The integration of ESG into the business model means considering ESG issues in the existing business model, which is defined by four factors: value proposition, value creation, value delivery, and value capture.

- ESG integration

- business model

- socially responsible investment

- ESG

- sustainability

- sustainable development

1. Introduction

2. ESG Integration: Socially Responsible Investment

3. ESG Integration into Firms: Sustainable Development

4. Findings: ESG integration into the business model

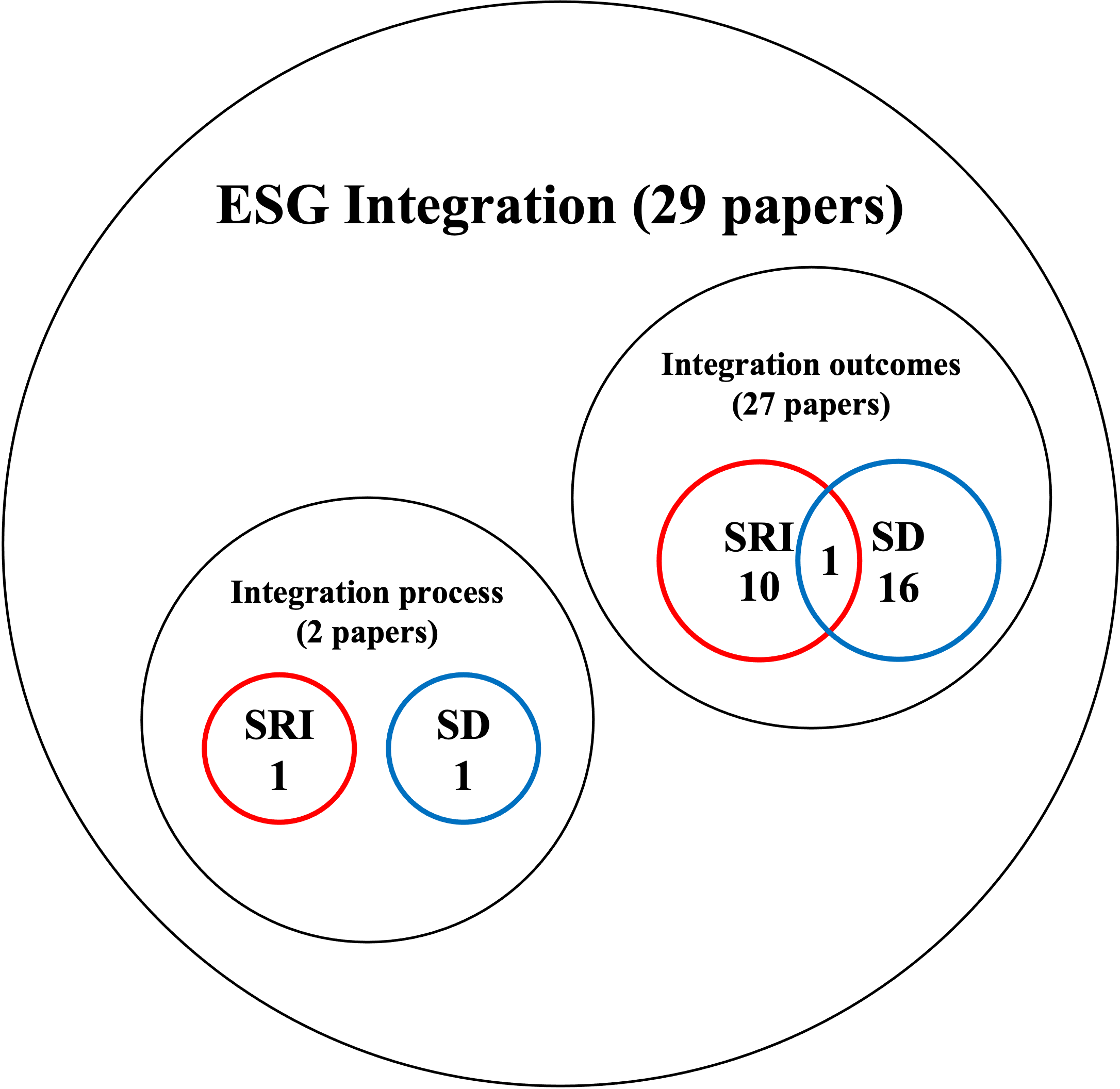

We found only 29 studies related to this ESG integration into the business model. Including 27 papers conceptualized ESG into the business model as an outcome; they included 10 papers along the lines of SRI, 16 papers following the view of SD, and 1 paper that addressed both SRI and SD. The papers provided only a general conception of the relationship between ESG and business models with no details of how the integration actually occurred. We grouped similar integration outcomes into four dimensions: (1) integration behaviors of ESG, in which the literature discusses the impact of government regulations, investors, and banks on integration behavior; (2) the advantages of ESG integration for firms and investors; (3) ESG practices, such as an examination of current cases addressing ESG in the business model; and (4) critical views of ESG in the business model.

Of the remaining two papers, the first examined the integration process based on the SRI view, while the second paper addressed the integration in terms of SD. The latter dealt with a firm integrating the concepts of sustainability and circular economy into its business model through value proposition, value delivery, value creation, and value capture.

Figure 2. Paper analysis results of ESG integration process and outcomes.

4. Conclusion

The literature provides only a conceptual understanding of the relationship between ESG and business models. There is neither an actual detailed case of the integration process nor an explanation of how firms can fully integrate ESG, transform, or improve their business model to resolve trade-offs [32], and enforce profit and sustainability. Moreover, there has been no discussion of ESG integration into core business models. Our results suggest that the pressure to integrate ESG leads to reluctant ESG adoption without a holistic integration of ESG into the business model. We state the need for more research into the integration process to motivate firms to reform their business models, foster sustainability, and enhance financial performance.

This entry is adapted from the peer-reviewed paper 10.3390/su14052959

References

- Eccles, R.; Stroehle, J. Exploring Social Origins in the Construction of ESG Measures; Saïd Business School, University of Oxford:Oxford, UK, 2018.

- Global Sustainable Investment Alliance. Global Sustainable Investment Review; Global Sustainable Investment Alliance: Washington,DC, USA, 2020.

- Ellen Pei-Yi Yu; Bac Van Luu; Catherine Huirong Chen; Greenwashing in environmental, social and governance disclosures. Research in International Business and Finance 2020, 52, 101192, 10.1016/j.ribaf.2020.101192.

- Philip Sugai; The Definition, Identification and Eradication of Value Washing. Journal of Creating Value 2021, 7, 165-169, 10.1177/23949643211032073.

- Zammit, A. Development at Risk Rethinking UN-Business Partnerships; South Centre: Geneva, Switzerland; UNRISD: Geneva, Switzerland, 2003; pp. 1–277

- Amir Amel-Zadeh; George Serafeim; Why and How Investors Use ESG Information: Evidence from a Global Survey. Financial Analysts Journal 2018, 74, 87-103, 10.2469/faj.v74.n3.2.

- Luluk Widyawati; A systematic literature review of socially responsible investment and environmental social governance metrics. Business Strategy and the Environment 2019, 29, 619-637, 10.1002/bse.2393.

- Nagel, S.; Hiss, S.;Woschnack, D.; Teufel, B. Between Efficiency and Resilience: The Classification of Companies according to their Sustainability Performance. Hist. Soc. Res. 2017, 42, 189–210.

- Robeco. Sustainability Report; Robeco: Rotterdam, The Netherlands, 2020.

- Gunnar Friede; Timo Busch; Alexander Bassen; ESG and financial performance: aggregated evidence from more than 2000 empirical studies. Journal of Sustainable Finance & Investment 2015, 5, 210-233, 10.1080/20430795.2015.1118917.

- Lavinia Conca; Francesco Manta; Domenico Morrone; Pierluigi Toma; The impact of direct environmental, social, and governance reporting: Empirical evidence in European‐listed companies in the agri‐food sector. Business Strategy and the Environment 2020, 30, 1080-1093, 10.1002/bse.2672.

- Chris Brooks; Ioannis Oikonomou; The effects of environmental, social and governance disclosures and performance on firm value: A review of the literature in accounting and finance. The British Accounting Review 2018, 50, 1-15, 10.1016/j.bar.2017.11.005.

- Eduardo Duque-Grisales; Javier Aguilera-Caracuel; Environmental, Social and Governance (ESG) Scores and Financial Performance of Multilatinas: Moderating Effects of Geographic International Diversification and Financial Slack. Journal of Business Ethics 2019, 168, 315-334, 10.1007/s10551-019-04177-w.

- Alexandre Sanches Garcia; W. Mendes; Renato J. Orsato; Sensitive industries produce better ESG performance: Evidence from emerging markets. Journal of Cleaner Production 2017, 150, 135-147, 10.1016/j.jclepro.2017.02.180.

- Mark Camilleri; The market for socially responsible investing: a review of the developments. Social Responsibility Journal 2020, 17, 412-428, 10.1108/srj-06-2019-0194.

- Alexander Landau; Janina Rochell; Christian Klein; Bernhard Zwergel; Integrated reporting of environmental, social, and governance and financial data: Does the market value integrated reports?. Business Strategy and the Environment 2020, 29, 1750-1763, 10.1002/bse.2467.

- Sayema Sultana. Dalilawati Zainal; The influence of environmental, social and governance (ESG) on investment decisions: The Bangladesh perspective. Pertanika Journal of Social Science and Humanities 25(S) 2017, 25, 155-173, .

- Emiel Van Duuren; Auke Plantinga; Bert Scholtens; ESG Integration and the Investment Management Process: Fundamental Investing Reinvented. Journal of Business Ethics 2015, 138, 525-533, 10.1007/s10551-015-2610-8.

- Michael Cappucci; The ESG Integration Paradox. Journal of Applied Corporate Finance 2018, 30, 22-28, 10.1111/jacf.12296.

- Dirk Schoenmaker; Willem Schramade; Investing for long-term value creation. Journal of Sustainable Finance & Investment 2019, 9, 356-377, 10.1080/20430795.2019.1625012.

- Gunnar Friede; Why don't we see more action? A metasynthesis of the investor impediments to integrate environmental, social, and governance factors. Business Strategy and the Environment 2019, 28, 1260-1282, 10.1002/bse.2346.

- Mauro Sciarelli; Silvia Cosimato; Giovanni Landi; Francesca Iandolo; Socially responsible investment strategies for the transition towards sustainable development: the importance of integrating and communicating ESG. The TQM Journal 2021, 33, 39-56, 10.1108/tqm-08-2020-0180.

- Justyna Przychodzen; Fernando Gómez-Bezares; Wojciech Przychodzen; Mikel Larreina; ESG Issues among Fund Managers—Factors and Motives. Sustainability 2016, 8, 1078, 10.3390/su8101078.

- Rodrigo Lozano; Towards better embedding sustainability into companies’ systems: an analysis of voluntary corporate initiatives. Journal of Cleaner Production 2012, 25, 14-26, 10.1016/j.jclepro.2011.11.060.

- Nicolas Chevrollier; Jianhong Zhang; Thijs Van Leeuwen; André Nijhof; The predictive value of strategic orientation for ESG performance over time. Corporate Governance: The International Journal of Business in Society 2020, 20, 123-142, 10.1108/cg-03-2019-0105.

- Aida Maria Ismail; Izrul Haida Mohd Latiff; Board Diversity and Corporate Sustainability Practices: Evidence on Environmental, Social and Governance (ESG) Reporting. International Journal of Financial Research 2019, 10, 31, 10.5430/ijfr.v10n3p31.

- Mahmoud Arayssi; Mohammad Jizi; Hala Hussein Tabaja; The impact of board composition on the level of ESG disclosures in GCC countries. Sustainability Accounting, Management and Policy Journal 2019, 11, 137-161, 10.1108/sampj-05-2018-0136.

- Jaime Lavin; Alejandro Montecinos-Pearce; ESG Reporting: Empirical Analysis of the Influence of Board Heterogeneity from an Emerging Market. Sustainability 2021, 13, 3090, 10.3390/su13063090.

- Shaista Wasiuzzaman; Wan Masliza Wan Mohammad; Board gender diversity and transparency of environmental, social and governance disclosure: Evidence from Malaysia. Managerial and Decision Economics 2019, 41, 145-156, 10.1002/mde.3099.

- Selena Aureli; Mara Del Baldo; Rosa Lombardi; Fabio Nappo; Nonfinancial reporting regulation and challenges in sustainability disclosure and corporate governance practices. Business Strategy and the Environment 2020, 29, 2392-2403, 10.1002/bse.2509.

- Busch, T.; Bauer, R.; Orlitzky, M. Sustainable Development and Financial Markets: Old Paths and New Avenues. Bus. Soc. 2016,55, 303–329.

- Geraldine Brennan; Mike Tennant; Sustainable value and trade-offs: Exploring situational logics and power relations in a UK brewery's malt supply network business model. Business Strategy and the Environment 2018, 27, 621-630, 10.1002/bse.2067.

- Geraldine Brennan; Mike Tennant; Sustainable value and trade-offs: Exploring situational logics and power relations in a UK brewery's malt supply network business model. Business Strategy and the Environment 2018, 27, 621-630, 10.1002/bse.2067.