with large interconnected and cascading reservoirs. Instead, they seemed to have been based mainly on the British experience, a country with a large predominance of thermoelectric plants [14][22][42][47].

Electricity generation started to be regulated by a new body, the National Electric Energy Agency (ANEEL). Energy commercialization activities, on the other hand, could be carried out by the generators themselves or by commercialization agents, the traders, who act as intermediaries. They can resell energy to other generators, large consumers, or other traders [22].

Under the BPS’s New Model, two types of consumers were admitted: Regulated or captive consumers, and free consumers. Free consumers now have the right to buy electricity directly from specific generators or through traders, through free negotiation of prices, terms, and quantity, and can choose their suppliers. Captive consumers, on the other hand, continued without any power to choose, being obliged to consume energy from the local distribution concessionaire, with a tariff regulated by ANEEL. The legislation established the minimum load limit of 3 MW and 69 kV, in 1995, for new consumers who could choose to become free consumers. The intention would be to start with larger consumers, to gradually improve the system, before admitting smaller consumers to the new free market, which is naturally more complicated and with more risks. The same legislation was provided for the revision of these minimum limits after five years, with the idea of gradually reducing these limits, admitting smaller and smaller consumers, until all consumers could be free [14][22][50].

In addition to ANEEL, the New Model established two other key new institutions: (1) The Wholesale Energy Market (MAE), responsible for managing contracts between the various agents and determining the value of the energy sold; (2) the National System Operator (ONS), solely responsible for the control and coordination of transmission and generation activities for the entire national system [14][22][48].

There were several errors in the reform process, such as not having been banned for companies of the same group to operate in different market segments, a ban implemented in other countries that had also gone through the unbundling process. It allowed the so-called self-dealing, when a private distributor breaks a contract with a cheaper, state-owned generator, opting for a private generator, much more expensive and owned by the same economic group as the buyer, generating real scandals. Despite these errors and some scandals, the reform did in fact allow the return of investments in the sector [14][22][41].

In 2001, however, an energy crisis caused by low affluence, which compromised the level of the hydroelectric reservoirs, a crisis aggravated by the precarious situation of the distribution system and the then low diversity of the national electrical generation mix, resulted in rationing that continued until 2002. The new institutional design came to be questioned as an “unfinished reform”. As a result, the need for changes focusing on the security of supply became clear. The dissatisfaction generated contributed to the election of the opposition in 2002 [22][24][47].

References

- Wallace-Wells, D. A Terra Inabitável: Uma História do Futuro, 1st ed.; Companhia das Letras: New York, NY, USA, 2019.

- Tan, Z. Air Pollution and Greenhouse Gases; Springer: Waterloo, ON, Canada, 2014.

- Nolan, C.; Overpeck, J.T.; Allen, J.R.; Anderson, P.M.; Betancourt, J.L.; Binney, H.A.; Brewer, S.; Bush, M.B.; Chase, B.M.; Cheddadi, R.; et al. Past and future global transformation of terrestrial ecosystems under climate change. Crit. Stud. Secur. 2018, 2, 210–222.

- Fox-Penner, P. Smart Power Anniversary Edition: Climate Change, the Smart Grid, and the Future of Electric Utilities, 1st ed.; Island Press: Washington, DC, USA, 2010.

- Galvin, R.W.; Yeager, K.E.; Stuller, J. Perfect Power: How the Microgrid Revolution will Unleash Cleaner, Greener, and More Abundant Energy; McGraw-Hill: New York, NY, USA, 2009.

- Hatziargyriou, N. Microgrid: Architectures and Control; John Wiley & Sons, Ltd.: West Sussex, UK, 2014.

- Hall, C.A.S.; Klitgaard, K. Energy and the Wealth of Nations: An Introduction to Biophysical Economics; Springer International Publishing: Cham, Switzerland, 2018.

- Global, Regional, and National Fossil-Fuel CO2 Emissions (1751–2014) (V.2017) (Dataset)|OSTI.GOV n.d. Available online: (accessed on 14 May 2020).

- Louie, H. Off-Grid Electrical Systems in Developing Countries; Springer International Publishing: Seattle, WA, USA, 2018.

- IEA. Global CO2 Emissions in 2019—Analysis—IEA n.d. Available online: (accessed on 14 May 2020).

- Plano Decenal de Expansão de Energia 2029; Ministério de Minas e Energia E de PE (EPE): Brasília, DF, Brasil, 2020; Volume 1.

- Mapa do Sistema Interligado Nacional. O Que é o Sist Interligado Nac 2019:1; EPE: Brasília, DF, Brasil, 2019.

- Leitão, M. História do Futuro; Editora Instrínseca: Rio de Janeiro, Brazil, 2015.

- Oliveira, A.; de Salomão, L.A. Setor Elétrico Brasileiro: Estado e Mercado, 1st ed.; Synergia Editora: Rio de Janeiro, Brazil, 2017.

- Balanço Energético Nacional 2009: Ano base 2008; EPE: Brasília, DF, Brasil, 2009.

- Balanço Energético Nacional 2010, Ano Base 2009; Ministério de Minas e Energia E de PE (EPE): Brasília, DF, Brasil, 2010.

- Balanço Energético Nacional 2011: Ano Base 2010; EPE: Brasília, DF, Brasil, 2011; Volume 72.

- Balanço Energético Nacional 2012: Ano base 2011; Ministério de Minas e Energia E de PE (EPE): Brasília, DF, Brasil, 2012.

- Ministério de Minas e Energia E de PE (EPE). Balanço Energético Nacional 2013: Ano Base 2012; Empresa de Pesquisa Energética (EPE): Brasília, DF, Brasil, 2013.

- Balanço Energético Nacional 2014: Ano Base 2013; Ministério de Minas e Energia E de PE (EPE): Brasília, DF, Brasil, 2014.

- Balanço Energético Nacional 2015: Ano Base 2014; Ministério de Minas e Energia E de PE (EPE): Brasília, DF, Brasil, 2015.

- Schror, J.M. Abertura do Mercado Livre de Energia Elétrica, 1st ed.; Synergia: Rio de Janeiro, Brazil, 2018.

- Nogueira, A.C.M.L.; Bertussi, G.L. O setor de energia elétrica brasileiro e a perspectiva de uma reforma setorial. Rev. Univ. Fed. Minas Gerais 2020, 26, 16–45.

- Polito, R. Setor Elétrico Brasileiro 2012–2018: Resiliência ou Transição, 1st ed.; Editora Synergia: Rio de Janeiro, Brazil, 2018.

- Balanço Energético Nacional 2006; EPE: Brasília, DF, Brasil, 2006.

- Balanço Energético Nacional 2007; Ministério de Minas e Energia E de PE (EPE): Brasília, DF, Brasil, 2007.

- Balanço Energético Nacional 2008; Ministério de Minas e Energia E de PE (EPE): Brasília, DF, Brasil, 2008.

- Balanço Energético Nacional 2019 Relatório Síntese|Ano Base 2018; Ministério de Minas e Energia E de PE (EPE): Brasília, DF, Brasil, 2019.

- Balanço Energético Nacional 2020 Relatório Síntese|Ano Base 2019; Ministério de Minas e Energia E de PE (EPE): Brasília, DF, Brasil, 2020.

- Andoni, M.; Robu, V.; Flynn, D.; Abram, S.; Geach, D.; Jenkins, D.; McCallum, P.; Peacock, A. Blockchain technology in the energy sector: A systematic review of challenges and opportunities. Renew. Sustain. Energy Rev. 2019, 100, 143–174.

- Parag, Y.; Sovacool, B.K. Electricity market design for the prosumer era. Nat. Energy 2016, 1.

- Sechilariu, M.; Locment, F. Chapter 1—Connecting and Integrating Variable Renewable Electricity in Utility Grid. In Urban DC Microgrid; Sechilariu, M., Locment, F., Eds.; Butterworth-Heinemann: Oxford, UK, 2016; pp. 1–33.

- Energy, I.; Iea, A. Global Energy Review; IEA Publications: Paris, France, 2020.

- EPE. Potencial dos Recursos Energéticos no Horizonte 2050; EPE: Brasília, DF, Brasil, 2018.

- Lopes, F.; Coelho, H. Electricity Markets with Increasing Levels of Renewable Generation Structure, Operation, Agent-Based Simulation, and Emerging Designs; Springer: Cham, Switzerland, 2018.

- Kirschen, D.S.; Strbac, G. Fundamentals Of Power System Economics, 2nd ed.; John Wiley & Sons Ltd.: Hoboken, NJ, USA, 2019.

- Joskow, P.L. Challenges for wholesale electricity markets with intermittent renewable generation at scale: The US experience. Oxf. Rev. Econ. Policy 2019, 35, 291–331.

- IEA Electricity Information 2019—Analysis—IEA. Available online: (accessed on 2 November 2020).

- Munson, R. From Edison to Enron: The Business of Power and What it Means for the Future of Electricity; Praeger Publishers: Westport, CT, USA, 2005.

- Falcão, D.M. Smart Grids E Microredes: O Futuro Já É Presente. VIII Simpase 2009, 1–11.

- Sioshansi, F.P. Competitive Electricity Markets—Design, Implementation, Performance, 1st ed.; Elsevier: Kidlington, Oxford, UK, 2008.

- Joskow, P.L. Lessons learned from electricity market liberalization. Energy J. 2008, 29, 9–42.

- Mayer, K.; Trück, S. Electricity markets around the world. J. Commod. Mark. 2018, 9, 77–100.

- Hunt, S. Making Competition Work in Electricity; John Wiley & Sons: New York, NY, USA, 2002.

- Goldenberg, J.; Prado, L.T.S. Reforma e crise do setor elétrico no período FHC. Tempo Soc. 2003, 15.

- Daza, E.F.B. SETOR ELÉTRICO BRASILEIRO: Uma Visão Regulatória e Econômica das Principais Empresas Pré MP 579; Simplíssimo: Porto Alegre, Brazil, 2019.

- Rodrigues, E.J. Setor Elétrico Brasileiro—Estrutura, Funcionamento, Instituições e Perspectivas para o Controle, 2nd ed.; Seven Systems International Ltd.a.: São Paulo, Brazil, 2013.

- Lima, S.A.J. A Energia Elétrica no Brasil e a Inevitável Abertura do Setor; Independent publication on Amazon Kindle: Strasbourg, France, 2016.

- Schor, J.M.D.C. Aplicação do Retail Wheeling ao Setor Elétrico Brasileiro: Vantagens e Possibilidades. Master’s Thesis, Universidade Federal de Pernambuco, Recife, Brazil, 2016.

- Machado, O. Comercializador Varejista: Agora vai? Canal Energ 2019. Available online: (accessed on 19 May 2020).

- Quem Somos, n.d. Available online: (accessed on 23 September 2020).

- ANEEL. Informações de Geração—ANEEL n.d. Available online: (accessed on 3 November 2020).

- Lin, J.; Magnago, F.H. Electricity Markets: Theories and Applications; John Wiley & Sons, Inc.: Hoboken, NJ, USA, 2017.

- Ponce-Jara, M.A.; Ruiz, E.; Gil, R.; Sancristóbal, E.; Pérez-Molina, C.; Castro, M. Smart Grid: Assessment of the past and present in developed and developing countries. Energy Strateg. Rev. 2017, 18, 38–52.

- Dantas, G.d.A.; de Castro, N.J.; Dias, L.; Antunes, C.H.; Vardiero, P.; Brandão, R.; Rosental, R.; Zamboni, L. Public policies for smart grids in Brazil. Renew. Sustain. Energy Rev. 2018, 92, 501–512.