Your browser does not fully support modern features. Please upgrade for a smoother experience.

Please note this is an old version of this entry, which may differ significantly from the current revision.

Subjects:

Computer Science, Information Systems

Since FinTech was stimulated by the invention of blockchain, without the full realization of blockchain technologies in the following years, FinTech has not been fully realized. The lack of distributed synchronization might be the most difficult challenge such that the trust provided by blockchain is not good enough for public use.

- FinTech

- blockchain

- finality

- consensus

- Proof-of-Work

- energy consumption

- realization

1. Introduction

Financial technology (abbreviated FinTech ) is the technology and innovation that aims to compete with traditional financial methods in the delivery of financial services. It is an emerging industry that uses technology to improve activities on automating investments, insurance, trading, banking services and risk management. Most technologies involve artificial intelligence (AI), Big Data, robotic process automation (RPA) and blockchain [1]. FinTech history dates back to the 19th century and even before that [2], but it was stimulated the most in the past two decades by blockchain because of the fundamental change of currencies and payment methods.

The words block and chain were used separately in Bitcoin white paper [3], in 2008, to devise electronic cash on the Internet. Before it was introduced in The Economist edition on 31 October 2015 as a trust machine, blockchain became the most significant innovation since the Internet [4]. Bitcoin was the first blockchain application before the term blockchain was coined. In addition to support Bitcoin-like cryptocurrencies, blockchain has supported more than 15,000 cryptocurrencies by December 2021 [5]. People has also developed many new features for blockchain where trust needs to be enforced in various applications, such as smart contract, which is a trustworthy program verified by peer nodes. Although there are still problems such as energy consumption, performance, security, scalability, privacy, storage and so on that still need to be solved, the total market value of cryptocurrencies has reached 2.235 T USD on 31 December 2021 [6], about 2.35% of the 2021 global GDP (Gross Domestic Product) 94.935 T USD [7]. The percentage is not high because, in order for value to be transferred on Internet, the trust and finality supported by current blockchains are still only stochastic. Stochastic finality might be good enough for speculators but not for prevalent applications for the public, such as Central Bank Digital Currency (CBDC). On the other hand, the percentage is very high because it ranks 10th among the GDP of all countries in 2021. In addition, the other problems mentioned above mainly come from the fact that there is no global event ordering [8] for synchronization in distributed systems. Since trust can reach a consensus in a timely manner, with distributed synchronization, blockchain can support real trust for most Internet applications, let alone the metaverse. Without trust supported by blockchain, the metaverse is only an augmented online game.

To reach consensus in computer science is to make participating processes agree on some data value or situation. Consensus plays the most important role for the behavior or features supported in blockchain. There is a wide variety of research and applications that attempt to solve different problems by using different methods to reach a consensus. However, a consensus cannot be reached at once in a distributed system, resulting partitions [10]. Although none of the instances solve all problems, they own enough users or markets to survive with different advantages, regardless of the notorious energy consumption in public blockchains or possible collusions in private blockchains. Actually, most of the problems come from the fact that stochastic finality cannot provide distributed synchronization efficiently and effectively. Common solutions are longer wait times or using multiple resources that ignore possible attacks or problems in real use, usually with various exceptions and a large number of transactions. Using epoch and several synchronized block intervals, deterministic finality can be achieved [11] with more flexibility than absolute finality. However, it requires long (100-block) epoch times and utilizes a distributed hash table to assume perfect (under some bound) network connection [12]. In reality, O(1) complexity is difficult to achieve in a jittering network environment, and it might not be flexible and trustworthy enough to impose business logic or reflect user investments.

As long as there are some stochastic and speculative benefits, applications do not need to wait for 100% mature technologies to develop and users would like to take some risks or even ignore risks. Social research studies even design laws and policies for governments to help reduce energy consumption [13], which might bring inconvenience in daily lives. Sedlmeir et al. [14] even found reasons that the energy consumption of blockchain does not pose a large threat to climate from a holistic point of view, while keeping the advantages of blockchain. Innovation occurs in this interaction of research and application but myths and abuses are incurred as well. The myth might be another reason for delaying realization. Moreover, although realized blockchain might bring a lot of benefits, vested interests or malicious authorities might go against it. Few research has addressed the problem of how to solve complex, technical, social, mental and business logical problems above. If we can find a consensus mechanism with flexible deterministic finality so that distributed synchronization is possible for blockchain transactions with various business logic, the problems above might be solvable.

OurChain [15] based on Bitcoin PoW (Proof-of-Work) was prototyped on July 2019 as a public blockchain with consensus on EPoW (Estimable PoW) [16], reaching a deterministic finality with a two-block epoch and global event ordering, called Proof-of-PowerTimestamp (PoPT), by comparing the timestamp first and then estimating computing power. Each block interval is 2 s. However, OurChain was not published because EPoW is not generalized or simple enough, resulting in a situation where the distributed synchronization problem was not solved. Extending from EPoW, GPoW (General PoW) is a general PoW supported by the order statistic [17,18] model. GPoW constructs a trust model of blockchain with closed-form formula to any given level of coefficient variance, develops the distributed synchronization solution and solves the energy consumption problem of PoW. The trilemma, consistency, availability and partition tolerance in a distributed system [10] becomes feasible by synchronization in a real-time manner. The closed-form formula can help to adjust system behavior dynamically to adapt to network jitter in real-time for reaching distributed synchronization. By GPoW, a flexible deterministic finality can be achieved by dynamically adjusting the target value of mining difficulty for different user behavior. The user behavior can be also modeled by functions of estimated computing power economically and flexibly by using EPoW.

2. Common Features of Blockchain

Decentralized, immutable, transparent and anonymous characteristics might be the most common features mentioned with blockchain. However, there are still related myths to be corrected.

-

Decentralized: It is the most important source of trust in blockchain, especially with the permissionless control of mining nodes. With the hash-based PoW, a block from any node can be verified by all nodes and be randomly chosen to be appended as the latest block. A trustless trust is the most trustworthy. However, this does not mean it removes centralization at all. Some authority as a center might still be necessary, such as the government or a central bank, to control the interest or tax rates;

-

Immutable: The data are reliable because they are hash-chained and are very difficult to change once written. However, it is not trustworthy since wrong inputs might produce wrong outputs and it might be replaced for the consensus mechanism, e.g., the longest chain policy in PoW. Therefore, appending transactions to offset previous mistakes is inevitable and acceptable;

- Transparent: All data in most blockchains are not encrypted and transparent to anyone. It might be misunderstood because the translation of cryptocurrency is wrong and means encrypted;

-

Anonymous: The block ID or transaction ID is only a hash of itself. It is anonymous but is still traceable by the IP address of network packet or other detective methods. Actually, anything used should leave some clues for being traced unless it is not used anymore.

3. Proof-of-Work (PoW)

PoW is a form of cryptographic proof in which one party (the prover) proves to other parties (the verifiers) that a certain amount of a specific computational effort has been expended for reaching some consensus. Verifiers can subsequently confirm this expenditure with minimal effort on their part [23]. PoW is represented by a piece of datum sent from a requester to the PoW service provider. It was first proposed to prevent junk mail [24] by performing some significant computing work before sending an email. Bitcoin was not the first attempt based on PoW [25]. For the first successful hash-based PoW used in blockchain as in Bitcoin, the point of PoW is to prove that enough computing work has been performed so that the winner can append a new block in the blockchain. Some reward, but not necessary, could be provided to the winner as an incentive to maintain the operation of blockchain after the block is really confirmed.

4. OurChain

OurChain, meant and read as your chain or our chain, is based on Bitcoin with EPoW mining and a smart contract, OurContract. With the estimated computing power of remote nodes by EPoW, deterministic finality can be reached by PowerTimestamp, which provides global event ordering by combining timestamp and estimated computing power together.

4.1. OurChain Architecture

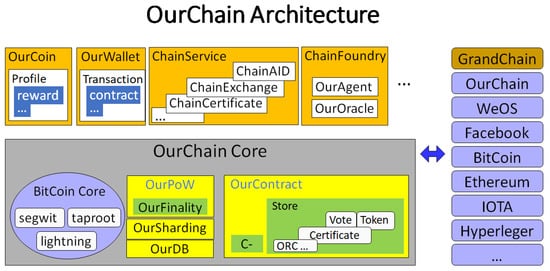

OurChain is a blockchain platform for building blockchains on architecture such as those shown in Figure 1, including the core and services. This blockchain is similar to a trusted distributed real-time operating system.

Figure 1. OurChain architecture.

On top of OurChain core, there are different services. OurCoin is the built-in payment coin with a profile to customize all OurChain system parameters such as reward for miners. OurWallet is our blockchain wallet for managing cryptocurrencies and sends transactions to exchange information or values by scripts or smart contracts. ChainService provides the service link to other blockchain middleware (DApp), where the information or values are certified and can be cached or shared with other nodes.

5. General Proof-of-Work (GPoW)

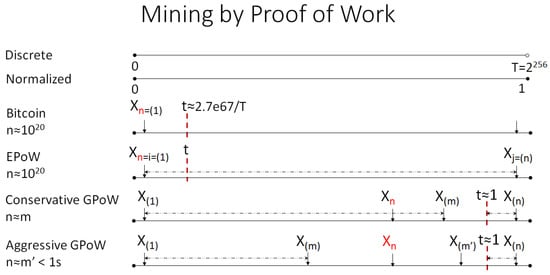

Although EPoW provides closed-form formula to estimate the computing power of remote nodes and support deterministic finality, the computation is still complex for further analysis. GPoW extends EPoW generalizing PoW with mathematic model for mining, constructing simple closed-form formula for further trust analysis in blockchains. Using GPoW, at least m valid nonces need to be collected but only m ones, corresponding to the lowest m hash values for estimating computing power, and they are broadcasted for estimating computing power at each round. Users can collect more than m valid nonces to find better m ones to broadcast according to different reward policies. If exactly m valid nonces are collected, it is called a conservative GPoW; otherwise, it is called an aggressive GPoW, as shown in Figure 2.

Figure 2. General proof-of-work.

6. Realization Issues

With PoPT and distributed synchronization, it appears that most technical problems in blockchain can be solved and can proceed toward realization soon. However, the realization incurs many existing non-technical and new technical problems. Basically, we believe that the trust of one thing is best supported by one blockchain, and many blockchains interacting on the Internet can discover the disguises of things. For example, the blockchain of traceable agricultural products might not find that some vegetable is as organic as recorded, but a blockchain with fertilizer purchasing might help. Each blockchain is an economy. The economies merge, split or create new ones.

6.1. Business Model

If blockchain can support trust on the Internet, before any form of metaverse is realized, we can conduct business on the Internet while governed by blockchains. The business model will be very different and can be implemented in blockchain as well using governance tokens executing online companies or Decentralized Autonomous Organizations (DAOs) [37], including the funding invested with different models for each round. A company might be supported by a blockchain or many blockchains. There might be also many different GrandChain-like NGOs [38].

6.2. Universal Distributed Applications

Many distributed applications (DApps) taking advantages of decentralization, the most significant feature of blockchain, would like to explore more market share in existing or even new industries. However, if the applications require no decentralization in nature, most trials fail in a few years. DApps that need to be decentralized are usually universal without limitations of location or situation to run their business. AID and GrandChain are this kind of universal DApps. Frozen chain freezing currencies according to court order or lost chain dealing with the currencies for which its key are lost might also be universal DApps. The question of how to realize universal DApps so that they are sustainable without being a new monopoly is significant in the realization of blockchain.

This entry is adapted from the peer-reviewed paper 10.3390/fintech1010007

This entry is offline, you can click here to edit this entry!