As the supply of commodities forms essential lifelines for modern society, commodity price

fluctuations can significantly impact the operation and sustainable development of macroeconomics,

production activities, and people’s security and well-being. The commodity trading market also plays

a pivotal role in the competition of the international industrial chain and the sustainable development

of the industry. The method of bibliometrics was used in this study to trace the development of

research on commodity prices, and statistical and co-citation analyses were conducted on selected

literature samples. It was found that the research hotspots in this field are concentrated on four

aspects: factors influencing commodity prices, the impact of price fluctuations on the macroeconomy,

forecasts of commodity prices, and the financialization of commodities. A current commodity price

research network centered on oil prices has formed. Future directions in this field, which developed

out of oil shock research 40 years ago, can further investigate the impact of factors and the responses

that can be made to emergencies on commodity prices, as well as continuing to develop better

methods of commodity price forecasting

- commodity prices

- bibliometrics

- co-citation

- cluster analysis

- Introduction

Commodities, essential lifelines for modern society, include almost all primary material commodities used for production and consumption, such as energy, minerals, and agricultural products. It is important to understand the driving factors for the fluctuations of commodity prices and the impact of commodity price changes on the macroeconomy [1]. In consumer and producer countries, a large part of income and welfare depends on the prices of these goods [2]. Commodity markets occasionally exhibit widespread mass booms and busts. These events affect the ability of the poor and those countries in the developing world to purchase basic necessities, such as food and energy, creating trade imbalance, and in some cases, political turmoil. The effect of the “boom and bust” of commodity prices resonates with ordinary people because trade imbalances and currency shocks that can then arise affect social welfare [3], the operation of the national economy, and enterprise production in a way that not all price surges do. Therefore, commodities price fluctuation has received attention from all quarters.

In addition, commodity prices are more volatile than others [4]. With the gradually deepening financialization of the commodity market, this greater fluctuation is obvious and is well known to be extremely susceptible to large-scale emergencies, creating rapid fluctuation. Starting from decade lows in the late 1990s, commodity prices continued to rise for the next 10 years, and reached their peak in June 2008. After the financial crisis, it was pushed to a record high by many countries’ economic stimulus. The price until 2011 was twice as much as that in 1988. From the second half of 2006 to the first half of 2008, driven by various factors, the prices of agricultural products on a global scale rose, triggering a round of food crises that seriously impacted the welfare of the poor worldwide. Due to the wide effects of COVID-19, the prices of metal products, such as steel and copper, fell sharply and then increased rapidly in 2020, posing a serious threat to the production and survival of downstream small- and medium-sized enterprises. In the long run, the trend of increasing volatility in commodity prices can be difficult to reverse, creating the necessity to pay more attention to the field of forecasting international commodity prices.

More importantly, the volatility of commodity prices has an important impact on the sustainable development of a country. Take energy as an example. Among the Sustainable Development Goals, SDG7 is the Sustainable Development Goal of Energy, which is to ensure that everyone has access to affordable, reliable, and sustainable modern energy. However, energy prices affect the stability and sustainable development of most countries, especially poor countries, where access to energy is limited; in addition, some populations have no access to energy at all, which goes against the goals of SDG7 [5]. On the other hand, sharp fluctuations in energy prices have had a significant impact, with rapid price declines not conducive to energy exporting countries; however, sharp price increases are unfavorable for energy importing countries, and exporting countries are affected by energy price vulnerability [6]. If the general trend of energy prices cannot be well grasped and a safe energy guarantee mechanism cannot be established, it will bring challenges to the sustainable development of the country [7,8]. Likewise, food sustainability is one of the main concepts for achieving global sustainable development [9]. SDG2 means ending hunger, achieving food security, improving nutrition, and promoting sustainable agriculture. High food prices will limit people’s ability to obtain food [10], which is fundamentally detrimental to the long-term development of the country.

Having a better understanding of the research history and development path of commodity prices, and grasping the current research hotspots and future development trends, are of theoretical and practical significance. In particular, it can help companies to prevent future business risks, help companies to take effective measures to hedge the cost risks caused by drastic price changes, and increase the expectations for future sustainable development. However, current research reviews in this field mainly use qualitative analysis methods, relying on an author’s subjective framework to sort out research themes and content [11], or only focusing on one specified commodity. For example, Chiroma et al. [12] reviewed the application of existing computer intelligence algorithms in crude oil price prediction, and analyzed the advantages and limitations of the research. Ederington et al. [13] reviewed the existing research on the relationship between crude oil prices and petroleum product prices, and summarized the causal and asymmetric relationship between the two. Abdallah et al. [14] used food safety, price fluctuations, and price transmission as keywords to quantitatively analyze literature on food safety and food prices; this revealed the current research hotspots and status quo.

Compared with traditional qualitative literature reviews, bibliometric analysis, using statistical methods, can evaluate and review research progress in a more comprehensive and objective way, and is visualized. Therefore, this paper uses the Citespace software to sort out the development of the field of “commodity prices”, grasp the overall growth trend of the number of documents and citations in this field, figure out the top scientific research institutions, countries and core authors, as well as their cooperation relationships. At the same time, through co-citation analysis, we can understand current research hotspots and dynamic evolution to clarify future research trends.

- Methods and Data

Bibliometric analysis is powerful for tracing the development path and grasping the research hotspots of a specified research field. Because it integrates mathematics, statistics, and philology to help researchers conduct quantitative analysis and visual research on literature, it can quickly identify the coupling relationship between published articles and the cooperation relationship between authors. The most common analysis methods include core author analysis, co-citation analysis, and co-word analysis [15–17].

For this study, research papers on commodity prices were searched for and collected from the “Web of Science Core Collection” database. We first searched the database using keywords, including “commodity price”, “price of commodity”, “food price”, and “oil price”, and limited the searched-for literature types to “Article” and “Review”. We then collected a list that contains 2962 articles from 1900 to 2020 (downloaded on 14 September 2021). Next, based on the title, keywords, and abstract, we excluded papers that are not closely related to the research topic, such as wholesale price of goods in a certain year, and product sales strategies. Finally, 1671 papers remained.

- Statistical Analysis of Commodity Prices

This section may be divided into subheadings. It should provide a concise and precise description of the experimental results, their interpretation, as well as the experimental conclusions that can be drawn.

3.1. Research on the Overall Growth Trend

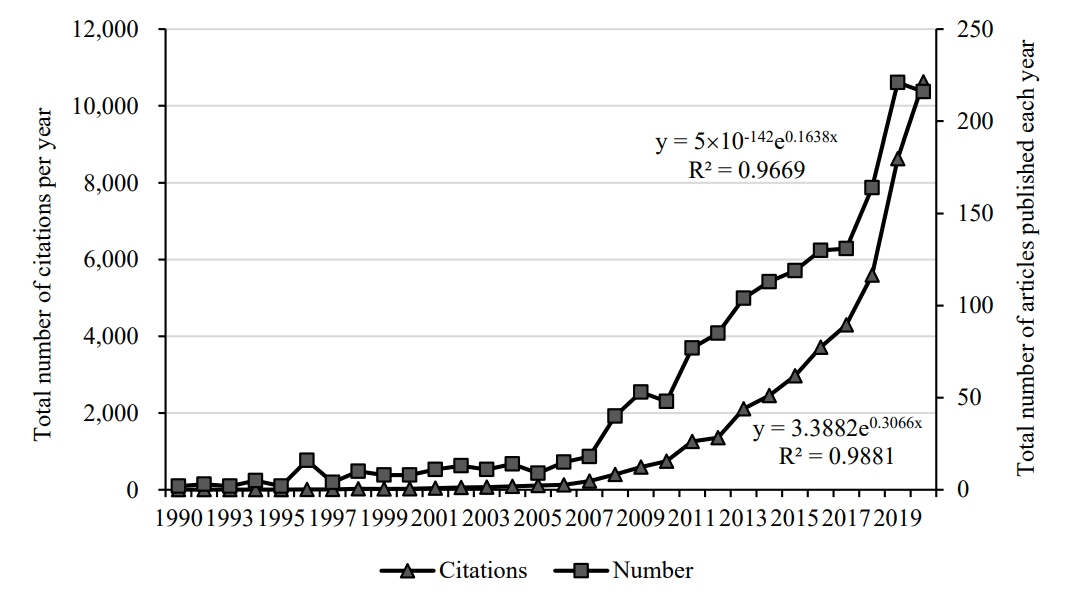

The degree of academic attention to a certain field can be reflected in the number of publications and citations. It can be seen from Figure 1 that the literature on commodity prices has gradually increased since 2000, and has shown an explosive growth trend after 2008, reaching 221 in 2019. From 1990 to 2019, the number of documents has doubled a hundredfold in 30 years. This is in line with the actual situation. The 2008 financial crisis caused violent fluctuations in commodity prices and severely impacted economic operations. Since then, more scholars have devoted themselves to research in this field.

Figure 1. The number of published documents in each year (1990–2020).

Figure 1 also reflects the changing trend of the number of citations in the field of commodity prices in the past 30 years. The number of citations grew from 5 in 1990 to 10,624 in 2020. The most cited article is Kilian’s article published on AER in 2009. This groundbreaking research decomposed the actual price of crude oil into three parts: crude oil supply shocks, shocks to the global industrial commodity demand, and demand shocks specific to the crude oil market; it discussed the reasons for major oil price shocks since 1975. As of 2020, this article has been cited 1,409 times, becoming a foundational work in the field of commodity prices.

For the quantitative work, our method was: apply exponential fitting to the number of articles published each year and the number of citations. The R-squares of the curves are 0.967 and 0.988, respectively, indicating that the number of research documents and citations in the field of commodity prices has exponentially increased; this reflects the high degree of concern of the academic community on commodity prices in recent years.

3.2. Publication Sources

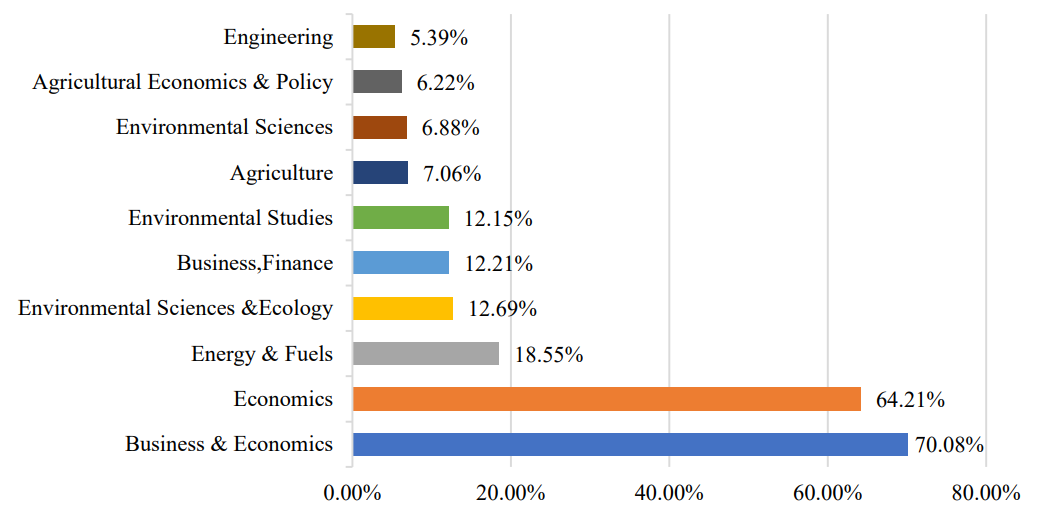

Figure 2 shows the main research areas of commodity prices and their proportions. The research direction is given by the Web of Science database. Since the research content of a document may involve multiple fields, the proportions of each field add up to more than 100%. It can be seen that the research is mainly concentrated on economics and energy, with a small proportion of research focusing on finance.

Figure 2. Main research areas and proportions.

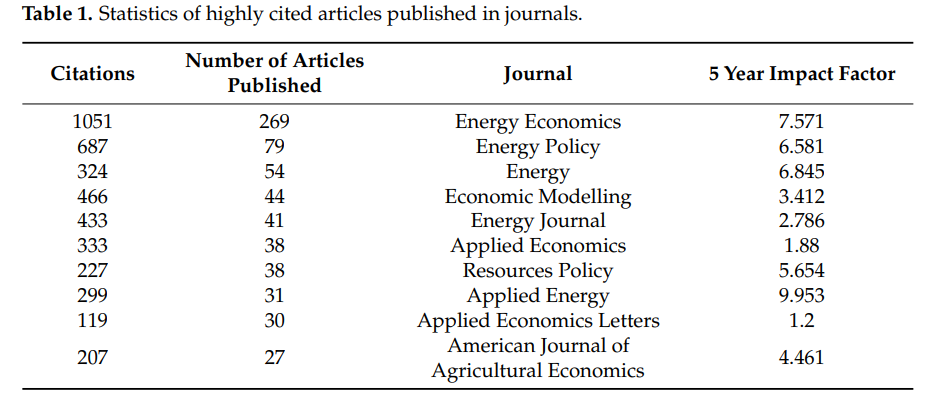

Paying attention to publications of frequently cited literature can clarify the degree of academic attention to the field of commodity prices. Table 1 shows some highly cited journals and their impact factors in the past five years. Among them, Energy Economics, Journal of Econometrics, Econometrica, and American Economic Review are highly cited. They are the top publications in the fields of energy, econometrics, and economics. It shows that in addition to relevant professional knowledge, research on commodity prices also involves using a large number of econometric models. From the perspective of the volume of publications, the literature in this field is mostly concentrated on Energy Economics, Energy Policy, and Energy, and the impact factors of these journals are all above 6; this indicates that there has been a batch of high-quality articles affecting economic operation and resource management in the field of commodity price research.

This entry is adapted from the peer-reviewed paper 10.3390/su14159536