Membrane technologies can be used in the dairy industry for many applications, such as milk clarification or fractioning and a concentration increase in specific components or the separation of them, since they cover a huge range of pore sizes (from 0 to 2 μm) and MWCOs (from 1 to 100,000 Da). For instance, MF can be used for fat globule (10 μm) fractionation as well as bacteria and spore (1 μm) removal. UF can be used for casein micelles (100 nm) or serum protein (10 nm) separation, whereas NF and RO can be used for lactose (1 nm), salt (0.1 nm) and water recovery.

- microfiltration

- ultrafiltration

- nanofiltration

- reverse osmosis

1. Introduction

One of the key processing tools in agro-food industries for the treatment of food products, as well as by-products or agro-food waste, is membrane technology [1][2][3][4][5]. In addition, the global market of membranes for food and beverage processing is estimated to achieve around USD 8.26 billion by 2024, an increase of 6.8% of the compound annual growth rate (CAGR) over the forecast period (2019–2024) [6]. Among them, the pressure-driven membrane processes, such as micro- (MF), ultra- (UF) and nano- (NF) filtration and reverse osmosis (RO), have been applied in agro-food industries to treat raw material streams and by-products [7][8][9][10][11][12]. The driving force of these membrane processes is the transmembrane pressure (TMP). Additionally, the key component in the membrane separation processes is the molecular weight cut-off (MWCO, usually expressed in Da) [7]. For that, pressure-driven membrane processes can be characterized according to these two parameters (TMP and MWCO) [8]. In this sense, MF requires > 100,000 Da and 0.1–2 bar; UF utilizes 1000–100,000 Da and 2–10 bar; NF uses 100–1000 Da and 5–40 bar; and RO needs 1–100 Da and 30–100 bar [13][14].

The largest share of the membrane market is for UF systems, accounting for 35% of the market, followed by MF processes (33%) and, lastly, NF/RO systems (30%). Otherwise, other filtration systems and membrane processes, such as electrodialysis (ED), pervaporation (PV) and membrane liquid contactors (MLCs), have only a small market share [15].

Compared to conventional methods, membrane technologies offer several advantages, including operation at a low temperature, the absence of phase transition, high separation efficiency, high productivity in terms of permeate fluxes, low energy consumption, simple equipment, simple operation and easy scale-up [7][15][16]. However, the bottleneck of membrane filtration is membrane fouling and concentration polarization phenomena, which cause a reduction in the flux and, consequently, process productivity losses over time [17]. The use of regular cleaning steps can minimize these phenomena [15].

Regarding the dairy industry, MF can be used as a pretreatment to remove both bacteria and fat, as well as to fractionate milk products. UF can be applied as a standardization process of milk; however, the breakthrough use of UF was to convert milk whey into refined proteins for commercial use. ED, with bipolar membranes (named EDBM), can be used to alkalinize acid whey [18]. NF can be utilized for whey demineralization [19] and RO for concentration steps.

2. Market role of Membrane Technologies in Dairy Industry

Milk products have high nutritive value, and, for this reason, they are more regularly included in daily dietary routines. This fact is driving the market size.

A change in demographic shifts and dietary patterns (e.g., taste, health needs and/or nutritive value) has led to a high consumption of yogurt, cheese and cream, boosting product demand and acting as a major driving factor for market growth. Shifting trends toward balancing nutrition with flavor and a variety of products may act as a major contributing factor toward industry growth. Therefore, the continuously increasing consumption and production of dairy products coupled with a rise in the deployment of production automation processes have also been identified to boost market demand. Indeed, technology innovation, an increase in the production of dairy products in various countries (such as the Netherlands, Germany, India, and Australia) and the rising consumption of processed milk products have been identified to boost market expectations over the forecast period. Moreover, automation in dairy processing favors the industry’s growth since it reduces contamination and cost while increasing efficiency, meeting the required quality standards [20][21].

In fact, the global dairy processing equipment market size was around EUR 7285 million in 2016 [20], and the global world milk and milk product market in 2017 was around 835 million tons [21]. Moreover, in 2016, the USA market was valued at EUR 650 million, and it is predicted to grow at a CAGR of 6.1% (from 2017 to 2025). Therefore, it seems that processed milk product consumption is increasing while its production is decreasing, which is due to the reduction in the number of cows. Therefore, one of the major changes has been the increase in milk consumption per capita.

Moreover, as mentioned throughout the manuscript, membrane filtration techniques can be used for several purposes, such as processed milk concentration (e.g., before transportation) or protein concentration, solid particle separation, fat fractioning, spore and bacteria removal and lactose recovery. For instance, it is possible to reduce the carbohydrate content in milk, as well as remove bacteria during the process of production.

3. Bibliometric Evolution of Membrane Technologies in Dairy Industry

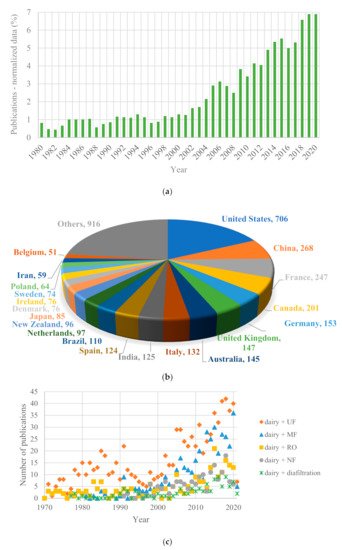

A bibliometric analysis of scientific publications, based on the Scopus database, was performed to identify the global research trends regarding membrane technology applications in the dairy industry during the time from 1980 to 2021. This analysis could improve our understanding of the most popular membrane applications in this field and provide a comparison of the membrane market view. The distribution of annual publications and the evolution of the number of accumulated articles containing the words “dairy” and “membrane” in the title, abstract or keywords are depicted in Figure 1 a.

As can be seen in Figure 1 a, the trend increases over the years from 26 articles (1980) up to 218 articles, which are the maximum published articles in a year (accomplished during 2019 and also during 2020). This trend confirms that membrane technologies are on the rise in dairy industries, and the integration of them into conventional processes could be a sustainable option for dairy processing, following a circular economy scheme for product valorization and waste minimization.

Finally, Figure 1 c was plotted to understand the evolution of the number of publications considering several membrane technologies, such as MF, UF, NF, RO and diafiltration, in dairy industries from 1970 to 2021. As reported in Figure 1 c, diafiltration is the membrane technology with the lowest number of publications in the dairy field (maximum of 9 articles in 2018), followed by NF (a maximum of 18 publications during 2018) and RO (2015 was the year with the most publications, up to 21). MF and UF are the most researched membrane technologies in relation to the dairy industry: a maximum of 36 publications were published in 2020 for MF and dairy, while 42 articles on UF and dairy were published during 2018. Therefore, the research on membrane technology, especially on the most popular techniques, such as MF and UF, must be considered as a very relevant issue within the global investigation regarding chemical engineering processes in the dairy industry.

Therefore, research investment in the dairy industry is in concordance with the membrane technology market in this industry, aforementioned in Section 3 . For instance, it is possible to conclude that UF is the most widely used process in the dairy industry as well as the most researched technology (with the highest number of publications). On the other hand, it can also be seen that the USA is the largest producer in the dairy industry, as well as the country with the highest scientific productivity.

4. Membrane Technology Processes in Dairy Industry

Therefore, MF can be used for bacteria and spore removal to be able to produce other dairy products, since there are many applications in the dairy industry for bacteria-free milk, such as cheese production. In this case, low-bacteria milk improves cheese quality, removing its off-flavors. Moreover, in the production of whey protein concentrates and isolates, bacteria removal by MF increases the quality of the product and keeps the heat treatment to a minimum, which better preserves the functional properties of the whey proteins [15][23].

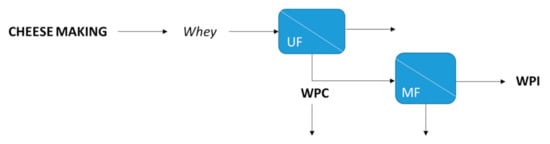

Indeed, two whey protein products can be mainly obtained in the dairy industry: whey protein concentrate (WPC), which is a concentrated protein solution (80%), and whey protein isolate (WPI), which can be produced by the separation of lactose and sugar from the whey protein concentrate. Kowalik-Klimczak [24] proposed the integration of UF and MF technology for cheesemaking treatment in order to produce whey proteins. UF was carried out to make cheese, obtaining whey protein concentrates (WPCs) as retentate. Moreover, if the retentate solution from UF was treated by MF, it was possible to obtain whey protein isolates (WPIs) as permeate (see Figure 2 ).

Moreover, it is possible to obtain inhibitors of different bacteria by treating the UF permeate of whey protein tryptic hydrolysate by NF. Furthermore, the retentate stream, rich in peptides, from the tryptic hydrolysate of whey protein can be valorized as a natural bio-preservative [25].

To summarize, the integrated scheme with membrane technologies for milk and cheese production would improve the quality and texture of milk and cheese, and also, the whole process would be optimized, recovering added-value by-products, such as whey proteins, lactose and casein.

This entry is adapted from the peer-reviewed paper 10.3390/foods10112768

References

- Daufin, G.; Escudier, J.P.; Carrére, H.; Bérot, S.; Fillaudeau, L.; Decloux, M. Recent and Emerging Applications of Membrane Processes in the Food and Dairy Industry. Food Bioprod. Process. Trans. Inst. Chem. Eng. Part C 2001, 79, 89–102.

- Carvalho, A.; Maubois, J.-L. Applications of membrane technologies in the dairy industry. In Engineering Aspects of Milk and Dairy Products; CRC Press: Boca Raton, FL, USA, 2009; pp. 33–56.

- Dhineshkumar, V.; Ramasamy, D. Review on Membrane Technology Applications in Food and Dairy Processing. J. Appl. Biotechnol. Bioeng. 2017, 3, 399–407.

- Bird, J. The Application of Membrane Systems in the Dairy Industry. J. Soc. Dairy Technol. 1996, 49, 16–23.

- Pouliot, Y. Membrane Processes in Dairy Technology-From a Simple Idea to Worldwide Panacea. Int. Dairy J. 2008, 18, 735–740.

- Global Membrane Technology Market for Food and Beverage Processing (2019–2024). Available online: https://www.autumnmarketresearch.com/industry-reports/global-membrane-technology-market-for-food-and-beverage-processing-2019-2024/ (accessed on 29 July 2020).

- Castro-Muñoz, R.; Yáñez-Fernández, J.; Fíla, V. Phenolic Compounds Recovered from Agro-Food by-Products Using Membrane Technologies: An Overview. Food Chem. 2016, 213, 753–762.

- Bazinet, L.; Doyen, A. Antioxidants, Mechanisms, and Recovery by Membrane Processes. Crit. Rev. Food Sci. Nutr. 2017, 57, 677–700.

- Castro-Muñoz, R.; Barragán-Huerta, B.E.; Fíla, V.; Denis, P.C.; Ruby-Figueroa, R. Current Role of Membrane Technology: From the Treatment of Agro-Industrial by-Products up to the Valorization of Valuable Compounds. Waste Biomass Valorization 2018, 9, 513–529.

- Castro-Muñoz, R.; Fíla, V. Membrane-Based Technologies as an Emerging Tool for Separating High-Added-Value Compounds from Natural Products. Trends Food Sci. Technol. 2018, 82, 8–20.

- Castro-Muñoz, R.; Conidi, C.; Cassano, A. Membrane-Based Technologies for Meeting the Recovery of Biologically Active Compounds from Foods and Their by-Products. Crit. Rev. Food Sci. Nutr. 2019, 59, 2927–2948.

- Castro-Muñoz, R.; Boczkaj, G.; Gontarek, E.; Cassano, A.; Fíla, V. Membrane Technologies Assisting Plant-Based and Agro-Food by-Products Processing: A Comprehensive Review. Trends Food Sci. Technol. 2020, 95, 219–232.

- Doug, E.; Budd, G.C. Overview of Water Treatment Processes. In Water Quality & Treatment: A Handbook on Drinking Water; Edzwald, J.K., Ed.; McGraw-Hill: New York, NY, USA, 2011.

- Fievet, P. Nanofiltration. In Encyclopedia of Membranes; Drioli, E., Giorno, L., Eds.; Springer: Berlin/Heidelberg, Germany, 2016; pp. 1360–1362. ISBN 978-3-662-44323-1.

- Lipnizki, F. Cross-Flow Membrane Applications in the Food Industry. In Membrane Technology: Membranes for Food Applications; WILEY-VCH Verlag GmbH & Co. KGaA: Weinheim, Germany, 2010; Volume 3, pp. 1–24. ISBN 9783527314829.

- Li, J.; Chase, H.A. Applications of Membrane Techniques for Purification of Natural Products. Biotechnol. Lett. 2010, 32, 601–608.

- Leu, M.; Marciniak, A.; Chamberland, J.; Pouliot, Y.; Bazinet, L.; Doyen, A. Effect of Skim Milk Treated with High Hydrostatic Pressure on Permeate Flux and Fouling during Ultrafiltration. J. Dairy Sci. 2017, 100, 7071–7082.

- Kravtsov, V.; Kulikova, I.; Mikhaylin, S.; Bazinet, L. Alkalinization of Acid Whey by Means of Electrodialysis with Bipolar Membranes and Analysis of Induced Membrane Fouling. J. Food Eng. 2020, 277, 109891.

- Nath, K.; Dave, H.K.; Patel, T.M. Revisiting the Recent Applications of Nanofiltration in Food Processing Industries: Progress and Prognosis. Trends Food Sci. Technol. 2018, 73, 12–24.

- Grand View Research Dairy Processing Equipment Market Size, Share & Trends Analysis Report. Available online: https://www.grandviewresearch.com/industry-analysis/dairy-processing-equipment-market (accessed on 19 February 2021).

- Kunal Ahuja, S.S. Dairy Processing Equipment Market Size 2018–2024—Industry Growth Report. Available online: https://www.gminsights.com/industry-analysis/dairy-processing-equipment-market (accessed on 19 February 2021).

- Scopus Analyze Search Results: TITLE-ABS-KEY (Dairy) AND TITLE-ABS-KEY (Membrane). Available online: https://www-scopus-com.recursos.biblioteca.upc.edu/term/analyzer.uri?sid=b1adcdc0a372fcf595cc6b33563d4e70&origin=resultslist&src=s&s=%28TITLE-ABS-KEY%28dairy%29+AND+TITLE-ABS-KEY%28membranes%29%29&sort=plf-f&sdt=b&sot=b&sl=51&count=3650&analyzeResults=Analyze+results&txGid=ca67ca3a31cba58a8a491ea4805d734b (accessed on 5 November 2020).

- Renhe, I.R.T.; Corredig, M. Effect of Partial Whey Protein Depletion during Membrane Filtration on Thermal Stability of Milk Concentrates. J. Dairy Sci. 2018, 101, 8757–8766.

- Kowalik-klimczak, A. The Possibilities of Using Membrane Filtration in The Dairy Industry. J. Mach. Constr. Maintenance 2017, 105, 99–108.

- Demers-Mathieu, V.; Gauthier, S.F.; Britten, M.; Fliss, I.; Robitaille, G.; Jean, J. Antibacterial Activity of Peptides Extracted from Tryptic Hydrolyzate of Whey Protein by Nanofiltration. Int. Dairy J. 2013, 28, 94–101.