Your browser does not fully support modern features. Please upgrade for a smoother experience.

Please note this is an old version of this entry, which may differ significantly from the current revision.

The Paris Agreement’s objectives related to climate change put aviation under great pressure and environmental inspection. In particular, the aviation industry is committed to achieving a 50% reduction in CO2 emissions by 2050 compared to 2005 levels. A shift to alternative aviation fuels seems imperative. The International Air Transport Association (IATA) has identified the production of drop-in sustainable liquid fuels (SAFs) as the most promising strategy, at least short term, to reduce the environmental impact of the sector.

- SAFs

- HEFA

- FT synthesis

- AtJ

- e-fuels

1. Introduction

The global aviation industry has been a constantly and rapidly expanding sector in recent years. The International Air Transport Association (IATA) claims that the request for air connectivity will continue to grow. Indicatively, according to the IATA annual review of 2019, the number of over 4 billion passengers in 2018 is the biggest in history, while the transport of 64 million tons of cargo to markets around the world, for the same year, represents a 3.4% increase compared to the already extraordinary high number of cargo transfers for 2017. The huge decline (~66%) in global revenue passenger kilometers observed in 2020 cannot be considered indicative, since the COVID-19 pandemic delivered the largest shock to air travel and the aviation industry since the Second World War [1][2].

The increasing demands of air traffic has led to increasing demand for aviation fuel (jet fuel). Approximately 80 billion gallons of jet fuel, classified as kerosene-type and naphtha-type, are produced annually worldwide. The extensive use of petroleum-derived jet fuel has resulted in a remarkable decline in petroleum reserves. Furthermore, the large consumption of jet fuel generates notable amounts of greenhouse gases (GHG), making the airline sector responsible for 3% of the total current GHG emissions [3]. The Paris Agreement’s objectives related to climate change put aviation, along with other sectors, under great pressure and environmental inspection. In Europe, the pressure is particularly intense and is expected to keep growing. The aviation industry is committed to achieving a 50% reduction in CO2 emissions by 2050 compared to 2005 levels. While it is important to have a holistic view on climate metrics and to target the parallel reduction of both CO2 and NOx emissions via modern aircraft design and improved engine operational measures, the priority for the aviation sector in order to meet its environmental targets is the decarbonization of liquid fuels that are fully compatible with the current infrastructure (drop-in fuels). The slow incremental changes in already-mature engine technology and the long lifetime (>25 years) of existing fleets validate this priority as a much faster and probably cost-efficient way to reduce emissions [4]. Therefore, the research focuses on the ongoing efforts for the development of low-carbon liquid fuels of the same quality as existing ones without underestimating in any way the importance of parallel advances on aircraft engine operation (i.e., fuel efficiency improvements, engine-out emissions) [5][6].

At present, aviation fuels mainly comprise kerosene fuels (i.e., Jet A or Jet A-1), but as petroleum residues are diminishing and, therefore, their prices are increasing, it is being understood that a shift to sustainable aviation fuels (SAFs) is auspicious and imperative. The IATA has identified the production of drop-in sustainable liquid fuels as the most promising strategy to reduce the environmental impact of the sector, since on the one hand, conventional fuel efficiency improvements are not sufficient to meet the targets for decarbonizing the industry and on the other hand, electrification along with the modern design of aircrafts or hydrogen involvement require extended infrastructure restructuring of the whole industry [3]. Investments are in place to expand SAF annual production from the current 125 million liters to 5 billion by 2025. With effective government incentives, production could reach 30 billion liters by 2030, which would be a tipping point for SAF production and utilization [7]. Relative market-oriented studies seem to confirm the projected SAF rapid evolution within the next several years by claiming that the SAF market is expected to increase from USD 216 million to more than USD 14 billion by 2030 [8].

2. Summary of Alternative Aviation Fuels and Current Status

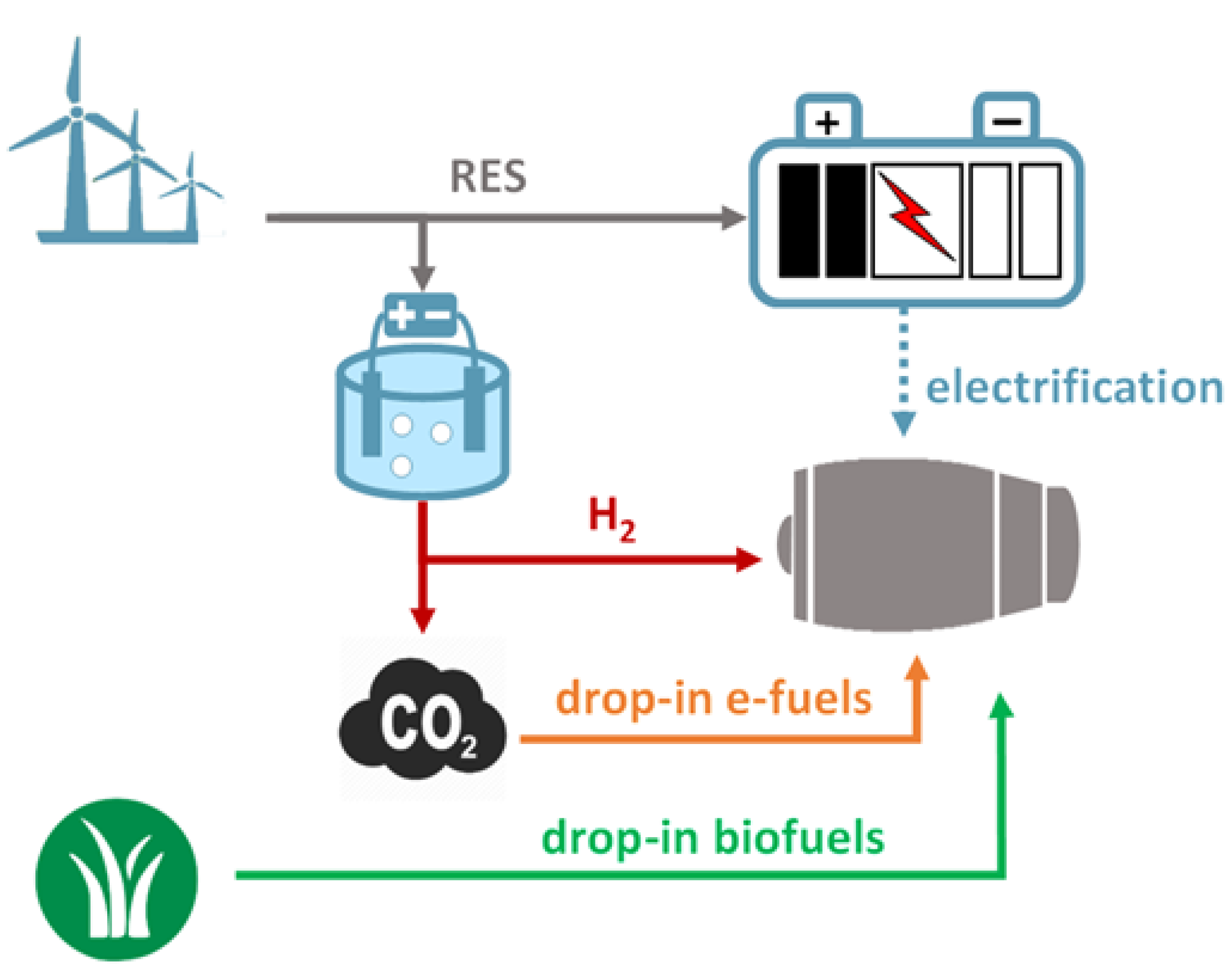

The current tendencies for a more sustainable aviation industry include the so-called ‘drop-in’ alternative aviation fuels, hydrogen, and the potential aviation electrification (i.e., hybrid or full-electric aircrafts) (Figure 1). The ‘drop-in’ alternative aviation fuels or sustainable aviation fuels (SAFs) refer to completely interchangeable substitutes for conventional petroleum-derived jet fuel (i.e., Jet A or Jet A-1) that are produced from sustainable resources (e.g., biogenic feedstock, renewable hydrogen + CO2). The fact that no adaptations are required for the existing fuel systems (i.e., engines, fuel distribution network) establishes SAFs as dominant alternatives towards the decarbonization of the aviation field. Hydrogen is a long-term sustainable fuel option, but requires extended modifications in current fuel infrastructure and overall aircraft design. Finally, aircraft propulsion via electrification in pure or hybrid mode could be an emerging option; nevertheless, energy storage limitations remain a major concern, especially for long-distance applications.

Figure 1. Alternatives towards decarbonization of the aviation field.

2.1. Sustainable Aviation Fuels (SAFs)

SAFs have recently started to attract great interest and have been identified by IATA as the most promising strategy to reduce CO2 emissions in the aviation sector. Jet fuels, produced from renewable or recyclable feedstock, can deliver up to an 80% reduction in carbon emissions over the complete life cycle of the fuel, while the International Energy Agency (IEA) claims that by 2050, biofuels could provide 27% of the total amount of transport fuel, mainly replacing diesel, kerosene, and jet fuel [9]. Currently, most SAF technologies are still being tested or are at a prototype level, but they are making good progress, with some (e.g., HEFA) already being used in commercial flights as blending components [10]. However, one of the challenges faced in the production of SAFs is creating fuel from renewable sources, such as biomass, at an affordable price. Moreover, the feedstock used for producing the SAFs must not raise the question of food vs. fuel or cause deforestation, or any other environmental/societal harm. Another major concern is producing a fuel that matches the energy density of conventional fuels and their qualities such as a low freezing point and good cold flow properties. The ASTM D7566 specification has been developed over many years following a strict testing regime and approval process dedicated to SAF safety compliance towards their implementation in commercial aviation. The expected scale-up of SAF production in the coming years requires the parallel intensification of quality control in order to ensure that the new fuel technologies introduced are safe [11][12].

2.1.1. Biofuels

Hydroprocessed Esters and Fatty Acids (HEFA)

Hydroprocessed renewable jet fuels (HRJs or HEFA) are produced by the hydrogenation of vegetable oils, used cooking oils (UCOs), animal fats, waste grease, algal oil, or bio-oil. They are high-energy biofuels that can be used in conventional aircraft engines without further engine modification. Some of their weaknesses (such as low lubricity) are overcome by blending HRJs with other conventional fuels. Using HEFA as an aviation fuel has already been tested by many airline companies in passenger flights. However, it should be mentioned that the feedstock for HEFA is usually costly, often raises the question of food vs. fuel, and its cultivation can cause severe land-use change. Biodiesel is also produced from fatty acids via esterification, but it is considered insufficient as an aviation fuel as its energy density is very low compared to conventional fuels, and its freezing point is very high [13][14].

Fischer–Tropsch Fuels (FT Fuels)

FT fuels are liquid hydrocarbons that are produced by the catalytic conversion of syngas (mixture of CO and H2), which in turn can be generated from a variety of biogenic feedstock via gasification. They are non-toxic, typically sulfur-free, and contain very few aromatics compared to diesel and gasoline, which results in lower emissions when used in jet engines. Fischer–Tropsch-synthesized kerosene with aromatics (FT-SPK/A) is a variation of the FT process in which a synthetic alternative aviation fuel containing aromatics is produced. The products in the FT process range from methane to long-chain hydrocarbons. The FT process is highly exothermic, meaning that the heat of reaction has to be quickly removed in order to avoid overheating and methane emissions. Like HEFA, FT fuels have low lubricity due to the absence of sulfur [13][15].

Alcohol-to-Jet (AtJ)

The AtJ process turns alcohols into jet fuel through the following reactions: dehydration, oligomerization, hydrogenation, isomerization, and distillation. The involved alcohols can be produced through conventional processes involving the fermentation of sugars deriving from sugar- and starch-rich crops such as sugarcane, corn, and wheat, or through advanced routes from lignocellulosic feedstock (e.g., hydrolysis). Alcohols can also be generated via gas fermentation by utilizing the carbon and hydrogen content of gases such as industrial off-gases. AtJ routes are attractive as they can convert various types of alcohols (so far, ethanol and isobutanol have been approved) from a wide range of sources into jet fuel as well as other hydrocarbons [13][16].

Direct Sugars to Hydrocarbons/Synthesized Iso-Paraffins (DSHC/SIP)

Genetically modified microorganisms (such as algae, bacteria, or yeast) can be used to convert sugar into hydrocarbons or lipids. Currently, biological routes almost exclusively use conventional sugar feedstock, although cellulosic sugars are being tested as well. The complexity and low efficiency of converting lignocellulosic sugars into fuels through DSHC translates into high feedstock cost and high energy consumption, which makes DSHC the most expensive alternative fuel route [13].

Others

The latest additions among the approved technologies (pathways) for SAF production are catalytic hydrothermolysis jet (CHJ) and hydroprocessed hydrocarbons (HC-HEFA). In the CHJ process (also called hydrothermal liquefaction), clean free fatty acid (FFA) oil from the processing of waste/energy oils is combined with the preheated feed water and then passed to the hydrothermal reactor. There, under high temperature and pressure conditions, a single phase is formed consisting of FFA and supercritical water wherein the FFAs are cracked, isomerized, and cyclized into paraffin, isoparaffin, cycloparaffin, and aromatic compounds. The HC-HEFA pathway refers to the hydroprocessing of bio-derived hydrocarbons (unlike the fatty acids or fatty acid esters found in HEFA production) that come from oils found in a specific alga (i.e., Botryococcus braunii). Other also possible pathways for bio-jet fuel production are under various stages of the ASTM evaluation process. A typical example is synthetic kerosene via aqueous phase reforming (APR-SK) [13][17].

So far, only biofuels have secured ASTM certification for commercial use (via blending). SAFs are met as blending components in mixtures with conventional aviation fuels rather than 100% bio-based compounds. Because the penetration of SAFs in the market is still limited and actually HEFA-driven, SAF can be blended at up to 50% with traditional jet fuel and all quality tests are completed as per a traditional jet fuel. However, along with the timely scale-up for the other certified jet fuel pathways, the safety research should be extended to evaluate the miscibility of fuels containing different synthetic compounds as well. The availability of a larger number of alternative certified blends would make possible their simultaneous presence in a fuel tank or aircraft, and in that case, even the slightest alteration in fuel quality should have been anticipated [18].

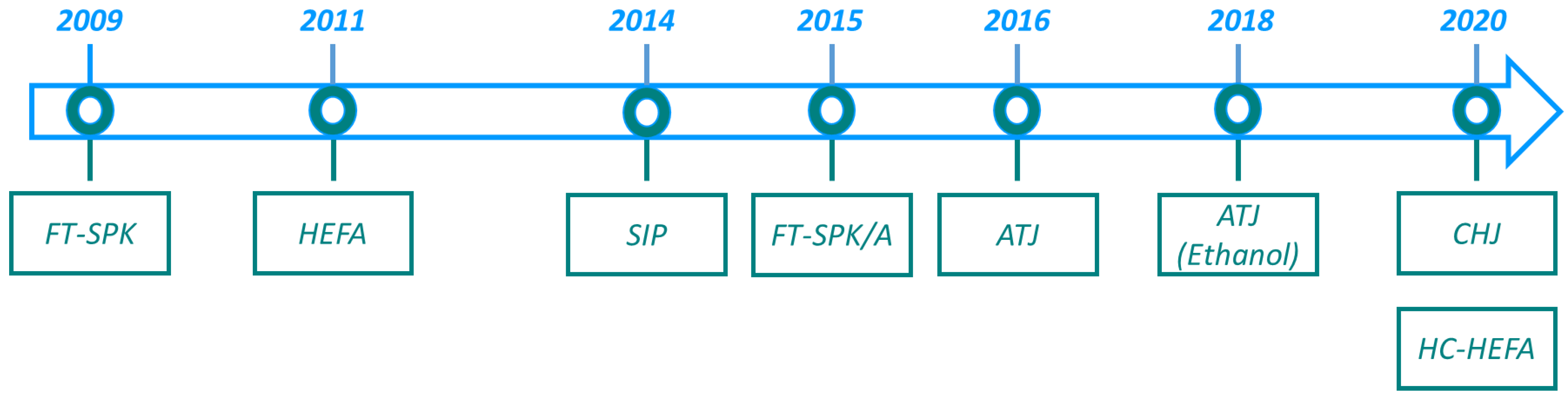

The SAF technology certification timeline is illustrated in Figure 2.

Figure 2. SAF technology certification timeline.

2.1.2. Electrofuels (e-Fuels)

Electrofuels or e-fuels are an emerging class of carbon-neutral drop-in replacement fuels that are made by storing electrical energy from renewable sources in the chemical bonds of liquid or gas fuels. E-fuels result from the combination of ‘green or e-hydrogen’, produced by electrolysis of water with renewable electricity, and CO2, which can be obtained from various sources including biomass combustion, industrial processes (e.g., flue gases from fossil oil combustion), biogenic CO2, and CO2 captured directly from the air. E-fuel production routes consist of e-hydrogen reacting with captured CO2, followed by different conversion routes according to the final desired e-fuel such as the methanization route for e-methane; methanol synthesis for e-methanol, e-DME, e-OME; or the reverse water–gas shift (RWGS) reaction to produce syngas + Fischer–Tropsch synthesis to produce e-liquid hydrocarbons, such as e-gasoline, e-diesel, or e-jet. E-jet production usually refers to the methanol route (e-methanol upgrade to jet) or the FT route (RWGS + Fischer–Tropsch) [13][19].

2.2. Hydrogen

The use of hydrogen in aviation, both as a source of propulsion power and as onboard power, has the potential to diminish noise pollution and GHG emissions and improve efficiency, as long as hydrogen is produced from renewable energy sources. Following thermal and biochemical methods, biohydrogen can be produced from a variety of biomass resources. It can be used either as liquid fuel for turboengines, or in fuel cells (FCs). In the first case, because of hydrogen’s low volumetric energy density, major aircraft changes are required in order to accommodate the cryogenic tanks to store liquid hydrogen (LH2). In addition, storing liquid hydrogen entails risks, as it burns in low concentrations upon mixing with air, and it needs a constant low temperature in order to be kept in the liquid phase. The additional weight of these tanks means extra energy consumption in comparison to kerosene aircrafts. As for the FCs, they can be used to power onboard electrical equipment or an electric propulsion system. They could be used in parallel with or in place of auxiliary power units (APUs), which consist of a small gas turbine supplying power when the aircraft is stationary or while cruising (as backup) [13].

2.3. Electrification (Hybrid or Full-Electric Aircrafts)

Many auxiliary aviation systems are being gradually electrified, because of the relatively lightweight and improved efficiency compared to mechanical systems. In addition, electric propulsion is being investigated given that it can come up with many benefits, such as noise reduction and emission savings. Electric aircrafts are divided into hybrid and full electric. Hybrid aircrafts have an electric motor with a battery and a turbofan (in series or parallel), thereby allowing for the downsizing of jet engines and increased fuel economy. Full-electric aircrafts could lead to zero onboard emissions and noise reduction. However, electric aircrafts face two severe challenges: the low energy density of batteries and the limitations on the distance traveled. Even the most promising batteries have an energy density far short of kerosene, while issues such as battery charging and infrastructure need a considerable amount of consideration [13].

2.4. Market Overview and Technology Readiness Level (TRL)

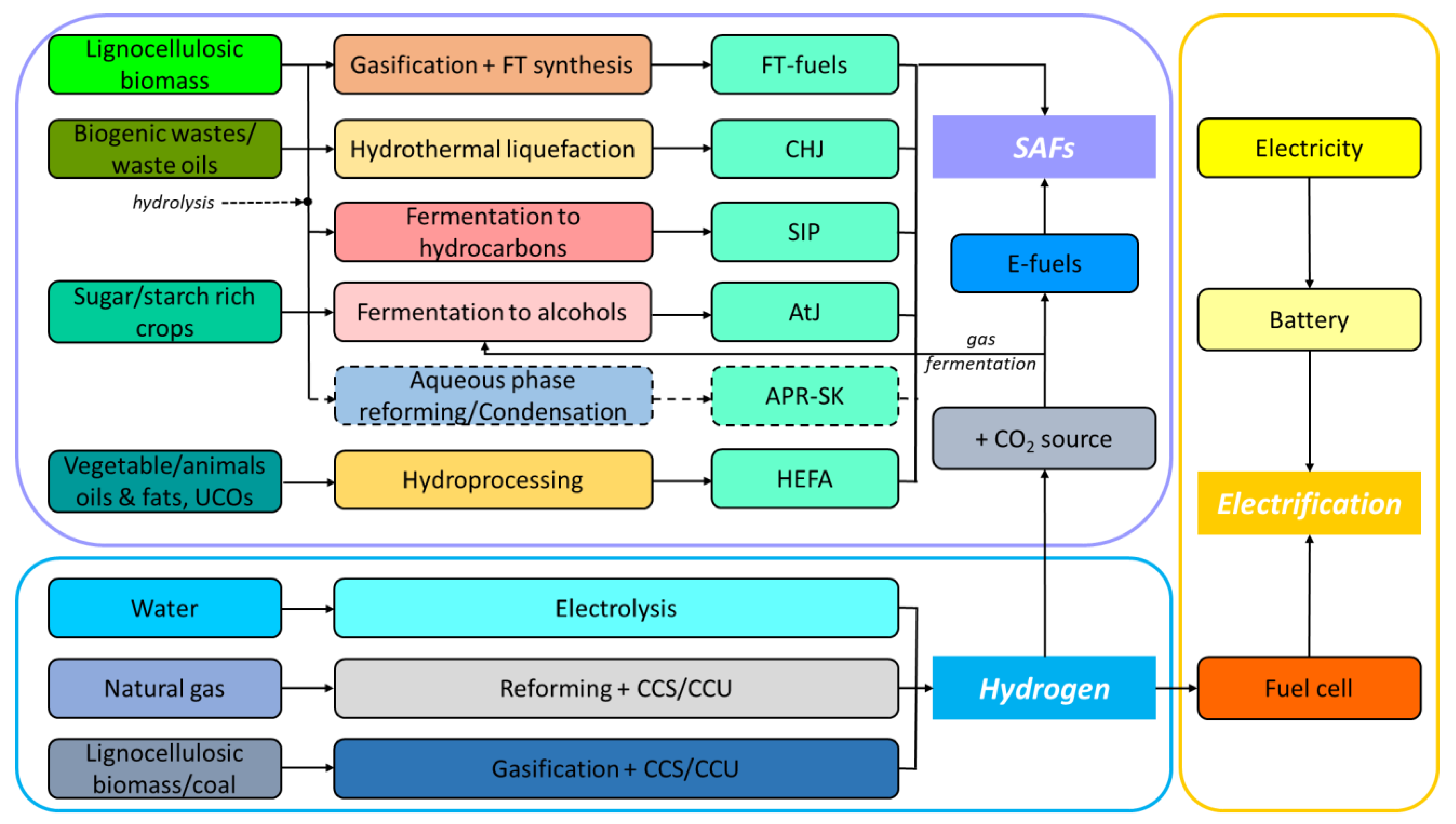

An overview of the current alternative fuel routes for the aviation sector, as described above, is presented in Figure 3.

Figure 3. Overview of alternative fuel routes for the aviation sector.

Concerning the technological maturity of the current tendencies in aviation, each route has seen different growth. Starting with SAFs, while HEFA is the only alternative fuel in commercial use, the FT and AtJ market developments are also particularly intense.

The HEFA technology is currently the most mature, with HEFA fuels being the only alternative already used commercially (TRL 9) [13]. HEFA-jet is produced on a batch basis by several commercial-scale facilities worldwide [20]. It can be blended up to 50% with conventional fuel, but flight trials have recently been performed with 100% HEFA. In particular, aviation leaders such as Airbus, Rolls Royce, and the German Aerospace Center (DLR) launched the first 100% SAF commercial passenger jet flight with the HEFA-fuel provided by Neste [21].

Neste reaches an annual capacity of 100 kt SAF and production will increase to 1.5 million tons annually by the end of 2023. Neste’s SAF is available at many major airports, including San Francisco International Airport (SFO), Heathrow Airport (LHR), and Frankfurt Airport (FRA) and is currently being used by many leading commercial airlines including KLM, Lufthansa, Delta, and American Airlines [22]. There are also synergies with leading fuel distributors that provide Neste’s SAF to the market [23][24].

As for the Fischer–Tropsch fuels, the bio-based gasification with FT synthesis is now just approaching commercialization (TRL 7-8), while the jet fuel produced through the FT route has been certified and can be blended up to 50% with fossil kerosene. The collaboration between British Airways and Velocys [25] aims to establish the first commercial Fischer–Tropsch BtL plant in the UK. Other notable commercial plants that are based on FT liquid production using sustainable feedstock are found in the USA (i.e., Red Rock Biofuels, Sierra Biofuels) [26].

Alcohol-to-jet fuels have been certified by ASTM (i.e., from ethanol and isobutanol) and can be blended up to 50%. This is another route that is approaching commercialization (TRL 7-8) [13]. In 2018, Virgin Atlantic completed the first commercial flight with AtJ fuel produced by Lanzatech [27]. Lanzatech is also the technology provider of the project FLITE that targets the installation of Europe’s first of its kind AtJ production plant at pre-commercial scale. In 2012 and 2014, both the US Air Force and the US Navy used bio-jet fuel produced by the AtJ pathway to conduct the first tests [28].

Lanzatech, via a spin-off called LanzaJet, aims to be amongst the leaders in the emerging SAF market. LanzaJet AtJ technology can process any source of sustainable ethanol, including ethanol produced from municipal solid waste, agricultural residues, industrial off-gases, and biomass. British Airways will purchase SAF from LanzaJet’s US plant in Georgia to power a number of the airline’s flights from late 2022. The deal also involves LanzaJet conducting early-stage planning for a potential large-scale commercial SAF biorefinery in the UK [29]. Another key player in the AtJ pathway is the Colorado renewable fuels producer Gevo. The Oneworld Alliance members will use Gevo’s SAF for operations in California including San Diego, San Francisco, San Jose, and Los Angeles International airports. Delivery of the fuel is expected to commence in 2027 for a five-year term [30].

Regarding SIP, there are two different production routes. The first, using conventional sugar feedstock, is at the pre-commercial level (TRL 7), while the second, based on cellulosic feedstock, is still at the prototype level (TRL 5). The certified route includes sugar fermentation to farnesene, which, after hydroprocessing to farnesane, can be blended up to 10% with fossil kerosene [13]. Lufthansa performed a commercial flight with a 10% farnesane blend from Amyris/Total in 2014 [31]. However, at present, potential SIP developers tend to target the chemical, pharmaceutical, food, and feed markets [13].

The technological maturity of e-fuels, or power-to-liquid (PtL) routes as they are also called, depends mostly on the maturity of the single components and the design configuration chosen. For example, routes where the CO2 comes from concentrated sources, such as CO2 waste streams from industrial processes, biogas upgrading, or beer brewing, are available for commercial use, while others such as CO2 captured directly from the air remain at an earlier level (TRL 5–7) [13]. In general, PtL can be characterized by a relatively high technological maturity, since the majority of the individual process steps for kerosene synthesis via PtL are proven technologies with high TRLs. E-fuel routes are already being implemented in over 40 pilot and demonstration projects in Europe [32]. The barriers towards full commercialization are the amount of capital-intensive equipment to deploy the technology, the need for a substantial increase in renewable electricity production, and the rather low energy efficiency due to the inherent thermodynamic conversion losses that occur during e-fuel production. Technologies at the lowest level of development include electrolytic or electro-photocatalytic CO2 conversion.

There are also commercial applications, such as Carbon Recycling International, which has produced over 4 kt of methanol per year since 2012 and aspires to commission the world’s first 110 kt/year recycled carbon methanol production plant after 2021 [33]. Energy supplier Uniper, Siemens Energy, and aircraft manufacturer Airbus are teaming up with chemical and energy company Sasol ecoFT to realize a commercial project to produce SAF for Germany named ‘Green Fuels Hamburg’. From 2026, the production facility in its initial configuration is projected to produce at least 10,000 tn of PtL-SAF annually [34].

Table 1 summarizes the current technology status of SAFs and the latest highlights of each route.

Table 1. Current technology status of SAFs.

| SAFs | Fuel | Technology Readiness Level (TRL) | Highlights |

|---|---|---|---|

| Biofuels | HEFA | 9 | Commercial passenger jet flight test with 100% HEFA fuel [21] Projection for annual production of 1.5 million tons by the end of 2023 (Neste) [22] |

| FT-fuels | 7–8 | Establishment of the first commercial Fischer–Tropsch BtL plant in the UK (Velocys) [25] | |

| AtJ | 7–8 | First commercial flight with AtJ fuel [27] British Airways will purchase SAF from LanzaJet’s US plant from late 2022 [29] Oneworld Alliance members will utilize Gevo’s SAF for operations in California from 2027, for a five year-term [30] |

|

| DSHC/SIP | 5–7 (depending on the sugar type) |

Commercial flight with 10% farnesane blend from Amyris/Total (2014) [31] | |

| E-fuels | e-jet, e-methanol * |

5–8 (depending on the CO2 source) |

World’s first 110 kt/year recycled carbon methanol production plant [33] ‘Green Fuels Hamburg’ [34] |

* considering methanol upgrade to SAF.

Although hydrogen aviation is not a new concept, it will require significant research and development (R&D), investments, and accompanying regulations to ensure safe, economic H2 aircrafts and infrastructure mastering the climate impact [35]. Airbus has performed a study called ‘Cryoplane’ in order to examine the concept of hydrogen-fueled turbo-engines, which led to the adoption of a minimal-change approach to the wing configuration and engine design [36]. However, the main research activities of hydrogen involvement in aviation are related to the development of hydrogen fuel cell aircrafts, as it is a much lighter way to power the electric airplanes than batteries. Fuel cell systems are tested as auxiliary power units in commercial aircrafts, even though they have not been deployed in serial production. H2 propulsion with fuel cell systems is also tested for urban air mobility (unmanned air vehicles and ‘taxi’-drones) [35]. One such project is the HY4, a four-seater hydrogen fuel cell aircraft, developed by DLR, which completed its first flight in 2016 [37]. Moreover, ZeroAvia USA has launched the HyFlyer project, which aims to decarbonize medium-range, six-seater aircrafts by replacing the conventional propeller with a fuel cell system [38]. In general, the immediate priorities for hydrogen aviation R&D are the development of lightweight tank systems, reliable fuel distribution components, H2 propulsion turbines with low NOx emission and long lifetimes, and high-power fuel cell systems [39].

Since the 1960s, many aviation auxiliary systems have gradually been electrified, while electric propulsion systems have seen development as well. However, concerning the latter, they all remain at a demonstration level [40]. Regarding the development of hybrid electric aircrafts, Airbus, Rolls-Royce, and Siemens AG collaborated to launch the flight demonstrator E-Fan X [41]. In addition, Boeing and NASA have partnered up in order to develop a hybrid electric aircraft, named ‘SUGAR Volt’, with twin engines designed to burn fuel when the power demand is high (e.g., take-off) and to run on electricity while traveling [42]. Other industries have experimented with building full-electric aircrafts, mostly for civil non-commercial aviation and urban air-taxis, such as Kitty Hawk USA that developed a two-seater to be used by Air New Zealand as an air-taxi [43]. Moreover, Airbus has taken on an air-taxi project called Vahana [44], while Lilium GmbH and Eviation Aircraft Ltd. have produced full-electric, five- and nine-seater aircrafts, respectively, meant for regional commuting [45][46][47]. In order for electric aircrafts to be more commercially available, challenges such as the plane’s mass reduction or the expansion of the batteries’ energy density must be faced. As already mentioned, there is a limitation in the envisaged travel distance and in order to tackle this, electric aircrafts could be used for commercial regional flights or for pilot training. Such an aircraft is the Pipistrel Alpha Electro, which is a two-seater, full-electric aircraft with a range of about 160 km on a single charge [48]. Concerning the endeavor to increase the energy density of batteries, OXIS Energy has made significant progress in developing solid-state lithium–sulfur batteries, which have an increased density and can be used in electric buses, electric trucks, aircraft, and marine trials [49].

In general, it can be observed that SAFs are technologically in a favorable position towards the decarbonization of the aviation industry. Their compatibility with the extended current infrastructure is a great advantage that is able to offer instant industrial compliance with the international policies and regulations. Hydrogen aviation or electrification require deep and comprehensive changes in the industry and can only be considered as long-term alternatives.

This entry is adapted from the peer-reviewed paper 10.3390/en16041904

References

- IATA. Annual Review 2020. In Proceedings of the 76th Annual General Meeting, Amsterdam, The Netherlands, 23–24 November 2020.

- IATA. Annual Review 2021. In Proceedings of the 77th Annual General Meeting, Boston, MA, USA, 3–5 October 2021.

- IATA. Why SAF Is the Future of Aviation? IATA: Montreal, QB, Canada, 2020.

- ICAO. Impacts of Aviation NOx Emissions on Air Quality, Health, and Climate. In ICAO Environmental Report 2022; ICAO: Montreal, QB, Canada, 2022.

- Sahu, T.K.; Shukla, C.P.; Belgiorno, G.; Maurya, R.K. Alcohols as alternative fuels in compression ignition engines for sustainable transportation: A review. Energy Sources Part A Recovery Util. Environ. Eff. 2022, 44, 8736–8759.

- Verhelst, S.; Turner, W.G.J.; Sileghem, L.; Vancoillie, J. Methanol as a fuel for internal combustion engines. Prog. Energy Combust. Sci. 2019, 70, 43–88.

- IATA. Incentives Needed to Increase SAF Production; IATA: Montreal, QB, Canada, 2022.

- Sustainable Aviation Fuel Market; The Brainy Insights: Pune, India, 2022.

- IEA. Technology Roadmap—Biofuels for Transport—Analysis; IEA: Paris, France, 2011; Available online: https://iea.blob.core.windows.net/assets/0905b11e-53d4-417a-a061-453934009476/Biofuels_Roadmap_WEB.pdf (accessed on 21 December 2022).

- Kandaramath Hari, T.; Yaakob, Z.; Binitha, N.N. Aviation biofuel from renewable resources: Routes, opportunities and challenges. Renew. Sustain. Energy Rev. 2015, 42, 1234–1244.

- GE Reports. SAFety First: Sustainable Aviation Fuel Is Taking Off, and Gurhan Andac Is Helping to See It’s Done Right. 2022. Available online: https://blog.geaerospace.com/sustainability/safety-first-sustainable-aviation-fuel-is-taking-off-and-gurhan-andac-is-helping-to-see-its-done-right/ (accessed on 21 December 2022).

- Let’s Talk about Sustainable Aviation Fuel Safety; Neste MY Renewable Jet Fuel: Espoo, Finland, 2019.

- Bauen, A.; Bitossi, N.; German, L.; Harris, A.; Leow, K. Sustainable Aviation Fuels: Status, challenges and prospects of drop-in liquid fuels, hydrogen and electrification in aviation. Johns. Matthey Technol. Rev. 2020, 64, 263–278.

- Clean Skies for Tomorrow: Sustainable Aviation Fuels as a Pathway to Net-Zero Aviation; World Economic Forum in Collaboration with McKinsey & Company: Davos, Switzerland, 2020.

- Wang, M.; Dewil, R.; Maniatis, K.; Wheeldon, J.; Tan, T.; Baeyens, J.; Fang, Y. Biomass-derived aviation fuels: Challenges and perspective. Prog. Energy Combust. Sci. 2019, 74, 31–49.

- Doliente, S.S.; Narayan, A.; Tapia, D.J.F.; Samsatli, J.N.; Zhao, Y.; Samsatli, S. Bio-aviation Fuel: A Comprehensive Review and Analysis of the Supply Chain Components. Front. Energy Res. 2020, 8, 110.

- IATA. Sustainable Aviation Fuel: Technical Certification. In Fact Sheet 2; IATA: Montreal, QB, Canada, 2021.

- Kaźmierczak, U.; Dzięgielewski, W.; Kulczycki, A. Miscibility of Aviation Turbine Engine Fuels Containing Various Synthetic Components. Energies 2022, 15, 6187.

- European Commission. ReFuelEU Aviation Iniative: Sustainable Aviation Fuels and the Fit for 55 Package; European Commission: Brussels, Belgium, 2022.

- Mawhood, B.; Gazis, E.; de Jong, S.; Hoefnagels, R.; Slade, R. Production pathways for renewable jet fuel: A review of commercialization status and future prospects. Biofuels Bioprod. Biorefining 2016, 10, 462–484.

- Airbus. An A350 Fuelled by 100% SAF Just Took Off; Airbus: Toulouse, France, 2021.

- NESTE. NESTE MY Sustainable Aviation Fuel. Available online: https://www.neste.com/products/all-products/saf#3468d8a8 (accessed on 21 December 2022).

- Q8Aviation. Q8 Aviation Delivers the First Sustainable Fuel to Gatwick Airport; Q8Aviation: Woking, UK, 2021.

- Aegean Airlines. SAF Flights for AEGEAN from Athens International Airport Powered by Hellenic Petroleum and NESTE; Aegean: Athens, Greece, 2022.

- A Collaboration between British Airways and Velocys. Available online: https://www.altalto.com (accessed on 21 December 2022).

- Ail, S.S.; Dasappa, S. Biomass to liquid transportation fuel via Fischer Tropsch synthesis—Technology review and current scenario. Renew. Sustain. Energy Rev. 2016, 58, 267–286.

- Virgin Atlantic and Lanzatech Celebrate as Revolutionary Sustainable Fuel Project Takes Flight. Available online: https://www.lanzatech.com/ (accessed on 21 December 2022).

- Gutiérrez-Antonio, C.; Gomez-Castro, F.I.; de Lira Flores, J.A.; Hernandez, S. A review on the production processes of renewable jet fuel. Renew. Sustain. Energy Rev. 2017, 79, 709–729.

- Airways, B. British Airways Fuels its Future with Second Sustainable Aviation Fuel Partnership. 2021. Available online: https://mediacentre.britishairways.com/pressrelease/details/12796 (accessed on 21 December 2022).

- Knowles, B. Major airlines to purchase Gevo sustainable aviation fuel. Renewable Energy, 25 July 2022. Available online: https://sustainabilitymag.com/renewable-energy/major-airlines-to-purchase-gevo-sustainable-aviation-fuel (accessed on 21 December 2022).

- Lufthansa Confirms Leadership Position on Alternative Aviation Fuels. Available online: https://aireg.de/ (accessed on 21 December 2022).

- VDMA. Position Paper ReFuel EU Aviation; VDMA: Frankfurt am Main, Germany, 2020.

- International, C.R. The Shunli CO2-to-Methanol Plant: Commercial Scale Production in China. Available online: https://www.carbonrecycling.is/projects (accessed on 21 December 2022).

- Green Fuels Hamburg Plans SAF Production. Renewable Energy Magazine. 28 June 2022. Available online: https://www.renewableenergymagazine.com/biofuels/green-fuels-hamburg-plans-saf-production-20220628 (accessed on 21 December 2022).

- Fuel Cells and Hydrogen Joint Undertaking. Hydrogen-Powered Aviation—A Fact-Based Study of Hydrogen Technology, Economics, and Climate Impact by 2050. 2020. Available online: www.fch.europa.eu (accessed on 21 December 2022).

- Airbus Deutschland GmbH. Liquid Hydrogen Fuelled Aircraft—System Analysis; Final Technical Report; Airbus Deutschland GmbH: Hamburg, Germany , 2003.

- Zero-Emission Air Transport—First Flight of Four-Seat Passenger Aircraft HY4; H2Fly GmbH: Stuttgart, Germany, 2016.

- Bogaisky, J. Startups Bet Hydrogen Fuel Cells Are Ready for Takeoff in Aviation; Forbes Media: Jersey City, NJ, USA, 2019.

- Marta Yugo, A.S.-C. A Look into the Role of e-Fuels in the Transport System in Europe (2030–2050). 2019. Available online: https://www.concawe.eu/wp-content/uploads/E-fuels-article.pdf (accessed on 21 December 2022).

- Thomson, R. Electrically Propelled Aircraft Developments Exceed 200 for the First Time; Roland Berger GmbH: Munich, Germany, 2020.

- E-Fan X; A Giant Leap towards Zero-Emission Flight. 2020. Available online: https://www.airbus.com/innovation/zero-emission/electric-flight/e-fan-x.html (accessed on 21 December 2022).

- Howard, C.E. Boeing and NASA Unveil Lightweight, Ultra-Thin, More Aerodynamic Transonic Truss-Braced Wing Concept; SAE International: Warrendale, PA, USA, 2019.

- Flying Taxis Are Taking off to Whisk People around Cities; The Economist: London, UK, 2019.

- Lovering, Z. Step Inside Alpha Two; Acubed: Sunnyvale, CA, USA, 2019.

- Dzikiy, P. Lilium’s New All-Electric Five-Seater Air Taxi Prototype Completes Test Flight; Electrek: New York, NY, USA, 2019.

- Hawkins, A.J. Electric Air Taxi Startup Lilium Completes First Test of Its New Five-Seater Aircraft; The Verge, Vox Media: Washington, DC, USA, 2019.

- Bailey, J. An Introduction to the Bizarre Eviation Electric Aircraft; Simple Flying: London, UK, 2019.

- Thapa, N.; Ram, S.; Kumar, S.; Mehta, J. All electric aircraft: A reality on its way. Mater. Today Proc. 2021, 43, 175–182.

- OXIS ENERGY. Set to Make Solid-State Lithium-Sulfur Cell Technology A Reality; OXIS ENERGY: Abingdon, UK, 2021.

This entry is offline, you can click here to edit this entry!