1. Delignification Process in Western Macedonia in Greece

Lignite mining in the Ptolemaida area has been going on since the 1920s in small private mines, not in terms of industrial exploitation but in particularly difficult, arduous, persistent and marginally efficient conditions. It is characteristic of that time that the average lignite miner produced about 500 kg of lignite per day, when at the same time in the mines of the German Ruhr, the daily production per employee exceeded 12 t [

8]. Since 1956, the production and exploitation of lignite in our region was launched at an intensive pace, fully industrialized, and grew with the involvement of the Public Power Corporation (PPC), with the peak of production in the period 2001–2004; as a result, it was judged as highly effective for our national economy [

9]. Since 2002, all indicators such as lignite production, investments in the lignite sector, workforce, etc. show that Western Macedonia has entered a state of delignification. Of course, due to the size of the lignite industry and the inherent inertia that accompanies it, the negative effects began to be experienced in the local community in the decade of 2010. Since 2010, there has been a constant decrease in lignite-fired power plants—the four oldest units stopped operating, a process that accelerated after 2019, triggered by the increased Emissions Trading System (ETS) carbon price, which increased the costs to produce lignite-based electricity combined with policies to promote the use of renewable energy and natural gas. According to the Master Plan (

https://www.sdam.gr/sites/default/files/consultation/Master_Plan_Public_Consultation_ENG.pdf, accessed on 3 February 2023) the transition process in Western Macedonia is governed by five basic principles:

-

Emphasis on labor-intensive areas to create employment opportunities in local communities;

-

Utilization of the inherent advantages of the affected areas;

-

Ensuring a quick transition with an emphasis on quick-wins;

-

Promoting social and environmental sustainability with an emphasis on sustainable development;

-

Integration of modern technology and promotion of innovation.

Based on the above principles, the vision for the “next day” regarding energy transition in Western Macedonia will be based on five pillars of development, as follows in (Figure 2):

Figure 2. Five key pillars of development.

-

Clean Energy;

-

Industry, small industry and trade;

-

Smart agricultural production;

-

Sustainable tourism;

-

Technology and education.

Considering that the region of Western Macedonia has been hosting 80% of the Greek lignite industry for about 70 years, creating the condition of high dependence of the local economy on the lignite value chain, Western Macedonia is called upon not only to adjust its production model to the new requirements but also to proceed immediately to a comprehensive productive restructuring and a full phase-out of lignite activities. In addition to the NPEC, a National Strategy for Circular Economy has been developed as a horizontal action aiming at the optimal use of resources (energy, water and raw material) in every economic sector. Under a Green Financing Scheme, a series of financing incentives is foreseen for companies investing in circular economy and industrial symbioses, in water reuse after biological treatment, etc. Green innovation concerning sustainable green investments will also be supported. A National Strategy for Adaptation to Climate Change is also being developed, incorporating actions aiming at biodiversity conservation, more effective water resources management, forest management, etc.

2. Circular Economy as Part of the Transition Planning

The new National Waste Management Plan (NWMP) pays special attention to recycling and sorting at the source and provides for a separate collection of biowaste for the whole country at the end of 2022, one year earlier than the Community directive. NWMP was developed as Greece’s response to the EU Action Plan for the Circular Economy and was endorsed by the Governmental Economic Policy Council in 2018. At the same time, it envisages intensification of the efforts for the separate collection of four streams for recycling, as well as priority in the strengthening of the collection network for recyclable materials. In addition, it sets high recycling targets within the framework of Community obligations (Directive 2018/851;

https://www.eea.europa.eu/policy-documents/directive-eu-2018-851-of, accessed on 3 February 2023). The adoption of the principles of Circular Economy and Industrial Coexistence for the overall management and utilization of waste, as secondary raw materials and/or alternative fuels, is also favored. Actions are proposed for the proper and integrated management of the country’s agricultural waste, which produces the largest amount of waste (40%) [

10] and is managed to date—with individual exceptions—is incinerated at the place of production, resulting in emissions of significant amounts of gaseous pollutants. Also included is the design for the collection and recovery of biodegradable agricultural waste for the purpose of their utilization in the production of by-products (e.g., fertilizer) and/or alternative fuels. Consequently, as shown in

Figure 3, there is a significant synergy between the objectives and actions included in the new NWMP, which can have a particularly positive effect on the prospect of entering the smart bin market in the period of 2020–2030 and, in fact, both in the domestic as well as in the commercial sector.

Figure 3. Schematic of indicative sizes of smart bins with integrated sensors.

3. The Smart Bin Technology

The adoption of the new National Waste Management Plan (NWMP) for the period of 2020–2030 (

https://www.eea.europa.eu/themes/waste/waste-prevention/countries/greece-waste-prevention-country-profile-2021, (accessed on 3 February 2023), which prefers and supports smart waste management actions, combined with the smart cities philosophy, which is constantly promoted by the European Union, create extremely favorable conditions for the entry of smart bins into the everyday life of the citizen. The ease of automatic disposal of sanitary waste in hospitals and clinics is expected to boost the adoption of automatic refuse bins in the commercial sector [

11]. In addition, hotels and restaurants are developing more and more automatic waste containers, especially for public health reasons, as part of their efforts to offer attractive services to customers. The main idea behind the adoption of smart bin technology is primarily related to the hygiene of public spaces. The problem we face in a modern city is empirically known by the citizens, where the neighborhood glass or paper bins are regularly overflowing and often their collection is delayed. As a result, citizens dump their rubbish next to bins, rubbish is scattered on the street and lost in the recycling process, and additional costs of cleaning the urban area and garbage collection are required. The consequences are obvious: degradation of public space and additional costs for taxpayers. Smart waste management with smart bins could, if not eliminate it altogether, significantly reduce the above problem. Obviously, waste management companies have the ability to calculate their routes and collection intervals according to experience and seasonal factors, such as celebrations, gatherings or important local events. However, edge technology could help to optimize the cleaning process and the immediate collection of waste. This practice would not only save significant financial resources but also help to avoid overfilling bins. Finally, every kilo of glass or paper that is not lost for recycling means extra money for the municipality.

Smart bins are designed to identify different types of waste. They consist of IoT-enabled sensors that act as real-time indicators to determine if the bins are full or not and help adjust the waste collection schedule accordingly. Smart bins are environmentally friendly, as they significantly reduce the need for misguided collection routes, resulting in reduced carbon dioxide (CO

22) emissions and associated greenhouse gases. The use of the compression system maximizes the capacity of the bin, significantly increasing the recycling rates, while the smart bins are standardized in such a way that they can be emptied using the existing collection equipment. According to the Danish Environmental Protection Agency, collecting a cup of coffee thrown in the street costs the municipality services about 2 euros to collect and drive into the trash bin. On the other hand, according to the same office, one third of Copenhagen’s citizens’ complaints to cleaning services are consistently related to overfilled bins [

6]. Therefore, smart waste management with a focus on smart bins not only significantly improves the management costs for municipalities but also creates cleanliness and hygiene conditions in the urban environment and is a constant requirement on the part of citizens. A variety of smart bin systems are currently available on the global market, many of which are still in a pilot phase.

According to an extensive study conducted in 2017 in Denmark regarding the future of the smart bin market, the following interesting findings arise [

8]: Low cost sensor: The total direct replacement of existing trash bins with smart bins is not a viable and attractive option for most public cleaning services. Therefore, the solution of adding sensors to existing bins is preferred. The sensor system must be quite inexpensive, so that if the bin is damaged or stolen it does not mean big financial expense or replacement. Based on the interviews, a cost of EUR 80 per bin, for the addition of sensors, would be perfectly acceptable on the part of municipal authorities. A further problem is the fact that waste collection bins are often burned or vandalized. This possibility makes municipalities reluctant to invest a lot of money in the smart bin market, especially in large urban centers. Construction Simplicity: Complex, high-tech solutions have long been unattractive on the municipal side. Municipalities usually choose simple but effective solutions, unlike, of course, service businesses. A very advanced and expensive device in a bin is not a selection criterion for a municipality; moreover, it will make it difficult to repair the technical services of the municipality. According to our research, municipalities want smart bins but not technologically complex ones. Open/transparent system: Great emphasis is placed on open data, open codes and compatibility. Municipalities are looking for solutions that can work together and where they have the freedom to change between different systems without great difficulties. This could, for example, mean that a municipality can choose other sensors; use the sensors on another platform; or even further, develop its own communication systems. In addition, the study highlighted a number of other findings:

-

Many potential customers (municipalities) already have a large number of conventional bins; so, a high price for new smart bin systems is definitely discouraging.

-

It is much easier for a municipality to receive funding from the Central Government to hire cleaning staff (job creation) rather than funding to implement an advanced waste management system.

-

While most smart bin solutions ensure durability for about a decade, customers are skeptical about these claims at 60%.

-

All public entities are looking for open-source solutions so they can easily build on it, modify or add new solutions. Most existing solutions are proprietary.

-

Many public bodies, even at the director level, are not sufficiently informed about the technological philosophy of smart bins.

4. The Global Market of Smart Bin Technology

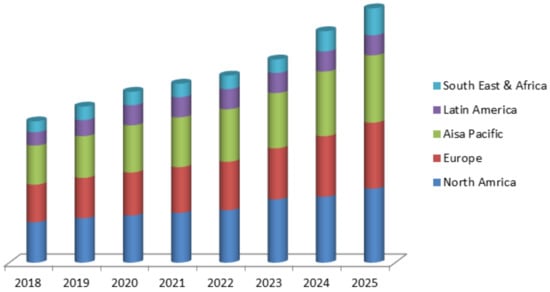

The global market of smart waste management is expected to reach USD 4.5 billion by 2025 [

12], as shown in

Figure 4. This market is projected to grow at a rate of 7% from 2019 to 2027 in revenue, mainly due to the adoption of the potential Internet of Things (IoT) and the technological philosophy of smart cities [

13]. During the projected period (2019–2025), North America is expected to become the leading smart waste collection market, followed by Europe and Asia-Pacific. The growing government initiatives, strict environmental regulations and large-scale investments with the emergence of IoT have brought about a real breakthrough, reducing the operational costs of these technologies. Moreover, the increasing adoption of IoT technology, which links a range of smart sensors and devices to monitor and automate city waste management functions, positively affects the market for intelligent waste collection around the world. Regarding geographical distribution, North America is expected to dominate the smart waste collection market, as the US has a significant market share and is expected to expand by 8.1% annually in the period of 2019–2027. In addition, the smart waste collection market in Europe and the Middle East is also projected to increase during the forecast period.

Figure 4. Geographic market distribution of smart bins with apparent growth around the world.

Particularly for smart bins, which are a key parameter of the smart waste management philosophy [

14], the market is expected to grow at a rate of 64.1% to reach USD 5.42 billion in 2025, according to a recent survey by Frost and Sullivan [

13]. The global market for smart waste bins is currently estimated at USD 278.8 million. According to Frost and Sullivan’s study (

https://www.researchandmarkets.com/reports/4856435/growth-opportunities-in-the-global-internet-ofproduct--toc, accessed on 3 February 2023), to gain a competitive advantage in the smart bin market, Frost and Sullivan needs to make the most of the growth opportunities that present themselves: Delivering value-added services such as cleaning and maintenance, on-site waste audits and working with other providers to develop a complete package of smart waste infrastructure.

-

Expanding into areas that are rapidly urbanizing and generating large amounts of waste.

-

Partner with providers for efficient design, installation and distribution of smart bins.

-

Developing a wide range of products, especially to enhance the entire value chain; for example, partnerships with Big Databases and image recognition technologies.

-

Launch new platforms that can manage data created from any connected smart bin device and transfer information about the use and performance of bins.

The waste management chain includes individual stages such as collection, transport, disposal and recycling. Especially, the stage involving collection and disposal shows the highest operating costs leading to the growing adoption of intelligent waste management. In the smart collection department, the emergence of the internet has revolutionized and effectively dealt with operational costs for waste management companies. Companies that offer smart practices for collecting waste focus primarily on three solutions: intelligent tracking, path optimization and data collection. By developing sensors, network infrastructure and data visualization platforms, waste management companies have been able to generate actionable information and make informed decisions. As a result, municipalities in some cities in the United States, the United Arab Emirates, the United Kingdom, etc., in cooperation with innovative waste management (such as Enevo, Smartbin, Bigbelly, etc.) save around 30% of the waste collection costs [

10]. After all, the smart bin market in North America is as follows (

https://www.grandviewresearch.com/industry-analysis/north-america-automatic-touchless-garbage-bin-market, accessed on 3 February 2023):

-

The growing trend for Smart Cities, especially in Canada and the USA, is leading to an increase in the market for smart cities, both in the commercial and domestic sectors.

-

A smart city leverages digital technology for better resource utilization and fewer broadcasts. This means more intelligent urban transport networks, upgraded water supply and waste disposal facilities, and more effective ways of lighting and heating buildings. It also means a more interactive and sensitive city administration, safer public spaces and meeting the needs of older people.

-

About 22% of cities in the United States and Canada have already implemented smart bin strategies, compared with just 7% of cities globally.

-

Due to government initiatives promoting sustainability, zero waste by 2020 and the penetration of smart city initiatives across the high-urban concentration region, North America is expected to represent the largest share in the smart waste management market.

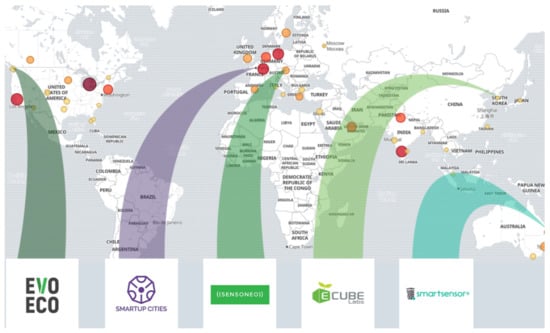

Also remarkable is the growing cooperation between waste management companies, material recycling companies and companies that develop software and automation. Recently, predominantly due to the pandemic of COVID-19, there has been a growing demand for hands-free containers in all public services and in the commercial sector. A development is expected to significantly accelerate the demand for smart bins across the economy. Around 150 companies are active worldwide offering solutions in the smart bin sector, including five flagship start-ups (

https://www.startus-insights.com/innovators-guide/5-top-smart-bin-solutions-impacting-smart-cities/, accessed on 3 February 2023), as shown in

Figure 5, offering integrated solutions and, above all, developing highly innovative practices that are expected to give technological advancement to the smart bin market.

Figure 5. Global diaspora of businesses active in smart bin production.

The current waste management process starts with the creation of waste, which is disposed of in waste bins near the point of its creation. The waste is then collected from the garbage dumps of municipalities or private companies at the prescribed times and transferred to temporary collection centers. Garbage at collection centers is then sent either for recycling or to landfills. This process partially solves the waste problem while creating other problems such as the following:

-

Some garbage bins are overfilled, while others are not met by garbage collection time;

-

Overloaded garbage cans create unsanitary conditions;

-

Unoptimized truck routes lead to excessive fuel use and environmental pollution;

-

Collected garbage complicates sorting at the recycling facility.

An example of a modern intelligent waste management system will include a trash-connected sensor that measures the fill level and a communication system that transfers data to the Cloud [

15]. The data are processed in the Cloud; therefore, the routes of the collection trucks are optimized. Smart waste management contributes to overall waste recycling efficiency, provides the opportunity to optimize the route for utilities and helps reduce fuel traffic and consumption. In conclusion, it seems that the smart bin solution concerns entrepreneurship at the international level and can bring tangible results both economically and environmentally. Due to this, market research has been conducted in Greece regarding the knowledge of the smart bin and the possible utilization of this technology.

This entry is adapted from the peer-reviewed paper 10.3390/recycling8010028