Your browser does not fully support modern features. Please upgrade for a smoother experience.

Please note this is an old version of this entry, which may differ significantly from the current revision.

Subjects:

Transportation Science & Technology

In response to severe environmental and energy crises, the world is increasingly focusing on electric vehicles (EVs) and related emerging technologies. Sensory, control, and telematics technologies are the keys to reliable autonomous driving. The integration and complementarity of EVs and autonomous driving will be an important opportunity for future smart transportation and smart cities.

- EV technologies

- new trends

- smart transportation

- autonomous driving

1. Autonomous Vehicle Technologies

Autonomous driving can be divided into multiple levels according to its degree of automation, of which the most acceptable definition is from SAE. The realization of autonomous driving involves complex technologies in multiple disciplines, and even perception is the key to its realization.

1.1. SAE Standards

According to the SAE J3016™ level standards, six levels of driving automation have been defined, including “No Automation”, “Driver Assistance”, “Partial Automation”, “Conditional Automation”, “High Automation”, and “Full Automation” [121,122,123].

1.2. Sensory Technology

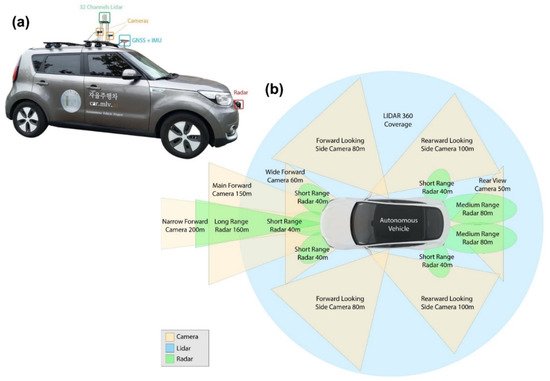

Advanced sensory technology is one of the most critical factors in realizing autonomous driving. In order to popularize autonomous driving, the vehicle itself is required to enhance the maneuverability of a human driver. The combination of different sensors can enable the vehicle to outperform humans in terms of visionary perception of the environment. The installation positions, coverage and maximum range of typical sensors for environment perception in an autonomous vehicle are displayed in Figure 1a,b.

The existing sensory technologies for automated driving can be principally divided into six categories:

- (a)

-

Ultrasonic sensors

Sensing range: 0–2 m.

Ultrasonic sensors in vehicles play an irreplaceable role in implementing automated parking, as they can detect obstacles within short distances, such as guardrails, pedestrians, vehicles, etc. [124]. However, they will be useless in medium- and high-speed situations.

- (b)

-

Computer vision

Sensing range: 0–120 m.

Multi-cameras can approximate human vision, and stereo cameras can even obtain depth information about the environment. The cameras can detect colors and fonts, which makes it possible to understand the semantic information embedded in traffic signs and stoplights, a capability that other sensors do not have [125]. They can perform as a redundant system in case of failure of other sensors, thus increasing the reliability of perception and system safety. However, the perception requirements for expected autonomous driving can only be met when the visibility range is increased to 250 m [126]. Adverse weather, such as rain, fog, and low light levels, can significantly limit the perception effect of such sensors. The recognition algorithm based on such sensors has yet to be developed, with the current pedestrian recognition success rate at 95% [127].

- (c)

-

Radio detection and ranging (radar) sensors

Sensing range: 0–250 m.

Radio waves emitted by radar transmitters will be reflected to the receiver when encountering obstacles. The distance and relative speed between the sensor and the obstacle can be calculated through the time difference. Specifically, if short- and long-range radar sensors are installed at the periphery of an autonomous vehicle, they will monitor the real-time position and speed of surrounding objects, including vehicles and pedestrians [128]. However, 2D radar, which can scan only in the horizontal plane, cannot reconstruct the height information of obstacles, so collisions may occur when the vehicle travels on a height-limited road [129]. 3D radar sensors will be applied to solve the problem.

- (d)

-

Light detection and ranging (LIDAR) sensors

Sensing range: 0–200 m.

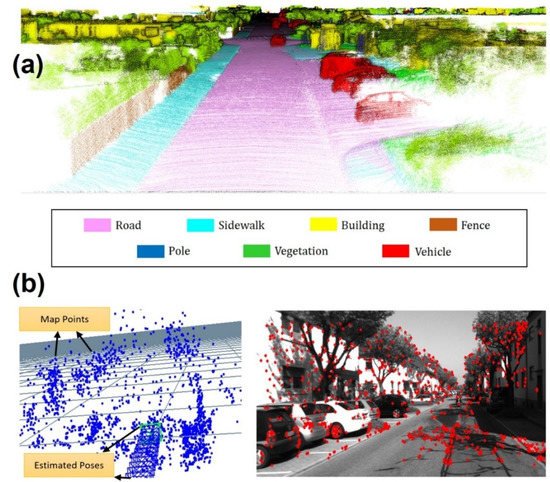

The LIDAR sensor follows the same principle as the radar sensor but uses an invisible beam instead of radio waves as the scanning medium [130]. Combined with onboard camera data, the sensor can create the 3D point cloud around the vehicle to accurately identify obstacles, such as the presence of vehicles, pedestrians, and signage (Figure 2a). However, LIDAR is more expensive than radar due to its complex mechanical structure, difficult calibration, and high cost of laser scanning components [131]. The gradual development of solid-state LIDAR is expected to sink the price to an acceptable range.

- (e)

-

Odometry

Wheel speed odometry uses a rotary encoder to record wheel rotation to estimate the position change relative to the initial point [132]. However, wheels are not in pure rolling motion to the ground at all times and may slide when driving on smooth roads or during sharp changes in speed. Sliding which cannot be recorded will cause cumulative errors, so the reliability of odometry will gradually decrease over time. Visual odometry attempts to analyze the frame-to-frame movement of the image to estimate the position and speed of the vehicle (Figure 2b), so it is not limited by the form of the motion to the ground [133].

- (f)

-

GPS and cloud technology

The vehicle can use GPS for accurate localization, contribute the location to the cloud in real-time, and obtain the surrounding environment conditions from an electronic map [134]. Multi-vehicle contributions will ensure the real-time and accuracy of data, such as broadcasting congested road conditions or traffic faults ahead to help other vehicles plan their path. However, this solution highly depends on the number of vehicle nodes that can contribute real-time information, making it difficult to achieve “crowd intelligence” in rural areas with low traffic density [135].

1.3. Control Technology

Intelligent control systems infer proper path planning according to road signs, obstacles, and the behavior of other traffic participants, based on understanding large amounts of sensor data. Although the technical means differ, most autonomous vehicles maintain a local map of surroundings in real-time, then use algorithms to identify appropriate paths and send corresponding commands to end-effectors for lateral and longitudinal vehicle control. Hard-coded rules, obstacle avoidance algorithms, decision models, and recognition algorithms will ensure that the planned path avoids obstacles while following traffic rules [140]. If the control system cannot calculate a uniquely determined navigation path, no solution, or multiple solutions, partially autonomous vehicles will throw an exception to notify the driver to take over. Autonomous vehicles can be distinguished by whether or not they are “connected”, indicating whether they are capable of communicating with other vehicles and intelligent traffic facilities [141].

1.4. Telematics Technology

Telematics is compounded by the terms “telecommunications” and “informatics”. Generally, Telematics is every application of telecommunications that integrates information exchange and services technology. As a technology covering everything about GPS and navigation systems, it can send, receive, and store information related to remote items—such as vehicles—through telecommunication devices [142]. Telematics systems help insurance companies predict traffic dangers based on recorded human driving behavior and readily identify valid and independent safety features [143]. Telematics technologies used in autonomous driving include mobile networks, for example, 5G and LTE, and global navigation satellite systems such as GPS, Galileo, and BDS [144]. As described in the previous section, “GPS and the cloud”, the high accuracy of real-time positioning guidance from GNSS and traffic information from the cloud will ensure that the vehicle drives to the destination accurately and quickly, following the optimal path.

2. Benefits and Business Opportunities

There is a general question, does autonomous driving technology have to be integrated with EVs? The answer is “no”, or more precisely, “not yet”. Mass-produced autonomous vehicles will likely be powered by conventional ICE. However, six valid reasons are given here to indicate that integrating electric drive technology with autonomous driving technology is the future trend.

2.1. Two Innovations at the Same Time

Innovations in automotive technology are often costly and tend to be applied first in premium vehicles. Early adopters who afford high product premiums generally focus on “technology differentiation” as the incentive to buy, meaning that they expect automakers to integrate as many innovations as possible, such as electric drive and autonomous driving technologies. With these products getting more affordable due to the declining cost of the innovations, the original product demand of early adopters will be extended to the mass market.

2.2. Easier Implementation of Autonomous Features on EVs

Since autonomous driving technology involves a large number of onboard sensors with high-performance computing hardware, it places higher demands on the vehicle’s electrical subsystem. Currently, conventional ICE engines generally use a 12 V electrical system provided by lead-acid batteries. In contrast, EV battery packs can undoubtedly provide an adequate power supply and more flexible voltage regulation, meaning that EVs will provide increased freedom to deploy autonomous driving technology. It is much easier to control the battery pack and electric motor than ICE with thousands of mechanical parts and complex wiring. Due to these advantages, autonomous driving R&D companies, including GM, Nissan, and Google, have used EVs as a starting platform for deploying autonomous driving technology.

2.3. Seamless Integration of Wireless Charging with Autonomy

Autonomous vehicles powered by conventional ICEs have difficulties in refueling and need the intervention of drivers, services, or intelligent robots, whereas wireless charging accessories produced by many companies already commercially available will solve the problem perfectly. Autonomous vehicles can drive to available parking spots and adjust to the optimal angle to ensure the charging receiver matches the pre-set wireless charging transmitter perfectly, maximizing wireless charging efficiency. Further, autonomous vehicles will achieve “opportunistic charging”: charging between driving behaviors to maintain a high battery level rather than awaiting a depleted battery [145].

2.4. Extension of Driving Range by Autonomy

The most significant challenge to the development of EVs is “range anxiety”, which is why all EV manufacturers are keen to introduce any technology that can extend driving range [146]. Predictions indicate that autonomous driving technology is expected to extend the driving range by 5% to 10% without hardware upgrades due to the smoothness of acceleration, deceleration, and steering enabled by advanced predictive models and decision algorithms [147]. While the accurate rate has to be further quantified based on experimental data, it does not hinder the allure of the prediction. Thus, automakers could invest in autonomous driving technology to alleviate EV “range anxiety” (same price, more extended range) or sink production costs (same range, smaller batteries).

2.5. Simultaneous Maturity

EVs and related infrastructure are not yet as broadly available. Fully autonomous driving is far from commercial application and yet both technologies are steadily advancing. As battery technology continues to develop, its cost per unit capacity is gradually sinking, facilitating the expansion of the EV market [148]. The iterations of sensors and software algorithms make it possible to optimize the autonomous driving experience at the exact cost, and gradually approach the direction of fully autonomous driving [149]. Therefore, the temporal synchronization of the two technologies’ evolution will prompt them to integrate and promote each other.

2.6. Simultaneous Mandate by Governments

As fossil energy sources become depleted and environmental issues become increasingly severe, it is foreseeable that government mandates will intervene in the production and sale of ICE vehicles. In fact, several governments worldwide have already discussed and initially developed timetables for when to prohibit the production and sale of ICE-powered vehicles. Meanwhile, when autonomous driving technology is undoubtedly proven to improve driving safety, governments may likewise mandate the technology as a necessary feature for vehicle production, such as airbags, ABS, and electronic stability control. The government may mandate both technologies in the future, thus creating a significant policy impetus for integration.

3. Technological Developments in EVs

Countries such as the U.S., South Korea, Singapore, and China have made active explorations in the field of autonomous driving of EVs and achieved some important results. The following introductions can serve as a microcosm of the development of autonomous driving for EVs, and provide guidance for the exploration and development of other emerging markets.

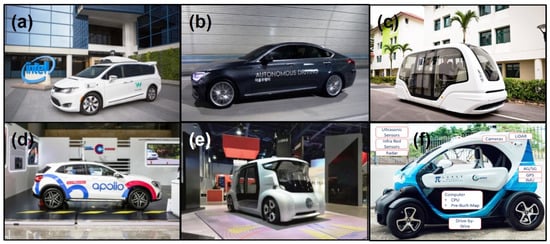

3.1. The U.S.

In 2009, Google began its involvement in autonomous driving and launched a related R&D project. In 2016, the project was expanded into a subsidiary called Waymo, which developed into the Alphabet autonomous driving department later [150]. In 2019, regulators in California approved Waymo’s proposal to carry passengers in its developed vehicles (Figure 3a). In 2016, Uber reached an agreement with Volvo to purchase 24,000 of its autonomous vehicles over three years starting in 2019 after testing prototypes of autonomous vehicles supplied by the company [151]. In June 2019, Uber launched its third-generation autonomous driving vehicles and planned to begin piloting the new vehicles on public roads in 2020. In January 2020, institutions in the U.S. jointly announced “Ensuring American Leadership in Automated Vehicle Technologies: Automated Vehicles 4.0”, which is based on AV 3.0 and aims to strategically lead the future of the transportation industry, and extended the scope to 38 U.S. government departments with direct or indirect interests in safety development and AV technology integration.

Figure 3. Representative autonomous vehicles around the world: (a) Waymo autonomous vehicle [152]; (b) Hyundai autonomous vehicle tested in “K-City” [153]; (c) Autonomous shuttle at Nanyang Technological University [154]; (d) Baidu autonomous vehicle [155]; (e) UISEE autonomous vehicle [156]; (f) Autonomous shuttle developed by APAS and HKPC.

3.2. South Korea

South Korea has invested heavily in a 3.45 million square foot test city called “K-City” in Hwaseong, Gyeonggi Province, covered with 5G network communications and equipped with rich urban scenarios such as four-lane highways and automated parking lots (Figure 3b). The launch of K-City, especially the highway, could provide the infrastructure to underpin the plan to commercialize Level Three autonomous vehicles. South Korea’s Ministry of Land, Infrastructure, and Transport announced security standards for operating Level Three autonomous vehicles in 2019. The government plans to achieve fully autonomous driving by 2030. It should construct and maintain the necessary communication and transportation infrastructure soon and bring both Level Three and Level Four autonomous vehicles into actual commercial use by 2027 at the latest. Related auxiliary systems, such as insurance agencies and performance assessments, will be available by 2024, together with telecommunications, traffic control, high precision maps, and other infrastructure to greet the era of fully autonomous vehicles. An open and shared autonomous driving industry backed by over 60 trillion won will be created, of which two-thirds of the funds will be provided by the Hyundai Motor Group.

3.3. Singapore

The Singapore government hopes to achieve a leading global technology for autonomous vehicles in the country. In 2017, the Ministry of Transport issued an array of regulations on self-driving vehicles, known as the AV Regulations, to support innovative experiments in autonomous driving. Singapore has become the first country worldwide to implement autonomous driving on a large scale, with the amendment to the Traffic Roads Act that makes it unnecessary to have a driver in a motor vehicle. The Ministry of Transport has established a regulatory environment for self-driving vehicles that is effective until 2022. However, it will continue to extend the regulatory sandbox or develop related permanent legislation to support autonomous driving. To contribute further to the growth of the self-driving vehicle industry, the Centre of Excellence for Testing and Research of Autonomous Vehicles was established to simulate natural traffic conditions, equipped with buildings, bus stops, signals, rain-making machines, etc. (Figure 3c). In addition, for non-peak travel and as-needed commutes, it plans to conduct live road tests of autonomous buses and shuttles in some regions, such as Tengah, Punggol, and the Jurong Innovation District, starting in 2022. The Land Transport Authority has decided to expand its scope of testing to satisfy companies’ needs for technological testing in more diverse transportation scenarios. It is foreseeable that all of western Singapore, containing over 1000 km of public roads, will be incorporated into the testing platform for autonomous vehicles, making it possible for corporations to test AVs in street blocks. The rich test set will comprehensively assess the robustness of current autonomous driving technologies and facilitate their upgrade to reach the security thresholds for long-distance inter-town travel, further laying the facilities and technology foundation for the development plan of autonomous vehicles in the early 2020s.

3.4. Mainland China

Chinese Internet leader Baidu announced in 2017 that it was collaborating with several companies in the autonomous driving field. As a pioneer in the autonomous driving industry in Mainland China, Baidu is jointly developing autonomous driving technology with automaker BMW and has set up test points in many regions, such as Shanghai and some cities in Anhui and Zhejiang. In the same year, Baidu launched a program, ”Apollo”, to provide new partners in the autonomous driving field with an open and secure software framework to assist them in integrating vehicle and hardware systems to build customized autonomous driving systems rapidly [157]. Figure 3d shows an autonomous test vehicle from Baidu. Baidu has also created an autonomous vehicle consortium and declared its intention to put autonomous vehicles on the road. In 2019, as expected, Baidu provided a commercial autonomous driving project in Hunan province, with an initial scale of 45 vehicles to conduct autonomous cab services on a 50 km-long public road. The Chinese government is eager to complete the economic transformation from a heavy and low-end manufacturing-driven economy to a high-tech and consumer-sector-driven economy. Therefore, recognizing the huge commercial potential of autonomous driving, it has developed several policies to support Mainland Chinese companies’ participation in the global competition for autonomous driving technologies. UISEE is another leader in commercializing autonomous driving in Mainland China, with its fully autonomous vehicle demonstrated at the Consumer Electronics Show 2017, and installing many sensors, such as stereo cameras, millimeter-wave radars, laser radar, and ultrasound sensors (Figure 3e). Intelligent algorithms integrated with deep learning could integrate data from each sensor into planning and decision models and combine with expert systems with self-learning and predictive functions to bring passengers a comfortable and secure driving experience. UISEE has developed prototype autonomous driving products for short commutes in relatively closed environments, including shuttles and sightseeing buses, and has already gotten practical testing at Guangzhou Baiyun International Airport. In 2019, UISEE put autonomous logistics vehicles into service for baggage transportation at Hong Kong International Airport.

Responding to the government’s guidance, the “Intelligent Networked Vehicle Road Test Management Specification (Trial)” was released to provide legal-level support for organizations to conduct autonomous vehicle road tests. Subsequently, 16 test points were established in Beijing, Shanghai, Chongqing, Wuxi, etc. In 2019, in order to build a healthy partnership, 16 test points signed a joint initiative regarding improving the security of intelligent networked vehicles, promoting vehicle–road cooperation, improving the efficiency of testing and evaluation, and enabling data sharing.

3.5. Hong Kong

Autonomous driving in Hong Kong is in its infancy. The Smart City Blueprint Consultancy Study Report released in 2017 proposed to “facilitate trials of autonomous vehicles in the West Kowloon Cultural District and other areas as appropriate”. Researchers in Hong Kong installed an autonomous driving system on a golf cart with the ability to sense its surroundings, making it the first autonomous vehicle in Hong Kong. Hong Kong does not yet have specific and appropriate regulatory legislation for autonomous driving functions. With Tesla, for example, the lane-changing and assisted steering functions are only allowed on particular roadways with medians and limits above 70 km/h, while the “summon”, which remotely navigates the vehicle into and out of parking spaces, is strictly prohibited. Meanwhile, its autopilot function is forbidden in most urban areas, and drivers are only authorized to enable it on high-speed roads and tunnels. In 2017, the Hong Kong Science and Technology Parks Corporation gathered technology startups and automotive companies Scania and Inchcape to create an intelligent mobility ecosystem to incubate smart transportation technologies. However, to carry out a trial project involving autonomous vehicles in the Science Park, one must first apply to the Ministry of Transport with details such as time and location to get the vehicle movement permit before conducting it on-site.

APAS and HKPC are enhancing the development of autonomous driving technology to facilitate local enterprises in Hong Kong to seize emerging business opportunities created by intelligent transportation. In 2018, with the support of the Innovation and Technology Commission, an independent R&D platform was created for autonomous vehicles to provide hardware support for future technology development and application (Figure 3f). In 2019, the Technical Advisory Committee on the Application of Autonomous Vehicle Technologies was established, composed of experts from relevant research institutions and industries, to promote its further development in Hong Kong. The committee will discuss how to develop a regulatory framework for autonomous driving with complete legal support, considering the experience of local pilot projects. However, the Hong Kong government has continued to severely restrict road testing of specific autonomous vehicles in the territory through the case-by-case application policy.

4. Prospects

Fully autonomous planning and execution of all driving behaviors without intervention mean that autonomous vehicles must be equipped with extremely robust and safe technologies. Before that, several significant and inter-coupled challenges must be addressed.

4.1. Immature Technology and Business Models

While technicians are ramping up to develop commercially available autonomous vehicles, there are few perspectives on the organization in which these vehicles will be utilized in the future. What role will autonomous vehicles assume in future transportation operations? Will users pay for the delivery service or vehicle ownership? If mobility-sharing companies could “service” vehicles to eliminate their individual characteristics, the entire business model of the industry would be subverted. Passengers will no longer focus on the type of vehicle they travel in but only on whether they move from place A to place B.

4.2. Regulation and Legislative Framework

A robust regulatory and legal framework plays an essential role in the continuous evolution of autonomous driving technology. An effective regulatory framework enables companies to evaluate the legal challenges brought by their solutions and avoid investing in dangerous ideas. Meanwhile, strict regulatory and legal constraints can enhance the public’s confidence in the security of autonomous driving. A practical test is undoubtedly the key to leading the reform in establishing and improving the regulatory and legislative framework.

4.3. Changes to Insurance

Autonomous vehicles will create complex challenges and reforms for the insurance industry, and insurers must redesign appropriate products for autonomous vehicle owners, passengers, and operators. Insurers cannot wholly and reasonably evaluate the risks associated with autonomous vehicles. With the expansion of autonomous vehicle services, people originally unqualified to drive will form a new customer base, and how to evaluate these risks will undoubtedly be another significant challenge for the insurance industry.

4.4. Investment in Infrastructure

The popularity of fully autonomous vehicles is directly associated with infrastructure. Firstly, the dynamic inspection of road infrastructure ensures that autonomous vehicles read road information accurately to drive correctly. Secondly, full coverage of data services within the road network is essential to prevent “offline”. Therefore, the investment in infrastructure development needs to be significantly increased.

4.5. Future Challenges and Opportunities

Challenges and opportunities in the future development of autonomous driving in EVs are summarized in Table 1.

Table 1. Summary of challenges and opportunities of application of autonomous driving in EVs [158].

| Challenges | Opportunities |

|---|---|

| Limited physics-based models | Data-based models and hybrid models |

| Lack of controllers for arbitrary situations | Fully applicable methods for numerical control design that can accommodate uncertainties and discover approximately optimal or even feasible solutions under real-time operation constraints |

| Decision-making algorithms in autonomous vehicles, from powertrain control-loops to autonomous driving functionality | Development of large V2X systems and learning-based components (e.g., neural networks) |

| Ensuring high reliability and low cost and complexity | Improved resilience against sensor and actuator failures, communication dropouts, and cyber attacks |

| A lot of uncertainty regarding the deployment of autonomous vehicles in terms of what levels of automation will be introduced to public roads and when | Construction of new physical and cyber infrastructure |

This entry is adapted from the peer-reviewed paper 10.3390/en15176271

This entry is offline, you can click here to edit this entry!