A major significant contribution of the open innovation paradigm is the ability or opportunity for firms to share knowledge and learn to improve on their innovative activities through sourcing of external knowledge or the utilization of the abundant pool of knowledge within the firm. This flow of the most important factor in the open knowledge economy, however, needs focus and institutional backing. Properly designed institutions induce innovation as a matter of competitive necessity. However, weak institutions make transactions within and across firms uncertain and costly, which restricts exchange possibilities.

- institutional quality

- open innovations

- emerging economy

- capacity utilization analysis

1. Introduction

2. Determinants of Sustainable Open Innovations—A Firm-Level Capacity Analysis

2.1. Inbound Open Innovation Instruments as Predictors of Firms’ Innovation

2.2. Institutional Quality Indicators and Their Role in Enhancing Firms’ Innovation

2.3. Influence of Institutional Quality on Firm Openness

2.4. Institutional Quality, Capacity Utilization, and Firm Innovation Performance

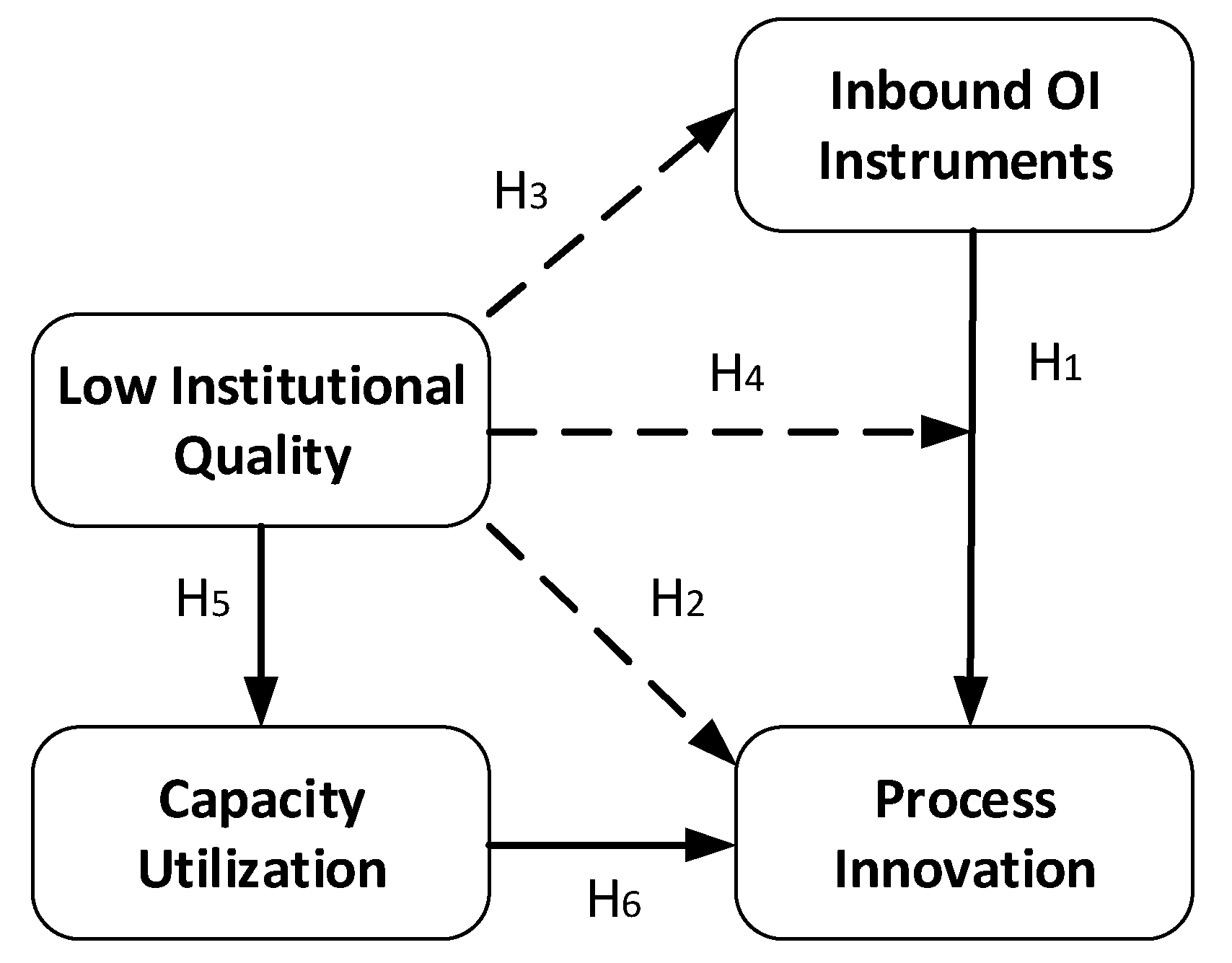

Figure 1. Conceptual Framework. Solid lines indicate positive effects; dashed lines indicate negative effects.

Figure 1. Conceptual Framework. Solid lines indicate positive effects; dashed lines indicate negative effects.This entry is adapted from the peer-reviewed paper 10.3390/su13169088

References

- Spithoven, A.; Clarysse, B.; Knockaert, M. Building absorptive capacity to organise inbound open innovation in traditional industries. Technovation 2010, 30, 130–141.

- Naqshbandi, M.M.; Tabche, I.; Choudhary, N. Managing open innovation. Manag. Decis. 2019, 57, 703–723.

- Aliasghar, O.; Rose, E.L.; Chetty, S. Where to search for process innovations? The mediating role of absorptive capacity and its impact on process innovation. Ind. Mark. Manag. 2019, 82, 199–212.

- Levinthal, D.; March, J.G. A model of adaptive organizational search. J. Econ. Behav. Organ. 1981, 2, 307–333.

- Laursen, K.; Salter, A. Open for innovation: The role of openness in explaining innovation performance among UK manufacturing firms. Strateg. Manag. J. 2006, 27, 131–150.

- Torres de Oliveira, R.; Verreynne, M.L.; Figueira, S.; Indulska, M.; Steen, J. How do institutional innovation systems affect open innovation? J. Small Bus. Manag. 2020, 1–45.

- Paunov, C. Corruption’s asymmetric impacts on firm innovation. J. Dev. Econ. 2016, 118, 216–231.

- Xu, G.; Yano, G. How does anti-corruption affect corporate innovation? Evidence from recent anti-corruption efforts in China. J. Comp. Econ. 2017, 45, 498–519.

- Goel, R.K.; Nelson, M.A. Capacity utilization in emerging economy firms: Some new insights related to the role of infrastructure and institutions. Q. Rev. Econ. Financ. 2020, 76, 97–104.

- Solow, R.M. Technical change and the aggregate production function. Rev. Econ. Stat. 1957, 312–320.

- Romer, P.M. Increasing returns and long-run growth. J. Political Econ. 1986, 94, 1002–1037.

- Aghion, P. Entrepreneurship and growth: Lessons from an intellectual journey. Small Bus. Econ. 2017, 48, 9–24.

- Baumol, W.J. Formal entrepreneurship theory in economics: Existence and bounds. J. Bus. Ventur. 1993, 8, 197–210.

- Bekana, D.M. Innovation and Economic Growth in Sub-Saharan Africa: Why Institutions Matter? An Empirical Study across 37 Countries. Arthaniti J. Econ. Theory Pract. 2020.

- Hussen, M.S.; Çokgezen, M. The impact of regional institutional quality on firm innovation: Evidence from Africa. Innov. Dev. 2021, 11, 69–90.

- Baris, S. Innovation and institutional quality: Evidence from OECD countries. Glob. J. Bus. Econ. Manag. Curr. Issues 2019, 9, 165–176.

- Barasa, L.; Knoben, J.; Vermeulen, P.; Kimuyu, P.; Kinyanjui, B. Institutions, resources and innovation in East Africa: A firm level approach. Res. Policy 2017, 46, 280–291.

- Tunyi, A.A.; Agyei-Boapeah, H.; Areneke, G.; Agyemang, J. Internal capabilities, national governance and performance in African firms. Res. Int. Bus. Financ. 2019, 50, 18–37.

- LiPuma, J.A.; Newbert, S.L.; Doh, J.P. The effect of institutional quality on firm export performance in emerging economies: A contingency model of firm age and size. Small Bus. Econ. 2013, 40, 817–841.

- Le HT, T.; Dao QT, M.; Pham, V.C.; Tran, D.T. Global trend of open innovation research: A bibliometric analysis. Cogent Bus. Manag. 2019, 6, 1633808.

- Zhylinska, O.; Bazhenova, O.; Zatonatska, T.; Dluhopolskyi, V.; Bedianashvili, G.; Chornodid, I. Innovation Processes and Economic Growth in the Context of European Integration. Sci. Pap. Univ. Pardubic. Ser. D Fac. Econ. Adm. 2020, 28, 1209.

- Stejskal, J.; Hájek, P.; Prokop, V. Collaboration and innovation models in information and communication creative industries—The case of Germany. J. Inf. Commun. Technol. 2018, 17, 2.

- Prokop, V.; Stejskal, J.; Klimova, V.; Zitek, V. The role of foreign technologies and R&D in innovation processes within catching-up CEE countries. PLoS ONE 2021, 16, e0250307.

- Gabriele Arnold, M. The role of open innovation in strengthening corporate responsibility. Int. J. Sustain. Econ. 2011, 3, 361–379.

- De Medeiros, J.F.; Ribeiro, J.L.D.; Cortimiglia, M.N. Success factors for environmentally sustainable product innovation: A systematic literature review. J. Clean. Prod. 2014, 65, 76–86.

- Carrillo-Hermosilla, J.; Del Río, P.; Könnölä, T. Diversity of eco-innovations: Reflections from selected case studies. J. Clean. Prod. 2010, 18, 1073–1083.

- Sisodiya, S.R.; Johnson, J.L.; Grégoire, Y. Inbound open innovation for enhanced performance: Enablers and opportunities. Ind. Mark. Manag. 2013, 42, 836–849.

- Li-Ying, J.; Mothe, C.; Nguyen, T.T.U. Linking forms of inbound open innovation to a driver-based typology of environmental innovation: Evidence from French manufacturing firms. Technol. Forecast. Soc. Chang. 2018, 135, 51–63.

- Prokop, V.; Stejskal, J. Determinants of innovation activities and SME absorption—Case study of Germany. Sci. Pap. Univ. Pardubic. Ser. D Fac. Econ. Adm. 2019, 46, 134–146.

- Akinwale, Y.O. Empirical analysis of inbound open innovation and small and medium-sized enterprises’ performance: Evidence from oil and gas industry. S. Afr. J. Econ. Manag. Sci. 2018, 21, 1–9.

- Oduro, S. Examining open innovation practices in low-tech SMEs: Insights from an emerging market. J. Sci. Technol. Policy Manag. 2019, 10, 509–532.

- De Padua Pieroni, M.; McAloone, T.; Pigosso, D. Business model innovation for circular economy: Integrating literature and practice into a conceptual process model. In Proceedings of the Design Society: International Conference on Engineering Design, Delft, The Netherlands, 5–8 August 2019; Cambridge University Press: Cambridge, UK, July 2019; Volume 1, pp. 2517–2526.

- Rauter, R.; Globocnik, D.; Perl-Vorbach, E.; Baumgartner, R.J. Open innovation and its effects on economic and sustainability innovation performance. J. Innov. Knowl. 2019, 4, 226–233.

- Geissdoerfer, M.; Savaget, P.; Bocken, N.M.; Hultink, E.J. The Circular Economy—A new sustainability paradigm? J. Clean. Prod. 2017, 143, 757–768.

- Valenteová, K.; Čukanová, M.; Steinhauser, D.; Sidor, J. Impact of institutional enviroment on the existence of fast-growing business in time of economic disturbances. Sci. Pap. Univ. Pardubic. Ser. D Fac. Econ. Adm. 2018, 43, 926.

- Bradley, S.W.; McMullen, J.S.; Artz, K.; Simiyu, E.M. Capital is not enough: Innovation in developing economies. J. Manag. Stud. 2012, 49, 684–717.

- Kidochukwu Obi, C.; Ifelunini, I. Mobilization of domestic resources for economic development financing in Nigeria: Does tax matter? Sci. Pap. Univ. Pardubic. Ser. D Fac. Econ. Adm. 2019, 45, 113–125.

- Roxas, B.; Chadee, D.; Erwee, R. Effects of rule of law on firm performance in South Africa. Eur. Bus. Rev. 2012, 24, 478–492.

- Zhu, Y.; Wittmann, X.; Peng, M.W. Institution-based barriers to innovation in SMEs in China. Asia Pac. J. Manag. 2012, 29, 1131–1142.

- Alonso, J.A.; Garcimartín, C. The determinants of institutional quality. More on the debate J. Int. Dev. 2013, 25, 206–226.

- Gribnau JL, M. The Integrity of the Tax System after BEPS: A Shared Responsibility. Erasmus Law Rev. 2017, 10, 12–28.

- Ndinga-Kanga, M.; van der Merwe, H.; Hartford, D. Forging a Resilient Social Contract in South Africa: States and Societies Sustaining Peace in the Post-Apartheid Era. J. Interv. State Build. 2020, 14, 22–41.

- Puffer, S.M.; McCarthy, D.J.; Boisot, M. Entrepreneurship in Russia and China: The impact of formal institutional voids. Entrep. Theory Pract. 2010, 34, 441–467.

- Chadee, D.; Roxas, B. Institutional environment, innovation capacity and firm performance in Russia. Crit. Perspect. Int. Bus. 2013, 9, 19–39.

- Liu, X. Corruption culture and corporate misconduct. J. Financ. Econ. 2016, 122, 307–327.

- Zeume, S. Bribes and firm value. Rev. Financ. Stud. 2017, 30, 1457–1489.

- Toleikienė, R.; Balčiūnas, S.; Juknevičienė, V. Youth Attitudes Towards Intolerance to Corruption in Lithuania. Sci. Pap. Univ. Pardubic. Ser. D Fac. Econ. Adm. 2020, 28, 109.

- Heo, Y.; Hou, F.; Park, S.G. Does corruption grease or sand the wheels of investment or innovation? Different effects in advanced and emerging economies. Appl. Econ. 2020, 53, 1–26.

- Breen, M.; Gillanders, R. Corruption, institutions and regulation. Econ. Gov. 2012, 13, 263–285.

- Achelhi, H.; Narjisse, L.; Mustapha, B.; Patrick, T. Barriers to innovation in Morocco: The Case of Tangier & Tetouan Region. Int. J. Soc. Sci. Educ. Res. 2016, 2, 592–612.

- Barone, E.; Ranamagar, N.; Solomon, J.F. A Habermasian model of stakeholder (non) engagement and corporate (ir) responsibility reporting. Account. Forum 2013, 37, 163–181.

- Zhang, Q.; Loh, L.; Wu, W. How do Environmental, Social and Governance Initiatives Affect Innovative Performance for Corporate Sustainability? Sustainability 2020, 12, 3380.

- Yang, D.; Wang, A.X.; Zhou, K.Z.; Jiang, W. Environmental strategy, institutional force, and innovation capability: A managerial cognition perspective. J. Bus. Ethics 2019, 159, 1147–1161.

- Garrone, P.; Grilli, L.; Mrkajic, B. The role of institutional pressures in the introduction of energy-efficiency innovations. Bus. Strategy Environ. 2018, 27, 1245–1257.

- Kafouros, M.; Wang, C.; Piperopoulos, P.; Zhang, M. Academic collaborations and firm innovation performance in China: The role of region-specific institutions. Res. Policy 2015, 44, 803–817.

- Clarke, G.R. Firm Registration and Bribes: Results from a Microenterprise Survey in Africa. In Proceedings of the 19th Annual Western Hemispheric Trade Conference, Laredo, TX, USA, 15–17 April 2015; p. 45.

- Buehn, A.; Schneider, F. Corruption and the shadow economy: Like oil and vinegar, like water and fire? Int. Tax Public Financ. 2012, 19, 172–194.

- Berdiev, A.N.; Goel, R.K.; Saunoris, J.W. Corruption and the shadow economy: One-way or two-way street? World Econ. 2018, 41, 3221–3241.